Home > Comparison > Consumer Cyclical > MELI vs TSCO

The strategic rivalry between MercadoLibre, Inc. and Tractor Supply Company shapes the specialty retail sector’s competitive landscape. MercadoLibre operates a digital commerce and fintech platform across Latin America, blending e-commerce with financial services. Tractor Supply Company runs a vast network of rural lifestyle retail stores in the U.S., focused on hardware and agricultural products. This analysis will evaluate which business model offers a superior risk-adjusted return for diversified portfolios facing evolving consumer trends.

Table of contents

Companies Overview

MercadoLibre and Tractor Supply Company both hold influential positions in the specialty retail sector with distinct market footprints.

MercadoLibre, Inc.: Latin America’s E-Commerce Powerhouse

MercadoLibre dominates Latin America’s online commerce landscape. Its core revenue engine combines marketplace transactions with fintech services like Mercado Pago and credit offerings. In 2026, it strategically expanded logistics and advertising platforms to deepen user engagement and enhance seller capabilities.

Tractor Supply Company: America’s Rural Lifestyle Retailer

Tractor Supply serves U.S. recreational farmers and ranchers through physical stores and e-commerce. Its revenue stems from diverse merchandise including livestock products, tools, and apparel. The company’s 2026 focus remains on expanding store footprint and strengthening its multi-brand retail strategy to capture rural market share.

Strategic Collision: Similarities & Divergences

Both companies operate in specialty retail but contrast in approach: MercadoLibre builds an integrated digital ecosystem while Tractor Supply relies on physical presence with digital support. Their primary battleground is customer loyalty in niche markets. Investors face divergent profiles—MercadoLibre offers high-growth fintech innovation, Tractor Supply delivers steady retail consistency.

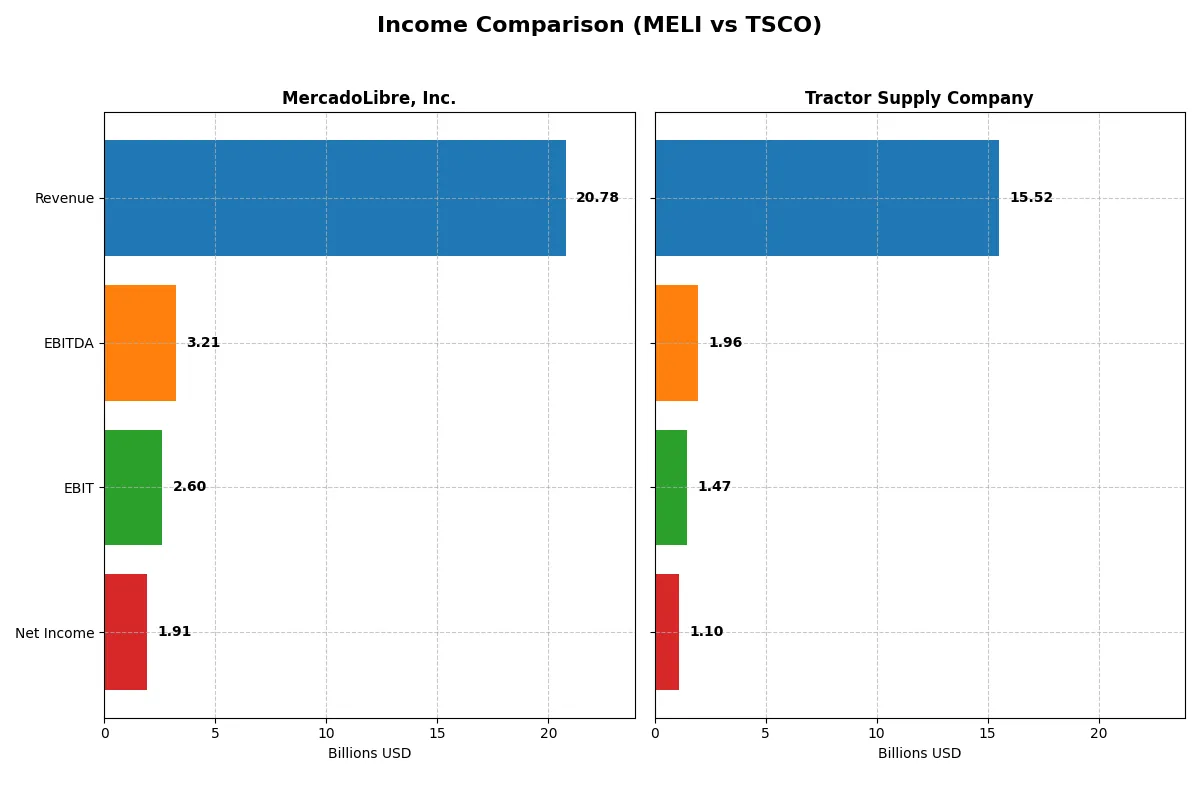

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | MercadoLibre, Inc. (MELI) | Tractor Supply Company (TSCO) |

|---|---|---|

| Revenue | 20.8B | 15.5B |

| Cost of Revenue | 11.2B | 10.4B |

| Operating Expenses | 6.95B | 3.69B |

| Gross Profit | 9.58B | 5.16B |

| EBITDA | 3.21B | 1.96B |

| EBIT | 2.60B | 1.47B |

| Interest Expense | 153M | 69M |

| Net Income | 1.91B | 0 |

| EPS | 37.69 | 0.00 |

| Fiscal Year | 2024 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs a more efficient and profitable corporate engine through recent financial performance.

MercadoLibre, Inc. Analysis

MercadoLibre’s revenue surged from $7B in 2021 to $20.8B in 2024, nearly tripling its top line. Net income exploded from $83M to $1.91B, reflecting strong margin expansion. The gross margin hovers at a robust 46%, while the net margin improved to 9.2%, signaling efficient cost control and scaling momentum in 2024.

Tractor Supply Company Analysis

Tractor Supply’s revenue grew steadily from $12.7B in 2021 to $15.5B in 2025, a moderate 22% rise. Net income edged up from $997M to $1.1B, but margins show pressure. Gross margin settled at 33%, with net margin around 7.1%. The latest year shows a slight dip in profitability, indicating margin compression amid stable sales.

Verdict: Explosive Growth vs. Steady Expansion

MercadoLibre dominates in revenue and net income growth, with superior margins and rapid margin expansion. Tractor Supply delivers consistent sales and profits but faces margin headwinds. For investors prioritizing high growth and scalable profitability, MercadoLibre’s profile stands out as more attractive.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | MercadoLibre, Inc. (MELI) | Tractor Supply Company (TSCO) |

|---|---|---|

| ROE | 44% | 42% |

| ROIC | 18% | 13% |

| P/E | 45.1 | 24.2 |

| P/B | 19.8 | 10.3 |

| Current Ratio | 1.21 | 1.34 |

| Quick Ratio | 1.20 | 0.16 |

| D/E (Debt-to-Equity) | 1.57 | 3.73 |

| Debt-to-Assets | 27% | 88% |

| Interest Coverage | 17.2 | 21.2 |

| Asset Turnover | 0.82 | 1.42 |

| Fixed Asset Turnover | 8.38 | 2.23 |

| Payout Ratio | 0 | 44% |

| Dividend Yield | 0% | 1.84% |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing hidden risks and operational strengths essential for informed investment decisions.

MercadoLibre, Inc.

MercadoLibre delivers a robust 43.9% ROE and solid 9.2% net margin, signaling strong profitability. However, its elevated P/E of 45.1 and P/B near 19.8 paint an expensive valuation picture. The firm opts for reinvestment in R&D over dividends, fueling future growth but limiting immediate shareholder returns.

Tractor Supply Company

Tractor Supply posts a commendable 42.5% ROE yet a more modest 7.1% net margin. Its P/E ratio at 24.2 reflects a fair valuation compared to MercadoLibre’s stretched multiples. The company maintains a 1.84% dividend yield, providing steady income alongside a balanced capital allocation approach.

Premium Valuation vs. Operational Safety

MercadoLibre commands premium multiples driven by growth reinvestment, while Tractor Supply offers a more conservative valuation with dividend income. Tractor Supply’s risk-reward profile suits income-focused investors, whereas MercadoLibre fits those prioritizing growth potential despite valuation risk.

Which one offers the Superior Shareholder Reward?

I observe that MercadoLibre (MELI) pays no dividends, reinvesting all free cash flow into growth and innovation, boasting a robust free cash flow per share of 139 and a price-to-free-cash-flow ratio near 12. In contrast, Tractor Supply Company (TSCO) delivers a 1.6–1.9% dividend yield with a payout ratio around 43%, but its free cash flow per share is only 1.2, paired with a higher price-to-free-cash-flow ratio above 35. TSCO supports returns with ongoing buybacks, though MELI’s aggressive reinvestment strategy and stronger free cash flow generation create a more sustainable, long-term total return potential. I conclude MELI offers a superior shareholder reward profile in 2026, favoring growth over immediate income.

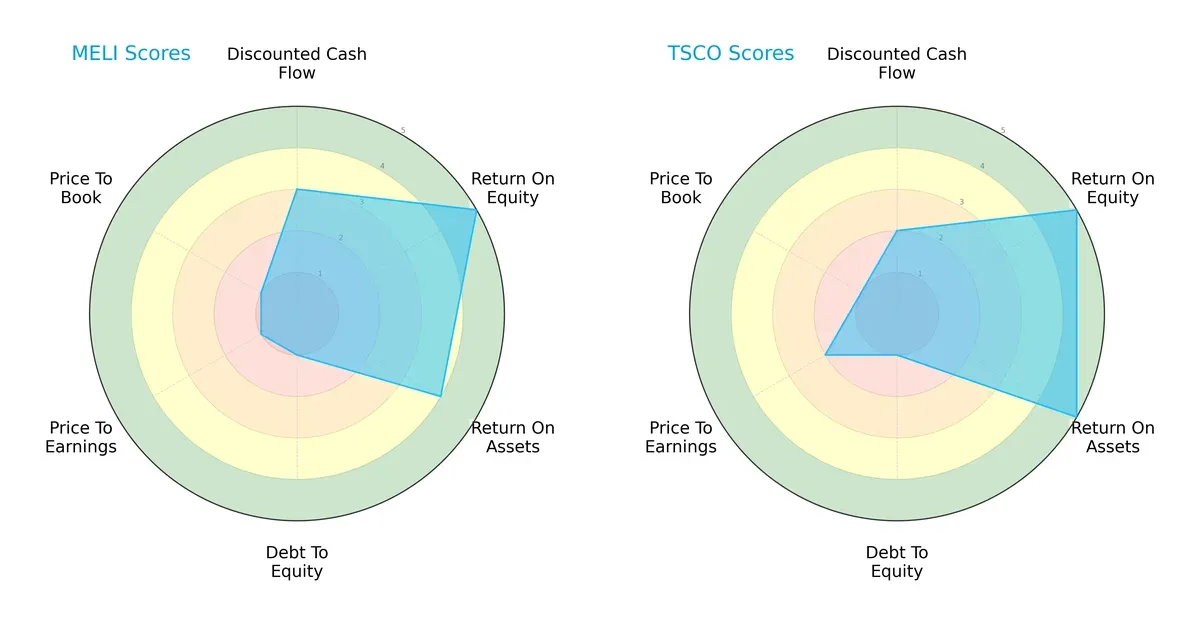

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of MercadoLibre, Inc. and Tractor Supply Company, highlighting their financial strengths and vulnerabilities:

MercadoLibre shows strengths in ROE (5) and ROA (4) but struggles with debt and valuation scores (all 1s). Tractor Supply matches MercadoLibre’s ROE (5) and outperforms in ROA (5) and P/E (2), though both share weak debt and P/B scores. Tractor Supply presents a more balanced profile, while MercadoLibre depends heavily on operational efficiency amid valuation concerns.

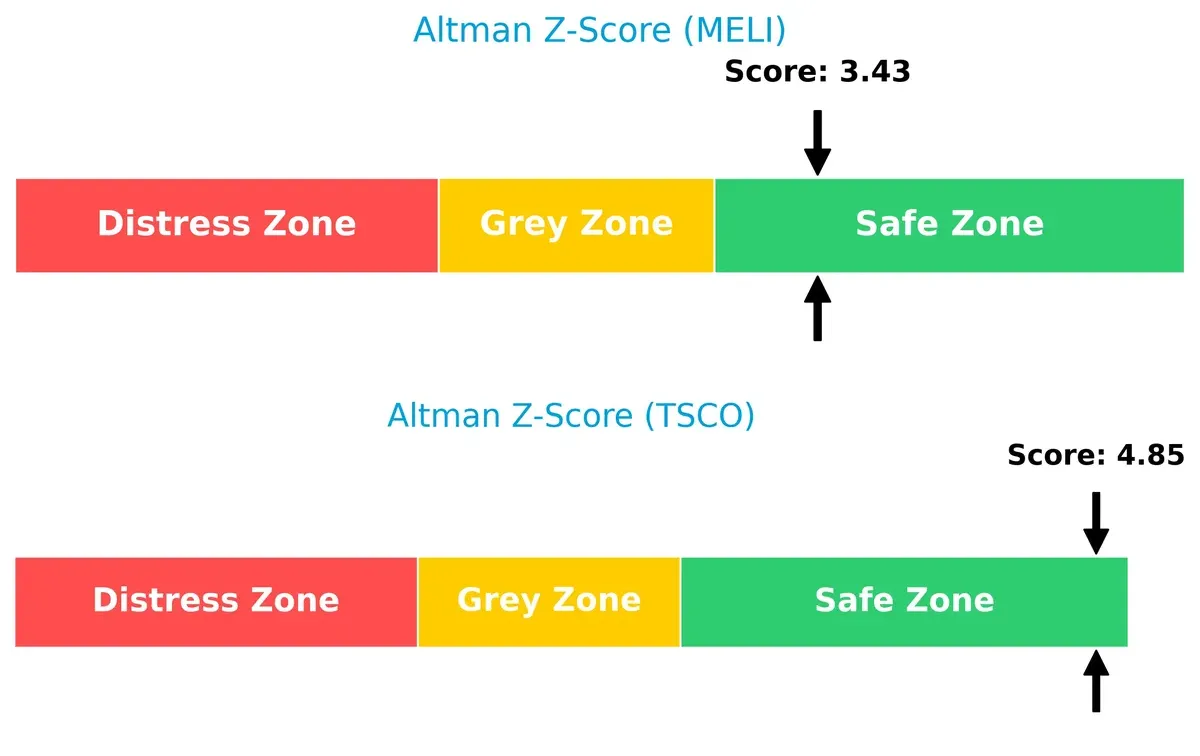

Bankruptcy Risk: Solvency Showdown

The Altman Z-Scores favor Tractor Supply (4.85) over MercadoLibre (3.43), signaling stronger long-term survival prospects in this cycle:

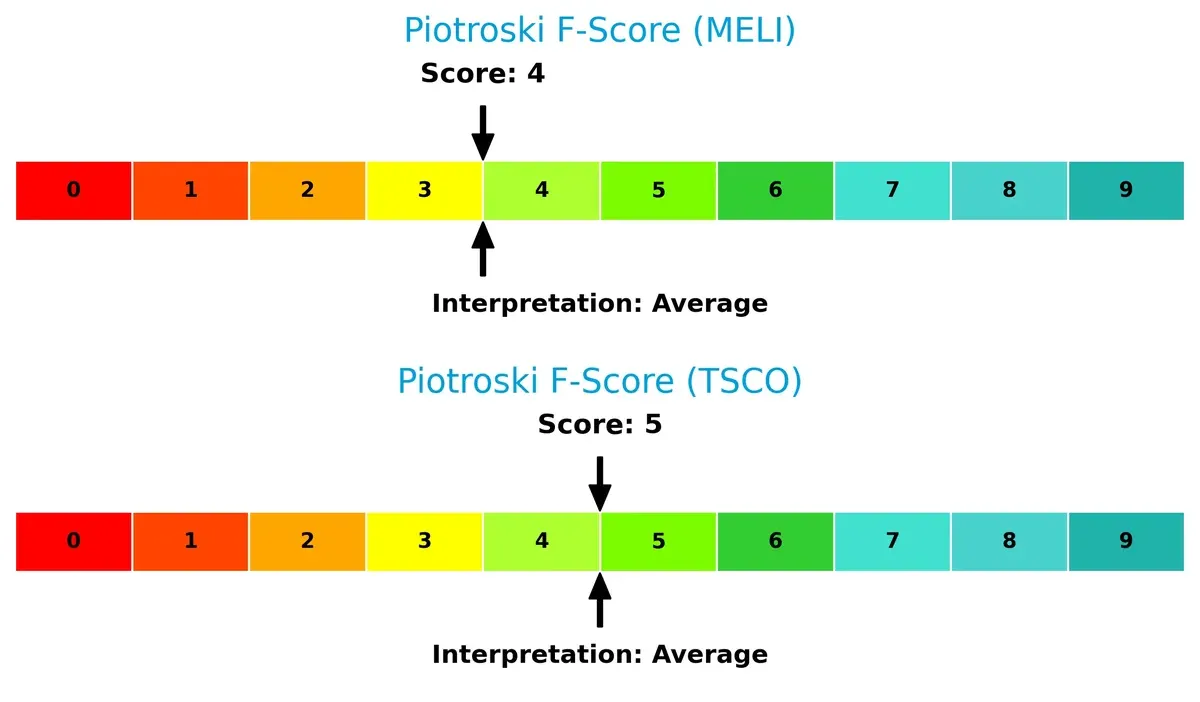

Financial Health: Quality of Operations

Piotroski F-Scores indicate moderate financial health for both, with Tractor Supply slightly ahead at 5 versus MercadoLibre’s 4, showing fewer red flags internally:

How are the two companies positioned?

This section dissects the operational DNA of MercadoLibre and Tractor Supply by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which business model offers the most resilient competitive advantage today.

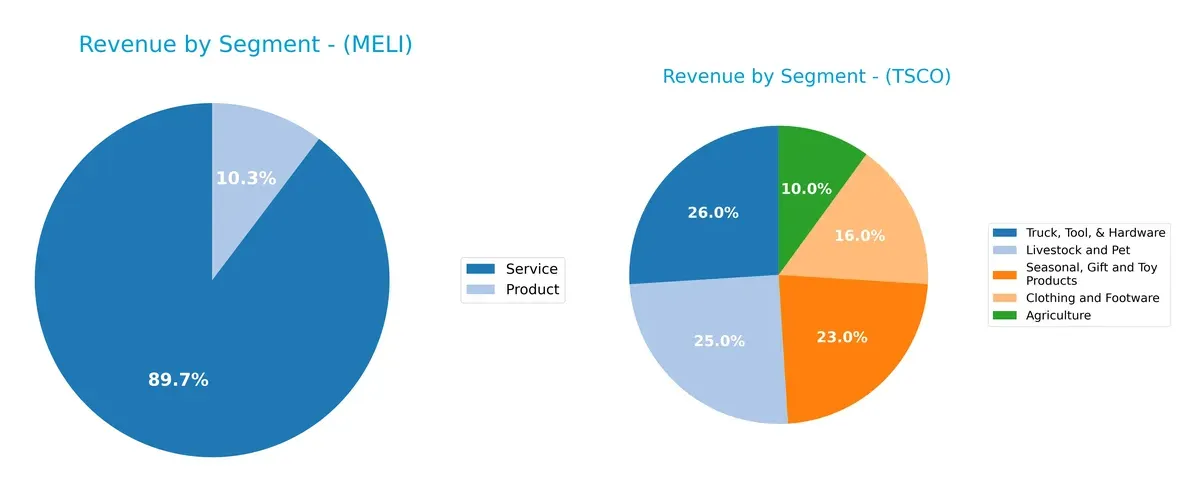

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how MercadoLibre and Tractor Supply diversify their income streams and where their primary sector bets lie:

MercadoLibre pivots heavily on its Service segment, generating $18.6B in 2024, dwarfing its Product revenue of $2.1B. This signals a strong ecosystem lock-in via fintech and commerce services. Tractor Supply, by contrast, shows a diversified portfolio with no single segment dominating—Truck, Tool & Hardware leads at $3.9B, closely followed by Livestock & Pet at $3.7B. This broad mix reduces concentration risk but demands excellence across distinct retail categories.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of MercadoLibre, Inc. (MELI) and Tractor Supply Company (TSCO):

MELI Strengths

- Strong profitability with 43.92% ROE and 17.73% ROIC

- Favorable interest coverage at 16.97

- Diverse revenue streams from products and services totaling $20.5B

- Solid geographic presence with large revenues in Brazil, Mexico, Argentina

- Favorable debt to assets ratio at 27.19%

- High fixed asset turnover at 8.38

TSCO Strengths

- Favorable WACC at 6.17% supports capital efficiency

- ROE of 42.46% and solid ROIC of 13.11% indicate profitability

- Asset turnover at 1.42 is favorable for retail sector

- Strong interest coverage at 21.22

- Broad product diversification across agriculture, clothing, hardware, livestock, and seasonal goods totaling ~$15.3B

- Neutral P/E at 24.18 reflects reasonable valuation

MELI Weaknesses

- High P/E of 45.11 and PB ratio at 19.81 suggest premium valuation risk

- Elevated debt to equity at 1.57 and unfavorable WACC at 10.02%

- No dividend yield to attract income investors

- Neutral current ratio at 1.21 limits liquidity cushion

- Moderate net margin at 9.2%

- Heavy reliance on Brazil segment may concentrate geographic risk

TSCO Weaknesses

- High debt to equity of 3.73 and debt to assets at 88.12% raise leverage concerns

- Very low quick ratio at 0.16 signals liquidity risk

- Unfavorable PB at 10.27 may indicate overvaluation

- Lower net margin at 7.06%

- Fixed asset turnover at 2.23 is only neutral for retail

Both companies demonstrate solid profitability and diversification within their sectors. MELI’s strengths lie in its geographic breadth and efficiency ratios, although it carries valuation and leverage risks. TSCO shows operational efficiency in asset use but faces significant leverage and liquidity challenges. These contrasts highlight different strategic priorities and financial risk profiles.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only barrier preserving long-term profits from relentless competition erosion. Let’s dissect the moats of MercadoLibre and Tractor Supply:

MercadoLibre, Inc.: Network Effects Powerhouse

MercadoLibre’s primary moat derives from powerful network effects across Latin America’s e-commerce and fintech platforms. This manifests as high ROIC well above WACC and robust margin stability. Expansion into financial services deepens this moat in 2026.

Tractor Supply Company: Niche Market Cost Advantage

Tractor Supply’s moat hinges on cost advantage within the rural lifestyle retail niche, contrasting MercadoLibre’s broad digital network. It generates steady value but shows a declining ROIC trend. Growth hinges on regional expansion and product diversification.

Network Effects vs. Niche Cost Advantage

MercadoLibre’s deeper, expanding network effects moat outmatches Tractor Supply’s narrower cost advantage. MercadoLibre is better positioned to defend market share amid intensifying digital competition in 2026.

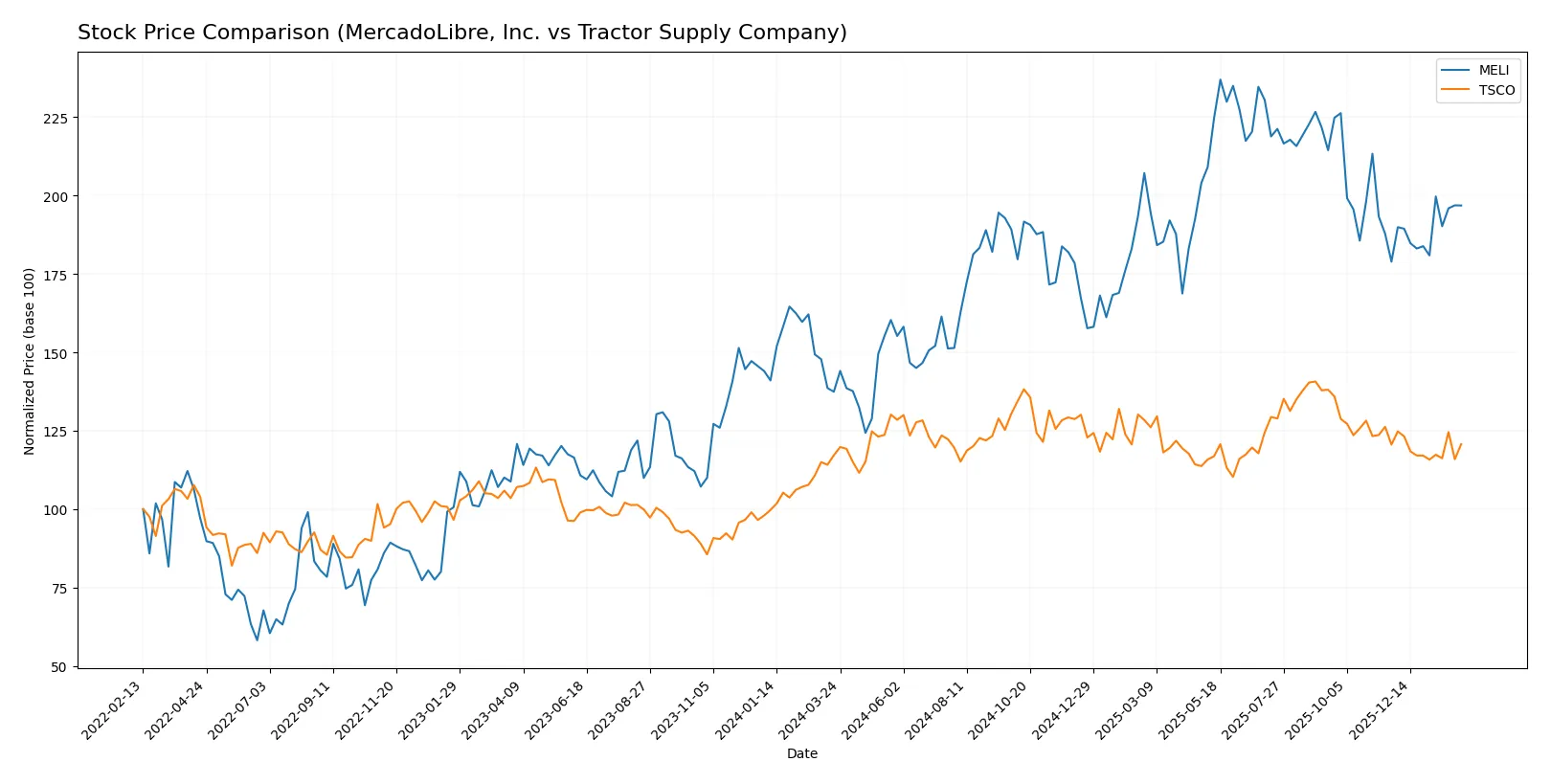

Which stock offers better returns?

Stock prices over the past 12 months reveal distinct dynamics, with MercadoLibre showing strong upward momentum and acceleration, while Tractor Supply posts modest gains amid decelerating trends.

Trend Comparison

MercadoLibre’s stock rose 43.19% over the past year, reflecting a bullish trend with accelerating gains and a high volatility level indicated by a 295.38 standard deviation. The price peaked at 2584.92.

Tractor Supply’s stock increased 3.01% over the same period, marking a mild bullish trend but with deceleration and low volatility, shown by a 2.97 standard deviation. The high was 61.76.

MercadoLibre outperformed Tractor Supply clearly, delivering substantially higher returns and exhibiting stronger momentum over the 12-month span.

Target Prices

Analysts present a confident target consensus for MercadoLibre and Tractor Supply Company.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| MercadoLibre, Inc. | 2700 | 2900 | 2830 |

| Tractor Supply Company | 50 | 67 | 59 |

MercadoLibre’s target consensus stands approximately 32% above its current price of $2,147, signaling robust growth expectations. Tractor Supply’s consensus at $59 implies a 11% upside from $52.98, reflecting moderate optimism among analysts.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

MercadoLibre, Inc. Grades

The following table summarizes recent grades from reputable institutions for MercadoLibre, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wedbush | Maintain | Outperform | 2025-12-19 |

| BTIG | Maintain | Buy | 2025-12-04 |

| UBS | Maintain | Buy | 2025-11-24 |

| BTIG | Maintain | Buy | 2025-11-14 |

| JP Morgan | Maintain | Neutral | 2025-11-03 |

| Morgan Stanley | Maintain | Overweight | 2025-11-03 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-10-30 |

| Benchmark | Maintain | Buy | 2025-10-30 |

| Barclays | Maintain | Overweight | 2025-10-30 |

| Barclays | Maintain | Overweight | 2025-10-21 |

Tractor Supply Company Grades

The following table summarizes recent grades from reputable institutions for Tractor Supply Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | Maintain | Buy | 2026-02-02 |

| Goldman Sachs | Maintain | Buy | 2026-01-30 |

| Jefferies | Maintain | Buy | 2026-01-30 |

| JP Morgan | Maintain | Neutral | 2026-01-30 |

| Telsey Advisory Group | Maintain | Outperform | 2026-01-30 |

| DA Davidson | Maintain | Buy | 2026-01-30 |

| Piper Sandler | Maintain | Overweight | 2026-01-30 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-30 |

| Mizuho | Maintain | Outperform | 2026-01-30 |

| TD Cowen | Maintain | Hold | 2026-01-30 |

Which company has the best grades?

MercadoLibre maintains consistent buy and outperform grades with no downgrades, reflecting strong analyst confidence. Tractor Supply shows a broader mix including hold and equal weight ratings, suggesting more varied opinions. Investors should note MercadoLibre’s more uniformly positive outlook.

Risks specific to each company

In 2026’s dynamic market, these categories reveal critical pressure points and systemic threats confronting MercadoLibre, Inc. and Tractor Supply Company:

1. Market & Competition

MercadoLibre, Inc.

- Faces intense competition from regional e-commerce giants in Latin America, challenging its market share and growth.

Tractor Supply Company

- Competes in U.S. rural retail with limited direct online rivals but pressure from big-box retailers and e-commerce persists.

2. Capital Structure & Debt

MercadoLibre, Inc.

- Moderate debt-to-assets ratio at 27.19% supports growth but debt-to-equity at 1.57 signals leverage risk.

Tractor Supply Company

- High debt-to-assets at 88.12% and debt-to-equity ratio of 3.73 raise concerns about financial flexibility and risk.

3. Stock Volatility

MercadoLibre, Inc.

- Beta of 1.421 indicates above-market volatility, reflecting sensitivity to emerging markets and tech cycles.

Tractor Supply Company

- Beta of 0.726 shows lower stock volatility, offering relative stability amid market fluctuations.

4. Regulatory & Legal

MercadoLibre, Inc.

- Exposure to complex Latin American regulatory environments, including fintech and e-commerce laws, poses ongoing compliance risk.

Tractor Supply Company

- Mainly U.S.-focused, faces standard retail regulatory compliance with less geopolitical legal complexity.

5. Supply Chain & Operations

MercadoLibre, Inc.

- Relies on third-party logistics in Latin America; regional infrastructure challenges may disrupt operations.

Tractor Supply Company

- Operates 2,016 stores with established supply chains but subject to U.S. rural distribution and weather risks.

6. ESG & Climate Transition

MercadoLibre, Inc.

- Increasing pressure to align fintech and logistics with sustainable practices amid Latin America’s climate policies.

Tractor Supply Company

- Faces growing scrutiny on sustainable sourcing and carbon footprint in agriculture-related retail.

7. Geopolitical Exposure

MercadoLibre, Inc.

- Significant exposure to Latin American political instability and currency fluctuations impacts revenue predictability.

Tractor Supply Company

- Primarily U.S.-based operations minimize direct geopolitical risk but vulnerable to domestic policy shifts.

Which company shows a better risk-adjusted profile?

MercadoLibre’s biggest risk is its high stock volatility and geopolitical exposure in Latin America. Tractor Supply’s key risk lies in its heavy debt load, threatening financial flexibility. Despite MELI’s leverage, its safer Altman Z-score and favorable ROIC vs. WACC suggest stronger operational efficiency. TSCO’s financial risk from debt weighs heavily despite stable cash flow. I see MercadoLibre as having a better risk-adjusted profile given its operational strengths and market positioning, though investors must monitor volatility closely.

Final Verdict: Which stock to choose?

MercadoLibre, Inc. (MELI) wields a powerful growth engine fueled by a durable competitive advantage and exceptional capital efficiency. Its rapidly increasing profitability demonstrates a mastery in scaling digital commerce across Latin America. The point of vigilance remains its high leverage, which could amplify risks in tighter credit conditions. MELI suits aggressive growth portfolios seeking exponential upside.

Tractor Supply Company (TSCO) relies on a solid retail moat anchored in steady cash flow and robust asset utilization. Its more conservative capital structure offers better stability relative to MELI, appealing to investors prioritizing consistent returns. While growth is modest and ROIC trends downwards, TSCO fits well within GARP portfolios balancing growth with reasonable valuation.

If you prioritize rapid expansion and market dominance, MELI is the compelling choice due to its strong economic moat and accelerating earnings growth. However, if you seek stability and dependable cash flow with moderate growth, TSCO offers better risk management and a proven retail franchise. Both carry risks but address distinct investor appetites in today’s market.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of MercadoLibre, Inc. and Tractor Supply Company to enhance your investment decisions: