Home > Comparison > Industrials > BA vs LMT

The strategic rivalry between The Boeing Company and Lockheed Martin Corporation shapes the Aerospace & Defense sector’s evolution. Boeing operates as a diversified industrial giant with commercial and defense segments, while Lockheed Martin focuses on high-technology defense systems and government contracts. This analysis pits Boeing’s broad market reach against Lockheed Martin’s specialized innovation to identify which trajectory offers superior risk-adjusted returns for a diversified portfolio in 2026.

Table of contents

Companies Overview

The Boeing Company and Lockheed Martin Corporation stand as pillars in the Aerospace & Defense sector, shaping global security and commercial aviation.

The Boeing Company: Aerospace & Defense Giant

Boeing commands the commercial and military aircraft market with diverse revenue streams spanning jetliners, satellites, and missile defense. Its 2026 strategy emphasizes expanding its Global Services segment, focusing on fleet support and digital maintenance solutions, consolidating its competitive edge in both commercial and defense arenas.

Lockheed Martin Corporation: Defense Technology Leader

Lockheed Martin specializes in advanced aerospace and defense systems, generating revenue through aeronautics, missile systems, and space technologies. Its 2026 focus centers on integrating network-enabled situational awareness and cyber solutions, enhancing intelligence and national security capabilities for U.S. and allied governments.

Strategic Collision: Similarities & Divergences

Both firms dominate the aerospace and defense landscape but diverge in approach: Boeing balances commercial aviation with defense services, while Lockheed Martin pursues a tightly integrated defense technology ecosystem. Their primary competition unfolds in military aerospace and missile defense contracts. Each presents distinct investment profiles reflecting Boeing’s broader market exposure and Lockheed’s government-centric specialization.

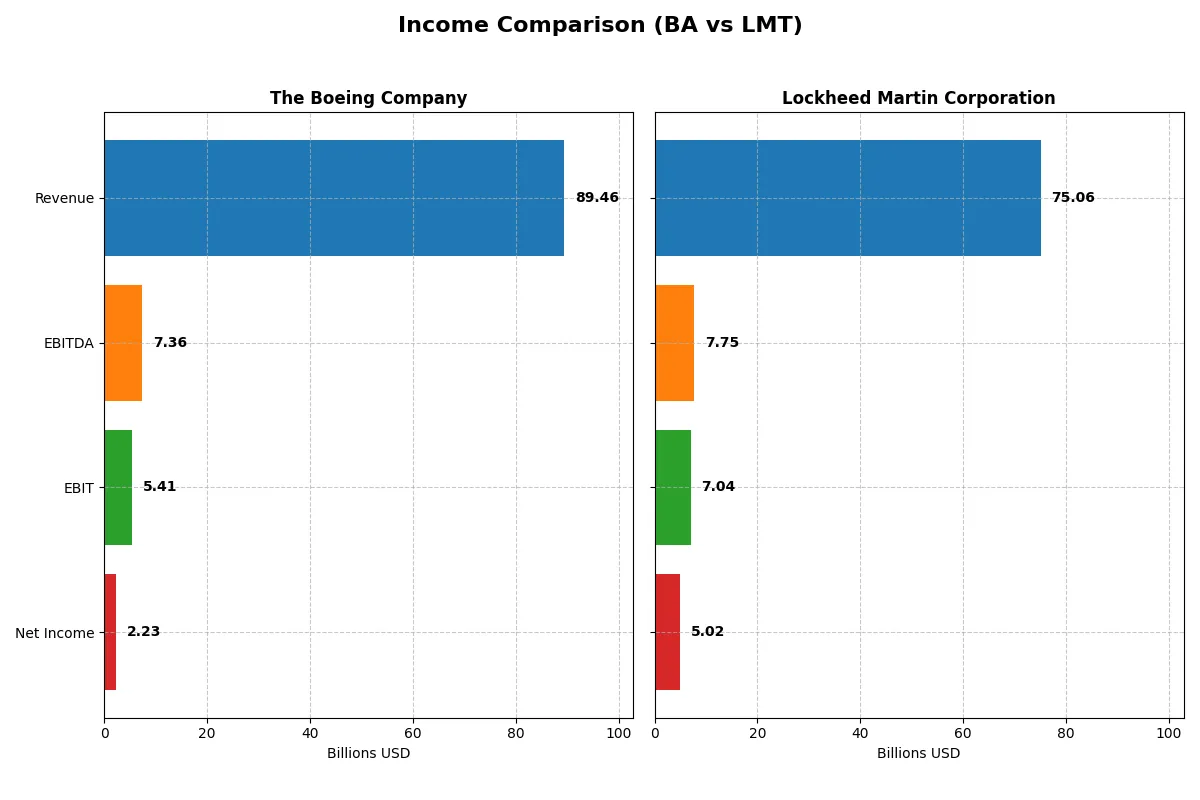

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | The Boeing Company (BA) | Lockheed Martin Corporation (LMT) |

|---|---|---|

| Revenue | 89.5B | 75.1B |

| Cost of Revenue | 85.2B | 67.4B |

| Operating Expenses | 9.7B | -0.1B |

| Gross Profit | 4.3B | 7.6B |

| EBITDA | 7.4B | 7.8B |

| EBIT | 5.4B | 7.0B |

| Interest Expense | 2.8B | 1.1B |

| Net Income | 2.2B | 5.0B |

| EPS | 2.49 | 21.56 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals how each company converts revenue into profit, highlighting operational efficiency and margin strength.

The Boeing Company Analysis

Boeing’s revenue surged from 62B in 2021 to 89B in 2025, reversing prior losses into a 2.2B net income in 2025. Gross and net margins steadily improved, with a notable 4.8% gross margin and 2.5% net margin in 2025. This rebound reflects strong momentum and operational recovery after a challenging period.

Lockheed Martin Corporation Analysis

Lockheed Martin showed consistent revenue growth from 67B in 2021 to 75B in 2025 but experienced a decline in net income, down 20.5% over five years to 5B in 2025. Its gross margin held steady at around 10%, while net margin remained favorable at 6.7%. However, recent margin compression and declining EPS signal emerging efficiency headwinds.

Margin Recovery vs. Margin Stability

Boeing demonstrates a powerful margin recovery, doubling net income and EPS with accelerating revenue growth. Lockheed Martin maintains higher margin levels but suffers declining profitability and EPS. For investors, Boeing’s turnaround profile offers higher growth potential, while Lockheed’s stable margin base faces pressure on profitability momentum.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies evaluated:

| Ratios | Boeing (BA) | Lockheed Martin (LMT) |

|---|---|---|

| ROE | 41.0% | 74.6% |

| ROIC | -6.7% | 17.4% |

| P/E | 74.1 | 22.3 |

| P/B | 30.3 | 16.6 |

| Current Ratio | 1.27 | 1.09 |

| Quick Ratio | 0.49 | 0.94 |

| D/E (Debt to Equity) | 9.92 | 0.17 |

| Debt-to-Assets | 32.2% | 2.0% |

| Interest Coverage | -1.95 | 6.92 |

| Asset Turnover | 0.53 | 1.25 |

| Fixed Asset Turnover | 5.73 | 8.46 |

| Payout Ratio | 14.8% | 62.4% |

| Dividend Yield | 0.20% | 2.80% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, revealing hidden risks and operational excellence that shape investment outcomes.

The Boeing Company

Boeing posts a strong ROE at 41%, signaling robust shareholder profitability despite a low net margin of 2.5%. Its P/E ratio of 74 indicates an expensive valuation, stretched beyond sector norms. Boeing’s minimal 0.2% dividend yield suggests limited shareholder returns, relying instead on reinvestment in R&D for future growth.

Lockheed Martin Corporation

Lockheed Martin delivers a stellar 75% ROE with a healthier net margin of 6.7%, reflecting superior operational efficiency. Its P/E ratio of 22.3 appears fair relative to industry peers. The company supports investors with a 2.8% dividend yield, complemented by solid free cash flow, underscoring balanced capital allocation.

Premium Valuation vs. Operational Safety

Lockheed Martin offers a better balance of profitability, valuation, and shareholder returns, backed by a favorable ratio profile. Boeing’s elevated valuation and weak free cash flow carry higher risk. Investors seeking steady income and operational safety may prefer Lockheed’s profile, while Boeing suits those focused on growth reinvestment.

Which one offers the Superior Shareholder Reward?

I compare The Boeing Company (BA) and Lockheed Martin Corporation (LMT) on distribution philosophy, dividend yield, payout ratios, and buybacks. Boeing yields a meager 0.2% with a low 15% payout but posts negative free cash flow (-2.5/share), signaling weak dividend sustainability. It lacks buyback activity amid financial strain. Lockheed Martin delivers a robust 2.8% dividend yield with a 62% payout ratio, supported by strong free cash flow of 29.9/share. It also conducts meaningful buybacks, enhancing total shareholder return. Historically, defense giants like LMT sustain shareholder rewards through balanced dividends and buybacks. I see LMT’s model as more sustainable and offering superior total return in 2026.

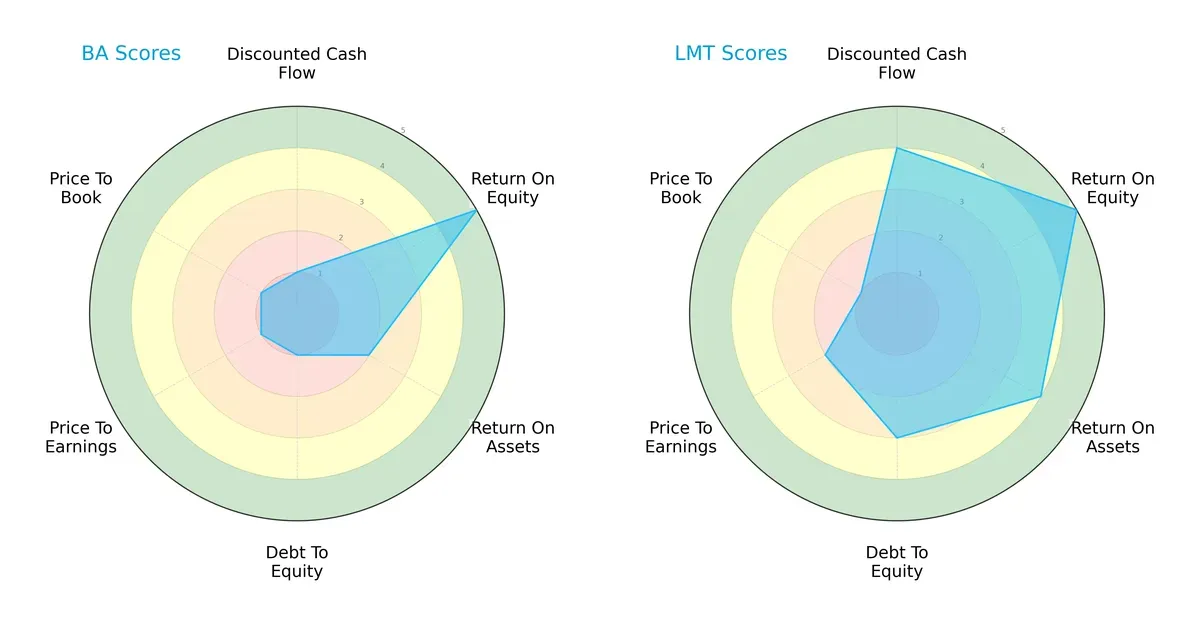

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of both firms, highlighting their strengths and vulnerabilities across key financial metrics:

Lockheed Martin Corporation (LMT) presents a more balanced profile, excelling in discounted cash flow (4 vs. 1) and return on assets (4 vs. 2) while maintaining moderate debt-to-equity (3 vs. 1) and valuation scores. The Boeing Company (BA) leans heavily on return on equity (5 each) but suffers from very unfavorable debt and valuation metrics. LMT’s diversified strengths suggest more prudent capital allocation and valuation discipline.

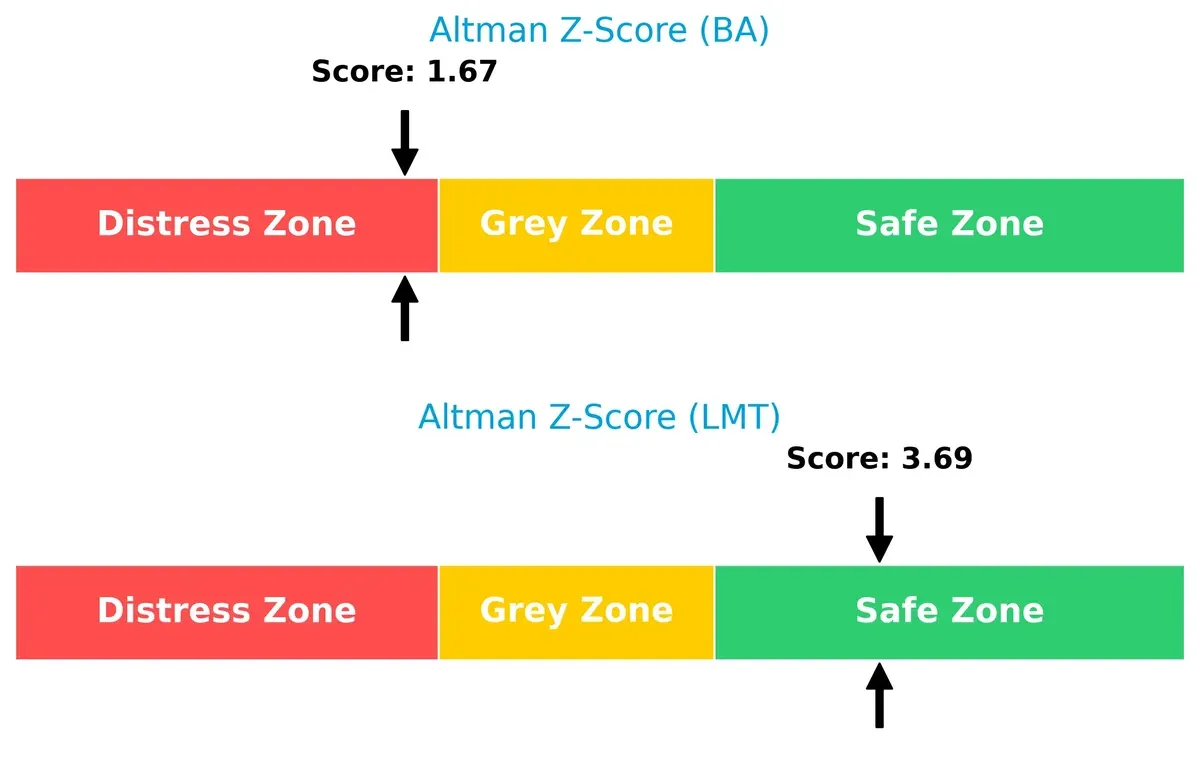

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score delta exposes a stark contrast in financial stability:

Lockheed Martin’s score of 3.7 places it securely in the safe zone, signaling robust solvency and lower bankruptcy risk. Boeing’s 1.7 score flags distress risk, warning investors of potential long-term survival challenges amid market volatility.

Financial Health: Quality of Operations

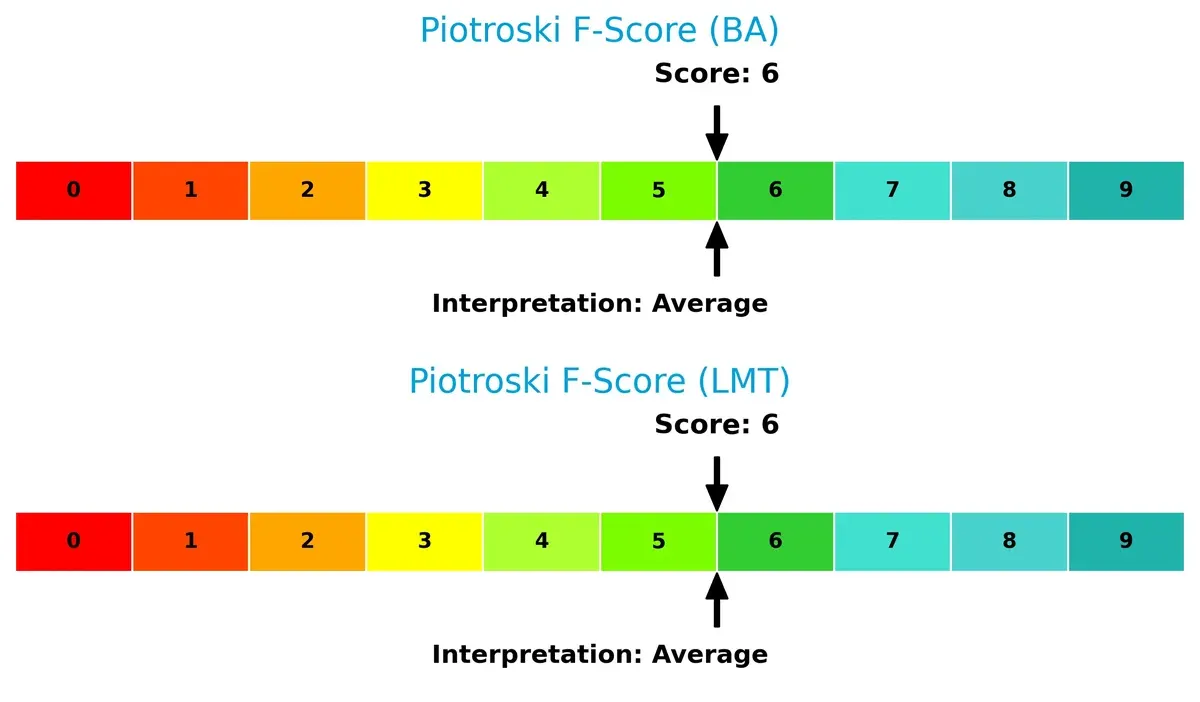

Both companies share identical Piotroski F-Scores, indicating comparable operational quality but with nuances to consider:

A score of 6 suggests average financial health for both firms. Neither shows severe red flags, yet neither achieves peak operational excellence. Investors should monitor internal metrics closely for deterioration, especially given Boeing’s solvency concerns.

How are the two companies positioned?

This section dissects the operational DNA of Boeing and Lockheed Martin by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which business model offers the most resilient competitive advantage today.

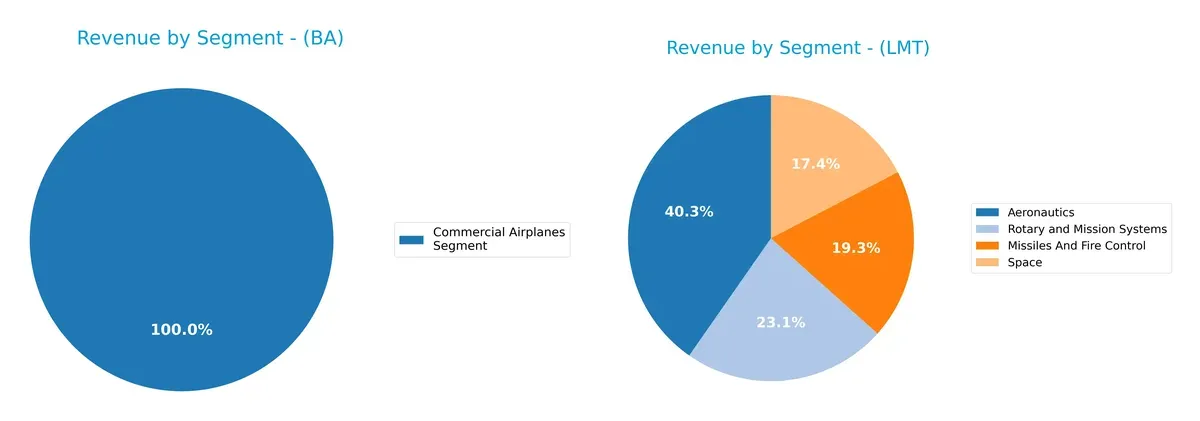

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how The Boeing Company and Lockheed Martin diversify their income streams and where their primary sector bets lie:

Boeing leans heavily on its Commercial Airplanes segment with $41.5B in 2025, supplemented by Defense and Global Services. Lockheed Martin splits revenue more evenly across Aeronautics ($30.3B), Rotary and Mission Systems ($17.3B), Missiles and Fire Control ($14.5B), and Space ($13B). Boeing’s concentration poses higher sector risk, while Lockheed’s balanced mix signals infrastructure dominance and resilience.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Boeing and Lockheed Martin based on diversification, profitability, financial health, innovation, global reach, and market share:

Boeing Strengths

- Diversified revenue across Commercial Airplanes, Defense, and Global Services

- Strong global presence with significant US and Asia revenues

- Favorable ROE and fixed asset turnover indicating efficient asset use

Lockheed Martin Strengths

- Well-diversified segments including Aeronautics, Missiles, Rotary, and Space

- High profitability with favorable ROE, ROIC, and WACC

- Strong financial health with low debt levels and high interest coverage

Boeing Weaknesses

- Negative ROIC and unfavorable net margin suggest operational inefficiencies

- High debt-to-equity and low quick ratio indicate liquidity concerns

- Very high P/E and P/B ratios may reflect overvaluation risk

Lockheed Martin Weaknesses

- Unfavorable P/B ratio signals potential valuation concerns

- Moderate net margin with neutral P/E ratio

- Slightly lower current ratio compared to Boeing, indicating tighter short-term liquidity

Boeing shows strengths in diversified operations and asset efficiency but faces financial and profitability challenges. Lockheed Martin demonstrates robust profitability and balance sheet strength but has valuation and liquidity nuances. These contrasting profiles suggest differing strategic priorities in risk management and growth focus.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat protects long-term profits from relentless competition and market shifts. I focus on the critical competitive edges that shield these firms:

The Boeing Company: Intangible Assets and Scale Powerhouse

Boeing’s moat stems from its vast aerospace scale and deep intangible assets like brand and government contracts. Despite a troubling ROIC trend, surging revenue and profit growth in 2025 hint at recovery. New commercial and defense programs could either reinforce or strain this fragile moat in 2026.

Lockheed Martin Corporation: Precision Defense Tech Leader

Lockheed Martin’s moat lies in its advanced defense technologies and steady government partnerships, delivering a healthy ROIC above WACC. Unlike Boeing, it has a more stable margin profile, though recent profitability declines warn of rising challenges. Expansion into cyber and space tech may offer fresh moat bolstering opportunities.

Moat Strength: Brand Legacy vs. Tech Innovation

Lockheed Martin holds the deeper moat with consistent value creation despite slight ROIC erosion. Boeing’s massive scale and intangible assets face a steeper challenge, undermining its competitive edge. Thus, Lockheed is better positioned to defend and grow its market share amid evolving aerospace and defense dynamics.

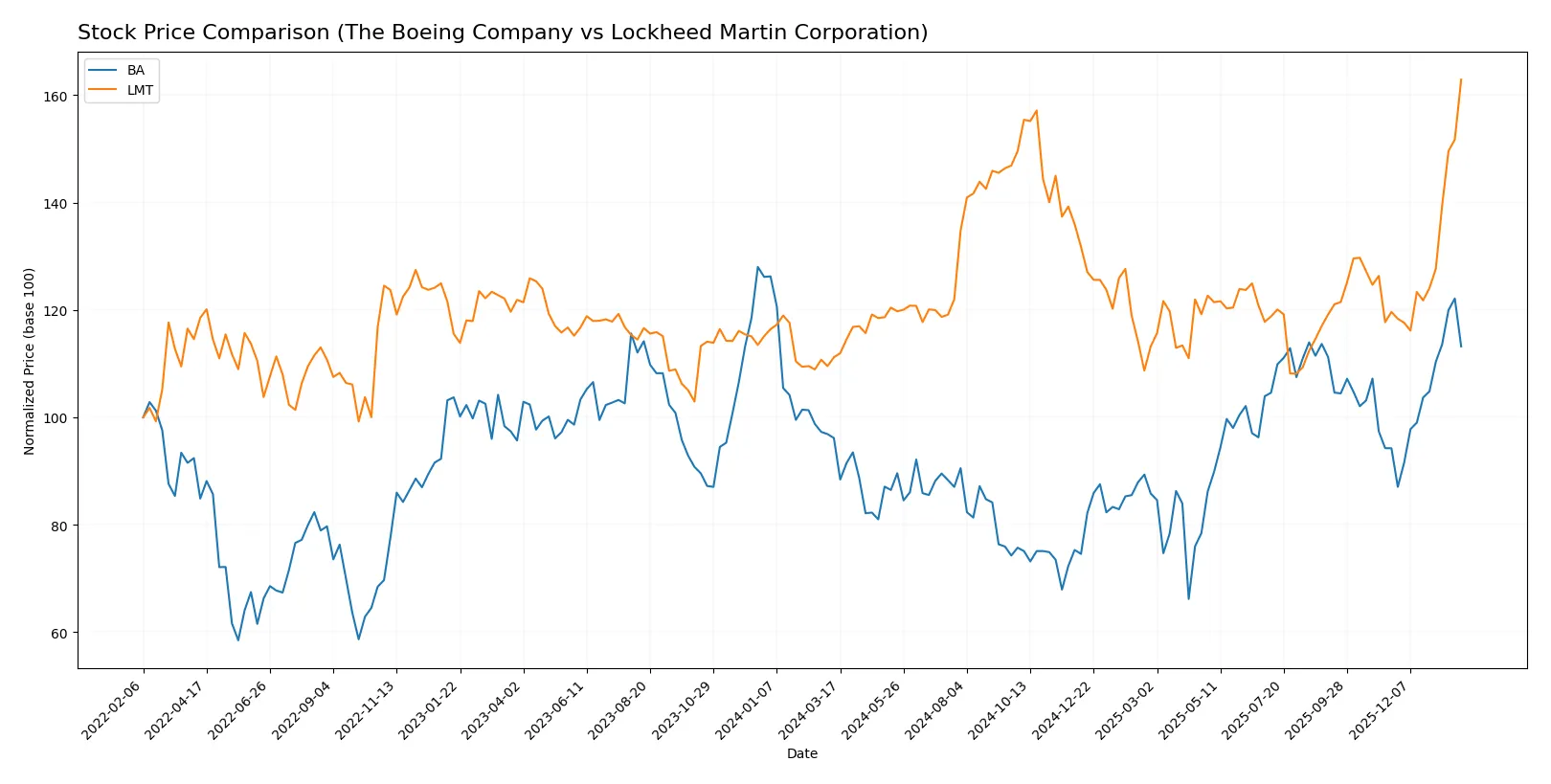

Which stock offers better returns?

Over the past 12 months, both The Boeing Company and Lockheed Martin Corporation showed strong upward price trends, with accelerating gains and notable price ranges defining their trading dynamics.

Trend Comparison

The Boeing Company’s stock rose 17.75% over the past year, showing a bullish trend with accelerating momentum and a high volatility level (std. dev. 26.41). Its price ranged from 136.59 to 252.15.

Lockheed Martin Corporation outperformed with a 46.5% gain, also bullish and accelerating. Its volatility was higher (std. dev. 47.89), with prices swinging between 421.01 and 634.22.

Lockheed Martin delivered the highest market performance, outperforming Boeing by nearly 29 percentage points in total return over the last year.

Target Prices

Analysts present a bullish consensus for both Boeing and Lockheed Martin, reflecting confidence in aerospace and defense sector growth.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| The Boeing Company | 150 | 298 | 256.73 |

| Lockheed Martin Corporation | 519 | 695 | 598.7 |

The target consensus for Boeing sits about 10% above its current price of 234, suggesting upside potential. Lockheed Martin’s consensus target is slightly below its current 634 price, indicating a more cautious outlook from analysts.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The Boeing Company Grades

The table below summarizes recent grades from major financial institutions for Boeing:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-28 |

| UBS | Maintain | Buy | 2026-01-28 |

| RBC Capital | Maintain | Outperform | 2026-01-28 |

| JP Morgan | Maintain | Overweight | 2026-01-28 |

| Bernstein | Maintain | Outperform | 2026-01-15 |

| Citigroup | Maintain | Buy | 2026-01-13 |

| JP Morgan | Maintain | Overweight | 2025-12-19 |

| Susquehanna | Maintain | Positive | 2025-11-12 |

| Freedom Capital Markets | Upgrade | Buy | 2025-11-03 |

| JP Morgan | Maintain | Overweight | 2025-10-30 |

Lockheed Martin Corporation Grades

Below is the summary of recent grades from notable financial firms for Lockheed Martin:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2026-01-30 |

| TD Cowen | Maintain | Hold | 2026-01-30 |

| UBS | Maintain | Neutral | 2026-01-15 |

| Citigroup | Maintain | Neutral | 2026-01-13 |

| Jefferies | Maintain | Hold | 2026-01-12 |

| Truist Securities | Upgrade | Buy | 2026-01-09 |

| JP Morgan | Downgrade | Neutral | 2025-12-19 |

| Morgan Stanley | Downgrade | Equal Weight | 2025-12-16 |

| UBS | Maintain | Neutral | 2025-10-22 |

| Bernstein | Maintain | Market Perform | 2025-10-20 |

Which company has the best grades?

Boeing consistently receives stronger grades, including multiple “Buy” and “Outperform” ratings. Lockheed Martin mostly holds “Hold” or “Neutral” grades with some recent downgrades. This suggests Boeing is viewed more favorably by analysts, potentially influencing investor confidence and valuation.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

The Boeing Company

- Faces intense competition in commercial airplanes and military sectors; struggles with a high P/E of 74 and weak net margin of 2.5%.

Lockheed Martin Corporation

- Dominates defense with strong margins (net margin 6.68%) and lower valuation (P/E 22.26), but faces sector-specific competitive pressures.

2. Capital Structure & Debt

The Boeing Company

- High debt-to-equity ratio (~9.92) and weak interest coverage (1.95) signal financial strain.

Lockheed Martin Corporation

- Maintains very low debt-to-equity (0.17) and strong interest coverage (6.3), indicating robust balance sheet.

3. Stock Volatility

The Boeing Company

- Beta of 1.16 suggests above-market volatility, increasing investment risk.

Lockheed Martin Corporation

- Beta at 0.25 indicates lower volatility, offering more stable returns amid market fluctuations.

4. Regulatory & Legal

The Boeing Company

- Subject to intense FAA scrutiny and regulatory risk in commercial aviation.

Lockheed Martin Corporation

- Faces defense contracting regulations and export controls but benefits from stable government contracts.

5. Supply Chain & Operations

The Boeing Company

- Complex global supply chains impact production; quick ratio 0.49 flags liquidity risk in operations.

Lockheed Martin Corporation

- More integrated supply operations with neutral quick ratio (0.94) support operational resilience.

6. ESG & Climate Transition

The Boeing Company

- Pressure to reduce emissions in commercial aviation; ESG risks may affect brand and regulations.

Lockheed Martin Corporation

- Defense-focused ESG challenges exist but less exposed to climate transition risks than Boeing.

7. Geopolitical Exposure

The Boeing Company

- Global commercial exposure subjects it to international trade tensions and geopolitical instability.

Lockheed Martin Corporation

- Primarily U.S. government-focused, with some foreign military sales, reducing broad geopolitical risk.

Which company shows a better risk-adjusted profile?

Lockheed Martin’s dominant position in defense, superior financial stability, and lower volatility deliver a stronger risk-adjusted profile. Boeing’s heavy leverage, regulatory scrutiny, and higher market risk create significant vulnerabilities. The critical risk for Boeing is its capital structure and liquidity strain; for Lockheed Martin, regulatory dependency on government contracts is key. Lockheed’s Altman Z-Score in the safe zone (3.69) versus Boeing’s distress zone (1.67) confirms my concern about Boeing’s financial fragility.

Final Verdict: Which stock to choose?

The Boeing Company’s superpower lies in its capacity for rapid revenue and earnings growth, signaling a potential turnaround momentum. However, its declining ROIC and stretched balance sheet remain points of vigilance. It suits aggressive growth portfolios willing to tolerate operational volatility for future upside.

Lockheed Martin commands a strategic moat through efficient capital allocation and strong returns well above its cost of capital. Its robust free cash flow and safer financial profile offer steadier performance relative to Boeing. This aligns with GARP investors seeking growth tempered by reasonable risk.

If you prioritize high-growth potential and can stomach short-term financial risks, Boeing presents an intriguing scenario based on its rebound in income metrics. However, if you seek sustainable value creation and stronger financial stability, Lockheed Martin outshines, offering superior capital efficiency and a proven moat. Both carry distinct risks requiring careful portfolio fit.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Boeing Company and Lockheed Martin Corporation to enhance your investment decisions: