Home > Comparison > Technology > LSCC vs MXL

The strategic rivalry between Lattice Semiconductor Corporation and MaxLinear, Inc. shapes the semiconductor sector’s evolution. Lattice operates as a niche FPGA innovator focused on low-power, customizable chips, while MaxLinear excels in high-performance analog and mixed-signal SoCs for communications infrastructure. This head-to-head highlights a contest between specialized integration and broad connectivity solutions. This analysis will determine which company offers superior risk-adjusted returns for a diversified technology portfolio.

Table of contents

Companies Overview

Lattice Semiconductor and MaxLinear both hold significant stakes in the semiconductor industry, shaping communications infrastructure globally.

Lattice Semiconductor Corporation: FPGA Innovator with IP Licensing Strength

Lattice Semiconductor specializes in field programmable gate arrays (FPGAs), driving revenue through multiple product families like Certus-NX and iCE40. Its strategic focus centers on delivering flexible, low-power semiconductors to communications, computing, and automotive OEMs. The company also leverages a technology licensing model to monetize its intellectual property, supplementing direct sales with a global distributor network.

MaxLinear, Inc.: Integrated Communications SoC Provider

MaxLinear offers high-performance analog and mixed-signal system-on-chip (SoC) solutions for wired and wireless infrastructure, focusing on communication platforms like DOCSIS modems and 4G/5G base stations. Its 2026 strategy emphasizes tightly integrated end-to-end solutions that combine RF, digital processing, and power management, serving a diverse customer base that includes OEMs and distributors worldwide.

Strategic Collision: FPGA Flexibility vs. SoC Integration

Lattice champions a modular, programmable semiconductor approach, while MaxLinear pursues highly integrated SoCs for communication networks. Both compete fiercely in communications infrastructure, yet Lattice’s IP licensing contrasts with MaxLinear’s hardware-software platform integration. This divergence creates distinct investment profiles: Lattice offers exposure to IP-driven recurring revenue, whereas MaxLinear focuses on hardware innovation and system-level solutions.

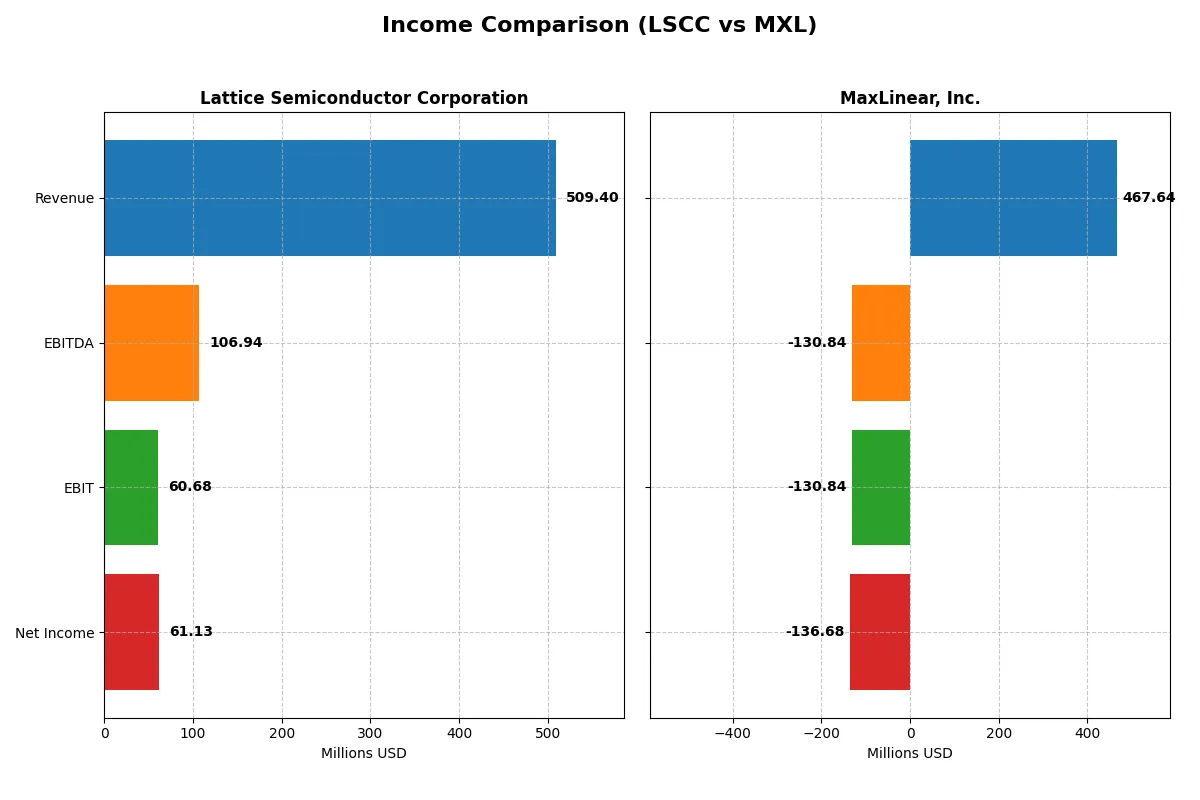

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Lattice Semiconductor Corporation (LSCC) | MaxLinear, Inc. (MXL) |

|---|---|---|

| Revenue | 509.4M | 360.5M |

| Cost of Revenue | 169.0M | 168.1M |

| Operating Expenses | 305.9M | 361.2M |

| Gross Profit | 340.4M | 192.4M |

| EBITDA | 106.9M | -181.7M |

| EBIT | 60.7M | -227.8M |

| Interest Expense | 0.27M | 10.9M |

| Net Income | 61.1M | -245.2M |

| EPS | 0.44 | -2.93 |

| Fiscal Year | 2024 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

The following income statement comparison reveals each company’s ability to convert revenue into profit and sustain operational efficiency over time.

Lattice Semiconductor Corporation Analysis

Lattice Semiconductor shows a revenue rise of 25% from 2020 to 2024 but a 31% drop from 2023 to 2024. Net income follows a similar pattern, growing overall but falling sharply last year to $61M. The company maintains strong gross margins at 67% and a healthy net margin near 12%, indicating solid cost control despite recent headwinds. Efficiency peaked in 2023 but weakened in 2024 amid revenue contraction.

MaxLinear, Inc. Analysis

MaxLinear’s revenue declined nearly 48% across 2021-2025 but rebounded 30% in the last year to $468M. Net income suffered steep losses overall, posting -$137M in 2025, though showing significant margin improvements recently. Gross margin stands at 57%, but negative net and EBIT margins close to -29% and -28% reflect ongoing operational challenges. The company exhibits momentum in recovery but remains unprofitable and inefficient.

Margin Stability vs. Recovery Momentum

Lattice Semiconductor delivers superior profitability with stable, favorable margins and positive net income growth over the medium term. MaxLinear struggles with heavy losses despite recent top-line and margin improvements. Fundamentally, Lattice’s income statement reflects a more resilient and efficient business. Investors seeking consistent earnings may prefer Lattice, while MaxLinear’s profile suits those focused on turnaround potential amid elevated risk.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Lattice Semiconductor (LSCC) | MaxLinear (MXL) |

|---|---|---|

| ROE | 8.60% | -47.49% |

| ROIC | 4.59% | -24.31% |

| P/E | 133 | -6.74 |

| P/B | 11.41 | 3.20 |

| Current Ratio | 3.66 | 1.77 |

| Quick Ratio | 2.62 | 1.28 |

| D/E (Debt-to-Equity) | 0.02 | 0.29 |

| Debt-to-Assets | 1.81% | 17.23% |

| Interest Coverage | 130 | -15.52 |

| Asset Turnover | 0.60 | 0.42 |

| Fixed Asset Turnover | 7.62 | 4.65 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, revealing hidden risks and operational excellence beyond surface-level financial statements.

Lattice Semiconductor Corporation

Lattice Semiconductor shows a moderate net margin of 12% but struggles with a weak ROE at 8.6%, below industry averages. Its valuation appears stretched, with a high P/E of 133 and P/B at 11.4. The company returns no dividends, instead prioritizing heavy R&D investments, reflecting a growth-focused capital allocation approach.

MaxLinear, Inc.

MaxLinear suffers a severe profitability slump, with a negative net margin of -68% and ROE at -47.5%. Despite a favorable negative P/E due to losses, its P/B of 3.2 signals some asset value. The balance sheet shows prudent liquidity. MaxLinear does not issue dividends, directing resources to aggressive R&D amid operational challenges.

Premium Valuation vs. Operational Safety

Lattice Semiconductor carries a premium valuation with modest profitability but strong investment in innovation. MaxLinear shows deeper losses and operational inefficiencies but maintains healthier liquidity. Investors prioritizing growth may lean toward Lattice, while those favoring cautious capital structures might consider MaxLinear’s conservative liquidity profile.

Which one offers the Superior Shareholder Reward?

Lattice Semiconductor (LSCC) and MaxLinear (MXL) both forgo dividends in 2026, focusing on reinvestment and buybacks. LSCC delivers strong free cash flow (1.7/share in 2024) and robust buyback capacity, with no dividend payout but a well-covered capex profile. MXL struggles with negative free cash flow (-0.75/share) and operating losses, limiting buyback potential. LSCC’s model is sustainable, balancing growth and capital return, while MXL’s path remains speculative and riskier. I conclude LSCC offers the superior total return outlook for disciplined shareholders in 2026.

Comparative Score Analysis: The Strategic Profile

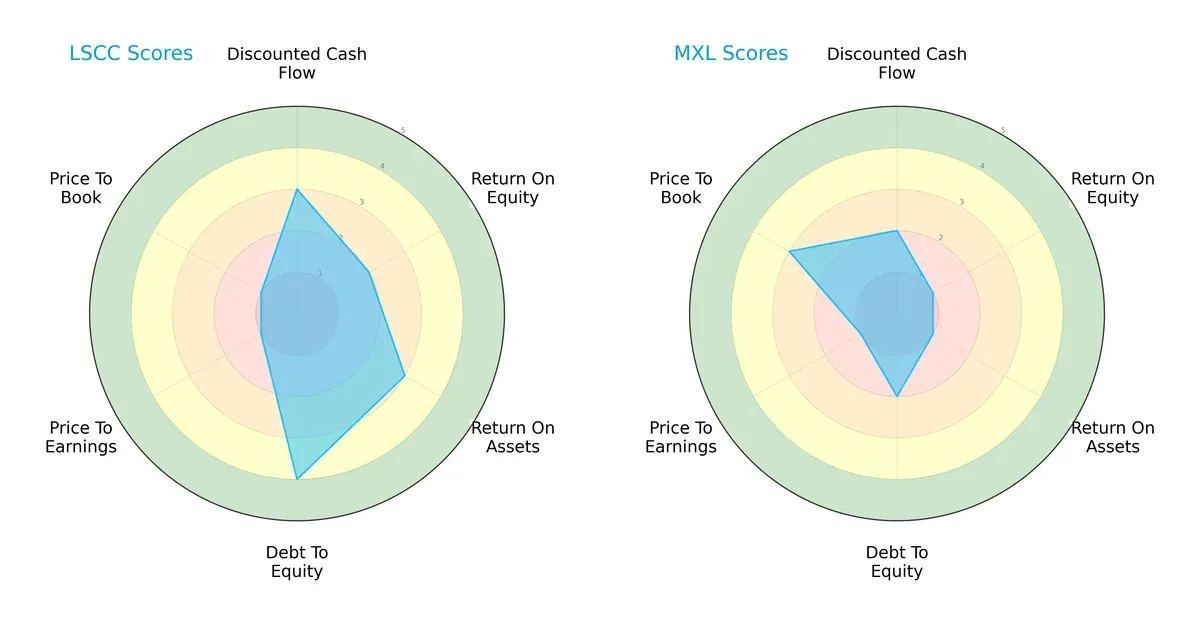

The radar chart reveals the fundamental DNA and trade-offs of Lattice Semiconductor Corporation and MaxLinear, Inc., highlighting their core financial strengths and weaknesses:

Lattice Semiconductor shows a more balanced profile with moderate DCF (3), ROE (2), and ROA (3) scores, and a strong debt-to-equity score (4), signaling disciplined capital structure. MaxLinear relies more on valuation metrics, scoring better on price-to-book (3) but lagging across ROE (1), ROA (1), and debt-to-equity (2), indicating weaker operational efficiency and higher leverage risk.

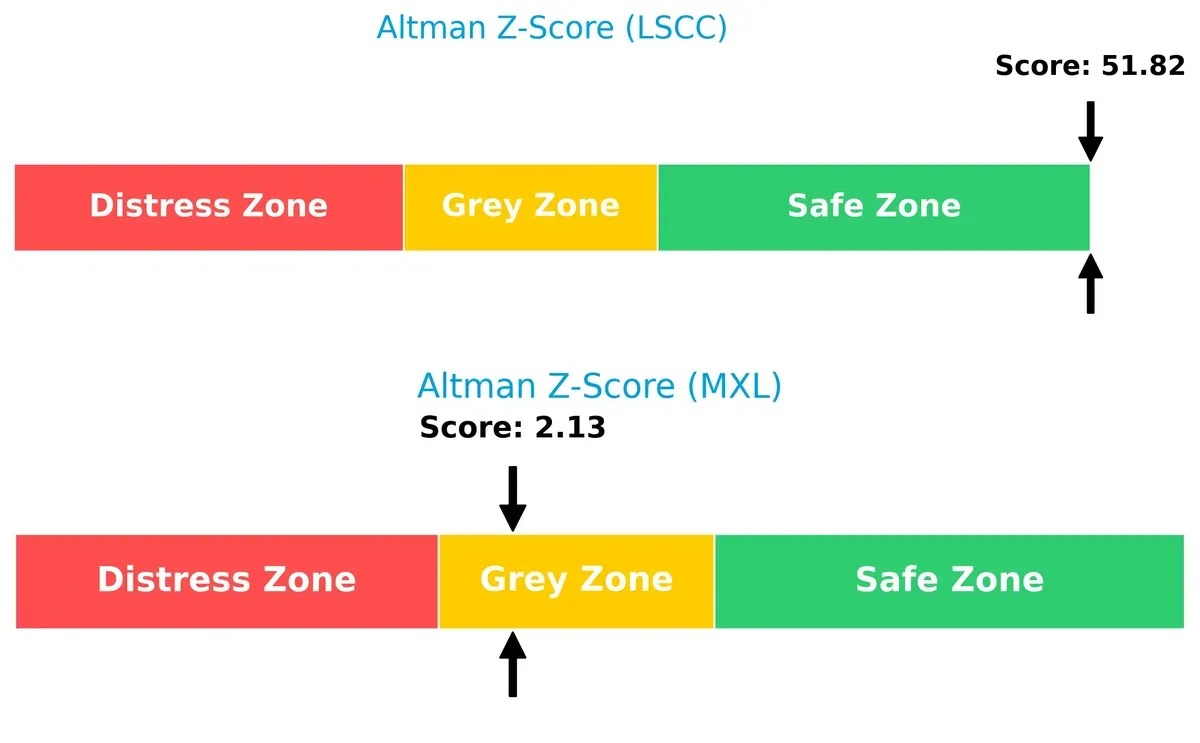

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap indicates Lattice Semiconductor stands in a very safe zone at 51.8, while MaxLinear resides in the grey zone at 2.13, implying higher bankruptcy risk during economic downturns:

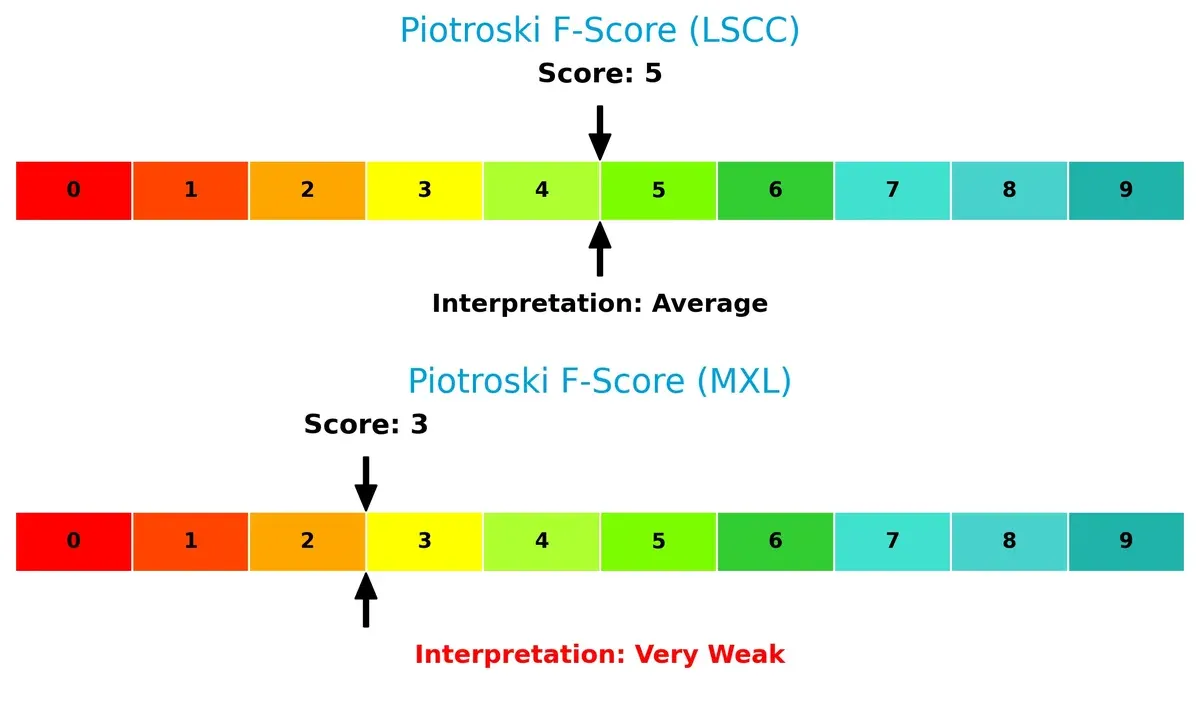

Financial Health: Quality of Operations

Lattice Semiconductor’s Piotroski F-Score of 5 suggests average financial health with room for improvement. MaxLinear’s weaker score of 3 raises red flags on operational quality and internal controls:

How are the two companies positioned?

This section dissects LSCC and MXL’s operational DNA by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats to reveal which model offers a more resilient, sustainable advantage today.

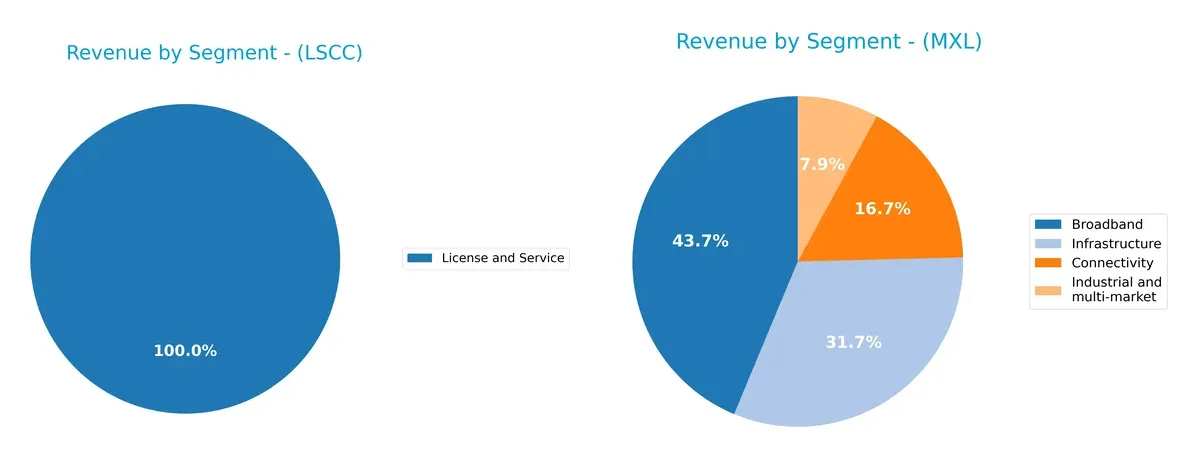

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how Lattice Semiconductor and MaxLinear diversify their income streams and where their primary sector bets lie:

Lattice Semiconductor relies heavily on its distributor product revenue, which dwarfs its direct and license streams, anchoring its business in broad market reach. MaxLinear presents a more balanced mix with significant contributions from Broadband, Infrastructure, Connectivity, and Industrial segments. This diversification reduces MaxLinear’s concentration risk, while Lattice’s dominant distributor channel suggests strong ecosystem lock-in but potential vulnerability to distributor dynamics.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Lattice Semiconductor Corporation and MaxLinear, Inc.:

LSCC Strengths

- Strong global presence with significant revenue from Asia and Americas

- Favorable net margin at 12%

- Very low debt-to-assets at 1.81%

- High interest coverage ratio of 228

- High fixed asset turnover at 7.62

MXL Strengths

- Diverse product segments including Broadband, Connectivity, Infrastructure

- Favorable current and quick ratios indicating liquidity

- Moderate debt-to-assets at 17.23% managed well

- Fixed asset turnover favorable at 4.65

- PE ratio favorable despite losses

LSCC Weaknesses

- Unfavorable ROE at 8.6% below WACC of 11.72%

- High PE and PB ratios suggesting overvaluation

- Unfavorable current ratio despite liquidity

- No dividend yield

- Slightly unfavorable overall ratios

MXL Weaknesses

- Negative net margin of -68% and ROE of -47% indicate poor profitability

- Negative interest coverage ratio signals risk

- Asset turnover low at 0.42

- Unfavorable PB ratio and overall ratios

- No dividend yield

Both companies show strengths in different areas: LSCC excels in profitability and financial stability, while MXL leverages product diversification and liquidity. However, LSCC’s valuation metrics and ROE are concerns, while MXL faces significant profitability and operational challenges. These contrasts highlight divergent strategic focuses and risk profiles.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only thing protecting long-term profits from relentless competition and market pressure. Let’s dissect these two semiconductor players’ moats:

Lattice Semiconductor Corporation: Intangible Assets and Specialized FPGA Expertise

Lattice’s moat stems from proprietary FPGA technology and IP licensing, which supports stable 12% net margins. However, its shrinking revenue and declining ROIC signal pressure from evolving chip demands in 2026.

MaxLinear, Inc.: Integrated SoC Solutions with High Innovation Focus

MaxLinear relies on mixed-signal SoC integration, differentiating it from Lattice’s FPGA-driven model. Despite stronger recent revenue growth, its negative margins and worsening ROIC highlight fragile value creation and operational challenges ahead.

Verdict: Proprietary FPGA IP Versus SoC Innovation — Who Holds the Competitive Edge?

Both firms suffer value destruction with declining ROICs, but Lattice’s niche FPGA technology offers a deeper moat than MaxLinear’s broader product scope. Lattice is better positioned to defend market share amid semiconductor disruption.

Which stock offers better returns?

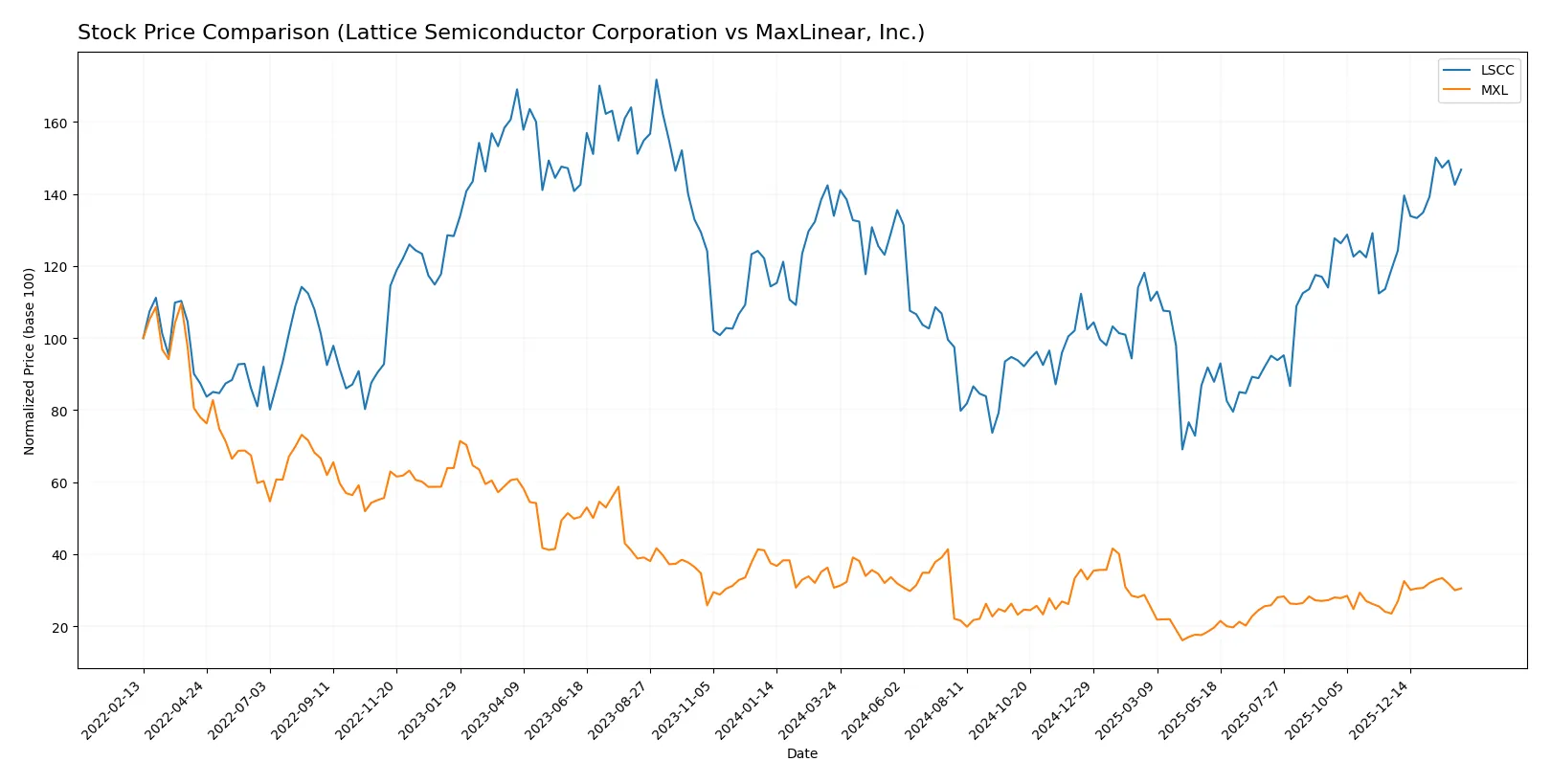

Both Lattice Semiconductor Corporation and MaxLinear, Inc. display dynamic price movements over the past year, with Lattice showing a steady upward trajectory and MaxLinear exhibiting a mild overall decline despite recent gains.

Trend Comparison

Lattice Semiconductor’s stock rose 9.6% over the past 12 months, marking a bullish trend with accelerating momentum and a high volatility level of 11.21%. Its price fluctuated between 39.03 and 84.8.

MaxLinear’s stock fell 0.62% over the same period, indicating a bearish trend despite recent positive acceleration. Volatility remained moderate at 3.34%, with prices ranging from 9.31 to 24.05.

Lattice outperformed MaxLinear overall, delivering the highest market performance with a clear bullish trend versus MaxLinear’s nearly flat to negative yearly return.

Target Prices

Analysts present a clear consensus on target prices for Lattice Semiconductor and MaxLinear, reflecting moderate upside potential.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Lattice Semiconductor Corporation | 65 | 105 | 84.67 |

| MaxLinear, Inc. | 15 | 25 | 21 |

The consensus target for Lattice Semiconductor stands slightly above its current price of $82.91, signaling modest appreciation potential. MaxLinear’s consensus target of $21 exceeds its current $17.64 share price, indicating analyst optimism in its near-term growth.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Lattice Semiconductor Corporation Grades

Here are the latest reliable grades from recognized institutions for Lattice Semiconductor Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | Maintain | Positive | 2026-01-22 |

| Keybanc | Maintain | Overweight | 2026-01-13 |

| Baird | Maintain | Outperform | 2025-11-04 |

| Rosenblatt | Maintain | Buy | 2025-11-04 |

| Benchmark | Maintain | Buy | 2025-11-04 |

| Stifel | Maintain | Buy | 2025-11-04 |

| Needham | Maintain | Buy | 2025-11-04 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Keybanc | Maintain | Overweight | 2025-09-30 |

| Needham | Maintain | Buy | 2025-09-22 |

MaxLinear, Inc. Grades

Below are the current reliable grades issued by established grading firms for MaxLinear, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-30 |

| Benchmark | Maintain | Buy | 2026-01-16 |

| Benchmark | Maintain | Buy | 2025-10-24 |

| Benchmark | Maintain | Buy | 2025-10-17 |

| Benchmark | Maintain | Buy | 2025-09-02 |

| Loop Capital | Maintain | Hold | 2025-08-04 |

| Wells Fargo | Maintain | Equal Weight | 2025-07-24 |

| Benchmark | Maintain | Buy | 2025-07-24 |

| Susquehanna | Maintain | Neutral | 2025-07-24 |

| Susquehanna | Maintain | Neutral | 2025-07-22 |

Which company has the best grades?

Lattice Semiconductor consistently receives strong buy and outperform ratings, indicating higher institutional confidence. MaxLinear shows mixed ratings, primarily buy and hold, suggesting more cautious optimism. Investors may interpret Lattice’s grades as a stronger endorsement.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Lattice Semiconductor Corporation (LSCC)

- LSCC faces intense competition in semiconductors but benefits from diversified FPGA product families and IP licensing.

MaxLinear, Inc. (MXL)

- MXL competes in RF and mixed-signal SoCs with exposure to multiple communication markets but struggles with profitability.

2. Capital Structure & Debt

Lattice Semiconductor Corporation (LSCC)

- LSCC has a very low debt-to-equity ratio (0.02) and strong interest coverage (228x), signaling low financial risk.

MaxLinear, Inc. (MXL)

- MXL carries higher leverage (debt-to-equity 0.29) and negative interest coverage, indicating possible debt servicing difficulties.

3. Stock Volatility

Lattice Semiconductor Corporation (LSCC)

- LSCC exhibits a beta of 1.67, implying above-market volatility but manageable within tech sector norms.

MaxLinear, Inc. (MXL)

- MXL has a slightly higher beta of 1.71, suggesting elevated volatility and risk relative to peers.

4. Regulatory & Legal

Lattice Semiconductor Corporation (LSCC)

- LSCC operates globally with potential IP licensing and compliance risks typical for semiconductor firms.

MaxLinear, Inc. (MXL)

- MXL faces regulatory scrutiny in communications sectors and must manage multi-market product compliance risks.

5. Supply Chain & Operations

Lattice Semiconductor Corporation (LSCC)

- LSCC’s global manufacturing and distributor network exposes it to supply chain disruptions but benefits from diversified end markets.

MaxLinear, Inc. (MXL)

- MXL’s broad product integration increases operational complexity and supply chain vulnerability, especially in RF components.

6. ESG & Climate Transition

Lattice Semiconductor Corporation (LSCC)

- LSCC’s ESG profile is not highlighted but semiconductor industry faces increasing pressure on energy use and sourcing.

MaxLinear, Inc. (MXL)

- MXL must address ESG concerns related to energy-efficient communications and sustainable production amid rising investor focus.

7. Geopolitical Exposure

Lattice Semiconductor Corporation (LSCC)

- LSCC’s global sales across Asia, Europe, and Americas expose it to trade tensions and export controls.

MaxLinear, Inc. (MXL)

- MXL’s global footprint in communications hardware similarly faces risks from geopolitical tensions affecting supply chains.

Which company shows a better risk-adjusted profile?

LSCC’s most impactful risk is its overvaluation, indicated by a high P/E of 132.7 and elevated price-to-book ratio, raising concerns about price corrections. MXL’s critical risk is its financial distress signs—negative margins, poor interest coverage, and a weak Piotroski score signal operational and solvency challenges. LSCC exhibits a safer risk-adjusted profile supported by a strong Altman Z-score (52) signaling low bankruptcy risk. Meanwhile, MXL’s Z-score in the grey zone (2.13) and weak profitability weigh heavily on its outlook. The stark contrast in financial health and leverage justifies my caution against MXL despite both firms operating in volatile semiconductor markets.

Final Verdict: Which stock to choose?

Lattice Semiconductor Corporation (LSCC) excels as a cash-generating machine with robust operational efficiency and a healthy balance sheet. Its main point of vigilance lies in declining profitability and a high valuation premium. LSCC suits portfolios aiming for aggressive growth with a tolerance for elevated risk.

MaxLinear, Inc. (MXL) leverages a strategic moat in niche communications technology, supported by a solid current ratio and manageable debt. Relative to LSCC, it offers a safer, more value-oriented profile despite ongoing profitability challenges. MXL fits well within Growth at a Reasonable Price (GARP) portfolios seeking turnaround potential.

If you prioritize dynamic cash flow and can tolerate valuation risk, LSCC outshines as the compelling choice due to its operational strength and market momentum. However, if you seek better stability and a more conservative entry point, MXL offers superior downside protection with potential for recovery, despite current value destruction.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Lattice Semiconductor Corporation and MaxLinear, Inc. to enhance your investment decisions: