Home > Comparison > Financial Services > TRV vs L

The strategic rivalry between The Travelers Companies, Inc. and Loews Corporation shapes the competitive landscape of the property and casualty insurance sector. Travelers operates as a large-scale, diversified insurer with a broad commercial and personal insurance portfolio. In contrast, Loews combines specialty insurance with diversified industrial operations, including energy pipelines and manufacturing. This analysis will assess which company offers a superior risk-adjusted return, guiding investors toward the more resilient corporate trajectory.

Table of contents

Companies Overview

The Travelers Companies, Inc. and Loews Corporation stand as significant players in the property and casualty insurance market.

The Travelers Companies, Inc.: Leading Property & Casualty Insurer

The Travelers Companies, Inc. dominates the property and casualty insurance sector with a broad portfolio spanning commercial and personal lines. It generates revenue through business insurance, bond and specialty insurance, and personal insurance segments. In 2026, it strategically emphasizes tailored coverage for diverse business sizes and risk management services, leveraging a robust distribution network of brokers and agents.

Loews Corporation: Diversified Insurance and Energy Conglomerate

Loews Corporation merges commercial property and casualty insurance with significant energy infrastructure and manufacturing operations. Its revenue streams include specialty insurance, surety bonds, and risk management services alongside natural gas pipeline operations. In 2026, the company focuses on expanding its integrated energy assets while maintaining steady growth in insurance through independent agents and brokers.

Strategic Collision: Similarities & Divergences

Both companies operate in property and casualty insurance, yet Travelers concentrates solely on insurance, while Loews blends insurance with energy and manufacturing. Their competitive battleground lies in specialized insurance products and risk management services. Investors face distinct profiles: Travelers offers focused insurance expertise, whereas Loews presents diversification benefits through its multi-industry footprint.

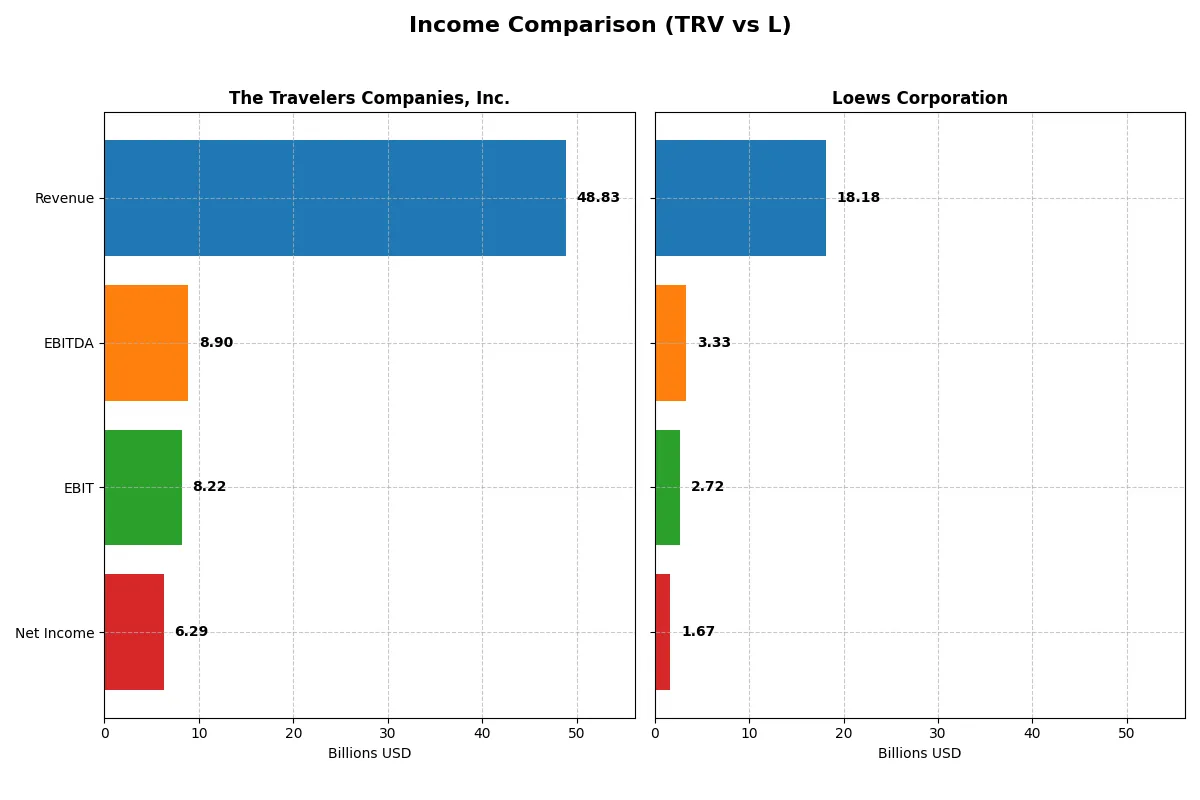

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | The Travelers Companies, Inc. (TRV) | Loews Corporation (L) |

|---|---|---|

| Revenue | 48.8B | 18.2B |

| Cost of Revenue | 27.2B | 10.2B |

| Operating Expenses | 13.8B | 5.7B |

| Gross Profit | 21.6B | 8.0B |

| EBITDA | 8.9B | 3.3B |

| EBIT | 8.2B | 2.7B |

| Interest Expense | 425M | 437M |

| Net Income | 6.3B | 1.7B |

| EPS | 27.84 | 7.97 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals how efficiently each company converts revenue into profit and manages its cost structure.

The Travelers Companies, Inc. Analysis

Travelers’ revenue grew steadily from 34.8B in 2021 to 48.8B in 2025, with net income more than doubling to 6.3B. Gross margin improved to a strong 44.25%, while net margin expanded to 12.88%. In 2025, the company showed robust momentum, increasing EBIT by 25% and EPS by nearly 28%, highlighting operational efficiency gains despite moderate revenue growth.

Loews Corporation Analysis

Loews increased revenue from 13.7B in 2021 to 18.2B in 2025, with net income rising modestly to 1.7B. Gross margin steadied near 44%, but net margin remained lower at 9.17%. The latest year saw a 17.5% EBIT increase and 24% EPS growth, reflecting solid profit expansion on moderate top-line gains, though margin contraction over the period signals some efficiency challenges.

Margin Strength vs. Growth Trajectory

Travelers leads with superior margin expansion and faster net income growth, delivering higher profitability from each revenue dollar. Loews grows steadily but lags in net margin improvement, limiting bottom-line leverage. For investors prioritizing efficiency and earnings growth, Travelers’ profile offers a more compelling fundamental advantage.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared:

| Ratios | The Travelers Companies, Inc. (TRV) | Loews Corporation (L) |

|---|---|---|

| ROE | 19.12% | 8.92% |

| ROIC | 12.03% | 168.44% |

| P/E | 10.34x | 13.21x |

| P/B | 1.98x | 1.18x |

| Current Ratio | 0.23 | 0 |

| Quick Ratio | 0.23 | 0 |

| D/E (Debt-to-Equity) | 0.28 | 0.51 |

| Debt-to-Assets | 6.45% | 10.99% |

| Interest Coverage | 18.34x | 5.22x |

| Asset Turnover | 0.34 | 0.21 |

| Fixed Asset Turnover | 0 | 1.70 |

| Payout Ratio | 15.57% | 3.12% |

| Dividend Yield | 1.51% | 0.24% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as the company’s DNA, revealing hidden risks and operational excellence critical for informed investment decisions.

The Travelers Companies, Inc.

Travelers shows strong profitability with a 19.12% ROE and a favorable 12.88% net margin. Its valuation looks attractive at a 10.34 P/E, signaling efficiency without being stretched. Shareholders benefit from a modest 1.51% dividend yield, supported by solid capital allocation and consistent free cash flow generation.

Loews Corporation

Loews posts a weaker 8.92% ROE and a neutral 9.17% net margin, reflecting subdued profitability. The stock trades at a fair 13.21 P/E but carries higher debt levels, with a neutral debt-to-equity ratio. The low 0.24% dividend yield highlights limited direct shareholder returns amid focus on reinvestment and growth.

Balanced Profitability vs. Growth Ambitions

Travelers offers a better blend of profitability, valuation, and shareholder returns, with robust operational metrics and prudent leverage. Loews shows promise through strong ROIC but suffers from weaker core profitability and minimal dividends. Investors seeking steady income may prefer Travelers, while those favoring growth might consider Loews’ reinvestment profile.

Which one offers the Superior Shareholder Reward?

I compare The Travelers Companies, Inc. (TRV) and Loews Corporation (L) on dividends and buybacks. TRV yields ~1.5%-2.2% with a moderate payout ratio around 16%-31%, fully covered by free cash flow, signaling a sustainable dividend. TRV also invests heavily in buybacks, enhancing total return. Loews pays a minimal dividend (~0.2%-0.4%) with a very low payout ratio (~3%-7%), prioritizing reinvestment and growth. Its buyback activity is modest but consistent. I see TRV’s balanced approach—solid dividend plus intense buybacks—as superior for 2026 total shareholder reward, combining income and capital appreciation potential more reliably than Loews’ conservative distribution.

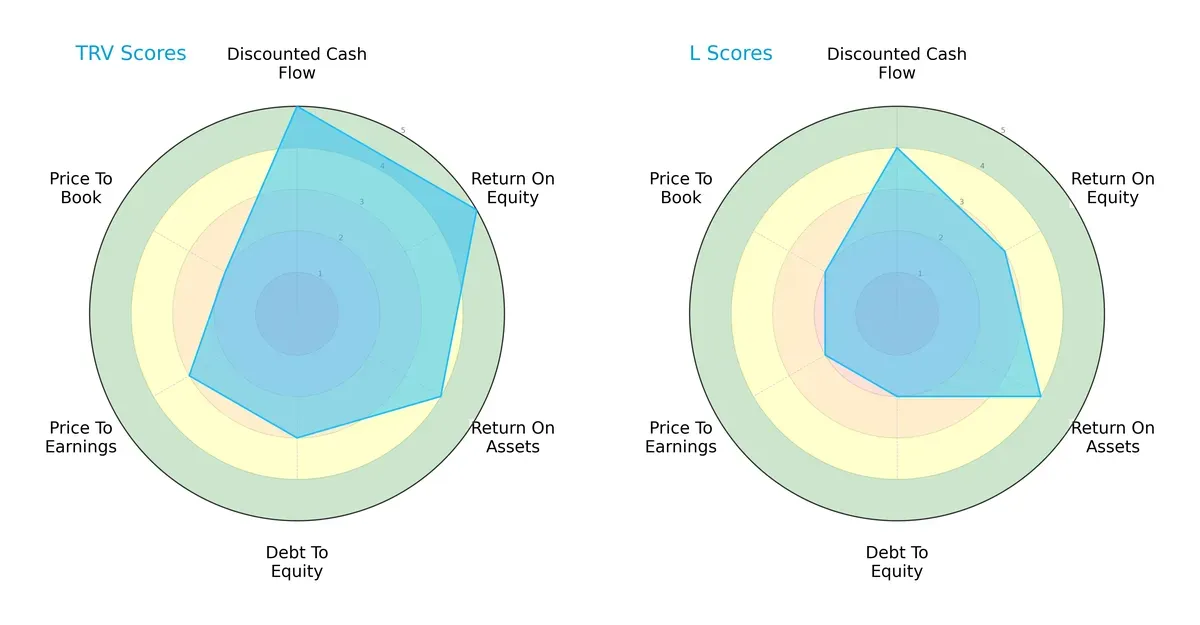

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of The Travelers Companies, Inc. and Loews Corporation across key financial metrics:

The Travelers exhibits a more balanced strength in discounted cash flow (5 vs. 4) and return on equity (5 vs. 3), indicating superior capital efficiency. Loews matches Travelers in return on assets (4 each) but lags in debt management (2 vs. 3) and valuation metrics, suggesting a heavier financial risk and less favorable market pricing. Travelers leans on a robust profitability edge, while Loews shows a weaker and less balanced profile.

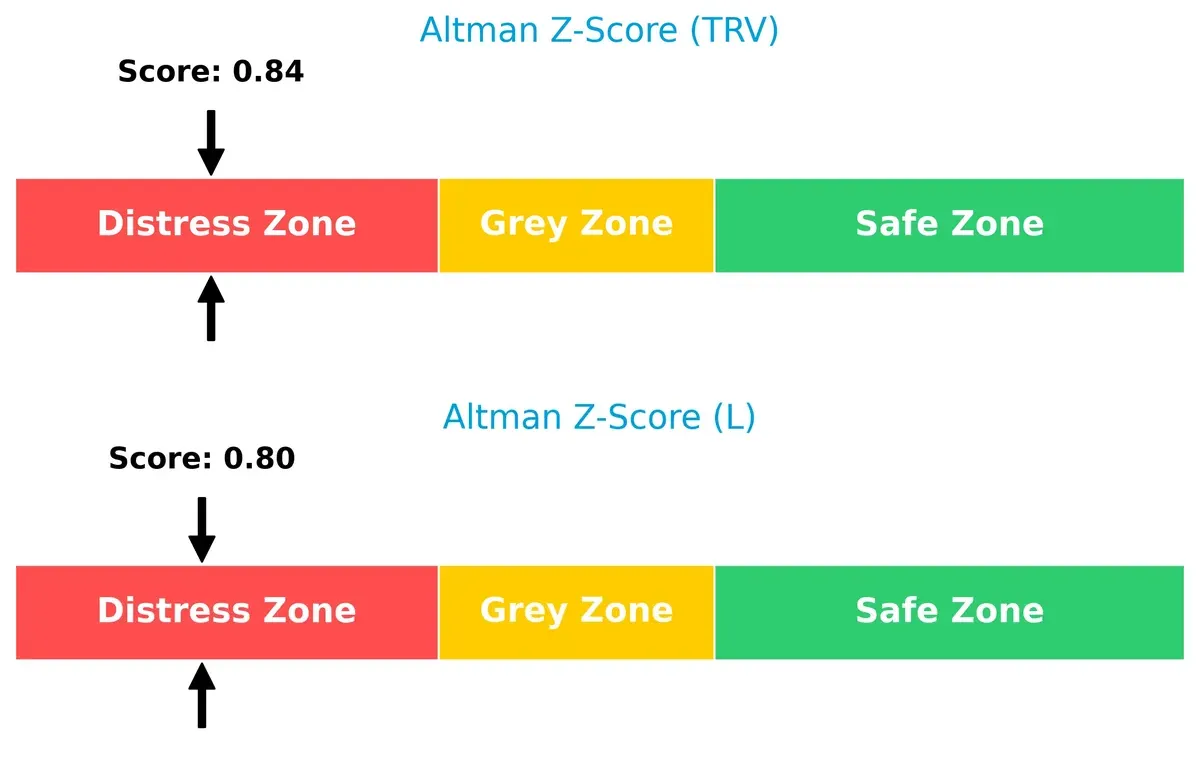

Bankruptcy Risk: Solvency Showdown

Both Travelers and Loews fall into the distress zone with Altman Z-Scores below 1.8, signaling significant bankruptcy risk amid current market pressures:

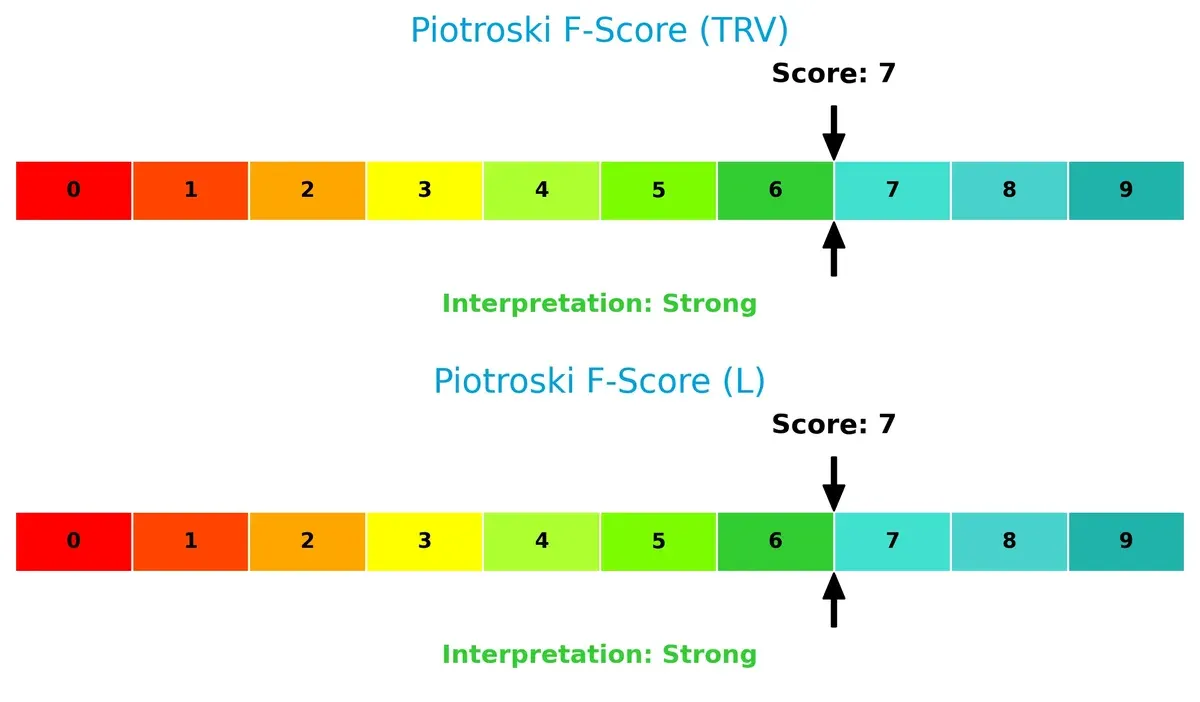

Financial Health: Quality of Operations

Travelers and Loews both score a strong 7 on the Piotroski F-Score, indicating solid operational quality and financial health without immediate red flags:

How are the two companies positioned?

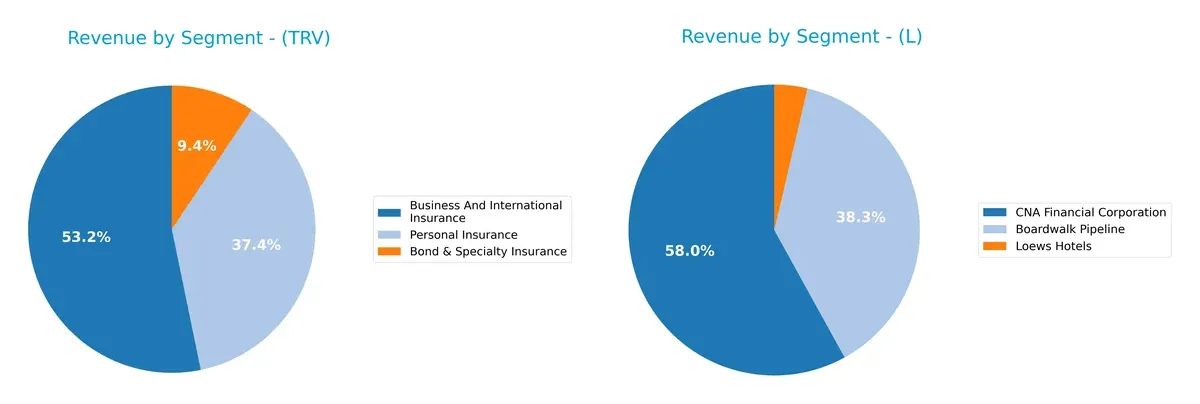

This section dissects the operational DNA of TRV and L by comparing their revenue distribution and internal dynamics, including strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how The Travelers Companies, Inc. and Loews Corporation diversify their income streams and where their primary sector bets lie:

Travelers anchors revenue in Business and International Insurance at $26B, with Personal Insurance and Bond & Specialty Insurance adding depth. Loews concentrates $15B in CNA Financial but diversifies with $9.9B from Boardwalk Pipeline and $945M from Loews Hotels. Travelers’ mix reflects an insurance ecosystem lock-in, while Loews balances financial services with energy infrastructure, reducing single-segment risk but exposing itself to sector cyclicality.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of The Travelers Companies, Inc. (TRV) and Loews Corporation (L):

TRV Strengths

- Strong profitability with 12.88% net margin and 19.12% ROE

- Favorable ROIC at 12.03% well above WACC of 5.78%

- Low debt-to-assets ratio at 6.45%

- Diverse insurance segments with steady revenue growth

- Significant US market presence with 46.36B revenue

- High interest coverage ratio at 19.34

L Strengths

- Extremely high ROIC at 168.44%, well above WACC of 5.56%

- Favorable P/E at 13.21 and P/B at 1.18

- Diverse business segments including pipeline and hotels, with CNA Financial leading revenue at 14.99B

- Favorable debt-to-assets at 10.99%

- Positive interest coverage ratio of 6.22

TRV Weaknesses

- Very low current and quick ratios at 0.23, indicating liquidity concerns

- Asset turnover at 0.34 and fixed asset turnover at 0 signal operational inefficiency

- Neutral P/B ratio at 1.98

- Dividend yield moderate at 1.51%

- High percentage of unfavorable ratios at 28.57%

L Weaknesses

- Zero current and quick ratios, indicating poor short-term liquidity

- Low ROE at 8.92% and neutral debt-to-equity at 0.51

- Unfavorable dividend yield at 0.24%

- Low asset turnover at 0.21

- Fixed asset turnover neutral at 1.7

- Higher unfavorable ratios at 35.71%

The Travelers Companies shows strong profitability and low leverage but faces liquidity and efficiency challenges. Loews Corporation boasts an impressive ROIC and favorable valuation metrics but struggles with liquidity and lower returns on equity. These factors shape their strategic priorities in capital allocation and operational focus.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true shield protecting long-term profits from relentless competition erosion. Let’s dissect the moats of two insurance giants:

The Travelers Companies, Inc.: Robust Economic Moat through Operational Excellence

Travelers leverages cost advantage combined with scale in property and casualty insurance. Its ROIC exceeds WACC by 6.2%, reflecting efficient capital use and margin stability. In 2026, expanding specialty insurance could deepen this moat.

Loews Corporation: Diversified Asset Moat with Mixed Profitability Signals

Loews benefits from a diversified portfolio including insurance and energy pipelines, generating a strong ROIC surplus but with a declining ROIC trend. Unlike Travelers, its profitability faces pressure. Opportunities lie in pipeline expansion and plastic manufacturing growth.

Moat Resilience: Operational Scale vs. Diversified Asset Base

Travelers boasts a wider and growing moat with consistent profitability gains, while Loews’ moat is narrower and weakening despite asset diversity. Travelers is better equipped to defend market share amid evolving industry challenges.

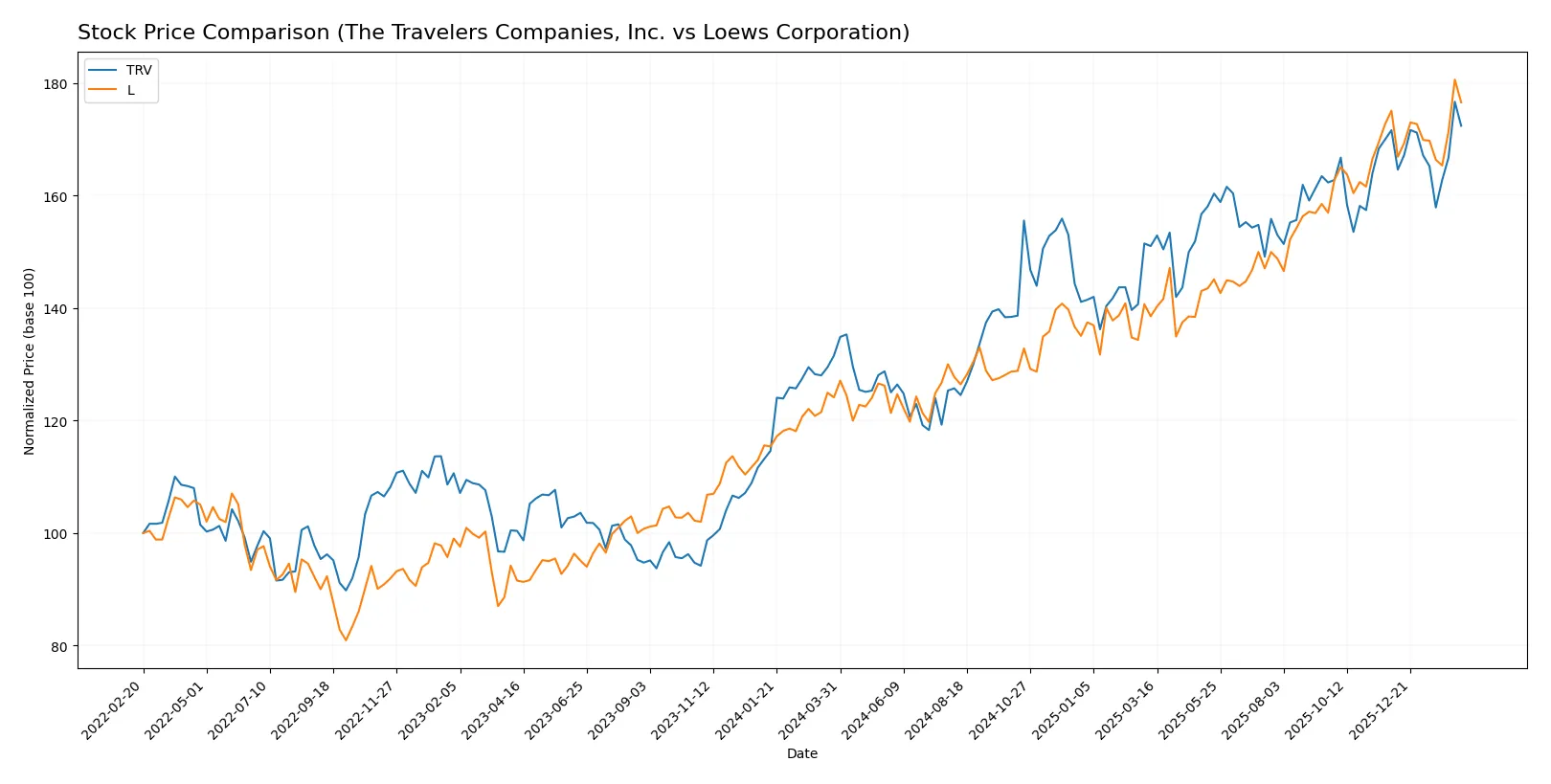

Which stock offers better returns?

The past year saw The Travelers Companies, Inc. and Loews Corporation both advance with solid gains, showing decelerating bullish momentum amid distinct trading volume trends.

Trend Comparison

The Travelers Companies, Inc. rose 31.08% over the past 12 months, maintaining a bullish trend but with decelerating momentum. It hit a high of 301.49 and a low of 201.87, with a high volatility of 25.57%.

Loews Corporation gained 42.29% in the same period, also bullish but slowing down. It showed less volatility at 10.04%, with a high near 111.27 and a low of 73.76.

Loews Corporation outperformed Travelers with a stronger annual gain and lower volatility, indicating superior market performance over the past year.

Target Prices

Analysts set a bullish target consensus for The Travelers Companies, Inc. with modest upside potential.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| The Travelers Companies, Inc. | 304 | 317 | 312.75 |

The Travelers trades at 294.21, below the consensus target of 312.75, indicating a potential 6.4% upside based on analyst expectations. No verified target price data is available for Loews Corporation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The Travelers Companies, Inc. Grades

The following table summarizes recent institutional grades for The Travelers Companies, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | Maintain | Overweight | 2026-02-02 |

| Citigroup | Maintain | Sell | 2026-01-27 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2026-01-23 |

| Roth Capital | Maintain | Buy | 2026-01-23 |

| Mizuho | Maintain | Neutral | 2026-01-22 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-22 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-14 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-13 |

| Barclays | Maintain | Equal Weight | 2026-01-08 |

| JP Morgan | Maintain | Underweight | 2026-01-07 |

Loews Corporation Grades

The following table summarizes recent institutional grades for Loews Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Outperform | 2025-05-27 |

| Deutsche Bank | Maintain | Hold | 2018-08-01 |

| Deutsche Bank | Maintain | Hold | 2018-07-31 |

| Deutsche Bank | Maintain | Hold | 2015-11-06 |

| Deutsche Bank | Maintain | Hold | 2015-11-05 |

| JP Morgan | Maintain | Hold | 2014-08-08 |

| JP Morgan | Maintain | Hold | 2014-08-07 |

| Deutsche Bank | Downgrade | Hold | 2014-03-24 |

| Deutsche Bank | Downgrade | Hold | 2014-03-23 |

| Deutsche Bank | Maintain | Buy | 2013-09-04 |

Which company has the best grades?

The Travelers Companies, Inc. holds a broader range of recent grades, mostly positive, including Buy and Overweight ratings. Loews Corporation’s grades are older and concentrated on Hold or Outperform, with fewer recent updates. Investors may view Travelers as having stronger, more current analyst support.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

The Travelers Companies, Inc.

- Strong market position in property & casualty insurance; faces intense competition from specialty insurers.

Loews Corporation

- Diversified insurance portfolio with non-insurance businesses; competitive pressure in natural gas and plastics segments.

2. Capital Structure & Debt

The Travelers Companies, Inc.

- Low debt-to-equity ratio (0.28) supports financial stability; strong interest coverage (19.34).

Loews Corporation

- Moderate leverage (D/E 0.51) raises risk; interest coverage lower but adequate at 6.22.

3. Stock Volatility

The Travelers Companies, Inc.

- Low beta (0.52) indicates less stock volatility versus market; stable dividend yield (1.51%).

Loews Corporation

- Slightly higher beta (0.61) implies moderate volatility; low dividend yield (0.24%) signals cautious income appeal.

4. Regulatory & Legal

The Travelers Companies, Inc.

- Insurance industry regulatory compliance is rigorous; exposures to claims and liability risks remain high.

Loews Corporation

- Complex regulatory environment across insurance, energy, and manufacturing sectors increases compliance burden.

5. Supply Chain & Operations

The Travelers Companies, Inc.

- Operations focus on risk management and underwriting efficiency; supply chain disruptions less impactful.

Loews Corporation

- Exposure to energy pipeline operations and manufacturing supply chains adds operational complexity and risk.

6. ESG & Climate Transition

The Travelers Companies, Inc.

- Increasing pressure to incorporate climate risks in underwriting; transition risks in property insurance.

Loews Corporation

- Climate transition impacts energy and plastics businesses; regulatory and reputational risks rising.

7. Geopolitical Exposure

The Travelers Companies, Inc.

- Primarily US-based with some international exposure; geopolitical risks moderate but manageable.

Loews Corporation

- Diversified geographic exposure including energy pipelines in sensitive regions; heightened geopolitical risk.

Which company shows a better risk-adjusted profile?

The Travelers Companies faces its biggest risk in liquidity, evidenced by very low current and quick ratios, despite strong profitability metrics. Loews Corporation’s leverage and multi-industry exposure raise financial and operational complexity risks. I see Travelers’ superior market stability and capital structure as giving it a better risk-adjusted profile, even with liquidity concerns. Recent data shows both firms in financial distress zones per Altman Z-Scores, but Travelers’ strong interest coverage (19.34 vs. 6.22) underscores its prudence in capital allocation.

Final Verdict: Which stock to choose?

The Travelers Companies, Inc. (TRV) stands out as a cash-generating powerhouse with a very favorable moat underscored by a growing ROIC well above its cost of capital. Its main point of vigilance is a persistently low current ratio, signaling liquidity challenges. TRV suits investors targeting aggressive growth with a focus on durable profitability.

Loews Corporation (L) offers a strategic moat through its exceptional ROIC, reflecting efficient capital use despite a declining trend. It carries higher leverage and a lower dividend yield, indicating a more conservative growth profile relative to TRV. L fits well within a GARP portfolio seeking steady growth with reasonable valuation discipline.

If you prioritize sustainable value creation and robust profitability expansion, TRV is the compelling choice due to its strong economic moat and accelerating earnings growth. However, if you seek a portfolio anchor with better capital efficiency and a more measured risk profile, L offers better stability despite its declining profitability trend. Both present distinct analytical scenarios depending on your appetite for growth versus stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Travelers Companies, Inc. and Loews Corporation to enhance your investment decisions: