Home > Comparison > Technology > KLAC vs MCHP

The strategic rivalry between KLA Corporation and Microchip Technology shapes the semiconductor industry’s evolution. KLA operates as a capital-intensive leader in process control and yield management, while Microchip focuses on embedded control solutions with broad applications. This head-to-head contrasts precision manufacturing with diversified embedded innovation. This analysis aims to identify which trajectory offers superior risk-adjusted returns, guiding investors seeking balance between technological depth and market breadth in their portfolios.

Table of contents

Companies Overview

KLA Corporation and Microchip Technology Incorporated hold pivotal roles in the semiconductor industry, shaping technology’s future.

KLA Corporation: Semiconductor Process Control Leader

KLA dominates as a provider of process control and yield management solutions for semiconductor manufacturing. It generates revenue chiefly from wafer inspection, metrology, and defect detection technologies. In 2026, KLA focuses strategically on enhancing integrated circuit process control and expanding its specialty semiconductor and PCB inspection capabilities.

Microchip Technology Incorporated: Embedded Control Innovator

Microchip Technology specializes in embedded control solutions, offering microcontrollers, microprocessors, and analog products. Its core revenue streams include selling smart, connected components for automotive, industrial, and communications sectors. The company’s 2026 strategy emphasizes broadening its portfolio of secure embedded systems and ramping up FPGA and memory product development.

Strategic Collision: Similarities & Divergences

Both firms excel in semiconductor domains but adopt distinct approaches: KLA invests in precision process control, while Microchip pursues versatile embedded solutions. Their primary battleground lies in semiconductor manufacturing and system integration markets. These focus differences create unique investment profiles—KLA thrives on capital-intensive equipment innovation, Microchip on scalable, application-specific components.

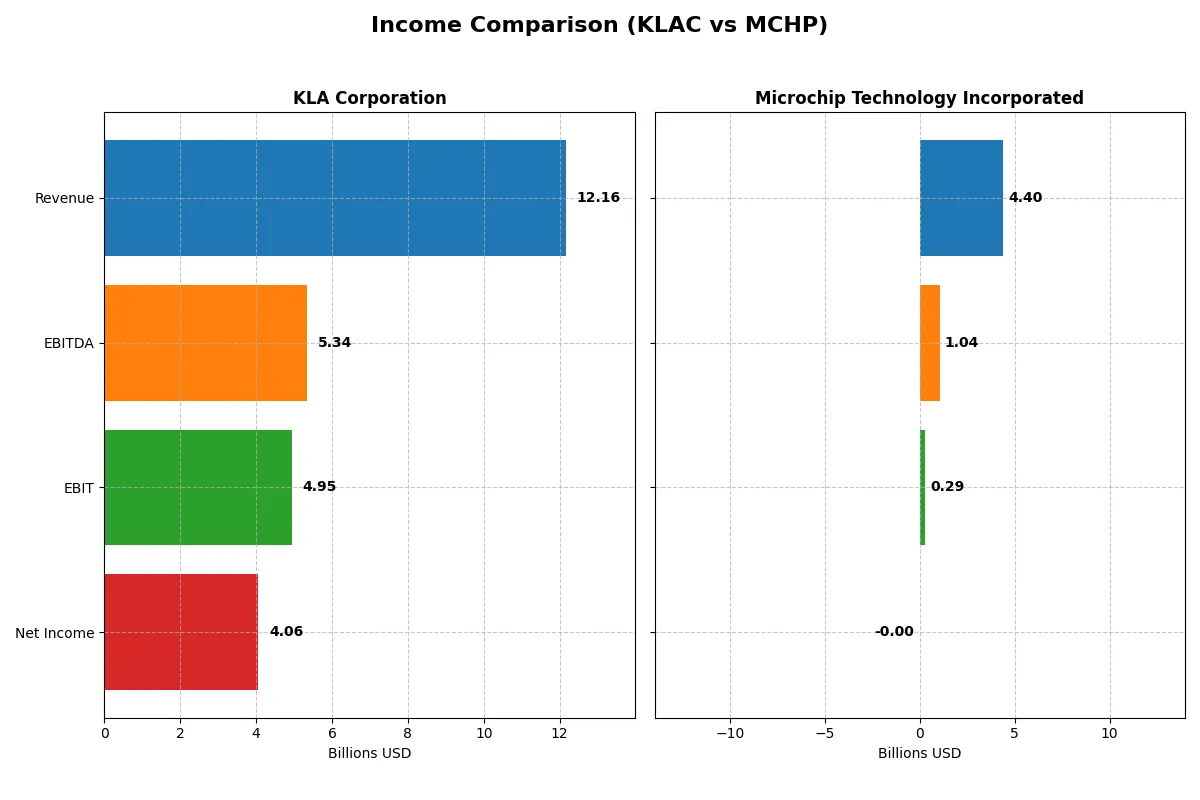

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | KLA Corporation (KLAC) | Microchip Technology (MCHP) |

|---|---|---|

| Revenue | 12.2B | 4.4B |

| Cost of Revenue | 4.6B | 1.9B |

| Operating Expenses | 2.3B | 2.2B |

| Gross Profit | 7.6B | 2.5B |

| EBITDA | 5.3B | 1.0B |

| EBIT | 4.9B | 290M |

| Interest Expense | 302M | 251M |

| Net Income | 4.1B | -0.5M |

| EPS | 30.53 | -0.005 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates with superior efficiency and stronger profitability momentum.

KLA Corporation Analysis

KLA displays robust revenue growth, surging from 6.9B in 2021 to 12.2B in 2025, nearly doubling net income from 2.1B to 4.1B. Gross and net margins remain strong at 62% and 33%, respectively, demonstrating excellent cost control and pricing power. In 2025, KLA’s efficiency accelerates with a 24% revenue increase and a 19% net margin expansion, signaling sustained operational momentum.

Microchip Technology Incorporated Analysis

Microchip’s revenue declines sharply, from 5.4B in 2021 to 4.4B in 2025, while net income flips from a 349M profit to a 2.7M loss. Gross margin holds at a decent 56%, but net margin collapses to near zero, reflecting deteriorating profitability. The latest year shows a severe drop in revenue and an 89% plunge in EBIT, indicating significant operational challenges and declining efficiency.

Growth and Profitability: Resilience vs. Retreat

KLA clearly outperforms Microchip with strong top-line growth and expanding margins, reflecting superior capital allocation and pricing strategy. Microchip’s shrinking revenue and negative net income signal structural issues undermining profitability. For investors, KLA’s profile offers growth and margin resilience, while Microchip’s reflects heightened risk and operational weakness.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose underlying fiscal health, valuation premiums, and capital efficiency for each company:

| Ratios | KLA Corporation (KLAC) | Microchip Technology Inc. (MCHP) |

|---|---|---|

| ROE | 0.87 | -0.00007 |

| ROIC | 0.38 | -0.00027 |

| P/E | 29.3 | -52021 |

| P/B | 25.4 | 3.67 |

| Current Ratio | 2.62 | 2.59 |

| Quick Ratio | 1.83 | 1.47 |

| D/E (Debt-to-Equity) | 1.30 | 0.80 |

| Debt-to-Assets | 0.38 | 0.37 |

| Interest Coverage | 17.3 | 1.18 |

| Asset Turnover | 0.76 | 0.29 |

| Fixed Asset Turnover | 9.70 | 3.72 |

| Payout Ratio | 22.3% | -1951% |

| Dividend Yield | 0.76% | 3.75% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, unveiling hidden risks and operational strengths essential for informed investing decisions.

KLA Corporation

KLA shows exceptional profitability with an 86.56% ROE and a strong 33.41% net margin, signaling operational excellence. However, its P/E of 29.34 and P/B of 25.39 mark the stock as expensive. The modest 0.76% dividend yield suggests a focus on reinvesting in R&D, supporting sustainable growth and shareholder value.

Microchip Technology Incorporated

Microchip posts negative profitability metrics, with a -0.01% ROE and net margin, reflecting operational struggles. Its P/E is distorted, but a reasonable P/B of 3.67 and a healthy 3.75% dividend yield highlight shareholder returns via dividends. The firm’s reinvestment in R&D at 22.35% of revenue aims to reverse earnings weakness.

Premium Valuation vs. Operational Safety

KLA commands a premium valuation justified by superior profitability and operational efficiency. Microchip offers greater income through dividends but carries profitability risks. Investors seeking growth with operational strength may prefer KLA, while those favoring dividend income amid uncertainty might lean toward Microchip.

Which one offers the Superior Shareholder Reward?

I compare KLA Corporation (KLAC) and Microchip Technology Incorporated (MCHP) on their shareholder return strategies. KLAC pays a modest 0.76% dividend yield with a sustainable payout ratio near 22%, backed by strong free cash flow coverage (~92%). Its aggressive buyback program further boosts total returns. MCHP yields a higher 3.75%, but with a negative net income in 2025 and a payout ratio skewed by losses, its dividend sustainability is questionable. MCHP’s buybacks are less consistent, reflecting operational volatility. Historically, KLAC’s balanced dividend and buyback blend, supported by robust margins and capital discipline, offers a more reliable long-term reward. I conclude KLAC provides the superior total shareholder return profile in 2026.

Comparative Score Analysis: The Strategic Profile

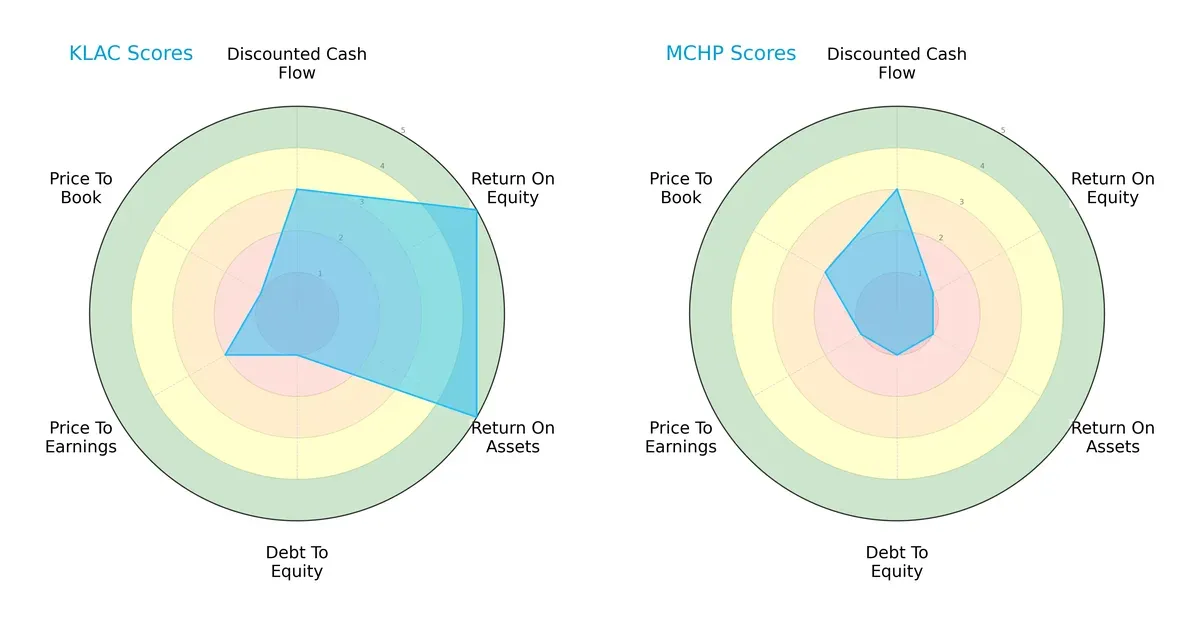

The radar chart reveals the fundamental DNA and trade-offs of KLA Corporation and Microchip Technology Incorporated:

KLA shows strength in profitability with very favorable ROE (5) and ROA (5) scores, indicating efficient capital and asset use. Microchip lags behind, scoring very unfavorably in these areas (ROE 1, ROA 1). Both share a weak debt-to-equity score (1), reflecting elevated financial risk. Valuation metrics differ: KLA has moderate P/E (2) but very unfavorable P/B (1), while Microchip scores poorly on P/E (1) but moderately on P/B (2). Overall, KLA presents a more balanced profile, relying on operational efficiency, whereas Microchip depends on limited valuation advantages.

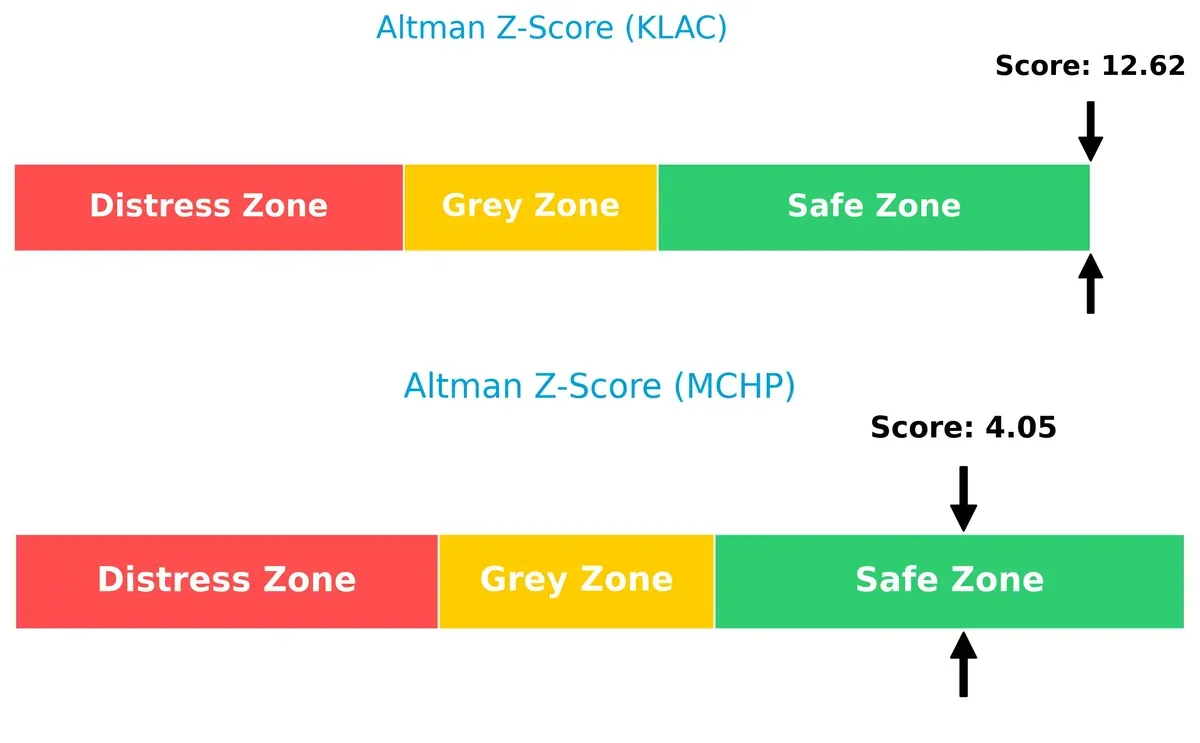

Bankruptcy Risk: Solvency Showdown

KLA’s Altman Z-Score of 12.6 far exceeds Microchip’s 4.1, placing both comfortably in the safe zone but highlighting KLA’s superior long-term solvency and resilience in this cycle:

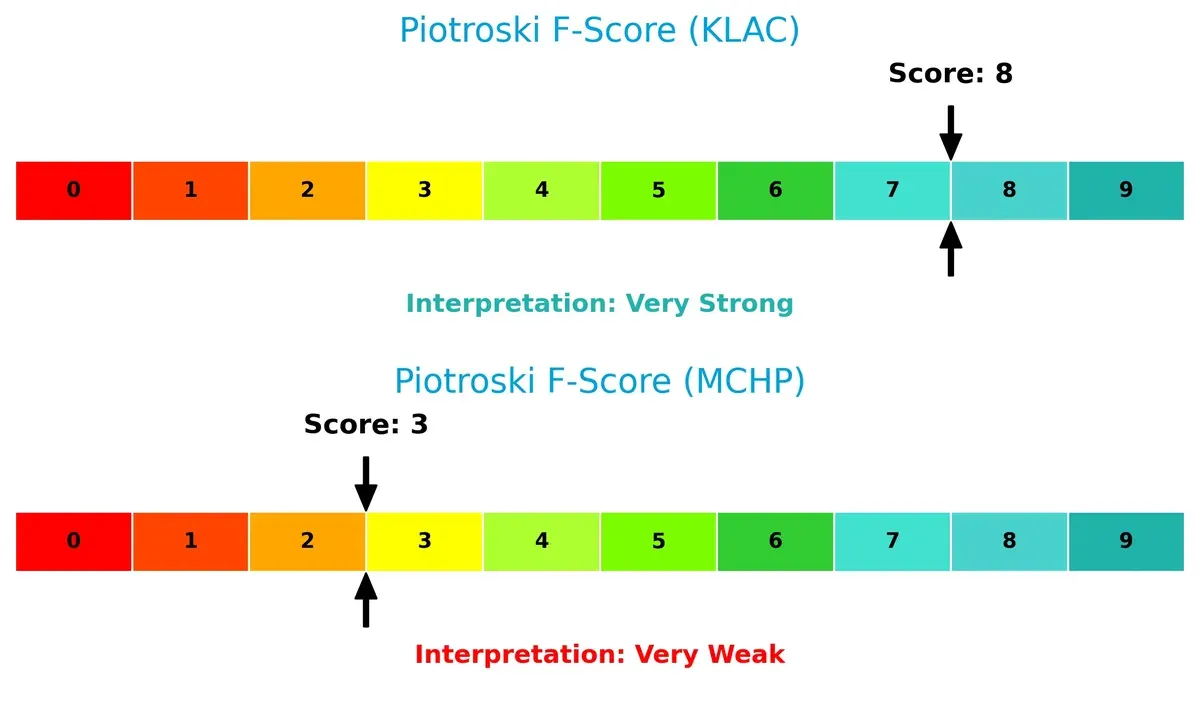

Financial Health: Quality of Operations

KLA scores an 8 on the Piotroski F-Score, signaling very strong financial health and robust internal metrics. Microchip’s score of 3 flags concerns in profitability and efficiency, suggesting operational weaknesses and potential red flags:

How are the two companies positioned?

This section dissects KLAC and MCHP’s operational DNA by comparing their revenue distribution and internal dynamics. It aims to confront their economic moats to reveal which model delivers the most resilient competitive advantage today.

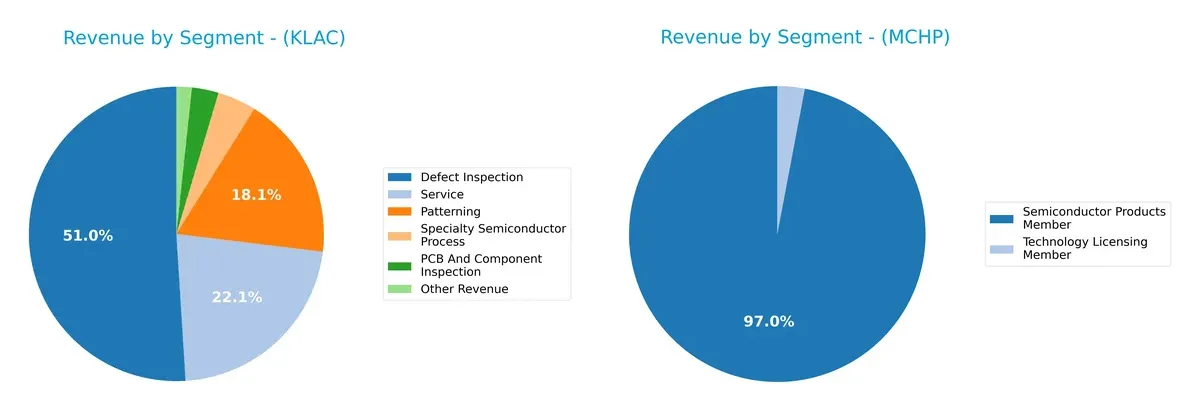

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how KLA Corporation and Microchip Technology diversify their income streams and reveals where their primary sector bets lie:

KLA Corporation’s revenue pivots across five meaningful segments, with Defect Inspection anchoring at $6.2B and Service at $2.7B in 2025. This mix signals a complex ecosystem lock-in around semiconductor process control. Microchip Technology leans heavily on its Semiconductor Products segment, generating $4.3B, while Technology Licensing contributes a mere $131M. This concentration exposes Microchip to product cycle risks but underscores infrastructure dominance in embedded solutions.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of KLA Corporation and Microchip Technology Incorporated:

KLA Corporation Strengths

- High profitability with 33.41% net margin

- Strong ROE at 86.56%

- Favorable ROIC of 37.97%

- Solid liquidity ratios: current 2.62, quick 1.83

- Diverse revenue streams across inspection and service segments

- Significant global presence, especially in China and Taiwan

Microchip Technology Strengths

- Favorable P/E ratio reflecting market valuation

- Strong dividend yield at 3.75%

- Solid current ratio at 2.59 and quick ratio at 1.47

- Favorable fixed asset turnover at 3.72

- Revenue focused on semiconductor products with technology licensing

KLA Corporation Weaknesses

- Elevated debt-to-equity ratio at 1.3

- High P/B ratio at 25.39 indicating premium valuation

- WACC at 10.42% exceeds ROIC benchmark

- Moderate debt-to-assets at 37.89%

- Dividend yield low at 0.76%

- P/E ratio relatively high at 29.34

Microchip Technology Weaknesses

- Negative net margin and ROE around -0.01% signaling unprofitability

- Negative ROIC at -0.03% below WACC

- Low interest coverage at 1.15 raises solvency concerns

- Weak asset turnover at 0.29

- Unfavorable P/B ratio at 3.67

- High proportion of unfavorable financial ratios overall

KLA leads in profitability, capital efficiency, and global diversification, but carries higher leverage and valuation risk. Microchip shows weaker profitability and operational efficiency but offers a higher dividend and more moderate valuation metrics. Each company’s profile signals different strategic priorities and financial health challenges.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole barrier protecting a firm’s long-term profits from relentless competitive erosion. Let’s examine these two semiconductor players:

KLA Corporation: Precision Process Control Moat

KLA’s moat stems from its specialized semiconductor process control systems, driving a consistent ROIC 27.5% above WACC. Margin stability and 40%+ EBIT margins highlight efficiency. Expansion in advanced wafer inspection deepens its edge in 2026.

Microchip Technology Incorporated: Embedded Systems Cost Advantage

Microchip relies on cost advantages in embedded microcontrollers but suffers a negative ROIC trend, signaling shrinking profitability. Unlike KLA’s precision tech moat, Microchip faces margin pressure and revenue declines, risking erosion unless it innovates aggressively.

Verdict: Precision Process Control vs. Embedded Cost Pressure

KLA’s deep, durable moat outpaces Microchip’s eroding cost advantage. With rising ROIC and margin expansion, KLA is better positioned to defend market share amid semiconductor complexity. Microchip must reverse value destruction to remain competitive.

Which stock offers better returns?

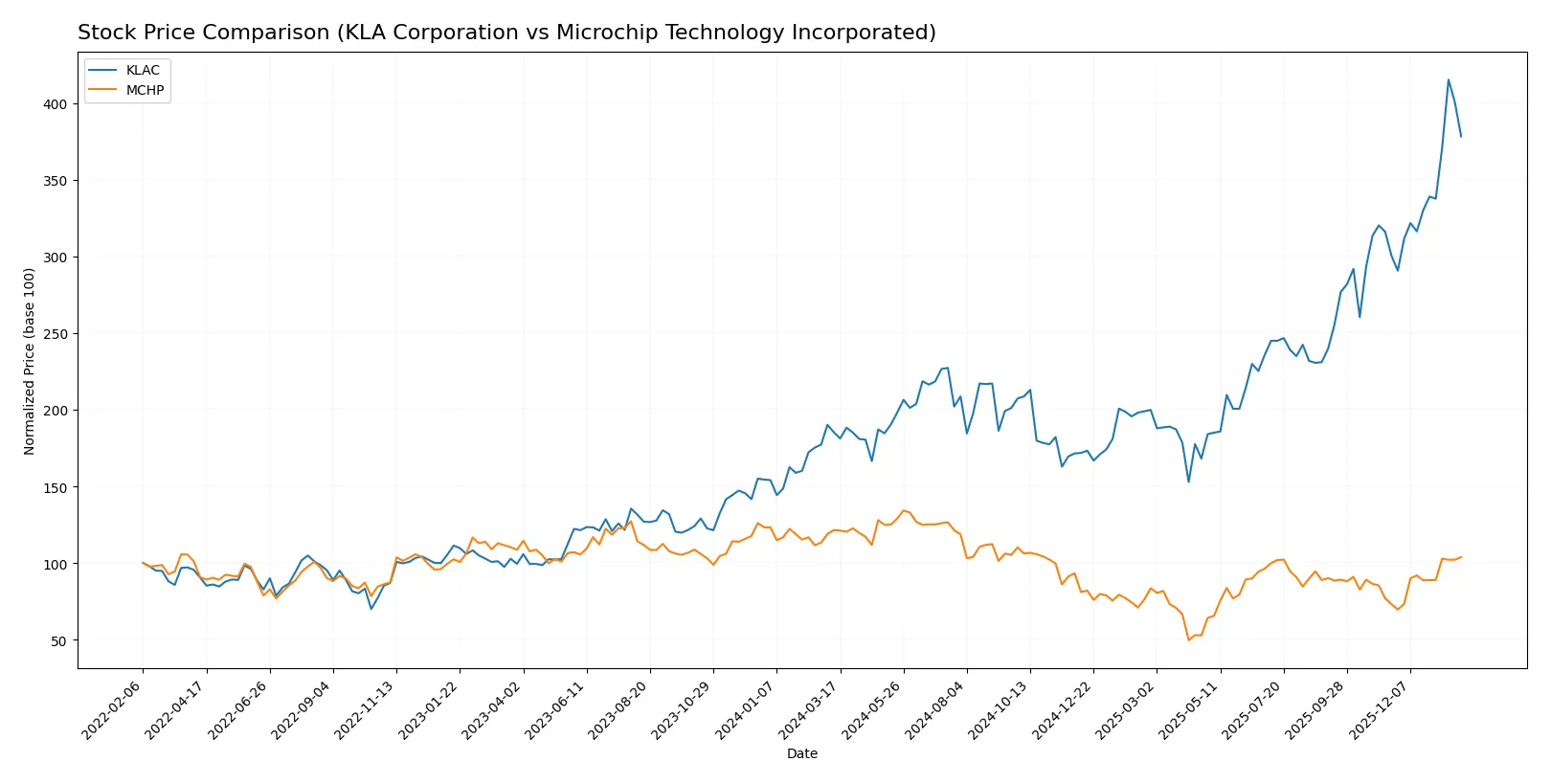

Over the past year, KLA Corporation’s stock surged sharply, while Microchip Technology showed a notable decline with recent signs of partial recovery.

Trend Comparison

KLA Corporation’s stock gained 104.22% over the past 12 months, reflecting a strong bullish trend with accelerating momentum and a wide price range from 577 to 1,568.

Microchip Technology’s stock declined 14.54% over the same period, marking a bearish trend despite accelerated movement and a narrower price range between 36 and 98.

KLA Corporation delivered the highest market performance, outperforming Microchip Technology with a substantial positive price change and stronger overall trend dynamics.

Target Prices

Analysts present a cautiously optimistic target consensus for these semiconductor players.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| KLA Corporation | 1,400 | 1,900 | 1,672 |

| Microchip Technology Incorporated | 60 | 95 | 81 |

The consensus target prices suggest upside potential for both stocks versus current prices. KLA’s target consensus exceeds its 1,428 USD price by 17%, while Microchip’s consensus is 7% above its 76 USD price. This indicates measured analyst confidence amid semiconductor sector volatility.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

KLA Corporation Grades

The table below summarizes recent institutional grades for KLA Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | Maintain | Outperform | 2026-01-30 |

| Barclays | Maintain | Overweight | 2026-01-30 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-30 |

| Jefferies | Maintain | Buy | 2026-01-30 |

| Stifel | Maintain | Buy | 2026-01-30 |

| Wells Fargo | Maintain | Overweight | 2026-01-30 |

| Needham | Maintain | Buy | 2026-01-30 |

| RBC Capital | Maintain | Sector Perform | 2026-01-30 |

| Deutsche Bank | Maintain | Hold | 2026-01-21 |

| Needham | Maintain | Buy | 2026-01-20 |

Microchip Technology Incorporated Grades

This table shows the latest institutional grades for Microchip Technology Incorporated.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-26 |

| Susquehanna | Maintain | Positive | 2026-01-22 |

| B of A Securities | Maintain | Neutral | 2026-01-21 |

| Citigroup | Maintain | Buy | 2026-01-15 |

| Piper Sandler | Maintain | Overweight | 2026-01-15 |

| B. Riley Securities | Maintain | Buy | 2026-01-12 |

| Mizuho | Maintain | Outperform | 2026-01-09 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-07 |

| JP Morgan | Maintain | Overweight | 2026-01-06 |

| Rosenblatt | Maintain | Buy | 2026-01-06 |

Which company has the best grades?

KLA Corporation generally holds stronger grades, with multiple “Buy” and “Outperform” ratings from top firms. Microchip also receives solid “Buy” and “Outperform” grades but shows more mixed opinions. This suggests investors may view KLA as more consistently favored by analysts.

Risks specific to each company

The following categories pinpoint critical pressure points and systemic threats facing both KLA Corporation and Microchip Technology Incorporated in the 2026 market environment:

1. Market & Competition

KLA Corporation

- Dominates semiconductor process control with strong market position but faces intense innovation pressure.

Microchip Technology Incorporated

- Operates in embedded control solutions facing aggressive competition and margin pressure.

2. Capital Structure & Debt

KLA Corporation

- High debt-to-equity ratio (1.3) signals elevated financial leverage risk.

Microchip Technology Incorporated

- Moderate leverage (0.8 debt-to-equity) but weak interest coverage (1.15) raises debt servicing concerns.

3. Stock Volatility

KLA Corporation

- Beta at 1.44 indicates higher-than-market volatility, typical in semiconductors.

Microchip Technology Incorporated

- Similar beta (1.44) reflects comparable volatility; however, recent price decline is less severe.

4. Regulatory & Legal

KLA Corporation

- Subject to global tech export controls and IP litigation risks inherent in semiconductor equipment.

Microchip Technology Incorporated

- Faces regulatory scrutiny on embedded systems security and compliance in automotive and industrial sectors.

5. Supply Chain & Operations

KLA Corporation

- Complex semiconductor equipment supply chains vulnerable to raw material shortages and geopolitical tensions.

Microchip Technology Incorporated

- Relies on diverse foundry partners; supply chain disruptions may impair production and delivery.

6. ESG & Climate Transition

KLA Corporation

- Pressure to reduce carbon footprint amid energy-intensive manufacturing processes.

Microchip Technology Incorporated

- Faces challenges integrating ESG in diverse product lines and global manufacturing footprint.

7. Geopolitical Exposure

KLA Corporation

- High exposure to US-China tech tensions affecting semiconductor equipment exports.

Microchip Technology Incorporated

- Global operations exposed to trade restrictions and regional instability in Asia and Europe.

Which company shows a better risk-adjusted profile?

KLA Corporation’s most impactful risk is its elevated financial leverage combined with high valuation multiples, posing capital structure concerns despite strong profitability. Microchip’s critical risk lies in its negative profitability and weak interest coverage, undermining financial stability. KLA’s superior Altman Z-score (12.6) and Piotroski score (8) confirm stronger financial health. Microchip’s weaker scores and operational risks yield a less favorable risk-adjusted profile. KLA’s recent market correction (-15.2%) reflects valuation pressures but maintains robust fundamentals, underscoring prudent investment appeal.

Final Verdict: Which stock to choose?

KLA Corporation’s superpower lies in its robust capital efficiency and expanding profitability. Its very favorable moat, demonstrated by a growing ROIC well above WACC, signals durable competitive advantage. The main point of vigilance is its elevated price multiples, which suggest a premium valuation. It best suits aggressive growth portfolios aiming for market leadership exposure.

Microchip Technology’s strategic moat centers on its niche in embedded control solutions, supported by recurring revenue streams and a strong dividend yield. Compared to KLA, it offers a more cautious safety profile but struggles with profitability and value destruction concerns. It aligns more with value-oriented or income-focused portfolios willing to tolerate near-term headwinds.

If you prioritize durable economic moats and accelerating earnings growth, KLA outshines as the compelling choice due to its capital allocation prowess and margin expansion. However, if you seek income and potential turnaround value, Microchip offers better stability in dividends despite its challenged fundamentals. Each represents a distinct analytical scenario tailored to differing risk appetites and investment horizons.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of KLA Corporation and Microchip Technology Incorporated to enhance your investment decisions: