In the competitive world of packaged foods, The Kraft Heinz Company (KHC) and Lamb Weston Holdings, Inc. (LW) stand out as two major players with distinct yet overlapping market footprints. Kraft Heinz offers a broad range of grocery staples globally, while Lamb Weston specializes in frozen potato products with a strong presence in retail and foodservice. This article will help you decide which company holds the most promise for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between The Kraft Heinz Company and Lamb Weston Holdings, Inc. by providing an overview of these two companies and their main differences.

The Kraft Heinz Company Overview

The Kraft Heinz Company operates in the packaged foods industry, manufacturing and marketing a broad range of food and beverage products globally. Its portfolio includes condiments, dairy, meals, meats, beverages, and snacks. The company sells through multiple channels, including direct sales, brokers, and online platforms, serving retail and foodservice customers. It is headquartered in Pittsburgh, Pennsylvania, and employs about 36K people.

Lamb Weston Holdings, Inc. Overview

Lamb Weston Holdings, Inc. specializes in producing and marketing frozen potato products worldwide, including value-added frozen potatoes and appetizers. It operates through segments like Global, Foodservice, and Retail, selling under various brands and retailer labels. Serving foodservice and retail customers, the company is based in Eagle, Idaho, with around 10.7K employees. It focuses primarily on frozen potato products and related commercial ingredients.

Key similarities and differences

Both companies operate in the consumer defensive sector within the packaged foods industry, serving retail and foodservice markets worldwide. Kraft Heinz offers a broader product range encompassing multiple food categories, while Lamb Weston is more specialized in frozen potato products. Kraft Heinz has a significantly larger workforce and market capitalization, reflecting its more diversified product portfolio and distribution channels.

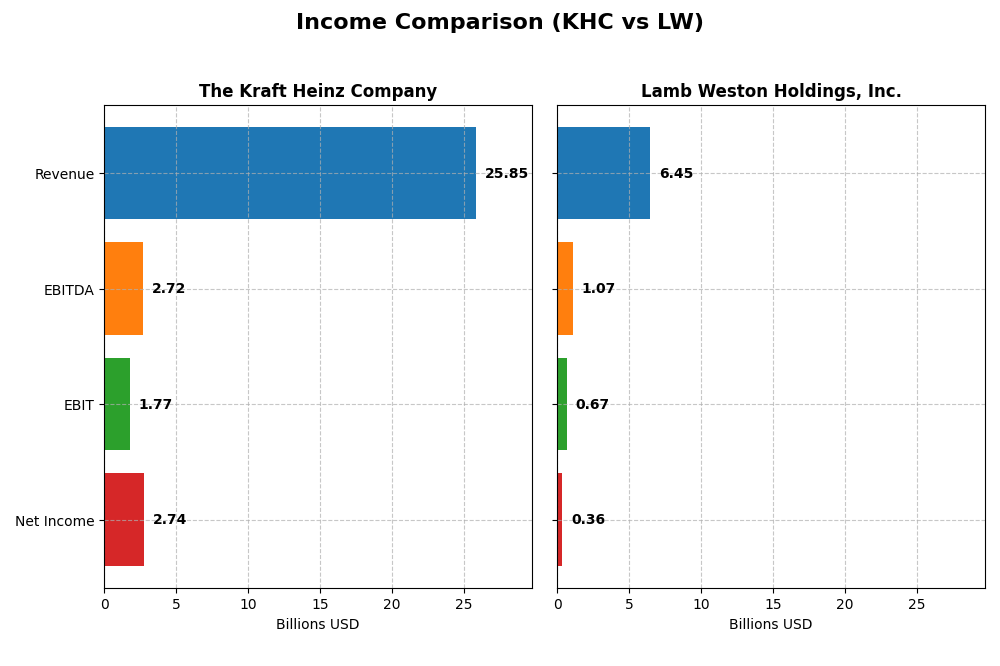

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for The Kraft Heinz Company and Lamb Weston Holdings, Inc. for their most recent fiscal years.

| Metric | The Kraft Heinz Company (KHC) | Lamb Weston Holdings, Inc. (LW) |

|---|---|---|

| Market Cap | 27.7B | 5.8B |

| Revenue | 25.8B (2024) | 6.5B (2025) |

| EBITDA | 2.7B (2024) | 1.1B (2025) |

| EBIT | 1.8B (2024) | 665M (2025) |

| Net Income | 2.7B (2024) | 357M (2025) |

| EPS | 2.27 (2024) | 2.51 (2025) |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

The Kraft Heinz Company

From 2020 to 2024, Kraft Heinz’s revenue showed a slight decline of -1.29%, while net income grew substantially by 670.79%. Gross margin remained stable at 34.7%, considered favorable, but EBIT margin was neutral at 6.84%. In 2024, revenue decreased by 2.98% and EBIT declined sharply by 61.1%, reflecting some operational challenges despite a slight gross profit increase.

Lamb Weston Holdings, Inc.

Lamb Weston experienced significant revenue growth of 75.74% over 2021–2025, with net income rising modestly by 12.4%. Its gross margin was favorable at 21.68%, and EBIT margin stood at a favorable 10.31%. However, in the most recent year, revenue slightly fell by 0.25% and net margin dropped by 50.64%, signaling a notable contraction in profitability despite overall growth.

Which one has the stronger fundamentals?

Both companies present mixed signals: Kraft Heinz benefits from strong net income growth and stable gross margins but struggles with recent revenue and EBIT declines. Lamb Weston shows robust revenue expansion and favorable margins historically but faces recent steep profit margin erosion. Each displays strengths and weaknesses, resulting in a neutral overall fundamental assessment.

Financial Ratios Comparison

This table presents a side-by-side comparison of key financial ratios for The Kraft Heinz Company (KHC) and Lamb Weston Holdings, Inc. (LW) based on their most recent fiscal year data.

| Ratios | The Kraft Heinz Company (KHC) 2024 | Lamb Weston Holdings, Inc. (LW) 2025 |

|---|---|---|

| ROE | 5.58% | 20.56% |

| ROIC | 6.61% | 7.43% |

| P/E | 13.53 | 22.21 |

| P/B | 0.75 | 4.56 |

| Current Ratio | 1.06 | 1.38 |

| Quick Ratio | 0.59 | 0.68 |

| D/E (Debt to Equity) | 0.40 | 2.39 |

| Debt-to-Assets | 22.5% | 56.2% |

| Interest Coverage | 1.85 | 3.70 |

| Asset Turnover | 0.29 | 0.87 |

| Fixed Asset Turnover | 3.61 | 1.68 |

| Payout Ratio | 70.4% | 57.9% |

| Dividend Yield | 5.20% | 2.61% |

Interpretation of the Ratios

The Kraft Heinz Company

The Kraft Heinz Company shows a mixed ratio profile with 50% favorable, 28.57% unfavorable, and 21.43% neutral ratios, leading to a slightly favorable overall assessment. Key strengths include a solid price-to-earnings ratio at 13.53 and a low price-to-book value of 0.75, though return on equity at 5.58% and interest coverage ratios are weak. The company pays dividends with a 5.2% yield, reflecting a balanced payout supported by free cash flow, but investors should monitor cash conversion and coverage risks.

Lamb Weston Holdings, Inc.

Lamb Weston Holdings, Inc. displays a less favorable ratio set, with only 21.43% favorable and 28.57% unfavorable, and half of its ratios rated neutral, resulting in a slightly unfavorable global view. The company enjoys a strong return on equity of 20.56% and a favorable dividend yield of 2.61%, but high debt-to-equity (2.39) and debt-to-assets (56.21%) ratios raise concerns about leverage. The modest payout is supported but caution is warranted due to leverage and weaker liquidity metrics.

Which one has the best ratios?

Comparing the two, The Kraft Heinz Company presents a more balanced and slightly favorable ratio profile, notably with better valuation and leverage metrics. Lamb Weston, while demonstrating stronger profitability and dividend yield, carries higher leverage and mixed liquidity ratios. Overall, Kraft Heinz’s ratios suggest a more stable financial footing, whereas Lamb Weston’s elevated debt levels introduce greater risk despite robust returns.

Strategic Positioning

This section compares the strategic positioning of KHC and LW, including Market position, Key segments, and disruption:

The Kraft Heinz Company (KHC)

- Large market cap (~27.7B USD) with low beta, indicating defensive stance; faces broad packaged foods competition.

- Diversified product portfolio: condiments, dairy, meals, snacks, coffee, beverages; multiple grocery and foodservice channels.

- Limited explicit exposure to technological disruption in traditional food production and distribution sectors.

Lamb Weston Holdings, Inc. (LW)

- Smaller market cap (~5.8B USD) with moderate beta, focused on packaged frozen potato products; niche competitive pressure.

- Concentrated in frozen potato products with segments: Global, Foodservice, Retail; serves retail, foodservice, and restaurants.

- No explicit indication of technological disruption exposure; operates in value-added frozen food manufacturing.

The Kraft Heinz Company vs Lamb Weston Holdings, Inc. Positioning

KHC employs a diversified approach across numerous food categories and broad distribution channels, offering risk spreading but complexity. LW focuses on a concentrated frozen potato niche, potentially enabling operational focus but less diversification.

Which has the best competitive advantage?

KHC demonstrates a very favorable economic moat with growing ROIC, indicating durable competitive advantage. LW also creates value but shows a declining ROIC trend, reflecting a slightly favorable moat with less sustainable profitability.

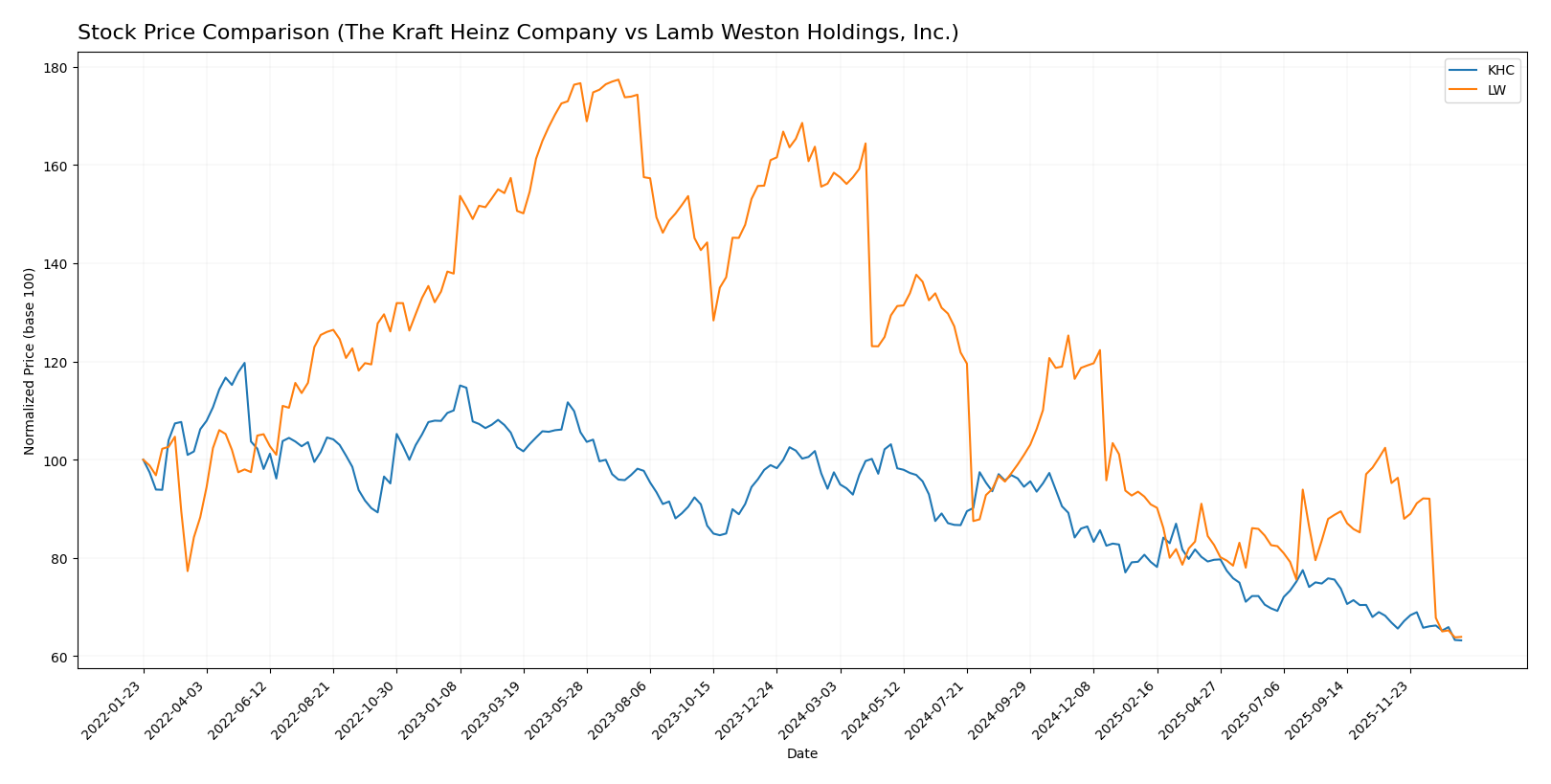

Stock Comparison

The stock price movements of The Kraft Heinz Company (KHC) and Lamb Weston Holdings, Inc. (LW) over the past year reveal significant bearish trends with differing volatility and volume dynamics, reflecting distinct trading behaviors and market pressures.

Trend Analysis

The Kraft Heinz Company (KHC) experienced a bearish trend over the past 12 months with a price decline of -35.12%, showing acceleration in the downward movement. Price volatility remained moderate with a standard deviation of 4.13.

Lamb Weston Holdings, Inc. (LW) also showed a bearish trend, with a steeper price drop of -59.65% over the same period, but with deceleration in its decline. The stock exhibited higher volatility, reflected by a standard deviation of 15.2.

Comparing both, KHC delivered the highest market performance over the past year, as its price decline was less severe than LW’s, indicating relatively better resilience despite the bearish environment.

Target Prices

The target price consensus for these packaged foods companies reflects moderate upside potential according to analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| The Kraft Heinz Company | 28 | 24 | 26.29 |

| Lamb Weston Holdings, Inc. | 68 | 46 | 52.67 |

Analysts expect Kraft Heinz’s price to rise modestly from its current $23.39, while Lamb Weston shows stronger upside from $41.43, indicating more bullish sentiment.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for The Kraft Heinz Company and Lamb Weston Holdings, Inc.:

Rating Comparison

KHC Rating

- Rating: B- with a status of Very Favorable, reflecting moderate overall financial strength.

- Discounted Cash Flow Score: 5, Very Favorable, suggests KHC may be undervalued based on DCF.

- ROE Score: 1, Very Unfavorable, signals low efficiency in generating profit from equity.

- ROA Score: 1, Very Unfavorable, points to poor asset utilization by KHC.

- Debt To Equity Score: 3, Moderate, suggests balanced financial risk management for KHC.

- Overall Score: 3, Moderate, denotes average financial standing for KHC.

LW Rating

- Rating: B with a status of Very Favorable, indicating a slightly stronger overall outlook.

- Discounted Cash Flow Score: 4, Favorable, shows LW is fairly valued but less so than KHC.

- ROE Score: 5, Very Favorable, indicates LW efficiently generates profit from shareholders.

- ROA Score: 4, Favorable, reflects good asset utilization by LW.

- Debt To Equity Score: 1, Very Unfavorable, indicates LW has higher financial risk.

- Overall Score: 3, Moderate, also indicates average overall financial health for LW.

Which one is the best rated?

Based strictly on the provided data, LW holds a higher rating (B vs. B-) and scores significantly better on ROE and ROA, indicating superior profitability and asset use. However, KHC shows a stronger discounted cash flow score and better debt management, balancing the comparison.

Scores Comparison

The scores comparison between The Kraft Heinz Company and Lamb Weston Holdings, Inc. is as follows:

KHC Scores

- Altman Z-Score: 0.44, in the distress zone indicating high bankruptcy risk.

- Piotroski Score: 6, classified as average financial strength.

LW Scores

- Altman Z-Score: 2.75, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 9, classified as very strong financial strength.

Which company has the best scores?

Based solely on the provided data, Lamb Weston Holdings, Inc. has stronger scores with a higher Altman Z-Score in the grey zone and a very strong Piotroski Score of 9, compared to Kraft Heinz’s distress zone Z-Score and average Piotroski Score.

Grades Comparison

This section compares the recent grades and ratings assigned to The Kraft Heinz Company and Lamb Weston Holdings, Inc.:

The Kraft Heinz Company Grades

The following table shows the most recent grades from reputable grading companies for KHC:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2025-12-15 |

| Barclays | Maintain | Equal Weight | 2025-10-31 |

| JP Morgan | Maintain | Neutral | 2025-10-30 |

| UBS | Maintain | Neutral | 2025-10-30 |

| TD Cowen | Maintain | Hold | 2025-10-30 |

| Evercore ISI Group | Maintain | In Line | 2025-10-30 |

| Piper Sandler | Maintain | Neutral | 2025-10-30 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-30 |

| Mizuho | Maintain | Neutral | 2025-10-28 |

| UBS | Maintain | Neutral | 2025-10-08 |

The overall trend for The Kraft Heinz Company shows consistent neutral to hold ratings, with no upgrades or downgrades recently.

Lamb Weston Holdings, Inc. Grades

The following table presents the latest grades from established grading firms for LW:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2025-12-23 |

| Barclays | Maintain | Overweight | 2025-12-23 |

| B of A Securities | Maintain | Neutral | 2025-12-22 |

| Stifel | Maintain | Hold | 2025-12-22 |

| Deutsche Bank | Maintain | Hold | 2025-12-22 |

| Wells Fargo | Maintain | Overweight | 2025-10-01 |

| B of A Securities | Maintain | Neutral | 2025-10-01 |

| Barclays | Maintain | Overweight | 2025-07-25 |

| Wells Fargo | Maintain | Overweight | 2025-07-24 |

| Wells Fargo | Maintain | Overweight | 2025-07-09 |

Lamb Weston Holdings, Inc. shows a stronger consensus with multiple overweight ratings, suggesting a more favorable outlook compared to KHC.

Which company has the best grades?

Lamb Weston Holdings, Inc. has received generally better grades, with several overweight ratings versus Kraft Heinz’s neutral and hold grades. This may indicate a comparatively stronger market sentiment toward LW, potentially affecting investor interest and stock performance expectations.

Strengths and Weaknesses

Below is a comparative table highlighting key strengths and weaknesses of The Kraft Heinz Company (KHC) and Lamb Weston Holdings, Inc. (LW) based on their recent financial performance, innovation, diversification, global presence, and market share.

| Criterion | The Kraft Heinz Company (KHC) | Lamb Weston Holdings, Inc. (LW) |

|---|---|---|

| Diversification | Highly diversified product portfolio across multiple food categories, including condiments, meals, dairy, and beverages. | More focused on frozen potato products with segments in foodservice, retail, and global markets. |

| Profitability | Moderate net margin (10.6%), stable ROIC (6.6%), favorable P/E (13.5), but low ROE (5.6%) and some liquidity concerns. | Lower net margin (5.5%), higher ROE (20.6%), better ROIC (7.4%), but higher debt levels and weaker liquidity ratios. |

| Innovation | Steady innovation in product lines with growing ROIC indicating efficient capital use and competitive advantage. | Innovation is less pronounced; profitability is declining as indicated by a negative ROIC trend. |

| Global presence | Strong global footprint with diverse geographic sales and a wide range of product categories. | Expanding global segment but less diversified geographically compared to KHC. |

| Market Share | Large market share in packaged foods and condiments, benefiting from strong brand recognition. | Leading in frozen potato products with a niche market share but vulnerable to competition. |

Key takeaways: KHC offers strong diversification and a durable competitive advantage with growing profitability, though some efficiency and liquidity issues remain. LW shows solid profitability metrics but faces challenges with declining ROIC and higher leverage, implying higher risk despite niche market strength. Investors should weigh KHC’s stability against LW’s growth potential and risk profile.

Risk Analysis

Below is a comparison of key risks for The Kraft Heinz Company (KHC) and Lamb Weston Holdings, Inc. (LW) based on the most recent data for 2025 and 2024:

| Metric | The Kraft Heinz Company (KHC) | Lamb Weston Holdings, Inc. (LW) |

|---|---|---|

| Market Risk | Low beta (0.065), stable price range | Moderate beta (0.442), wider price range |

| Debt Level | Moderate debt/equity (0.4), debt to assets 22.5% | High debt/equity (2.39), debt to assets 56.2% |

| Regulatory Risk | Moderate, food industry regulations | Moderate, food industry and international trade |

| Operational Risk | Medium, asset turnover low (0.29) | Medium, asset turnover better (0.87) |

| Environmental Risk | Moderate, consumer defensive sector exposure | Moderate, agricultural supply chain sensitivities |

| Geopolitical Risk | Moderate, international markets exposure | Moderate, global supply and trade dependencies |

KHC’s biggest risks lie in its moderate leverage and operational efficiency issues, as reflected in low asset turnover and interest coverage. LW faces more significant financial risk due to high debt levels, though it benefits from stronger profitability and financial health scores. The most impactful risk for KHC is financial distress potential, indicated by an Altman Z-score in the distress zone (0.44). LW’s risk is more balanced but debt remains a key concern despite a better Altman Z-score (2.75, grey zone). Both companies operate in regulated food sectors with moderate exposure to geopolitical and environmental factors.

Which Stock to Choose?

The Kraft Heinz Company (KHC) shows a mixed income evolution with declining revenue but strong net income growth over 2020-2024. Its financial ratios are slightly favorable overall, with good valuation metrics and manageable debt levels. Profitability is moderate, and its debt-to-equity and interest coverage ratios indicate some financial risk. The company’s rating is very favorable, supported by a very favorable moat indicating durable competitive advantage and growing ROIC.

Lamb Weston Holdings, Inc. (LW) exhibits a neutral income statement overall, with strong revenue growth but recent declines in margins and earnings. Its financial ratios are slightly unfavorable, mainly due to high debt and valuation concerns, despite strong returns on equity and assets. LW’s rating is very favorable, with a slightly favorable moat signifying value creation but a declining ROIC trend. Bankruptcy risk is lower than KHC’s, reflected by a better Altman Z-score and a very strong Piotroski score.

Investors seeking stability and a durable competitive advantage might find KHC’s profile more aligned with quality investing, given its favorable moat and steady value creation. Conversely, those focused on higher returns with tolerance for financial leverage and margin variability could interpret LW’s strong equity returns and growth potential as attractive for growth-oriented strategies. Both stocks present risks and merits that could appeal differently depending on individual investment goals and risk tolerance.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Kraft Heinz Company and Lamb Weston Holdings, Inc. to enhance your investment decisions: