Home > Comparison > Consumer Defensive > MKC vs LW

The strategic rivalry between McCormick & Company and Lamb Weston defines the current trajectory of the packaged foods sector. McCormick operates as a global leader in spices and flavor solutions, emphasizing branded consumer products and B2B seasoning blends. In contrast, Lamb Weston focuses on value-added frozen potato products with a strong presence in retail and foodservice. This analysis weighs their distinct growth models to identify the superior risk-adjusted option for diversified portfolios.

Table of contents

Companies Overview

McCormick & Company and Lamb Weston Holdings dominate distinct niches within the packaged foods sector, shaping consumer tastes globally.

McCormick & Company, Incorporated: Global Flavor Innovator

McCormick leads as a global manufacturer of spices, seasonings, and condiments, generating revenue through Consumer and Flavor Solutions segments. It focuses on expanding its diverse portfolio of branded and private-label products worldwide. In 2026, it emphasized innovation and geographic diversification to strengthen its market foothold across foodservice and retail channels.

Lamb Weston Holdings, Inc.: Frozen Potato Specialist

Lamb Weston excels as a producer of value-added frozen potato products, serving retail and foodservice markets internationally. Its revenue stems from four segments including Global and Foodservice, leveraging brands like Alexia and Grown in Idaho. The company prioritizes expanding product variety and distribution channels while tapping into evolving consumer preferences in convenience foods.

Strategic Collision: Similarities & Divergences

Both companies operate in packaged foods but diverge in focus: McCormick champions a broad seasoning portfolio, while Lamb Weston specializes in frozen potatoes. Their battleground lies in meeting consumer demand for flavor and convenience through innovation and channel expansion. McCormick’s diverse brand ecosystem contrasts with Lamb Weston’s niche product mastery, defining distinct investment profiles shaped by scale and specialization.

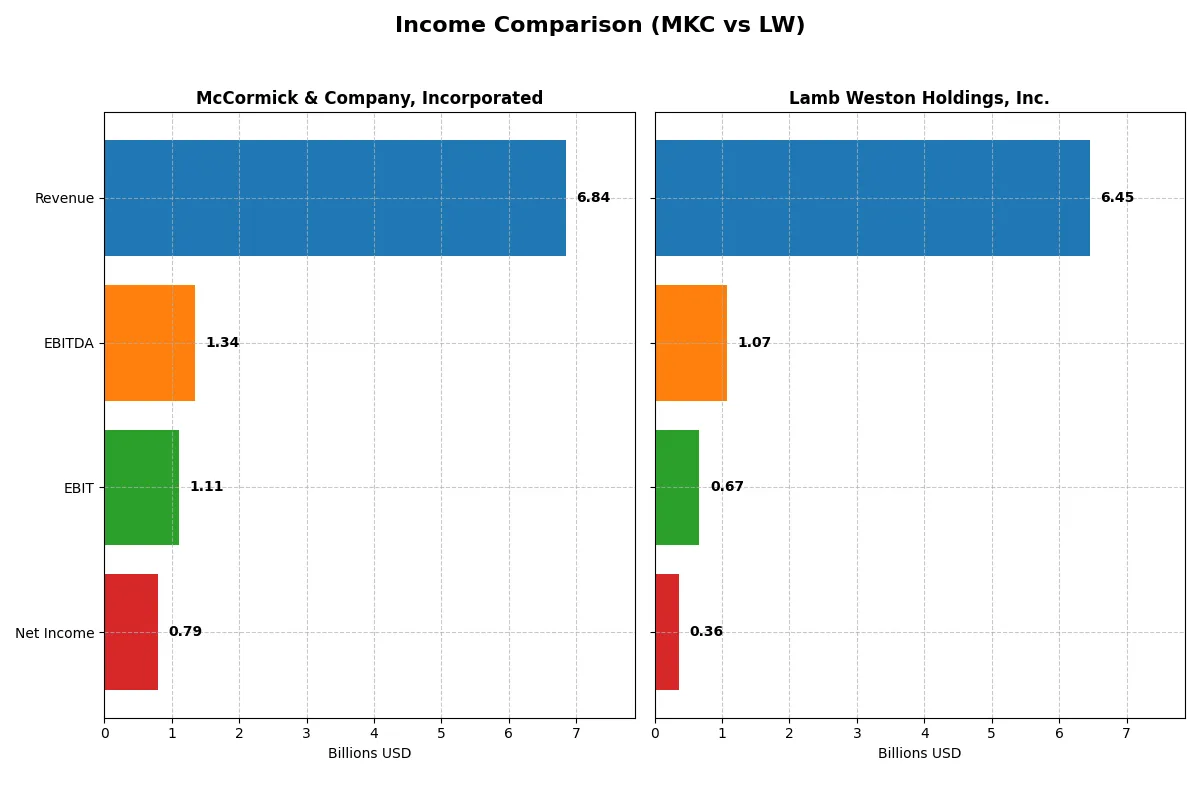

Income Statement Comparison

This table dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | McCormick & Company, Incorporated (MKC) | Lamb Weston Holdings, Inc. (LW) |

|---|---|---|

| Revenue | 6.84B | 6.45B |

| Cost of Revenue | 4.25B | 5.05B |

| Operating Expenses | 1.50B | 0.73B |

| Gross Profit | 2.59B | 1.40B |

| EBITDA | 1.34B | 1.07B |

| EBIT | 1.11B | 0.67B |

| Interest Expense | 0.20B | 0.18B |

| Net Income | 0.79B | 0.36B |

| EPS | 2.94 | 2.51 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes the true operational efficiency and profitability momentum of two distinct corporate engines.

McCormick & Company, Incorporated Analysis

McCormick’s revenue climbed steadily to 6.84B in 2025, with net income rising to 789M. Gross margin holds firm near 38%, and net margin remains robust at 11.5%, signaling consistent profitability. The latest year shows stable EBIT and EPS growth, reflecting efficient cost control and resilient earnings despite slight revenue growth deceleration.

Lamb Weston Holdings, Inc. Analysis

Lamb Weston’s revenue reached 6.45B in 2025, slightly down from the previous year, while net income fell sharply to 357M. Gross margin contracted to 21.7% and net margin shrank to 5.5%, indicating margin pressure. The latest fiscal year reveals a notable decline in EBIT and EPS, highlighting challenges in sustaining profitability amid cost headwinds.

Margin Strength vs. Growth Volatility

McCormick delivers superior margin quality and steady bottom-line gains, outperforming Lamb Weston’s higher revenue scale but volatile profitability. McCormick’s consistent margin expansion and controlled expenses mark it as the fundamentally stronger performer. Investors favoring stability and efficiency may find McCormick’s profile more attractive than Lamb Weston’s cyclical earnings swings.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | McCormick & Company, Inc. (MKC) | Lamb Weston Holdings, Inc. (LW) |

|---|---|---|

| ROE | 13.76% | 20.56% |

| ROIC | 7.93% | 7.43% |

| P/E | 22.59 | 20.13 |

| P/B | 3.11 | 4.14 |

| Current Ratio | 0.70 | 1.38 |

| Quick Ratio | 0.28 | 0.68 |

| D/E | 0.70 | 2.39 |

| Debt-to-Assets | 30.3% | 56.2% |

| Interest Coverage | 5.57 | 3.70 |

| Asset Turnover | 0.52 | 0.87 |

| Fixed Asset Turnover | 4.72 | 1.68 |

| Payout ratio | 61.2% | 57.9% |

| Dividend yield | 2.71% | 2.88% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as the company’s DNA, exposing hidden risks and operational strengths that shape investment decisions precisely.

McCormick & Company, Incorporated

McCormick posts a solid 13.8% ROE and a favorable net margin of 11.5%, signaling efficient core profitability. Its P/E of 22.6 is fairly valued, though a 3.1 P/B ratio appears stretched. The company supports shareholders with a 2.7% dividend yield, balancing returns with reinvestment in operational excellence.

Lamb Weston Holdings, Inc.

Lamb Weston displays a stronger ROE at 20.6% but a lower net margin of 5.5%, reflecting moderate profitability. Its P/E ratio at 20.1 is reasonable, yet a high 4.1 P/B signals valuation risk. The 2.9% dividend yield rewards shareholders while the firm manages higher leverage, increasing financial risk.

Valuation Discipline vs. Profitability Leverage

McCormick offers a more balanced risk profile with modest valuation and stable profitability. Lamb Weston excels in ROE but carries heavier debt and stretched valuation. Investors seeking operational safety may prefer McCormick; those targeting higher returns with elevated risk might consider Lamb Weston.

Which one offers the Superior Shareholder Reward?

I find McCormick & Company delivers a more sustainable shareholder reward in 2026. McCormick balances a solid 2.7% dividend yield with a 61% payout ratio, backed by strong free cash flow coverage (77%). Its disciplined buyback program complements dividends, enhancing total returns. Lamb Weston offers a higher 2.9% yield but suffers from weaker free cash flow coverage (27%) and a less consistent buyback intensity. Lamb Weston’s elevated debt ratios also raise risk. Historically, McCormick’s distribution approach aligns better with long-term value creation, making it the superior total return choice amid current market conditions.

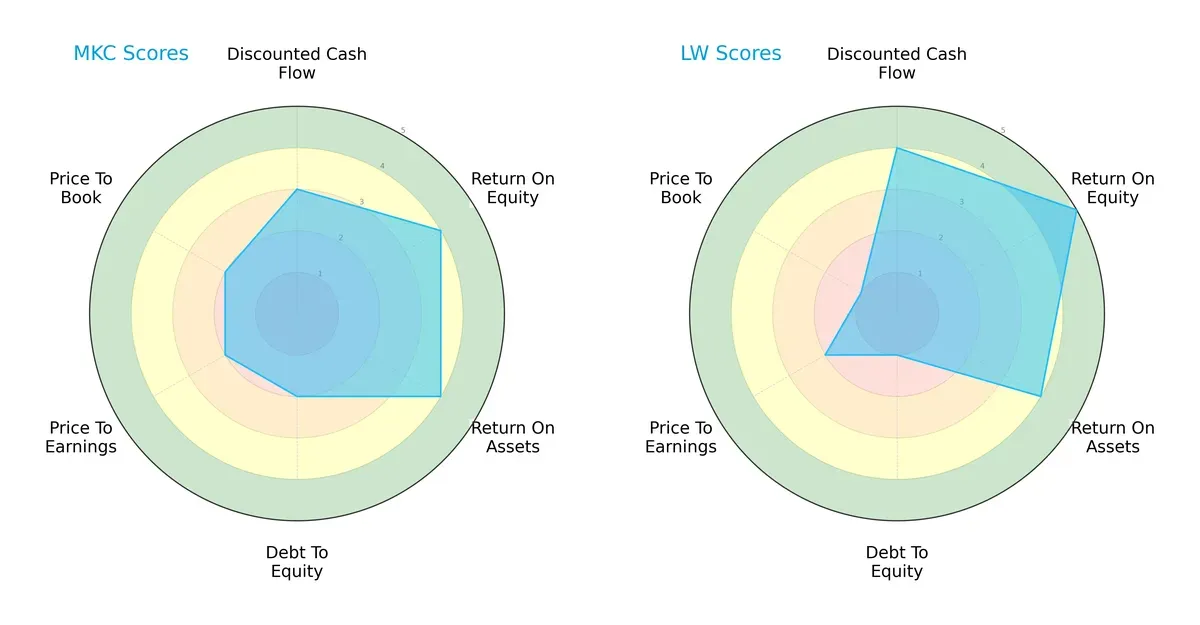

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of McCormick & Company and Lamb Weston, highlighting their financial strengths and vulnerabilities:

Lamb Weston leads with a stronger discounted cash flow (4 vs. 3) and return on equity (5 vs. 4), signaling superior profitability and valuation appeal. McCormick shows a more balanced debt-to-equity score (2 vs. 1), indicating better financial stability. Both firms score equally on return on assets (4) and price-to-earnings (2), but McCormick edges Lamb Weston on price-to-book (2 vs. 1). Overall, Lamb Weston relies on operational efficiency, while McCormick maintains steadier leverage management.

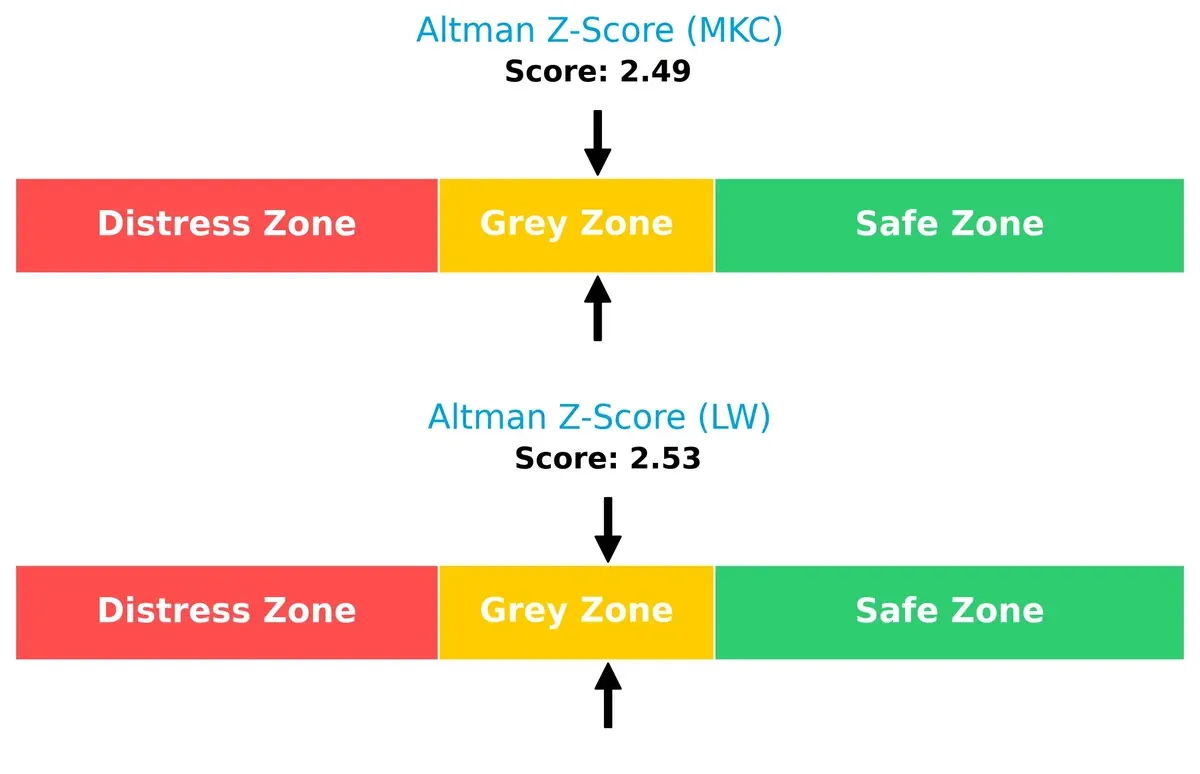

Bankruptcy Risk: Solvency Showdown

The Altman Z-Scores place both firms in the “grey zone,” suggesting moderate bankruptcy risk in this cycle:

McCormick scores 2.49, slightly below Lamb Weston’s 2.53, indicating comparable but cautious financial health. Neither company is in the safe zone, so investors must monitor leverage and liquidity closely amid market volatility.

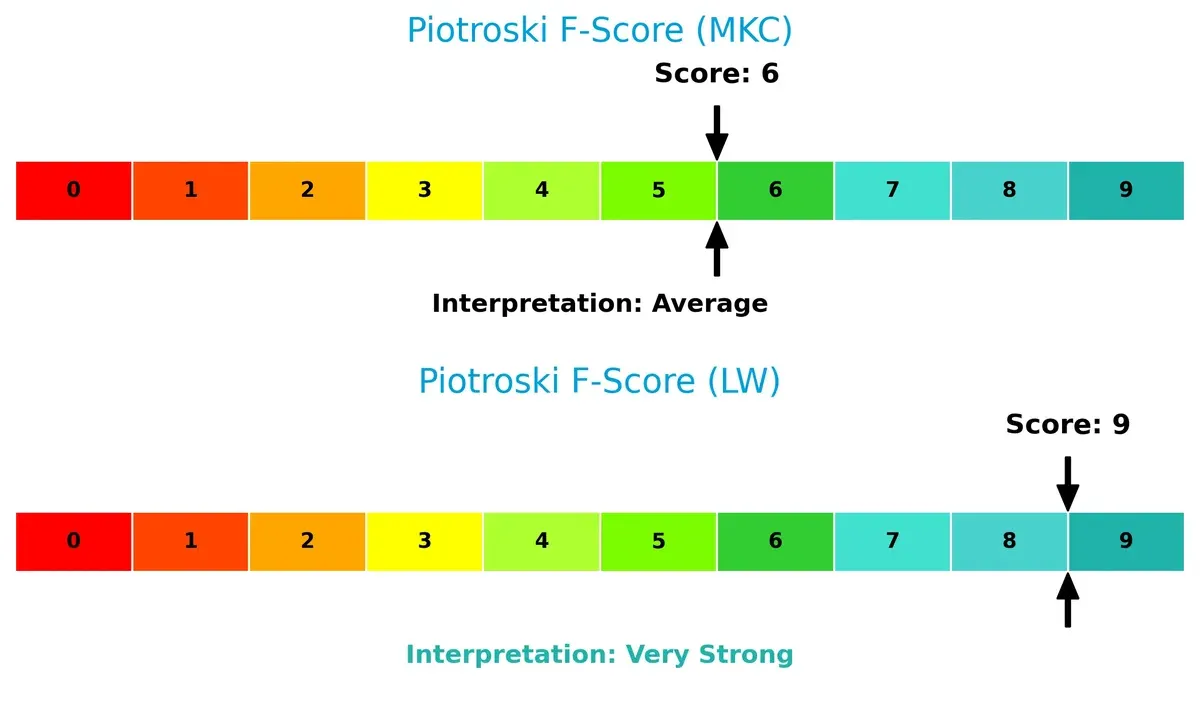

Financial Health: Quality of Operations

Lamb Weston’s Piotroski F-Score of 9 signals peak operational health, while McCormick’s 6 is average, highlighting potential internal weaknesses:

Lamb Weston excels in profitability, liquidity, and efficiency metrics, suggesting strong management and capital allocation. McCormick’s moderate score flags some red flags in its financial fundamentals, warranting closer scrutiny before commitment.

How are the two companies positioned?

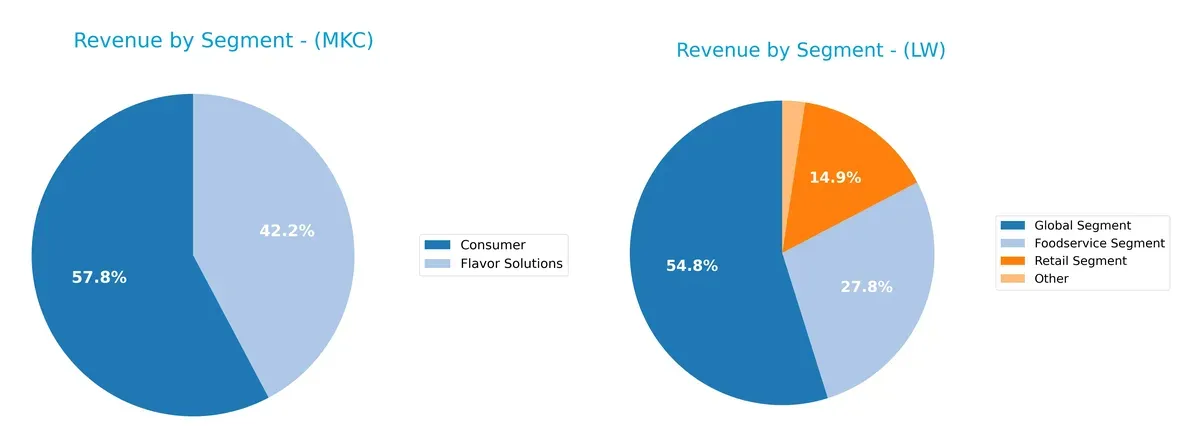

This section dissects the operational DNA of McCormick & Company and Lamb Weston by comparing their revenue distribution by segment and internal dynamics. The goal is to confront their economic moats to identify which offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how McCormick & Company and Lamb Weston diversify their income streams and where their primary sector bets lie:

McCormick anchors its revenue in two balanced segments: Consumer at $3.95B and Flavor Solutions at $2.89B, showcasing a focused yet diversified portfolio. Lamb Weston leans heavily on its Global Segment at $2.93B, dwarfing Foodservice at $1.49B and Retail at $798M. This concentration exposes Lamb Weston to sector-specific risks but underlines its infrastructure dominance globally, while McCormick pivots on a stable dual-segment ecosystem.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of McCormick & Company and Lamb Weston Holdings based on diversification, profitability, financials, innovation, global presence, and market share:

McCormick & Company Strengths

- Diversified revenue from Consumer and Flavor Solutions segments

- Favorable net margin at 11.54%

- Strong interest coverage at 5.65

- Low WACC at 6.18% supports capital efficiency

- High fixed asset turnover at 4.72

- Dividend yield at 2.71%

Lamb Weston Holdings Strengths

- High ROE at 20.56% indicates strong profitability

- Favorable WACC at 4.89% reduces capital costs

- Diverse revenue with Foodservice, Global, Retail segments

- Neutral current ratio at 1.38 implies liquidity balance

- Dividend yield slightly higher at 2.88%

- Global and North America geographic coverage

McCormick & Company Weaknesses

- Unfavorable liquidity with current ratio 0.7 and quick ratio 0.28

- High price-to-book at 3.11 may signal overvaluation

- Neutral ROE and ROIC suggest room for improvement

- Moderate debt level with D/E at 0.7

- Neutral asset turnover at 0.52 limits efficiency

Lamb Weston Holdings Weaknesses

- High debt-to-equity ratio at 2.39 signals leverage risk

- Unfavorable debt-to-assets ratio at 56.21%

- Quick ratio unfavorable at 0.68 suggests liquidity pressure

- Neutral interest coverage at 3.69 is less robust

- Elevated price-to-book at 4.14 may indicate overvaluation

McCormick excels in margin control, asset efficiency, and capital costs but faces liquidity challenges. Lamb Weston shows superior profitability and geographic breadth but carries higher financial leverage and liquidity risks. These factors will shape each company’s strategic focus on financial health and growth opportunities.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only thing protecting long-term profits from the erosion of competition. Let’s analyze how McCormick and Lamb Weston defend their turf:

McCormick & Company, Incorporated: Intangible Assets Moat

McCormick’s primary moat lies in strong brand recognition and proprietary blends. This drives stable 16% EBIT margins and consistent ROIC growth. New product innovation and global expansion could deepen its moat in 2026.

Lamb Weston Holdings, Inc.: Cost Advantage Moat

Lamb Weston’s moat stems from scale-driven cost efficiencies in frozen potato production. Despite a higher ROIC than McCormick, its declining profitability signals margin pressures. Market expansion and product diversification remain key future opportunities.

Intangible Assets vs. Cost Leadership: Who Defends Better?

McCormick’s growing ROIC and brand power create a deeper moat than Lamb Weston’s cost advantage, which faces margin contraction. I see McCormick better poised to sustain and grow market share.

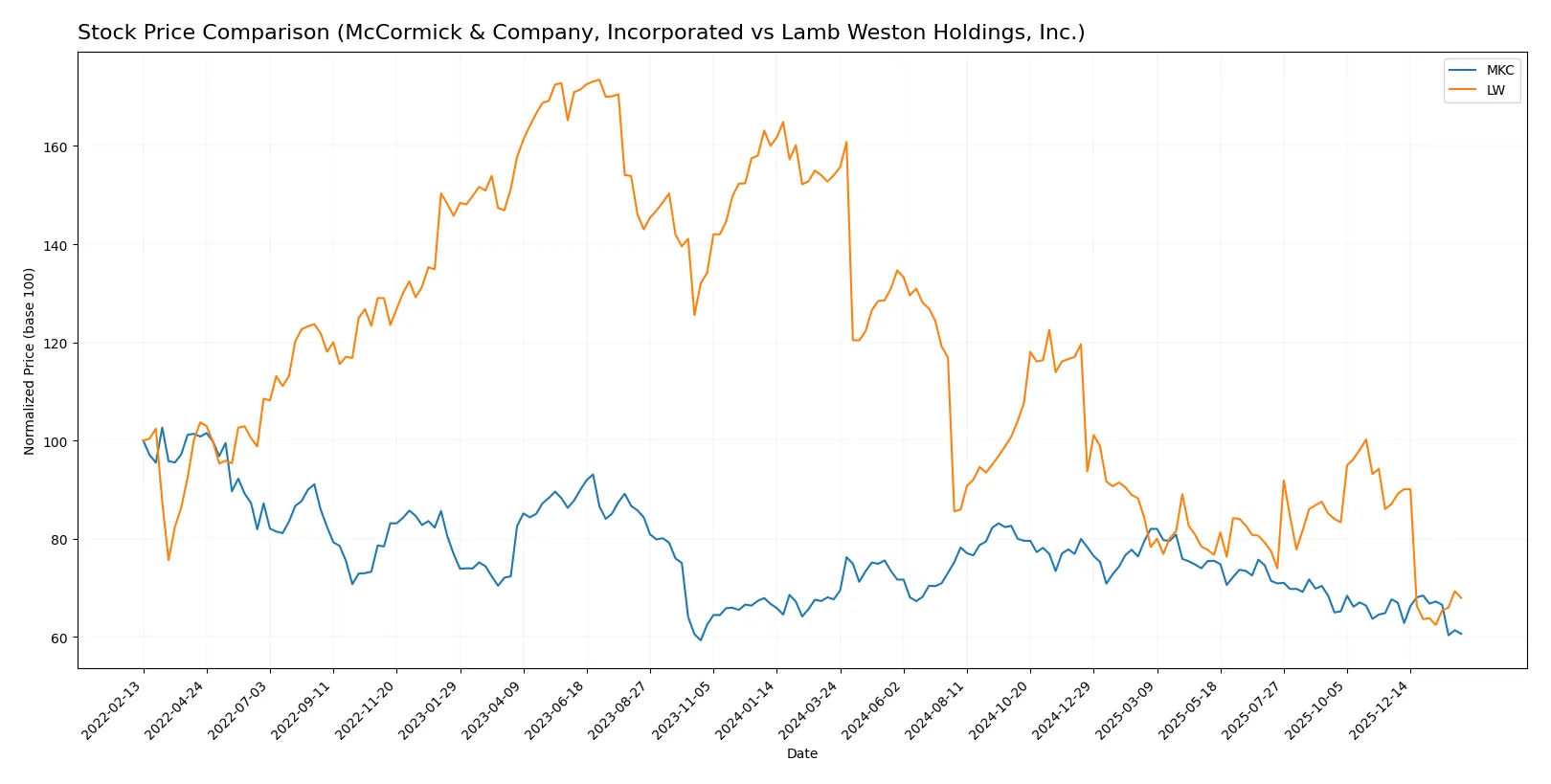

Which stock offers better returns?

Over the past 12 months, both McCormick & Company and Lamb Weston Holdings have experienced significant price declines, with notable deceleration in their downtrends and contrasting trading volume dynamics.

Trend Comparison

McCormick & Company’s stock fell 10.37% over the last year, marking a bearish trend with decelerating losses. The price ranged from a high of 83.76 to a low of 60.79, showing moderate volatility (5.41 std deviation).

Lamb Weston Holdings’ stock declined 55.89% in the same period, also bearish with deceleration. It showed greater volatility (14.19 std deviation) and a wider price range between 106.53 and 41.37.

Comparing both, McCormick’s stock delivered higher relative market performance, with a smaller percentage loss and less extreme volatility than Lamb Weston.

Target Prices

Analysts set a moderate upside for these packaged foods companies, indicating cautious optimism.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| McCormick & Company, Incorporated | 67 | 85 | 73.57 |

| Lamb Weston Holdings, Inc. | 46 | 68 | 52.67 |

McCormick’s consensus target exceeds its current price of 61.1 by about 20%, suggesting room for appreciation. Lamb Weston’s target implies a roughly 17% upside from its 45.02 price, reflecting moderate growth expectations.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

McCormick & Company, Incorporated Grades

The following table summarizes recent institutional grades for McCormick & Company, Incorporated:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-26 |

| UBS | Maintain | Neutral | 2026-01-23 |

| Stifel | Maintain | Hold | 2026-01-23 |

| Bernstein | Maintain | Outperform | 2025-10-08 |

| Barclays | Maintain | Equal Weight | 2025-10-08 |

| Jefferies | Maintain | Buy | 2025-10-08 |

| Deutsche Bank | Maintain | Hold | 2025-10-08 |

| UBS | Maintain | Neutral | 2025-10-08 |

| Stifel | Maintain | Hold | 2025-10-08 |

| UBS | Maintain | Neutral | 2025-10-01 |

Lamb Weston Holdings, Inc. Grades

The following table summarizes recent institutional grades for Lamb Weston Holdings, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2025-12-23 |

| Barclays | Maintain | Overweight | 2025-12-23 |

| Stifel | Maintain | Hold | 2025-12-22 |

| Deutsche Bank | Maintain | Hold | 2025-12-22 |

| B of A Securities | Maintain | Neutral | 2025-12-22 |

| B of A Securities | Maintain | Neutral | 2025-10-01 |

| Wells Fargo | Maintain | Overweight | 2025-10-01 |

| Barclays | Maintain | Overweight | 2025-07-25 |

| Wells Fargo | Maintain | Overweight | 2025-07-24 |

| Wells Fargo | Maintain | Overweight | 2025-07-09 |

Which company has the best grades?

Lamb Weston Holdings holds generally stronger grades, with multiple Overweight ratings from Wells Fargo and Barclays. McCormick’s ratings cluster around Hold and Neutral, with fewer Buy or Outperform grades. Investors might interpret Lamb Weston’s more bullish consensus as a sign of higher growth expectations.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

McCormick & Company, Incorporated

- Operates in a highly competitive packaged foods market with strong brand portfolio but faces pricing pressure and consumer shifts.

Lamb Weston Holdings, Inc.

- Competes in frozen potato products with strong foodservice exposure, vulnerable to changing consumer preferences and commodity price swings.

2. Capital Structure & Debt

McCormick & Company, Incorporated

- Moderate leverage (D/E 0.7), manageable debt load, strong interest coverage (5.65x), but weak liquidity ratios pose risk.

Lamb Weston Holdings, Inc.

- High leverage (D/E 2.39), elevated debt-to-assets (56.2%), weaker interest coverage (3.69x), raising financial risk concerns.

3. Stock Volatility

McCormick & Company, Incorporated

- Beta of 0.61 signals lower volatility and defensive appeal in turbulent markets.

Lamb Weston Holdings, Inc.

- Beta of 0.44 indicates lower volatility but less upside in bullish phases compared to peers.

4. Regulatory & Legal

McCormick & Company, Incorporated

- Subject to food safety and labeling regulations globally; potential risk from evolving international trade policies.

Lamb Weston Holdings, Inc.

- Faces regulatory scrutiny in food safety and agricultural imports; exposure to tariffs and trade restrictions impacts margins.

5. Supply Chain & Operations

McCormick & Company, Incorporated

- Diverse supplier base mitigates risk but global supply chain disruptions could increase costs.

Lamb Weston Holdings, Inc.

- Reliance on agricultural input supply chain exposes firm to weather volatility and logistic bottlenecks.

6. ESG & Climate Transition

McCormick & Company, Incorporated

- ESG initiatives underway but faces pressure to improve resource efficiency and reduce carbon footprint.

Lamb Weston Holdings, Inc.

- High exposure to climate risks in agriculture; sustainability investments critical to maintain market access.

7. Geopolitical Exposure

McCormick & Company, Incorporated

- Global presence including emerging markets increases geopolitical risk but also growth opportunities.

Lamb Weston Holdings, Inc.

- Primarily North American focus limits geopolitical risk but less diversification to offset regional shocks.

Which company shows a better risk-adjusted profile?

McCormick faces operational and liquidity risks despite moderate leverage, while Lamb Weston carries higher financial risk due to elevated debt. McCormick’s diversified portfolio and stronger interest coverage lend it a more balanced risk profile. Lamb Weston’s high leverage and supply chain sensitivity heighten its vulnerability. I remain cautious on Lamb Weston’s capital structure and operational exposure, favoring McCormick for risk-adjusted stability.

Final Verdict: Which stock to choose?

McCormick & Company stands out for its resilient profitability and steadily improving return on capital. Its superpower lies in operational efficiency within a competitive sector. A point of vigilance is its weak liquidity position, indicating potential short-term financial stress. It suits portfolios seeking steady income with moderate growth — a Defensive Growth profile.

Lamb Weston commands a strategic moat through premium market positioning and strong return on equity. Its recurring cash flow and dividend yield offer a cushion against volatility, though its high leverage signals elevated financial risk compared to McCormick. It aligns with Growth at a Reasonable Price (GARP) investors willing to accept cyclical swings for long-term value creation.

If you prioritize stable cash generation and operational discipline, McCormick offers a compelling choice due to its consistent profitability and improving capital returns. However, if you seek higher growth potential with a willingness to tolerate financial leverage, Lamb Weston outshines by delivering superior equity returns and a robust dividend, albeit with increased risk.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of McCormick & Company, Incorporated and Lamb Weston Holdings, Inc. to enhance your investment decisions: