In the fast-evolving world of e-commerce, PDD Holdings Inc. and MercadoLibre, Inc. stand out as major players driving innovation across different markets. PDD, with its stronghold in China and emerging global presence, and MercadoLibre, dominating Latin America with integrated fintech solutions, both operate in the specialty retail sector. This comparison explores their strategies and market dynamics to help you identify which company might offer the most compelling investment opportunity today.

Table of contents

Companies Overview

I will begin the comparison between PDD Holdings Inc. and MercadoLibre, Inc. by providing an overview of these two companies and their main differences.

PDD Holdings Inc. Overview

PDD Holdings Inc. is a multinational commerce group operating the e-commerce platforms Pinduoduo and Temu. It focuses on integrating businesses and consumers into the digital economy through a diverse product offering that includes agricultural produce, apparel, electronics, and household goods. Founded in 2015 and headquartered in Dublin, Ireland, PDD is positioned as a key player in specialty retail with a market cap of approximately 169B USD.

MercadoLibre, Inc. Overview

MercadoLibre, Inc. operates online commerce platforms primarily serving Latin America, including its marketplace and fintech solutions such as Mercado Pago. The company also offers logistics, advertising, credit, and classified services, supporting a broad e-commerce ecosystem. Established in 1999 and based in Montevideo, Uruguay, MercadoLibre is a major force in specialty retail with a market cap near 110B USD and a workforce exceeding 84K employees.

Key similarities and differences

Both PDD and MercadoLibre operate in the specialty retail sector with a focus on e-commerce platforms, facilitating digital commerce between businesses and consumers. PDD emphasizes a broad product range on platforms like Pinduoduo, while MercadoLibre combines marketplace services with fintech, logistics, and advertising solutions. Although both are NASDAQ-listed, PDD is headquartered in Ireland and has a lower beta, suggesting different market risk profiles compared to Uruguay-based MercadoLibre.

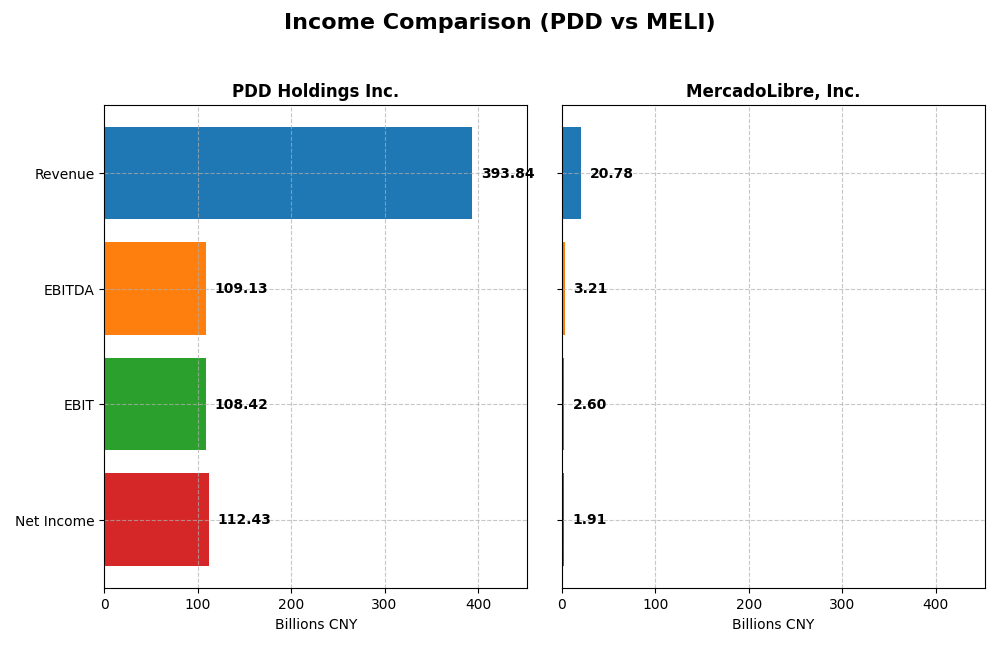

Income Statement Comparison

This table compares key income statement metrics for PDD Holdings Inc. and MercadoLibre, Inc. based on their most recent fiscal year data.

| Metric | PDD Holdings Inc. (CNY) | MercadoLibre, Inc. (USD) |

|---|---|---|

| Market Cap | 169B | 110B |

| Revenue | 394B | 20.8B |

| EBITDA | 109B | 3.2B |

| EBIT | 108B | 2.6B |

| Net Income | 112B | 1.9B |

| EPS | 81.24 | 37.69 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

PDD Holdings Inc.

PDD Holdings has demonstrated strong growth in Revenue and Net Income from 2020 to 2024, with revenue increasing by 562% and net income by 1666%. Margins have remained favorable, with a gross margin of 60.92% and net margin of 28.55% in 2024. The latest year showed accelerated growth, with an 84.7% rise in EBIT and improved net margin, reflecting solid operational efficiency.

MercadoLibre, Inc.

MercadoLibre’s revenue and net income have also grown robustly, with a 423% revenue increase and exceptional net income growth of 191,200% over the period. Margins remain favorable but lower than PDD’s, with a 46.09% gross margin and 9.2% net margin in 2024. The recent fiscal year saw significant profit expansion, including a 50.4% EBIT growth and a near doubling of EPS, signaling enhanced profitability.

Which one has the stronger fundamentals?

Both PDD and MercadoLibre exhibit favorable income statements with strong revenue and profit growth along with improving margins. PDD boasts higher margins and consistent operational leverage, while MercadoLibre shows extraordinary net income growth and improving profitability from a smaller base. The choice between them depends on prioritizing margin strength versus extraordinary growth dynamics.

Financial Ratios Comparison

The table below presents the most recent financial ratios for PDD Holdings Inc. and MercadoLibre, Inc., providing a snapshot of their profitability, liquidity, valuation, leverage, and operational efficiency as of fiscal year 2024.

| Ratios | PDD Holdings Inc. | MercadoLibre, Inc. |

|---|---|---|

| ROE | 35.9% | 43.9% |

| ROIC | 28.4% | 17.7% |

| P/E | 8.7 | 45.1 |

| P/B | 3.13 | 19.8 |

| Current Ratio | 2.21 | 1.21 |

| Quick Ratio | 2.20 | 1.20 |

| D/E (Debt-to-Equity) | 0.034 | 1.57 |

| Debt-to-Assets | 2.1% | 27.2% |

| Interest Coverage | 0 | 17.2 |

| Asset Turnover | 0.78 | 0.82 |

| Fixed Asset Turnover | 66.3 | 8.38 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

PDD Holdings Inc.

PDD Holdings exhibits mostly strong financial ratios in 2024, including a high net margin of 28.55%, ROE at 35.89%, and ROIC at 28.35%, all marked favorable. The company shows excellent liquidity with a current ratio of 2.21 and low debt levels. However, the price-to-book ratio is unfavorable at 3.13. PDD does not pay dividends, likely reinvesting in growth and innovation, reflecting a strategic focus over shareholder payouts.

MercadoLibre, Inc.

MercadoLibre’s ratios for 2024 present a mixed picture; while ROE is very strong at 43.92% and interest coverage is favorable at 16.97, the net margin is moderate at 9.2%, and the PE ratio is quite high at 45.11. Liquidity ratios are average, with a current ratio of 1.21. Like PDD, MercadoLibre does not pay dividends, possibly prioritizing reinvestment and expansion in Latin America’s digital commerce sector.

Which one has the best ratios?

Comparing the two, PDD Holdings demonstrates a more favorable overall ratio profile, with about 79% favorable metrics versus MercadoLibre’s 43%, indicating stronger profitability and balance sheet health. MercadoLibre’s higher leverage and valuation multiples weigh on its ratios. Thus, PDD’s ratios appear more solid and balanced in this 2024 comparison.

Strategic Positioning

This section compares the strategic positioning of PDD Holdings Inc. and MercadoLibre, Inc. regarding market position, key segments, and exposure to technological disruption:

PDD Holdings Inc.

- Strong multinational commerce group with a large market cap and low beta, facing varied competitive pressure in specialty retail.

- Focused on e-commerce platforms like Pinduoduo and Temu, offering diverse products from agriculture to electronics and household goods.

- Operates in digital commerce with emphasis on integrating businesses and people, with no explicit mention of disruption risks.

MercadoLibre, Inc.

- Leading Latin American online commerce platform with substantial market presence and higher beta indicating market sensitivity.

- Diverse platform including marketplace, fintech, logistics, classifieds, and advertising services driving growth.

- Exposure to fintech innovation, logistics integration, and multiple digital services indicating ongoing technological evolution.

PDD Holdings Inc. vs MercadoLibre, Inc. Positioning

PDD pursues a diversified e-commerce portfolio mainly in goods, while MercadoLibre concentrates on combining commerce with fintech and logistics. PDD’s broad product categories contrast with MercadoLibre’s integrated service ecosystem. Both face distinct advantages and challenges given their strategic focus.

Which has the best competitive advantage?

Both companies show a very favorable moat with growing ROIC above WACC, indicating durable competitive advantages. PDD’s moat reflects strong value creation in commerce, while MercadoLibre’s moat benefits from fintech and service integration, each sustaining profitability effectively.

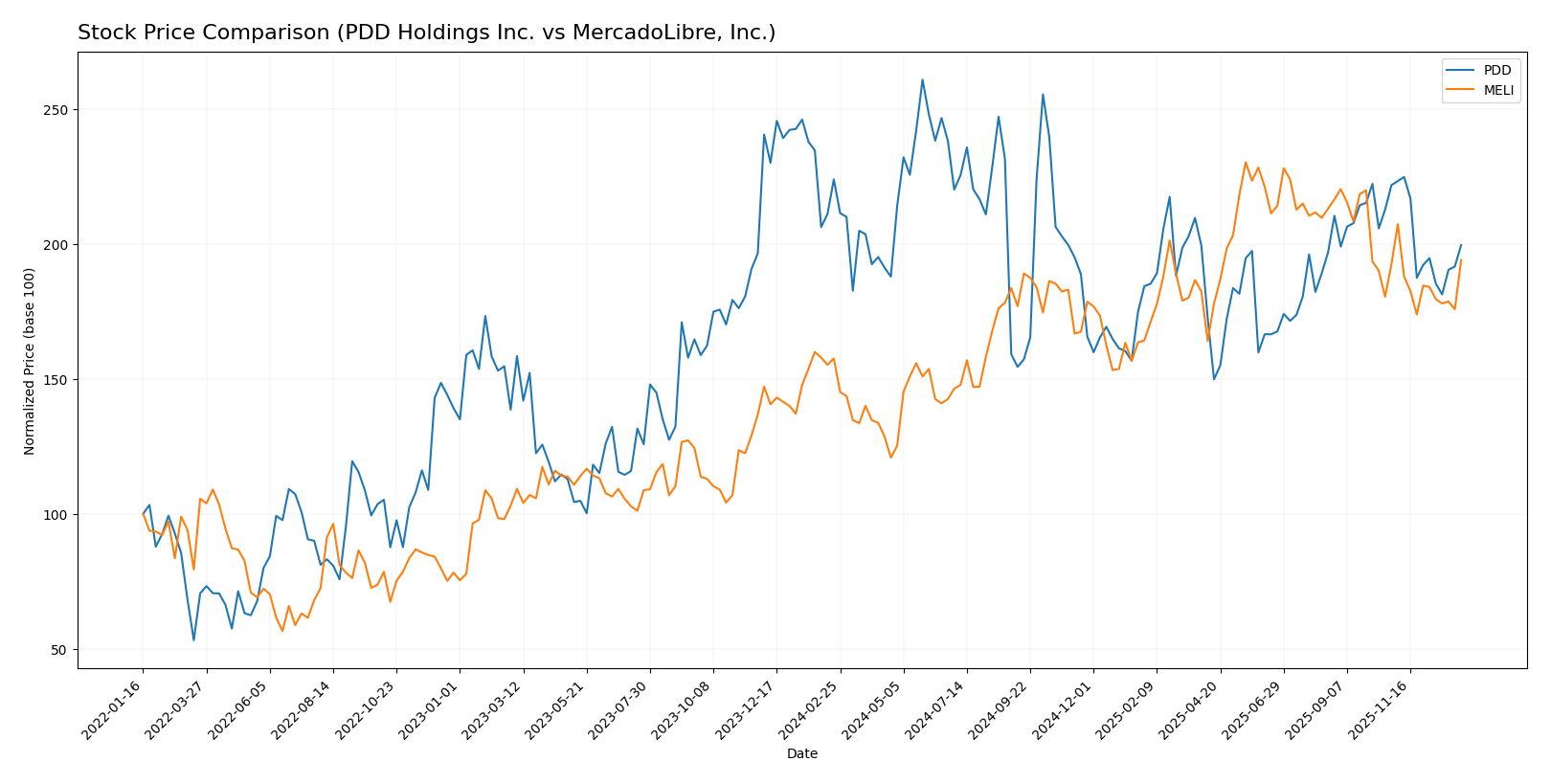

Stock Comparison

The stock price movements over the past year reveal contrasting dynamics between PDD Holdings Inc. and MercadoLibre, Inc., with PDD showing a notable decline while MercadoLibre exhibits substantial growth despite recent deceleration.

Trend Analysis

PDD Holdings Inc. experienced a bearish trend over the past 12 months, with a price decline of -10.88%. The trend shows deceleration, with the highest price at 157.57 and the lowest at 90.5, and a standard deviation of 15.64 indicating moderate volatility.

MercadoLibre, Inc. displayed a bullish trend over the same period, gaining 23.16%. Despite deceleration, the stock reached a high of 2584.92 and a low of 1356.43, with a high standard deviation of 304.85 reflecting significant volatility.

Comparing the two, MercadoLibre delivered the highest market performance with a positive 23.16% price change, while PDD posted a negative return, indicating divergent investor sentiment and market outcomes.

Target Prices

The consensus target prices from verified analysts suggest positive upside potential for both PDD Holdings Inc. and MercadoLibre, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| PDD Holdings Inc. | 170 | 120 | 147.29 |

| MercadoLibre, Inc. | 2900 | 2700 | 2830 |

Analysts expect PDD shares to rise moderately from the current 120.55 USD, while MercadoLibre shows a strong upside from 2178.41 USD, indicating more optimistic growth prospects for MELI.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for PDD Holdings Inc. and MercadoLibre, Inc.:

Rating Comparison

PDD Rating

- Rating: A+, indicating a very favorable overall assessment of financial health.

- Discounted Cash Flow Score: 4, suggesting a favorable valuation based on future cash flows.

- ROE Score: 5, showing very efficient profit generation from shareholders’ equity.

- ROA Score: 5, indicating excellent asset utilization to generate earnings.

- Debt To Equity Score: 5, demonstrating very strong financial stability with low reliance on debt.

- Overall Score: 4, a favorable comprehensive financial performance rating.

MELI Rating

- Rating: B-, also marked as very favorable but lower than PDD’s rating.

- Discounted Cash Flow Score: 3, reflecting a moderate valuation outlook.

- ROE Score: 5, equally very favorable in generating profit for equity holders.

- ROA Score: 4, a favorable but slightly lower asset efficiency than PDD.

- Debt To Equity Score: 1, indicating very unfavorable financial leverage.

- Overall Score: 3, a moderate overall financial performance score.

Which one is the best rated?

Based strictly on the provided data, PDD is better rated overall, with higher scores in discounted cash flow, ROA, debt-to-equity, and overall financial health. MELI matches PDD in ROE but scores significantly lower in financial stability and overall score.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for PDD Holdings Inc. and MercadoLibre, Inc.:

PDD Scores

- Altman Z-Score: 2.84, indicating moderate bankruptcy risk in the grey zone.

- Piotroski Score: 6, showing average financial strength and investment potential.

MELI Scores

- Altman Z-Score: 3.46, indicating low bankruptcy risk in the safe zone.

- Piotroski Score: 4, showing average financial strength and investment potential.

Which company has the best scores?

MercadoLibre has a higher Altman Z-Score in the safe zone, suggesting stronger financial stability than PDD, which is in the grey zone. Both have average Piotroski Scores, with PDD scoring slightly higher at 6 versus 4 for MercadoLibre.

Grades Comparison

Here is a detailed comparison of the recent grades assigned to PDD Holdings Inc. and MercadoLibre, Inc.:

PDD Holdings Inc. Grades

The following table summarizes recent grades from notable grading companies for PDD Holdings Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Freedom Capital Markets | Maintain | Buy | 2026-01-06 |

| B of A Securities | Maintain | Neutral | 2025-11-19 |

| B of A Securities | Maintain | Neutral | 2025-08-26 |

| Barclays | Maintain | Overweight | 2025-08-26 |

| Benchmark | Maintain | Buy | 2025-08-26 |

| New Street Research | Downgrade | Neutral | 2025-08-26 |

| China Renaissance | Downgrade | Hold | 2025-05-28 |

| Benchmark | Maintain | Buy | 2025-05-28 |

| JP Morgan | Maintain | Neutral | 2025-05-28 |

| Jefferies | Maintain | Buy | 2025-05-27 |

Overall, PDD’s grades show a majority of Buy and Neutral ratings, with occasional downgrades to Hold or Neutral, indicating a cautiously optimistic consensus.

MercadoLibre, Inc. Grades

The following table presents recent grades from verifiable grading companies for MercadoLibre, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wedbush | Maintain | Outperform | 2025-12-19 |

| BTIG | Maintain | Buy | 2025-12-04 |

| UBS | Maintain | Buy | 2025-11-24 |

| BTIG | Maintain | Buy | 2025-11-14 |

| JP Morgan | Maintain | Neutral | 2025-11-03 |

| Morgan Stanley | Maintain | Overweight | 2025-11-03 |

| Barclays | Maintain | Overweight | 2025-10-30 |

| Benchmark | Maintain | Buy | 2025-10-30 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-10-30 |

| Barclays | Maintain | Overweight | 2025-10-21 |

MercadoLibre’s grades consistently show strong Buy, Outperform, and Overweight ratings, reflecting a positive sentiment from analysts.

Which company has the best grades?

MercadoLibre, Inc. has received comparatively stronger grades, with several Outperform and Overweight ratings, versus PDD Holdings Inc.’s more mixed Buy and Neutral evaluations. This difference suggests that MercadoLibre is viewed more favorably by analysts, which could influence investor confidence and portfolio considerations.

Strengths and Weaknesses

Below is a comparison table highlighting the key strengths and weaknesses of PDD Holdings Inc. and MercadoLibre, Inc. based on the latest financial and operational data.

| Criterion | PDD Holdings Inc. | MercadoLibre, Inc. |

|---|---|---|

| Diversification | Strong diversification with balanced revenue streams from online marketing (198B CNY) and transaction services (196B CNY) | Focused on commerce and fintech services, with service revenue (18.6B USD) dominating product sales (2.1B USD) |

| Profitability | High net margin at 28.55%, ROE 35.89%, ROIC 28.35%, indicating excellent profitability and value creation | Moderate net margin of 9.2%, strong ROE of 43.92% and ROIC of 17.73%, profitable but with lower margin efficiency |

| Innovation | Demonstrates strong operational efficiency with a very favorable economic moat and growing ROIC trend (+333%) | Very favorable moat and extremely high ROIC growth (+39,297%), reflecting rapid innovation and competitive edge |

| Global presence | Primarily China-focused, limiting geographic diversification | Strong presence across Latin America, leveraging regional growth opportunities |

| Market Share | Large scale in domestic market with growing transaction volume and online marketing dominance | Leading e-commerce and fintech player in Latin America, with expanding market penetration |

Key takeaways: PDD Holdings shows robust profitability and balanced revenue sources with strong operational efficiency in China, while MercadoLibre leverages innovation and regional dominance in Latin America, though with slightly lower margins. Both companies demonstrate durable competitive advantages but differ in geographic focus and diversification.

Risk Analysis

The following table compares key risks faced by PDD Holdings Inc. and MercadoLibre, Inc. based on the latest available data from 2024-2026.

| Metric | PDD Holdings Inc. | MercadoLibre, Inc. |

|---|---|---|

| Market Risk | Low beta (0.006) indicates low volatility; sensitive to Chinese e-commerce market conditions. | High beta (1.421) suggests higher volatility; exposure to Latin American markets with economic fluctuations. |

| Debt level | Very low debt-to-equity (0.03) and debt-to-assets (2.1%) ratios, indicating low financial risk. | Higher debt-to-equity ratio (1.57) but moderate debt-to-assets (27.19%); increased leverage risk. |

| Regulatory Risk | Moderate, due to operating in China and global trade tensions impacting cross-border e-commerce. | Significant, with regulatory scrutiny in multiple Latin American countries affecting fintech and commerce segments. |

| Operational Risk | Moderate, reliant on platform growth and logistics efficiency; rapid innovation required. | High, given complex logistics and financial services integration across diverse markets. |

| Environmental Risk | Low to moderate; no major direct environmental liabilities but supply chain sustainability is a concern. | Moderate; logistics operations have environmental impacts, with increasing pressure for greener solutions. |

| Geopolitical Risk | Elevated, due to China-US relations influencing trade and technology access. | Moderate, linked to political instability and currency volatility in Latin America. |

In synthesis, MercadoLibre faces more impactful risks related to high leverage, regulatory complexity, and operational challenges in volatile Latin American markets. PDD Holdings benefits from low debt and market risk but must navigate geopolitical tensions and regulatory scrutiny in China. Investors should weigh these factors carefully in their risk management strategies.

Which Stock to Choose?

PDD Holdings Inc. shows a strong income evolution with 59% revenue growth in the last year and favorable profitability metrics including a 28.55% net margin. Its financial ratios are mostly very favorable, supported by low debt levels and a robust A+ rating. The company exhibits a durable competitive advantage, with a very favorable moat due to a high ROIC exceeding WACC by over 23%.

MercadoLibre, Inc. has steady income growth of 37.53% in the past year and a positive net margin of 9.2%. Its financial ratios are mixed, with favorable returns but higher debt and less attractive valuation multiples, reflected in a B- rating. The company also demonstrates a very favorable moat with a growing ROIC above its WACC, supporting its competitive position.

Investors prioritizing value and financial stability might find PDD’s strong profitability, low leverage, and very favorable rating appealing, while those seeking growth with tolerance for higher debt could see potential in MercadoLibre’s sustained income growth and competitive moat. The choice depends on the investor’s risk profile and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of PDD Holdings Inc. and MercadoLibre, Inc. to enhance your investment decisions: