Home > Comparison > Technology > PEGA vs MTCH

The strategic rivalry between Pegasystems Inc. and Match Group, Inc. shapes the competitive landscape of the technology sector. Pegasystems operates as a capital-intensive software solutions provider focused on enterprise automation, while Match Group excels as a high-margin consumer-facing dating platform operator. This analysis pits enterprise software robustness against consumer engagement dynamism. I will determine which company’s trajectory offers a superior risk-adjusted return for a diversified portfolio in today’s tech environment.

Table of contents

Companies Overview

Pegasystems and Match Group both hold pivotal roles in the software application market, shaping distinct user experiences globally.

Pegasystems Inc.: Enterprise Software Innovator

Pegasystems Inc. leads in enterprise software applications, generating revenue through its Pega Platform and Pega Infinity. The company focuses on customer engagement and digital process automation, serving sectors like financial services and healthcare. In 2026, its strategic priority centers on unifying customer interactions and automating sales and service processes to boost enterprise productivity.

Match Group, Inc.: Global Dating Platform Leader

Match Group dominates the online dating software space with flagship brands like Tinder and Match. It monetizes through subscription and advertising services across multiple dating platforms. In 2026, the company emphasizes expanding its global brand portfolio and enhancing user engagement to maintain leadership in a highly competitive market.

Strategic Collision: Similarities & Divergences

Both firms operate in software applications but diverge sharply: Pegasystems builds closed ecosystems focused on enterprise automation, while Match Group thrives on open, consumer-facing platforms. Their primary competition lies in maintaining user engagement—Pegasystems with clients’ operational efficiency, Match Group with consumer retention. These differences define unique investment profiles: enterprise software stability versus consumer growth volatility.

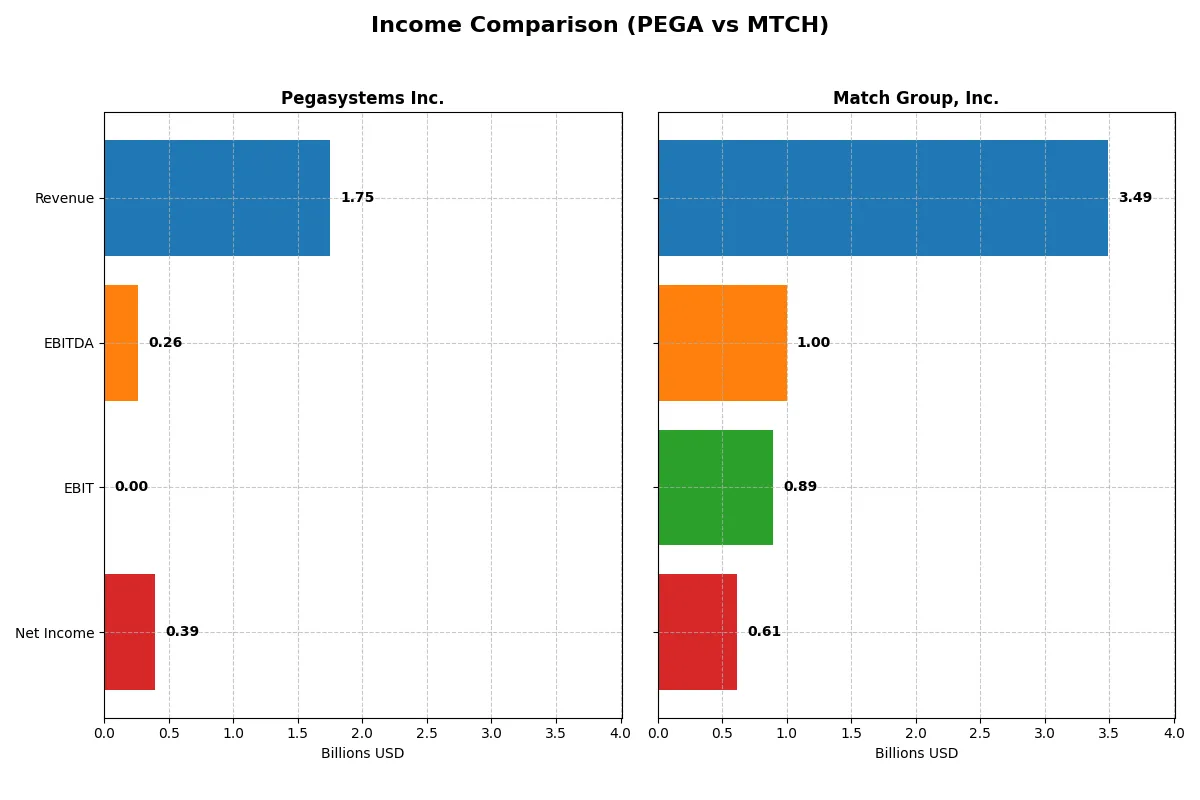

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Pegasystems Inc. (PEGA) | Match Group, Inc. (MTCH) |

|---|---|---|

| Revenue | 1.75B | 3.49B |

| Cost of Revenue | 421M | 948M |

| Operating Expenses | 1.04B | 1.67B |

| Gross Profit | 1.32B | 2.54B |

| EBITDA | 263M | 999M |

| EBIT | 0 | 894M |

| Interest Expense | -1.3M | 148M |

| Net Income | 393M | 613M |

| EPS | 2.30 | 2.53 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company’s financial engine runs more efficiently and delivers superior shareholder value.

Pegasystems Inc. Analysis

Pegasystems grew revenue from $1.21B in 2021 to $1.75B in 2025, with net income surging from a loss of $63M to a profit of $393M. Its gross margin remains robust near 76%, while net margin expanded sharply to 22.5%, reflecting a dramatic turnaround in profitability and operational efficiency in 2025.

Match Group, Inc. Analysis

Match Group’s revenue rose steadily from $3B in 2021 to $3.49B in 2025, with net income climbing from $277M to $613M. It maintains a strong gross margin around 73% and a solid net margin near 17.6%. Despite slower revenue growth recently, the company sustains healthy EBIT margins above 25%, signaling stable operating leverage.

Margin Power vs. Revenue Scale

Pegasystems outpaces Match Group in margin expansion and profitability growth, delivering a remarkable net income turnaround. Match Group, however, commands a larger revenue base with steady earnings and superior EBIT margins. Investors seeking dynamic margin improvement may prefer Pegasystems, while those favoring scale and consistent operating profits might lean toward Match Group.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Pegasystems Inc. (PEGA) | Match Group, Inc. (MTCH) |

|---|---|---|

| ROE | 49.97% | -2.42% |

| ROIC | 29.43% | 18.50% |

| P/E | 25.92 | 12.77 |

| P/B | 12.95 | N/A (negative book value) |

| Current Ratio | 1.33 | 1.42 |

| Quick Ratio | 1.33 | 1.42 |

| D/E (Debt-to-Equity) | 0.08 | N/A (negative equity) |

| Debt-to-Assets | 3.73% | 89.06% |

| Interest Coverage | -204.75 | 5.91 |

| Asset Turnover | 1.07 | 0.78 |

| Fixed Asset Turnover | 0 | 26.59 |

| Payout ratio | 3.92% | 30.36% |

| Dividend yield | 0.15% | 2.38% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, uncovering hidden risks and operational strengths that investors must decode to assess true value.

Pegasystems Inc.

Pegasystems delivers robust profitability with a 50% ROE and a strong 22.54% net margin, signaling operational efficiency. However, its valuation appears stretched, with a high P/E of 25.92 and P/B of 12.95. Shareholder returns remain modest, reflected by a low 0.15% dividend yield, suggesting reinvestment into R&D drives growth.

Match Group, Inc.

Match Group shows a favorable valuation with a P/E of 12.77 and a solid 17.59% net margin, indicating reasonable pricing for earnings. Despite a negative ROE at -242%, it maintains strong free cash flow yields and a 2.38% dividend yield, suggesting disciplined capital return amidst operational challenges and higher leverage.

Premium Valuation vs. Cash Flow Strength

Pegasystems commands higher profitability but trades at stretched multiples, risking valuation premium. Match Group offers a balanced valuation with better dividend yield but weaker profitability signals. Investors must weigh growth-driven reinvestment against cash flow stability for portfolio fit.

Which one offers the Superior Shareholder Reward?

I see Pegasystems Inc. (PEGA) pays a minimal dividend yield of 0.15% with a low payout ratio around 4%. Its buyback activity appears modest but sustainable given a strong free cash flow per share of 2.96. Match Group, Inc. (MTCH) offers a far richer dividend yield near 2.38% and a payout ratio of 30%, supported by robust free cash flow of 4.22 per share. MTCH’s substantial buyback program complements its distribution, enhancing total shareholder return. I note PEGA’s conservative dividend and buyback approach favors reinvestment in growth, while MTCH balances income with capital returns. For 2026, MTCH’s higher yield and aggressive buybacks offer a superior total return profile, assuming stable cash flows and manageable leverage risks.

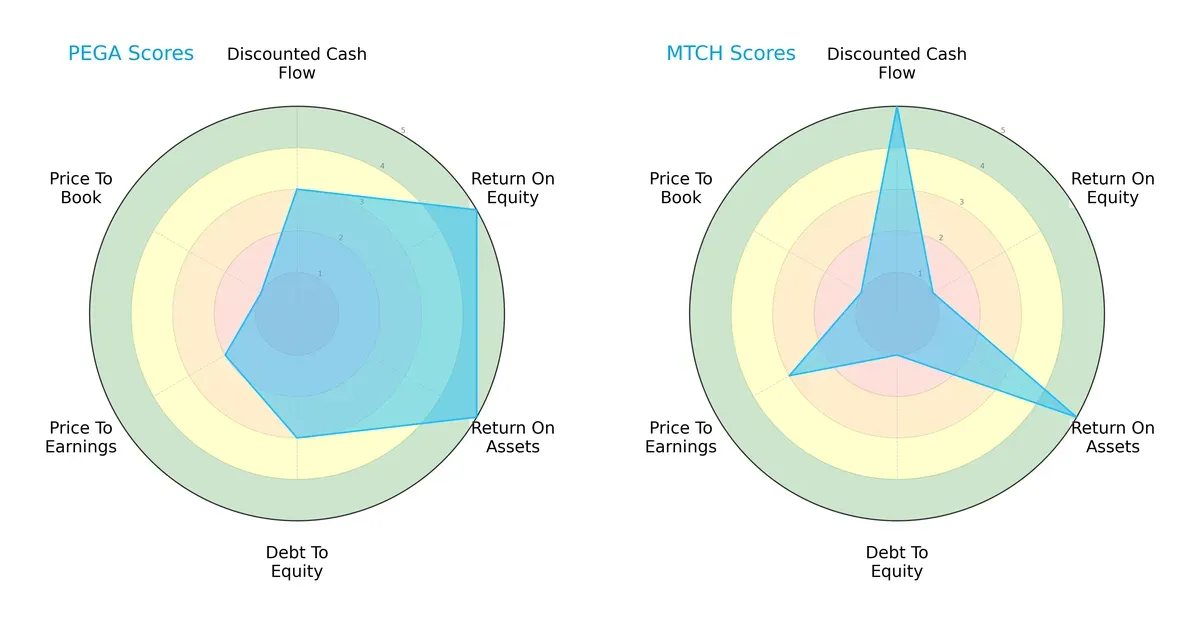

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Pegasystems Inc. and Match Group, Inc., highlighting their distinct strategic strengths and vulnerabilities:

Pegasystems shows a balanced profile with strong ROE (5) and ROA (5), moderate DCF (3) and debt-to-equity (3), but weak valuation scores (P/E 2, P/B 1). Match Group relies heavily on cash flow (DCF 5) and asset efficiency (ROA 5) but struggles with equity returns (ROE 1) and carries high financial risk (debt-to-equity 1). Pegasystems offers steadier profitability, while Match Group depends on operational cash flow and faces balance sheet challenges.

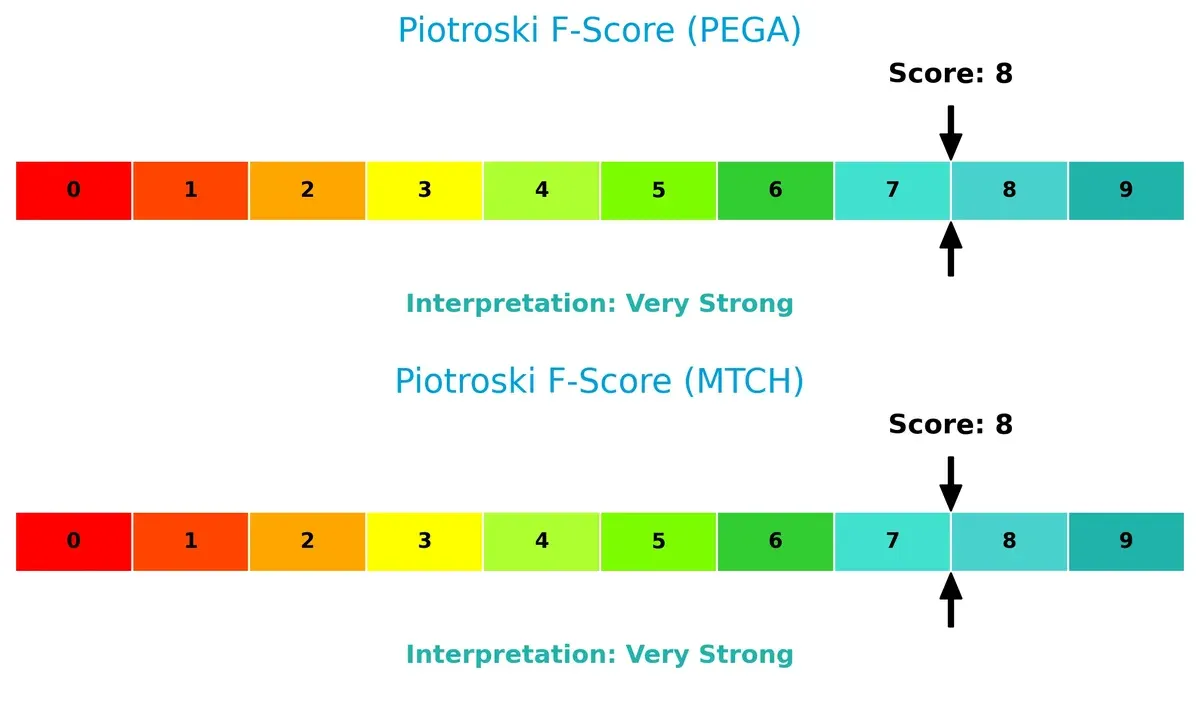

Bankruptcy Risk: Solvency Showdown

Pegasystems’ Altman Z-Score of 6.25 places it well into the safe zone, while Match Group’s 0.63 signals distress. This gap implies Pegasystems has a far stronger buffer against bankruptcy risk in this volatile cycle:

Financial Health: Quality of Operations

Both firms score 8 on the Piotroski F-Score, indicating very strong financial health. Neither shows immediate red flags in profitability, leverage, or liquidity, suggesting solid operational quality despite differing capital structures:

How are the two companies positioned?

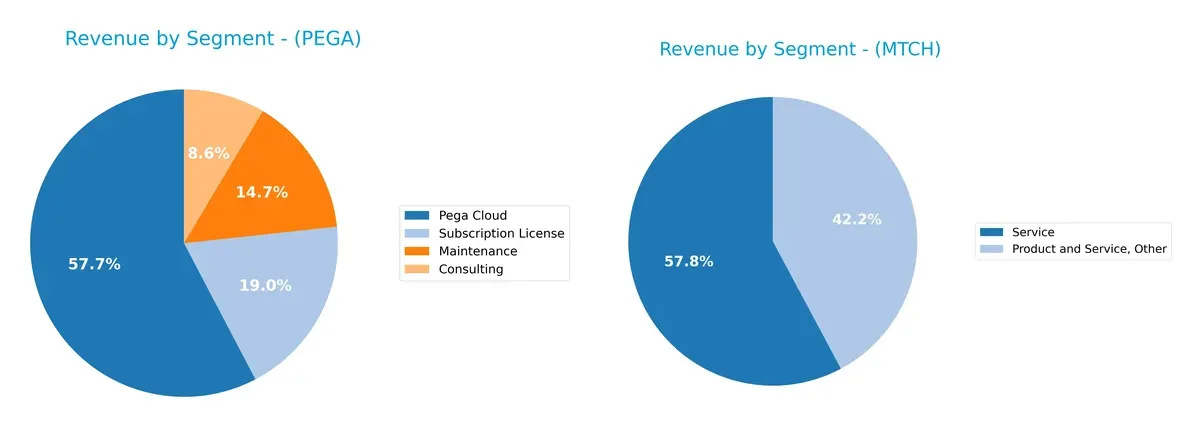

This section dissects the operational DNA of Pegasystems and Match Group by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and identify which business model delivers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This comparison dissects how Pegasystems Inc. and Match Group, Inc. diversify their income streams and where their primary sector bets lie:

Pegasystems anchors its revenue in Pega Cloud at $1.54B, supported by Subscription License ($507M), Maintenance ($393M), and Consulting ($228M). This mix shows strong cloud and recurring revenue focus, reducing concentration risk. Match Group, however, relies heavily on its core Dating segment, historically dominating revenue with limited diversification. Pegasystems’ strategy pivots on cloud infrastructure dominance, while Match Group faces higher concentration risk tied to single-market dependency.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Pegasystems Inc. and Match Group, Inc.:

Pegasystems Inc. Strengths

- High profitability with 22.54% net margin and 49.97% ROE

- Strong ROIC of 29.43% exceeding WACC

- Low debt levels with 3.73% debt-to-assets

- Diversified revenue streams including cloud and consulting

- Solid global presence with significant US and EMEA sales

Match Group, Inc. Strengths

- Favorable profitability metrics including 17.59% net margin

- Strong capital efficiency with 18.5% ROIC and 7.65% WACC

- Low valuation multiples with PE at 12.77

- Robust interest coverage of 6.06

- High dividend yield of 2.38%

- Market presence with substantial US and Non-US revenues

Pegasystems Inc. Weaknesses

- Unfavorable valuation multiples: PE 25.92 and PB 12.95

- Interest coverage near zero signals risk

- Fixed asset turnover at zero indicates underutilization

- Low dividend yield at 0.15%

- Moderate current ratio of 1.33 may limit liquidity

Match Group, Inc. Weaknesses

- Negative ROE at -241.99% reflects profitability concerns

- Very high debt-to-assets at 89.06% indicates leverage risk

- Negative debt-to-equity ratio suggests accounting issues

- Asset turnover only neutral at 0.78

Pegasystems shows strong profitability and low leverage but faces valuation and liquidity risks. Match Group boasts favorable valuation and dividend metrics but carries significant leverage and profitability red flags. Both companies’ profiles imply strategic focus areas differ markedly in financial health and market positioning.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the crucial barrier that shields long-term profits from competitive erosion and market pressure:

Pegasystems Inc.: Intangible Assets and Platform Integration Moat

Pegasystems leverages deep intangible assets and integrated software platforms. Its high ROIC and expanding margins confirm this moat’s strength. New automation products in 2026 could further entrench its advantage.

Match Group, Inc.: Network Effects Moat

Match Group’s moat stems from strong network effects across its dating platforms, unlike Pegasystems’ software focus. It sustains solid profitability but faces a declining ROIC trend. Expansion into emerging markets may offset this.

Platform Integration vs. Network Effects: The Moat Faceoff

Pegasystems exhibits a deeper moat with growing ROIC and scalable platform assets. Match Group creates value but shows profitability erosion. Pegasystems is better positioned to defend and grow its market share long-term.

Which stock offers better returns?

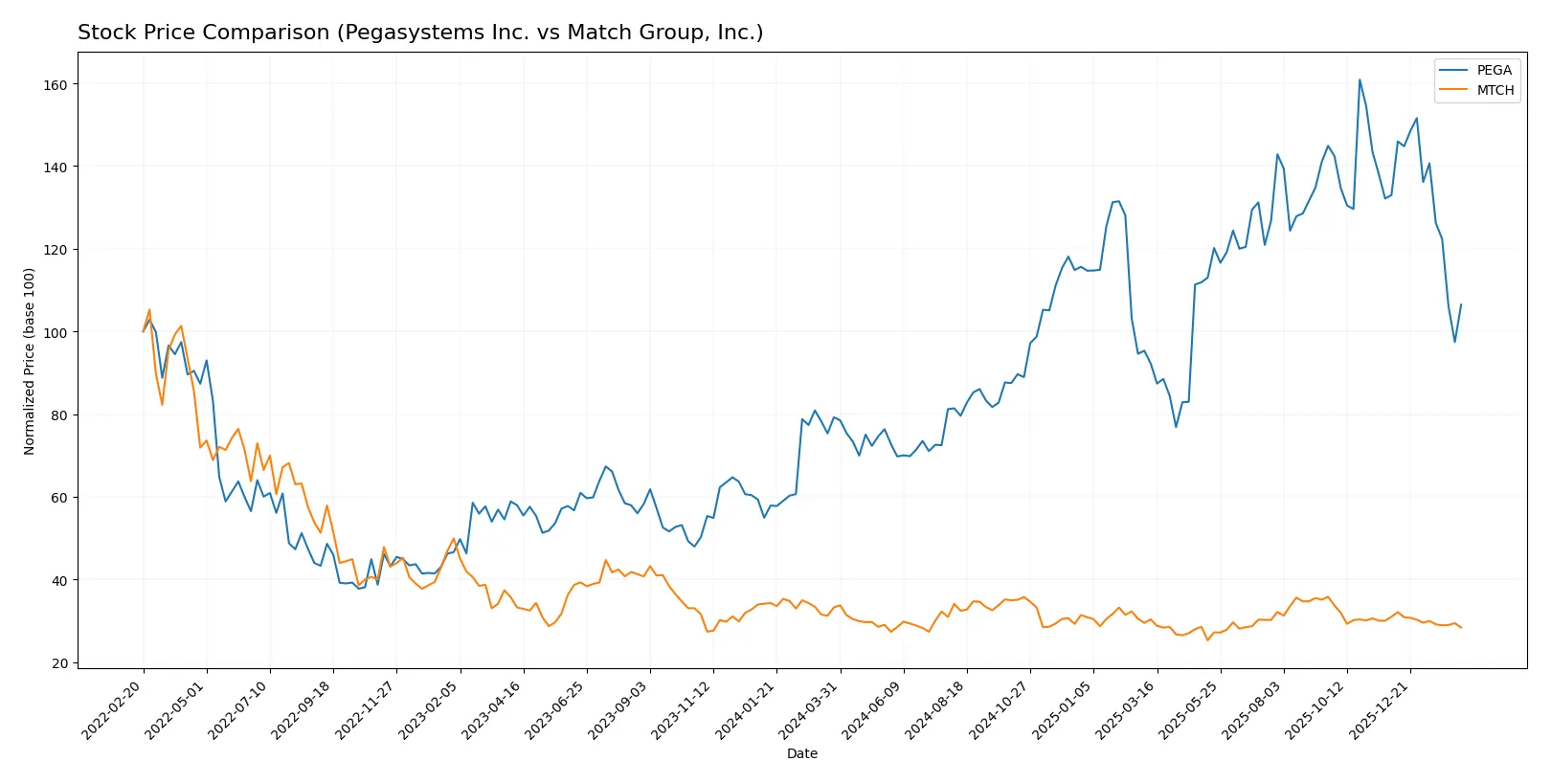

Over the past 12 months, Pegasystems Inc. surged 34.4% before decelerating recently, while Match Group, Inc. declined 14.7%, reflecting contrasting market dynamics and investor sentiment.

Trend Comparison

Pegasystems Inc. exhibits a bullish 34.4% gain over the last year but shows recent deceleration with a near 20% drop since November 2025, signaling volatility within a strong upward cycle.

Match Group, Inc. reveals a bearish trend with a 14.7% decline over the year and continued deceleration, including an 8.4% drop in the recent quarter, indicating sustained downward pressure.

Pegasystems outperformed Match Group significantly, delivering the highest market returns despite recent weakness, highlighting stronger price momentum over the full 12-month span.

Target Prices

Analysts present a cautiously optimistic consensus on Pegasystems Inc. and Match Group, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Pegasystems Inc. | 48 | 65 | 58.25 |

| Match Group, Inc. | 33 | 43 | 36 |

Pegasystems’ consensus target sits roughly 33% above its current price of $43.85, signaling upside potential. Match Group’s target consensus at $36 also suggests modest gains versus its $30.50 price. Both reflect measured confidence amid sector volatility.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent institutional grades for Pegasystems Inc. and Match Group, Inc.:

Pegasystems Inc. Grades

This table lists recent grades assigned by reputable firms to Pegasystems Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | Maintain | Buy | 2026-02-12 |

| RBC Capital | Maintain | Outperform | 2026-02-12 |

| Citizens | Maintain | Market Outperform | 2026-02-12 |

| Barclays | Upgrade | Overweight | 2026-02-12 |

| Wedbush | Maintain | Outperform | 2026-02-12 |

| Citigroup | Maintain | Buy | 2026-02-12 |

| Rosenblatt | Maintain | Buy | 2026-02-06 |

| JP Morgan | Maintain | Overweight | 2025-12-05 |

| RBC Capital | Maintain | Outperform | 2025-10-23 |

| Wedbush | Maintain | Outperform | 2025-10-23 |

Match Group, Inc. Grades

This table shows recent institutional grades for Match Group, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Buy | 2026-02-05 |

| JP Morgan | Maintain | Neutral | 2026-02-04 |

| Truist Securities | Maintain | Hold | 2026-02-04 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-13 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-05 |

| Evercore ISI Group | Maintain | In Line | 2025-11-05 |

| Truist Securities | Maintain | Hold | 2025-11-05 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-20 |

| Susquehanna | Maintain | Positive | 2025-08-07 |

| Evercore ISI Group | Maintain | In Line | 2025-08-06 |

Which company has the best grades?

Pegasystems Inc. consistently earns outperform and buy ratings, with one recent upgrade. Match Group, Inc. mostly receives hold, neutral, or equal weight ratings. Investors might interpret Pegasystems’ stronger grades as greater institutional confidence.

Risks specific to each company

Both Pegasystems Inc. and Match Group, Inc. face critical pressure points and systemic threats in the 2026 market environment. These risks are categorized as follows:

1. Market & Competition

Pegasystems Inc.

- Operates in enterprise software with strong customer engagement platforms but faces intense tech innovation pressure.

Match Group, Inc.

- Dominates dating apps globally but contends with rapid shifts in user preferences and emerging competitors.

2. Capital Structure & Debt

Pegasystems Inc.

- Maintains low debt-to-equity (0.08) and debt-to-assets (3.73%), signaling conservative leverage.

Match Group, Inc.

- High debt-to-assets (89.06%) and negative debt-to-equity indicate elevated financial risk and heavy reliance on borrowing.

3. Stock Volatility

Pegasystems Inc.

- Beta of 1.07 indicates moderate volatility close to the overall market.

Match Group, Inc.

- Higher beta at 1.32 shows greater stock price volatility and sensitivity to market swings.

4. Regulatory & Legal

Pegasystems Inc.

- Faces standard software compliance and data privacy regulations across diverse global markets.

Match Group, Inc.

- Encountering heightened scrutiny over data privacy, especially in dating platforms, raising potential legal liabilities.

5. Supply Chain & Operations

Pegasystems Inc.

- Relies on cloud infrastructure and direct sales, vulnerable to tech disruptions but with diversified client base.

Match Group, Inc.

- Dependent on continuously engaging users and maintaining platform stability; operational risks tied to brand reputation.

6. ESG & Climate Transition

Pegasystems Inc.

- Moderate ESG risks given software industry footprint; opportunities in sustainable digital transformation.

Match Group, Inc.

- ESG risks center on data ethics and user safety, critical for brand trust and regulatory compliance.

7. Geopolitical Exposure

Pegasystems Inc.

- Presence in Americas, Europe, Asia-Pacific exposes it to trade tensions and regulatory shifts.

Match Group, Inc.

- Global user base faces geopolitical risks including data localization laws and censorship in key markets.

Which company shows a better risk-adjusted profile?

Pegasystems’ conservative capital structure and strong financial health reduce its risk profile despite competitive pressures. Match Group shows higher financial leverage and regulatory risks but benefits from favorable valuation metrics. However, Match Group’s Altman Z-Score in the distress zone signals significant bankruptcy risk, contrasting with Pegasystems’ safe zone score. I conclude Pegasystems offers a superior risk-adjusted profile in 2026, balancing growth potential with prudent financial management.

Final Verdict: Which stock to choose?

Pegasystems Inc. wields a powerful combination of rapidly growing profitability and a very favorable moat, signaling efficient capital use and value creation. Its point of vigilance lies in a stretched valuation, which might temper upside. It suits aggressive growth portfolios seeking high return potential amid some valuation risk.

Match Group’s strategic moat stems from its strong recurring revenue and solid free cash flow yield, offering greater safety and financial stability than Pegasystems. Despite a declining ROIC trend, its reasonable valuation and robust cash flow appeal to Growth at a Reasonable Price (GARP) investors prioritizing steadier returns.

If you prioritize high-growth and expanding profitability, Pegasystems outshines with its superior ROIC and strong capital efficiency. However, if you seek better stability and cash flow safety with a more attractive valuation, Match Group offers a compelling profile despite its profitability challenges. Both require careful risk assessment aligned with your investment horizon.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Pegasystems Inc. and Match Group, Inc. to enhance your investment decisions: