Home > Comparison > Financial Services > MA vs PYPL

The strategic rivalry between Mastercard Incorporated and PayPal Holdings defines the trajectory of the financial credit services sector. Mastercard operates as a global payment technology powerhouse with integrated transaction processing and value-added services. In contrast, PayPal leverages a digital payments platform emphasizing consumer convenience and global reach. This analysis explores which model delivers a superior risk-adjusted return, providing investors with clarity on the optimal exposure within this dynamic industry.

Table of contents

Companies Overview

Mastercard and PayPal dominate the evolving landscape of digital payments and financial services.

Mastercard Incorporated: Global Payment Network Leader

Mastercard excels as a technology-driven payment processor facilitating transaction authorization, clearing, and settlement worldwide. Its core revenue stems from providing integrated payment products and value-added services to financial institutions, merchants, and governments. In 2026, Mastercard sharpens its strategic focus on cybersecurity, open banking, and digital identity platforms to enhance transaction safety and expand service integration.

PayPal Holdings, Inc.: Digital Payments Innovator

PayPal operates a technology platform enabling seamless digital payments across 200 markets with multiple currencies. Its revenue engine revolves around supporting merchants and consumers through PayPal, Venmo, and other brands that facilitate global money transfers and digital wallets. The company’s 2026 strategy centers on expanding cross-border payment capabilities and diversifying its merchant solutions to capture growing e-commerce demand.

Strategic Collision: Similarities & Divergences

Both firms invest heavily in technology to drive payment innovation, but Mastercard emphasizes infrastructure and secure processing networks, while PayPal prioritizes platform versatility and consumer-facing apps. Their primary battleground lies in global digital payment adoption and merchant services. Mastercard offers a robust, scalable network; PayPal delivers agility and consumer engagement. These differences define their distinct risk and growth profiles for investors.

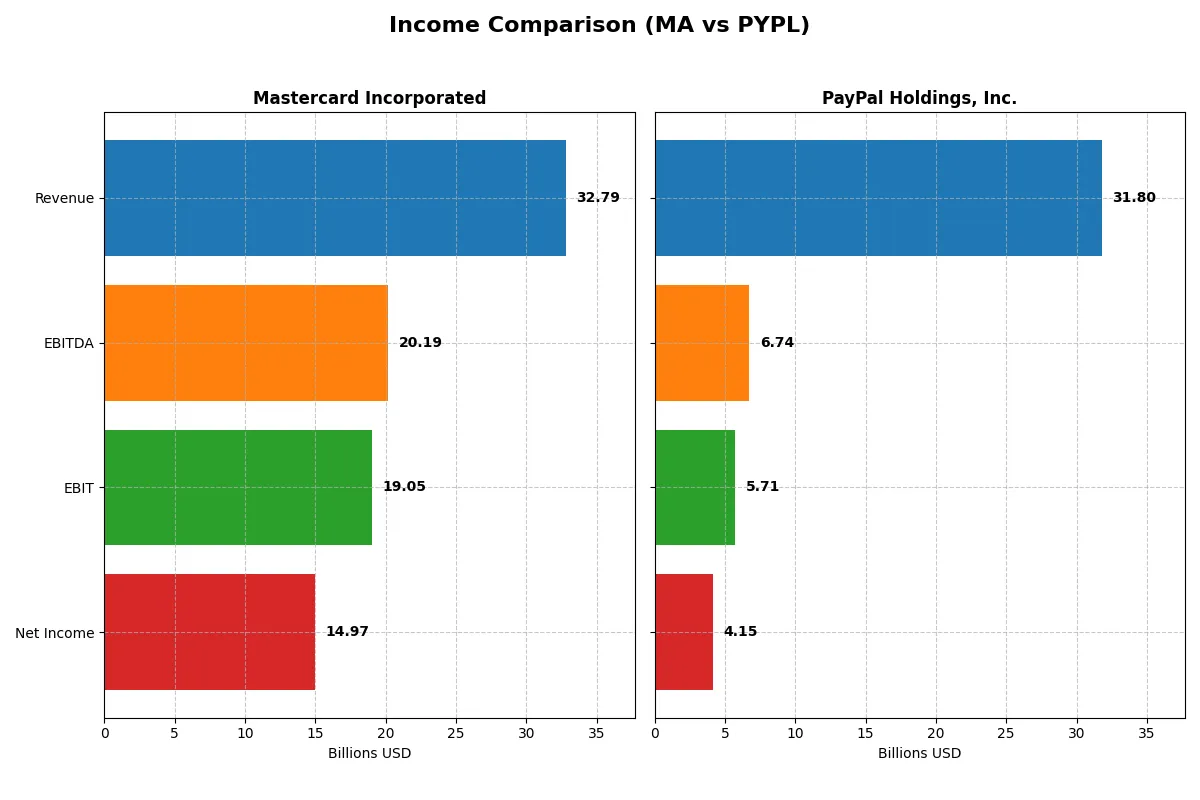

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Mastercard (MA) | PayPal (PYPL) |

|---|---|---|

| Revenue | 32.8B | 31.8B |

| Cost of Revenue | 5.4B | 17.1B |

| Operating Expenses | 7.96B | 9.33B |

| Gross Profit | 27.4B | 14.7B |

| EBITDA | 20.2B | 6.74B |

| EBIT | 19.1B | 5.71B |

| Interest Expense | 722M | 382M |

| Net Income | 14.97B | 4.15B |

| EPS | 16.55 | 4.03 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes which company drives superior operational efficiency and profit generation in their core business.

Mastercard Incorporated Analysis

Mastercard’s revenue surged from 19B in 2021 to 32.8B in 2025, reflecting a strong 74% growth over five years. Its net income rose sharply to 15B in 2025, with a stellar net margin near 46%. The company maintains high gross (83%) and EBIT (58%) margins, signaling excellent cost control and operating leverage. Momentum remains robust, with 2025’s revenue and EBIT growing over 16% and 19%, respectively.

PayPal Holdings, Inc. Analysis

PayPal increased revenue from 21.5B in 2020 to 31.8B in 2024, a solid 48% rise. However, net income stagnated around 4.1B, with net margins at a modest 13%. Gross margin holds at 46%, but EBIT margin trails Mastercard at 18%. PayPal’s latest year shows muted revenue growth of 6.8%, with EBIT and net margin declining, indicating operational challenges and margin pressure.

Verdict: High Margin Growth vs. Moderate Scale Expansion

Mastercard clearly outperforms PayPal in both profit margins and net income growth, demonstrating superior capital allocation and operational efficiency. PayPal’s revenue growth is respectable but overshadowed by weak bottom-line momentum and margin compression. For investors prioritizing sustainable earnings and margin resilience, Mastercard’s profile offers a more compelling fundamental foundation.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Mastercard Incorporated (MA) | PayPal Holdings, Inc. (PYPL) |

|---|---|---|

| ROE | 193.5% | 20.3% |

| ROIC | 48.6% | 12.5% |

| P/E | 34.2 | 21.2 |

| P/B | 66.2 | 4.30 |

| Current Ratio | 1.03 | 1.26 |

| Quick Ratio | 1.03 | 1.26 |

| D/E (Debt-to-Equity) | 2.46 | 0.48 |

| Debt-to-Assets | 35.1% | 12.1% |

| Interest Coverage | 26.9 | 13.9 |

| Asset Turnover | 0.61 | 0.39 |

| Fixed Asset Turnover | 14.2 | 21.1 |

| Payout Ratio | 18.4% | 0% |

| Dividend Yield | 0.54% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, uncovering hidden risks and operational strengths vital for informed investment decisions.

Mastercard Incorporated

Mastercard delivers stellar profitability with a 193% ROE and a robust 45.65% net margin, signaling exceptional operational efficiency. However, its valuation appears stretched, with a high 34.21 P/E and an elevated 66.19 P/B ratio. Shareholder returns include a modest 0.54% dividend yield, reflecting a strategy focused more on capital growth than income.

PayPal Holdings, Inc.

PayPal shows moderate profitability, with a 20.31% ROE and a 13.04% net margin, indicating decent but less dominant efficiency. Its valuation is more reasonable at a 21.18 P/E, though the 4.3 P/B ratio flags some caution. PayPal pays no dividend, reinvesting heavily in R&D and growth, supporting future expansion.

Premium Valuation vs. Operational Safety

Mastercard commands a premium valuation supported by superior profitability but carries stretched price multiples and weaker dividend yield. PayPal offers a more balanced valuation with solid reinvestment in growth, though with lower profitability. Mastercard suits risk-tolerant investors seeking strong returns; PayPal fits those prioritizing growth potential and valuation discipline.

Which one offers the Superior Shareholder Reward?

Mastercard (MA) delivers a balanced distribution strategy with a 0.54% dividend yield and a conservative 18% payout ratio, supported by strong free cash flow of $19.1/share. Its robust buyback program enhances shareholder value sustainably. PayPal (PYPL) pays no dividends, reinvesting heavily in growth and acquisitions, with a lower free cash flow of $6.6/share but a more aggressive buyback approach. Historically, MA’s steady dividends plus buybacks offer more reliable total returns in 2026, while PYPL’s reinvestment strategy carries higher growth potential but greater risk. I favor Mastercard for superior risk-adjusted shareholder reward today.

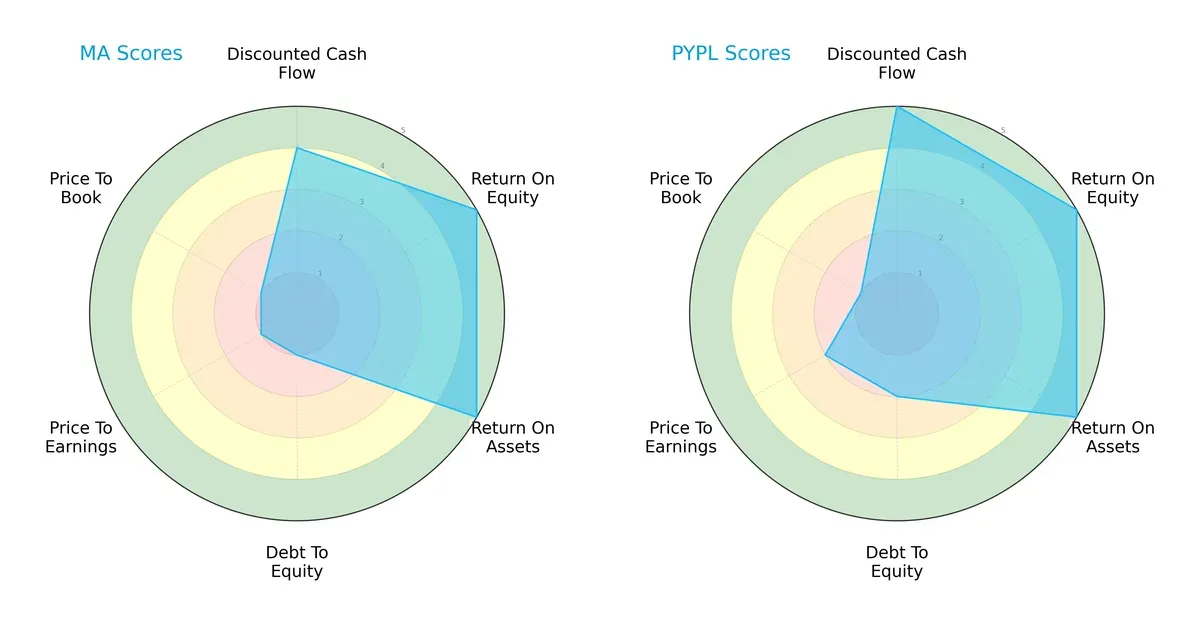

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Mastercard and PayPal, highlighting their financial strengths and valuation nuances:

Mastercard shows robust profitability with top ROE and ROA scores but suffers from a heavy debt load and expensive valuation, reflected in very unfavorable debt-to-equity and price multiples. PayPal delivers a more balanced profile with slightly better cash flow valuation and moderate leverage, though its price-to-book remains weak. PayPal’s diversified strengths suggest a steadier financial foundation, while Mastercard relies heavily on operational efficiency despite financial risk.

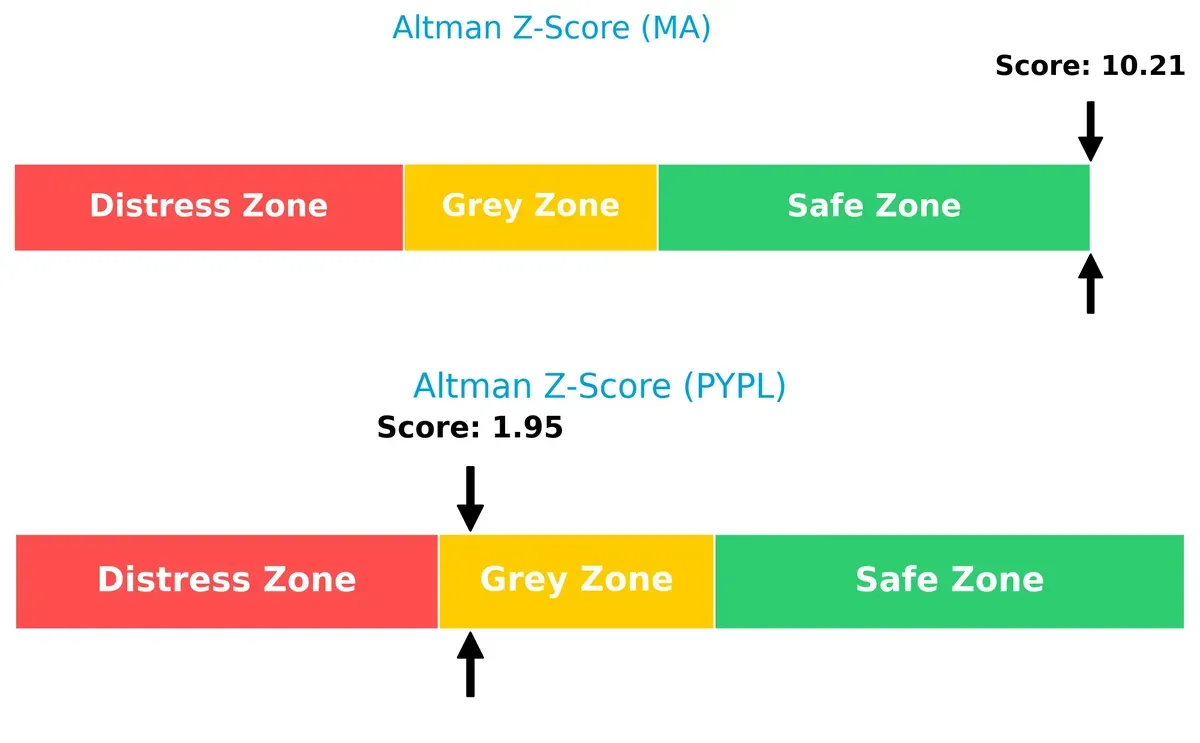

Bankruptcy Risk: Solvency Showdown

Mastercard’s Altman Z-Score of 10.2 signals a very safe zone, while PayPal’s 1.95 places it in the grey zone, indicating moderate bankruptcy risk in this economic cycle:

Financial Health: Quality of Operations

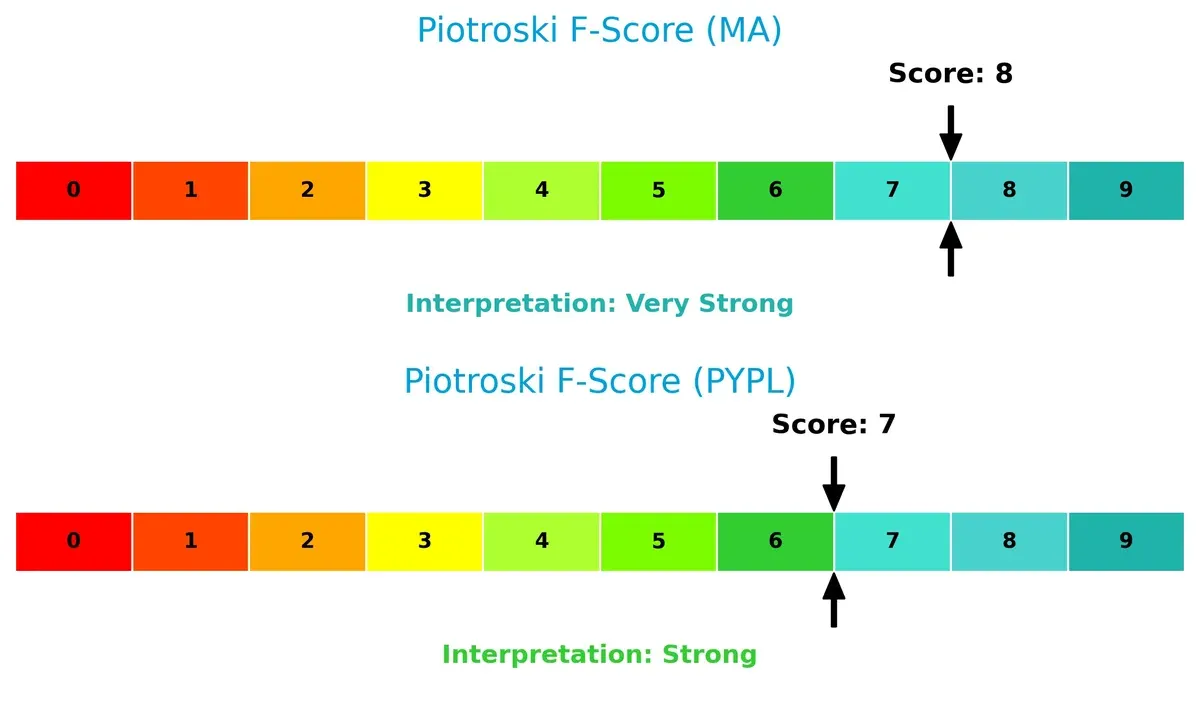

Mastercard scores an 8 on the Piotroski F-Score, marking very strong financial health. PayPal’s 7 is strong but slightly behind, suggesting minor internal metric concerns compared to Mastercard:

How are the two companies positioned?

This section dissects Mastercard and PayPal’s operational DNA by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats and reveal which model delivers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

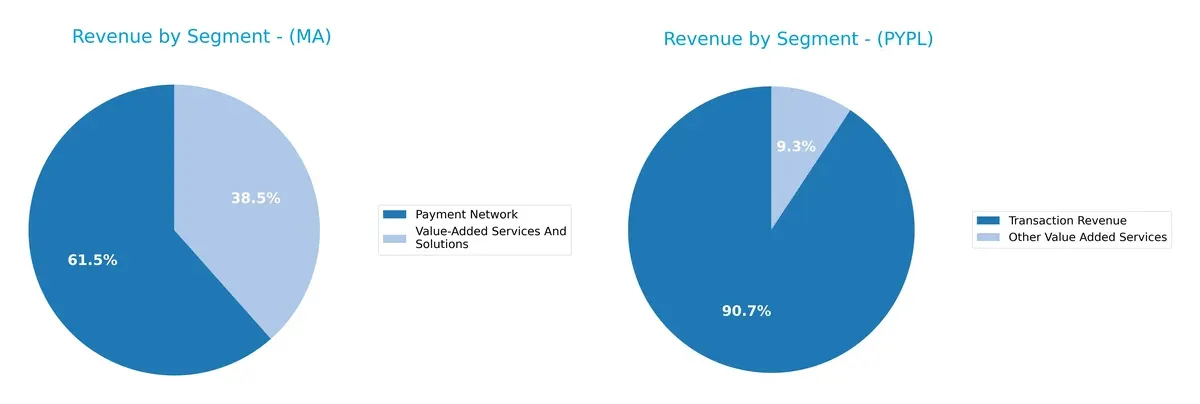

This visual comparison dissects how Mastercard Incorporated and PayPal Holdings, Inc. diversify their income streams and where their primary sector bets lie:

Mastercard balances its revenue between Payment Network at $17.3B and Value-Added Services at $10.8B, showing a moderately diversified base. PayPal relies heavily on Transaction Revenue, $28.8B, dwarfing its $3B Other Value Added Services. Mastercard’s split suggests ecosystem lock-in with multiple revenue pillars. PayPal’s concentration in transaction fees pivots on volume growth but carries concentration risk if payment volumes falter.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Mastercard and PayPal:

Mastercard Strengths

- High profitability with net margin 45.65% and ROIC 48.63%

- Strong global presence with $15.8B international revenue in 2024

- Diverse revenue streams including Payment Network and Value-Added Services

- Favorable quick ratio and high interest coverage

PayPal Strengths

- Solid profitability with net margin 13.04% and ROIC 12.47%

- Favourable leverage metrics with low debt-to-assets 12.1% and debt/equity 0.48

- Steady revenue growth in transaction and value-added services

- Favorable quick ratio and interest coverage metrics

Mastercard Weaknesses

- High price multiples with P/E 34.21 and P/B 66.19 suggest overvaluation risk

- Elevated debt/equity 2.46 and dividend yield only 0.54%

- Neutral current ratio 1.03 indicates tight liquidity

- Lower asset turnover 0.61 vs. PayPal’s fixed asset turnover

PayPal Weaknesses

- Lower profitability relative to Mastercard with net margin 13.04%

- Unfavorable asset turnover 0.39 limits operational efficiency

- No dividend yield may deter income-focused investors

- P/B ratio 4.3 flagged as unfavorable

Both companies demonstrate strong profitability and solid global footprints but differ on valuation and leverage dimensions. Mastercard’s premium multiples and higher debt warrant caution despite superior margins, while PayPal’s balance sheet shows lower leverage but weaker asset efficiency and profitability. These differences highlight contrasting strategic profiles in the payments sector.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat protects long-term profits from relentless competition erosion. Without it, market share and margins erode quickly:

Mastercard Incorporated: Network Effects Powerhouse

Mastercard’s moat centers on powerful network effects, enabling seamless payment processing worldwide. This drives high ROIC (41%) and stable margins near 58%. Expansion into open banking and digital identity in 2026 could further deepen its competitive advantage.

PayPal Holdings, Inc.: Platform Ecosystem with Growth Challenges

PayPal’s moat arises from its wide digital payment platform and brand recognition. While ROIC growth is strong, its margin profile lags Mastercard, reflecting more operational pressure. New product launches and international expansion offer growth potential but also risk margin compression.

Verdict: Network Effects vs. Platform Ecosystem Resilience

Mastercard’s wider and deeper moat, evidenced by superior ROIC and margin stability, outweighs PayPal’s solid but narrower competitive positioning. Mastercard is better equipped to defend and expand its global market share in 2026.

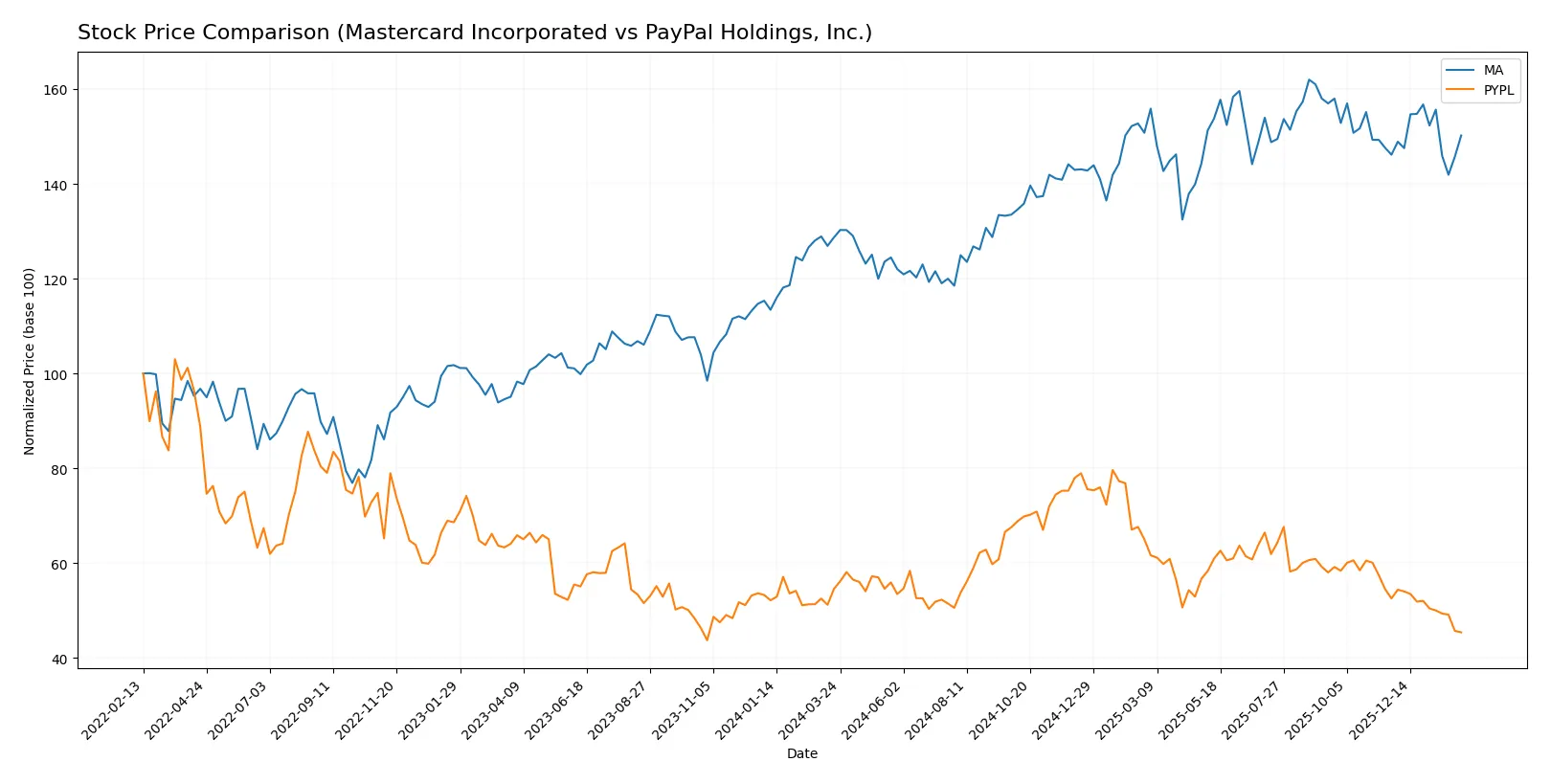

Which stock offers better returns?

The past year reveals Mastercard’s strong upward momentum with a 16.72% gain, while PayPal’s shares declined sharply by 16.74%, reflecting contrasting trading dynamics.

Trend Comparison

Mastercard’s stock exhibits a bullish trend over 12 months, gaining 16.72% with decelerating momentum. It reached a high of 598.96 and a low of 438.18, showing notable volatility with a 45.79 standard deviation.

PayPal’s stock displays a bearish trend over 12 months, falling 16.74% with deceleration. The price ranged between 52.33 and 91.81, accompanied by lower volatility at a 9.2 standard deviation.

Mastercard outperformed PayPal in market performance, delivering positive returns against PayPal’s significant decline over the same period.

Target Prices

Analysts present a clear consensus on target prices for Mastercard and PayPal.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Mastercard Incorporated | 609 | 739 | 666.87 |

| PayPal Holdings, Inc. | 50 | 100 | 70.06 |

The consensus target for Mastercard exceeds its current price of 555.37, signaling analyst confidence. PayPal’s target average at 70.06 also sits above its current 52.33 price, suggesting room for upside.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is a comparison of recent institutional grades for Mastercard Incorporated and PayPal Holdings, Inc.:

Mastercard Incorporated Grades

The table below summarizes recent grade actions from reputable financial institutions for Mastercard:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-01-30 |

| Macquarie | Maintain | Outperform | 2026-01-30 |

| JP Morgan | Maintain | Overweight | 2026-01-30 |

| TD Cowen | Maintain | Buy | 2026-01-30 |

| Raymond James | Maintain | Outperform | 2026-01-30 |

| RBC Capital | Maintain | Outperform | 2026-01-30 |

| Morgan Stanley | Maintain | Overweight | 2026-01-30 |

| Compass Point | Upgrade | Buy | 2026-01-13 |

| HSBC | Upgrade | Buy | 2025-12-08 |

| Tigress Financial | Maintain | Strong Buy | 2025-11-06 |

PayPal Holdings, Inc. Grades

The table below presents recent institutional grades for PayPal from established grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2026-01-14 |

| Daiwa Capital | Downgrade | Neutral | 2026-01-13 |

| Susquehanna | Maintain | Positive | 2026-01-08 |

| Citigroup | Maintain | Neutral | 2026-01-05 |

| Mizuho | Maintain | Outperform | 2025-12-22 |

| Morgan Stanley | Downgrade | Underweight | 2025-12-18 |

| Baird | Downgrade | Neutral | 2025-12-12 |

| B of A Securities | Downgrade | Neutral | 2025-12-11 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-09 |

| Evercore ISI Group | Maintain | In Line | 2025-12-08 |

Which company has the best grades?

Mastercard consistently earns higher grades, including multiple “Outperform” and “Buy” ratings. PayPal shows mixed to neutral grades with several downgrades. This difference may influence investor confidence and portfolio weighting decisions.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing Mastercard Incorporated and PayPal Holdings, Inc. in the 2026 market environment:

1. Market & Competition

Mastercard Incorporated

- Dominates payment processing with wide merchant and issuer network but faces fintech disruption.

PayPal Holdings, Inc.

- Strong in digital wallets and peer-to-peer but faces stiff competition from emerging fintech and traditional banks.

2. Capital Structure & Debt

Mastercard Incorporated

- High debt-to-equity ratio (2.46) signals leverage risk despite strong interest coverage.

PayPal Holdings, Inc.

- Conservative debt profile with a low debt-to-equity ratio (0.48) reduces financial risk.

3. Stock Volatility

Mastercard Incorporated

- Lower beta (0.82) indicates less volatility and defensive stock behavior.

PayPal Holdings, Inc.

- Higher beta (1.42) suggests greater price swings and market sensitivity.

4. Regulatory & Legal

Mastercard Incorporated

- Global payments subject to stringent regulations; regulatory costs could rise.

PayPal Holdings, Inc.

- Faces regulatory scrutiny over digital payments, data privacy, and cross-border transactions.

5. Supply Chain & Operations

Mastercard Incorporated

- Relies on robust tech infrastructure with strong cybersecurity investments.

PayPal Holdings, Inc.

- Dependent on technology platforms vulnerable to operational disruptions and cyber threats.

6. ESG & Climate Transition

Mastercard Incorporated

- Focuses on sustainable finance initiatives but exposed to ESG compliance costs.

PayPal Holdings, Inc.

- ESG efforts growing but risks remain in energy consumption and data privacy issues.

7. Geopolitical Exposure

Mastercard Incorporated

- Extensive international presence exposes it to geopolitical tensions and currency risks.

PayPal Holdings, Inc.

- Global operations face similar geopolitical and regulatory uncertainties impacting cross-border payments.

Which company shows a better risk-adjusted profile?

Mastercard’s biggest risk lies in its elevated leverage, which could constrain flexibility amid rising interest rates. PayPal’s main vulnerability is its higher stock volatility, reflecting market uncertainty around fintech innovation and competition. Despite Mastercard’s leverage concerns, its stable market position and lower beta suggest a more controlled risk profile. PayPal’s favorable debt position is offset by higher market sensitivity and a borderline Altman Z-score in the grey zone. Recent data showing Mastercard’s strong interest coverage contrasts with PayPal’s heightened beta, justifying my caution on PayPal’s price swings. Overall, Mastercard shows a slightly better risk-adjusted profile heading into 2026.

Final Verdict: Which stock to choose?

Mastercard’s superpower lies in its unmatched capital efficiency and robust economic moat. It consistently delivers high returns on invested capital well above its cost of capital, signaling durable value creation. A point of vigilance is its elevated debt-to-equity ratio, which could pressure financial flexibility. This stock fits best in an Aggressive Growth portfolio seeking strong profitability.

PayPal’s strategic moat is anchored in its recurring revenue model and expanding digital payment ecosystem. It offers a safer financial profile with moderate leverage and solid liquidity. While its growth lags Mastercard, PayPal suits a GARP (Growth at a Reasonable Price) portfolio focused on stability with growth potential.

If you prioritize high-efficiency growth and can tolerate higher financial leverage, Mastercard outshines as the compelling choice due to superior ROIC and profitability. However, if you seek better financial stability and a more conservative risk profile, PayPal offers superior safety and recurring revenue resilience. Both firms demonstrate durable competitive advantages, but your risk appetite shapes the preferred scenario.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Mastercard Incorporated and PayPal Holdings, Inc. to enhance your investment decisions: