In the fast-evolving semiconductor industry, Lattice Semiconductor Corporation (LSCC) and Onto Innovation Inc. (ONTO) stand out as key players driving technological progress. Both companies operate in overlapping markets but focus on distinct innovation strategies—LSCC on programmable chips and IP licensing, ONTO on advanced process control and metrology tools. This comparison aims to uncover which company offers the most compelling investment opportunity for your portfolio in 2026.

Table of contents

Companies Overview

I will begin the comparison between Lattice Semiconductor Corporation and Onto Innovation Inc. by providing an overview of these two companies and their main differences.

Lattice Semiconductor Corporation Overview

Lattice Semiconductor Corporation, based in Hillsboro, Oregon, focuses on developing and selling semiconductor products globally, including field programmable gate arrays and video connectivity application-specific standard products. The company serves original equipment manufacturers in communications, computing, consumer, industrial, and automotive markets. Founded in 1983, it operates with 1,110 employees and trades on NASDAQ with a market cap of $11.7B.

Onto Innovation Inc. Overview

Onto Innovation Inc., headquartered in Wilmington, Massachusetts, designs and manufactures process control tools and software for semiconductor and advanced packaging device makers. Its offerings include defect inspection, optical metrology, lithography systems, and process control software. Established in 1940 and formerly known as Rudolph Technologies, Onto Innovation employs 1,551 people and has a market capitalization of $10.7B on the NYSE.

Key similarities and differences

Both companies operate within the semiconductor industry and provide technology solutions supporting semiconductor manufacturing. Lattice focuses on semiconductor components like FPGAs and video connectivity products, while Onto Innovation specializes in process control tools and software for defect inspection and yield management. Each targets different stages of the semiconductor supply chain, with Lattice serving OEMs and Onto Innovation serving device manufacturers and packaging firms.

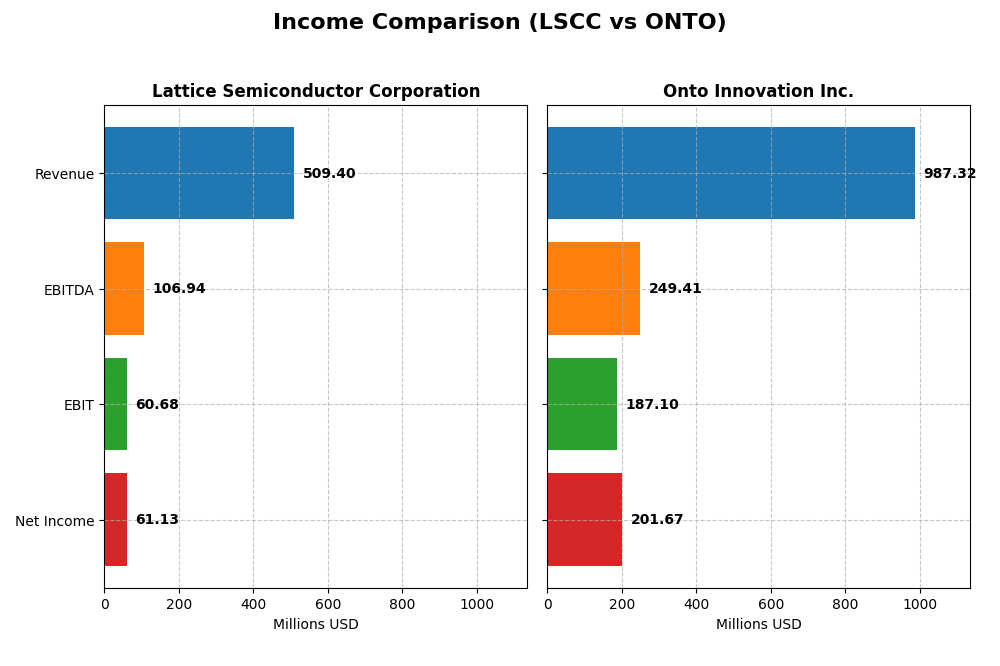

Income Statement Comparison

The table below shows the key income statement metrics for Lattice Semiconductor Corporation and Onto Innovation Inc. for the fiscal year 2024.

| Metric | Lattice Semiconductor Corporation | Onto Innovation Inc. |

|---|---|---|

| Market Cap | 11.7B | 10.7B |

| Revenue | 509M | 987M |

| EBITDA | 107M | 249M |

| EBIT | 61M | 187M |

| Net Income | 61M | 202M |

| EPS | 0.44 | 4.09 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Lattice Semiconductor Corporation

Lattice Semiconductor showed overall revenue growth of 25% and net income growth of 29% from 2020 to 2024. Margins remained stable, with a gross margin near 67% and a net margin around 12%, reflecting favorable profitability. However, 2024 saw a revenue decline of about 31%, with net income dropping 66%, signaling a sharp slowdown and margin compression in the latest year.

Onto Innovation Inc.

Onto Innovation experienced robust growth with revenue up 77% and net income soaring 550% over five years. Margins improved significantly, achieving a 52% gross margin and a 20% net margin in 2024. The most recent year posted strong gains, with revenue up 21% and net income rising 38%, highlighting expanding profitability and operational efficiency.

Which one has the stronger fundamentals?

Onto Innovation exhibits stronger fundamentals with consistent growth and margin expansion, including a 100% favorable income statement evaluation. Lattice Semiconductor’s fundamentals are mixed: stable margins over the long term but a pronounced decline in 2024, causing 43% unfavorable income metrics. Overall, Onto’s financials indicate more robust and improving profitability.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Lattice Semiconductor Corporation (LSCC) and Onto Innovation Inc. (ONTO) based on their most recent full fiscal year 2024 data.

| Ratios | Lattice Semiconductor Corporation (LSCC) | Onto Innovation Inc. (ONTO) |

|---|---|---|

| ROE | 8.60% | 10.47% |

| ROIC | 4.59% | 8.77% |

| P/E | 133x | 41.8x |

| P/B | 11.41x | 4.37x |

| Current Ratio | 3.66 | 8.69 |

| Quick Ratio | 2.62 | 7.00 |

| D/E (Debt-to-Equity) | 0.021 | 0.0079 |

| Debt-to-Assets | 1.81% | 0.72% |

| Interest Coverage | 130x | N/A |

| Asset Turnover | 0.60 | 0.47 |

| Fixed Asset Turnover | 7.62 | 7.16 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Lattice Semiconductor Corporation

Lattice Semiconductor Corporation shows a mixed ratio profile with 43% favorable but 50% unfavorable indicators, resulting in a slightly unfavorable overall view. Key strengths include low debt levels and strong interest coverage, while concerns arise from high valuation multiples (PE 132.74, PB 11.41) and weak returns on equity and invested capital. The company does not pay dividends, likely prioritizing reinvestment and growth.

Onto Innovation Inc.

Onto Innovation presents a more balanced ratio set, with 43% favorable and 43% unfavorable, rated as neutral overall. It benefits from a solid net margin of 20.43% and strong liquidity ratios, supported by negligible debt. However, valuation multiples remain elevated (PE 41.76, PB 4.37), and asset turnover is weak. This company also does not pay dividends, suggesting a focus on capital retention and development.

Which one has the best ratios?

Onto Innovation holds a neutral stance with slightly better profitability and liquidity ratios, while Lattice Semiconductor’s profile is slightly unfavorable due to high valuation and weaker returns. Both firms maintain strong balance sheets and no dividend payouts, reflecting reinvestment strategies. Onto Innovation’s more moderate valuation and returns edge it ahead in this comparison.

Strategic Positioning

This section compares the strategic positioning of LSCC and ONTO, focusing on market position, key segments, and exposure to technological disruption:

LSCC

- Operates globally with significant competitive pressure in semiconductors industry.

- Key segments include FPGA products and IP licensing targeting communications and automotive.

- Faces disruption risks from rapid semiconductor technology changes and licensing demands.

ONTO

- Competes worldwide in semiconductor process control tools with moderate competitive pressure.

- Focuses on process control tools, metrology, lithography, and software for semiconductor makers.

- Exposure to disruption through evolving process control technologies and software innovation.

LSCC vs ONTO Positioning

LSCC has a diversified product and licensing portfolio serving multiple end markets, while ONTO concentrates on semiconductor process control tools and software. LSCC’s broader approach targets various industries; ONTO’s focus may allow specialized innovation but limits market scope.

Which has the best competitive advantage?

Both companies currently shed value with ROIC below WACC. ONTO shows improving profitability with a growing ROIC trend, while LSCC faces declining returns, indicating ONTO may have a slightly stronger path toward competitive advantage.

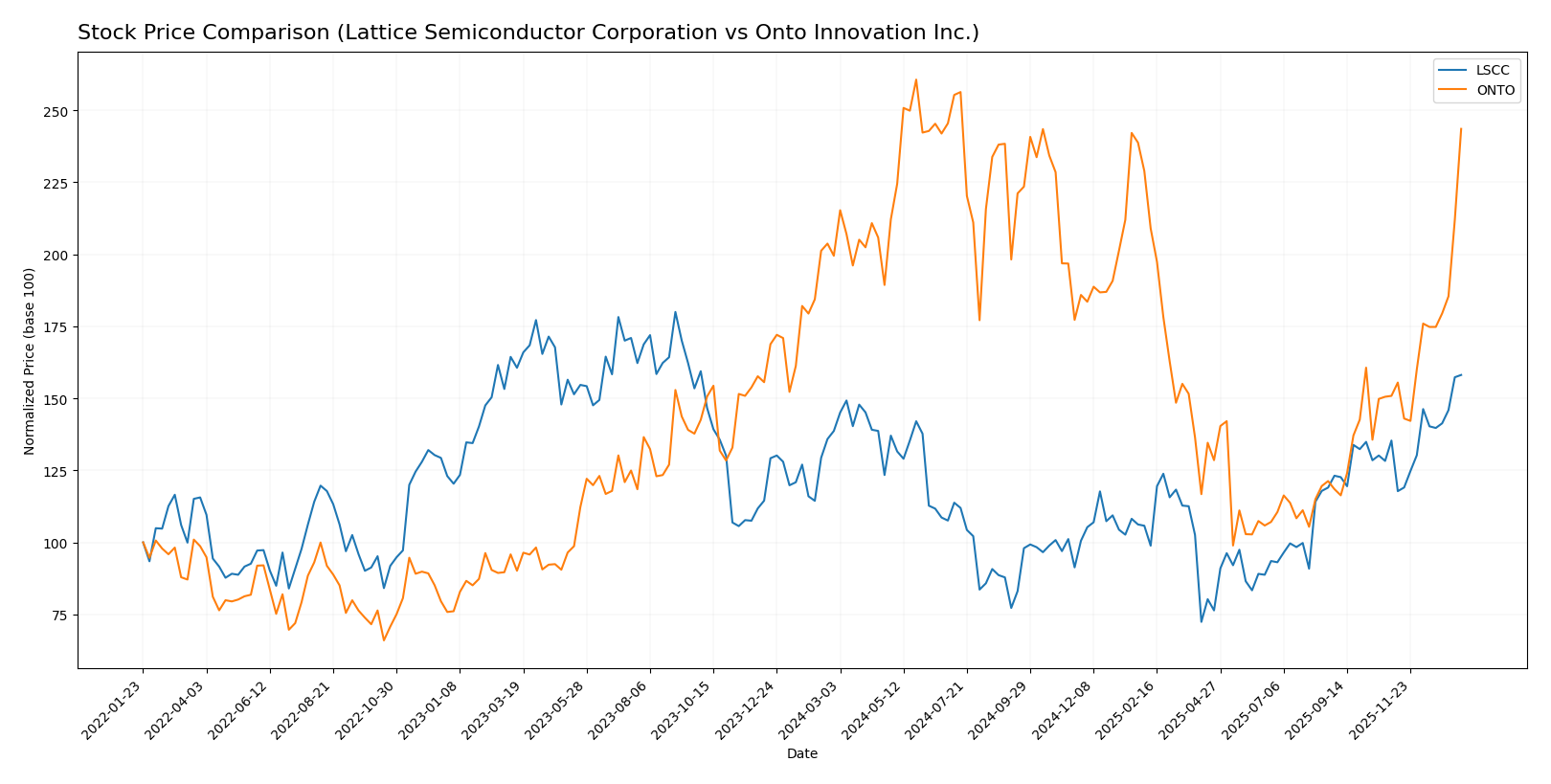

Stock Comparison

The stock price movements over the past year reveal notable bullish trends with accelerating momentum for both Lattice Semiconductor Corporation and Onto Innovation Inc., reflecting strong trading dynamics and significant price appreciations.

Trend Analysis

Lattice Semiconductor Corporation’s stock exhibited a 14.02% increase over the past 12 months, indicating a bullish trend with accelerating momentum and volatility characterized by an 11.01 std deviation. The price ranged between 39.03 and 85.23.

Onto Innovation Inc. showed a stronger bullish trend with a 22.07% gain over the same period, also accelerating and marked by higher volatility at 42.61 std deviation. Its price fluctuated from 88.5 to 233.14.

Comparing both, Onto Innovation delivered the highest market performance with a 22.07% rise, outperforming Lattice Semiconductor’s 14.02% gain over the past year.

Target Prices

Analysts provide a clear target price consensus for both Lattice Semiconductor Corporation and Onto Innovation Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Lattice Semiconductor Corporation | 105 | 65 | 83 |

| Onto Innovation Inc. | 200 | 160 | 178 |

The consensus target price for Lattice Semiconductor is slightly below its current price of 85.23, suggesting moderate upside potential. Onto Innovation’s consensus target is below its current price of 217.85, indicating a cautious outlook from analysts.

Analyst Opinions Comparison

This section compares the analysts’ ratings and financial scores for Lattice Semiconductor Corporation and Onto Innovation Inc.:

Rating Comparison

LSCC Rating

- Rating: B-, considered very favorable overall.

- Discounted Cash Flow Score: 3, moderate valuation indicator.

- ROE Score: 2, moderate profitability from equity.

- ROA Score: 3, moderate asset utilization efficiency.

- Debt To Equity Score: 4, favorable financial risk profile.

- Overall Score: 2, moderate overall financial standing.

ONTO Rating

- Rating: B+, considered very favorable overall.

- Discounted Cash Flow Score: 3, moderate valuation indicator.

- ROE Score: 3, moderate profitability from equity.

- ROA Score: 4, favorable asset utilization efficiency.

- Debt To Equity Score: 4, favorable financial risk profile.

- Overall Score: 3, moderate overall financial standing.

Which one is the best rated?

Based strictly on provided data, ONTO holds a higher rating (B+) and scores better in ROE, ROA, and overall score compared to LSCC’s B- rating and lower scores. Both share similar discounted cash flow and debt to equity scores.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for LSCC and ONTO:

LSCC Scores

- Altman Z-Score: 52.69, indicating a safe zone status.

- Piotroski Score: 5, reflecting an average financial health.

ONTO Scores

- Altman Z-Score: 34.16, indicating a safe zone status.

- Piotroski Score: 4, reflecting an average financial health.

Which company has the best scores?

Both LSCC and ONTO are in the safe zone based on their Altman Z-Scores, with LSCC having a higher score. LSCC also has a slightly better Piotroski Score, indicating marginally stronger financial health compared to ONTO.

Grades Comparison

Here is a detailed comparison of the recent grades and ratings for Lattice Semiconductor Corporation and Onto Innovation Inc.:

Lattice Semiconductor Corporation Grades

The following table summarizes the latest grades assigned by recognized grading companies for Lattice Semiconductor Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-13 |

| Stifel | Maintain | Buy | 2025-11-04 |

| Baird | Maintain | Outperform | 2025-11-04 |

| Needham | Maintain | Buy | 2025-11-04 |

| Rosenblatt | Maintain | Buy | 2025-11-04 |

| Benchmark | Maintain | Buy | 2025-11-04 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Keybanc | Maintain | Overweight | 2025-09-30 |

| Needham | Maintain | Buy | 2025-09-22 |

| Benchmark | Maintain | Buy | 2025-09-11 |

Overall, Lattice Semiconductor Corporation has consistently maintained positive ratings, predominantly “Buy” and “Outperform,” indicating stable analyst confidence.

Onto Innovation Inc. Grades

The table below shows the recent grades assigned by verified grading companies for Onto Innovation Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Hold | 2026-01-14 |

| Needham | Maintain | Buy | 2026-01-06 |

| Jefferies | Maintain | Buy | 2025-12-15 |

| B. Riley Securities | Maintain | Buy | 2025-11-18 |

| Needham | Maintain | Buy | 2025-11-18 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-05 |

| Oppenheimer | Maintain | Outperform | 2025-10-14 |

| Stifel | Maintain | Hold | 2025-10-13 |

| B. Riley Securities | Maintain | Buy | 2025-10-10 |

| Jefferies | Upgrade | Buy | 2025-09-23 |

Onto Innovation Inc. has maintained mostly “Buy” and “Outperform” ratings with some “Hold” grades, indicating a generally positive but slightly more mixed analyst sentiment.

Which company has the best grades?

Both Lattice Semiconductor Corporation and Onto Innovation Inc. carry a consensus “Buy” rating with multiple “Buy” and “Outperform” grades. However, Lattice Semiconductor shows a stronger uniformity in positive grades, while Onto Innovation includes some “Hold” ratings. This difference may influence investor confidence and perceived risk differently between the two.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses between Lattice Semiconductor Corporation (LSCC) and Onto Innovation Inc. (ONTO) based on recent financial and operational data.

| Criterion | Lattice Semiconductor Corporation (LSCC) | Onto Innovation Inc. (ONTO) |

|---|---|---|

| Diversification | Limited product diversification; mainly licenses and product sales from distributors | Highly diversified with parts, service, and systems/software revenue streams |

| Profitability | Moderate net margin (12%) but negative ROIC vs WACC, indicating value destruction | Higher net margin (20.43%) and improving ROIC trend but still slightly unfavorable ROIC vs WACC |

| Innovation | Declining ROIC trend suggests challenges in capital efficiency and innovation impact | Growing ROIC trend indicates improving efficiency and innovation benefits |

| Global presence | Strong distributor network but less diversified revenue sources | Broad product and service offerings with growing global sales |

| Market Share | Strong in niche semiconductor segments but facing profitability pressure | Expanding market share supported by diverse product portfolio and service offerings |

Key takeaways: LSCC shows signs of financial stress with declining profitability and value destruction despite a solid market position. ONTO, while currently shedding value, demonstrates improving profitability and innovation trends, offering a potentially more favorable risk-reward profile for investors.

Risk Analysis

Below is a comparative risk table for Lattice Semiconductor Corporation (LSCC) and Onto Innovation Inc. (ONTO) based on the most recent 2024 data.

| Metric | Lattice Semiconductor Corporation (LSCC) | Onto Innovation Inc. (ONTO) |

|---|---|---|

| Market Risk | High beta (1.72) indicates higher volatility | Moderate beta (1.46) suggests medium volatility |

| Debt level | Very low debt-to-equity (0.02), low financial risk | Very low debt-to-equity (0.01), low financial risk |

| Regulatory Risk | Moderate; operates globally in semiconductor industry | Moderate; exposed to global tech regulations |

| Operational Risk | Medium; supply chain sensitivity in semiconductors | Medium; complex process control tools manufacturing |

| Environmental Risk | Moderate; standard semiconductor environmental impact | Moderate; manufacturing processes involve chemical use |

| Geopolitical Risk | Significant; global manufacturing and sales subject to trade tensions | Significant; global supply chains and export controls affect operations |

The most impactful risks for both companies stem from market volatility and geopolitical tensions affecting the semiconductor sector. LSCC’s higher beta signals greater price fluctuations, while both maintain very low debt levels, reducing financial distress risk. Operational and environmental risks are typical for their industry but manageable with good governance.

Which Stock to Choose?

Lattice Semiconductor Corporation (LSCC) shows a favorable income statement with strong gross and net margins, but recent revenue and earnings growth have declined sharply. Financial ratios reveal a mix of strengths and weaknesses, with a slightly unfavorable global rating despite low debt and strong interest coverage. The company is shedding value as its ROIC falls below WACC, indicating declining profitability and value destruction.

Onto Innovation Inc. (ONTO) reports robust income growth and high profitability with favorable margins and expanding earnings. Its financial ratios are more balanced, earning a neutral global evaluation with solid liquidity and low leverage. Although also shedding value with ROIC below WACC, ONTO demonstrates improving profitability and a growing ROIC trend, signaling potential value creation ahead.

For investors, ONTO might appear more attractive for those seeking growth and improving profitability, while LSCC could be considered by those prioritizing stability in debt management despite recent income setbacks. The choice could depend on whether an investor favors growth dynamics or a more cautious financial profile.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Lattice Semiconductor Corporation and Onto Innovation Inc. to enhance your investment decisions: