Home > Comparison > Consumer Defensive > KHC vs MKC

The strategic rivalry between The Kraft Heinz Company and McCormick & Company defines the trajectory of the packaged foods sector. Kraft Heinz operates as a capital-intensive food and beverage giant with broad product lines and global reach. McCormick, by contrast, specializes in high-margin spices and flavor solutions, catering to both consumers and manufacturers. This analysis evaluates which company’s operational model offers a superior risk-adjusted return for a diversified portfolio.

Table of contents

Companies Overview

The Kraft Heinz Company and McCormick & Company stand as leading forces in the global packaged foods industry.

The Kraft Heinz Company: Packaged Foods Giant

The Kraft Heinz Company dominates the packaged foods market with a diverse portfolio including condiments, cheese, meals, and beverages. Its core revenue engine hinges on broad geographic reach and multi-channel distribution, spanning grocery stores to e-commerce. In 2026, the company emphasizes innovation in healthy snacks and expanding digital sales capabilities to sustain growth.

McCormick & Company, Incorporated: Flavor Solutions Specialist

McCormick & Company focuses on spices, seasoning mixes, and condiments, serving both consumers and multinational food manufacturers. Its competitive advantage lies in strong brand recognition across multiple continents and a dual-segment strategy targeting retail and foodservice markets. The firm prioritizes expanding its flavor solutions business and enhancing global market penetration this year.

Strategic Collision: Similarities & Divergences

Both companies thrive in packaged foods but differ sharply in scope and approach. Kraft Heinz favors a broad product portfolio and mass-market penetration, while McCormick excels with a focused flavor-centric model and specialized customer segments. Their primary battleground remains North American retail shelves and global foodservice contracts. These distinctions create unique risk-return profiles for investors seeking scale versus niche leadership.

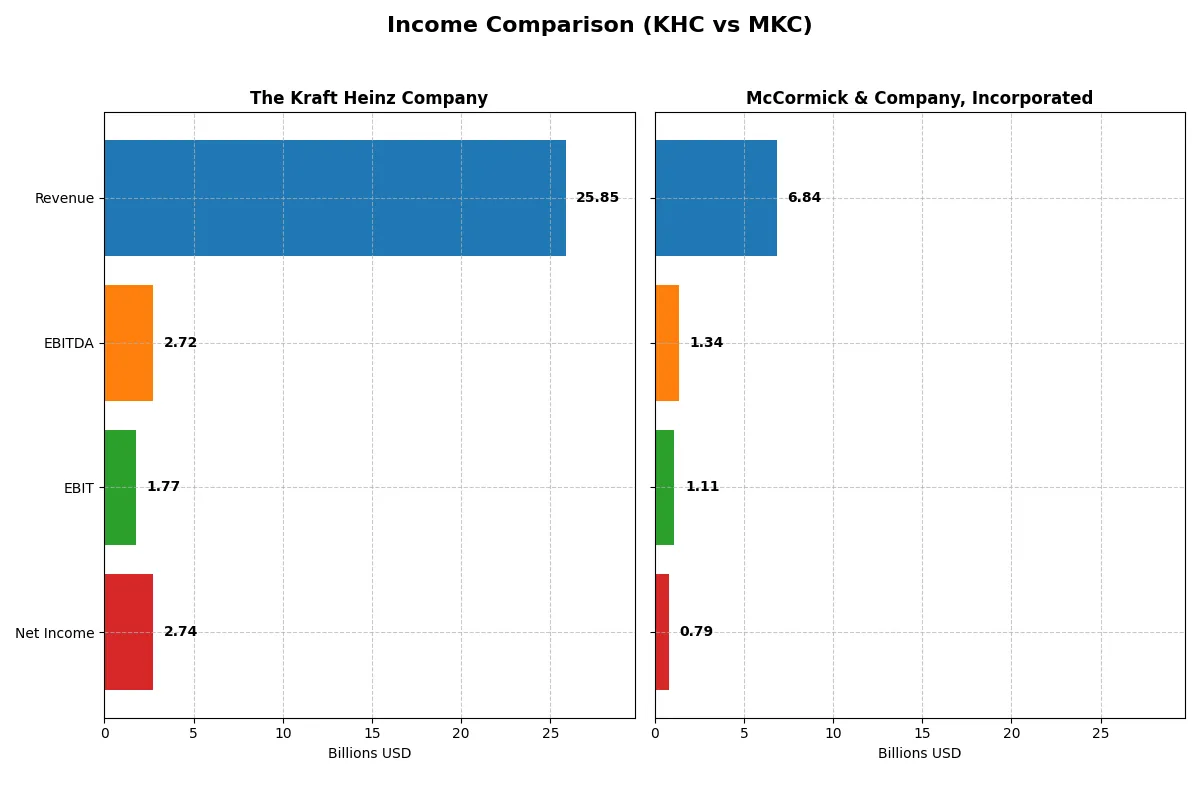

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | The Kraft Heinz Company (KHC) | McCormick & Company, Incorporated (MKC) |

|---|---|---|

| Revenue | 25.8B | 6.84B |

| Cost of Revenue | 16.9B | 4.25B |

| Operating Expenses | 7.29B | 1.50B |

| Gross Profit | 8.97B | 2.59B |

| EBITDA | 2.72B | 1.34B |

| EBIT | 1.77B | 1.11B |

| Interest Expense | 912M | 196M |

| Net Income | 2.74B | 789M |

| EPS | 2.27 | 2.94 |

| Fiscal Year | 2024 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs its business more efficiently and delivers stronger profitability.

The Kraft Heinz Company Analysis

KHC’s revenue slightly declined to $25.8B in 2024 from $26.6B in 2023, showing mild top-line pressure. Gross profit remained stable near $8.97B, supporting a favorable gross margin of 34.7%. However, net income slipped modestly to $2.74B, reflecting a net margin of 10.6%. Efficiency waned with EBIT dropping sharply, signaling operational challenges.

McCormick & Company, Incorporated Analysis

MKC’s revenue grew steadily to $6.84B in 2025, up from $6.72B in 2024, sustaining a favorable gross margin of 37.9%. Net income advanced to $789M, with net margin holding firm at 11.5%. EBIT margin improved to 16.2%, underscoring operational strength and consistent profit growth, despite slight margin compression over one year.

Margin Strength vs. Growth Momentum

MKC edges KHC with superior EBIT and gross margins, showcasing stronger operational control and profit conversion. KHC, despite a larger scale, faces declining revenue and EBIT pressures weakening its margin profile. For investors, MKC’s steady margin expansion and growth momentum present a more attractive earnings quality compared to KHC’s mixed efficiency signals.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | The Kraft Heinz Company (KHC) | McCormick & Company, Incorporated (MKC) |

|---|---|---|

| ROE | 5.58% | 13.76% |

| ROIC | 2.06% | 7.93% |

| P/E | 13.53 | 22.59 |

| P/B | 0.75 | 3.11 |

| Current Ratio | 1.06 | 0.70 |

| Quick Ratio | 0.59 | 0.28 |

| D/E (Debt-to-Equity) | 0.40 | 0.70 |

| Debt-to-Assets | 22.5% | 30.3% |

| Interest Coverage | 1.85 | 5.57 |

| Asset Turnover | 0.29 | 0.52 |

| Fixed Asset Turnover | 3.61 | 4.72 |

| Payout Ratio | 70.4% | 61.2% |

| Dividend Yield | 5.20% | 2.71% |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, revealing hidden risks and operational excellence beyond surface-level financials.

The Kraft Heinz Company

KHC displays modest profitability with a 5.58% ROE and a favorable 10.62% net margin, indicating steady core operations. Its valuation remains attractive, with a P/E of 13.53 and P/B of 0.75, signaling a potentially undervalued stock. The firm returns value through a neutral 5.2% dividend yield, balancing shareholder income despite limited reinvestment in R&D.

McCormick & Company, Incorporated

MKC commands higher profitability, boasting a 13.76% ROE and 11.54% net margin, reflecting efficient capital use. Its valuation is stretched with a P/E of 22.59 and an unfavorable P/B of 3.11, suggesting premium pricing. MKC provides a 2.71% dividend yield, complemented by reinvestment strategies to sustain growth and operational strength.

Balanced Profitability vs. Premium Valuation

KHC offers a safer valuation with moderate profitability, ideal for risk-conscious investors seeking steady income. MKC excels operationally but trades at a premium, appealing to those prioritizing growth and efficiency despite higher valuation risks. Each profile caters to distinct investor preferences on the risk-reward spectrum.

Which one offers the Superior Shareholder Reward?

I compare Kraft Heinz (KHC) and McCormick (MKC) by analyzing their dividend yields, payout ratios, and share buybacks. KHC yields 4.33–5.20% with payout ratios around 69–70%, supported by solid free cash flow coverage (~75%). MKC pays a lower yield (1.58–2.71%) with more conservative payout ratios (~48–61%), reflecting a strategy prioritizing reinvestment and controlled distributions. Both companies execute buybacks, but KHC’s historical payout and buyback intensity suggest greater near-term cash returns, while MKC’s higher margins and reinvestment focus point to sustainable growth. I conclude KHC currently offers superior total shareholder reward through income and buybacks, but MKC appeals for growth-oriented investors seeking longer-term value.

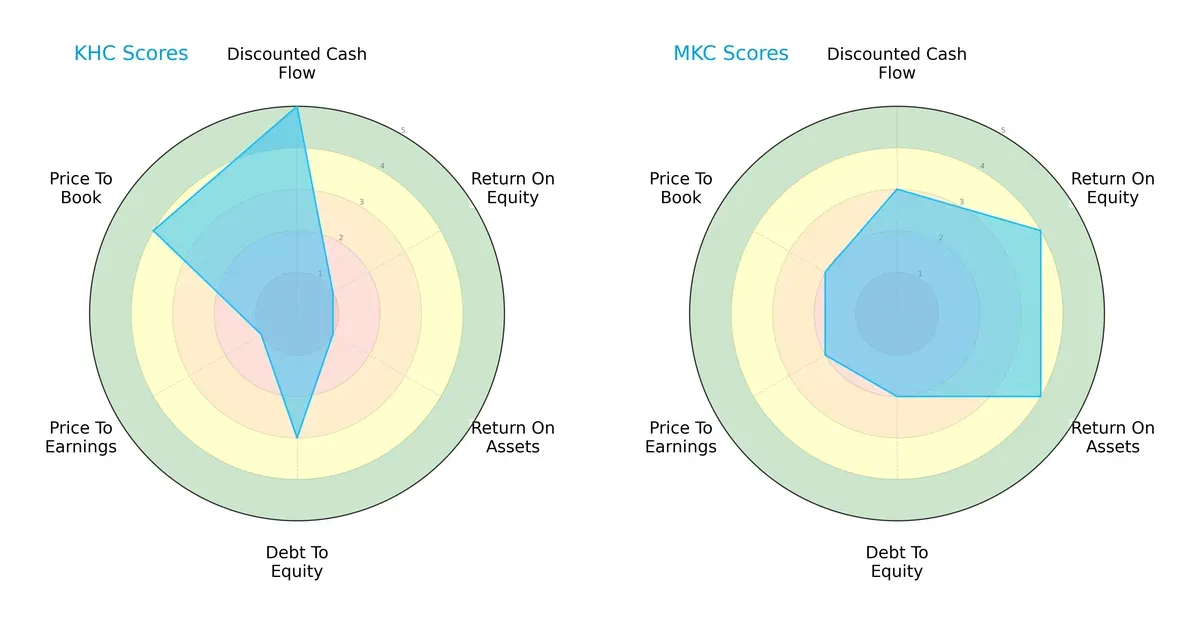

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of The Kraft Heinz Company and McCormick & Company, Incorporated:

KHC excels in discounted cash flow and price-to-book valuation, signaling strong intrinsic value and asset backing. However, it struggles with profitability metrics, showing very unfavorable ROE and ROA scores. MKC presents a more balanced profile, with favorable returns on equity and assets but moderate DCF and valuation scores. MKC leverages operational efficiency, while KHC depends heavily on valuation advantages.

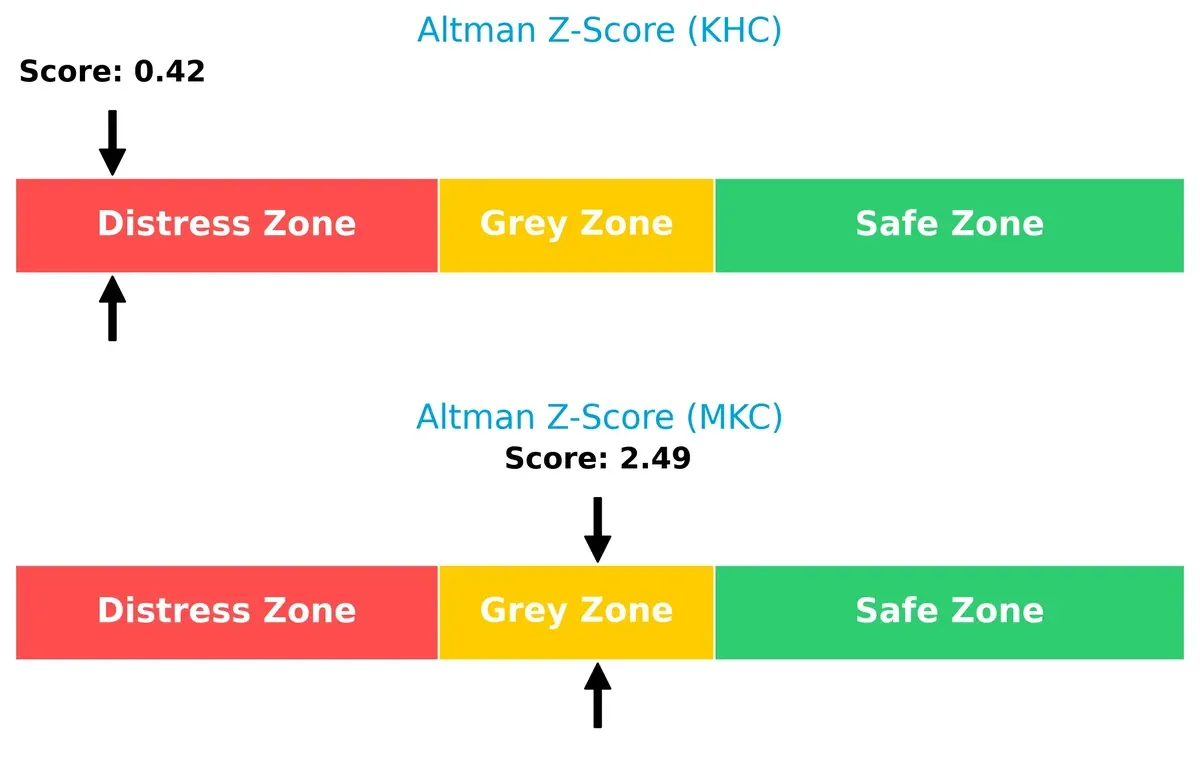

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score difference indicates KHC faces severe financial distress, while MKC remains in a moderate risk zone, suggesting better survival prospects in this cycle:

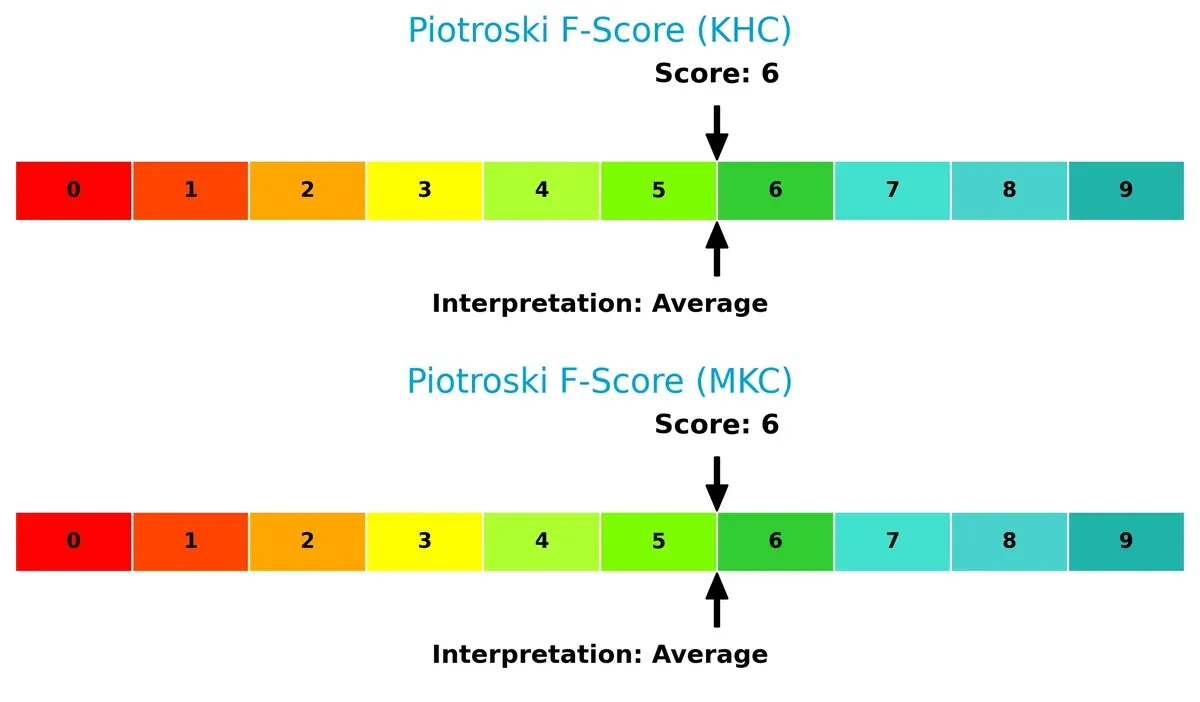

Financial Health: Quality of Operations

Both firms score a 6 on the Piotroski F-Score, reflecting average financial health. Neither shows acute red flags, but both have room for operational improvement:

How are the two companies positioned?

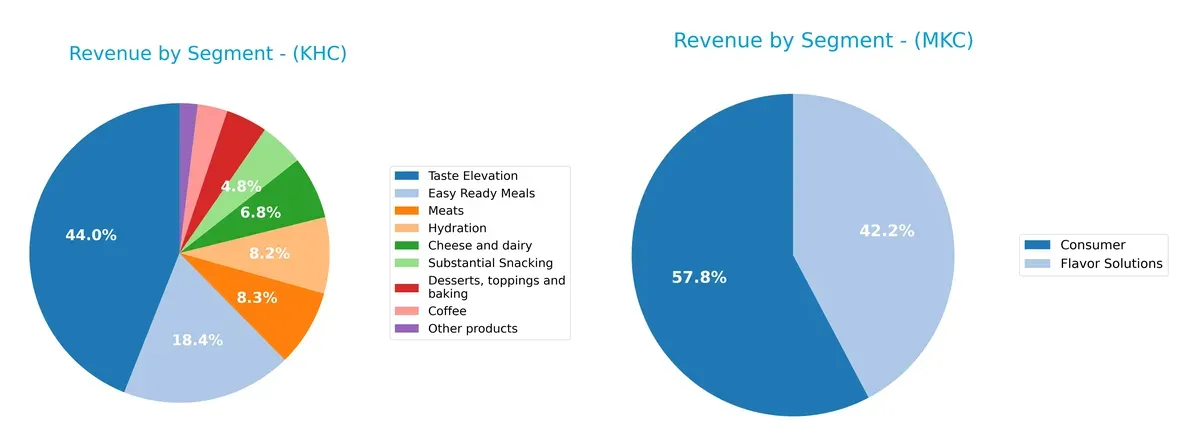

This section dissects The Kraft Heinz Company and McCormick’s operational DNA by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how The Kraft Heinz Company and McCormick & Company diversify their income streams and reveals where their primary sector bets lie:

Kraft Heinz shows a broad mix, with Taste Elevation anchoring revenue at $11.37B and multiple segments like Meats ($2.14B) and Hydration ($2.13B) contributing significantly. In contrast, McCormick pivots mainly on two segments: Consumer ($3.85B) and Flavor Solutions ($2.88B). Kraft Heinz’s diversified portfolio reduces concentration risk, while McCormick’s focus on flavors creates a moat via specialized market leadership.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of The Kraft Heinz Company and McCormick & Company, Incorporated:

KHC Strengths

- Diverse product segments including Cheese, Coffee, Meats, and Ready Meals

- Favorable net margin at 10.62%

- Low debt-to-assets ratio at 22.51%

- Attractive P/E of 13.53 and P/B of 0.75

- Strong U.S. market presence with $17.8B revenue

- Favorable fixed asset turnover at 3.61

MKC Strengths

- Favorable net margin at 11.54%

- ROE and ROIC neutral but above KHC levels

- Favorable interest coverage at 5.65

- Higher fixed asset turnover at 4.72

- Balanced geographic presence across Americas, EMEA, Asia Pacific

- Consistent revenue growth in Consumer and Flavor Solutions segments

KHC Weaknesses

- Unfavorable ROE of 5.58% below WACC

- Low ROIC at 2.06%, below WACC of 4.12%

- Weak quick ratio at 0.59 signals liquidity risk

- Unfavorable interest coverage at 1.94

- Low asset turnover at 0.29 indicates inefficiency

- Reliance on U.S. market limits global diversification

MKC Weaknesses

- Unfavorable quick ratio at 0.28 and current ratio at 0.7

- Higher debt-to-equity ratio at 0.7 may indicate leverage risk

- P/B of 3.11 considered high relative to peers

- Neutral asset turnover at 0.52 suggests room for efficiency gains

- Lower dividend yield at 2.71% limits income appeal

The comparison reveals KHC’s broad product and U.S. market strength with some financial efficiency concerns. MKC shows better profitability and geographic diversification but faces liquidity and valuation challenges. Both companies maintain slightly favorable overall financial profiles, impacting strategic focus areas differently.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only thing protecting long-term profits from the erosion of competition. Here’s how these two giants stand:

The Kraft Heinz Company: Scale and Brand Power

Kraft Heinz relies on strong brand recognition and scale-driven cost advantages. Despite shedding value (ROIC below WACC), its improving profitability hints at potential moat strengthening by 2026.

McCormick & Company, Incorporated: Specialty and Innovation

McCormick leverages intangible assets and product innovation, maintaining a slightly favorable moat with ROIC above WACC. Its consistent margin strength supports expansion into emerging flavor markets in 2026.

Scale Dominance vs. Innovation Edge

McCormick’s moat is deeper, shown by its positive ROIC spread and stable margin profile. Kraft Heinz faces value destruction but may close the gap with operational improvements. McCormick appears better positioned to defend and grow market share.

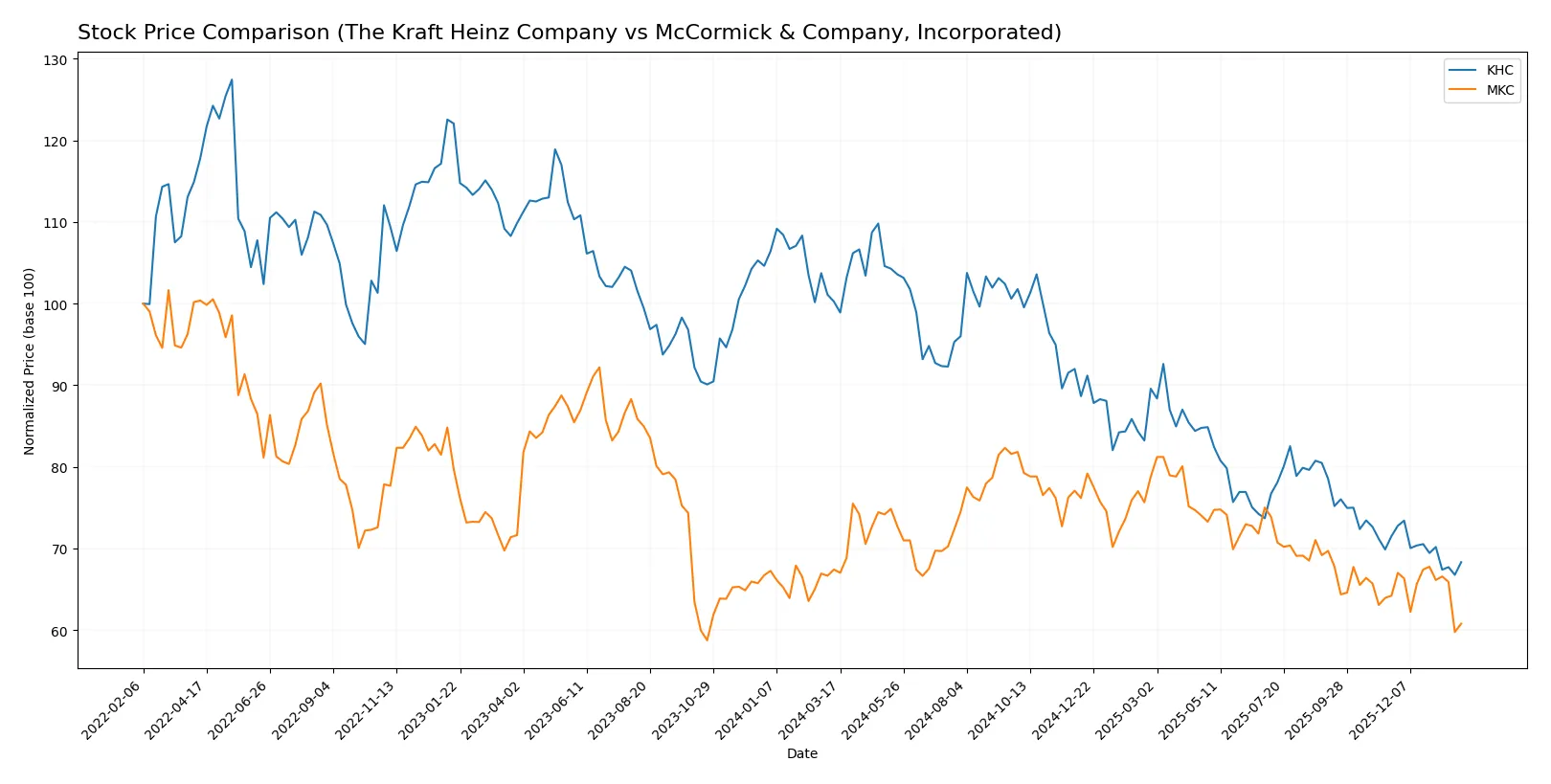

Which stock offers better returns?

The past year reveals a clear downward trajectory for both stocks, with The Kraft Heinz Company experiencing sharper declines and McCormick & Company showing a less steep fall.

Trend Comparison

The Kraft Heinz Company’s stock dropped 31.86% over the past year, signaling a bearish trend with decelerating losses. The price fluctuated between $23.2 and $38.16, showing moderate volatility (4.17 std dev).

McCormick & Company’s stock declined 9.84% in the same period, also bearish with deceleration. Its price ranged from $60.79 to $83.76, exhibiting slightly higher volatility (5.29 std dev).

KHC’s larger decline contrasts with MKC’s milder fall, making MKC the better performer in market returns over the past year.

Target Prices

Analysts show a cautiously optimistic outlook for both Kraft Heinz and McCormick, reflecting steady growth potential.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| The Kraft Heinz Company | 23 | 28 | 25.25 |

| McCormick & Company, Incorporated | 67 | 85 | 73.57 |

Kraft Heinz’s consensus target of 25.25 slightly exceeds its current price of 23.74, indicating modest upside. McCormick’s target consensus of 73.57 significantly outpaces its 61.83 share price, suggesting stronger growth expectations.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is the latest available grade information from leading financial institutions for both companies:

The Kraft Heinz Company Grades

The following table summarizes recent grades assigned to The Kraft Heinz Company by major grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Neutral | 2026-01-21 |

| Jefferies | Maintain | Hold | 2026-01-21 |

| Morgan Stanley | Downgrade | Underweight | 2026-01-16 |

| UBS | Maintain | Neutral | 2026-01-14 |

| Piper Sandler | Maintain | Neutral | 2025-12-15 |

| Barclays | Maintain | Equal Weight | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-30 |

| UBS | Maintain | Neutral | 2025-10-30 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-30 |

| JP Morgan | Maintain | Neutral | 2025-10-30 |

McCormick & Company, Incorporated Grades

Below is a summary of recent grading activity for McCormick & Company from recognized financial analysts.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-26 |

| UBS | Maintain | Neutral | 2026-01-23 |

| Stifel | Maintain | Hold | 2026-01-23 |

| Bernstein | Maintain | Outperform | 2025-10-08 |

| Barclays | Maintain | Equal Weight | 2025-10-08 |

| Jefferies | Maintain | Buy | 2025-10-08 |

| Deutsche Bank | Maintain | Hold | 2025-10-08 |

| UBS | Maintain | Neutral | 2025-10-08 |

| Stifel | Maintain | Hold | 2025-10-08 |

| UBS | Maintain | Neutral | 2025-10-01 |

Which company has the best grades?

McCormick & Company holds generally stronger ratings, including an Outperform and Buy from Bernstein and Jefferies. The Kraft Heinz Company mostly receives Neutral or Hold grades with one Underweight downgrade. Investors may view McCormick’s higher grades as a sign of greater confidence from analysts, potentially affecting market perception and valuation.

Risks specific to each company

The following categories pinpoint critical pressure points and systemic threats facing The Kraft Heinz Company and McCormick & Company, Incorporated in the 2026 market environment:

1. Market & Competition

The Kraft Heinz Company

- Faces intense competition in packaged foods with pressure on innovation and brand relevance.

McCormick & Company, Incorporated

- Operates in a niche with strong brand loyalty but faces global competition and pricing pressures.

2. Capital Structure & Debt

The Kraft Heinz Company

- Maintains moderate leverage (D/E 0.4) with some stress on interest coverage (1.94x).

McCormick & Company, Incorporated

- Higher leverage (D/E 0.7) but healthier interest coverage (5.65x), indicating better debt servicing.

3. Stock Volatility

The Kraft Heinz Company

- Extremely low beta (0.065) suggests stable stock but limited upside in volatile markets.

McCormick & Company, Incorporated

- Moderate beta (0.613) offers balanced risk-return potential amid market swings.

4. Regulatory & Legal

The Kraft Heinz Company

- Subject to food safety and labeling regulations across multiple jurisdictions.

McCormick & Company, Incorporated

- Similar regulatory exposure but benefits from diversified geographic footprint reducing single-region risk.

5. Supply Chain & Operations

The Kraft Heinz Company

- Shows low asset turnover (0.29), indicating operational inefficiencies and potential supply chain bottlenecks.

McCormick & Company, Incorporated

- Higher asset turnover (0.52) reflects more efficient asset use and adaptable supply chain management.

6. ESG & Climate Transition

The Kraft Heinz Company

- Faces growing pressure to improve sustainability in agriculture sourcing and packaging.

McCormick & Company, Incorporated

- Actively investing in ESG initiatives but still exposed to climate risks in raw material sourcing.

7. Geopolitical Exposure

The Kraft Heinz Company

- Global footprint exposes it to trade tensions and tariffs, especially in emerging markets.

McCormick & Company, Incorporated

- Also globally diversified but with stronger presence in stable developed markets reducing geopolitical risks.

Which company shows a better risk-adjusted profile?

The Kraft Heinz Company’s biggest risk is its weak financial health, highlighted by a distress-zone Altman Z-Score and poor interest coverage. McCormick’s main risk lies in leverage levels but balanced by stronger operational efficiency and a grey-zone Z-Score. McCormick offers a better risk-adjusted profile, supported by healthier debt servicing and asset utilization. The recent low interest coverage ratio for Kraft Heinz signals rising vulnerability to debt costs, intensifying financial strain in a competitive market.

Final Verdict: Which stock to choose?

The Kraft Heinz Company’s superpower lies in its value-oriented pricing and resilient brand portfolio that sustains steady cash flows. Its point of vigilance is a persistent struggle to generate returns above its cost of capital, signaling capital efficiency challenges. This stock might suit investors targeting income with a tolerance for cyclical volatility.

McCormick & Company boasts a strategic moat rooted in premium pricing power and expanding operating margins, supported by steady growth in returns on invested capital. It offers a more stable financial footing compared to Kraft Heinz. This profile aligns with investors favoring growth with measured risk exposure.

If you prioritize income and value underpinned by a defensive brand, Kraft Heinz is a compelling choice despite its capital allocation hurdles. However, if you seek growth fueled by operational efficiency and a strengthening moat, McCormick outshines with better stability and growth prospects, albeit at a higher valuation premium.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Kraft Heinz Company and McCormick & Company, Incorporated to enhance your investment decisions: