Lattice Semiconductor Corporation (LSCC) and SkyWater Technology, Inc. (SKYT) are two notable players in the semiconductor industry, each carving out a unique niche through innovation and market focus. LSCC specializes in programmable logic devices, while SKYT excels in semiconductor manufacturing services, serving overlapping sectors like automotive and industrial tech. This analysis will help you decide which company offers the most compelling investment opportunity in the evolving tech landscape.

Table of contents

Companies Overview

I will begin the comparison between Lattice Semiconductor Corporation and SkyWater Technology, Inc. by providing an overview of these two companies and their main differences.

Lattice Semiconductor Corporation Overview

Lattice Semiconductor Corporation develops and sells semiconductor products globally, focusing on field programmable gate arrays and video connectivity application-specific standard products. Founded in 1983 and headquartered in Hillsboro, Oregon, LSCC primarily serves original equipment manufacturers across communications, computing, consumer, industrial, and automotive sectors. The company also licenses its technology portfolio through IP services and patent monetization.

SkyWater Technology, Inc. Overview

SkyWater Technology, Inc. offers semiconductor development and manufacturing services, including engineering and process development support. Founded in 2017 and based in Bloomington, Minnesota, SKYT serves diverse industries such as computation, aerospace and defense, automotive, bio-health, consumer, and industrial IoT. The company specializes in silicon-based analog and mixed-signal, power discrete, microelectromechanical systems, and radiation-hardened integrated circuits.

Key similarities and differences

Both LSCC and SKYT operate in the semiconductor industry and serve multiple end markets including consumer and industrial sectors. LSCC focuses on product development and licensing of programmable logic devices, whereas SKYT emphasizes semiconductor manufacturing and process co-development services. LSCC is a more established company with a larger market cap and employee base, while SKYT is a younger firm with higher beta, indicating greater stock volatility.

Income Statement Comparison

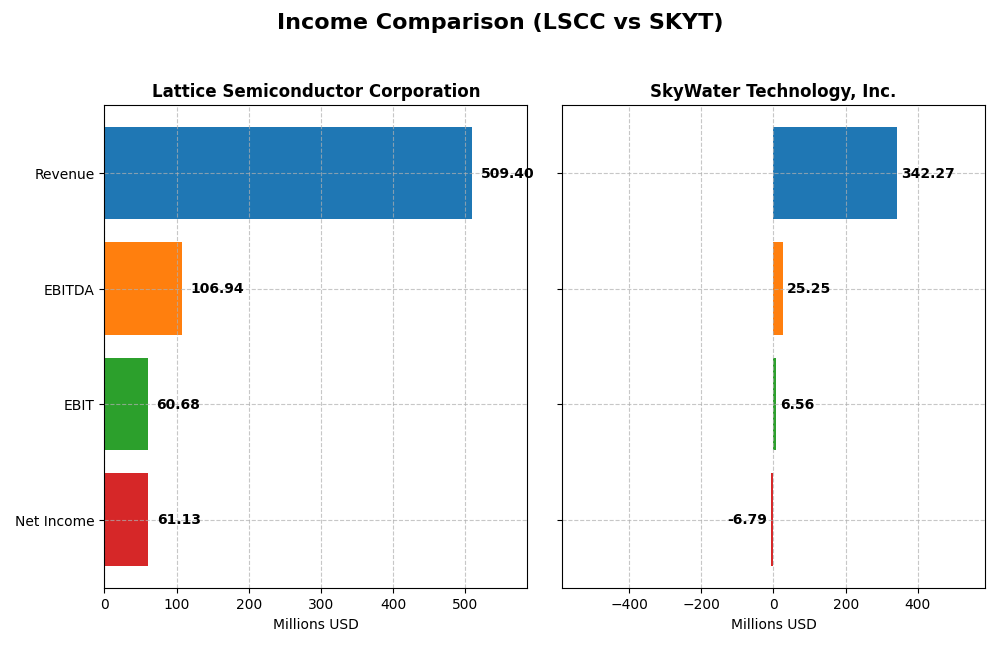

This table presents a factual comparison of key income statement metrics for Lattice Semiconductor Corporation and SkyWater Technology, Inc. based on their most recent fiscal year data.

| Metric | Lattice Semiconductor Corporation | SkyWater Technology, Inc. |

|---|---|---|

| Market Cap | 11.7B | 1.54B |

| Revenue | 509M | 342M |

| EBITDA | 107M | 25.3M |

| EBIT | 61M | 6.56M |

| Net Income | 61.1M | -6.79M |

| EPS | 0.44 | -0.14 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Lattice Semiconductor Corporation

Lattice Semiconductor showed overall revenue growth of 24.82% and net income growth of 28.99% from 2020 to 2024. Margins remained stable with a favorable gross margin of 66.82% and net margin at 12%. However, in 2024, revenue declined by 30.9% and net income dropped sharply, indicating a slowdown despite generally solid profitability metrics.

SkyWater Technology, Inc.

SkyWater Technology experienced strong revenue growth of 143.72% and net income growth of 67.05% over the 2020-2024 period. Gross margin improved to 20.34% and net margin, though negative, showed favorable growth. The 2024 fiscal year featured a 19.39% revenue increase and a notable reduction in net loss, signaling enhanced operational efficiency and positive momentum.

Which one has the stronger fundamentals?

Evaluating fundamentals, Lattice offers higher absolute margins and consistent profitability despite recent setbacks, while SkyWater shows rapid growth but remains unprofitable overall. Lattice’s stable margins contrast with SkyWater’s improving but still negative net margin. Both have favorable outlooks, yet Lattice demonstrates stronger margin control, whereas SkyWater excels in growth dynamics.

Financial Ratios Comparison

The table below presents the most recent financial ratios for Lattice Semiconductor Corporation (LSCC) and SkyWater Technology, Inc. (SKYT) based on their 2024 fiscal year data, providing an overview of key performance and financial health indicators.

| Ratios | Lattice Semiconductor Corporation (LSCC) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| ROE | 8.60% | -11.79% |

| ROIC | 4.59% | 3.40% |

| P/E | 133x | -100x |

| P/B | 11.41x | 11.82x |

| Current Ratio | 3.66 | 0.86 |

| Quick Ratio | 2.62 | 0.76 |

| D/E (Debt-to-Equity) | 0.02 | 1.33 |

| Debt-to-Assets | 1.81% | 24.46% |

| Interest Coverage | 130x | 0.74x |

| Asset Turnover | 0.60 | 1.09 |

| Fixed Asset Turnover | 7.62 | 2.07 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Lattice Semiconductor Corporation

Lattice Semiconductor shows mixed financial ratios, with net margin at a favorable 12.0% but return on equity (8.6%) and return on invested capital (4.59%) marked as unfavorable. The company maintains a low debt-to-equity ratio of 0.02 and strong interest coverage (228.11), yet a high price-to-earnings ratio (132.74) may concern valuation. It pays no dividend, likely focusing on reinvestment and growth.

SkyWater Technology, Inc.

SkyWater’s ratios are largely unfavorable, including negative net margin (-1.98%) and negative return on equity (-11.79%). Current and quick ratios below 1 suggest liquidity concerns. Despite a favorable price-to-earnings ratio due to negative earnings, its debt-to-equity ratio at 1.33 and weak interest coverage (0.74) indicate financial risk. No dividends are paid, reflecting reinvestment or growth priorities.

Which one has the best ratios?

Lattice Semiconductor has a more balanced ratio profile with 42.86% favorable ratios and strong liquidity, while SkyWater shows predominantly unfavorable ratios (71.43%) and weaker financial health. Lattice’s lower leverage and better profitability metrics position it more favorably in ratio comparisons, though some valuation and return metrics remain cautionary.

Strategic Positioning

This section compares the strategic positioning of Lattice Semiconductor Corporation and SkyWater Technology, Inc., focusing on market position, key segments, and exposure to disruption:

Lattice Semiconductor Corporation

- Large market cap of 11.7B with NASDAQ Global Select listing; faces typical semiconductor competitive pressure.

- Focus on semiconductor products including FPGA families and IP licensing, serving communications, computing, automotive sectors.

- Technology portfolio includes field programmable gate arrays and video connectivity products; no explicit note on disruption exposure.

SkyWater Technology, Inc.

- Smaller market cap of 1.5B, listed on NASDAQ Capital Market, with higher beta indicating greater volatility.

- Provides semiconductor development and manufacturing services for analog, mixed-signal, and rad-hard ICs across diverse industries.

- Engages in co-creation of technologies with customers, indicating active adaptation to technological change.

Lattice Semiconductor Corporation vs SkyWater Technology, Inc. Positioning

Lattice Semiconductor has a diversified product portfolio focused on FPGA and IP licensing, serving multiple end markets, while SkyWater concentrates on semiconductor manufacturing services with a focus on technology co-development. Lattice’s larger scale contrasts with SkyWater’s specialized service-driven approach.

Which has the best competitive advantage?

Both companies are currently shedding value, but Lattice Semiconductor’s declining ROIC indicates worsening profitability, whereas SkyWater shows growing ROIC despite value destruction, suggesting improving operational efficiency over time.

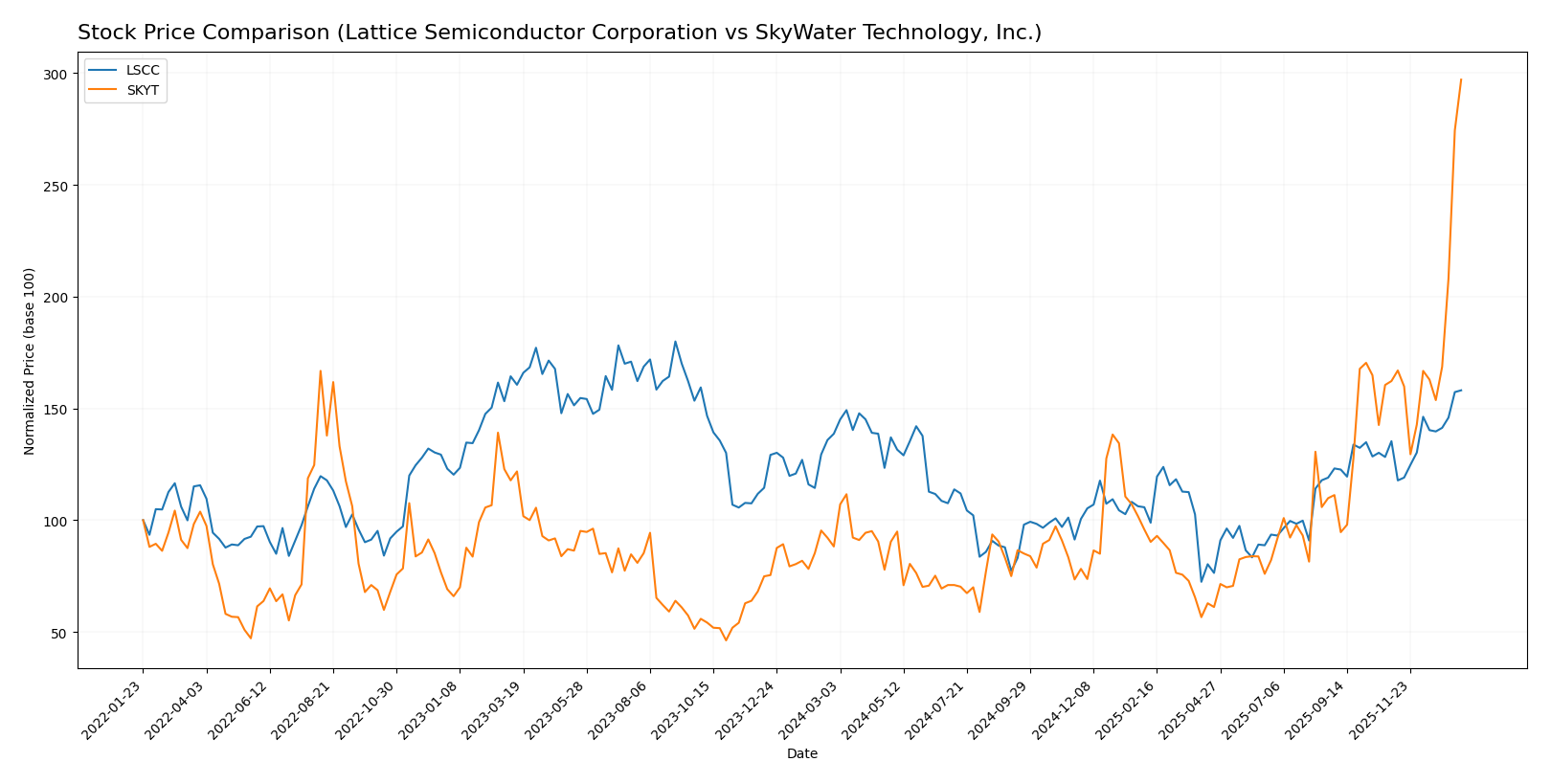

Stock Comparison

The stock price movements of Lattice Semiconductor Corporation (LSCC) and SkyWater Technology, Inc. (SKYT) over the past 12 months reveal significant bullish trends with notable acceleration phases in both cases.

Trend Analysis

Lattice Semiconductor Corporation (LSCC) exhibited a bullish trend over the past year with a 14.02% price increase, showing acceleration and a high price volatility of 11.01 std deviation, peaking at 85.23 and bottoming at 39.03.

SkyWater Technology, Inc. (SKYT) displayed a strong bullish trend with a 236.8% price increase over the same period, accompanied by acceleration and lower volatility at 4.41 std deviation, reaching a high of 32.03 and a low of 6.1.

Comparatively, SKYT outperformed LSCC with a substantially higher market performance, delivering a more significant price appreciation over the past year.

Target Prices

Analysts present a clear consensus on target prices for Lattice Semiconductor Corporation and SkyWater Technology, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Lattice Semiconductor Corporation | 105 | 65 | 83 |

| SkyWater Technology, Inc. | 25 | 25 | 25 |

For Lattice Semiconductor, the consensus target price of 83 slightly undercuts its current price around 85.23, suggesting moderate downside risk. SkyWater’s target consensus at 25 is well below its current price near 32.03, indicating a more cautious analyst outlook.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Lattice Semiconductor Corporation and SkyWater Technology, Inc.:

Rating Comparison

LSCC Rating

- Rating: B- with a very favorable status.

- Discounted Cash Flow Score: 3, considered moderate for valuation.

- ROE Score: 2, moderate efficiency in generating profit from equity.

- ROA Score: 3, moderate effectiveness in asset utilization.

- Debt To Equity Score: 4, favorable financial stability with low leverage.

- Overall Score: 2, moderate overall financial standing.

SKYT Rating

- Rating: B+ with a very favorable status.

- Discounted Cash Flow Score: 1, considered very unfavorable for valuation.

- ROE Score: 5, very favorable efficiency in generating profit from equity.

- ROA Score: 5, very favorable effectiveness in asset utilization.

- Debt To Equity Score: 1, very unfavorable financial stability, high leverage.

- Overall Score: 3, moderate overall financial standing but higher than LSCC.

Which one is the best rated?

Based on the provided data, SkyWater Technology holds a higher overall rating (B+) and scores better in ROE and ROA, while Lattice Semiconductor has stronger debt-to-equity metrics and a better discounted cash flow score. Overall, SkyWater is rated slightly better.

Scores Comparison

Here is a comparison of the financial scores for Lattice Semiconductor Corporation (LSCC) and SkyWater Technology, Inc. (SKYT):

LSCC Scores

- Altman Z-Score: 52.7, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 5, reflecting average financial strength and value.

SKYT Scores

- Altman Z-Score: 2.20, placing it in the grey zone with moderate bankruptcy risk.

- Piotroski Score: 5, indicating average financial strength and value.

Which company has the best scores?

LSCC shows a significantly higher Altman Z-Score, placing it firmly in a safe zone, while SKYT remains in a grey zone. Both companies have an identical Piotroski Score of 5, reflecting average financial health.

Grades Comparison

Here is a comparison of recent grades assigned by recognized grading companies for both Lattice Semiconductor Corporation and SkyWater Technology, Inc.:

Lattice Semiconductor Corporation Grades

The following table summarizes recent grades assigned by reputable firms to Lattice Semiconductor Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-13 |

| Stifel | Maintain | Buy | 2025-11-04 |

| Baird | Maintain | Outperform | 2025-11-04 |

| Needham | Maintain | Buy | 2025-11-04 |

| Rosenblatt | Maintain | Buy | 2025-11-04 |

| Benchmark | Maintain | Buy | 2025-11-04 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Keybanc | Maintain | Overweight | 2025-09-30 |

| Needham | Maintain | Buy | 2025-09-22 |

| Benchmark | Maintain | Buy | 2025-09-11 |

Overall, Lattice Semiconductor’s grades consistently indicate a positive outlook with multiple “Buy” and “Overweight” ratings maintained over recent months.

SkyWater Technology, Inc. Grades

The following table shows recent grades assigned by established grading companies to SkyWater Technology, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-08-07 |

| Needham | Maintain | Buy | 2025-05-08 |

| Needham | Maintain | Buy | 2025-02-27 |

| Needham | Maintain | Buy | 2024-11-11 |

| Piper Sandler | Maintain | Overweight | 2024-10-25 |

| Piper Sandler | Maintain | Overweight | 2024-08-08 |

| Needham | Maintain | Buy | 2024-05-09 |

SkyWater Technology’s grades also reflect a stable positive consensus with repeated “Buy” and “Overweight” ratings from several reputable firms.

Which company has the best grades?

Both Lattice Semiconductor Corporation and SkyWater Technology, Inc. have received predominantly “Buy” and “Overweight” grades from credible analysts, indicating favorable market sentiment. Lattice Semiconductor shows a slightly larger number of ratings and a broader range of grading companies, which could suggest wider analyst coverage. Investors might interpret these grades as positive signals, but the similar consensus implies comparable perceived potential in both companies.

Strengths and Weaknesses

Below is a comparison table summarizing the key strengths and weaknesses of Lattice Semiconductor Corporation (LSCC) and SkyWater Technology, Inc. (SKYT) based on their latest financial and operational data.

| Criterion | Lattice Semiconductor Corporation (LSCC) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Diversification | Moderate: Primarily product revenue from distributors and direct sales, some license and service revenue | Higher: Diverse revenue streams including advanced technology services (fixed price, time and materials) and wafer services |

| Profitability | Moderate profitability with a 12% net margin but unfavorable ROIC (4.59%) below WACC (11.86%) | Negative profitability: net margin -1.98%, ROIC (3.4%) well below WACC (19.8%) but showing improving trend |

| Innovation | Moderate: Stable product revenue but declining ROIC indicates challenges in capital efficiency | Developing: Growing ROIC trend suggests improving innovation and operational efficiency |

| Global presence | Established global distribution channels for semiconductor products | Growing global footprint through diverse service offerings and wafer manufacturing |

| Market Share | Strong in semiconductor distribution with significant product sales | Smaller market share but expanding in advanced technology service niche |

Key takeaways: LSCC has stable revenue streams and moderate profitability but faces challenges in capital efficiency and innovation, reflected by a declining ROIC. SKYT, while currently unprofitable, shows promise with a growing ROIC and diversified service offerings, suggesting potential for future value creation. Both companies require cautious consideration due to profitability concerns and market dynamics.

Risk Analysis

Below is a comparative overview of key risks faced by Lattice Semiconductor Corporation (LSCC) and SkyWater Technology, Inc. (SKYT) based on the latest assessments for 2024–2026.

| Metric | Lattice Semiconductor Corporation (LSCC) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Risk | Moderate (Beta 1.72; sensitive to tech sector fluctuations) | High (Beta 3.49; highly volatile, sensitive to market swings) |

| Debt level | Very Low (Debt-to-Equity 0.02; strong balance sheet) | High (Debt-to-Equity 1.33; elevated financial risk) |

| Regulatory Risk | Moderate (Global semiconductor regulations impact) | Moderate to High (Defense sector exposure increases scrutiny) |

| Operational Risk | Moderate (Reliance on suppliers and niche FPGA markets) | Moderate (Newer firm, scaling manufacturing capabilities) |

| Environmental Risk | Low (Standard industry environmental impact) | Low to Moderate (Manufacturing processes with potential environmental concerns) |

| Geopolitical Risk | Moderate (Global supply chain exposure) | Moderate to High (Aerospace/defense clients sensitive to geopolitical tensions) |

The most significant risks are SkyWater’s high market volatility and elevated debt, which could impact its financial stability, especially given its grey zone Altman Z-score indicating moderate bankruptcy risk. Lattice Semiconductor shows a safer financial profile but faces moderate sector cyclicality and regulatory risks. Investors should weigh SkyWater’s growth potential against its higher financial and geopolitical risks.

Which Stock to Choose?

Lattice Semiconductor Corporation (LSCC) shows a favorable income statement with strong gross and net margins but faces a recent decline in revenue and profitability growth. Its financial ratios are slightly unfavorable overall, though it maintains low debt and robust interest coverage, supported by a very favorable B- rating and a safe-zone Altman Z-score. However, its economic moat evaluation indicates value destruction with declining ROIC.

SkyWater Technology, Inc. (SKYT) presents a favorable income trend marked by strong revenue and net margin growth, despite a current negative net margin. Its financial ratios are largely unfavorable, with high debt and weak liquidity, but the company holds a very favorable B+ rating and an average Piotroski score. Its economic moat is slightly unfavorable due to value destruction, though ROIC is improving.

Investors prioritizing stability and financial strength might find LSCC’s solid rating and safer financial position more suitable, while those focused on growth potential might interpret SKYT’s accelerating income growth and rising ROIC as promising despite its financial risks. Both companies carry risks reflected in their value destruction status, suggesting caution and the need for a profile-aligned approach.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Lattice Semiconductor Corporation and SkyWater Technology, Inc. to enhance your investment decisions: