The semiconductor industry remains a cornerstone of modern technology, driving innovation across multiple sectors. Taiwan Semiconductor Manufacturing Company Limited (TSM) and Lattice Semiconductor Corporation (LSCC) are two key players with overlapping markets but distinct approaches—TSM focuses on large-scale wafer fabrication, while LSCC specializes in programmable logic devices. This article will dissect their strengths and risks to help you decide which stock fits best in your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Taiwan Semiconductor Manufacturing Company Limited and Lattice Semiconductor Corporation by providing an overview of these two companies and their main differences.

Taiwan Semiconductor Manufacturing Company Limited Overview

Taiwan Semiconductor Manufacturing Company Limited (TSM) is a leading semiconductor manufacturer headquartered in Hsinchu City, Taiwan. The company specializes in wafer fabrication processes and produces integrated circuits used in high-performance computing, smartphones, IoT, automotive, and digital consumer electronics. Established in 1987, TSM offers a broad array of semiconductor solutions and engineering support worldwide.

Lattice Semiconductor Corporation Overview

Lattice Semiconductor Corporation (LSCC), based in Hillsboro, Oregon, develops and sells semiconductor products, including field programmable gate arrays and video connectivity application-specific standard products. Founded in 1983, LSCC primarily serves original equipment manufacturers in communications, computing, consumer, industrial, and automotive markets, distributing products through direct sales and independent channels across Asia, Europe, and the Americas.

Key similarities and differences

Both TSM and LSCC operate within the semiconductor industry and serve global markets. TSM focuses on wafer fabrication and integrated circuit manufacturing with a broad product range, while LSCC specializes in programmable gate arrays and IP licensing. TSM is significantly larger, with over 65K employees and a market cap exceeding 1.6T USD, compared to LSCC’s approximately 1.1K employees and a market cap of 11.7B USD, highlighting their different scales and business models.

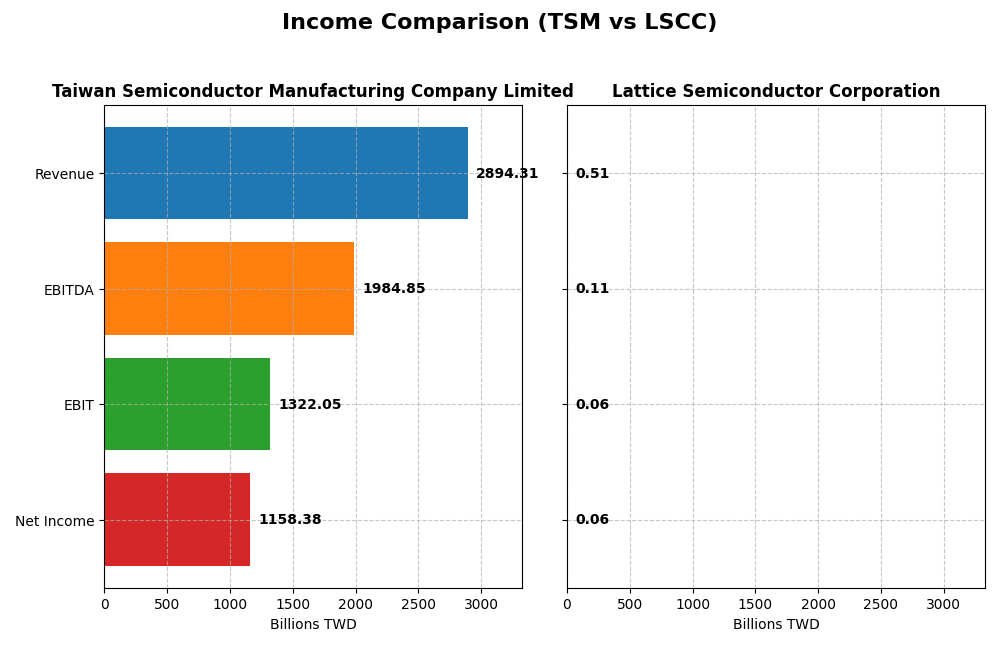

Income Statement Comparison

The table below compares key income statement metrics for Taiwan Semiconductor Manufacturing Company Limited (TSM) and Lattice Semiconductor Corporation (LSCC) for the fiscal year 2024.

| Metric | Taiwan Semiconductor Manufacturing Company Limited (TSM) | Lattice Semiconductor Corporation (LSCC) |

|---|---|---|

| Market Cap | 1.7T TWD | 11.7B USD |

| Revenue | 2.89T TWD | 509M USD |

| EBITDA | 1.98T TWD | 107M USD |

| EBIT | 1.32T TWD | 61M USD |

| Net Income | 1.16T TWD | 61M USD |

| EPS | 223.4 TWD | 0.44 USD |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Taiwan Semiconductor Manufacturing Company Limited

From 2020 to 2024, Taiwan Semiconductor exhibited robust revenue growth of 116.11%, reaching TWD 2.89T in 2024, with net income surging 126.8% to TWD 1.16T. Margins remained strong and stable, with gross margin at 56.12% and net margin at 40.02%. The latest year showed favorable revenue and profit growth with a slight net margin improvement.

Lattice Semiconductor Corporation

Lattice Semiconductor’s revenue increased 24.82% over the 2020–2024 period, hitting USD 509M in 2024, while net income rose 28.99% to USD 61M. Margins were favorable, notably a gross margin of 66.82%, but net margin stood at 12%. However, 2024 saw a marked decline in revenue and earnings, including a significant contraction in net margin and EPS.

Which one has the stronger fundamentals?

Taiwan Semiconductor demonstrates stronger fundamentals, with consistent and substantial growth in revenue and net income, alongside high and stable margins. Lattice Semiconductor, despite favorable margins overall, experienced a pronounced decline in its most recent year’s financial performance, reflecting higher volatility and risk in its income statement trends.

Financial Ratios Comparison

The table below presents the key financial ratios for Taiwan Semiconductor Manufacturing Company Limited (TSM) and Lattice Semiconductor Corporation (LSCC) based on their most recent fiscal year data (2024).

| Ratios | Taiwan Semiconductor Manufacturing Company Limited (TSM) | Lattice Semiconductor Corporation (LSCC) |

|---|---|---|

| ROE | 27.29% | 8.60% |

| ROIC | 20.00% | 4.59% |

| P/E | 29.04 | 132.74 |

| P/B | 7.92 | 11.41 |

| Current Ratio | 2.36 | 3.66 |

| Quick Ratio | 2.14 | 2.62 |

| D/E (Debt-to-Equity) | 0.25 | 0.02 |

| Debt-to-Assets | 15.65% | 1.81% |

| Interest Coverage | 126.0 | 129.5 |

| Asset Turnover | 0.43 | 0.60 |

| Fixed Asset Turnover | 0.88 | 7.62 |

| Payout Ratio | 31.34% | 0.00% |

| Dividend Yield | 1.08% | 0.00% |

Interpretation of the Ratios

Taiwan Semiconductor Manufacturing Company Limited

Taiwan Semiconductor Manufacturing Company Limited shows strong profitability with a net margin of 40.02% and a return on equity (ROE) of 27.29%, both favorable. Its financial health is solid with a current ratio of 2.36 and low debt-to-assets at 15.65%. However, valuation ratios like P/E (29.04) and P/B (7.92) appear high. The company pays dividends with a 1.08% yield, indicating moderate shareholder returns.

Lattice Semiconductor Corporation

Lattice Semiconductor Corporation exhibits mixed ratio performance. While net margin at 12% and interest coverage at 228.11 are favorable, ROE at 8.6% and ROIC at 4.59% are weak. The company has very low debt (D/E 0.02), but a high P/E of 132.74 and no dividend payout, reflecting a reinvestment strategy typical for growth-focused firms prioritizing R&D. Quick ratio is strong at 2.62, but current ratio is assessed unfavorably.

Which one has the best ratios?

Taiwan Semiconductor Manufacturing Company Limited demonstrates a more favorable overall ratio profile, with superior profitability, balance sheet strength, and dividend returns. Lattice Semiconductor Corporation has strengths in liquidity and interest coverage but faces challenges in profitability and valuation, resulting in a slightly unfavorable ratio outlook compared to its peer.

Strategic Positioning

This section compares the strategic positioning of TSM and LSCC, focusing on Market position, Key segments, and exposure to disruption:

TSM

- Market leader with a large market cap of 1.7T USD, facing typical semiconductor pressures

- Focuses on wafer fabrication for diverse applications: computing, smartphones, automotive

- Invests in technology start-ups, supporting innovation; established manufacturing scale

LSCC

- Smaller player with 11.7B USD market cap, competing in niche FPGA and IP licensing markets

- Specializes in field programmable gate arrays and video connectivity products

- Licenses IP and patents, dependent on tech licensing revenue; moderate disruption risk

TSM vs LSCC Positioning

TSM adopts a diversified, large-scale manufacturing approach with broad market exposure, while LSCC concentrates on FPGA and IP licensing niches. TSM benefits from scale, but LSCC’s focus targets specialized segments with licensing revenue dependence.

Which has the best competitive advantage?

TSM holds a slightly favorable moat with value creation despite declining profitability, whereas LSCC’s moat is very unfavorable, shedding value with declining returns, indicating TSM currently has the stronger competitive advantage.

Stock Comparison

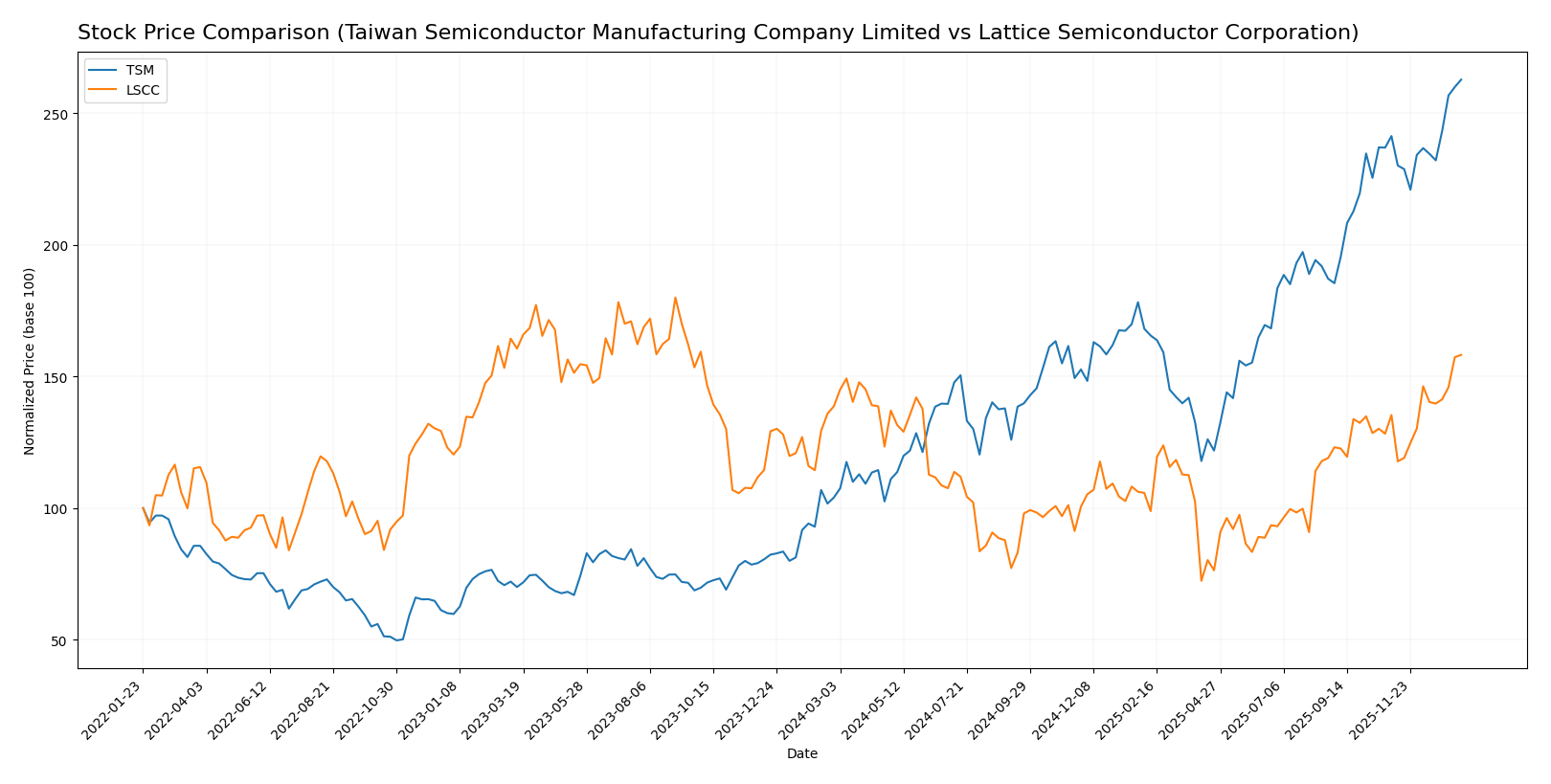

The past year revealed significant price appreciation for Taiwan Semiconductor Manufacturing Company Limited (TSM) and moderate gains for Lattice Semiconductor Corporation (LSCC), with both stocks showing bullish momentum and distinct trading volume dynamics.

Trend Analysis

Taiwan Semiconductor Manufacturing Company Limited (TSM) exhibited a strong bullish trend over the past 12 months, with a 152.54% price increase and accelerating momentum from a low of 127.7 to a high of 327.11, supported by notable volatility (std deviation 51.25).

Lattice Semiconductor Corporation (LSCC) also followed a bullish trajectory, gaining 14.09% over 12 months with acceleration, reaching a high of 85.28 and showing lower volatility (std deviation 11.01), supported by a recent 16.89% gain.

Comparing both stocks, TSM delivered substantially higher market performance over the past year, outperforming LSCC by a wide margin in price appreciation despite LSCC’s recent stronger buyer dominance in volume.

Target Prices

The current analyst consensus indicates a positive outlook for these semiconductor companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Taiwan Semiconductor Manufacturing Company Limited | 400 | 330 | 361.25 |

| Lattice Semiconductor Corporation | 105 | 65 | 83 |

Analysts expect Taiwan Semiconductor’s price to rise above the current 327.11 USD, signaling potential growth, while Lattice Semiconductor’s consensus is slightly below its current 85.28 USD price, suggesting a cautious stance.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Taiwan Semiconductor Manufacturing Company Limited (TSM) and Lattice Semiconductor Corporation (LSCC):

Rating Comparison

TSM Rating

- Rating: A-, indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: 5, very favorable, suggesting undervaluation.

- ROE Score: 5, very favorable, reflecting efficient profit generation.

- ROA Score: 5, very favorable, signifying strong asset utilization.

- Debt To Equity Score: 3, moderate, implying balanced financial risk.

- Overall Score: 4, favorable, demonstrating strong overall financial health.

LSCC Rating

- Rating: B-, showing a moderate overall evaluation.

- Discounted Cash Flow Score: 3, moderate, indicating average valuation.

- ROE Score: 2, moderate, showing less efficient equity utilization.

- ROA Score: 3, moderate, indicating average asset efficiency.

- Debt To Equity Score: 4, favorable, indicating lower financial risk.

- Overall Score: 2, moderate, suggesting weaker overall financial standing.

Which one is the best rated?

Based strictly on the provided data, TSM is better rated than LSCC, with higher scores in discounted cash flow, ROE, ROA, and overall financial health. LSCC has a slightly better debt-to-equity score but lower overall ratings.

Scores Comparison

Here is a comparison of the Altman Z-Score and the Piotroski Score for both companies:

TSM Scores

- Altman Z-Score: 2.94, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 8, indicating very strong financial health.

LSCC Scores

- Altman Z-Score: 52.69, in the safe zone indicating very low bankruptcy risk.

- Piotroski Score: 5, indicating average financial health.

Which company has the best scores?

LSCC has a substantially higher Altman Z-Score, placing it in the safe zone, while TSM has a higher Piotroski Score indicating stronger financial health. Each leads in a different score category based on the provided data.

Grades Comparison

The following presents a comparison of the most recent reliable grades for Taiwan Semiconductor Manufacturing Company Limited and Lattice Semiconductor Corporation:

Taiwan Semiconductor Manufacturing Company Limited Grades

This table summarizes recent analyst grades from reputable firms for TSM:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | Maintain | Outperform | 2025-12-08 |

| Needham | Maintain | Buy | 2025-10-27 |

| Barclays | Maintain | Overweight | 2025-10-17 |

| Needham | Maintain | Buy | 2025-10-16 |

| Susquehanna | Maintain | Positive | 2025-10-10 |

| Barclays | Maintain | Overweight | 2025-10-09 |

| Barclays | Maintain | Overweight | 2025-09-16 |

| Needham | Maintain | Buy | 2025-07-17 |

| Susquehanna | Maintain | Positive | 2025-07-14 |

| Needham | Maintain | Buy | 2025-07-01 |

Overall, TSM’s grades consistently reflect a positive outlook, with actions predominantly maintaining Buy or Outperform ratings, indicating stable analyst confidence.

Lattice Semiconductor Corporation Grades

This table shows recent analyst grades from verified sources for LSCC:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-13 |

| Stifel | Maintain | Buy | 2025-11-04 |

| Baird | Maintain | Outperform | 2025-11-04 |

| Needham | Maintain | Buy | 2025-11-04 |

| Rosenblatt | Maintain | Buy | 2025-11-04 |

| Benchmark | Maintain | Buy | 2025-11-04 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Keybanc | Maintain | Overweight | 2025-09-30 |

| Needham | Maintain | Buy | 2025-09-22 |

| Benchmark | Maintain | Buy | 2025-09-11 |

LSCC shows a strong pattern of Buy and Outperform ratings with consistent maintenance actions, reflecting sustained positive sentiment from analysts.

Which company has the best grades?

Both TSM and LSCC have received predominantly Buy and Outperform grades from multiple reputable analysts, with neither showing strong buy or sell extremes. However, TSM has a slightly higher number of Buy recommendations and a broader range of grading firms, potentially indicating marginally stronger market analyst confidence. Investors might consider these patterns when assessing the perceived risk and growth potential embedded in each stock’s analyst ratings.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Taiwan Semiconductor Manufacturing Company Limited (TSM) and Lattice Semiconductor Corporation (LSCC) based on their recent financial and operational data.

| Criterion | Taiwan Semiconductor Manufacturing Company Limited (TSM) | Lattice Semiconductor Corporation (LSCC) |

|---|---|---|

| Diversification | High revenue from wafers and other products; broad product portfolio | Limited diversification, mainly license and service revenue |

| Profitability | Strong profitability with 40.02% net margin, ROIC 20.0%, creating value despite declining trend | Lower profitability, 12.0% net margin, ROIC 4.59%, value destroying with declining ROIC |

| Innovation | Leading semiconductor manufacturing technology, sustained global demand | Focus on niche markets with specialized products but limited scale |

| Global presence | Extensive global footprint as a leading semiconductor foundry | Smaller scale, more regional focus |

| Market Share | Dominant market leader in semiconductor foundry segment | Smaller market share in the semiconductor industry |

Key takeaways: TSM demonstrates strong profitability, global presence, and diversification but faces a declining ROIC trend. LSCC struggles with profitability and value creation, has limited diversification, though it maintains a niche market position. Investors should weigh TSM’s industry leadership and stable financials against LSCC’s higher risk profile.

Risk Analysis

Below is a table summarizing key risks associated with Taiwan Semiconductor Manufacturing Company Limited (TSM) and Lattice Semiconductor Corporation (LSCC) as of 2026.

| Metric | Taiwan Semiconductor Manufacturing Company Limited (TSM) | Lattice Semiconductor Corporation (LSCC) |

|---|---|---|

| Market Risk | Moderate, beta 1.27 indicates sensitivity to market swings | Higher, beta 1.72 suggests greater volatility |

| Debt level | Low, debt-to-equity 0.25 and debt-to-assets 15.65% favorable | Very low, debt-to-equity 0.02 and debt-to-assets 1.81% favorable |

| Regulatory Risk | Elevated due to geopolitical tensions involving Taiwan and China | Moderate, subject to US regulations and trade policies |

| Operational Risk | Moderate, large global operations with some asset turnover inefficiencies | Moderate, smaller scale but reliant on specialized products |

| Environmental Risk | Moderate, manufacturing processes involve hazardous materials | Lower, smaller footprint and less resource-intensive |

| Geopolitical Risk | High, Taiwan-China relations pose significant risk | Moderate, US-based with exposure to global markets |

The most impactful risk for TSM remains geopolitical, given ongoing tensions between Taiwan and China, which could disrupt supply chains. LSCC faces higher market volatility and regulatory uncertainties but benefits from low debt and a safe financial position. Both companies require careful monitoring of global trade conditions and technological shifts.

Which Stock to Choose?

Taiwan Semiconductor Manufacturing Company Limited (TSM) shows a favorable income evolution with strong revenue and net income growth over 2020-2024. Its profitability ratios are mostly favorable, debt levels are well-managed, and it holds a very favorable A- rating, supported by robust financial health scores.

Lattice Semiconductor Corporation (LSCC) displays mixed income results with recent unfavorable revenue and net margin declines despite favorable gross margins. Its profitability and financial ratios are less consistent, debt is low, but the overall B- rating is moderate, reflecting challenges in sustaining value creation.

For investors prioritizing strong financial stability and consistent profitability, TSM’s favorable rating and income growth might appear more suitable. Conversely, those with tolerance for volatility and focus on potential growth could see LSCC’s recent price acceleration and lower debt as opportunities, though its value creation profile is less robust.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Taiwan Semiconductor Manufacturing Company Limited and Lattice Semiconductor Corporation to enhance your investment decisions: