Home > Comparison > Technology > LRCX vs SKYT

The strategic rivalry between Lam Research Corporation and SkyWater Technology, Inc. shapes the semiconductor sector’s innovation and supply chain dynamics. Lam Research, a capital-intensive equipment manufacturer, contrasts with SkyWater’s nimble semiconductor development and manufacturing services. This head-to-head pits established scale and technological breadth against specialized, flexible production. This analysis will identify which firm’s trajectory offers superior risk-adjusted returns for a diversified portfolio amid evolving industry demands.

Table of contents

Companies Overview

Lam Research and SkyWater Technology hold key roles in the semiconductor industry, shaping chip manufacturing worldwide.

Lam Research Corporation: Semiconductor Equipment Powerhouse

Lam Research dominates the semiconductor equipment market, generating revenue by designing and servicing advanced wafer fabrication tools. Its core competitive advantage lies in precision etching and deposition systems that serve major chipmakers globally. In 2026, Lam’s strategic focus remains on expanding its portfolio of high-end plasma and atomic layer deposition technologies to meet evolving semiconductor complexity.

SkyWater Technology, Inc.: Specialty Semiconductor Manufacturer

SkyWater Technology operates as a specialized semiconductor manufacturer and development partner, focusing on analog, power discrete, and rad-hard integrated circuits. Its revenue engine hinges on providing tailored manufacturing services and co-development support across defense, automotive, and IoT sectors. In 2026, SkyWater emphasizes scaling its contract manufacturing capabilities to capture niche markets requiring custom, high-reliability chips.

Strategic Collision: Similarities & Divergences

Lam Research and SkyWater both serve semiconductor clients but differ fundamentally in approach—Lam invests in proprietary equipment for wafer fabrication, while SkyWater offers foundry services and co-engineering. Their primary battleground lies in advanced semiconductor production, yet Lam competes on technology innovation and scale, whereas SkyWater targets specialized applications with customer collaboration. This divergence shapes distinct investment profiles: Lam as a technology platform leader, SkyWater as a nimble, niche manufacturer.

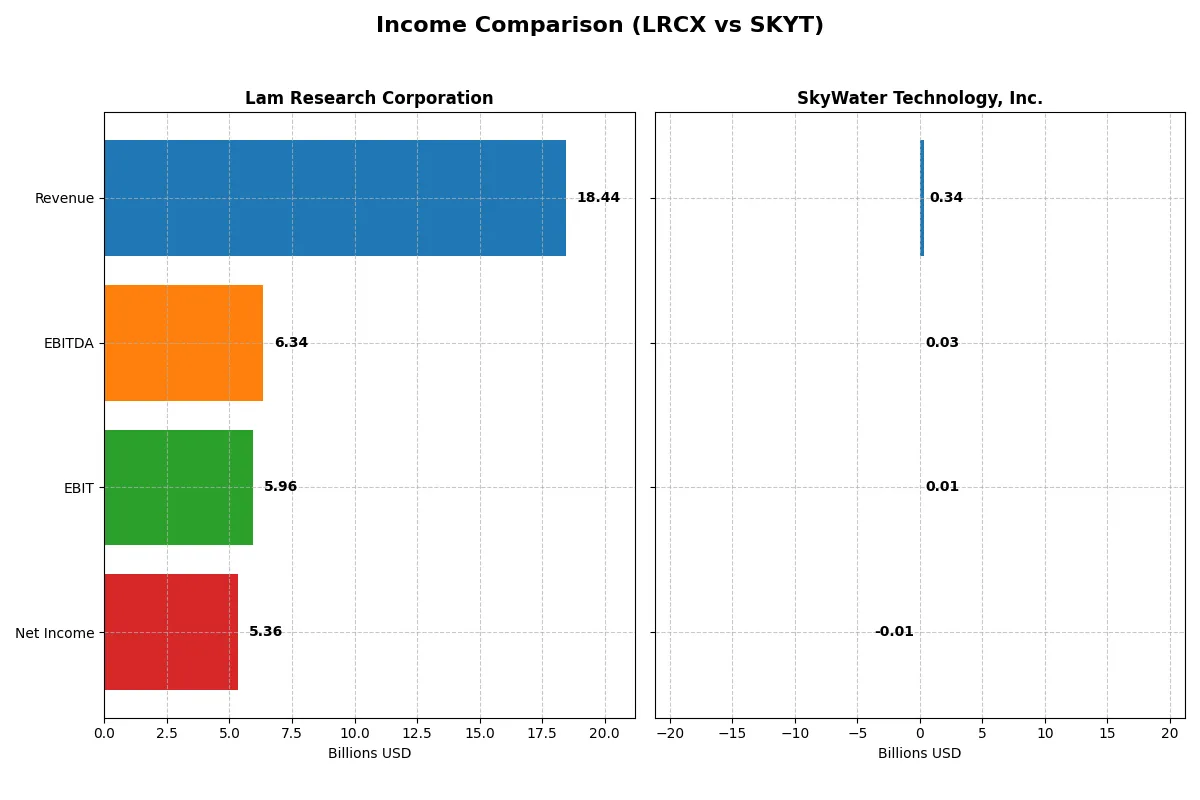

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Lam Research Corporation (LRCX) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Revenue | 18.4B | 342M |

| Cost of Revenue | 9.46B | 273M |

| Operating Expenses | 3.08B | 63.1M |

| Gross Profit | 8.98B | 70M |

| EBITDA | 6.34B | 25.3M |

| EBIT | 5.96B | 6.56M |

| Interest Expense | 178M | 8.84M |

| Net Income | 5.36B | -6.79M |

| EPS | 4.17 | -0.14 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs a more efficient and profitable corporate engine through recent financial performance.

Lam Research Corporation Analysis

Lam Research’s revenue climbed steadily to $18.4B in 2025, with net income surging to $5.4B. Its gross margin remains strong at 48.7%, while net margin sits at a robust 29.1%. In 2025, Lam accelerates earnings growth with a 31% rise in EBIT, showcasing impressive operational efficiency and solid margin expansion.

SkyWater Technology, Inc. Analysis

SkyWater’s revenue grew 19% to $342M in 2024, but it still registers a net loss of $6.8M. Gross margin improved to 20.3%, yet net margin remains negative at -2.0%. Despite weak profitability, SkyWater’s 144% EBIT growth in 2024 signals improving operational leverage and momentum from a challenging baseline.

Margin Power vs. Revenue Scale

Lam Research dominates with superior scale and profitability, delivering double-digit net margins and consistent EPS growth. SkyWater shows promising topline momentum with significant margin recovery but remains unprofitable. For investors prioritizing consistent earnings and operational strength, Lam’s profile offers a clearer path to value creation.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency for the companies compared below:

| Ratios | Lam Research Corporation (LRCX) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| ROE | 54.3% | -11.8% |

| ROIC | 34.0% | 3.4% |

| P/E | 23.4 | -100.3 |

| P/B | 12.7 | 11.8 |

| Current Ratio | 2.21 | 0.86 |

| Quick Ratio | 1.55 | 0.76 |

| D/E | 0.48 | 1.33 |

| Debt-to-Assets | 22.3% | 24.5% |

| Interest Coverage | 33.1 | 0.74 |

| Asset Turnover | 0.86 | 1.09 |

| Fixed Asset Turnover | 7.59 | 2.07 |

| Payout Ratio | 21.5% | 0% |

| Dividend Yield | 0.92% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing hidden operational strengths and risks beneath the surface.

Lam Research Corporation

Lam Research dominates with a robust 54.33% ROE and strong 29.06% net margin, signaling exceptional profitability. Its P/E of 23.36 and P/B of 12.69 show a stretched valuation, but not overly expensive. The firm returns value modestly through a 0.92% dividend yield, balancing shareholder rewards with reinvestment in R&D (11.37% of revenue).

SkyWater Technology, Inc.

SkyWater struggles with a negative ROE of -11.79% and a -1.98% net margin, reflecting operational challenges. Its P/E is negative, which appears favorable but stems from losses. The company shows weak liquidity with a 0.86 current ratio and high debt (D/E 1.33), offering no dividend and focusing on growth through R&D (4.39% of revenue).

Premium Valuation vs. Operational Safety

Lam Research offers a superior balance of profitability and operational strength despite a premium valuation. SkyWater’s unfavorable ratios and liquidity issues represent higher risk. Investors seeking stability and operational excellence will find Lam Research a better fit, while risk-tolerant investors might consider SkyWater’s turnaround potential.

Which one offers the Superior Shareholder Reward?

Lam Research Corporation (LRCX) pays a consistent dividend with a yield near 0.9% and a sustainable payout ratio around 21%. Its free cash flow comfortably covers dividends, supporting steady returns. LRCX also executes robust buybacks, amplifying total shareholder reward. In contrast, SkyWater Technology, Inc. (SKYT) pays no dividends and shows negative net margins. Its modest buyback activity is limited by weak cash flow and high leverage. I view LRCX’s balanced dividend and aggressive buyback strategy as a superior model for long-term shareholder value in 2026.

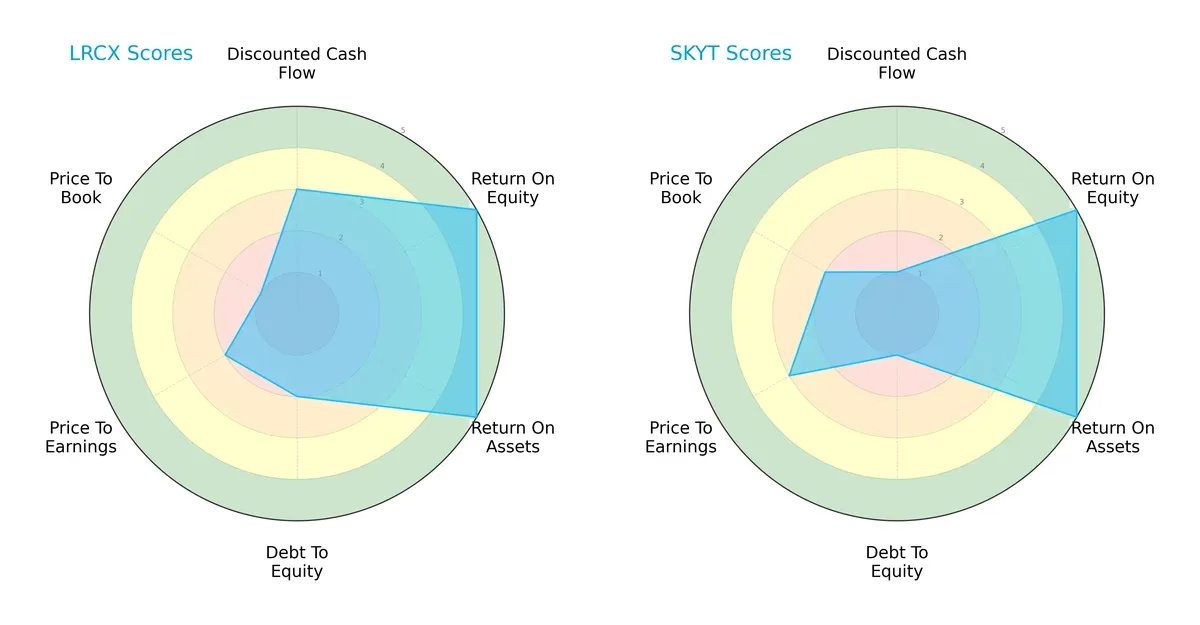

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Lam Research and SkyWater Technology, highlighting their operational and valuation contrasts:

Lam Research boasts superior returns on equity and assets (both scored 5), signaling operational efficiency. SkyWater matches this profitability but lags in discounted cash flow (1 vs. 3 for Lam) and exhibits weaker debt management (debt/equity score 1 vs. 2). Valuation metrics favor SkyWater modestly on P/E and P/B ratios, suggesting a relative bargain. Overall, Lam Research presents a more balanced profile, leveraging profitability and moderate leverage, while SkyWater relies heavily on valuation appeal despite financial risk.

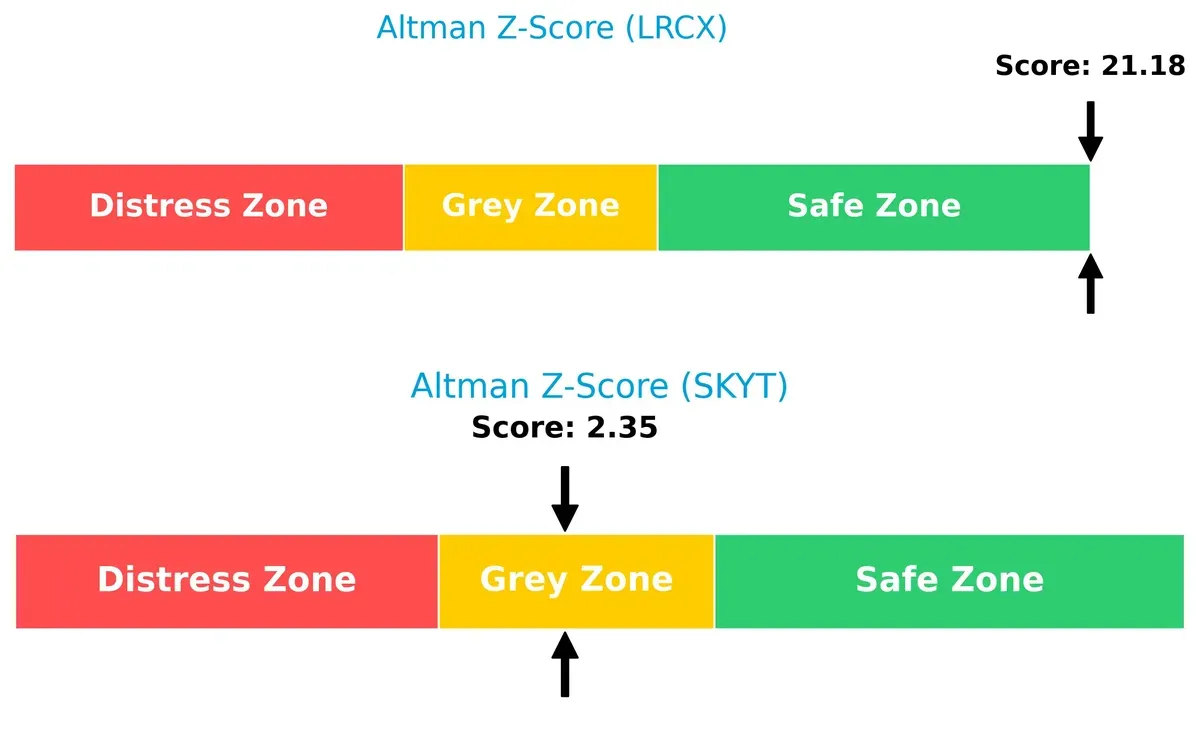

Bankruptcy Risk: Solvency Showdown

Lam Research’s Altman Z-Score of 21.18 vastly surpasses SkyWater’s 2.35, placing it deep in the safe zone versus SkyWater’s grey zone:

This stark delta indicates Lam Research’s fortress-like solvency and negligible bankruptcy risk. SkyWater’s score signals caution; it faces moderate distress potential under cyclical pressures, demanding vigilant risk management from investors.

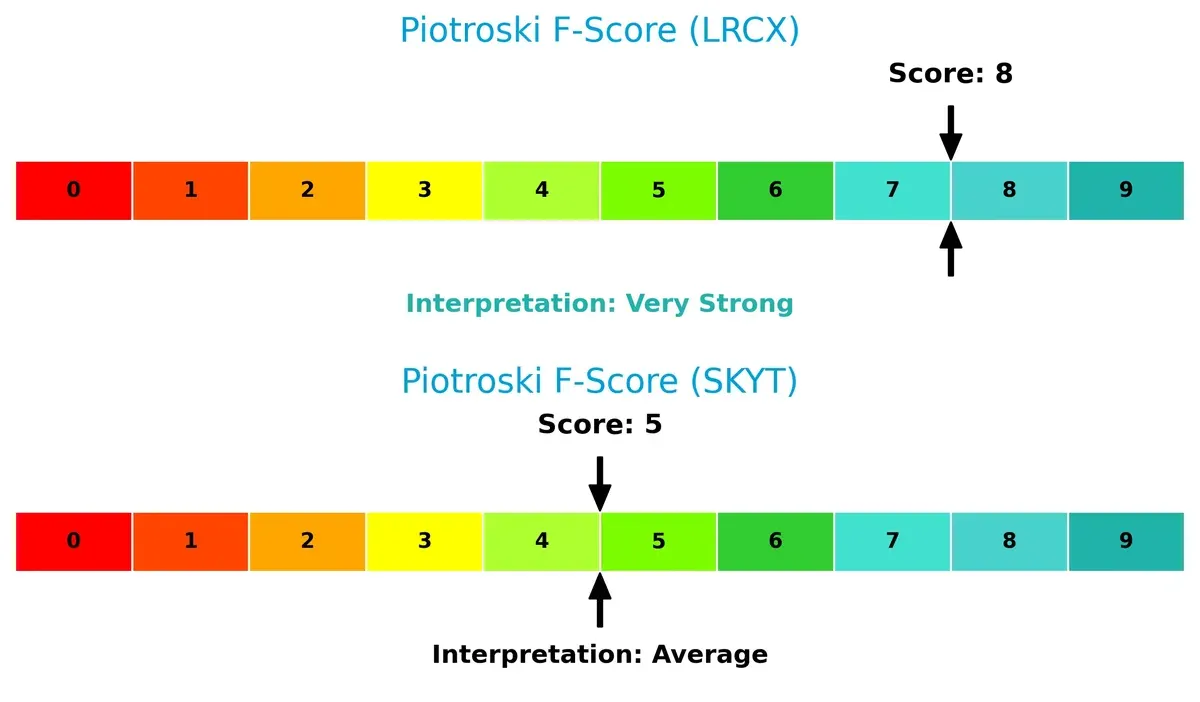

Financial Health: Quality of Operations

Lam Research scores an 8 on the Piotroski F-Score, signaling very strong financial health, while SkyWater’s 5 marks average operational quality:

Lam’s high score reflects robust profitability, liquidity, and efficient capital allocation. SkyWater’s middling score flags potential red flags in internal metrics, underscoring weaker fundamentals and operational inconsistencies relative to its peer.

How are the two companies positioned?

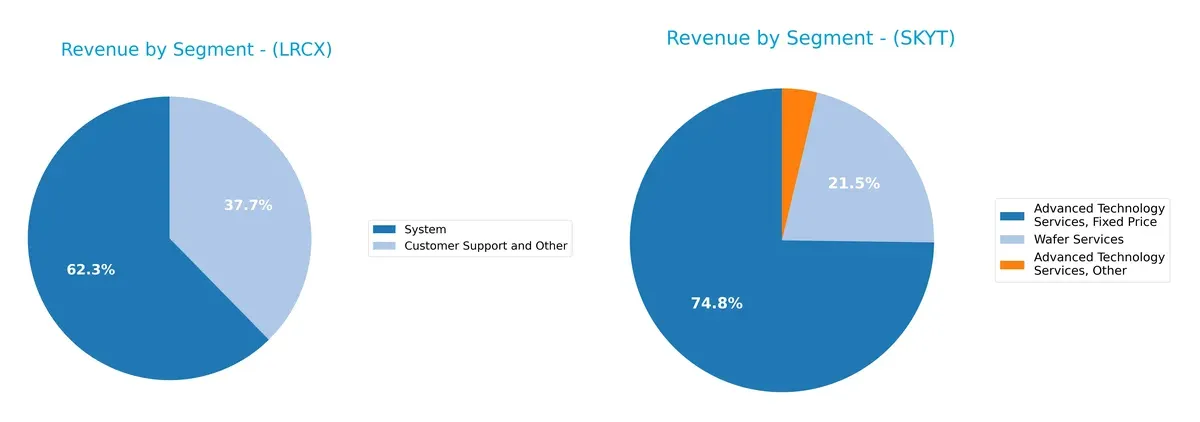

This section dissects the operational DNA of Lam Research and SkyWater by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats to reveal which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

The following comparison dissects how Lam Research Corporation and SkyWater Technology diversify their income streams and where their primary sector bets lie:

Lam Research anchors revenue in its System segment with $11.5B in 2025, complemented by $6.9B in Customer Support, showing a strong but balanced two-segment model. SkyWater’s revenue splits across Advanced Technology Services and Wafer Services, with no single dominant segment, reflecting diversification. Lam’s focus on high-value systems signals infrastructure dominance, while SkyWater’s spread mitigates concentration risk but may dilute strategic scale advantages.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Lam Research Corporation and SkyWater Technology, Inc.:

Lam Research Strengths

- High profitability with 29% net margin

- Strong ROE at 54%

- Favorable liquidity ratios above 1.5

- Diverse global revenue including China, Korea, US

- Robust system segment sales over 11B USD

- Low debt to assets at 22%

SkyWater Strengths

- Asset turnover above 1.0 indicates efficient use of assets

- Favorable debt to assets ratio at 24%

- PE ratio favorable due to negative earnings

- Focused US market presence with over 329M USD revenue

- Diversified advanced technology service offerings

- Demonstrates customer service revenues

Lam Research Weaknesses

- High WACC at 12% compared to ROIC

- Unfavorable high PB ratio near 13

- Dividend yield below 1%

- Moderate asset turnover at 0.86

- Exposure to geopolitical risks in China and Asia

SkyWater Weaknesses

- Negative profitability metrics including -2% net margin and -12% ROE

- Low liquidity with current ratio below 1

- High debt to equity at 1.33

- Poor interest coverage below 1

- Unfavorable PB ratio near 12

- Zero dividend yield

Lam Research’s financial strength and global diversification highlight its solid market position despite some valuation concerns. SkyWater faces significant profitability and liquidity challenges, impacting its financial stability and growth prospects.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat alone shields long-term profits from relentless competitive pressure. Let’s dissect the core moats protecting these semiconductor firms:

Lam Research Corporation: Technological Expertise and Scale Moat

Lam Research’s competitive edge stems from advanced semiconductor processing equipment and global scale. Its 21.9% ROIC above WACC confirms durable value creation. Continued innovation and geographic diversification deepen this moat in 2026.

SkyWater Technology, Inc.: Emerging Niche Player with Growing Profitability

SkyWater relies on specialized semiconductor manufacturing services, targeting niche markets versus Lam’s broad scale. Despite a negative ROIC vs. WACC, its rapidly improving profitability signals potential moat development amid market expansion.

Moat Strength Showdown: Scale and Innovation vs. Niche Growth Potential

Lam Research commands a wider, more durable moat through superior returns and global footprint. SkyWater shows promise but lacks Lam’s entrenched value creation. Lam is better positioned to defend and grow market share in 2026.

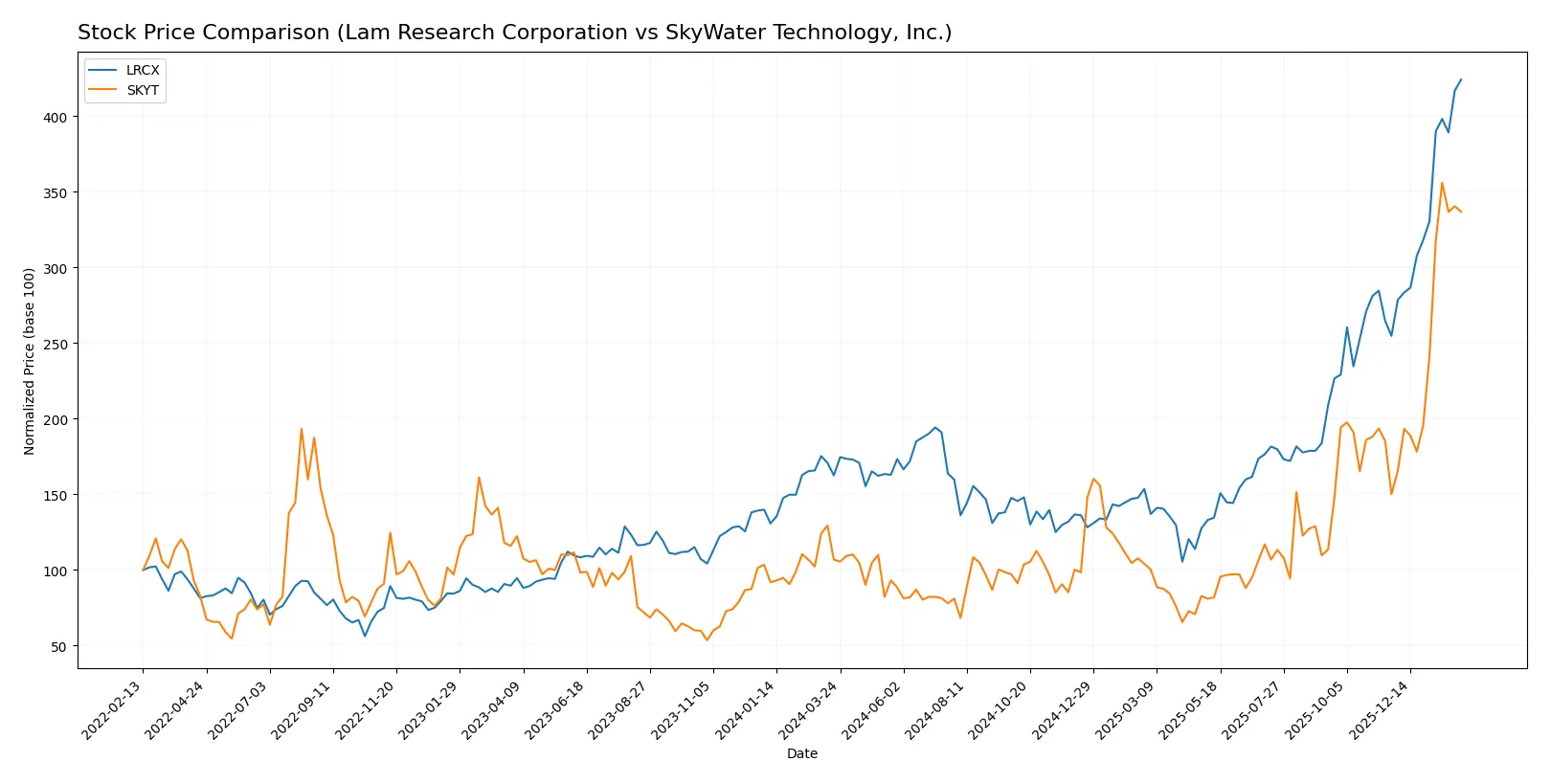

Which stock offers better returns?

Over the past year, both Lam Research Corporation and SkyWater Technology have shown strong price gains with accelerating bullish trends, driven by increasing buyer dominance and notable price appreciation.

Trend Comparison

Lam Research’s stock surged 161% over the past 12 months with accelerating momentum. Price volatility is high, reflected by a 39.19 standard deviation, peaking at 237.5 and bottoming at 59.09.

SkyWater Technology’s stock rose 215% over the last year, also with acceleration. It exhibits low volatility at a 5.65 standard deviation, reaching a high of 33.1 and a low of 6.1.

SkyWater Technology outperformed Lam Research with a 215% gain versus 161%. Both trends are bullish and accelerating, but SkyWater delivered the highest market return.

Target Prices

Analysts set a wide-ranging but optimistic target consensus for Lam Research Corporation and a firm target for SkyWater Technology, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Lam Research Corporation | 127 | 325 | 266.76 |

| SkyWater Technology, Inc. | 35 | 35 | 35 |

Lam Research’s consensus target at $266.76 exceeds its current $237.5 price, showing upside potential. SkyWater trades below its $35 target, suggesting limited near-term growth expectations.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent institutional grades for Lam Research Corporation and SkyWater Technology, Inc.:

Lam Research Corporation Grades

This table lists the latest grades from major financial institutions for Lam Research Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-29 |

| Wells Fargo | Maintain | Overweight | 2026-01-29 |

| JP Morgan | Maintain | Overweight | 2026-01-29 |

| RBC Capital | Maintain | Outperform | 2026-01-29 |

| Citigroup | Maintain | Buy | 2026-01-29 |

| Stifel | Maintain | Buy | 2026-01-29 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-29 |

| Needham | Maintain | Buy | 2026-01-29 |

| Susquehanna | Maintain | Positive | 2026-01-29 |

| Goldman Sachs | Maintain | Buy | 2026-01-29 |

SkyWater Technology, Inc. Grades

This table shows recent institutional grades for SkyWater Technology, Inc., including several downgrades.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Downgrade | Hold | 2026-01-27 |

| Piper Sandler | Downgrade | Neutral | 2026-01-27 |

| Needham | Downgrade | Hold | 2026-01-27 |

Which company has the best grades?

Lam Research Corporation holds consistently positive grades from multiple top-tier institutions, reflecting broad confidence. SkyWater Technology, Inc. faces recent downgrades, signaling increased caution. Investors may view Lam Research’s stronger grades as a sign of relative institutional favor.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Lam Research Corporation

- Dominates semiconductor equipment with strong market cap and established global reach.

SkyWater Technology, Inc.

- Smaller player focused on semiconductor manufacturing services, facing intense competition and limited scale.

2. Capital Structure & Debt

Lam Research Corporation

- Maintains moderate debt with favorable debt-to-equity (0.48) and strong interest coverage (33.43).

SkyWater Technology, Inc.

- High debt-to-equity (1.33) and poor interest coverage (0.74) indicate financial strain and refinancing risk.

3. Stock Volatility

Lam Research Corporation

- Beta at 1.78 shows above-market volatility but manageable for a large tech firm.

SkyWater Technology, Inc.

- Very high beta of 3.51 signals extreme stock volatility and investor risk.

4. Regulatory & Legal

Lam Research Corporation

- Operates globally, subject to complex semiconductor export rules and IP protections.

SkyWater Technology, Inc.

- Faces regulatory scrutiny in aerospace and defense sectors, increasing legal compliance costs.

5. Supply Chain & Operations

Lam Research Corporation

- Benefits from diversified global supply chain, but exposed to geopolitical tensions in Asia.

SkyWater Technology, Inc.

- Relies on specialized manufacturing processes with limited supplier base, risking operational disruptions.

6. ESG & Climate Transition

Lam Research Corporation

- Increasing ESG commitments but faces pressure to reduce manufacturing carbon footprint.

SkyWater Technology, Inc.

- Emerging firm with developing ESG policies, potentially vulnerable to investor ESG scrutiny.

7. Geopolitical Exposure

Lam Research Corporation

- Significant exposure to US-China trade tensions due to global sales footprint.

SkyWater Technology, Inc.

- US-centric operations lower direct geopolitical risks but limit international growth opportunities.

Which company shows a better risk-adjusted profile?

Lam Research faces notable geopolitical and market competition risks but maintains robust financial health and liquidity. SkyWater exhibits elevated financial risk with weak liquidity, high volatility, and operational constraints. Lam’s superior Altman Z-Score (21.18, safe zone) versus SkyWater’s grey zone (2.35) confirms its stronger risk-adjusted profile. The critical risk for Lam is geopolitical exposure, while for SkyWater, it is financial instability evidenced by poor interest coverage and liquidity ratios. Lam’s proven capital structure and global scale justify my confidence despite market pressures.

Final Verdict: Which stock to choose?

Lam Research Corporation (LRCX) wields unmatched operational efficiency and a robust economic moat, demonstrated by consistent value creation above its cost of capital. Its point of vigilance lies in a relatively high price-to-book ratio, which demands careful valuation scrutiny. LRCX suits portfolios aiming for aggressive growth with strong fundamentals.

SkyWater Technology, Inc. (SKYT) offers a strategic moat in its niche technology innovation, supported by rapid revenue and profitability growth. However, it carries higher financial risk and weaker liquidity than LRCX, reflecting a less stable profile. SKYT fits investors seeking growth at a reasonable price with a tolerance for volatility.

If you prioritize durable competitive advantage and consistent profitability, LRCX is the compelling choice due to its strong moat and financial robustness. However, if you seek high-growth potential with a willingness to accept elevated risk, SKYT offers superior upside despite current value destruction. Each scenario reflects distinct investor profiles and risk appetites.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Lam Research Corporation and SkyWater Technology, Inc. to enhance your investment decisions: