In the fast-evolving semiconductor industry, Lattice Semiconductor Corporation (LSCC) and CEVA, Inc. (CEVA) stand out for their innovative approaches to technology licensing and product development. Both companies serve overlapping markets, focusing on connectivity, AI, and embedded solutions that drive modern electronics. This comparison will explore their strengths and risks, helping you decide which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Lattice Semiconductor Corporation and CEVA, Inc. by providing an overview of these two companies and their main differences.

Lattice Semiconductor Corporation Overview

Lattice Semiconductor Corporation develops and sells semiconductor products across Asia, Europe, and the Americas. The company offers field programmable gate arrays and video connectivity application-specific standard products. It licenses technology through IP licensing and patent monetization, serving original equipment manufacturers in communications, computing, consumer, industrial, and automotive markets. Lattice is headquartered in Hillsboro, Oregon, with a market cap of approximately 10.8B USD.

CEVA, Inc. Overview

CEVA, Inc. licenses wireless connectivity and smart sensing technologies to semiconductor and OEM companies globally. It designs digital signal processors, AI processors, wireless platforms, and software for sensor fusion, imaging, computer vision, and AI. CEVA targets mobile, consumer, automotive, robotics, industrial, aerospace, and IoT sectors. The company is based in Rockville, Maryland, with a market cap near 540M USD.

Key similarities and differences

Both Lattice and CEVA operate in the semiconductor industry and rely on technology licensing as a key revenue source. Lattice focuses on programmable gate arrays and video products, while CEVA specializes in DSP cores, AI processors, and wireless platforms. Lattice serves broader original equipment manufacturers, whereas CEVA targets specialized wireless and sensing applications for various high-tech markets. The scale difference is notable, with Lattice being significantly larger by market cap and workforce.

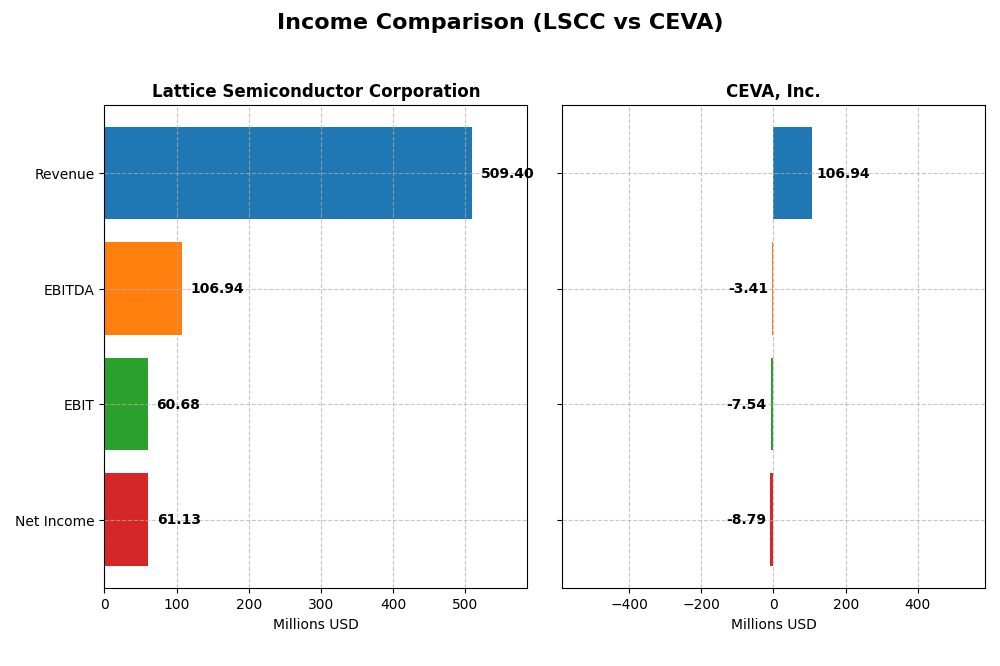

Income Statement Comparison

The table below compares the key income statement metrics for Lattice Semiconductor Corporation and CEVA, Inc. for the fiscal year 2024.

| Metric | Lattice Semiconductor Corporation | CEVA, Inc. |

|---|---|---|

| Market Cap | 10.8B USD | 538M USD |

| Revenue | 509M USD | 107M USD |

| EBITDA | 107M USD | -3.4M USD |

| EBIT | 61M USD | -7.5M USD |

| Net Income | 61M USD | -8.8M USD |

| EPS | 0.44 USD | -0.37 USD |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Lattice Semiconductor Corporation

Lattice Semiconductor showed a 25% revenue increase from 2020 to 2024, with net income growing nearly 29% over the same period. Margins remained stable, with a gross margin of 66.82% and a net margin of 12.0% in 2024. However, 2024 saw a sharp revenue decline of 31%, accompanied by a 66% drop in net margin, indicating a slowdown in profitability despite overall positive growth.

CEVA, Inc.

CEVA’s revenue increased modestly by 6.6% from 2020 to 2024, but net income declined significantly, with a 269% drop over the period. The company maintained a high gross margin of 88.06% in 2024, yet its EBIT and net margins remained negative at -7.06% and -8.22%, respectively. The most recent year showed revenue and margin improvements, with a 9.8% gross profit increase and a 32.6% net margin growth.

Which one has the stronger fundamentals?

Lattice Semiconductor demonstrates stronger fundamentals due to positive long-term growth in revenue and net income, coupled with favorable margin stability. Despite recent declines, its overall financial health appears better. CEVA, while showing recent margin improvements, has struggled with consistent net losses and negative margins over the period, indicating weaker profitability fundamentals.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Lattice Semiconductor Corporation (LSCC) and CEVA, Inc. based on their most recent fiscal year data (2024).

| Ratios | Lattice Semiconductor Corporation (LSCC) | CEVA, Inc. |

|---|---|---|

| ROE | 8.60% | -3.30% |

| ROIC | 7.75% | -8.56% |

| P/E | 133 | -84.8 |

| P/B | 11.41 | 2.79 |

| Current Ratio | 3.66 | 7.09 |

| Quick Ratio | 2.62 | 7.09 |

| D/E (Debt-to-Equity) | 0.021 | 0.021 |

| Debt-to-Assets | 1.81% | 1.79% |

| Interest Coverage | 130 | 0 |

| Asset Turnover | 0.60 | 0.34 |

| Fixed Asset Turnover | 7.62 | 8.43 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Lattice Semiconductor Corporation

Lattice Semiconductor shows a mixed financial profile with some strong points like a favorable quick ratio of 2.62 and low debt levels (DE 0.02, debt to assets 1.81%). However, it faces challenges with high valuation multiples (PE 132.74, PB 11.41) and an unfavorable current ratio of 3.66. The company does not pay dividends, likely due to reinvestment needs and growth strategy.

CEVA, Inc.

CEVA’s ratios are mostly weak, highlighted by negative profitability measures such as a -8.22% net margin and -3.3% ROE, alongside a concerning zero interest coverage. The firm maintains a strong liquidity position with a quick ratio of 7.09 and low debt, but the unfavorable asset turnover of 0.34 signals operational inefficiency. CEVA also does not distribute dividends, consistent with its negative earnings and focus on R&D.

Which one has the best ratios?

Between the two, Lattice Semiconductor presents a more balanced ratio profile, showing favorable leverage and liquidity metrics despite some overvaluation concerns. CEVA’s ratios reveal more pronounced profitability and operational weaknesses, with a higher proportion of unfavorable indicators. Overall, Lattice’s ratios suggest a relatively stronger financial standing compared to CEVA.

Strategic Positioning

This section compares the strategic positioning of LSCC and CEVA, including market position, key segments, and exposure to technological disruption:

LSCC

- Leading semiconductor company with significant market cap facing competitive pressure in tech.

- Focuses on field programmable gate arrays, IP licensing, and video connectivity for OEMs.

- Exposure to disruption through programmable logic and IP licensing amid evolving semiconductor tech.

CEVA

- Smaller market cap semiconductors licensor with moderate competitive pressure in wireless and AI tech.

- Licenses DSPs, AI processors, wireless platforms, and software for mobile, IoT, automotive, and robotics.

- Faces technological disruption in AI, 5G, IoT connectivity, and smart sensing requiring constant innovation.

LSCC vs CEVA Positioning

LSCC’s approach is diversified with product sales and licensing across multiple regions and markets, whereas CEVA is more concentrated on licensing advanced wireless and sensing technologies. LSCC benefits from broader market reach; CEVA focuses on specialized IP solutions.

Which has the best competitive advantage?

Both LSCC and CEVA show very unfavorable MOAT evaluations with declining ROIC and value destruction. Neither company currently demonstrates a sustainable competitive advantage based on recent capital efficiency trends.

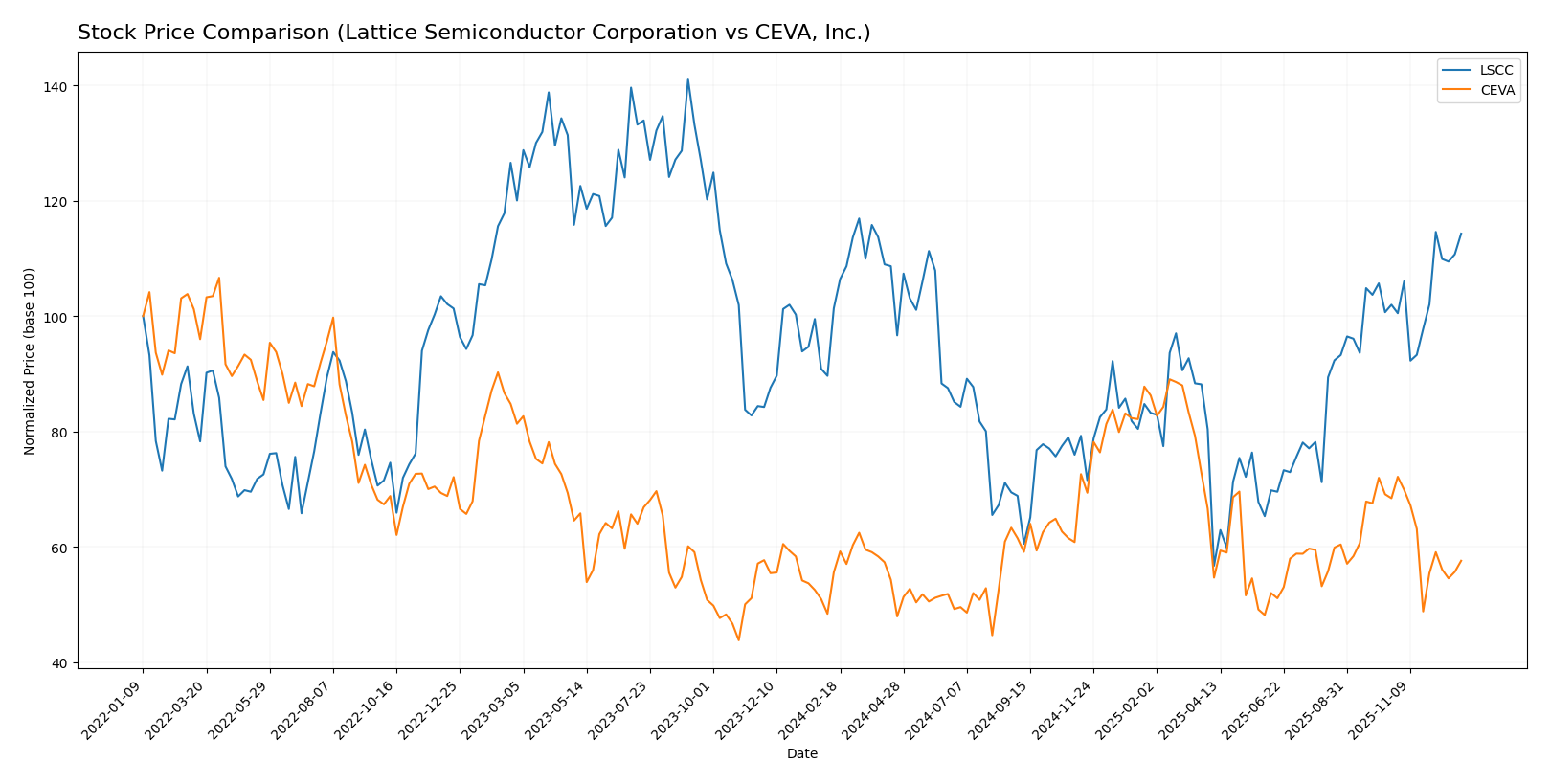

Stock Comparison

The stock price movements over the past 12 months reveal divergent dynamics, with Lattice Semiconductor Corporation exhibiting sustained bullish momentum and accelerating gains, while CEVA, Inc. shows moderate overall growth but recent weakening in price performance.

Trend Analysis

Lattice Semiconductor Corporation’s stock price increased by 12.78% over the last year, indicating a bullish trend with acceleration. The stock ranged from $39.03 to a high of $80.45, showing notable volatility (std deviation 10.57). Recent data confirm continued upward momentum.

CEVA, Inc.’s stock rose by 3.6% over the past year, signaling a bullish but decelerating trend. Prices fluctuated between $17.39 and $34.67, with lower volatility (std deviation 4.4). However, recent months show a sharp decline of 15.84%, reflecting weakening investor sentiment.

Comparing both, Lattice Semiconductor’s stock outperformed CEVA’s over the last year, delivering the highest market gains and stronger recent momentum despite greater volatility.

Target Prices

The current analyst target consensus reflects optimistic expectations for these semiconductor companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Lattice Semiconductor Corporation | 85 | 65 | 79 |

| CEVA, Inc. | 28 | 28 | 28 |

For Lattice Semiconductor, the consensus target of 79 is slightly above the current price of 78.65, signaling moderate upside potential. CEVA’s target consensus of 28 exceeds its current price of 22.42, indicating stronger anticipated growth from analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Lattice Semiconductor Corporation and CEVA, Inc.:

Rating Comparison

LSCC Rating

- Rating: B-, classified as Very Favorable

- Discounted Cash Flow Score: 3, indicating Moderate

- Return on Equity Score: 2, indicating Moderate

- Return on Assets Score: 3, indicating Moderate

- Debt To Equity Score: 4, indicating Favorable

- Overall Score: 2, indicating Moderate

CEVA Rating

- Rating: C+, classified as Very Favorable

- Discounted Cash Flow Score: 3, indicating Moderate

- Return on Equity Score: 1, indicating Very Unfavorable

- Return on Assets Score: 1, indicating Very Unfavorable

- Debt To Equity Score: 4, indicating Favorable

- Overall Score: 2, indicating Moderate

Which one is the best rated?

Based strictly on provided data, LSCC holds a higher rating (B-) compared to CEVA’s C+, with better scores in return on equity and return on assets, while both share similar discounted cash flow, debt to equity, and overall scores.

Scores Comparison

The scores comparison between Lattice Semiconductor Corporation and CEVA, Inc. is as follows:

LSCC Scores

- Altman Z-Score of 38.99 indicates a strong safe zone.

- Piotroski Score of 5 reflects average financial health.

CEVA Scores

- Altman Z-Score of 11.52 indicates a strong safe zone.

- Piotroski Score of 4 reflects average financial health.

Which company has the best scores?

Based on the provided data, LSCC has a higher Altman Z-Score and a slightly better Piotroski Score than CEVA. Both are in the safe zone for bankruptcy risk and have average financial strength scores.

Grades Comparison

The following is a summary of recent grades assigned by reputable grading companies for both companies:

Lattice Semiconductor Corporation Grades

This table shows the latest grades assigned to Lattice Semiconductor Corporation by major grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Baird | Maintain | Outperform | 2025-11-04 |

| Needham | Maintain | Buy | 2025-11-04 |

| Stifel | Maintain | Buy | 2025-11-04 |

| Benchmark | Maintain | Buy | 2025-11-04 |

| Rosenblatt | Maintain | Buy | 2025-11-04 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Keybanc | Maintain | Overweight | 2025-09-30 |

| Needham | Maintain | Buy | 2025-09-22 |

| Benchmark | Maintain | Buy | 2025-09-11 |

| Benchmark | Maintain | Buy | 2025-08-05 |

The grades for Lattice Semiconductor Corporation consistently indicate a strong buy or outperform stance with no recent downgrades, reflecting positive analyst sentiment.

CEVA, Inc. Grades

This table presents the most recent grades for CEVA, Inc. from recognized grading organizations.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-11-12 |

| Rosenblatt | Maintain | Buy | 2025-11-11 |

| Rosenblatt | Maintain | Buy | 2025-08-14 |

| Oppenheimer | Maintain | Outperform | 2025-05-09 |

| Rosenblatt | Maintain | Buy | 2025-05-08 |

| Barclays | Maintain | Overweight | 2025-05-08 |

| Rosenblatt | Maintain | Buy | 2025-04-23 |

| Barclays | Maintain | Overweight | 2025-02-14 |

| Rosenblatt | Maintain | Buy | 2025-02-14 |

| Rosenblatt | Maintain | Buy | 2025-02-11 |

CEVA, Inc. has maintained a stable pattern of buy and overweight ratings, indicating sustained confidence from analysts.

Which company has the best grades?

Both companies have received predominantly positive grades with no downgrades, but Lattice Semiconductor Corporation shows a slightly stronger consensus with multiple “Buy” and “Outperform” ratings from diverse firms. This may signal relatively higher analyst conviction, potentially influencing investors’ confidence in its prospects.

Strengths and Weaknesses

Below is a comparison table highlighting the key strengths and weaknesses of Lattice Semiconductor Corporation (LSCC) and CEVA, Inc. based on their recent financial performance, market position, and operational metrics.

| Criterion | Lattice Semiconductor Corporation (LSCC) | CEVA, Inc. |

|---|---|---|

| Diversification | Moderate: Focuses primarily on FPGA products and licensing; some service revenue (~$17M in 2022) | Moderate: Revenue split between licensing (~$60M) and royalties (~$47M); product focus in connectivity and sensing |

| Profitability | Mixed: Positive net margin (12%), but ROIC below WACC, indicating value destruction | Negative net margin (-8.2%) and negative ROIC, indicating ongoing losses and value destruction |

| Innovation | Moderate: Stable product and licensing revenue but declining ROIC trend (-6.6%) | Moderate to low: Declining ROIC trend (-3486%), signaling challenges in maintaining competitive advantage |

| Global presence | Solid presence with distributor network supporting ~$330M in product revenue | Global licensing footprint in wireless and sensing markets, growing royalties indicate expanding reach |

| Market Share | Niche market player in low-power FPGAs with steady product revenue | Specializes in licensing IP for connectivity and sensing, with growing licensing revenue |

Key takeaways: Both companies face challenges as their ROIC trails their cost of capital, signaling value destruction. LSCC shows better profitability and a more balanced asset turnover, while CEVA struggles with negative margins and a steep decline in returns, warranting cautious evaluation before investment.

Risk Analysis

Below is a comparative table of key risks for Lattice Semiconductor Corporation (LSCC) and CEVA, Inc. based on the latest 2024 data:

| Metric | Lattice Semiconductor (LSCC) | CEVA, Inc. (CEVA) |

|---|---|---|

| Market Risk | High beta 1.73; volatile tech sector | Beta 1.47; moderate volatility |

| Debt level | Very low debt-to-equity 0.02; strong interest coverage | Very low debt 0.02; zero interest coverage raises concern |

| Regulatory Risk | Moderate, US and global semiconductor regulations | Moderate, licensing and IP regulations in wireless tech |

| Operational Risk | Medium; complex supply chain and innovation demands | Medium-high; reliance on licensing and tech development |

| Environmental Risk | Low; semiconductor manufacturing impacts controlled | Low; less direct manufacturing footprint |

| Geopolitical Risk | Medium; global supply chains sensitive to trade policies | High; exposure to international markets and tech export controls |

The most impactful risks are market volatility for LSCC and CEVA, driven by sector sensitivity and technological innovation pace. CEVA’s zero interest coverage ratio signals potential financial stress, increasing operational risk. Geopolitical tensions affecting semiconductor supply chains and licensing environments remain a key concern for both companies.

Which Stock to Choose?

Lattice Semiconductor Corporation (LSCC) shows a favorable income statement overall despite a 30.9% revenue decline in 2024. Its profitability metrics include a 12% net margin and a moderate return on invested capital (7.75%). The company maintains low debt levels and a strong interest coverage ratio, with a very favorable B- rating reflecting balanced strengths and weaknesses.

CEVA, Inc. (CEVA) reports positive revenue growth of 9.77% in 2024 but exhibits persistent losses with negative net margin (-8.22%) and returns on equity (-3.3%). While debt levels remain low, its financial ratios are mostly unfavorable, and it carries a very favorable C+ rating tempered by weaker profitability and operating performance.

For investors prioritizing stable profitability and overall financial health, LSCC’s favorable income metrics and balanced rating might appear more attractive. Conversely, those focused on growth potential could find CEVA’s revenue gains and valuation metrics suggestive of opportunities, despite its current value destruction and weaker profitability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Lattice Semiconductor Corporation and CEVA, Inc. to enhance your investment decisions: