Marvell Technology, Inc. and Lattice Semiconductor Corporation are two prominent players in the semiconductor industry, each carving out unique niches with innovative product portfolios. While Marvell focuses on complex integrated circuits and storage solutions, Lattice specializes in field programmable gate arrays and connectivity products. Their overlapping markets and distinct innovation strategies make this comparison essential for investors seeking growth and resilience. Let’s explore which company offers the most compelling investment opportunity today.

Table of contents

Companies Overview

I will begin the comparison between Marvell Technology, Inc. and Lattice Semiconductor Corporation by providing an overview of these two companies and their main differences.

Marvell Technology Overview

Marvell Technology, Inc. designs, develops, and sells a broad portfolio of integrated circuits including Ethernet solutions, processors, ASICs, and storage controllers. The company serves global markets with operations spanning the US, Asia, and Israel. Headquartered in Wilmington, Delaware, Marvell focuses on advanced semiconductor products supporting communications, storage, and networking industries.

Lattice Semiconductor Overview

Lattice Semiconductor Corporation develops and sells field programmable gate arrays and video connectivity products worldwide, targeting communications, computing, consumer, and industrial markets. The company licenses technology through IP cores and patent monetization. Headquartered in Hillsboro, Oregon, Lattice operates with a smaller workforce and emphasizes programmable solutions and IP licensing.

Key similarities and differences

Both companies operate in the semiconductor industry and serve global markets with advanced technology products. Marvell offers a wider range of integrated circuit solutions including storage and networking, while Lattice specializes in programmable gate arrays and IP licensing. Marvell’s scale and employee count significantly surpass Lattice’s, reflecting a broader product portfolio and market reach.

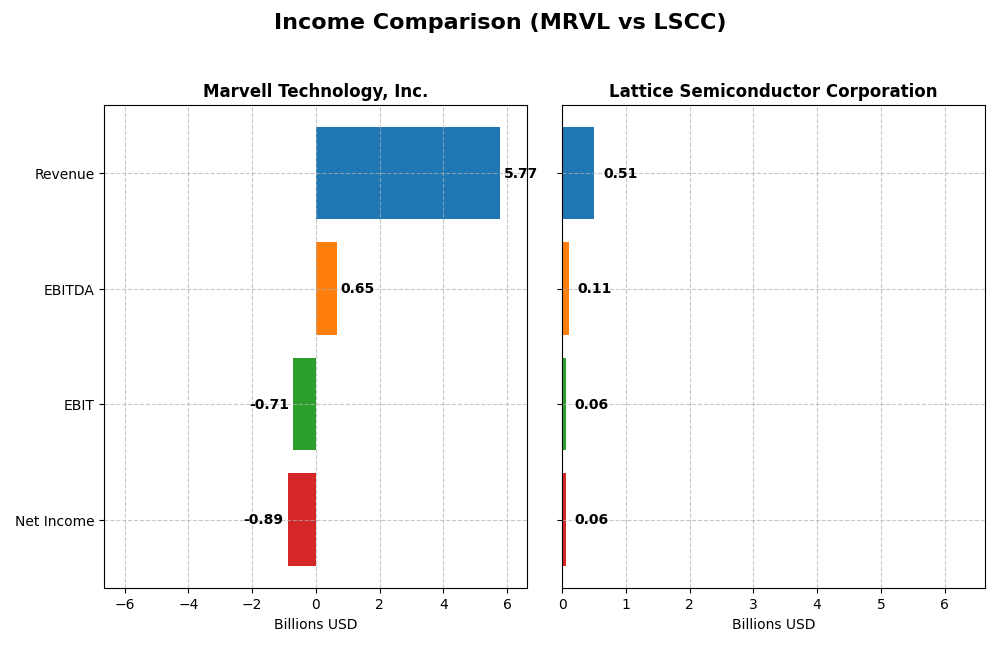

Income Statement Comparison

This table compares the key income statement metrics for Marvell Technology, Inc. and Lattice Semiconductor Corporation for their most recent fiscal years.

| Metric | Marvell Technology, Inc. | Lattice Semiconductor Corporation |

|---|---|---|

| Market Cap | 69.3B | 11.7B |

| Revenue | 5.77B | 509M |

| EBITDA | 652M | 107M |

| EBIT | -705M | 61M |

| Net Income | -885M | 61M |

| EPS | -1.02 | 0.44 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Marvell Technology, Inc.

Marvell Technology’s revenue grew steadily from 3B in 2021 to 5.8B in 2025, nearly doubling over five years. However, net income remained negative throughout, reaching -885M in 2025. Gross margins stayed favorable at 41.3%, but operating and net margins were negative, reflecting persistent losses. The latest year showed slight revenue growth of 4.7% but worsening EBIT margins and ongoing net losses.

Lattice Semiconductor Corporation

Lattice Semiconductor’s revenue increased from 408M in 2020 to a peak of 737M in 2023, then declined to 509M in 2024. Net income followed a similar pattern, reaching 259M in 2023 before dropping to 61M in 2024. Margins were consistently favorable, with a 66.8% gross margin and positive EBIT and net margins. The most recent year saw notable declines in revenue, profit, and margins.

Which one has the stronger fundamentals?

Lattice Semiconductor displays stronger fundamentals with consistently positive net and EBIT margins and overall income growth over the period. Marvell shows robust revenue expansion but persistent net losses and unfavorable EBIT margins. Recent year trends favor Marvell’s revenue growth but highlight Lattice’s superior profitability and margin stability despite recent declines.

Financial Ratios Comparison

The following table presents a side-by-side comparison of key financial ratios for Marvell Technology, Inc. and Lattice Semiconductor Corporation, based on their most recent fiscal year data.

| Ratios | Marvell Technology, Inc. (2025) | Lattice Semiconductor Corporation (2024) |

|---|---|---|

| ROE | -6.59% | 8.60% |

| ROIC | -3.88% | 4.59% |

| P/E | -110.4 | 132.7 |

| P/B | 7.27 | 11.41 |

| Current Ratio | 1.54 | 3.66 |

| Quick Ratio | 1.03 | 2.62 |

| D/E (Debt-to-Equity) | 0.32 | 0.02 |

| Debt-to-Assets | 21.5% | 1.81% |

| Interest Coverage | -3.80 | 129.54 |

| Asset Turnover | 0.29 | 0.60 |

| Fixed Asset Turnover | 5.56 | 7.62 |

| Payout Ratio | -23.4% | 0% |

| Dividend Yield | 0.21% | 0% |

Interpretation of the Ratios

Marvell Technology, Inc.

Marvell Technology shows a mixed ratio profile with unfavorable net margin (-15.35%), ROE (-6.59%), and ROIC (-3.88%) indicating profitability challenges. Positive aspects include a solid current ratio (1.54) and low debt-equity (0.32), reflecting manageable leverage. The company pays dividends, but with a low yield (0.21%) and payout risks given weak free cash flow coverage.

Lattice Semiconductor Corporation

Lattice Semiconductor presents a better profitability picture with a favorable net margin (12.0%) but an unfavorable ROE (8.6%) and ROIC (4.59%). Its liquidity is strong with an excellent quick ratio (2.62) and minimal debt (debt-to-assets 1.81%). The company does not pay dividends, likely focusing on reinvestment and growth, supported by very high interest coverage (228.11).

Which one has the best ratios?

Both companies have a similar share of favorable ratios (42.86%), but Marvell suffers from more significant profitability and leverage concerns, while Lattice shows stronger liquidity and earnings quality. Despite Lattice’s high P/E and valuation ratios, its operational metrics are generally healthier, making its overall ratio evaluation slightly more favorable.

Strategic Positioning

This section compares the strategic positioning of Marvell Technology, Inc. and Lattice Semiconductor Corporation, including market position, key segments, and exposure to technological disruption:

Marvell Technology, Inc.

- Large market cap ~$69B, operating under high competitive pressure in semiconductors.

- Diversified segments: data center, enterprise networking, carrier infrastructure, automotive and industrial, consumer products.

- Exposure to disruption through integrated circuits and Ethernet solutions in multiple advanced tech areas.

Lattice Semiconductor Corporation

- Smaller market cap ~$11.7B, facing competitive pressure in specialized FPGA market.

- Focused on field programmable gate arrays and video connectivity products, plus IP licensing.

- Exposure via FPGA innovation and IP licensing, serving communications, computing, and automotive sectors.

Marvell Technology, Inc. vs Lattice Semiconductor Corporation Positioning

Marvell pursues a diversified approach with broad semiconductor product lines, offering scale advantages but facing complex market dynamics. Lattice concentrates on niche programmable logic devices and IP licensing, allowing focused innovation but narrower market scope.

Which has the best competitive advantage?

Both companies show very unfavorable MOAT evaluations due to declining ROIC below WACC, indicating value destruction and weakening competitive advantages over recent years. Neither currently demonstrates a sustainable competitive advantage.

Stock Comparison

The stock price movements of Marvell Technology, Inc. and Lattice Semiconductor Corporation over the past year reveal distinct bullish trends, with Marvell showing deceleration and Lattice demonstrating acceleration in their price gains.

Trend Analysis

Marvell Technology, Inc. experienced a bullish trend over the past 12 months with an 18.94% price increase, though this growth has decelerated recently alongside a notable standard deviation of 16.46. The stock reached a high of 124.76 and a low of 49.43 during this period.

Lattice Semiconductor Corporation also showed a bullish trend with a 14.02% rise over the last year, coupled with accelerating growth and moderate volatility reflected by an 11.01 standard deviation. Its price ranged between 39.03 and 85.23.

Comparing these stocks, Marvell Technology delivered the highest overall market performance with a larger percentage gain despite recent deceleration, while Lattice showed strong recent momentum and acceleration.

Target Prices

The current analyst consensus shows optimistic target prices for both Marvell Technology, Inc. and Lattice Semiconductor Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Marvell Technology, Inc. | 156 | 80 | 117 |

| Lattice Semiconductor Corporation | 105 | 65 | 83 |

Analysts expect Marvell’s stock price to rise significantly from the current 80.38 USD consensus to around 117 USD, while Lattice Semiconductor’s consensus target of 83 USD is slightly below its current price of 85.23 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Marvell Technology, Inc. and Lattice Semiconductor Corporation:

Rating Comparison

MRVL Rating

- Rating: B+ indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: Moderate score of 3 reflecting balanced valuation.

- ROE Score: Favorable score of 4 shows efficient profit generation on equity.

- ROA Score: Very favorable score of 5, strong asset utilization.

- Debt To Equity Score: Moderate score of 2, indicating moderate financial risk.

- Overall Score: Moderate score of 3 summarizing company’s financial standing.

LSCC Rating

- Rating: B- also considered very favorable but lower than MRVL’s rating.

- Discounted Cash Flow Score: Moderate score of 3, similar valuation outlook.

- ROE Score: Moderate score of 2, lower efficiency in generating equity returns.

- ROA Score: Moderate score of 3, average asset utilization.

- Debt To Equity Score: Favorable score of 4, indicating stronger balance sheet.

- Overall Score: Moderate score of 2, reflecting a somewhat weaker position.

Which one is the best rated?

Based on the provided data, Marvell Technology holds a higher overall rating (B+) and stronger scores in ROE and ROA compared to Lattice Semiconductor’s B- rating and generally moderate scores. Lattice shows an advantage in debt to equity but overall scores favor Marvell.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Marvell Technology, Inc. and Lattice Semiconductor Corporation:

MRVL Scores

- Altman Z-Score: 6.76, indicating a safe financial zone with low bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial health and investment potential.

LSCC Scores

- Altman Z-Score: 52.69, indicating a safe financial zone with very low bankruptcy risk.

- Piotroski Score: 5, reflecting average financial health and moderate investment potential.

Which company has the best scores?

Based on the provided scores, LSCC has a significantly higher Altman Z-Score, suggesting stronger financial stability, while MRVL has a higher Piotroski Score, indicating better overall financial health. Each leads in different scoring aspects.

Grades Comparison

The following presents the recent grades issued by recognized grading companies for Marvell Technology, Inc. and Lattice Semiconductor Corporation:

Marvell Technology, Inc. Grades

This table summarizes the latest grades from major grading firms for Marvell Technology, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | Maintain | Buy | 2026-01-07 |

| Melius Research | Upgrade | Buy | 2026-01-05 |

| Benchmark | Downgrade | Hold | 2025-12-08 |

| B. Riley Securities | Maintain | Buy | 2025-12-03 |

| JP Morgan | Maintain | Overweight | 2025-12-03 |

| Susquehanna | Maintain | Positive | 2025-12-03 |

| Benchmark | Maintain | Buy | 2025-12-03 |

| Oppenheimer | Maintain | Outperform | 2025-12-03 |

| Stifel | Maintain | Buy | 2025-12-03 |

| Rosenblatt | Maintain | Buy | 2025-12-03 |

Overall, Marvell Technology’s grades predominantly reflect a Buy consensus, with occasional Hold and positive ratings, indicating steady analyst confidence with minor caution.

Lattice Semiconductor Corporation Grades

The following table details recent grading company ratings for Lattice Semiconductor Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-13 |

| Stifel | Maintain | Buy | 2025-11-04 |

| Baird | Maintain | Outperform | 2025-11-04 |

| Needham | Maintain | Buy | 2025-11-04 |

| Rosenblatt | Maintain | Buy | 2025-11-04 |

| Benchmark | Maintain | Buy | 2025-11-04 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Keybanc | Maintain | Overweight | 2025-09-30 |

| Needham | Maintain | Buy | 2025-09-22 |

| Benchmark | Maintain | Buy | 2025-09-11 |

Lattice Semiconductor’s grades consistently show Buy and Overweight ratings, with some Outperform and Positive opinions, illustrating a strong and stable analyst outlook.

Which company has the best grades?

Both Marvell Technology and Lattice Semiconductor carry a Buy consensus, but Lattice Semiconductor shows a slightly more uniform pattern of Buy and Overweight ratings without downgrades, potentially signaling steadier analyst confidence. This may influence investors seeking consistent endorsement signals.

Strengths and Weaknesses

Below is a comparison table summarizing the key strengths and weaknesses of Marvell Technology, Inc. (MRVL) and Lattice Semiconductor Corporation (LSCC) based on their recent financial performance and market position.

| Criterion | Marvell Technology, Inc. (MRVL) | Lattice Semiconductor Corporation (LSCC) |

|---|---|---|

| Diversification | Highly diversified with significant revenue from Data Center (4.16B), Enterprise Networking (626M), Carrier Infrastructure (338M), Automotive & Industrial (322M), and Consumer (316M) segments | Primarily focused on License and Service revenue (17M in 2022) with limited diversification |

| Profitability | Negative net margin (-15.35%), negative ROIC (-3.88%), and declining profitability; value destroying | Positive net margin (12%), slightly unfavorable ROIC (4.59%), but declining trend; value destroying |

| Innovation | Moderate innovation capacity but facing challenges reflected in declining ROIC and profitability | Innovation constrained by smaller scale but maintains efficient capital use with very low debt |

| Global presence | Strong global presence supported by large data center and networking segments | More niche market focus with smaller global footprint |

| Market Share | Large market share in Data Center and Networking markets | Smaller market share in specialized semiconductor licensing |

Key takeaways: Marvell shows broad diversification and strong presence in key tech sectors but struggles with profitability and value creation. Lattice is more narrowly focused but maintains better margin control and financial stability, though still faces challenges in growth and innovation. Both companies require caution due to declining returns on invested capital.

Risk Analysis

Below is a comparative table outlining key risks associated with Marvell Technology, Inc. (MRVL) and Lattice Semiconductor Corporation (LSCC) based on the most recent data available for 2025 and 2024 respectively:

| Metric | Marvell Technology, Inc. (MRVL) | Lattice Semiconductor Corporation (LSCC) |

|---|---|---|

| Market Risk | High beta (1.945) indicates elevated volatility. | High beta (1.716), moderately volatile. |

| Debt level | Moderate debt-to-equity ratio (0.32) with favorable debt-to-assets (21.5%). | Very low debt-to-equity (0.02) and debt-to-assets (1.81%), low financial leverage. |

| Regulatory Risk | Significant global footprint including China and Asia may expose to trade and regulatory uncertainties. | Also global but smaller scale; regulatory risk moderate. |

| Operational Risk | Negative net margin (-15.35%) and interest coverage (-3.72) suggest operational challenges and difficulty covering interest expenses. | Positive net margin (12%) and strong interest coverage (228.11) reflect operational strength. |

| Environmental Risk | No specific data, but semiconductor industry faces increasing scrutiny on environmental impact. | Similar industry exposure; environmental compliance remains important. |

| Geopolitical Risk | Operations in multiple Asia-Pacific countries including China, Taiwan, and South Korea, regions with geopolitical tensions. | Global operations but smaller exposure, still subject to geopolitical uncertainties. |

In synthesis, Marvell faces the most impactful risks in operational challenges and geopolitical exposure, particularly given its higher volatility, negative profitability, and interest coverage issues. Lattice Semiconductor exhibits stronger financial health and operational performance but must manage market volatility and maintain regulatory compliance. Investors should weigh Marvell’s higher risk profile against potential returns while considering Lattice’s stability and growth prospects.

Which Stock to Choose?

Marvell Technology, Inc. (MRVL) shows a mixed income evolution with a modest 4.7% revenue growth over one year but declining profitability and negative net margin (-15.35%). Financial ratios reveal more unfavorable than favorable indicators, including a negative ROE (-6.59%) and ROIC (-3.88%), yet a moderate debt level and decent liquidity. The company carries a very favorable B+ rating despite a very unfavorable MOAT due to declining value creation.

Lattice Semiconductor Corporation (LSCC) presents a favorable income profile with strong gross and net margins (66.82% and 12.0%) but recent revenue decline (-30.9%) and decreased profitability growth. Its financial ratios are slightly unfavorable overall, with favorable leverage and coverage ratios offset by high valuation multiples. LSCC holds a very favorable B- rating, though its MOAT is also very unfavorable, reflecting value destruction.

Considering ratings and overall financial profiles, MRVL might appeal to investors valuing moderate rating strength despite profitability challenges, while LSCC could be more attractive for those prioritizing solid income margins and strong liquidity but facing valuation concerns. Risk-averse investors could view LSCC’s stable margins favorably, whereas growth-oriented investors may see potential in MRVL’s revenue growth despite its weaker profitability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Marvell Technology, Inc. and Lattice Semiconductor Corporation to enhance your investment decisions: