In today’s dynamic technology landscape, Match Group, Inc. and SoundHound AI, Inc. stand out as innovative players reshaping their respective markets. Match Group dominates online dating with a diverse portfolio of popular brands, while SoundHound AI pioneers voice artificial intelligence, enabling smarter conversational experiences. Both operate in the software application industry, making their contrasting approaches fascinating to compare. Join me as we explore which company presents the most compelling opportunity for investors in 2026.

Table of contents

Companies Overview

I will begin the comparison between Match Group and SoundHound AI by providing an overview of these two companies and their main differences.

Match Group Overview

Match Group, Inc. operates in the technology sector, specializing in software applications for dating services worldwide. Based in Dallas, Texas, it manages a portfolio of well-known dating brands including Tinder, Match, OkCupid, and Hinge. With a market cap of approximately 7.4B USD and 2,500 employees, its mission centers on connecting people through innovative dating platforms.

SoundHound AI Overview

SoundHound AI, Inc., headquartered in Santa Clara, California, develops voice artificial intelligence platforms to enhance conversational experiences across various industries. Its key product, the Houndify platform, offers tools such as speech recognition and natural language understanding. The company has a market capitalization near 4.7B USD and employs 842 people, focusing on advancing voice-enabled interactions.

Key similarities and differences

Both companies operate in the software application industry within the technology sector and are listed on NASDAQ. Match Group focuses on consumer-facing dating products, while SoundHound AI provides B2B voice AI solutions. Additionally, Match Group has a larger market cap and workforce, whereas SoundHound AI exhibits higher beta, indicating greater stock volatility compared to Match Group’s more established presence.

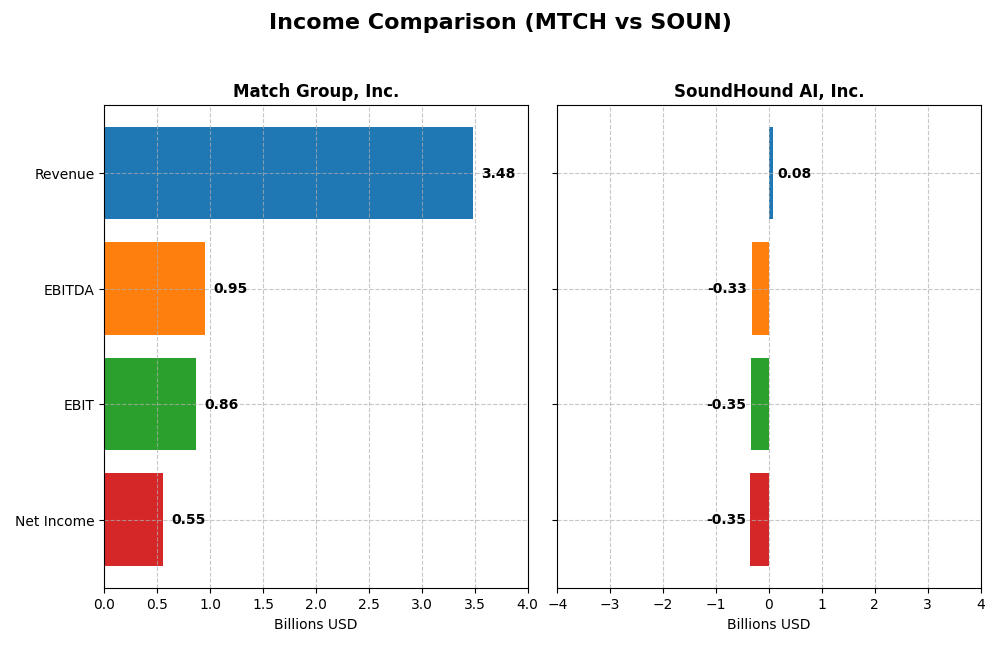

Income Statement Comparison

The table below presents the latest fiscal year income statement figures for Match Group, Inc. and SoundHound AI, Inc., allowing a straightforward financial comparison of these two technology companies.

| Metric | Match Group, Inc. (MTCH) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Market Cap | 7.4B | 4.7B |

| Revenue | 3.48B | 85M |

| EBITDA | 952M | -329M |

| EBIT | 864M | -348M |

| Net Income | 551M | -351M |

| EPS | 2.12 | -1.04 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Match Group, Inc.

Match Group’s revenue steadily increased from $2.39B in 2020 to $3.48B in 2024, marking a 45.5% growth over five years. Net income surged 239.6% over the period, reaching $551M in 2024. Margins remain strong, with a gross margin of 71.5% and net margin of 15.8%. However, 2024 saw a slight slowdown in revenue growth to 3.4% and a decline in net margin by 18.2%.

SoundHound AI, Inc.

SoundHound AI’s revenue expanded rapidly, from $13M in 2020 to $85M in 2024, an increase of 550.6%. Despite this, the company posted consistent net losses, totaling -$351M in 2024. Gross margin is moderate at 48.9%, but EBIT and net margins are deeply negative, reflecting ongoing operating losses. The latest year showed strong revenue growth of 84.6%, yet profitability worsened substantially.

Which one has the stronger fundamentals?

Match Group exhibits stronger fundamentals with sustained revenue and profit growth, favorable margins, and positive net income trends. SoundHound AI demonstrates impressive top-line growth but faces significant unprofitability and unfavorable margins, indicating higher risk. The contrast in profitability and margin stability favors Match Group’s financial health over the period analyzed.

Financial Ratios Comparison

This table presents the most recent financial ratios for Match Group, Inc. and SoundHound AI, Inc., offering a side-by-side view of their key performance and financial health indicators as of fiscal year 2024.

| Ratios | Match Group, Inc. (MTCH) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| ROE | -8.7% | -191.9% |

| ROIC | 16.4% | -68.1% |

| P/E | 15.4 | -19.1 |

| P/B | -133.7 | 36.8 |

| Current Ratio | 2.54 | 3.77 |

| Quick Ratio | 2.54 | 3.77 |

| D/E | -62.1 | 0.02 |

| Debt-to-Assets | 88.5% | 0.8% |

| Interest Coverage | 5.1 | -28.1 |

| Asset Turnover | 0.78 | 0.15 |

| Fixed Asset Turnover | 22.0 | 14.3 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Match Group, Inc.

Match Group shows mostly favorable financial ratios, including a solid net margin of 15.84% and a strong return on invested capital at 16.38%, indicating efficient use of capital. The company’s current and quick ratios of 2.54 suggest good liquidity, though its high debt-to-assets ratio of 88.51% is a concern. Match Group pays dividends, with a last dividend of $0.76, but has a 0% dividend yield, signaling limited shareholder returns from dividends.

SoundHound AI, Inc.

SoundHound AI’s ratios reveal significant weaknesses, including a highly negative net margin of -414.06% and unfavorable returns on equity and capital employed. Despite a low debt-to-assets ratio of 0.79%, the company has a negative interest coverage ratio, raising solvency concerns. SoundHound does not pay dividends, reflecting its high growth phase and focus on reinvestment, alongside elevated research and development expenses.

Which one has the best ratios?

Match Group’s financial ratios are predominantly favorable, with strong profitability and liquidity metrics, despite some leverage concerns. In contrast, SoundHound’s ratios are largely unfavorable, reflecting operational losses and financial strain typical of a high-growth tech firm. Based on these evaluations, Match Group exhibits stronger and more stable financial ratios.

Strategic Positioning

This section compares the strategic positioning of Match Group, Inc. and SoundHound AI, Inc. across market position, key segments, and exposure to technological disruption:

Match Group, Inc.

- Leading dating software provider with a 7.4B market cap and established brand portfolio.

- Primary business in dating products including Tinder, Match, and others; revenue driven by subscription services.

- Moderate exposure as a software applications company; innovation in AI could affect future competitiveness.

SoundHound AI, Inc.

- Voice AI platform developer with a 4.7B market cap focusing on conversational experiences.

- Revenue driven by hosted services, licensing, and professional services for conversational AI.

- High exposure to AI and voice recognition technology disruption in multiple industries.

Match Group, Inc. vs SoundHound AI, Inc. Positioning

Match Group pursues a concentrated strategy focused on online dating platforms, leveraging a strong brand portfolio and subscription revenues. SoundHound AI operates a more diversified AI platform business targeting various conversational applications, with growing revenue streams from hosted and licensing services.

Which has the best competitive advantage?

Match Group holds a slightly favorable moat with positive value creation but declining profitability. SoundHound AI has a slightly unfavorable moat, currently destroying value but showing improving profitability trends.

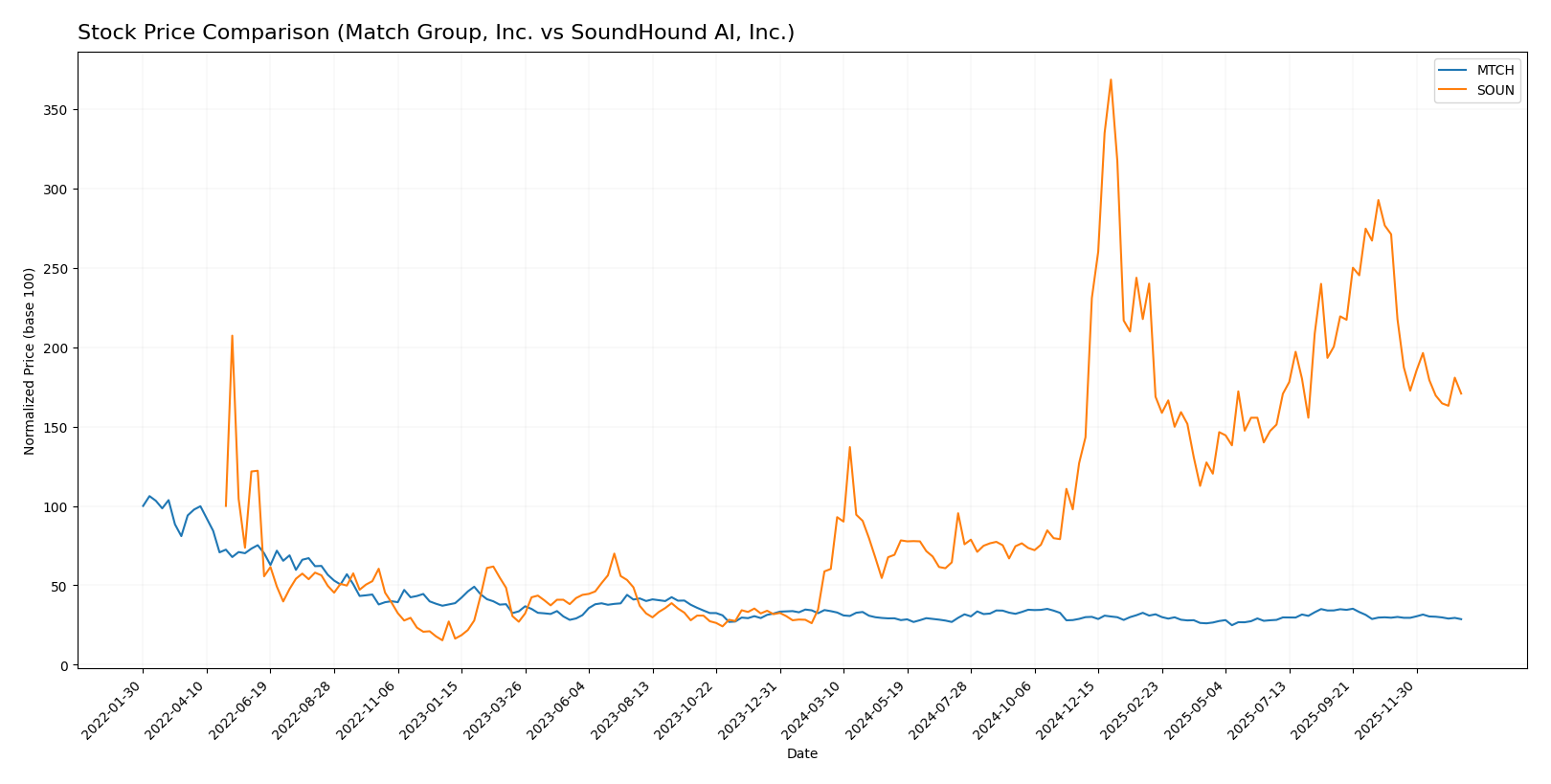

Stock Comparison

The stock price movements of Match Group, Inc. and SoundHound AI, Inc. over the past 12 months reveal contrasting trends, with significant divergences in performance and trading volumes during recent months.

Trend Analysis

Match Group, Inc. (MTCH) shows a bearish trend over the past year with a price decline of 14.98%, accompanied by deceleration and moderate volatility (std deviation 2.64). The stock peaked at 38.51 and bottomed at 27.18.

SoundHound AI, Inc. (SOUN) exhibits a strong bullish trend with a 183.16% price increase over the same period, despite recent deceleration and higher volatility (std deviation 4.66). The price ranged from a low of 3.55 to a high of 23.95.

Comparing the two, SoundHound AI delivered the highest market performance with a substantial positive price change, while Match Group experienced a notable decline, indicating divergent investor sentiment and momentum.

Target Prices

Analysts present a clear target price consensus for Match Group, Inc. and SoundHound AI, Inc., reflecting their outlooks.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Match Group, Inc. | 43 | 33 | 36.29 |

| SoundHound AI, Inc. | 15 | 11 | 13.33 |

The target consensus for Match Group at 36.29 is above its current price of 31.34, suggesting moderate upside potential. SoundHound AI’s consensus target of 13.33 also indicates room for growth from the current 11.10 price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Match Group, Inc. (MTCH) and SoundHound AI, Inc. (SOUN):

Rating Comparison

MTCH Rating

- Rating: B, considered very favorable by analysts.

- Discounted Cash Flow Score: 5, very favorable, indicating undervaluation potential.

- ROE Score: 1, very unfavorable, reflecting low efficiency in generating profit from equity.

- ROA Score: 5, very favorable, indicating effective asset utilization.

- Debt To Equity Score: 1, very unfavorable, indicating higher financial risk.

- Overall Score: 3, moderate, reflecting a balanced financial standing.

SOUN Rating

- Rating: C-, a less favorable rating compared to MTCH.

- Discounted Cash Flow Score: 1, very unfavorable, suggesting possible overvaluation.

- ROE Score: 1, very unfavorable, showing similar inefficiency in equity profit generation.

- ROA Score: 1, very unfavorable, indicating poor asset efficiency.

- Debt To Equity Score: 4, favorable, showing lower financial leverage risk.

- Overall Score: 1, very unfavorable, indicating weaker overall financial health.

Which one is the best rated?

Based strictly on the provided data, MTCH holds a better overall rating with a “B” grade and stronger discounted cash flow and asset utilization scores. SOUN’s scores indicate higher financial risk and weaker profitability metrics, reflected in a lower “C-” rating and overall score.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score for Match Group, Inc. and SoundHound AI, Inc.:

Match Group Scores

- Altman Z-Score: 0.52, in distress zone indicating high bankruptcy risk.

- Piotroski Score: 8, very strong financial health indication.

SoundHound AI Scores

- Altman Z-Score: 6.62, in safe zone indicating low bankruptcy risk.

- Piotroski Score: 3, very weak financial health indication.

Which company has the best scores?

SoundHound AI has a significantly higher Altman Z-Score, placing it in a safe zone, while Match Group’s score signals distress. Conversely, Match Group shows a much stronger Piotroski Score than SoundHound AI, indicating better financial strength by this metric.

Grades Comparison

Here is a detailed comparison of recent grades assigned to Match Group, Inc. and SoundHound AI, Inc.:

Match Group, Inc. Grades

The following table summarizes recent grades from recognized financial institutions for Match Group, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-13 |

| Truist Securities | Maintain | Hold | 2025-11-05 |

| Evercore ISI Group | Maintain | In Line | 2025-11-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-05 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-20 |

| Susquehanna | Maintain | Positive | 2025-08-07 |

| Evercore ISI Group | Maintain | In Line | 2025-08-06 |

| JP Morgan | Maintain | Neutral | 2025-08-06 |

| UBS | Maintain | Neutral | 2025-07-23 |

| Wells Fargo | Maintain | Equal Weight | 2025-06-27 |

The overall trend for Match Group is stable with a consensus bias toward holding or equal weight, reflecting moderate confidence without strong buy signals.

SoundHound AI, Inc. Grades

The following table presents recent grades from established financial firms for SoundHound AI, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-12 |

| DA Davidson | Maintain | Buy | 2025-11-18 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-16 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| Wedbush | Maintain | Outperform | 2025-09-11 |

| DA Davidson | Maintain | Buy | 2025-09-10 |

| Ladenburg Thalmann | Upgrade | Buy | 2025-08-11 |

| Wedbush | Maintain | Outperform | 2025-08-08 |

SoundHound AI exhibits a generally positive outlook with multiple buy and outperform ratings, including recent upgrades, indicating growing analyst confidence.

Which company has the best grades?

SoundHound AI, Inc. has received more positive and upgraded grades compared to Match Group, Inc., which shows a more cautious consensus. This suggests that investors might view SoundHound as having higher growth potential, while Match Group is seen as a stable but less dynamic choice.

Strengths and Weaknesses

Below is a comparative overview of the strengths and weaknesses of Match Group, Inc. (MTCH) and SoundHound AI, Inc. (SOUN) based on their recent financial performance, market positioning, and innovation capabilities.

| Criterion | Match Group, Inc. (MTCH) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Diversification | Moderate—primarily focused on dating services with some other segments | Limited—mainly in hosted services, licensing, and professional services |

| Profitability | Favorable net margin (15.8%) and ROIC (16.4%) but declining ROIC trend | Negative net margin (-414%) and ROIC (-68%), though ROIC trend is improving |

| Innovation | Consistent product and service offerings in dating and related platforms | Growing innovation with increasing hosted services revenue and licensing |

| Global presence | Strong global presence with leading market share in online dating | Emerging presence with niche AI-driven voice and speech technologies |

| Market Share | Leading position in dating market; steady but facing competition | Small market share but potential for growth in AI voice recognition |

Key takeaways: Match Group remains a financially solid and profitable leader in online dating, though its profitability is declining. SoundHound AI shows significant losses but is improving profitability indicators and demonstrating growth potential in AI innovation. Investors should weigh stable returns against growth risks.

Risk Analysis

Below is a comparative table highlighting key risks for Match Group, Inc. (MTCH) and SoundHound AI, Inc. (SOUN) based on their latest 2024 financial data and market context:

| Metric | Match Group, Inc. (MTCH) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Market Risk | Moderate (Beta 1.33) | High (Beta 2.88) |

| Debt level | High debt-to-assets (88.5%) | Low debt (Debt-to-assets 0.79%) |

| Regulatory Risk | Moderate (Tech industry scrutiny) | Moderate (AI data/privacy regulations) |

| Operational Risk | Moderate (Industry competition) | High (Early-stage AI platform risks) |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate (US-based, global user base) | Moderate (US tech, global clients) |

The most impactful risk for Match Group is its high debt level, which could strain financial stability despite favorable operational metrics. SoundHound faces significant market and operational risks due to its high stock volatility and early-stage financial challenges, reflected in unfavorable profitability ratios and weak financial scores. Investors should weigh Match Group’s leverage concerns against SoundHound’s growth uncertainty and higher volatility.

Which Stock to Choose?

Match Group, Inc. (MTCH) shows a favorable income evolution with strong gross and EBIT margins and a positive net margin of 15.84%. Its financial ratios are mostly favorable, including a strong current ratio and interest coverage, despite high debt-to-assets. Profitability is solid with a positive ROIC above WACC, though ROE is negative. The company holds a very favorable overall rating with a B grade.

SoundHound AI, Inc. (SOUN) exhibits mixed income trends: strong revenue growth but negative net margin at -414.06%. Its financial ratios are largely unfavorable, reflecting challenges in profitability and asset turnover, though debt metrics appear sound. ROIC is below WACC indicating value destruction, but improving profitability trends. The overall rating is very unfavorable despite a C- grade, with concerns in key performance scores.

For investors focused on value creation and financial stability, MTCH’s favorable rating and income statement performance may appear more suitable, while those accepting higher risk and prioritizing growth potential might find SOUN’s rapid revenue expansion and improving ROIC trend worth consideration. The choice could depend on tolerance for volatility and strategic investment goals.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Match Group, Inc. and SoundHound AI, Inc. to enhance your investment decisions: