Home > Comparison > Consumer Defensive > MKC vs MICC

The strategic rivalry between McCormick & Company and The Magnum Ice Cream Company shapes the packaged foods sector’s competitive landscape. McCormick operates as a diversified flavor solutions leader with a broad portfolio spanning spices and condiments. In contrast, Magnum focuses on premium ice cream products, emphasizing brand-driven growth. This analysis explores their distinct operational models to identify which offers superior risk-adjusted returns for a diversified portfolio in consumer defensive markets.

Table of contents

Companies Overview

McCormick & Company and The Magnum Ice Cream Company stand as pivotal players in the packaged foods market.

McCormick & Company: Global Flavor Solutions Leader

McCormick dominates as a global manufacturer and marketer of spices and seasonings. It generates revenue through two segments: Consumer products sold under iconic brands like French’s and Old Bay, and Flavor Solutions providing custom blends to food manufacturers. In 2026, McCormick prioritizes innovation in flavor development across diverse markets to strengthen its global footprint.

The Magnum Ice Cream Company: Premium Frozen Treat Specialist

Magnum Ice Cream Company specializes exclusively in the ice cream segment of packaged foods. Its core revenue stems from premium ice cream sales, leveraging strong brand appeal and product innovation. In its early public phase since late 2025, Magnum focuses on expanding market penetration and scaling production capabilities to capture global consumer demand.

Strategic Collision: Similarities & Divergences

Both companies operate within consumer defensive packaged foods, yet McCormick embraces a broad flavor portfolio, while Magnum narrows focus on premium ice cream. They compete indirectly on consumer taste preferences and brand loyalty. McCormick’s diversified product base contrasts with Magnum’s niche specialization, shaping distinctly different investment profiles centered on breadth versus focused growth potential.

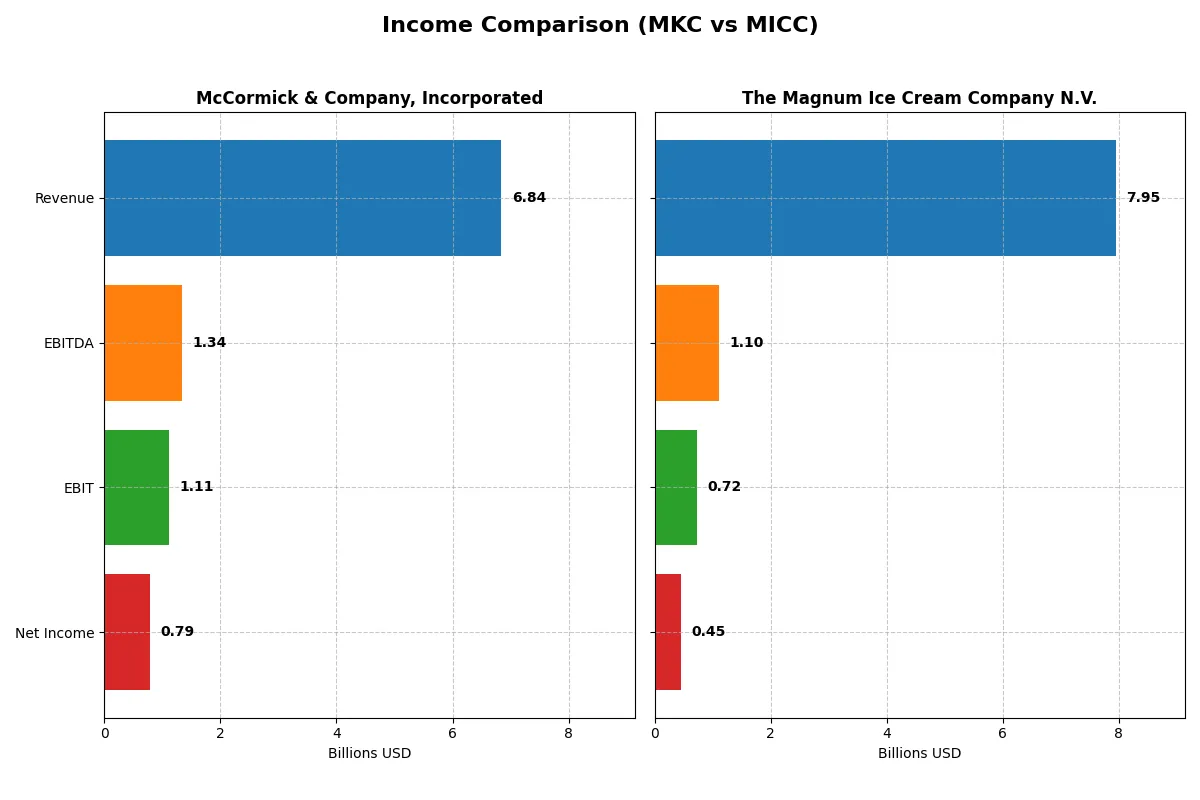

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | McCormick & Company, Incorporated (MKC) | The Magnum Ice Cream Company N.V. (MICC) |

|---|---|---|

| Revenue | 6.84B | 7.95B |

| Cost of Revenue | 4.25B | 5.17B |

| Operating Expenses | 1.50B | 2.04B |

| Gross Profit | 2.59B | 2.77B |

| EBITDA | 1.34B | 1.10B |

| EBIT | 1.11B | 725M |

| Interest Expense | 196M | 142M |

| Net Income | 789M | 450M |

| EPS | 2.94 | 0.74 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison uncovers which company converts revenue into profits more efficiently and drives shareholder value best.

McCormick & Company, Incorporated Analysis

McCormick’s revenue steadily climbs, reaching $6.84B in 2025 with net income at $789M. The firm maintains a strong gross margin near 38% and a net margin above 11%, underscoring solid cost control. Despite modest revenue growth of 1.7% in 2025, operating expenses align well, keeping EBIT stable and reflecting disciplined margin management.

The Magnum Ice Cream Company N.V. Analysis

Magnum’s revenues rose to €7.95B in 2024, yet net income declined to €450M. Its gross margin of 34.9% is slightly lower, and net margin stands at 5.7%, highlighting weaker profitability. Although revenue growth is moderate at 4.3%, rising operating expenses and a 12% net margin contraction signal pressure on earnings efficiency and shareholder returns.

Margin Strength vs. Revenue Expansion

McCormick outperforms Magnum with superior margins and consistent net income growth, despite slower revenue gains. Magnum’s higher top-line growth fails to translate into profits, eroding its net margin and earnings per share. For investors prioritizing fundamental profitability, McCormick’s profile offers a more robust and sustainable earnings engine.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | McCormick & Company, Incorporated (MKC) | The Magnum Ice Cream Company N.V. (MICC) |

|---|---|---|

| ROE | 13.76% | 16.20% |

| ROIC | 7.93% | 16.42% |

| P/E | 22.59 | 19.60 |

| P/B | 3.11 | 3.18 |

| Current Ratio | 0.70 | 0.80 |

| Quick Ratio | 0.28 | 0.35 |

| D/E (Debt-to-Equity) | 0.70 | 0.07 |

| Debt-to-Assets | 30.27% | 3.41% |

| Interest Coverage | 5.57 | 5.18 |

| Asset Turnover | 0.52 | 1.44 |

| Fixed Asset Turnover | 4.72 | 3.37 |

| Payout ratio | 61.19% | 2.44% |

| Dividend yield | 2.71% | 0.12% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as the company’s DNA, uncovering hidden risks and operational strengths that guide investment decisions with clarity.

McCormick & Company, Incorporated

McCormick shows solid profitability with a 13.76% ROE and an 11.54% net margin, indicating stable earnings. Its P/E of 22.59 suggests a fairly valued stock, though a 3.11 P/B ratio signals some premium. The 2.71% dividend yield rewards shareholders, balancing moderate growth with income distribution.

The Magnum Ice Cream Company N.V.

Magnum Ice Cream boasts a strong 16.2% ROE and 16.42% ROIC, reflecting efficient capital use. Its P/E of 19.6 appears reasonable, with a low debt ratio enhancing financial stability. However, a minimal 0.12% dividend yield indicates limited direct shareholder returns, likely favoring reinvestment for growth.

Balanced Strength vs. Growth Efficiency

McCormick presents a dependable income profile with moderate valuation risks, while Magnum Ice Cream offers superior operational efficiency and growth focus. Investors seeking steady dividends may prefer McCormick, whereas growth-oriented investors might lean toward Magnum’s dynamic capital deployment.

Which one offers the Superior Shareholder Reward?

I see McCormick & Company, Incorporated (MKC) maintains a classic distribution model with a 2.7% dividend yield and a 61% payout ratio, supported by robust free cash flow coverage near 77%. Its steady buyback program enhances shareholder returns, reflecting disciplined capital allocation. The Magnum Ice Cream Company N.V. (MICC) pays almost no dividends, with a 0.12% yield and a negligible payout ratio. Instead, MICC aggressively reinvests in growth and maintains a lean debt profile, fueling operational leverage. However, MKC’s balanced approach offers a more sustainable and attractive total return profile for 2026 investors seeking both income and capital appreciation.

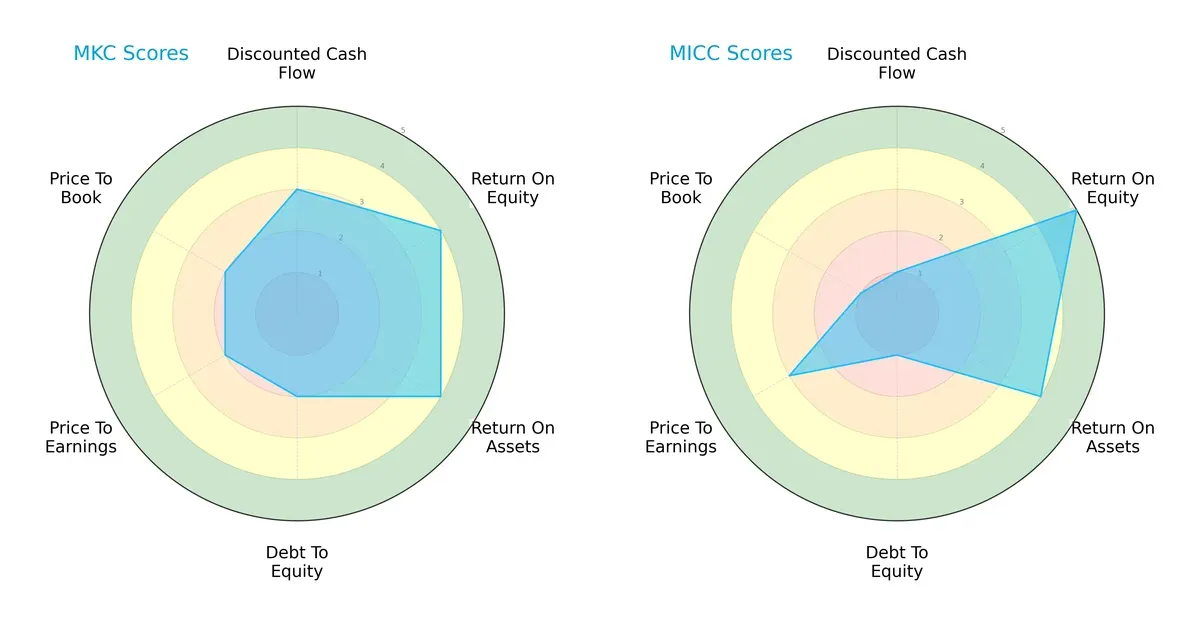

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of McCormick & Company and The Magnum Ice Cream Company N.V.:

McCormick exhibits a balanced profile with moderate DCF (3) and valuation scores (P/E and P/B at 2), supported by favorable ROE (4) and ROA (4). Magnum Ice Cream leans on a strong ROE (5) and solid ROA (4) but suffers from a weak discounted cash flow score (1) and poor debt-to-equity (1), indicating financial risk. McCormick’s steadier debt management contrasts with Magnum’s reliance on operational efficiency, making McCormick the more balanced play.

Bankruptcy Risk: Solvency Showdown

McCormick’s Altman Z-Score of 2.49 places it in the grey zone, signaling moderate bankruptcy risk in this cycle:

Financial Health: Quality of Operations

McCormick’s Piotroski F-Score of 6 suggests average financial health, with no immediate red flags in operational metrics:

How are the two companies positioned?

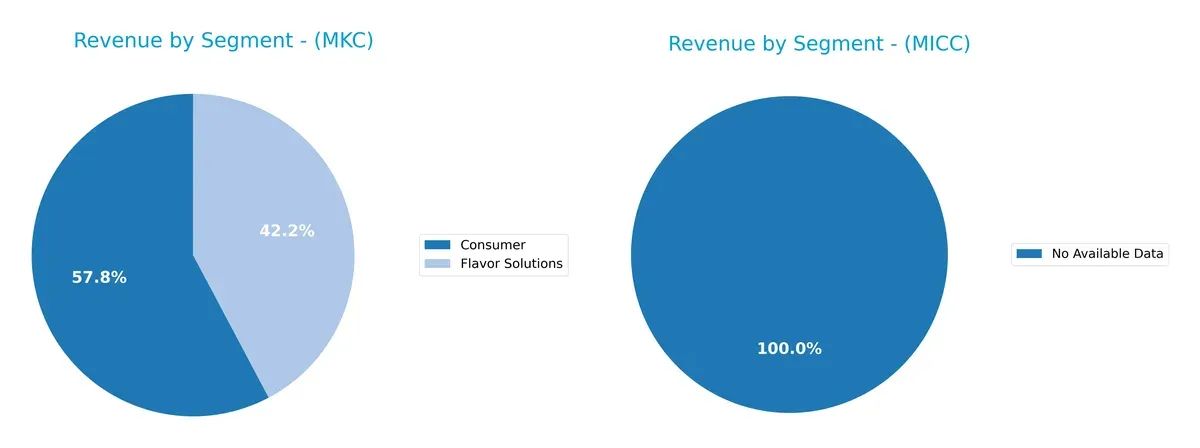

This section dissects the operational DNA of McCormick and Magnum by comparing their revenue distribution by segment and internal strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how both firms diversify their income streams and where their primary sector bets lie:

McCormick & Company anchors its revenue in two balanced segments: Consumer at $3.95B and Flavor Solutions at $2.89B for 2025. This mix shows a strong dual focus, reducing risk through product diversity. Magnum Ice Cream Company lacks available data, preventing segmentation analysis. McCormick’s structure suggests ecosystem lock-in in flavor innovation and consumer goods, a strategic advantage in a competitive food sector.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of McCormick & Company, Incorporated (MKC) and The Magnum Ice Cream Company N.V. (MICC):

MKC Strengths

- Diversified revenue from Consumer (3.95B) and Flavor Solutions (2.89B) segments

- Strong global presence with Americas (4.87B), EMEA (1.27B), and Asia Pacific (704M)

- Favorable net margin (11.54%) and WACC (6.18%)

- High fixed asset turnover (4.72) and dividend yield (2.71%)

MICC Strengths

- Favorable ROE (16.2%) and ROIC (16.42%) well above WACC (5.73%)

- Low debt-to-equity (0.07) and debt-to-assets (3.41%) indicating conservative leverage

- Strong asset turnover (1.44) and fixed asset turnover (3.37)

- Favorable interest coverage (5.11)

MKC Weaknesses

- Unfavorable liquidity ratios: current ratio (0.7), quick ratio (0.28) raise short-term risk concerns

- Price-to-book ratio high (3.11)

- Neutral ROE (13.76%) and ROIC (7.93%) only slightly above WACC

- Moderate debt level (D/E 0.7, debt/assets 30.27%)

MICC Weaknesses

- Unfavorable dividend yield (0.12%)

- Unfavorable liquidity ratios: current ratio (0.8), quick ratio (0.35)

- Price-to-book ratio elevated (3.18)

- Lower net margin (5.66%) compared to MKC

MKC demonstrates strength in diversified revenue streams and global market reach but shows potential liquidity risks. MICC excels in profitability and conservative leverage yet has weaker liquidity and dividend payout. These factors shape each company’s strategic and financial positioning.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat protects long-term profits from competitive erosion. Only durable advantages can sustain superior returns over time:

McCormick & Company, Incorporated: Intangible Assets Moat

McCormick leverages strong brand equity and proprietary flavor solutions, reflected in stable 16% EBIT margins. Rising ROIC signals improving profitability, but slow revenue growth could pressure the moat in 2026.

The Magnum Ice Cream Company N.V.: Cost Advantage Moat

Magnum exploits scale and production efficiency to maintain a 34.9% gross margin, outperforming McCormick on ROIC vs. WACC by 10.7%. Its stable profitability suggests a robust moat, with growth potential in premium ice cream markets.

Intangible Assets vs. Cost Efficiency: Who Holds the Stronger Moat?

Magnum’s superior ROIC premium and stable margins give it a deeper moat than McCormick’s intangible asset base. Magnum is better positioned to defend market share amid evolving consumer preferences.

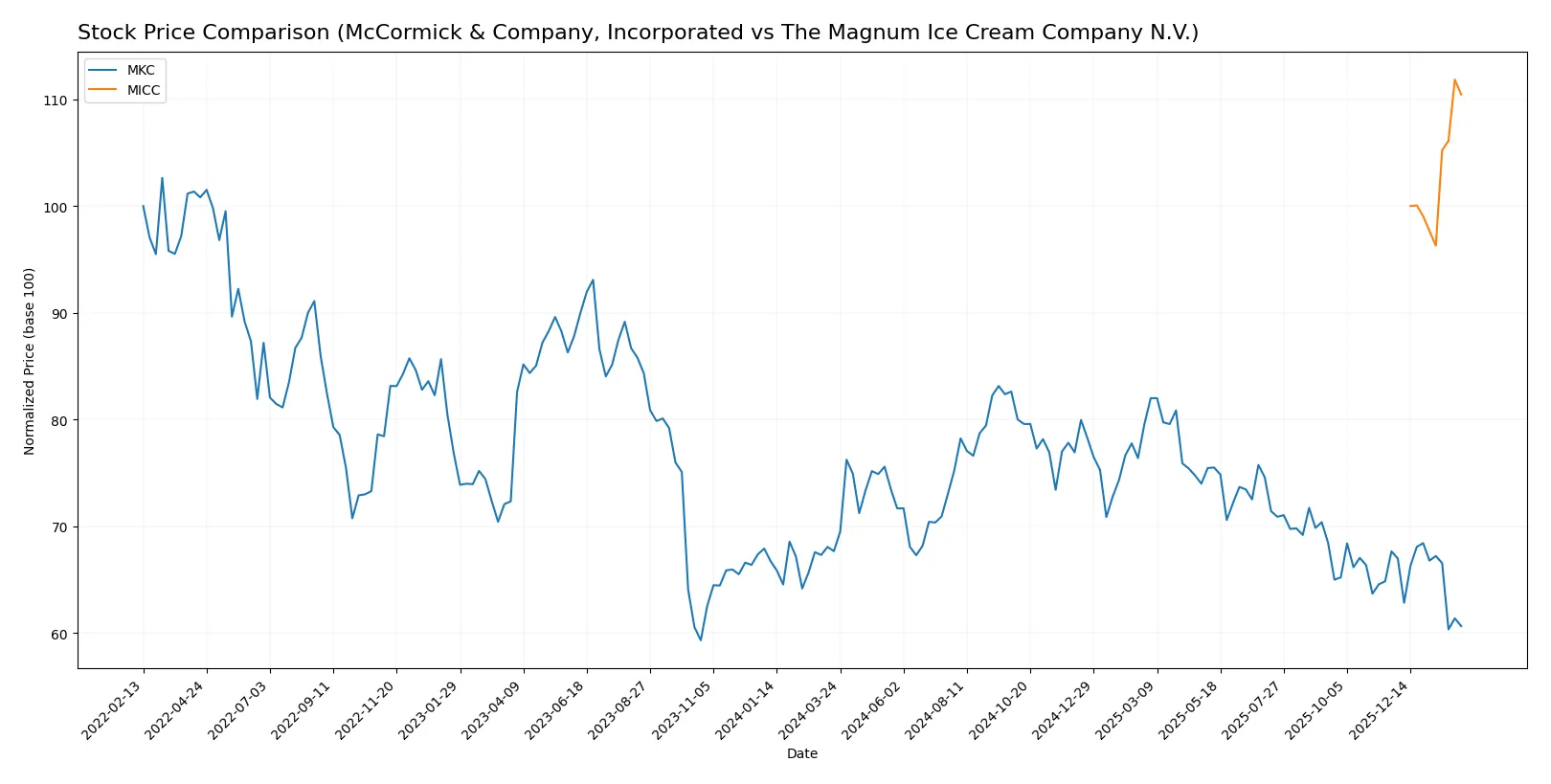

Which stock offers better returns?

Over the past 12 months, McCormick & Company’s stock declined steadily while The Magnum Ice Cream Company gained ground, reflecting contrasting trading momentum and price dynamics.

Trend Comparison

McCormick & Company’s stock shows a 12-month price decline of 10.37%, signaling a bearish trend with decelerating losses and a volatility standard deviation of 5.41. The stock peaked at 83.76 and troughed at 60.79.

The Magnum Ice Cream Company’s stock gained 10.46% over the same period, reflecting a stable bullish trend with low volatility (std dev 0.85) and prices ranging between 15.28 and 17.75.

Comparing both, Magnum Ice Cream delivered the highest market performance with a clear bullish trend, while McCormick’s stock exhibited a bearish trend and decelerating downside.

Target Prices

Analysts present a clear consensus outlook with defined target ranges for both companies.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| McCormick & Company, Incorporated | 67 | 85 | 73.57 |

| The Magnum Ice Cream Company N.V. | 16 | 16 | 16 |

McCormick’s target consensus at $73.57 sits well above its current $61.1 stock price, signaling upside potential. Magnum Ice Cream’s consensus target of $16 falls below its current $17.53 price, suggesting limited near-term gains.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is a summary of the most recent institutional grades for the two companies:

McCormick & Company, Incorporated Grades

The following table shows recent grades from prominent financial institutions for McCormick & Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-26 |

| UBS | Maintain | Neutral | 2026-01-23 |

| Stifel | Maintain | Hold | 2026-01-23 |

| Bernstein | Maintain | Outperform | 2025-10-08 |

| Barclays | Maintain | Equal Weight | 2025-10-08 |

| Jefferies | Maintain | Buy | 2025-10-08 |

| Deutsche Bank | Maintain | Hold | 2025-10-08 |

| UBS | Maintain | Neutral | 2025-10-08 |

| Stifel | Maintain | Hold | 2025-10-08 |

| UBS | Maintain | Neutral | 2025-10-01 |

The Magnum Ice Cream Company N.V. Grades

No reliable institutional grades are available for The Magnum Ice Cream Company N.V.

Which company has the best grades?

McCormick & Company holds a broader and more consistent grading history, with a mix of neutral to outperform ratings. Magnum Ice Cream lacks institutional grades, limiting comparative insight. Investors may find McCormick’s grades provide clearer signals on market sentiment and risks.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing McCormick & Company and The Magnum Ice Cream Company in the 2026 market environment:

1. Market & Competition

McCormick & Company, Incorporated

- Established brands face intense competition in packaged foods, requiring constant innovation.

The Magnum Ice Cream Company N.V.

- Newer company with growing brand presence but facing strong market incumbents in ice cream.

2. Capital Structure & Debt

McCormick & Company, Incorporated

- Moderate debt-to-equity ratio of 0.7 signals balanced leverage but raises caution for liquidity.

The Magnum Ice Cream Company N.V.

- Very low debt-to-equity ratio of 0.07 indicates strong financial stability and low leverage risk.

3. Stock Volatility

McCormick & Company, Incorporated

- Beta of 0.613 suggests lower volatility than the market, offering more stability.

The Magnum Ice Cream Company N.V.

- Beta of 0 indicates extremely low historical price volatility but limited trading history.

4. Regulatory & Legal

McCormick & Company, Incorporated

- Operating across multiple regions exposes it to complex food safety and labeling regulations.

The Magnum Ice Cream Company N.V.

- Primarily European operations with evolving EU food regulations present compliance challenges.

5. Supply Chain & Operations

McCormick & Company, Incorporated

- Diverse global supply chain faces risks from raw material price fluctuations and logistics delays.

The Magnum Ice Cream Company N.V.

- Ice cream production relies on cold chain logistics, vulnerable to energy cost spikes and disruptions.

6. ESG & Climate Transition

McCormick & Company, Incorporated

- Increasing pressure to reduce environmental footprint in sourcing and packaging.

The Magnum Ice Cream Company N.V.

- High energy consumption in production demands rapid adaptation to climate policies.

7. Geopolitical Exposure

McCormick & Company, Incorporated

- Exposure to US-China trade tensions and global supply chain disruptions.

The Magnum Ice Cream Company N.V.

- European-centric but susceptible to Brexit-related trade complexities and geopolitical shifts.

Which company shows a better risk-adjusted profile?

McCormick’s largest risk lies in its weak liquidity ratios, which could strain short-term operations amid market volatility. Magnum’s key risk is its high valuation and limited liquidity history, increasing vulnerability to market shocks. I see Magnum as having a better risk-adjusted profile due to its low leverage and strong profitability metrics, despite its infancy. McCormick’s balance between steady profitability and moderate debt demands vigilance on liquidity, especially given its exposure to global supply chain and regulatory risks.

Final Verdict: Which stock to choose?

McCormick & Company excels as a cash-efficient operator with a steadily growing return on capital. Its main point of vigilance lies in a weak liquidity position, signaling potential short-term funding challenges. This stock suits an income-focused portfolio that values moderate growth with reliable dividends.

The Magnum Ice Cream Company boasts a robust strategic moat through its impressive return on invested capital, significantly exceeding its cost of capital. It carries lower financial risk than McCormick, supported by minimal debt levels. This stock fits well with investors seeking growth at a reasonable price and a stronger safety profile.

If you prioritize stable income and a proven ability to generate free cash flow, McCormick offers a compelling scenario despite its liquidity risks. However, if you seek superior capital efficiency and lower leverage with a growth orientation, Magnum Ice Cream outshines with its favorable moat and financial stability. Both present distinct analytical cases contingent on your risk tolerance and growth expectations.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of McCormick & Company, Incorporated and The Magnum Ice Cream Company N.V. to enhance your investment decisions: