Home > Comparison > Technology > MXL vs INDI

The strategic rivalry between MaxLinear, Inc. and indie Semiconductor, Inc. shapes the semiconductor industry’s evolution. MaxLinear operates as a diversified SoC provider with a broad communications focus. Indie Semiconductor specializes in automotive semiconductors and software for advanced driver assistance and connectivity. This analysis contrasts their operational models and growth trajectories to identify which offers superior risk-adjusted returns for a diversified portfolio.

Table of contents

Companies Overview

MaxLinear and indie Semiconductor stand as influential players in the semiconductor industry, shaping modern connectivity and automotive tech.

MaxLinear, Inc.: Integrated Communications Pioneer

MaxLinear commands the semiconductor space with its radiofrequency and mixed-signal SoCs. Its revenue derives from high-performance communication chips powering broadband modems, Wi-Fi routers, and 4G/5G infrastructure. In 2026, MaxLinear sharpened its focus on delivering end-to-end communication platform solutions, targeting wired and wireless infrastructure to capitalize on expanding connectivity demands.

indie Semiconductor, Inc.: Automotive Tech Innovator

indie Semiconductor specializes in automotive semiconductors and software, enabling advanced driver assistance, infotainment, and electrification. Its core revenue stream comes from devices supporting in-cabin wireless charging and telematics systems. The company’s 2026 strategy centers on enhancing automotive user experience and connectivity through innovative photonic and electronic components for next-gen vehicles.

Strategic Collision: Similarities & Divergences

MaxLinear and indie operate within semiconductors but diverge sharply in focus. MaxLinear embraces a broad communications ecosystem, while indie pursues a specialized automotive niche. Their battleground lies in embedded systems integration, competing for OEM and ODM partnerships. MaxLinear offers a mature, diversified portfolio, whereas indie presents a high-beta growth profile with concentrated automotive exposure.

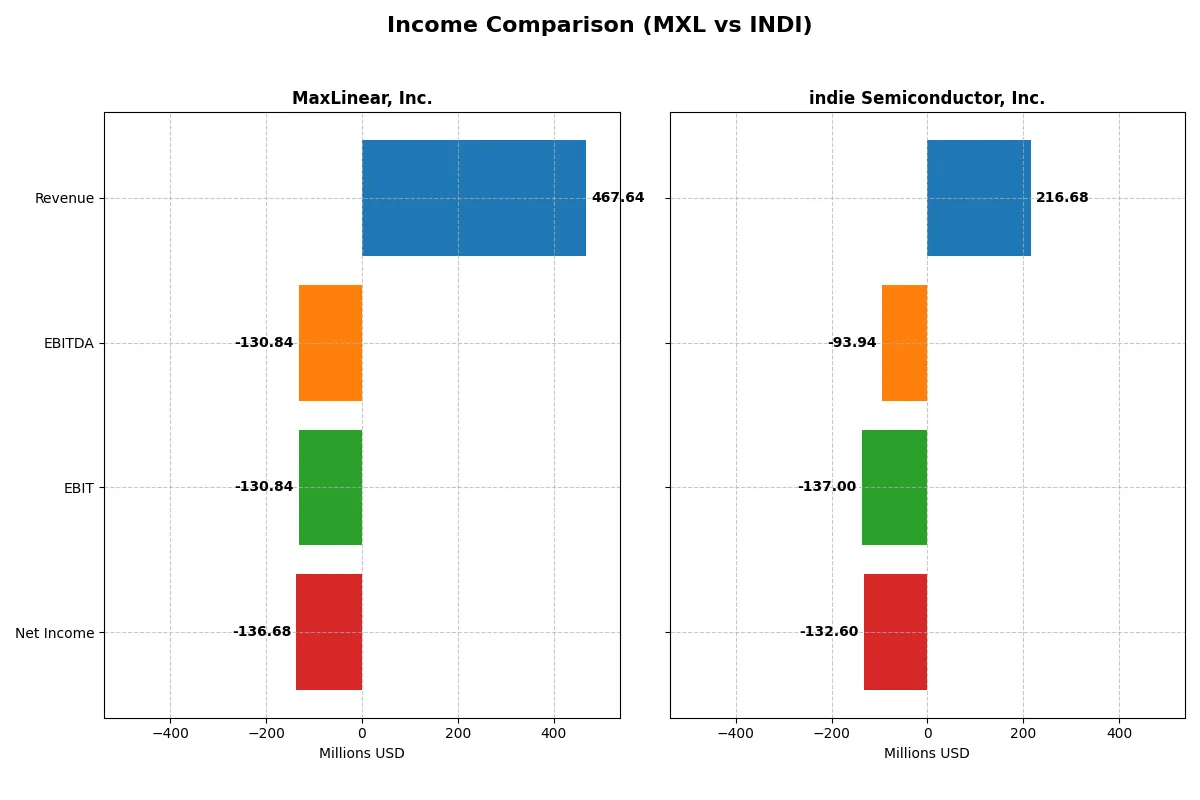

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | MaxLinear, Inc. (MXL) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Revenue | 468M | 217M |

| Cost of Revenue | 202M | 126M |

| Operating Expenses | 393M | 260M |

| Gross Profit | 266M | 90M |

| EBITDA | -131M | -94M |

| EBIT | -131M | -137M |

| Interest Expense | 10M | 9.3M |

| Net Income | -137M | -133M |

| EPS | -1.58 | -0.76 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs a more efficient and financially sustainable business engine.

MaxLinear, Inc. Analysis

MaxLinear’s revenue dropped nearly 48% from 2021 to 2025 but rebounded 30% in the latest year to $468M. Despite a solid 57% gross margin, it records a negative net margin of -29%, reflecting ongoing operational struggles. The 2025 data show improving efficiency and a 46% EPS growth, signaling positive momentum after prior losses.

indie Semiconductor, Inc. Analysis

indie Semiconductor’s revenue surged over 850% across five years, reaching $217M in 2024, though it slightly declined 3% year-over-year. The gross margin sits at 42%, below MaxLinear’s, while the net margin is deeply negative at -61%. Despite solid gross profit growth, operating losses persist, and net income remains negative, indicating continued heavy investment and operational challenges.

Margin Strength vs. Growth Ambition

MaxLinear demonstrates stronger margin control and improving profitability momentum, despite a revenue decline over the period. indie Semiconductor shows impressive revenue growth but struggles with deep losses and weaker margins. For investors, MaxLinear’s profile suggests a more disciplined operation, whereas indie’s high growth comes with higher financial risk.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | MaxLinear, Inc. (MXL) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| ROE | -47.5% | -31.7% |

| ROIC | -24.3% | -19.3% |

| P/E | -6.74 | -5.35 |

| P/B | 3.20 | 1.70 |

| Current Ratio | 1.77 | 4.82 |

| Quick Ratio | 1.28 | 4.23 |

| D/E | 0.29 | 0.95 |

| Debt-to-Assets | 17.2% | 42.3% |

| Interest Coverage | -15.5 | -18.4 |

| Asset Turnover | 0.42 | 0.23 |

| Fixed Asset Turnover | 4.65 | 4.30 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, uncovering hidden risks and highlighting operational strengths behind the numbers.

MaxLinear, Inc.

MaxLinear posts deeply negative profitability, with ROE at -47.5% and net margins at -68%, signaling operational struggles. Its P/E is negative but viewed favorably due to losses, while a high P/B ratio of 3.2 suggests market skepticism. The firm retains earnings, focusing heavily on R&D (62% of revenue), aiming for long-term growth rather than dividends.

indie Semiconductor, Inc.

indie Semiconductor shows weak profitability with a ROE of -31.7% and net margins of -61.2%, reflecting ongoing losses. Its P/E is also negative but slightly more favorable than MaxLinear’s, and its moderate P/B of 1.7 indicates more conservative valuation. The company reinvests aggressively in R&D (81% of revenue) and absorbs stock-based compensation, foregoing dividends to fuel innovation.

Growth Investment vs. Operational Frailty

Both companies suffer from unfavorable profitability and carry negative earnings yields, reflecting high operational risk. MaxLinear’s higher P/B and stronger focus on R&D signal a bolder growth stance but with stretched efficiency. indie Semiconductor’s lower valuation metrics and stronger liquidity suggest a more cautious profile. Investors seeking aggressive growth may favor MaxLinear’s reinvestment, while those wary of risk might consider indie’s steadier balance sheet.

Which one offers the Superior Shareholder Reward?

MaxLinear, Inc. (MXL) and indie Semiconductor, Inc. (INDI) have no dividend payouts. I focus on their share buyback intensity and reinvestment strategies. MXL generated positive free cash flow of 0.14/share in 2024, supporting modest buybacks to enhance shareholder value. INDI, meanwhile, posted negative free cash flow of -0.42/share and negative operating cash flow, indicating no buybacks and heavy reinvestment or cash burn. MXL’s stronger cash generation and lower debt-to-equity ratio (0.29 vs. INDI’s 0.95) suggest a more sustainable capital allocation. I conclude MXL offers a superior total return profile with better financial health and shareholder reward potential in 2026.

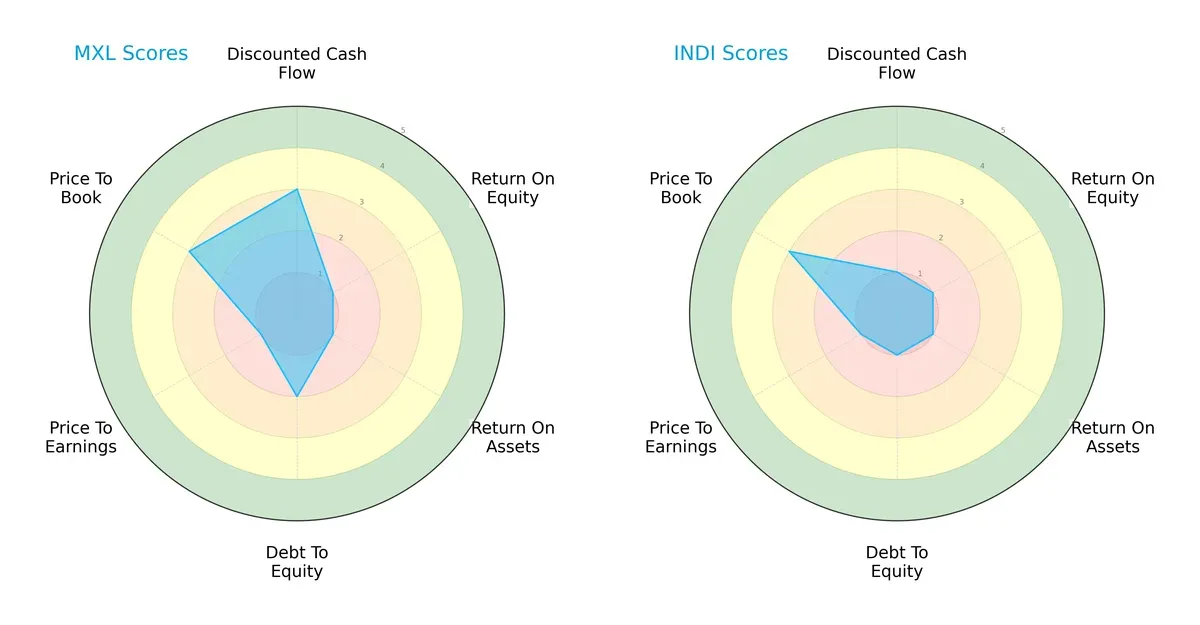

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of MaxLinear, Inc. and indie Semiconductor, Inc., highlighting their financial strengths and weaknesses:

MaxLinear shows a more balanced profile with moderate DCF (3) and debt-to-equity (2) scores, despite very unfavorable returns (ROE and ROA at 1). Indie Semiconductor struggles across almost all metrics, with very unfavorable scores except a moderate price-to-book valuation. MaxLinear leans on disciplined capital structure, while Indie depends on weak operational performance and valuation metrics.

Bankruptcy Risk: Solvency Showdown

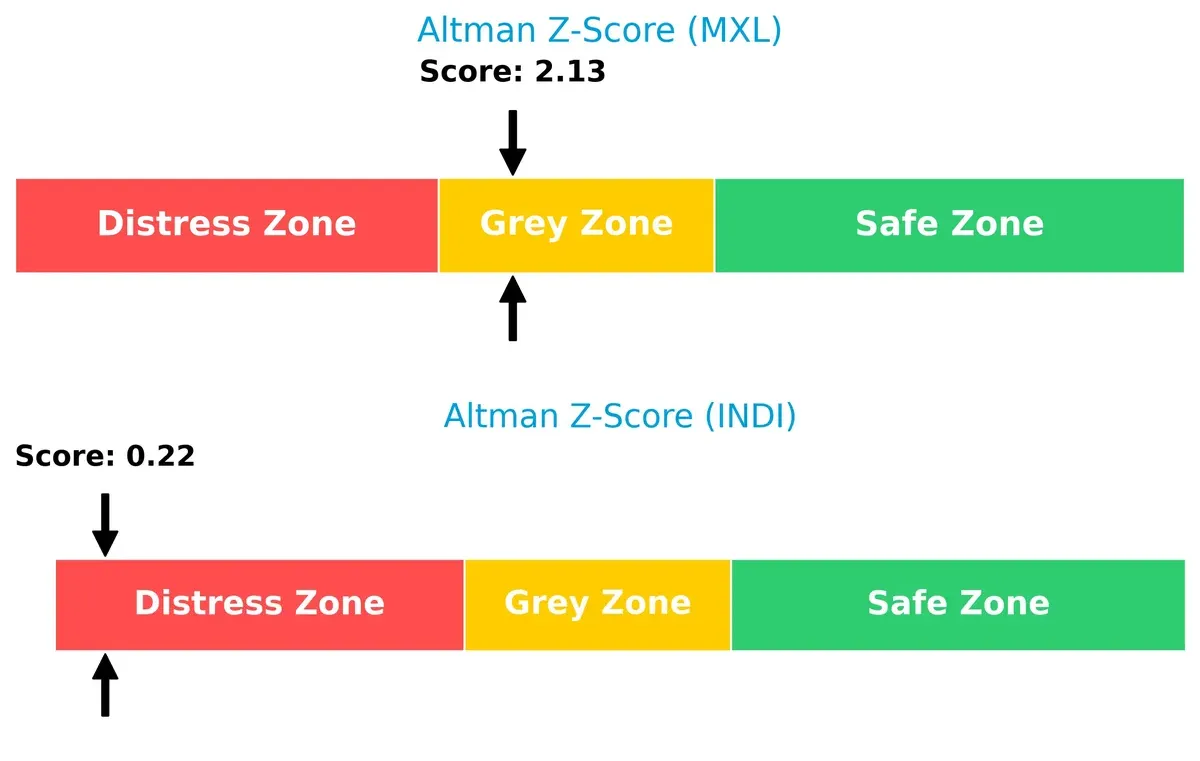

MaxLinear’s Altman Z-Score of 2.13 places it in the grey zone, signaling moderate bankruptcy risk. Indie Semiconductor’s 0.22 score marks distress, indicating severe financial instability and heightened default risk:

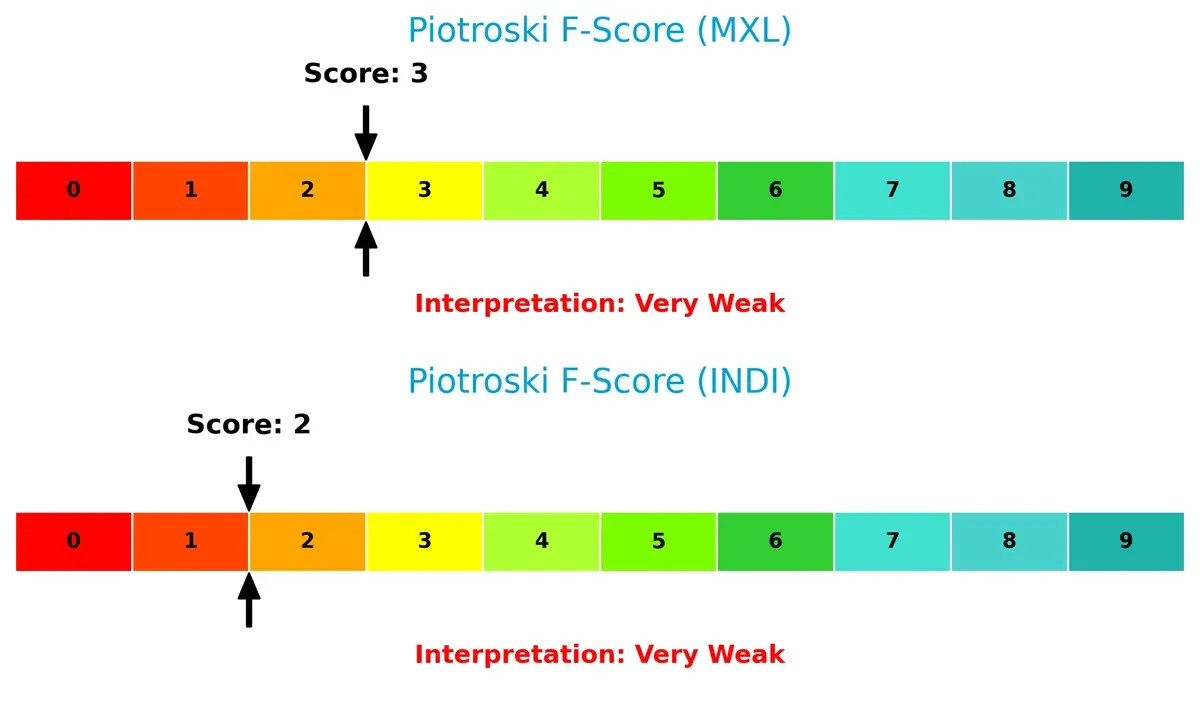

Financial Health: Quality of Operations

Both firms exhibit very weak Piotroski F-Scores, with MaxLinear at 3 and Indie at 2. Neither shows peak financial health, but MaxLinear slightly outperforms Indie, which raises more red flags in operational efficiency and profitability:

How are the two companies positioned?

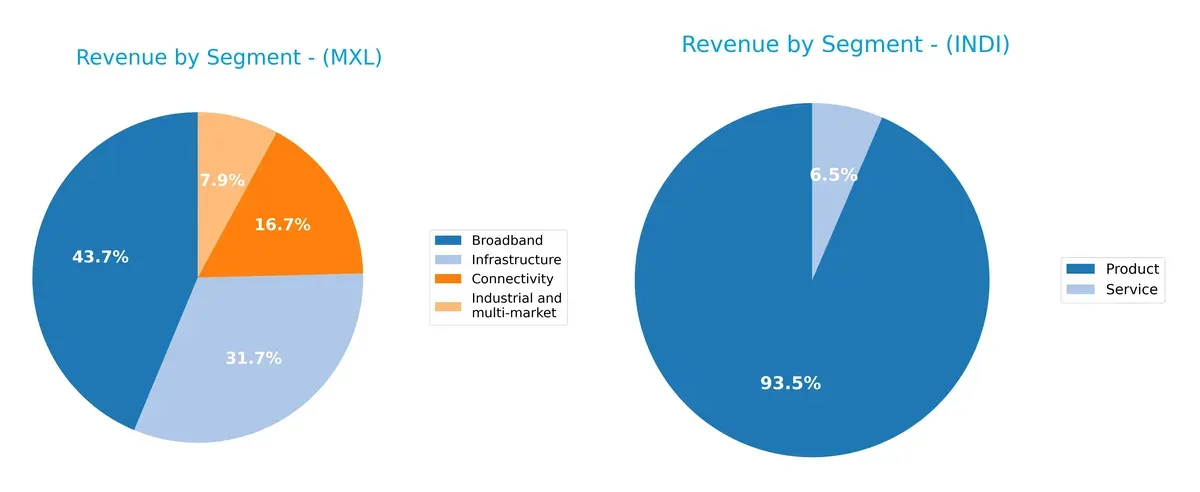

This section dissects the operational DNA of MXL and INDI by comparing their revenue distribution by segment alongside their internal strengths and weaknesses. Its final aim is to confront their economic moats to identify which business model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how MaxLinear, Inc. and indie Semiconductor, Inc. diversify their income streams and where their primary sector bets lie:

MaxLinear anchors revenue in Broadband at $204M and Infrastructure at $148M, with notable contributions from Connectivity and Industrial segments, showing a balanced approach. Indie Semiconductor pivots heavily on Product sales at $203M, while Service revenue trails at $14M, highlighting concentration risk. MaxLinear’s diversified mix supports ecosystem lock-in, whereas Indie’s reliance on one segment demands vigilance against market shifts.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of MaxLinear, Inc. and indie Semiconductor, Inc.:

MaxLinear Strengths

- Diverse product segments including Broadband and Infrastructure

- Solid fixed asset turnover at 4.65

- Favorable current and quick ratios indicate liquidity

indie Semiconductor Strengths

- Favorable quick ratio at 4.23

- Presence in significant markets including China and the US

- Positive P/E ratio suggests some market valuation support

MaxLinear Weaknesses

- Negative net margin, ROE, and ROIC reflect poor profitability

- Unfavorable interest coverage and asset turnover ratios

- Unfavorable debt-to-equity and price-to-book ratios

indie Semiconductor Weaknesses

- Negative profitability metrics including net margin and ROE

- Unfavorable interest coverage and low asset turnover

- High debt-to-assets ratio and unfavorable current ratio

MaxLinear shows stronger liquidity and asset efficiency but struggles with profitability and leverage metrics. indie Semiconductor faces similar profitability challenges but has a stronger presence in large geographic markets and better liquidity in quick assets. Both need to address profitability and capital structure issues to support sustainable growth.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole shield protecting long-term profits from relentless competitive erosion in dynamic markets:

MaxLinear, Inc.: Integrated SoC Solutions With Moderate Switching Costs

MaxLinear’s moat stems from high integration of RF and mixed-signal SoCs, creating moderate switching costs. Despite a 57% gross margin, its declining ROIC signals weakening profitability. Expansion into 5G and fiber optics could deepen its moat if operational efficiency improves by 2026.

indie Semiconductor, Inc.: Niche Automotive Semiconductor Innovator

indie Semiconductor’s moat relies on specialized automotive applications and intellectual property, differing from MaxLinear’s broader telecom focus. Its lower gross margin and negative ROIC reflect early-stage scaling challenges. Yet, rising automotive electrification offers runway to strengthen its moat by 2026.

Profitability Resilience vs. Specialized Innovation: The Moat Showdown

Both firms destroy value with negative ROIC trending downward, signaling fragile moats. MaxLinear’s broader integration offers a wider moat, but indie’s automotive niche presents a potentially deeper moat if it scales efficiently. MaxLinear currently holds a slight edge defending market share amid sector volatility.

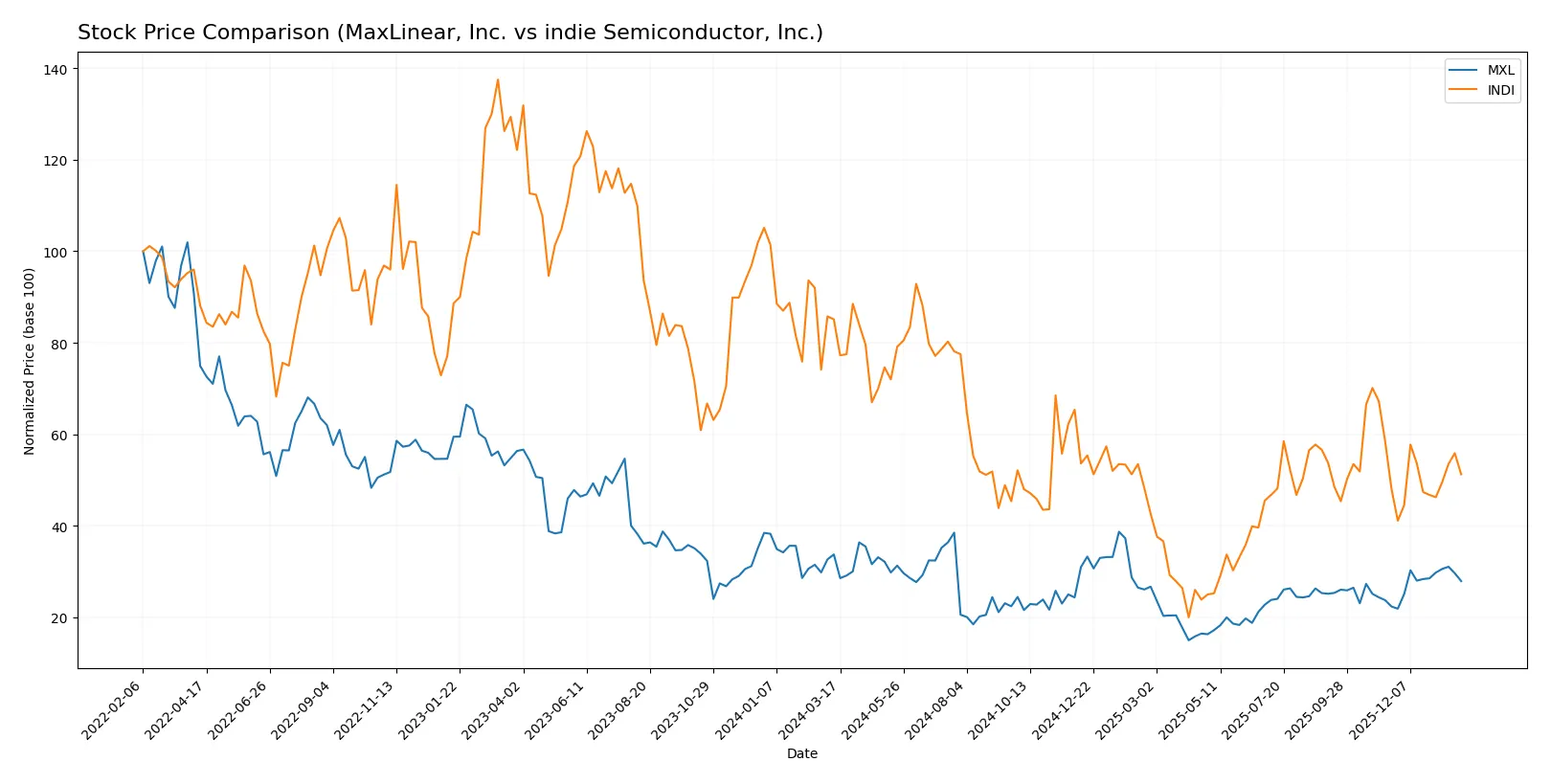

Which stock offers better returns?

Both MaxLinear, Inc. and indie Semiconductor, Inc. experienced significant price declines over the past year, with recent positive momentum emerging in late 2025 through early 2026.

Trend Comparison

MaxLinear, Inc. shows a bearish trend with a -17.26% price change over 12 months, but recent acceleration pushed prices up 24.82% in the past 2.5 months, indicating a strong rebound.

indie Semiconductor, Inc. also exhibits a bearish trend, declining -39.79% over 12 months, with a modest 6.49% recovery recently, showing slower positive momentum and lower volatility than MaxLinear.

MaxLinear’s stock outperformed indie Semiconductor over the year and in the recent period, delivering higher market returns and stronger acceleration in price recovery.

Target Prices

Analysts present a cautiously optimistic outlook for MaxLinear and indie Semiconductor with clear target price ranges.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| MaxLinear, Inc. | 15 | 25 | 21 |

| indie Semiconductor, Inc. | 8 | 8 | 8 |

MaxLinear’s consensus target of 21 exceeds its current 17.35 price, indicating upside potential. indie Semiconductor’s target of 8 doubles its present 4.1 price, signaling high expected growth but with elevated risk.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is a summary of institutional grades for MaxLinear, Inc. and indie Semiconductor, Inc.:

MaxLinear, Inc. Grades

The table below shows recent grades from reputable firms for MaxLinear, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-30 |

| Benchmark | Maintain | Buy | 2026-01-16 |

| Benchmark | Maintain | Buy | 2025-10-24 |

| Benchmark | Maintain | Buy | 2025-10-17 |

| Benchmark | Maintain | Buy | 2025-09-02 |

| Loop Capital | Maintain | Hold | 2025-08-04 |

| Wells Fargo | Maintain | Equal Weight | 2025-07-24 |

| Benchmark | Maintain | Buy | 2025-07-24 |

| Susquehanna | Maintain | Neutral | 2025-07-24 |

| Susquehanna | Maintain | Neutral | 2025-07-22 |

indie Semiconductor, Inc. Grades

The table below details recent grades from recognized institutions for indie Semiconductor, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-11-10 |

| Benchmark | Maintain | Buy | 2025-06-25 |

| Benchmark | Maintain | Buy | 2025-06-11 |

| Benchmark | Maintain | Buy | 2025-05-21 |

| Benchmark | Maintain | Buy | 2025-05-13 |

| Craig-Hallum | Maintain | Buy | 2025-05-13 |

| Keybanc | Maintain | Overweight | 2025-05-13 |

| Benchmark | Maintain | Buy | 2025-04-09 |

| Benchmark | Maintain | Buy | 2025-02-21 |

| Keybanc | Maintain | Overweight | 2025-02-21 |

Which company has the best grades?

indie Semiconductor, Inc. has consistently received “Buy” and “Overweight” ratings from multiple firms, indicating stronger analyst confidence. MaxLinear, Inc. shows mixed ratings from “Buy” to “Equal Weight” and “Hold,” reflecting more cautious sentiment. These differences may influence investor perception and portfolio positioning.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

MaxLinear, Inc. (MXL)

- Faces intense competition in mature semiconductor segments, pressuring margins.

indie Semiconductor, Inc. (INDI)

- Operates in a niche automotive semiconductor market but faces rapid tech shifts and emerging rivals.

2. Capital Structure & Debt

MaxLinear, Inc. (MXL)

- Maintains a conservative debt-to-equity of 0.29, supporting financial flexibility.

indie Semiconductor, Inc. (INDI)

- High debt-to-equity near 0.95 raises leverage concerns and increases financial risk.

3. Stock Volatility

MaxLinear, Inc. (MXL)

- Beta of 1.77 indicates elevated volatility but less than INDI; still riskier than S&P 500 average.

indie Semiconductor, Inc. (INDI)

- Extremely high beta at 2.54 signals pronounced stock price swings and investor uncertainty.

4. Regulatory & Legal

MaxLinear, Inc. (MXL)

- Subject to typical semiconductor industry regulations with moderate compliance risk.

indie Semiconductor, Inc. (INDI)

- Automotive semiconductor focus exposes INDI to stricter safety and emissions regulations.

5. Supply Chain & Operations

MaxLinear, Inc. (MXL)

- Benefits from diversified customer base but vulnerable to global chip shortages.

indie Semiconductor, Inc. (INDI)

- Dependent on specialized components with supply chain risks amplified by automotive industry demands.

6. ESG & Climate Transition

MaxLinear, Inc. (MXL)

- ESG efforts moderate; not a core competitive advantage yet.

indie Semiconductor, Inc. (INDI)

- Automotive electrification focus aligns with climate transition but requires heavy R&D investment.

7. Geopolitical Exposure

MaxLinear, Inc. (MXL)

- Concentrated U.S.-based operations limit direct geopolitical risk but supply chains remain exposed.

indie Semiconductor, Inc. (INDI)

- Global supply chain dependencies increase vulnerability to trade tensions and export controls.

Which company shows a better risk-adjusted profile?

MaxLinear’s most significant risk lies in its weak profitability and operational metrics despite moderate leverage. indie Semiconductor faces critical financial distress risks due to its high leverage and poor liquidity ratios. MaxLinear’s lower beta and stronger balance sheet offer a more stable risk-adjusted profile. Notably, indie Semiconductor’s Altman Z-Score plunges into the distress zone, signaling elevated bankruptcy risk, which justifies heightened investor caution.

Final Verdict: Which stock to choose?

MaxLinear, Inc. (MXL) stands out for its burgeoning operational momentum and robust research and development focus. Its superpower lies in a scalable, innovation-driven model that could fuel a turnaround. The main point of vigilance remains its current negative profitability and declining ROIC, signaling ongoing value destruction. It suits aggressive growth portfolios willing to ride the recovery cycle.

indie Semiconductor, Inc. (INDI) offers a strategic moat rooted in substantial investment in R&D and a high current ratio that cushions liquidity risks. Its recurring revenue potential could stabilize returns relative to MXL’s volatility. However, persistent losses and deteriorating profitability underscore a need for caution. INDI fits GARP portfolios seeking growth with some margin of safety.

If you prioritize aggressive growth and can tolerate short-term volatility, MXL’s innovation pipeline and improving income statement might outshine INDI despite its current value destruction. However, if you seek a more measured approach with liquidity strength and a clearer path to recurring revenue, INDI offers better stability but commands a premium due to lingering profitability challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of MaxLinear, Inc. and indie Semiconductor, Inc. to enhance your investment decisions: