Home > Comparison > Technology > MXL vs SKYT

The strategic rivalry between MaxLinear, Inc. and SkyWater Technology, Inc. shapes the semiconductor industry’s evolution. MaxLinear operates as a high-performance analog and mixed-signal SoC provider, while SkyWater focuses on semiconductor development and manufacturing services. This head-to-head pits product integration against manufacturing specialization. This analysis aims to identify which company’s business model presents the superior risk-adjusted return potential for a diversified technology portfolio.

Table of contents

Companies Overview

MaxLinear and SkyWater Technology command notable roles in the semiconductor sector, shaping communication and manufacturing solutions.

MaxLinear, Inc.: Integrated Communications SoC Leader

MaxLinear dominates as a provider of high-performance RF and mixed-signal SoCs for connected homes, industrial, and wireless infrastructure. Its revenue stems from integrated communication platforms, including broadband modems, Wi-Fi routers, and 4G/5G radio transceivers. In 2026, the company focuses on expanding its footprint in next-gen network infrastructure and power management systems, leveraging its comprehensive end-to-end solutions.

SkyWater Technology, Inc.: Specialty Semiconductor Manufacturer

SkyWater specializes in semiconductor development and manufacturing services, catering to niche markets like aerospace, automotive, and bio-health. It generates revenue by co-creating technologies with clients and providing manufacturing for silicon-based analog, power discrete, and rad-hard ICs. The firm prioritizes engineering collaboration and process innovation to serve diverse industrial applications in 2026.

Strategic Collision: Similarities & Divergences

MaxLinear pursues a vertically integrated model with end-to-end communication products, while SkyWater operates as a flexible foundry partner emphasizing customization. They compete primarily in the broader semiconductor space, albeit targeting different customer segments—MaxLinear leans on volume and system integration, SkyWater on specialized process capabilities. Their investment profiles diverge between platform scaling and bespoke manufacturing services.

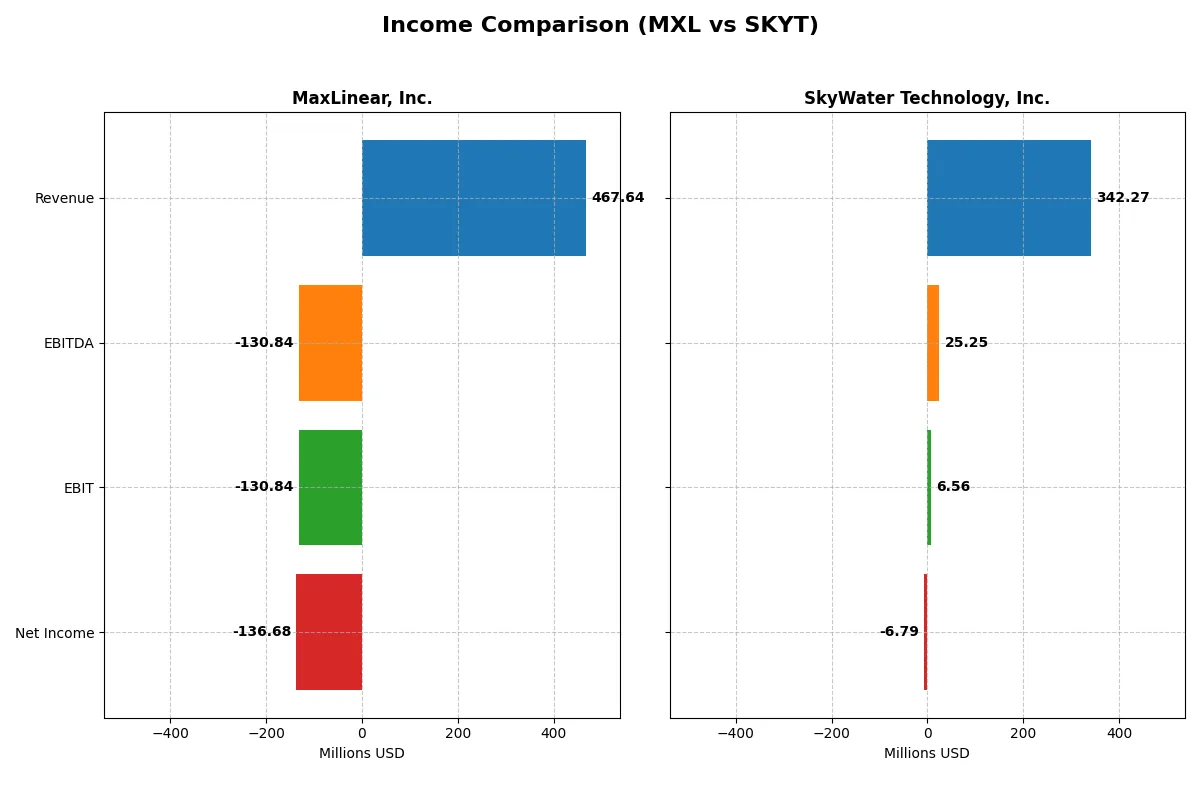

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | MaxLinear, Inc. (MXL) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Revenue | 468M | 342M |

| Cost of Revenue | 202M | 273M |

| Operating Expenses | 393M | 63M |

| Gross Profit | 266M | 70M |

| EBITDA | -131M | 25M |

| EBIT | -131M | 7M |

| Interest Expense | 10M | 9M |

| Net Income | -137M | -7M |

| EPS | -1.58 | -0.14 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

The following income statement comparison reveals which company drives superior operational efficiency and profitability in their respective markets.

MaxLinear, Inc. Analysis

MaxLinear’s revenue plunged nearly 48% from 2021 to 2025, falling to $468M in 2025. Net income swung deeply negative, hitting -$137M in 2025 despite a solid 56.8% gross margin. However, operating losses persist, with a -28% EBIT margin revealing ongoing inefficiencies. Recent growth in revenue and margins shows some recovery momentum.

SkyWater Technology, Inc. Analysis

SkyWater steadily expanded revenue by 144% from 2020 to 2024, reaching $342M. Gross margin remains modest at 20.3%, but the company achieved a positive EBIT margin of nearly 2% in 2024. Net losses narrowed to -$6.8M, reflecting improved cost control and margin expansion. Year-over-year growth highlights sustained operational progress.

Margin Resilience vs. Growth Trajectory

MaxLinear offers stronger gross margins but struggles with heavy operating losses and declining revenue, signaling structural challenges. SkyWater posts lower margins but displays consistent revenue and profit improvement, signaling healthier fundamentals. For investors, SkyWater’s growth with improving profitability presents a more attractive risk-reward profile.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | MaxLinear, Inc. (MXL) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| ROE | -47.5% | -11.8% |

| ROIC | -24.3% | 3.4% |

| P/E | -6.7 | -100.3 |

| P/B | 3.20 | 11.82 |

| Current Ratio | 1.77 | 0.86 |

| Quick Ratio | 1.28 | 0.76 |

| D/E | 0.29 | 1.33 |

| Debt-to-Assets | 17.2% | 24.5% |

| Interest Coverage | -15.5 | 0.74 |

| Asset Turnover | 0.42 | 1.09 |

| Fixed Asset Turnover | 4.65 | 2.07 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, uncovering hidden risks and operational strengths that drive investment decisions.

MaxLinear, Inc.

MaxLinear shows deeply unfavorable profitability with ROE at -47.5% and a net margin of -68%. The valuation appears stretched despite a favorable negative P/E, reflecting losses. Its current and quick ratios are solid, but it offers no dividend, instead reinvesting heavily in R&D (62%) to fuel growth amid operational challenges.

SkyWater Technology, Inc.

SkyWater posts a weak ROE of -11.8% and a marginal net margin of -2%, indicating low profitability. Its P/E ratio is extremely negative but favorable due to losses, while the price-to-book is high at 11.8x. The company carries high leverage and poor liquidity, with no dividend payout, relying on modest R&D reinvestment (4.4%) to support future prospects.

Valuation Stretch vs. Operational Fragility

Both companies exhibit unfavorable profitability and valuation metrics, but MaxLinear’s stronger liquidity and focused R&D investment offer a better balance of risk and reward. SkyWater’s elevated leverage and weaker cash ratios suggest higher financial vulnerability. Investors seeking growth amid operational headwinds might lean toward MaxLinear’s profile.

Which one offers the Superior Shareholder Reward?

MaxLinear, Inc. (MXL) and SkyWater Technology, Inc. (SKYT) both pay no dividends. MXL’s payout ratio stands at 0%, emphasizing reinvestment in growth. Its free cash flow per share was negative in 2024 (-0.75), signaling near-term cash constraints despite moderate buyback activity. SKYT also pays no dividend and shows limited free cash flow (0.15 in 2024) but runs a modest buyback program. MXL maintains a healthier current ratio (~1.77 vs. SKYT’s 0.86) and lower leverage, supporting sustainability. I see MXL’s capital allocation as more disciplined, with stronger operational cash flow trends despite recent losses. For 2026, MXL offers a superior total return profile based on its prudent reinvestment and buyback balance.

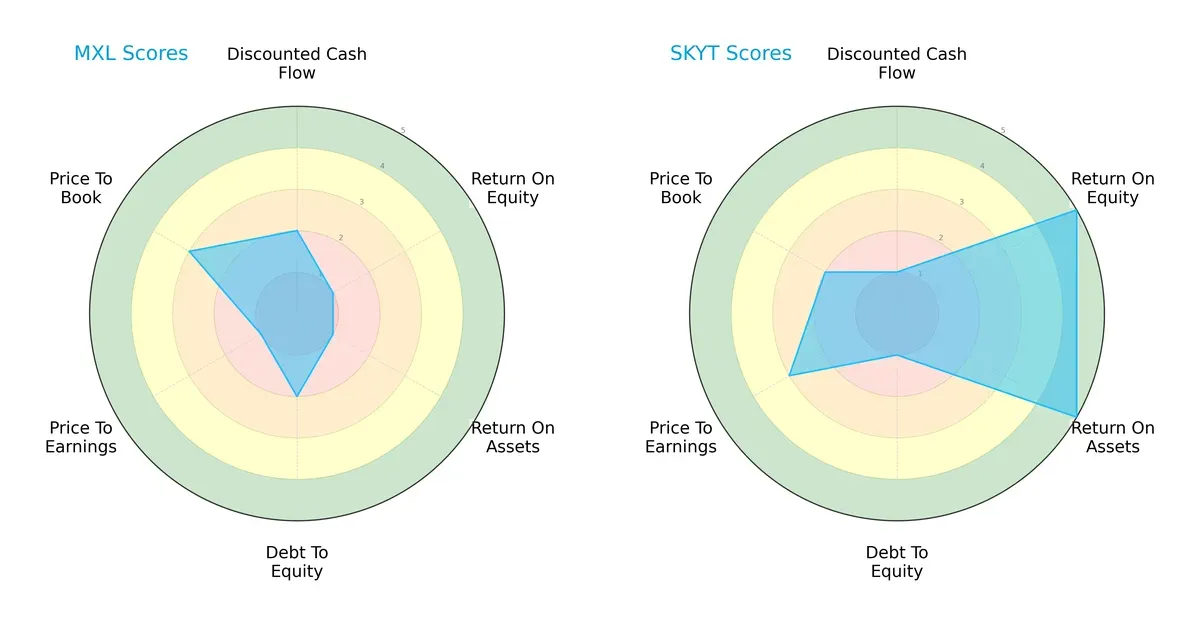

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of MaxLinear, Inc. and SkyWater Technology, Inc., highlighting their core financial strengths and weaknesses:

MaxLinear shows moderate discounted cash flow and debt-to-equity scores but struggles with very unfavorable returns on equity and assets, signaling operational inefficiencies. SkyWater Technology exhibits very favorable ROE and ROA, underscoring strong profitability, yet its debt-to-equity and DCF scores are weak. SkyWater has a more balanced profitability profile, while MaxLinear leans on moderate valuation metrics with less operational efficiency.

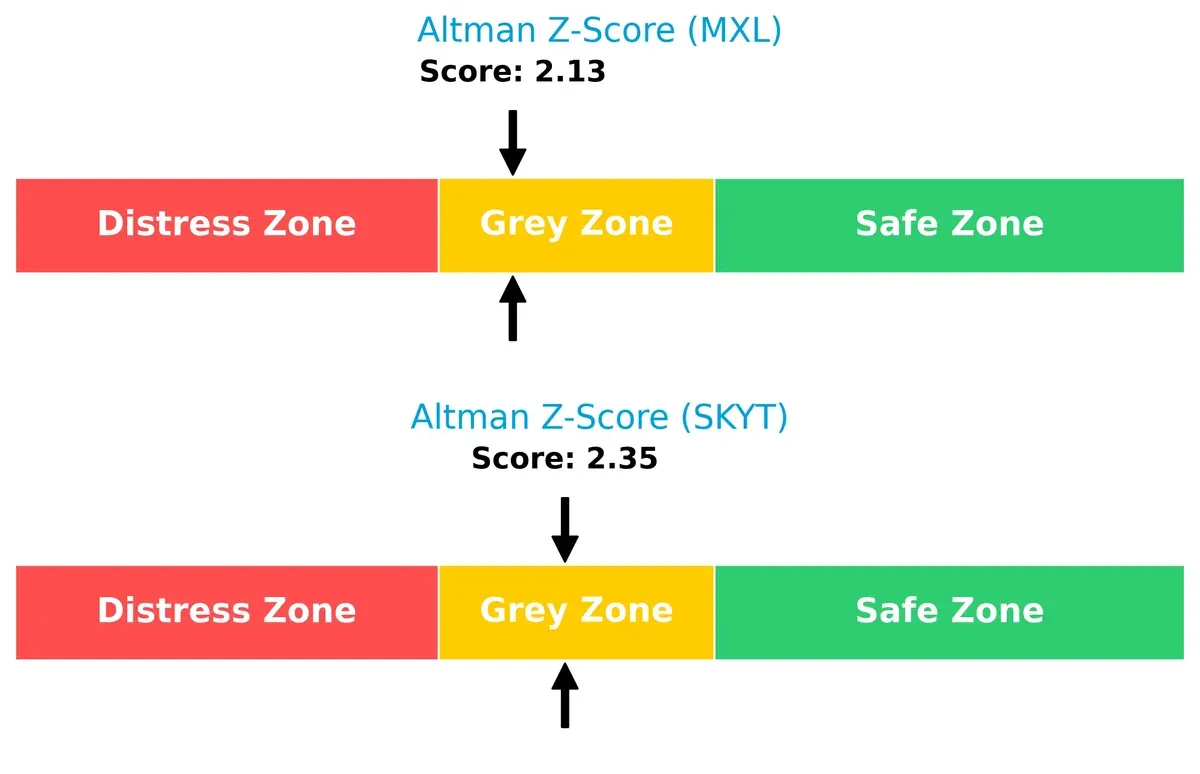

Bankruptcy Risk: Solvency Showdown

The Altman Z-Scores place both firms in the grey zone, indicating moderate bankruptcy risk and signaling caution in this economic cycle:

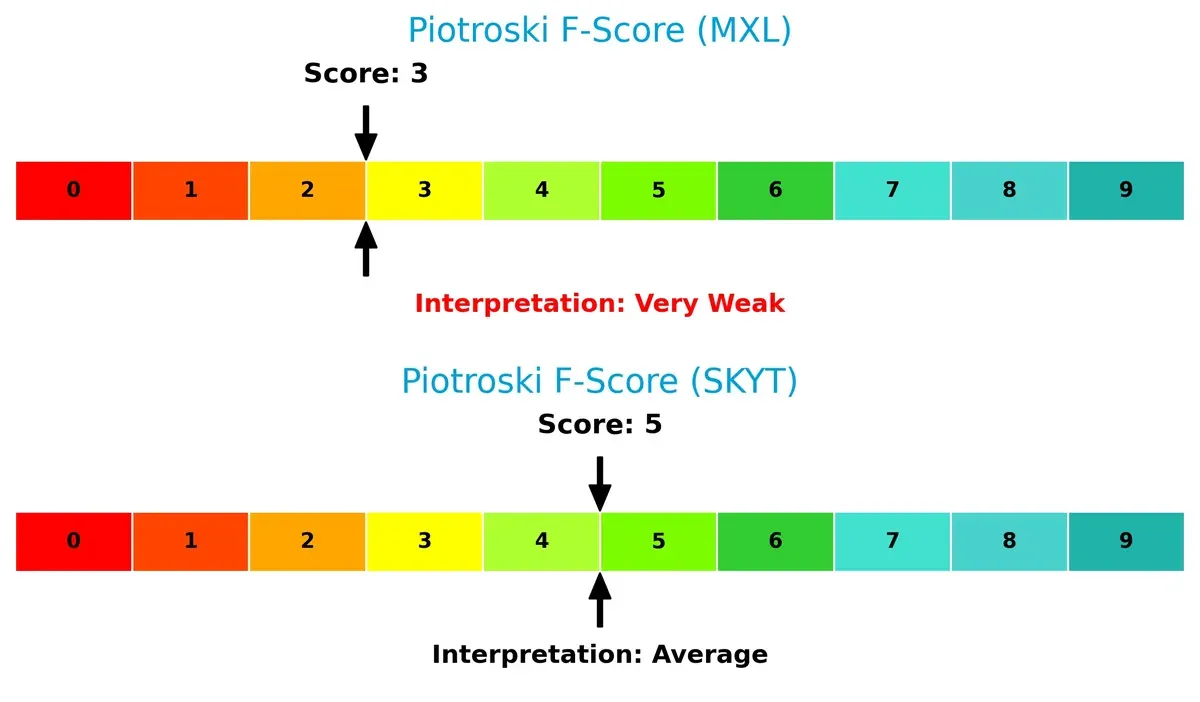

Financial Health: Quality of Operations

SkyWater Technology’s Piotroski F-Score of 5 suggests average financial health, outperforming MaxLinear’s weak score of 3. This difference flags potential internal weaknesses in MaxLinear’s operational and financial metrics:

How are the two companies positioned?

This section dissects the operational DNA of MXL and SKYT by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to identify which company offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

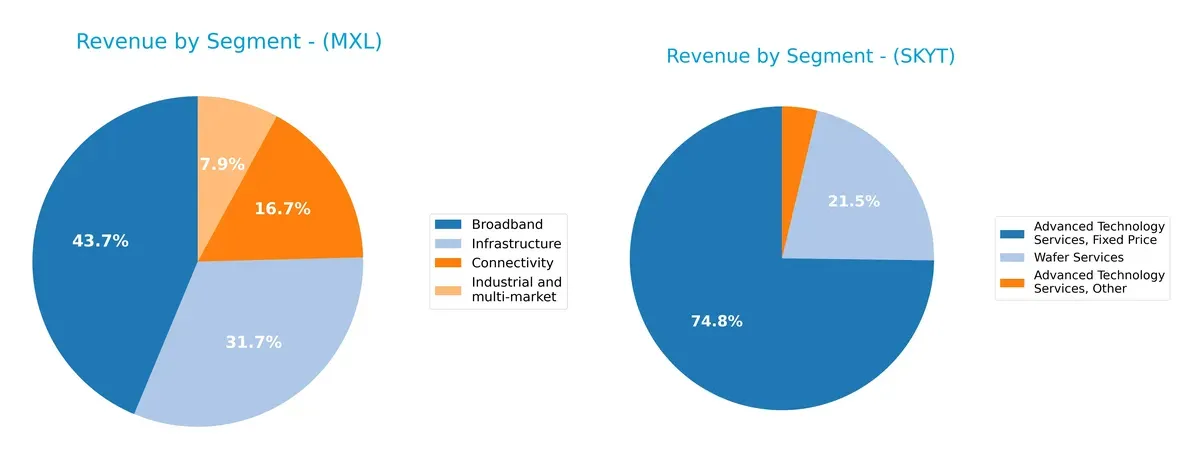

This visual comparison dissects how MaxLinear, Inc. and SkyWater Technology, Inc. diversify income streams and reveal where their primary sector bets lie:

MaxLinear anchors revenue in Broadband with $204M, followed by Infrastructure at $148M, showing moderate diversification across four segments. SkyWater pivots heavily on Advanced Technology Services, exceeding $122M in one sub-segment alone, while Wafer Services trail at $27M. MaxLinear’s broader mix suggests less concentration risk, while SkyWater’s heavy reliance on a single service category signals potential exposure to market fluctuations in semiconductor fabrication services.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of MaxLinear, Inc. (MXL) and SkyWater Technology, Inc. (SKYT):

MXL Strengths

- Diversified product segments including Broadband, Connectivity, and Infrastructure

- Favorable current and quick ratios indicate solid liquidity

- Low debt to assets ratio supports financial stability

- Strong fixed asset turnover reflects efficient use of fixed assets

SKYT Strengths

- Favorable asset turnover shows efficient total asset use

- Favorable debt to assets ratio supports capital structure

- Diverse technology services and wafer services revenue streams

- Large U.S. market presence with growing revenues

MXL Weaknesses

- Negative net margin, ROE, and ROIC indicate poor profitability

- High WACC increases capital cost burden

- Unfavorable interest coverage signals risk in debt servicing

- Market concentration in Asia with limited U.S. presence

- No dividend yield limits income appeal

SKYT Weaknesses

- Negative net margin and ROE reflect ongoing losses

- High WACC signals costly capital

- Poor liquidity ratios raise short-term risk concerns

- High debt to equity ratio increases financial leverage risk

- Limited geographic diversification, heavily U.S.-centric

Overall, MXL shows strengths in liquidity and asset efficiency but suffers from weak profitability and regional concentration. SKYT benefits from operational efficiency and U.S. market scale yet faces challenges in profitability, liquidity, and leverage. These factors shape their strategic priorities around improving returns and managing financial risks.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true shield protecting long-term profits from relentless competitive erosion. Let’s dissect the core moats at play:

MaxLinear, Inc. (MXL): Intangible Assets Driving Integration Excellence

MaxLinear’s moat stems from proprietary SoC designs combining RF, analog, and digital functions. Despite a very unfavorable ROIC trend, its 57% gross margin reflects pricing power. New 5G and fiber products could deepen defensibility, yet declining profitability demands caution in 2026.

SkyWater Technology, Inc. (SKYT): Growing Operational Efficiency in Custom Manufacturing

SkyWater’s moat lies in its specialized semiconductor process development and manufacturing. Unlike MaxLinear, it shows improving ROIC trends and solid revenue growth. Its niche in aerospace and defense markets offers expansion potential amid rising profitability in 2026.

Integration Synergy vs. Manufacturing Specialization

MaxLinear’s deep integration moat is eroding with declining ROIC, while SkyWater’s operational moat strengthens despite still shedding value. I see SkyWater as better positioned to defend and expand its market share through niche manufacturing excellence.

Which stock offers better returns?

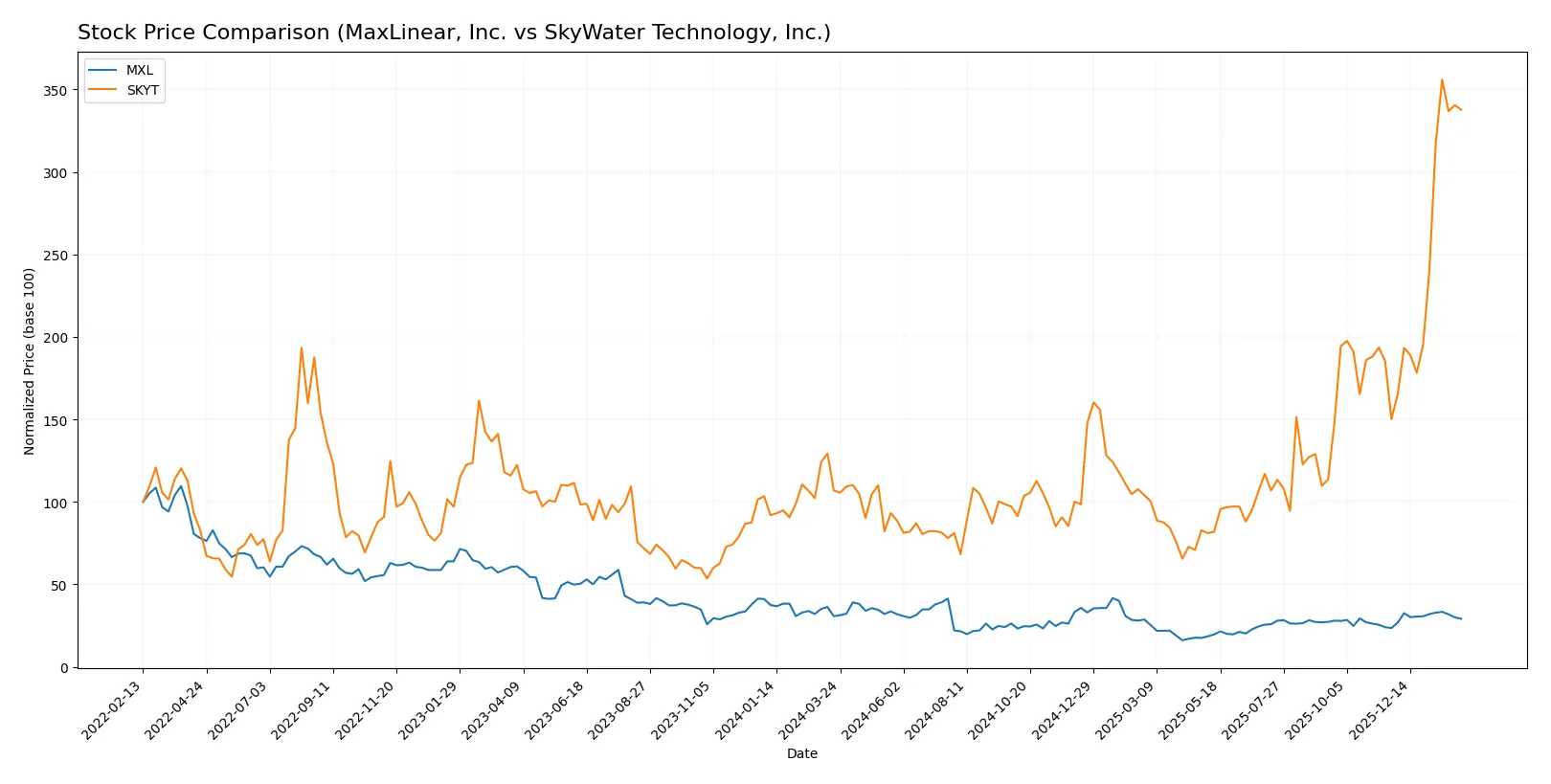

Stock prices of MaxLinear, Inc. and SkyWater Technology, Inc. show contrasting dynamics over the past year, with SkyWater exhibiting strong gains while MaxLinear faced a decline, both experiencing recent acceleration phases.

Trend Comparison

MaxLinear’s stock declined 4.99% over the last 12 months, marking a bearish trend with accelerating downside momentum. The price ranged between $9.31 and $24.05, with moderate volatility (3.34 std deviation).

SkyWater’s stock surged 215.9% over 12 months, reflecting a bullish trend with accelerating gains. Its price moved from $6.10 to $33.10, showing relatively higher volatility (5.66 std deviation).

Comparing trends, SkyWater significantly outperformed MaxLinear in market returns over the past year, delivering the highest stock price appreciation by a wide margin.

Target Prices

Analysts present a bullish consensus for both MaxLinear, Inc. and SkyWater Technology, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| MaxLinear, Inc. | 15 | 25 | 21 |

| SkyWater Technology, Inc. | 35 | 35 | 35 |

MaxLinear’s consensus target of 21 exceeds its current price of 16.87, signaling upside potential. SkyWater’s target of 35 also suggests significant appreciation from its current 31.32 level.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent institutional grades for MaxLinear, Inc. and SkyWater Technology, Inc.:

MaxLinear, Inc. Grades

These grades from recognized firms reflect MaxLinear’s current market stance:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | maintain | Equal Weight | 2026-01-30 |

| Benchmark | maintain | Buy | 2026-01-16 |

| Benchmark | maintain | Buy | 2025-10-24 |

| Benchmark | maintain | Buy | 2025-10-17 |

| Benchmark | maintain | Buy | 2025-09-02 |

| Loop Capital | maintain | Hold | 2025-08-04 |

| Wells Fargo | maintain | Equal Weight | 2025-07-24 |

| Benchmark | maintain | Buy | 2025-07-24 |

| Susquehanna | maintain | Neutral | 2025-07-24 |

| Susquehanna | maintain | Neutral | 2025-07-22 |

SkyWater Technology, Inc. Grades

The following table lists the latest institutional grades for SkyWater Technology:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | downgrade | Hold | 2026-01-27 |

| Piper Sandler | downgrade | Neutral | 2026-01-27 |

| Needham | downgrade | Hold | 2026-01-27 |

| TD Cowen | maintain | Buy | 2025-11-06 |

| Needham | maintain | Buy | 2025-11-06 |

| Piper Sandler | maintain | Overweight | 2025-11-06 |

| Needham | maintain | Buy | 2025-08-07 |

| Needham | maintain | Buy | 2025-05-08 |

| Needham | maintain | Buy | 2025-02-27 |

| Needham | maintain | Buy | 2024-11-11 |

Which company has the best grades?

MaxLinear consistently holds Buy and Equal Weight ratings, indicating stable positive sentiment. SkyWater experienced recent downgrades to Hold and Neutral, reflecting increased caution. Investors may interpret MaxLinear’s steadier grades as a sign of relative institutional confidence.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing MaxLinear, Inc. and SkyWater Technology, Inc. in the 2026 market environment:

1. Market & Competition

MaxLinear, Inc.

- Faces intense competition in semiconductors with declining margins and negative returns on invested capital.

SkyWater Technology, Inc.

- Operates in a niche semiconductor manufacturing segment but battles higher beta and market volatility.

2. Capital Structure & Debt

MaxLinear, Inc.

- Maintains moderate leverage with a debt-to-equity ratio of 0.29 and manageable debt-to-assets at 17%.

SkyWater Technology, Inc.

- Exhibits higher financial risk with debt-to-equity of 1.33, despite a reasonable debt-to-assets ratio of 24%.

3. Stock Volatility

MaxLinear, Inc.

- Beta of 1.71 signals above-average volatility but remains less volatile than peers.

SkyWater Technology, Inc.

- Extremely high beta at 3.51 suggests susceptibility to market swings and riskier stock behavior.

4. Regulatory & Legal

MaxLinear, Inc.

- Standard semiconductor industry regulatory risks with no major legal exposures disclosed.

SkyWater Technology, Inc.

- Faces typical sector regulatory risks; no significant legal issues reported but must monitor defense-related compliance.

5. Supply Chain & Operations

MaxLinear, Inc.

- Supply chain complexity in RF and mixed-signal SoCs can impact delivery and costs.

SkyWater Technology, Inc.

- Relies on specialized manufacturing processes vulnerable to supply disruptions and capacity constraints.

6. ESG & Climate Transition

MaxLinear, Inc.

- No disclosed ESG controversies; sector-wide pressure to improve sustainability in manufacturing.

SkyWater Technology, Inc.

- Faces growing demands to enhance ESG performance, especially in energy-intensive fabrication processes.

7. Geopolitical Exposure

MaxLinear, Inc.

- Primarily US-based with global customers; moderately exposed to trade tensions impacting supply chains.

SkyWater Technology, Inc.

- US headquartered with exposure to defense contracts; geopolitical shifts could affect customer demand and regulations.

Which company shows a better risk-adjusted profile?

MaxLinear’s primary risk lies in operational inefficiency and poor profitability, with negative ROIC and interest coverage raising red flags. SkyWater’s main risk is its high financial leverage and extreme stock volatility, signaling vulnerability to market shocks. Despite both firms showing unfavorable financials, MaxLinear’s lower debt and volatility offer a comparatively better risk-adjusted profile. The recent data highlight MaxLinear’s struggle with sustained negative margins, while SkyWater’s elevated beta and debt-to-equity ratio amplify its risk exposure.

Final Verdict: Which stock to choose?

MaxLinear, Inc. (MXL) demonstrates a superpower in its accelerating revenue and gross profit growth, signaling improving operational momentum. However, its persistent value destruction and negative returns on capital remain points of vigilance. MXL may appeal to investors seeking aggressive growth with a tolerance for financial instability.

SkyWater Technology, Inc. (SKYT) leverages a strategic moat through a steadily growing ROIC and improving profitability, hinting at emerging competitive strength. Although it faces liquidity constraints and higher leverage, it provides better stability relative to MXL. SKYT fits portfolios focused on growth at a reasonable price with an eye on operational turnaround.

If you prioritize aggressive growth and can withstand operational risks, MXL presents a compelling scenario due to its strong top-line momentum. However, if you seek improving profitability with greater financial discipline, SKYT offers better stability and a more cautious growth profile despite its challenges. Each stock suits distinct investor appetites shaped by risk tolerance and strategic focus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of MaxLinear, Inc. and SkyWater Technology, Inc. to enhance your investment decisions: