Home > Comparison > Financial Services > PGR vs L

The strategic rivalry between The Progressive Corporation and Loews Corporation shapes the property and casualty insurance sector’s future. Progressive operates as a market-leading insurer with a broad personal and commercial lines portfolio. Loews combines insurance with diversified industrial and energy assets, creating a unique multi-industry model. This analysis will dissect their operational contrasts and risk profiles to identify which company offers superior risk-adjusted returns for a diversified portfolio in 2026.

Table of contents

Companies Overview

The Progressive Corporation and Loews Corporation are key players in the US property and casualty insurance market.

The Progressive Corporation: Auto and Property Insurance Leader

The Progressive Corporation dominates as a personal and commercial property-casualty insurer. Its core revenue comes from personal autos, commercial vehicles, and residential property insurance. In 2026, Progressive focuses on expanding its digital distribution and underwriting capabilities to capture tech-savvy consumers and improve risk assessment accuracy.

Loews Corporation: Diversified Insurance and Energy Conglomerate

Loews Corporation offers a broad range of commercial insurance products alongside energy and manufacturing operations. It generates revenue from specialty insurance lines, pipeline transportation, and plastic container manufacturing. Loews prioritizes optimizing its insurance portfolio while leveraging its energy assets for stable cash flow in 2026.

Strategic Collision: Similarities & Divergences

Progressive emphasizes a direct-to-consumer, tech-driven model, while Loews integrates insurance with energy infrastructure and manufacturing. Their primary battleground is commercial and specialty insurance, where underwriting discipline and scale matter most. Progressive’s pure-play insurance profile contrasts with Loews’ diversified conglomerate structure, offering distinct risk and growth dynamics for investors.

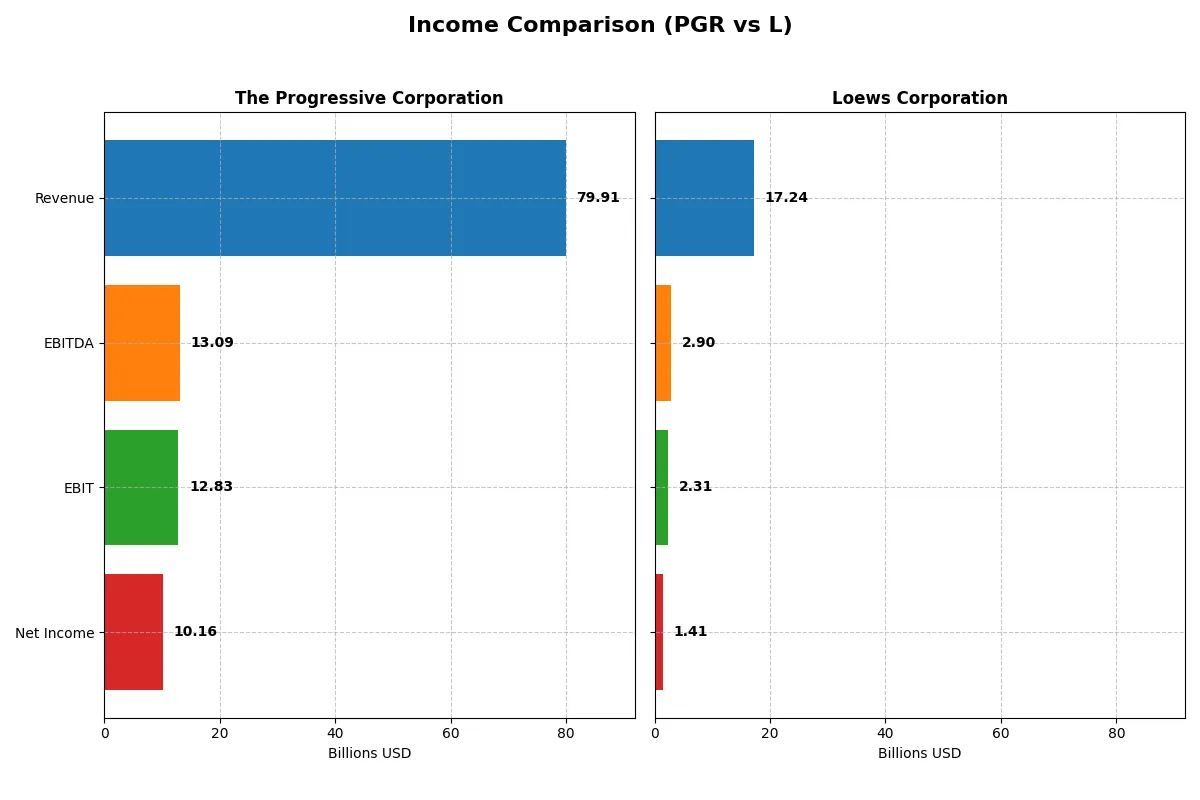

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | The Progressive Corporation (PGR) | Loews Corporation (L) |

|---|---|---|

| Revenue | 79.9B | 17.2B |

| Cost of Revenue | 55.3B | 9.5B |

| Operating Expenses | 11.8B | 5.8B |

| Gross Profit | 24.6B | 7.7B |

| EBITDA | 13.1B | 2.9B |

| EBIT | 12.8B | 2.3B |

| Interest Expense | 255M | 441M |

| Net Income | 10.2B | 1.4B |

| EPS | 17.27 | 6.42 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes which company runs a more efficient and profitable business engine across growth and margin metrics.

The Progressive Corporation Analysis

Progressive’s revenue soared from $47.7B in 2021 to $79.9B in 2025, with net income exploding from $3.3B to $10.2B. Its gross margin sustains a sturdy 30.8%, while the net margin climbs to 12.7%, signaling tight cost control. In 2025, Progressive exhibits strong momentum, growing net income by nearly 20% year-over-year.

Loews Corporation Analysis

Loews grew revenue from $13.7B in 2021 to $17.2B in 2024, with net income rising from $1.6B to $1.4B, though net margin softens to 8.2%. Its gross margin remains high at 44.7%, but EBIT and net margin declined slightly last year, indicating some pressure on profitability despite revenue gains.

Margin Expansion vs. Revenue Surge

Progressive demonstrates superior revenue growth and margin expansion, translating into a robust net income trajectory. Loews shows high gross margins but weaker recent profit momentum and margin compression. For investors, Progressive’s profile offers stronger earnings growth and improving profitability, appealing to those prioritizing operational efficiency and scale.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | The Progressive Corporation (PGR) | Loews Corporation (L) |

|---|---|---|

| ROE | 2.23% (2025) | 8.29% (2024) |

| ROIC | 9.30% (2025) | 298.8% (2024) |

| P/E | 13.19 (2025) | 13.19 (2024) |

| P/B | 29.35 (2025) | 1.09 (2024) |

| Current Ratio | 0 (2025) | 0 (2024) |

| Quick Ratio | 0 (2025) | 0 (2024) |

| D/E | 0 (2025) | 0.52 (2024) |

| Debt-to-Assets | 0 (2025) | 11% (2024) |

| Interest Coverage | 50.33 (2025) | 4.25 (2024) |

| Asset Turnover | 0.88 (2025) | 0.21 (2024) |

| Fixed Asset Turnover | 0 (2025) | 1.61 (2024) |

| Payout Ratio | 28.37% (2025) | 3.89% (2024) |

| Dividend Yield | 2.15% (2025) | 0.29% (2024) |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, revealing hidden risks and operational excellence that shape investment decisions.

The Progressive Corporation

Progressive demonstrates strong core profitability with a robust 222.54% ROE and a favorable 12.72% net margin. Its P/E ratio of 13.19 signals a fairly valued stock, while a high P/B of 29.35 suggests some valuation stretch. The company rewards shareholders with a solid 2.15% dividend yield, reflecting disciplined capital allocation.

Loews Corporation

Loews posts a modest 8.29% ROE and an 8.2% net margin, indicating moderate profitability. The P/E ratio matches Progressive’s at 13.19, but a low P/B of 1.09 suggests undervaluation. Loews shows a strong 29,880% ROIC, likely due to accounting nuances. Dividend yield is weak at 0.29%, implying limited income return.

Balanced Profitability vs. Valuation Discipline

Progressive offers superior profitability and shareholder return, but at a stretched book value. Loews presents a more conservative valuation with weaker profitability and dividends. Investors prioritizing income and efficiency may lean toward Progressive, while those seeking valuation discipline might favor Loews.

Which one offers the Superior Shareholder Reward?

I observe that Progressive (PGR) delivers a higher dividend yield of 2.15% with a moderate payout ratio of 28%, signaling healthy free cash flow coverage. Its buyback intensity remains meaningful, supporting total shareholder return. Loews (L) offers a lower dividend yield near 0.3% with a conservative 4% payout ratio, focusing buybacks on steady cash flow and reinvestment. Loews’ distribution seems more sustainable through conservative dividends and consistent buybacks, balancing growth and return. However, in 2026, I find Progressive’s combination of higher yield and active buybacks offers superior total return for income-focused investors.

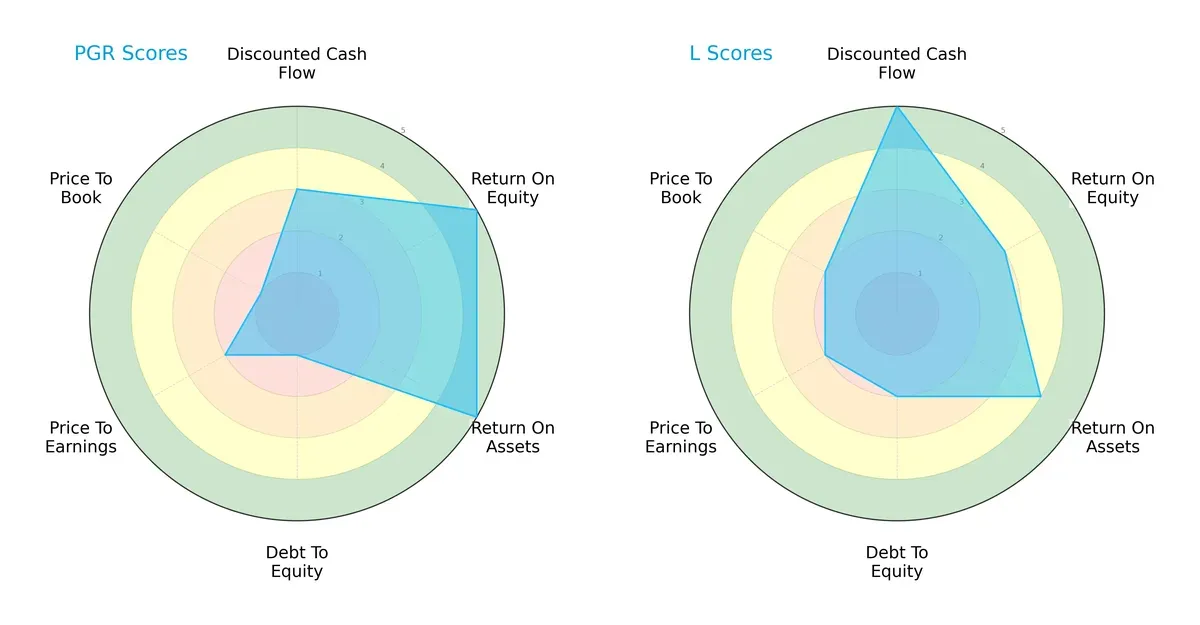

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of both firms, highlighting their core financial strengths and weaknesses:

The Progressive Corporation (PGR) excels in profitability metrics, boasting very favorable ROE and ROA scores at 5 each. However, its financial leverage is a glaring weakness, with a very unfavorable debt-to-equity score of 1, dragging down its valuation metrics (P/B at 1). Loews Corporation (L) presents a more balanced profile, with a very favorable DCF score of 5 and moderate debt-to-equity risk at 2. Loews trades at slightly better valuation multiples. I see Loews as the more balanced operator, while Progressive relies heavily on its robust operational efficiency despite financial leverage risks.

—

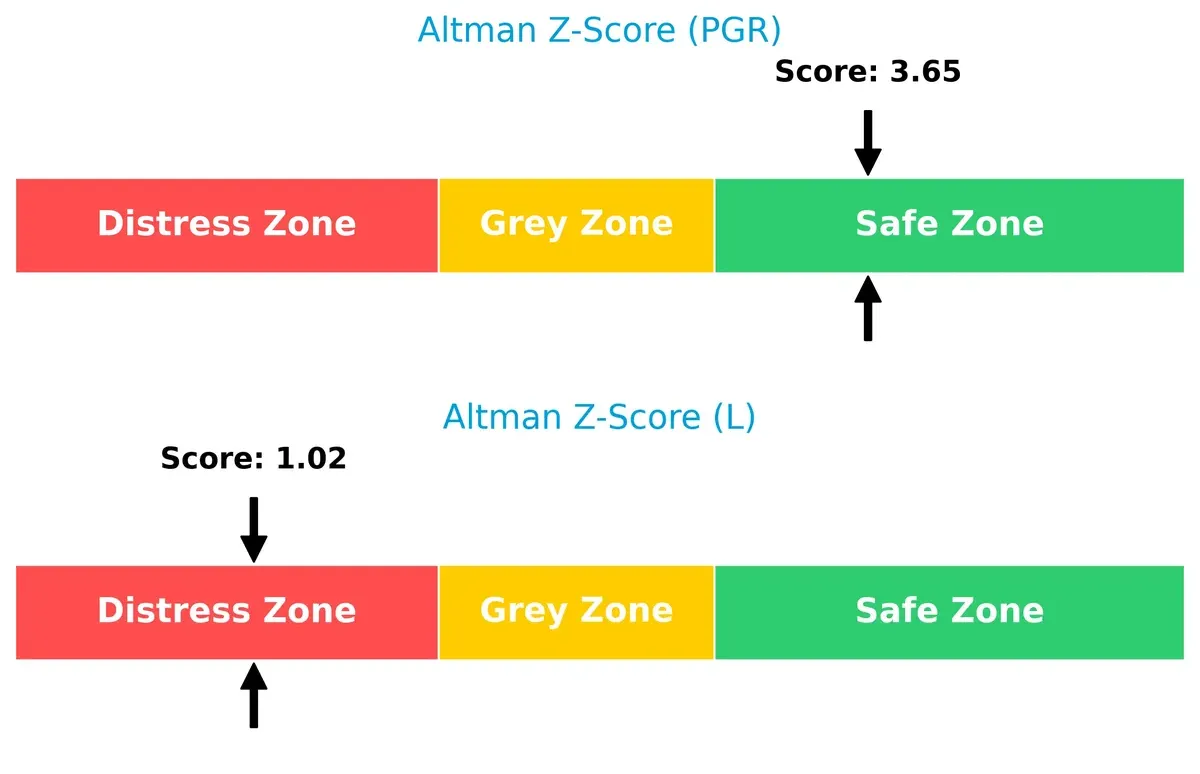

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap sharply favors Progressive, signaling a safer long-term survival outlook amid market volatility:

Progressive scores a solid 3.65, comfortably in the safe zone, indicating robust financial stability. Loews, however, sits at 1.02, deep in the distress zone, flagging significant bankruptcy risk if adverse conditions persist. This divergence underscores Progressive’s superior capital structure resilience in this cycle.

—

Financial Health: Quality of Operations

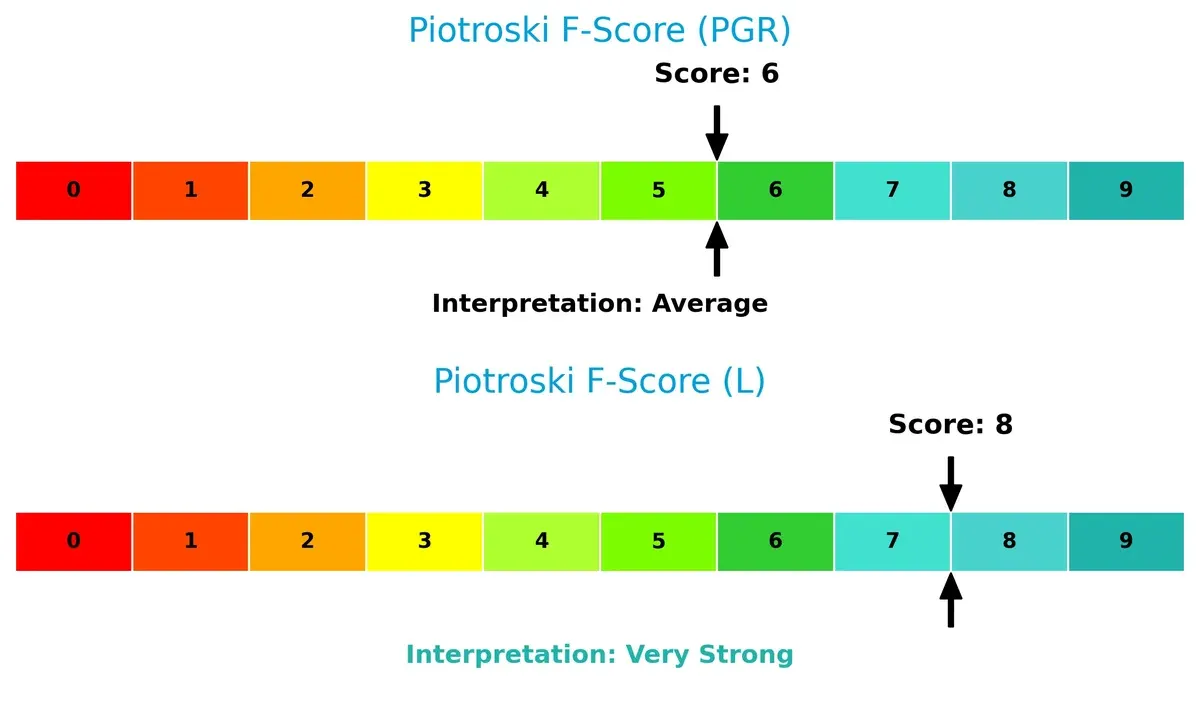

Loews demonstrates stronger internal financial health, outpacing Progressive’s average operational quality:

Loews attains a very strong Piotroski score of 8, reflecting high-quality earnings, sound leverage, and efficient asset use. Progressive’s score of 6, while decent, signals some red flags in internal metrics. Loews thus stands out as the firmer operational performer with fewer financial weaknesses.

How are the two companies positioned?

This section dissects the operational DNA of Progressive and Loews by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

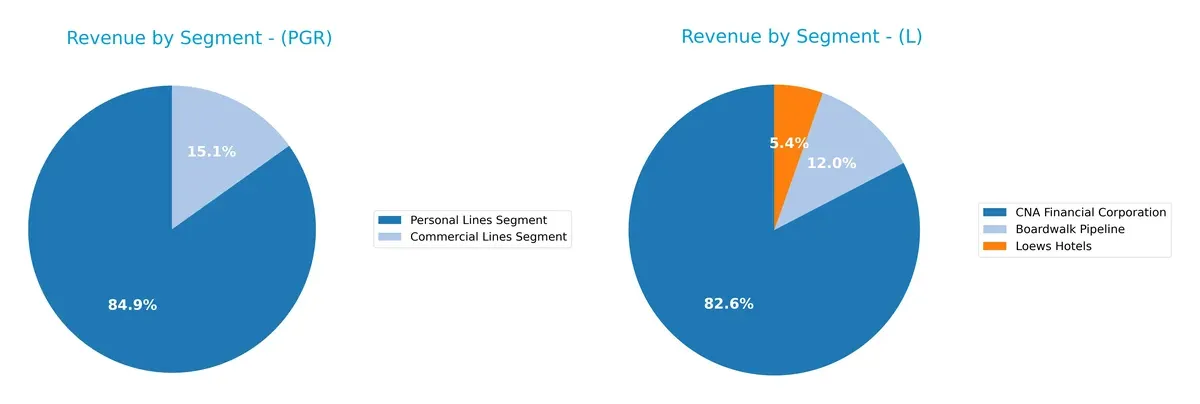

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how The Progressive Corporation and Loews Corporation diversify their income streams and where their primary sector bets lie:

The Progressive Corporation anchors revenue in its Personal Lines Segment with $60.9B, dwarfing its $10.9B Commercial Lines. This heavy reliance signals concentration risk but also deep consumer insurance expertise. Loews Corporation presents a more diversified mix: CNA Financial dominates at $14.3B, while Boardwalk Pipeline and Loews Hotels contribute $2.1B and $0.9B, respectively, reflecting a balanced portfolio across insurance, energy infrastructure, and hospitality.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of The Progressive Corporation and Loews Corporation:

The Progressive Corporation Strengths

- Strong profitability with 12.72% net margin and 222.54% ROE

- Favorable cost of capital at 5.44% WACC

- Robust interest coverage ratio of 50.33

- Large revenue from diversified personal and commercial insurance lines

Loews Corporation Strengths

- Favorable ROIC significantly above WACC at 29,880%

- Balanced debt to assets at 10.91%

- Positive interest coverage ratio of 5.25

- Diversified revenue from insurance, pipelines, and hospitality sectors

The Progressive Corporation Weaknesses

- Unfavorable liquidity with zero current and quick ratios

- High price-to-book ratio at 29.35 indicating possible overvaluation

- Neutral asset turnover and unfavorable fixed asset turnover

- Limited segment diversification beyond insurance

Loews Corporation Weaknesses

- Low return on equity at 8.29%

- Poor asset turnover at 0.21

- Low dividend yield of 0.29%

- Neutral debt to equity ratio at 0.52

- Unfavorable liquidity ratios with zero current and quick ratios

The Progressive Corporation excels in profitability and conservative leverage but faces liquidity and valuation concerns. Loews Corporation shows strong capital returns in certain metrics and diversified operations but struggles with operational efficiency and liquidity. Both companies must address liquidity weaknesses to strengthen financial resilience.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive erosion. Let’s dissect the moats of two insurance giants:

The Progressive Corporation: Customer-Centric Switching Costs

Progressive’s moat hinges on high switching costs fueled by tailored insurance products and digital ease. Its consistent 3.9% ROIC advantage over WACC and margin stability prove efficient capital use. New market entries and product innovation in 2026 should reinforce this durable moat.

Loews Corporation: Diversified Asset Moat with Operational Scale

Loews leverages a diverse portfolio including insurance, energy pipelines, and manufacturing, creating a unique asset moat. Its extraordinary ROIC surge—over 29,800% above WACC—signals exceptional value creation. However, complexity could introduce execution risk as it pursues growth across sectors in 2026.

Capital Efficiency vs. Asset Diversification: The Moat Showdown

Progressive’s focused customer switching costs build a deep moat around insurance operations. Loews’ diverse asset base offers a wider moat but with greater operational challenges. I see Loews better equipped to defend market share through superior capital allocation and sector diversification.

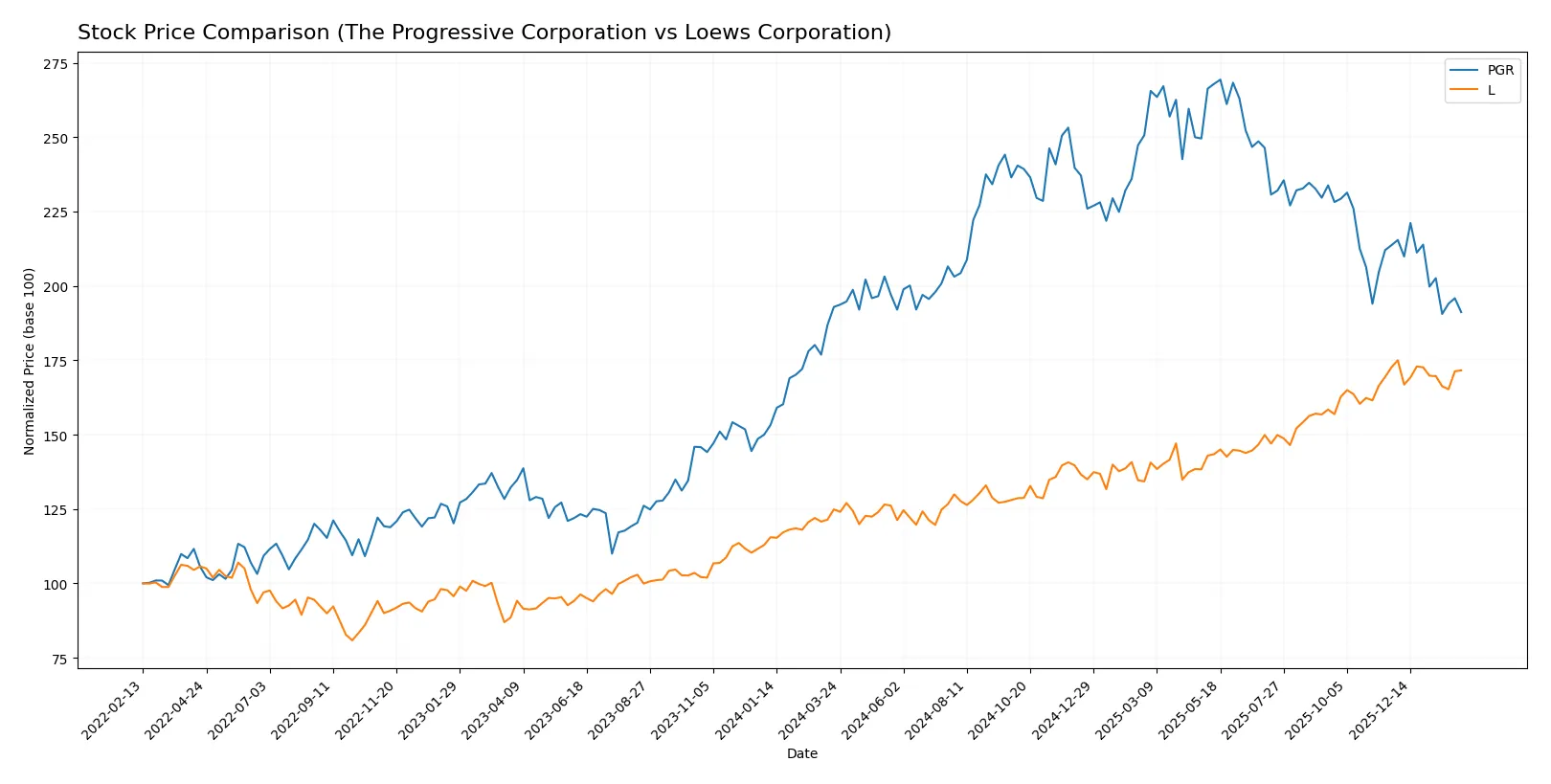

Which stock offers better returns?

The past year shows contrasting dynamics: Progressive Corporation’s price declined slightly, while Loews Corporation gained substantial ground despite recent mild pullbacks.

Trend Comparison

Progressive Corporation’s stock fell 0.9% over the past 12 months, indicating a bearish trend with decelerating losses. The price ranged between 202.37 and 286.03, showing significant volatility.

Loews Corporation’s stock rose 37.43% over the same period, reflecting a bullish but decelerating trend. Its price fluctuated between 73.76 and 107.87, with lower volatility than Progressive.

Loews outperformed Progressive by a wide margin, delivering the highest market returns despite a recent slight decline in momentum.

Target Prices

Analysts present a solid target consensus for The Progressive Corporation, reflecting optimistic growth expectations.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| The Progressive Corporation | 214 | 265 | 236.55 |

The Progressive’s target consensus of 236.55 implies a roughly 16% upside from the current 203.04 stock price, signaling confidence in its market positioning. No verified target price data is available from recognized analysts for Loews Corporation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The Progressive Corporation Grades

Here are the latest institutional grades for The Progressive Corporation from reputable firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2026-01-30 |

| BMO Capital | Maintain | Market Perform | 2026-01-29 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-29 |

| Morgan Stanley | Maintain | Underweight | 2026-01-29 |

| Barclays | Upgrade | Overweight | 2026-01-08 |

| JP Morgan | Maintain | Overweight | 2026-01-07 |

| Evercore ISI Group | Maintain | In Line | 2026-01-07 |

Loews Corporation Grades

Below are the institutional grades available for Loews Corporation from established grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Outperform | 2025-05-27 |

| Deutsche Bank | Maintain | Hold | 2018-08-01 |

| Deutsche Bank | Maintain | Hold | 2018-07-31 |

| Deutsche Bank | Maintain | Hold | 2015-11-06 |

| Deutsche Bank | Maintain | Hold | 2015-11-05 |

| JP Morgan | Maintain | Hold | 2014-08-08 |

Which company has the best grades?

Loews Corporation holds the strongest recent rating with an Outperform by RBC Capital. Progressive shows mixed grades, mostly Market Perform or Equal Weight, with some Overweight upgrades. Investors may view Loews as having a more confident institutional outlook, while Progressive’s ratings suggest caution and varied sentiment.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing The Progressive Corporation and Loews Corporation in the 2026 market environment:

1. Market & Competition

The Progressive Corporation

- Operates in a highly competitive P&C insurance market with strong digital direct sales.

Loews Corporation

- Diverse insurance products plus energy and manufacturing segments increase market complexity.

2. Capital Structure & Debt

The Progressive Corporation

- Virtually debt-free with excellent interest coverage, indicating low financial risk.

Loews Corporation

- Moderate leverage (D/E 0.52) with healthy interest coverage, manageable but higher risk than PGR.

3. Stock Volatility

The Progressive Corporation

- Low beta of 0.34 suggests defensive stock with limited market sensitivity.

Loews Corporation

- Beta at 0.61 indicates moderate volatility, more sensitive to market swings than PGR.

4. Regulatory & Legal

The Progressive Corporation

- Subject to U.S. insurance regulations; potential exposure to changing property/casualty rules.

Loews Corporation

- Faces regulatory scrutiny across insurance, energy pipelines, and manufacturing sectors, increasing complexity.

5. Supply Chain & Operations

The Progressive Corporation

- Operations rely on efficient claims processing; digital channels mitigate supply chain risks.

Loews Corporation

- Energy and manufacturing operations expose Loews to commodity price swings and supply chain disruptions.

6. ESG & Climate Transition

The Progressive Corporation

- Insurance underwriting increasingly exposed to climate-related losses; ESG integration critical.

Loews Corporation

- Energy segment faces transition risks amid decarbonization; plastic manufacturing may face regulatory pressures.

7. Geopolitical Exposure

The Progressive Corporation

- Primarily U.S.-focused, limiting direct geopolitical risk.

Loews Corporation

- International energy and insurance operations increase exposure to geopolitical and trade tensions.

Which company shows a better risk-adjusted profile?

The Progressive Corporation’s strongest risk is regulatory changes in property-casualty insurance, but its debt-free capital structure and low stock volatility provide a sturdy risk cushion. Loews Corporation faces significant exposure from its diversified, capital-intensive businesses, particularly energy’s climate transition risks. Despite a stronger Piotroski score, Loews’ Altman Z-score indicates distress risk, contrasting with Progressive’s safe zone. Overall, Progressive offers a superior risk-adjusted profile backed by robust financial stability and lower operational complexity.

Final Verdict: Which stock to choose?

The Progressive Corporation (PGR) excels as a cash-generating powerhouse with a durable competitive advantage rooted in steadily growing ROIC above its cost of capital. Its main point of vigilance lies in liquidity ratios, which could pressure short-term flexibility. PGR suits portfolios targeting aggressive growth with strong fundamentals.

Loews Corporation (L) stands out for its strategic moat of exceptional capital efficiency and value creation, reflected by a sky-high ROIC compared to WACC. It offers a safer profile than PGR due to moderate debt levels and a more attractive valuation. L fits well within GARP portfolios focused on stability and reasonable growth.

If you prioritize aggressive expansion fueled by operational excellence, PGR is the compelling choice due to its consistent value creation and robust earnings growth. However, if you seek a blend of durable profitability with better valuation and moderate risk, L offers better stability and commands a more reasonable premium. Both present distinct analytical scenarios aligned with differing investor risk tolerances.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Progressive Corporation and Loews Corporation to enhance your investment decisions: