MercadoLibre, Inc. and eBay Inc. are two prominent players in the specialty retail sector, both operating dynamic online marketplaces that connect buyers and sellers globally. MercadoLibre focuses on Latin America with a strong fintech integration, while eBay maintains a broad international presence with a diverse user base. Their overlapping market strategies and innovation in e-commerce make this comparison timely. Let’s explore which company offers the most compelling investment opportunity for you.

Table of contents

Companies Overview

I will begin the comparison between MercadoLibre and eBay by providing an overview of these two companies and their main differences.

MercadoLibre Overview

MercadoLibre, Inc. operates online commerce platforms across Latin America, offering a marketplace that connects businesses and individuals for buying and selling merchandise. The company also provides financial technology services through Mercado Pago, logistics solutions with Mercado Envios, and additional services such as classifieds, advertising, and storefront management. Headquartered in Montevideo, Uruguay, MercadoLibre employs over 84K people and holds a market cap of $110B.

eBay Overview

eBay Inc. manages marketplace platforms that facilitate transactions between buyers and sellers globally, primarily through its flagship site ebay.com and mobile apps. The company supports a diverse range of commerce participants, including retailers and auctioneers, enabling listings, sales, and payments across multiple channels. Founded in 1995 and based in San Jose, California, eBay has around 11.5K employees and a market cap of $41B.

Key similarities and differences

Both MercadoLibre and eBay operate in the specialty retail sector with marketplace business models that connect buyers and sellers online. However, MercadoLibre has a broader scope in Latin America, integrating fintech, logistics, and advertising services, while eBay focuses on its core marketplace platforms with a global reach. MercadoLibre’s workforce and market capitalization are significantly larger, reflecting its expansive service offerings and regional dominance.

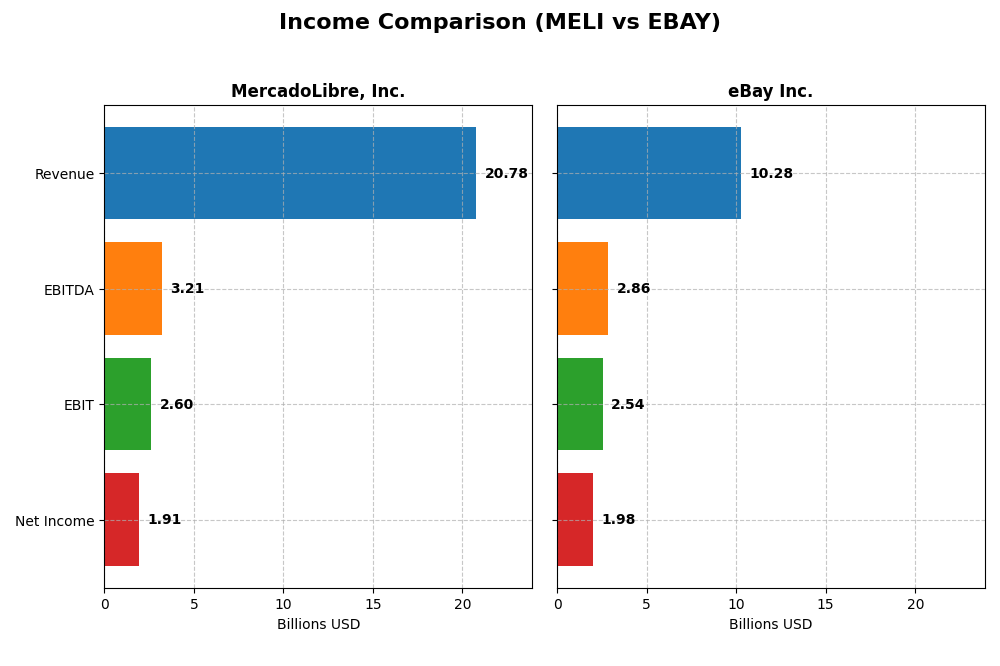

Income Statement Comparison

The following table compares the key income statement metrics for MercadoLibre, Inc. and eBay Inc. for the fiscal year 2024, providing a snapshot of their financial performance.

| Metric | MercadoLibre, Inc. | eBay Inc. |

|---|---|---|

| Market Cap | 110.4B | 41.1B |

| Revenue | 20.8B | 10.3B |

| EBITDA | 3.2B | 2.9B |

| EBIT | 2.6B | 2.5B |

| Net Income | 1.9B | 2.0B |

| EPS | 37.69 | 3.98 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

MercadoLibre, Inc.

MercadoLibre’s revenue and net income have shown strong upward trends from 2020 to 2024, with revenue growing from $3.97B to $20.78B, and net income surging from a slight loss to $1.91B. Margins have improved substantially, with gross margin at 46.09% and net margin at 9.2% in 2024. The latest year saw robust growth in revenue (+37.5%) and net income (+40.8%), reflecting operational strength and margin expansion.

eBay Inc.

eBay’s revenue increased moderately from $8.89B in 2020 to $10.28B in 2024, but net income declined significantly, from $5.67B to $1.98B over the same period. Margins remain favorable with a gross margin near 72% and net margin at 19.21% in 2024, though recent growth slowed, showing a 1.7% revenue increase and net income contraction (-29.8%) in the last year, signaling some pressure on profitability.

Which one has the stronger fundamentals?

MercadoLibre demonstrates stronger fundamentals, supported by consistent high growth in revenue and net income, along with improving margins and favorable operating leverage. In contrast, eBay’s growth has plateaued with declining net income and margins, despite maintaining high absolute profitability. Overall, MercadoLibre’s income statement exhibits a more favorable trajectory over the analyzed period.

Financial Ratios Comparison

Below is a comparison of key financial ratios for MercadoLibre, Inc. (MELI) and eBay Inc. (EBAY) based on their most recent fiscal year 2024 data.

| Ratios | MercadoLibre, Inc. (MELI) | eBay Inc. (EBAY) |

|---|---|---|

| ROE | 43.9% | 38.3% |

| ROIC | 17.7% | 13.4% |

| P/E | 45.1 | 15.6 |

| P/B | 19.8 | 6.0 |

| Current Ratio | 1.21 | 1.24 |

| Quick Ratio | 1.20 | 1.24 |

| D/E (Debt-to-Equity) | 1.57 | 1.52 |

| Debt-to-Assets | 27.2% | 40.6% |

| Interest Coverage | 17.2 | 8.95 |

| Asset Turnover | 0.82 | 0.53 |

| Fixed Asset Turnover | 8.38 | 6.08 |

| Payout ratio | 0% | 27.0% |

| Dividend yield | 0% | 1.73% |

Interpretation of the Ratios

MercadoLibre, Inc.

MercadoLibre shows a mix of favorable and unfavorable ratios, with strong returns on equity (43.92%) and invested capital (17.73%), indicating efficient use of capital. However, high price-to-earnings (45.11) and price-to-book (19.81) ratios suggest valuation concerns. The company does not pay dividends, likely due to reinvestment in growth and innovation, prioritizing expansion over shareholder payouts.

eBay Inc.

eBay presents mostly favorable profitability ratios, including a solid net margin of 19.21% and return on equity of 38.29%, with a more moderate price-to-earnings ratio of 15.56. The dividend yield of 1.73% is supported by stable earnings, but some ratios like debt-to-equity (1.52) are less favorable. eBay maintains a dividend policy, balancing shareholder returns with operational stability.

Which one has the best ratios?

Both MercadoLibre and eBay exhibit slightly favorable overall ratio profiles with strengths in profitability and capital efficiency. MercadoLibre’s higher valuation metrics and leverage concerns contrast with eBay’s steadier dividend yield and more moderate valuation. The choice depends on investor preference for growth versus income stability, as neither company overwhelmingly outperforms the other in all key ratios.

Strategic Positioning

This section compares the strategic positioning of MercadoLibre and eBay, focusing on Market position, Key segments, and exposure to disruption:

MercadoLibre, Inc.

- Leading Latin America online commerce platform, facing regional competition and market expansion challenges.

- Diverse segments including commerce, fintech, logistics, advertising, and digital storefronts driving growth.

- Exposure through fintech innovations and logistics services enhancing platform efficiency and user experience.

eBay Inc.

- Established US and international marketplace platform with broad buyer-seller network under competitive pressure.

- Primarily marketplace and advertising revenues, focusing on buyer-seller connections and payment services.

- Exposure mainly via marketplace platform and payment services integration, adapting to mobile and offline channels.

MercadoLibre vs eBay Positioning

MercadoLibre adopts a diversified approach with commerce, fintech, logistics, and advertising, supporting varied revenue streams. eBay remains more concentrated on marketplace and advertising, emphasizing buyer-seller interactions but less diversified in financial services.

Which has the best competitive advantage?

Both companies demonstrate a very favorable moat with growing ROIC above WACC, indicating durable competitive advantages; MercadoLibre shows a higher ROIC spread and growth, suggesting stronger value creation efficiency.

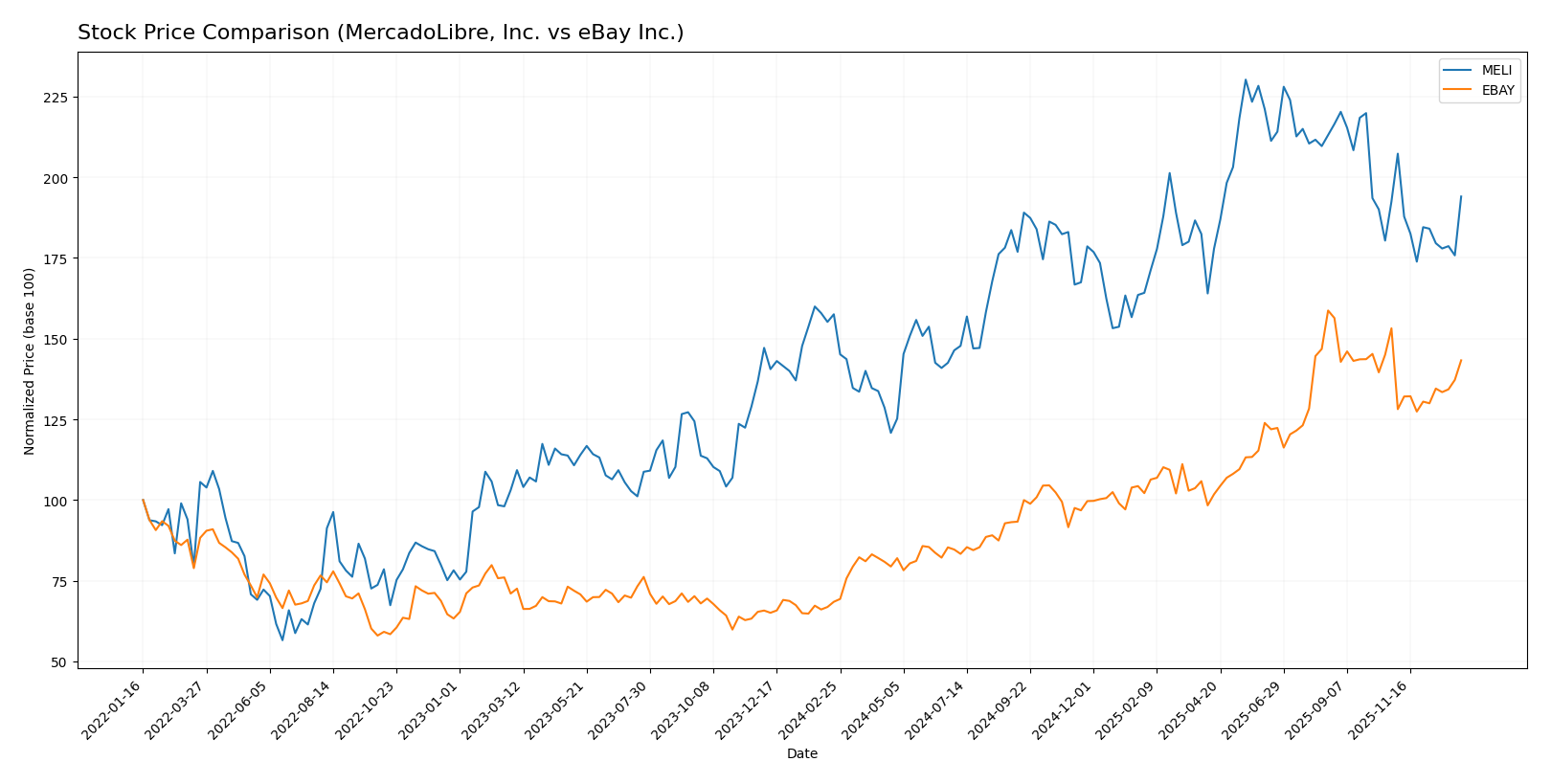

Stock Comparison

The stock price chart highlights significant bullish trends for both MercadoLibre, Inc. and eBay Inc. over the past 12 months, with notable price increases and evolving trading volumes shaping their market dynamics.

Trend Analysis

MercadoLibre, Inc. (MELI) experienced a 23.16% price increase over the past year, indicating a bullish trend with deceleration. The stock showed a high volatility (std deviation 304.85) and ranged between 1356.43 and 2584.92.

eBay Inc. (EBAY) recorded a 109.23% rise over the same period, also bullish but decelerating. Its volatility was lower (std deviation 14.19), with prices fluctuating from 43.45 to 100.7.

Comparing both, eBay delivered the highest market performance with a 109.23% gain, outperforming MercadoLibre’s 23.16% increase over the last 12 months.

Target Prices

Analysts present a clear target price consensus for MercadoLibre, Inc. and eBay Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| MercadoLibre, Inc. | 2900 | 2700 | 2830 |

| eBay Inc. | 115 | 65 | 96.69 |

The consensus target prices imply upside potential for both stocks compared to their current prices: MercadoLibre trades at 2178.41 USD, well below its 2830 USD consensus, while eBay’s current price of 90.91 USD sits slightly below its 96.69 USD consensus. This suggests moderate optimism from analysts on both equities.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for MercadoLibre, Inc. and eBay Inc.:

Rating Comparison

MELI Rating

- Rating: B- rated as Very Favorable overall.

- Discounted Cash Flow Score: 3, indicating moderate valuation based on cash flow.

- ROE Score: 5, considered very favorable for profitability from equity.

- ROA Score: 4, favorable in asset utilization efficiency.

- Debt To Equity Score: 1, very unfavorable indicating high financial risk.

- Overall Score: 3, moderate across key financial metrics.

EBAY Rating

- Rating: B+ rated as Very Favorable overall.

- Discounted Cash Flow Score: 3, indicating moderate valuation based on cash flow.

- ROE Score: 5, considered very favorable for profitability from equity.

- ROA Score: 5, very favorable in asset utilization efficiency.

- Debt To Equity Score: 1, very unfavorable indicating high financial risk.

- Overall Score: 3, moderate across key financial metrics.

Which one is the best rated?

Based on the provided data, eBay holds a higher rating (B+) compared to MercadoLibre’s B-. Both share the same overall and DCF scores, but eBay has a better ROA score, enhancing its financial efficiency rating.

Scores Comparison

Here is a comparison of MercadoLibre and eBay scores based on Altman Z-Score and Piotroski Score:

MercadoLibre Scores

- Altman Z-Score: 3.46, indicating a safe financial zone.

- Piotroski Score: 4, reflecting average financial strength.

eBay Scores

- Altman Z-Score: 5.84, indicating a safe financial zone.

- Piotroski Score: 6, reflecting average financial strength.

Which company has the best scores?

eBay shows a higher Altman Z-Score and Piotroski Score than MercadoLibre, indicating stronger financial stability and health based on this data.

Grades Comparison

The following presents a comparison of recent grades assigned to MercadoLibre, Inc. and eBay Inc.:

MercadoLibre, Inc. Grades

This table summarizes recent grades from established financial institutions for MercadoLibre, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wedbush | Maintain | Outperform | 2025-12-19 |

| BTIG | Maintain | Buy | 2025-12-04 |

| UBS | Maintain | Buy | 2025-11-24 |

| BTIG | Maintain | Buy | 2025-11-14 |

| JP Morgan | Maintain | Neutral | 2025-11-03 |

| Morgan Stanley | Maintain | Overweight | 2025-11-03 |

| Barclays | Maintain | Overweight | 2025-10-30 |

| Benchmark | Maintain | Buy | 2025-10-30 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-10-30 |

| Barclays | Maintain | Overweight | 2025-10-21 |

MercadoLibre’s grades mainly range from Buy to Outperform, indicating a generally positive consensus with no recent downgrades.

eBay Inc. Grades

Below are the most recent grades from recognized grading firms for eBay Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-08 |

| Truist Securities | Maintain | Hold | 2025-11-03 |

| Piper Sandler | Maintain | Overweight | 2025-10-30 |

| Barclays | Maintain | Overweight | 2025-10-30 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-30 |

| Benchmark | Maintain | Buy | 2025-10-30 |

| UBS | Maintain | Neutral | 2025-10-30 |

| Needham | Maintain | Buy | 2025-10-30 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-30 |

| Evercore ISI Group | Maintain | In Line | 2025-10-30 |

eBay’s grades show a wider range from Hold/Neutral to Buy/Overweight, reflecting a more mixed analyst outlook.

Which company has the best grades?

MercadoLibre generally receives stronger grades, mostly Buy to Outperform, while eBay’s grades are more mixed, centered around Hold to Buy. This suggests MercadoLibre is viewed more favorably, potentially implying higher growth expectations, whereas eBay’s varied ratings indicate more cautious investor sentiment.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for MercadoLibre, Inc. (MELI) and eBay Inc. (EBAY) based on the most recent data and financial metrics:

| Criterion | MercadoLibre, Inc. (MELI) | eBay Inc. (EBAY) |

|---|---|---|

| Diversification | Strong with expanding product and service lines; significant growth in fintech and commerce segments | Moderate; mainly marketplaces with growing advertising revenues |

| Profitability | ROIC 17.73% (favorable), Net margin 9.2% (neutral); high ROE 43.92% | ROIC 13.39% (favorable), Net margin 19.21% (favorable); ROE 38.29% |

| Innovation | Very favorable economic moat with rapidly growing ROIC, indicating durable competitive advantage | Also very favorable moat with growing ROIC but less aggressive growth compared to MELI |

| Global presence | Strong presence in Latin America with rapid expansion in e-commerce and fintech services | Established global player with strong marketplace footprint, less fintech exposure |

| Market Share | Growing market share in Latin America; service revenues at $18.6B in 2024 | Large marketplace with $8.6B revenue in marketplaces and $1.6B in advertising |

Key takeaways: MercadoLibre shows stronger growth and diversification, particularly in fintech, with a very favorable moat and profitability metrics. eBay remains profitable with a solid global presence but has a narrower service scope and slower ROIC growth. Both companies have durable competitive advantages, but MercadoLibre’s innovation and expansion offer higher growth potential balanced with some valuation caution.

Risk Analysis

Below is a comparison table of key risks faced by MercadoLibre, Inc. (MELI) and eBay Inc. (EBAY) based on their latest 2024 financial and market data:

| Metric | MercadoLibre, Inc. (MELI) | eBay Inc. (EBAY) |

|---|---|---|

| Market Risk | High beta 1.42, volatile Latin American markets | High beta 1.35, US market exposure |

| Debt level | DE ratio 1.57 (unfavorable), interest coverage strong | DE ratio 1.52 (unfavorable), moderate interest coverage |

| Regulatory Risk | Moderate, Latin America fintech regulations evolving | Moderate, US and international e-commerce regulations |

| Operational Risk | High due to logistics complexity in LATAM | Moderate, platform stability and competition |

| Environmental Risk | Low, limited direct impact | Low, primarily digital operations |

| Geopolitical Risk | Elevated, Latin American political instability | Moderate, global trade tensions impact |

The most likely and impactful risks are MercadoLibre’s exposure to volatile Latin American markets and geopolitical instability, which could affect growth and operations. eBay faces regulatory and competitive pressures but benefits from a more stable US base. Both companies carry significant debt levels, requiring careful monitoring.

Which Stock to Choose?

MercadoLibre, Inc. (MELI) shows a strong income evolution with a 37.53% revenue growth in 2024 and favorable profitability metrics, including a 9.2% net margin and a 43.92% ROE. Its debt profile is mixed, with a high debt-to-equity ratio but a favorable debt-to-assets ratio, and it holds a very favorable B- rating.

eBay Inc. (EBAY) presents stable income with a small 1.69% revenue growth in 2024, a solid 19.21% net margin, and a 38.29% ROE. Despite a moderate debt-to-equity ratio and neutral debt-to-assets status, it maintains a very favorable B+ rating, supported by strong profitability and liquidity ratios.

Considering ratings and financials, MELI’s high growth and very favorable moat with increasing ROIC suggest appeal for growth-oriented investors, while EBAY’s stable profitability, favorable rating, and lower volatility might be more attractive for risk-averse investors seeking quality and income stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of MercadoLibre, Inc. and eBay Inc. to enhance your investment decisions: