Home > Comparison > Energy > VLO vs MPC

The strategic rivalry between Valero Energy Corporation and Marathon Petroleum Corporation shapes the trajectory of the Energy sector’s refining and marketing landscape. Valero operates as a diversified refiners and renewable fuels producer, while Marathon integrates downstream refining with a significant midstream logistics presence. This analysis pits Valero’s specialization against Marathon’s vertical integration to identify which model delivers superior risk-adjusted returns for a balanced portfolio.

Table of contents

Companies Overview

Valero Energy Corporation and Marathon Petroleum Corporation both command substantial presence in the US refining and marketing landscape.

Valero Energy Corporation: Integrated Energy Refiner & Marketer

Valero dominates as an integrated manufacturer and marketer of transportation fuels and petrochemical products. Its revenue primarily stems from refining petroleum and producing renewable diesel and ethanol. In 2021, Valero emphasized expanding its renewable diesel capacity alongside maintaining a strong downstream footprint through 15 refineries and 7,000 retail outlets.

Marathon Petroleum Corporation: Downstream Energy Powerhouse

Marathon Petroleum excels as a fully integrated downstream energy firm focusing on refining, marketing, and midstream logistics. It generates revenue by refining crude oil and distributing fuels primarily in the US. The company’s 2021 strategy concentrated on optimizing refining margins while expanding midstream assets and supporting 7,159 branded outlets across multiple regions.

Strategic Collision: Similarities & Divergences

Both firms leverage integrated refining and marketing to capture value along the energy supply chain but diverge in their asset focus. Valero invests heavily in renewable fuels, while Marathon emphasizes midstream logistics and geographic diversification. Their primary battleground is US fuel retail and refining throughput. Valero’s profile suggests a pivot toward cleaner fuels; Marathon remains a logistics and refining stalwart with broad scale.

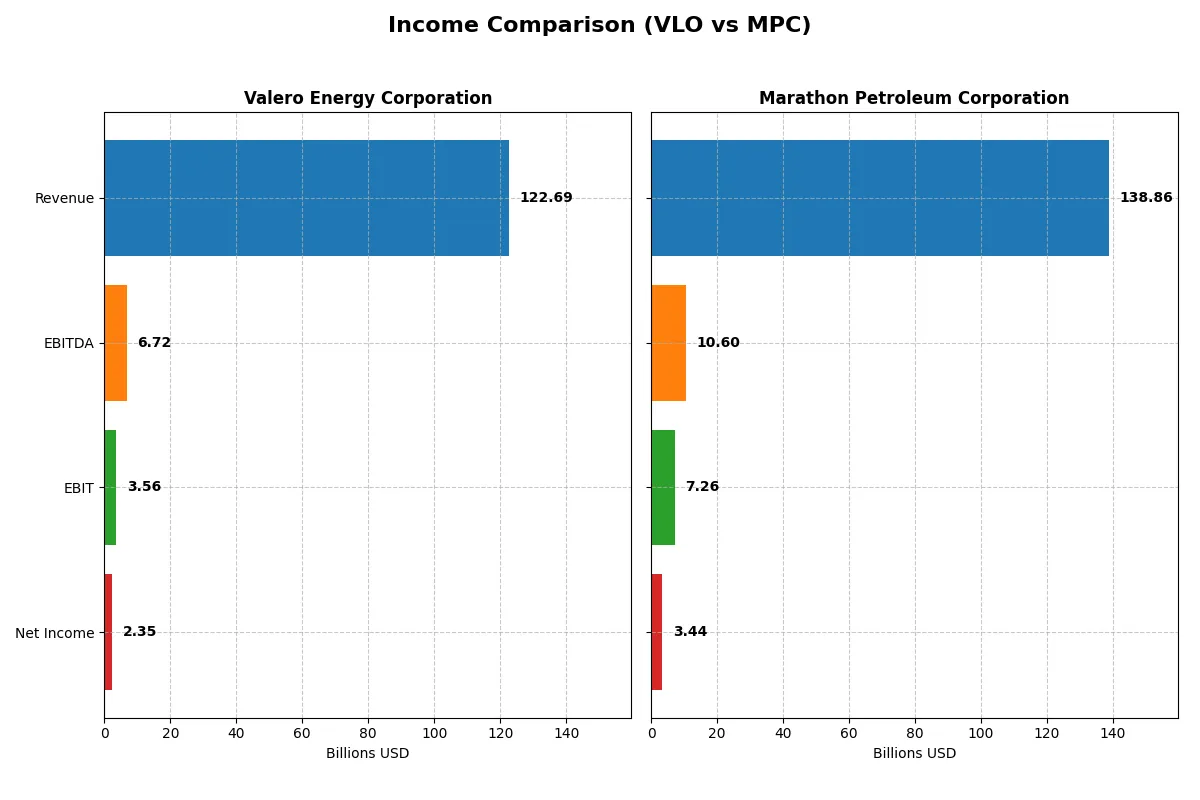

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Valero Energy Corporation (VLO) | Marathon Petroleum Corporation (MPC) |

|---|---|---|

| Revenue | 123B | 139B |

| Cost of Revenue | 117.3B | 129.6B |

| Operating Expenses | 1.06B | 4.04B |

| Gross Profit | 5.37B | 9.29B |

| EBITDA | 6.72B | 10.6B |

| EBIT | 3.56B | 7.27B |

| Interest Expense | 556M | 1.34B |

| Net Income | 2.35B | 3.45B |

| EPS | 7.57 | 10.12 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals how efficiently each company converts revenue into profit amid fluctuating market conditions.

Valero Energy Corporation Analysis

Valero’s revenue declined from 145B in 2023 to 123B in 2025, while net income dropped from 8.8B to 2.3B. Gross and net margins weakened but remain stable around 4.4% and 1.9%. Despite recent declines, Valero shows solid overall net income growth of 152% since 2021, signaling resilience and improving cost control.

Marathon Petroleum Corporation Analysis

Marathon’s revenue fell from 148B in 2023 to 139B in 2024, with net income plunging from 9.7B to 3.4B. Gross margin at 6.7% and net margin at 2.5% outperform Valero. However, the sharp one-year declines in profit and margins suggest operational challenges. Marathon’s overall net income growth of 135% since 2020 highlights long-term recovery but recent momentum is weak.

Margin Stability vs. Earnings Momentum

Valero sustains steady margins and demonstrates stronger net income growth despite recent revenue pressure. Marathon shows superior margin percentages but suffers from volatile earnings and sharp recent declines. Valero’s profile offers more stable profitability growth, making it attractive for investors seeking consistent earnings momentum.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Valero Energy Corporation (VLO) | Marathon Petroleum Corporation (MPC) |

|---|---|---|

| ROE | 9.90% | 19.41% |

| ROIC | 9.00% | 7.26% |

| P/E | 21.42 | 13.81 |

| P/B | 2.12 | 2.68 |

| Current Ratio | 3.47 | 1.17 |

| Quick Ratio | 2.93 | 0.71 |

| D/E | 1.44 | 1.62 |

| Debt-to-Assets | 69.86% | 36.47% |

| Interest Coverage | 7.76 | 3.90 |

| Asset Turnover | 2.51 | 1.76 |

| Fixed Asset Turnover | 0 (not provided) | 3.82 |

| Payout ratio | 59.48% | 33.50% |

| Dividend yield | 2.78% | 2.43% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, revealing hidden risks and operational strengths beneath headline figures.

Valero Energy Corporation

Valero’s ROE at 9.9% and net margin at 1.91% signal modest profitability, while a P/E of 21.42 suggests a fairly valued stock. The company maintains a 2.78% dividend yield, rewarding shareholders steadily. However, a high current ratio of 3.47 and debt metrics highlight balance sheet caution despite operational efficiency.

Marathon Petroleum Corporation

Marathon boasts a strong 19.41% ROE and a net margin of 2.48%, reflecting robust profitability. Its P/E ratio of 13.81 makes the stock appear attractively priced. The dividend yield at 2.43% supports shareholder returns, while moderate leverage and solid asset turnover indicate effective capital use with manageable risk.

Balanced Profitability vs. Valuation Appeal

Marathon Petroleum presents a better balance of profitability and valuation, combining a higher ROE with a lower P/E ratio. Valero offers steady dividends and operational efficiency but carries more financial leverage risks. Investors seeking growth and value may prefer Marathon’s profile, while income-focused investors might lean toward Valero.

Which one offers the Superior Shareholder Reward?

Valero Energy (VLO) offers a more attractive shareholder reward than Marathon Petroleum (MPC) in 2026. Valero yields 2.78% with a payout ratio near 59%, supported by solid free cash flow and a strong buyback program. Marathon yields less at 2.43% with a lower payout ratio of 33%, reflecting a more conservative distribution. Both engage in buybacks, but Valero’s aggressive capital return and consistent free cash flow coverage make its model more sustainable. Marathon’s higher leverage and weaker dividend coverage raise caution. I conclude Valero delivers superior total shareholder return potential due to balanced dividends and robust buybacks.

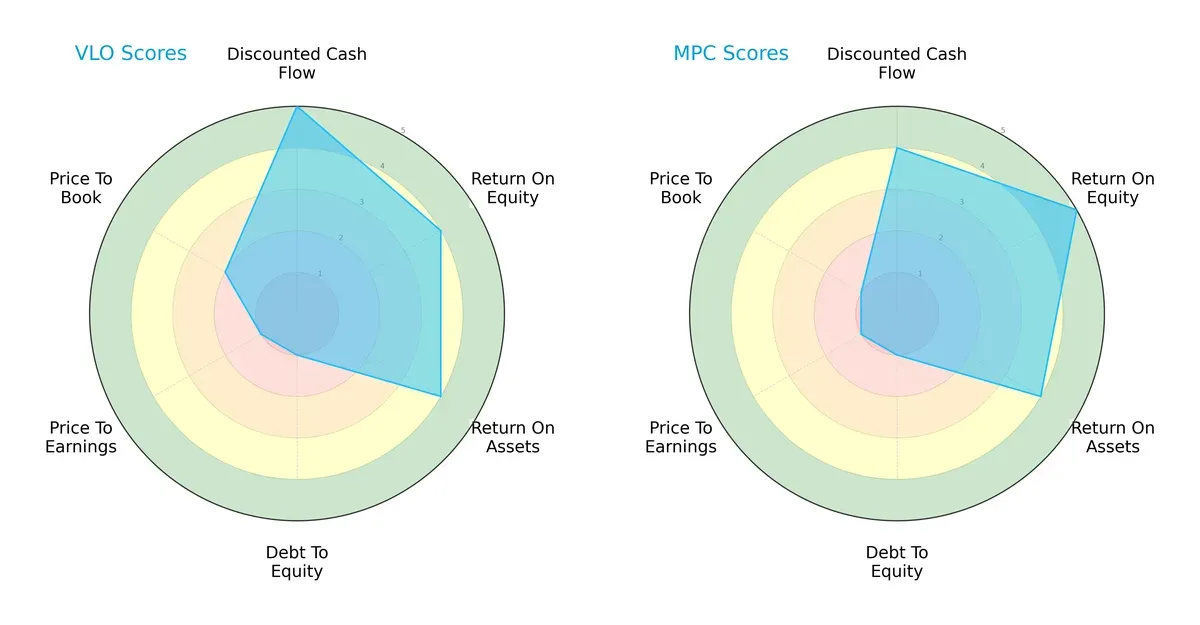

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of both firms, highlighting their financial strengths and valuation challenges:

Valero Energy (VLO) excels in discounted cash flow (DCF) with a top score of 5, signaling strong future cash flow expectations. Marathon Petroleum (MPC) leads in return on equity (ROE) at 5, showcasing superior profit generation from shareholders’ equity. Both firms match evenly in return on assets (ROA) at 4, reflecting efficient asset utilization. However, both suffer from weak debt-to-equity and price-to-earnings scores at 1, indicating leverage concerns and potential overvaluation risks. VLO holds a moderate edge in price-to-book at 2 versus MPC’s 1, suggesting a slightly better valuation balance. Overall, VLO shows a more balanced profile with strong cash flow backing, while MPC relies heavily on equity profitability.

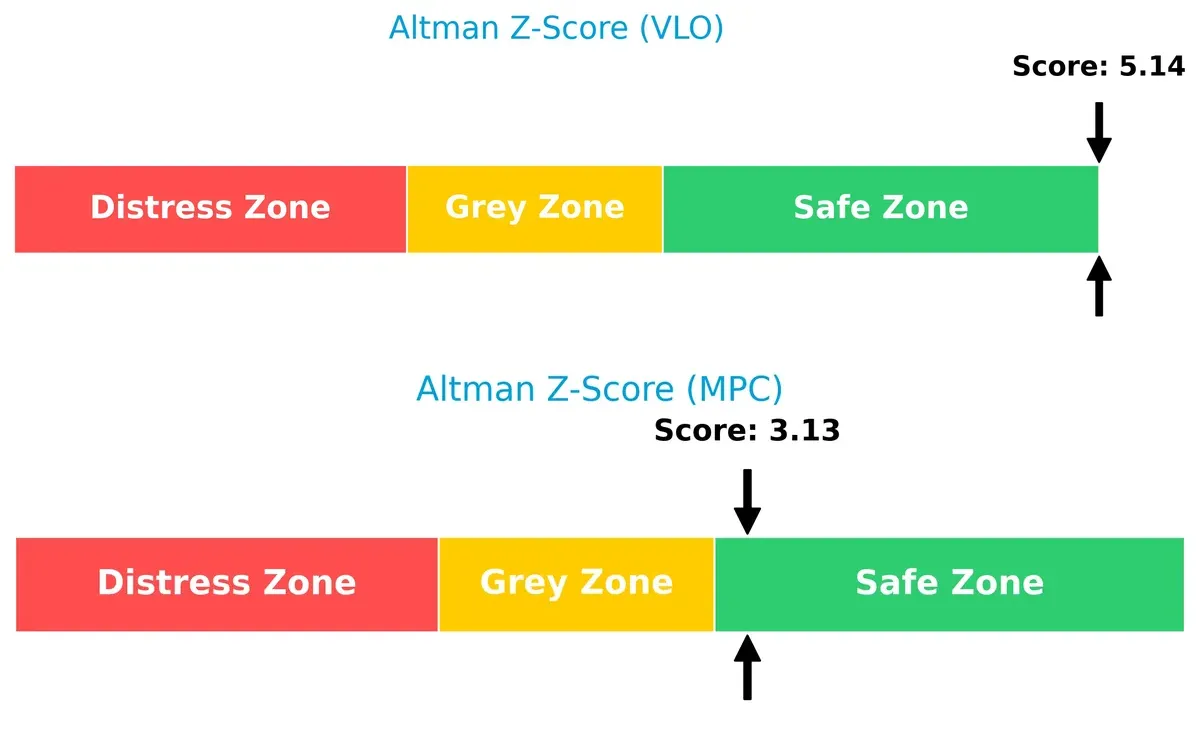

Bankruptcy Risk: Solvency Showdown

The Altman Z-Scores place both companies safely above distress thresholds, with Valero at 5.14 and Marathon at 3.13, signaling strong long-term solvency and lower bankruptcy risk in this cycle:

Financial Health: Quality of Operations

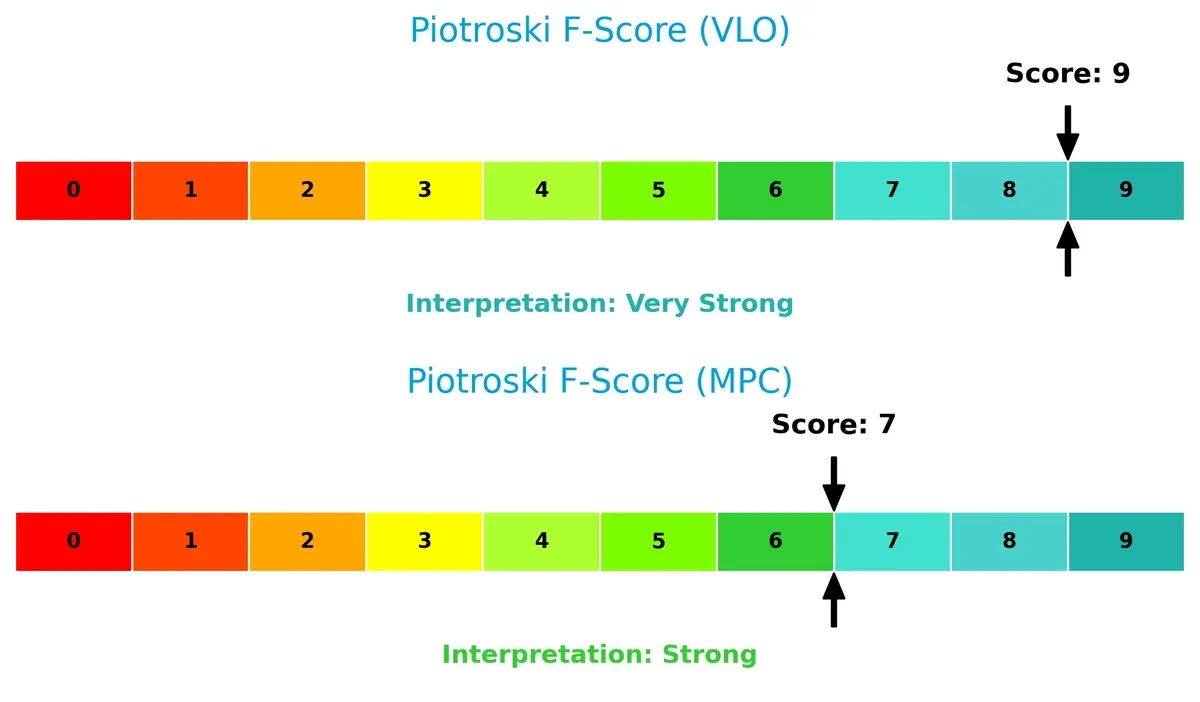

Valero’s Piotroski F-Score of 9 indicates peak financial health, reflecting robust profitability, liquidity, and operational efficiency. Marathon’s score of 7 is strong but reveals minor internal weaknesses compared to Valero’s near-perfect score:

How are the two companies positioned?

This section dissects the operational DNA of Valero and Marathon by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to reveal which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

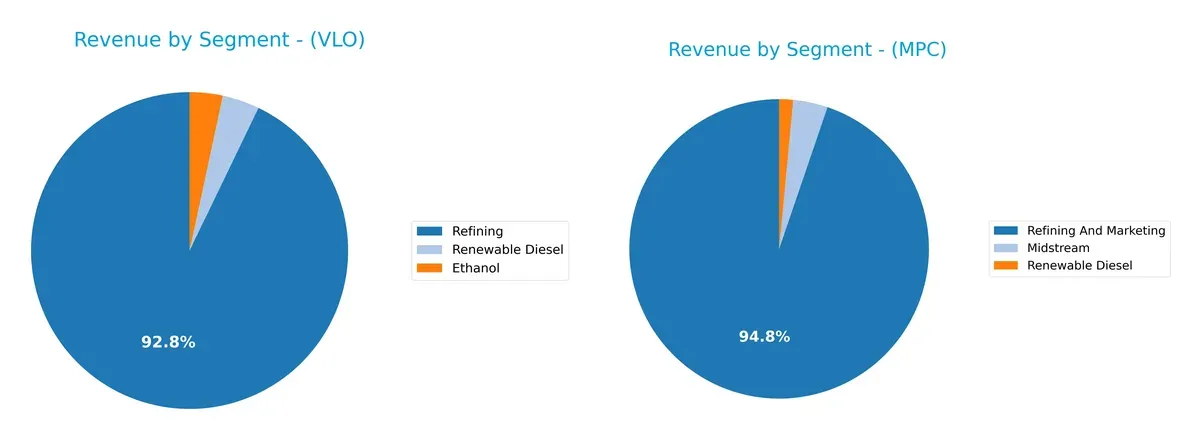

This visual comparison dissects how Valero Energy Corporation and Marathon Petroleum Corporation diversify their income streams and where their primary sector bets lie:

Valero leans heavily on refining, with $124B in 2024, dwarfing its $4.5B ethanol and $5.1B renewable diesel segments. Marathon also anchors refining and marketing at $132B but pairs it with a meaningful $5.2B midstream segment, adding diversification. Valero’s concentration in refining signals exposure to commodity cycles, whereas Marathon’s midstream stake cushions volatility and builds infrastructure lock-in. Marathon’s mix suggests a more balanced strategic positioning in 2024.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Valero Energy Corporation (VLO) and Marathon Petroleum Corporation (MPC):

VLO Strengths

- Strong asset turnover at 2.51 indicates efficient use of assets

- Favorable quick ratio at 2.93 supports liquidity

- Higher dividend yield at 2.78% attracts income investors

MPC Strengths

- Higher ROE at 19.41% shows superior profitability

- Favorable PE at 13.81 suggests reasonable valuation

- Strong fixed asset turnover at 3.82 reflects effective capital use

VLO Weaknesses

- High debt to assets at 69.86% signals financial risk

- Unfavorable net margin at 1.91% limits profitability

- Unfavorable current ratio of 3.47 may indicate working capital inefficiency

MPC Weaknesses

- Unfavorable quick ratio at 0.71 raises liquidity concerns

- Debt to assets at 36.47% is neutral but warrants monitoring

- Lower net margin at 2.48% limits earnings efficiency

Both companies show mixed financial profiles, with VLO facing higher leverage risks and MPC excelling in profitability metrics. These factors shape each firm’s strategic focus on risk management and operational efficiency.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive erosion in capital-intensive industries like refining:

Valero Energy Corporation: Integrated Scale with Operational Efficiency

Valero’s moat stems from its cost advantage and extensive asset base, reflected in a robust ROIC 2.3% above WACC and growing profitability. Its diversified fuels portfolio and international footprint bolster margin stability. In 2026, expanding renewable diesel capacity may deepen this moat but increasing regulatory pressures pose risks.

Marathon Petroleum Corporation: Midstream Integration and Market Reach

Marathon’s competitive edge lies in its midstream integration and broad retail presence, contrasting Valero’s cost focus. Despite a lower ROIC premium of 1.3%, its scale in logistics and refining drives steady revenue growth. Future investments in refining upgrades and logistics may unlock new value, though margin pressures remain a challenge.

Cost Leadership vs. Integrated Logistics: The Refining Moat Face-off

Valero’s wider moat benefits from superior capital efficiency and margin resilience, positioning it to better absorb market shocks. Marathon’s moat is narrower but supported by growing midstream integration. Overall, Valero appears better equipped to defend and expand its market share in a volatile energy landscape.

Which stock offers better returns?

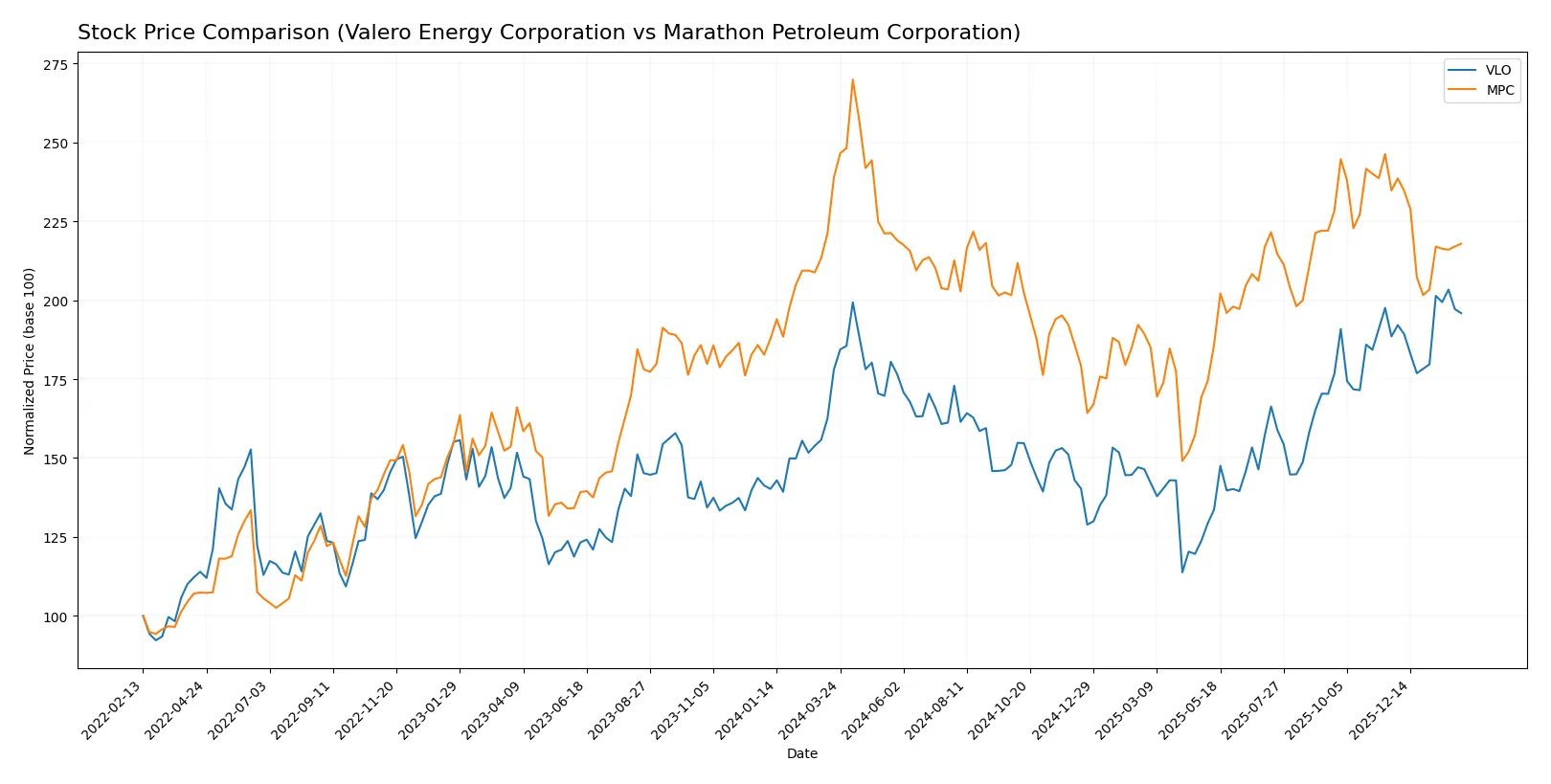

The past year shows Valero Energy’s stock gaining 10.1% with accelerating bullish momentum, while Marathon Petroleum’s shares declined 8.7%, reflecting a decelerating bearish trend.

Trend Comparison

Valero Energy’s stock rose 10.1% over the past year, marking a bullish trend with accelerating gains and a high price peak of 187.09. Volatility remains elevated with a 19.03 standard deviation.

Marathon Petroleum’s stock fell 8.7% in the same period, indicating a bearish trend with decelerating losses and a peak price of 219.13. Volatility is comparable at 19.25 standard deviation.

Valero Energy outperformed Marathon Petroleum, delivering the highest market return with positive acceleration, while Marathon’s stock showed sustained downward pressure.

Target Prices

Analysts show a bullish consensus for Valero Energy Corporation and Marathon Petroleum Corporation, signaling upside potential from current prices.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Valero Energy Corporation | 162 | 220 | 190.22 |

| Marathon Petroleum Corporation | 174 | 220 | 196.71 |

Valero’s consensus target of 190.22 exceeds its current price of 180.22, suggesting modest upside. Marathon’s 196.71 target also outpaces its 176.91 price, implying stronger growth expectations.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent institutional grades for Valero Energy Corporation and Marathon Petroleum Corporation:

Valero Energy Corporation Grades

This table lists recent grades from major financial institutions for Valero Energy Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-30 |

| Piper Sandler | Maintain | Overweight | 2026-01-30 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-27 |

| Piper Sandler | Maintain | Overweight | 2026-01-08 |

| JP Morgan | Maintain | Overweight | 2026-01-08 |

| Mizuho | Downgrade | Neutral | 2025-12-12 |

| B of A Securities | Downgrade | Neutral | 2025-12-11 |

| Barclays | Maintain | Overweight | 2025-11-17 |

| Piper Sandler | Maintain | Overweight | 2025-11-14 |

| Wells Fargo | Maintain | Overweight | 2025-11-10 |

Marathon Petroleum Corporation Grades

The following table shows recent institutional grades for Marathon Petroleum Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-01-14 |

| Mizuho | Maintain | Neutral | 2026-01-13 |

| Barclays | Maintain | Overweight | 2026-01-13 |

| Piper Sandler | Maintain | Neutral | 2026-01-08 |

| Barclays | Maintain | Overweight | 2025-11-17 |

| Piper Sandler | Maintain | Neutral | 2025-11-14 |

| Wells Fargo | Maintain | Overweight | 2025-11-05 |

| Raymond James | Maintain | Outperform | 2025-10-17 |

| Barclays | Maintain | Overweight | 2025-10-13 |

| Scotiabank | Maintain | Sector Outperform | 2025-10-09 |

Which company has the best grades?

Marathon Petroleum holds a broader range of positive grades, including Outperform and Sector Outperform, suggesting stronger institutional confidence. Valero shows mostly Overweight ratings but experienced recent downgrades to Neutral. Investors might view Marathon’s grades as reflecting a more optimistic outlook.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing Valero Energy Corporation and Marathon Petroleum Corporation in the 2026 market environment:

1. Market & Competition

Valero Energy Corporation

- Faces intense competition in refining and renewable diesel segments; market cap slightly larger at 56B USD.

Marathon Petroleum Corporation

- Competes aggressively in refining and midstream; strong brand presence with 7,159 outlets in 37 states.

2. Capital Structure & Debt

Valero Energy Corporation

- High debt-to-assets ratio of 69.9% signals elevated leverage risk; debt-to-equity at 1.44 is unfavorable.

Marathon Petroleum Corporation

- Lower debt-to-assets at 36.5% indicates more conservative leverage; debt-to-equity also unfavorable at 1.62.

3. Stock Volatility

Valero Energy Corporation

- Beta of 0.722 suggests moderate stock volatility below market average.

Marathon Petroleum Corporation

- Beta of 0.708 indicates slightly lower volatility than Valero, reflecting steadier price swings.

4. Regulatory & Legal

Valero Energy Corporation

- Exposed to tightening environmental regulations in US, Canada, and EU markets.

Marathon Petroleum Corporation

- Faces stringent US refining regulations and midstream compliance challenges, with some international exposure.

5. Supply Chain & Operations

Valero Energy Corporation

- Operates 15 refineries and 12 ethanol plants; complex logistics increase operational risk.

Marathon Petroleum Corporation

- Integrated refining and midstream assets, including pipelines and terminals, buffer supply chain shocks.

6. ESG & Climate Transition

Valero Energy Corporation

- Invests in renewable diesel and ethanol, signaling partial adaptation to energy transition.

Marathon Petroleum Corporation

- Midstream segment and refining operations face significant pressure to reduce carbon footprint.

7. Geopolitical Exposure

Valero Energy Corporation

- International presence in Canada, UK, and Ireland adds geopolitical risk beyond US borders.

Marathon Petroleum Corporation

- Primarily US-focused with some exposure to Mexico; geopolitical risks are more contained.

Which company shows a better risk-adjusted profile?

Valero’s largest risk is its high leverage, with debt-to-assets near 70%, raising financial strain concerns despite strong liquidity ratios. Marathon’s key risk lies in operational complexity across refining and midstream segments, increasing exposure to regulatory and supply chain disturbances. Marathon’s lower leverage and favorable profitability metrics grant it a better risk-adjusted profile. Notably, Valero’s quick ratio of 2.93 contrasts Marathon’s weaker 0.71, underscoring Valero’s liquidity strength but overshadowed by its debt burden.

Final Verdict: Which stock to choose?

Valero Energy Corporation’s superpower is its durable competitive advantage, evidenced by a steadily growing ROIC that comfortably outpaces its cost of capital. This cash-generating machine excels in operational efficiency, though its elevated leverage signals a point of vigilance. It suits investors seeking aggressive growth with a tolerance for capital structure risks.

Marathon Petroleum Corporation boasts a strategic moat rooted in solid asset turnover and improving profitability, supported by a favorable debt profile relative to Valero. Its consistent free cash flow and reasonable valuation offer a safety cushion. MPC fits portfolios favoring growth at a reasonable price, blending stability with upside potential.

If you prioritize durable value creation and operational efficiency, Valero outshines due to its strong economic moat and cash flow generation. However, if you seek better financial stability and a more conservative growth trajectory, Marathon Petroleum offers superior balance sheet strength and valuation appeal. Both present compelling but distinct analytical scenarios for different investor profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Valero Energy Corporation and Marathon Petroleum Corporation to enhance your investment decisions: