Medtronic plc and STERIS plc are two prominent players in the medical devices industry, both headquartered in Ireland and listed on the NYSE. While Medtronic focuses on device-based therapies across cardiovascular, surgical, neuroscience, and diabetes segments, STERIS specializes in infection prevention and procedural products with strong sterilization and healthcare services. This comparison will help investors identify which company offers the most compelling investment opportunity in this vital healthcare sector.

Table of contents

Companies Overview

I will begin the comparison between Medtronic plc and STERIS plc by providing an overview of these two companies and their main differences.

Medtronic Overview

Medtronic plc is a leading player in the medical devices sector, focused on developing, manufacturing, and selling device-based medical therapies worldwide. Its broad portfolio includes cardiovascular, medical surgical, neuroscience, and diabetes products. Founded in 1949 and headquartered in Dublin, Ireland, Medtronic serves a global customer base including healthcare systems and clinicians with advanced technology solutions.

STERIS Overview

STERIS plc specializes in infection prevention and procedural products and services, operating through four segments: Healthcare, Applied Sterilization Technologies, Life Sciences, and Dental. Founded in 1985 and also based in Dublin, Ireland, it provides a comprehensive range of cleaning chemistries, sterilizers, surgical equipment, and maintenance services primarily to hospitals and pharmaceutical manufacturers worldwide.

Key similarities and differences

Both Medtronic and STERIS operate in the medical devices industry and are headquartered in Ireland, serving global healthcare markets. Medtronic’s business focuses on implantable devices and surgical technologies, while STERIS emphasizes infection prevention, sterilization, and procedural support products. Medtronic has a significantly larger workforce and market capitalization, reflecting its broader product range and market reach compared to STERIS’s more specialized offerings.

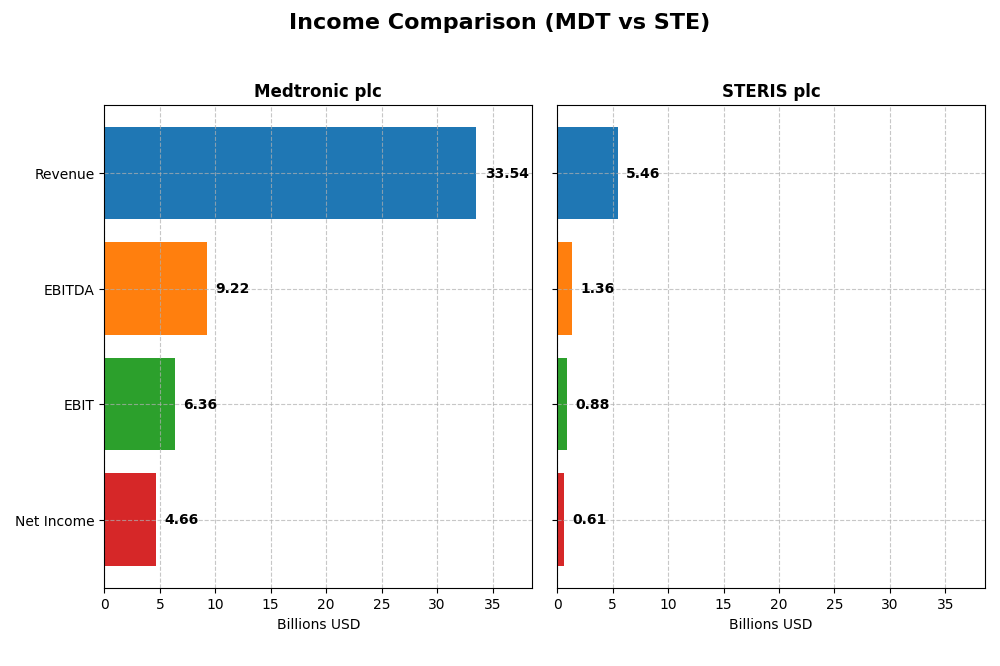

Income Statement Comparison

The table below compares key income statement metrics for Medtronic plc and STERIS plc for their most recent fiscal year, providing a snapshot of their financial performance.

| Metric | Medtronic plc (MDT) | STERIS plc (STE) |

|---|---|---|

| Market Cap | 125B | 25B |

| Revenue | 33.5B | 5.46B |

| EBITDA | 9.22B | 1.36B |

| EBIT | 6.36B | 882M |

| Net Income | 4.66B | 615M |

| EPS | 3.63 | 6.24 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Medtronic plc

Medtronic’s revenue increased steadily from 30.1B in 2021 to 33.5B in 2025, with net income growing from 3.6B to 4.7B. Margins remained stable and favorable, with a gross margin of 65.3% and a net margin of 13.9% in 2025. The recent year showed moderate revenue growth at 3.6%, alongside strong EBIT and net margin improvements, reflecting operational efficiency gains.

STERIS plc

STERIS experienced significant revenue growth from 3.1B in 2021 to 5.5B in 2025, and net income rose from 397M to 615M. Its margins are favorable but lower than Medtronic’s, with a 44.0% gross margin and 11.3% net margin in 2025. The latest year showed moderate revenue growth at 6.2%, but operating expenses grew unfavorably, offsetting some margin benefits despite strong EPS and net margin expansion.

Which one has the stronger fundamentals?

Medtronic demonstrates stronger fundamentals with more stable and higher margins, consistent net income growth, and favorable expense management. STERIS shows impressive revenue growth but faces challenges with operating expense increases and a declining net margin over the period. Both companies have favorable income statements overall, yet Medtronic’s margin quality and profitability metrics appear more robust.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Medtronic plc (MDT) and STERIS plc (STE) for the most recent fiscal year 2025, reflecting their profitability, liquidity, leverage, efficiency, and dividend metrics.

| Ratios | Medtronic plc (MDT) | STERIS plc (STE) |

|---|---|---|

| ROE | 9.7% | 9.3% |

| ROIC | 6.1% | 7.2% |

| P/E | 23.4 | 36.3 |

| P/B | 2.27 | 3.38 |

| Current Ratio | 1.85 | 1.96 |

| Quick Ratio | 1.42 | 1.39 |

| D/E (Debt-to-Equity) | 0.59 | 0.33 |

| Debt-to-Assets | 31.1% | 21.7% |

| Interest Coverage | 8.2 | 10.0 |

| Asset Turnover | 0.37 | 0.54 |

| Fixed Asset Turnover | 4.91 | 2.58 |

| Payout Ratio | 77.0% | 35.8% |

| Dividend Yield | 3.29% | 0.98% |

Interpretation of the Ratios

Medtronic plc

Medtronic shows a mix of strong and moderate financial ratios, with favorable net margin (13.9%) and interest coverage (8.72), indicating good profitability and ability to service debt. However, return on equity (9.71%) and asset turnover (0.37) are less impressive, suggesting efficiency concerns. The company offers a solid dividend yield of 3.29%, well-covered by free cash flow, supporting stable shareholder returns.

STERIS plc

STERIS demonstrates favorable liquidity and debt ratios, including a current ratio of 1.96 and debt-to-assets of 21.7%, reflecting a conservative balance sheet. Its net margin (11.26%) is decent, though return on equity (9.31%) and price multiples are less attractive. The dividend yield is low at 0.98%, which may reflect a cautious payout policy or reinvestment focus, with shareholder returns more modest.

Which one has the best ratios?

Both companies show slightly favorable global ratio evaluations, but Medtronic’s stronger profitability and dividend yield contrast with STERIS’s more conservative leverage and liquidity profile. Medtronic’s higher proportion of favorable ratios and better coverage of shareholder returns present a more balanced financial stance, while STERIS’s higher unfavorable ratio percentage highlights some valuation and efficiency challenges.

Strategic Positioning

This section compares the strategic positioning of Medtronic plc (MDT) and STERIS plc (STE) focusing on Market position, Key segments, and exposure to technological disruption:

Medtronic plc

- Leading global medical devices company with significant market cap and moderate competitive pressure.

- Diversified portfolio across cardiac, neuroscience, diabetes, and surgical segments driving revenue growth.

- Exposure to technological advances in robotic surgery, remote monitoring, and digital health solutions.

STERIS plc

- Mid-sized medical devices and services provider facing moderate competitive pressure in niche sterilization markets.

- Focused on infection prevention, sterilization, healthcare, life sciences, and dental segments with balanced product and service revenue.

- Moderate exposure to technology via automated sterilization and equipment management services in healthcare settings.

Medtronic plc vs STERIS plc Positioning

MDT has a diversified multi-segment approach emphasizing advanced device-based therapies, offering broad exposure across healthcare specialties. STE concentrates on infection prevention and sterilization services, combining products and services but with narrower segment focus, which may affect scalability.

Which has the best competitive advantage?

Both companies show slightly unfavorable MOAT status with value destruction but improving profitability. MDT’s larger scale and technology investments suggest a potentially stronger competitive position despite current challenges.

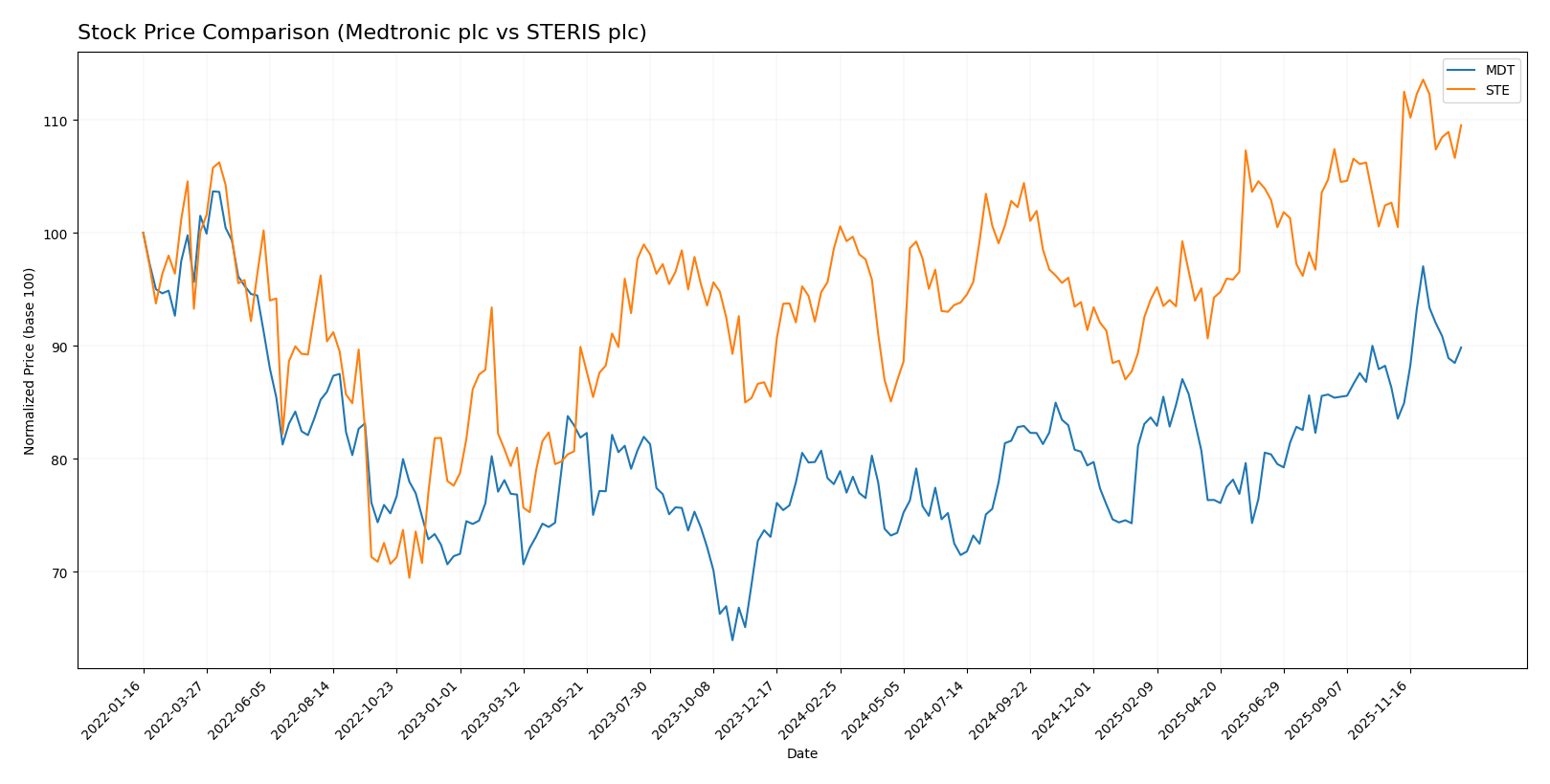

Stock Comparison

The stock price movements of Medtronic plc and STERIS plc over the past 12 months reveal clear bullish trends with accelerating momentum, marked by notable price appreciations and distinct trading volume dynamics.

Trend Analysis

Medtronic plc’s stock price increased by 15.53% over the past year, showing a bullish trend with accelerating momentum. The price fluctuated between 77.61 and 105.33, supported by moderate volatility (std deviation 5.91).

STERIS plc’s stock price rose by 11.07% over the same period, also demonstrating a bullish trend with acceleration. Its price ranged from 199.51 to 266.28, with higher volatility (std deviation 14.87) compared to Medtronic.

Comparing both, Medtronic delivered the highest market performance with a 15.53% gain versus STERIS’s 11.07%, despite STERIS showing greater price volatility and buyer dominance in recent trading.

Target Prices

The consensus target prices from recognized analysts indicate positive upside potential for both Medtronic plc and STERIS plc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Medtronic plc | 120 | 103 | 111.67 |

| STERIS plc | 265 | 245 | 256.67 |

Analysts expect Medtronic’s stock to appreciate from the current price of $97.53 to an average target near $111.67, while STERIS is expected to hold steady around its current $256.82 price, reflecting moderate upside potential.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Medtronic plc and STERIS plc:

Rating Comparison

MDT Rating

- Rating: B, status Very Favorable

- Discounted Cash Flow Score: 4, status Favorable

- ROE Score: 3, status Moderate

- ROA Score: 4, status Favorable

- Debt To Equity Score: 1, status Very Unfavorable

- Overall Score: 3, status Moderate

STE Rating

- Rating: B, status Very Favorable

- Discounted Cash Flow Score: 4, status Favorable

- ROE Score: 3, status Moderate

- ROA Score: 4, status Favorable

- Debt To Equity Score: 2, status Moderate

- Overall Score: 3, status Moderate

Which one is the best rated?

Both Medtronic and STERIS share the same overall rating of B and identical scores for DCF, ROE, ROA, and overall score. However, STERIS has a better debt-to-equity score, indicating relatively lower financial risk compared to Medtronic.

Scores Comparison

Here is a comparison of the financial health scores for Medtronic plc and STERIS plc:

MDT Scores

- Altman Z-Score of 3.20, indicating a safe zone from bankruptcy risk.

- Piotroski Score of 7, reflecting a strong financial condition.

STE Scores

- Altman Z-Score of 5.91, indicating a safe zone from bankruptcy risk.

- Piotroski Score of 8, reflecting a very strong financial condition.

Which company has the best scores?

STERIS plc has higher scores in both Altman Z-Score and Piotroski Score compared to Medtronic plc, suggesting comparatively stronger financial health based on the provided data.

Grades Comparison

The following presents the most recent and reliable grades for Medtronic plc and STERIS plc:

Medtronic plc Grades

This table summarizes recent grades and actions by reputable grading companies for Medtronic plc:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | Maintain | Outperform | 2026-01-09 |

| Barclays | Maintain | Overweight | 2026-01-08 |

| William Blair | Upgrade | Outperform | 2026-01-06 |

| Truist Securities | Maintain | Hold | 2025-12-18 |

| Truist Securities | Maintain | Hold | 2025-11-20 |

| Barclays | Maintain | Overweight | 2025-11-20 |

| UBS | Maintain | Neutral | 2025-11-19 |

| Morgan Stanley | Maintain | Overweight | 2025-11-19 |

| Goldman Sachs | Upgrade | Neutral | 2025-11-19 |

| Wells Fargo | Maintain | Overweight | 2025-11-19 |

Medtronic’s grades show a positive trend with multiple upgrades and consistent overweight or outperform ratings, indicating analyst confidence.

STERIS plc Grades

The table below details recent grades and actions by reputable grading firms for STERIS plc:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2025-08-08 |

| Keybanc | Maintain | Overweight | 2025-07-22 |

| Morgan Stanley | Upgrade | Overweight | 2025-07-15 |

| Morgan Stanley | Maintain | Equal Weight | 2025-05-19 |

| JMP Securities | Maintain | Market Outperform | 2025-05-16 |

| Stephens & Co. | Maintain | Overweight | 2025-05-15 |

| Morgan Stanley | Maintain | Equal Weight | 2025-05-12 |

| JMP Securities | Maintain | Market Outperform | 2025-04-10 |

| Needham | Maintain | Hold | 2025-04-07 |

| JMP Securities | Maintain | Market Outperform | 2025-02-06 |

STERIS maintains predominantly overweight and market outperform ratings, with stable grades and few changes, showing steady analyst sentiment.

Which company has the best grades?

Medtronic plc has received more frequent upgrades and consistently strong ratings such as Outperform and Overweight compared to STERIS plc’s stable but less frequently upgraded grades. This difference may influence investors seeking growth potential reflected by analyst optimism.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of Medtronic plc (MDT) and STERIS plc (STE) based on recent financial and market data.

| Criterion | Medtronic plc (MDT) | STERIS plc (STE) |

|---|---|---|

| Diversification | Highly diversified with four strong segments: Cardiac & Vascular (12.5B), Neuroscience (9.8B), Medical Surgical (8.4B), Diabetes (2.8B) | Moderate diversification: Product (2.9B) and Service (2.6B) segments |

| Profitability | Net margin 13.9% (favorable), ROIC 6.08% (neutral), but ROIC < WACC indicating slight value destruction | Net margin 11.3% (favorable), ROIC 7.17% (neutral), also ROIC < WACC, slight value destruction |

| Innovation | Strong, reflected in growing ROIC trend (+23%) and significant investment across segments | Moderate innovation, ROIC trend growing but slower (+2.6%), focus on products and services |

| Global presence | Extensive global footprint with strong market share in medical devices | Solid presence in infection prevention and surgical products, but smaller scale |

| Market Share | Leading in multiple medical device categories, large revenue base (35B+ total) | Smaller scale market share, revenue approx. 5.3B, growing steadily |

Key takeaways: Both companies show growing profitability trends but currently operate with ROIC below their WACC, indicating slight value destruction. MDT’s broad diversification and large scale provide resilience and innovation capacity, while STE’s focused product-service approach supports steady growth. Investors should weigh MDT’s scale and innovation against STE’s niche market strength and improving efficiency.

Risk Analysis

Below is a comparative table summarizing key risk factors for Medtronic plc (MDT) and STERIS plc (STE) based on the latest 2025 data:

| Metric | Medtronic plc (MDT) | STERIS plc (STE) |

|---|---|---|

| Market Risk | Beta 0.73 (lower volatility) | Beta 1.03 (market average volatility) |

| Debt level | Debt-to-Equity 0.59 (neutral) | Debt-to-Equity 0.33 (favorable) |

| Regulatory Risk | Moderate (Healthcare sector, global regulations) | Moderate (Healthcare sector, global regulations) |

| Operational Risk | High complexity in diverse product lines and global operations | Moderate complexity, focused on sterilization and healthcare services |

| Environmental Risk | Moderate, medical device manufacturing impact | Moderate, chemical and sterilization product usage |

| Geopolitical Risk | Exposure to international markets | Exposure to international markets |

Medtronic faces moderate operational and regulatory risks due to its broad global footprint and product complexity, though it benefits from lower market volatility. STERIS shows stronger debt metrics and a very strong financial health score, reducing financial risk, but its higher beta indicates greater market sensitivity. Regulatory and geopolitical risks remain relevant for both in the healthcare space.

Which Stock to Choose?

Medtronic plc (MDT) shows a favorable income evolution with steady revenue and net income growth, strong gross and EBIT margins, and a slight increase in profitability. Financial ratios reveal a balanced debt level, solid current and quick ratios, and a slightly favorable overall rating, despite a moderate ROE and asset turnover. The company’s rating is very favorable, supported by a strong Altman Z-Score and Piotroski Score, yet its MOAT evaluation indicates slight value destruction but improving profitability.

STERIS plc (STE) demonstrates favorable income growth, notably higher revenue and net income increases overall, with solid gross and EBIT margins. Its financial ratios emphasize low debt and good liquidity, though some valuation metrics are unfavorable. STE’s rating is very favorable, with a higher Altman Z-Score and a very strong Piotroski Score. The MOAT evaluation also shows slight value destruction but a growing ROIC trend, signaling improving profitability.

From an analytical perspective, both companies have slightly favorable financial ratios and favorable income statements, with very favorable ratings and strong financial health scores. Investors seeking steady profitability with moderate debt might find MDT appealing, while those focusing on stronger growth metrics and higher financial strength scores might lean toward STE. The choice could therefore depend on whether an investor prioritizes stability and consistent margin improvement or higher growth potential amid slightly greater valuation risk.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Medtronic plc and STERIS plc to enhance your investment decisions: