Home > Comparison > Technology > KLAC vs INDI

The strategic rivalry between KLA Corporation and indie Semiconductor defines the current trajectory of the semiconductor industry. KLA dominates with its capital-intensive process control and yield management solutions, while indie Semiconductor pursues high-growth automotive semiconductor and software innovations. This head-to-head contrasts mature industry leadership with emerging technological disruption. This analysis will determine which corporate path offers the superior risk-adjusted return for a diversified technology portfolio.

Table of contents

Companies Overview

KLA Corporation and indie Semiconductor, Inc. represent two distinct forces in the semiconductor landscape, each shaping critical industry segments.

KLA Corporation: Leader in Process Control Solutions

KLA Corporation dominates the semiconductor process control market. Its core revenue engine stems from wafer inspection, metrology, and defect management solutions essential to IC manufacturing. In 2026, KLA’s strategic focus intensifies on advanced process control technologies and expanding specialty semiconductor services to reinforce its competitive edge.

indie Semiconductor, Inc.: Innovator in Automotive Semiconductors

indie Semiconductor, Inc. specializes in automotive semiconductor and software solutions. Its revenue growth hinges on advanced driver assistance, connected car technologies, and electrification components. The company’s 2026 strategy targets deepening penetration in automotive applications, emphasizing user experience and telematics as key growth drivers.

Strategic Collision: Similarities & Divergences

KLA pursues a precision process control philosophy with a broad semiconductor industrial footprint. indie Semiconductor embraces a specialized, software-driven approach focusing on automotive innovation. Their battle for market share centers on semiconductor complexity versus application-specific solutions. Investors face contrasting profiles: KLA offers stable industrial dominance, while indie Semiconductor carries higher growth potential amid increased automotive electrification risks.

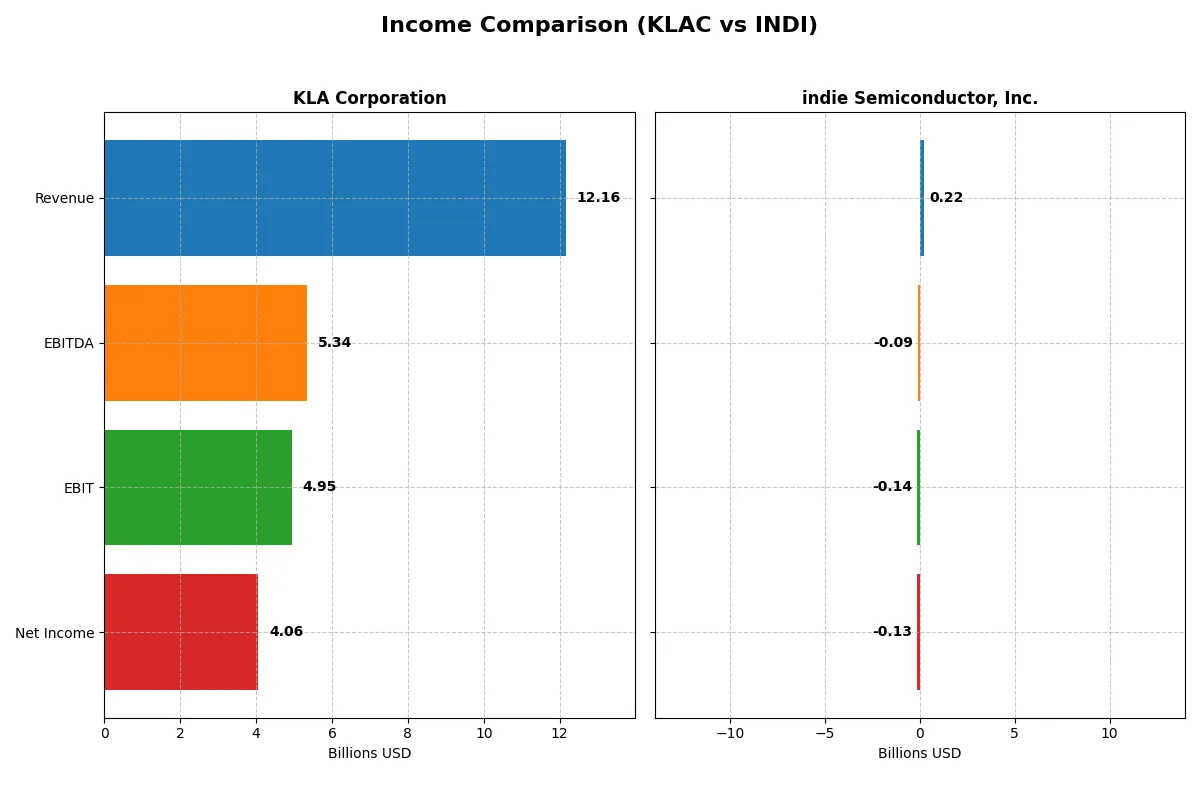

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | KLA Corporation (KLAC) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Revenue | 12.2B | 217M |

| Cost of Revenue | 4.58B | 126M |

| Operating Expenses | 2.33B | 260M |

| Gross Profit | 7.58B | 90.3M |

| EBITDA | 5.34B | -94M |

| EBIT | 4.95B | -137M |

| Interest Expense | 302M | 9.3M |

| Net Income | 4.06B | -133M |

| EPS | 30.53 | -0.76 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals how efficiently each company converts sales into profits, exposing the strength of their corporate engines.

KLA Corporation Analysis

KLA’s revenue rose sharply from 6.9B in 2021 to 12.2B in 2025, nearly doubling net income to 4.1B. Gross margins remain robust at 62.3%, while net margins hit 33.4%, signaling exceptional profitability. The 2025 surge in EBIT and EPS growth highlights strong operational momentum and disciplined cost control.

indie Semiconductor, Inc. Analysis

indie Semiconductor’s revenue grew impressively from 22.6M in 2020 to 217M in 2024, but net losses persist, deepening to -133M in 2024. Despite a favorable gross margin of 41.7%, EBIT and net margins remain negative, reflecting ongoing operational challenges. The recent year shows modest EPS improvement but declining top-line growth.

Margin Strength vs. Growth Struggles

KLA dominates with high and expanding profitability, underpinned by excellent margin management and strong revenue momentum. indie Semiconductor exhibits rapid revenue growth but struggles to translate sales into profits, burdened by persistent negative margins. For investors, KLA’s proven earnings power offers a safer profile compared to indie’s high-risk, early-stage growth model.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | KLA Corporation (KLAC) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| ROE | 87% | -32% |

| ROIC | 38% | -19% |

| P/E | 29.3 | -5.35 |

| P/B | 25.4 | 1.70 |

| Current Ratio | 2.62 | 4.82 |

| Quick Ratio | 1.83 | 4.23 |

| D/E | 1.30 | 0.95 |

| Debt-to-Assets | 38% | 42% |

| Interest Coverage | 17.3 | -18.4 |

| Asset Turnover | 0.76 | 0.23 |

| Fixed Asset Turnover | 9.70 | 4.30 |

| Payout ratio | 22% | 0% |

| Dividend yield | 0.76% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as the company’s DNA, exposing hidden risks and operational excellence critical to investor decisions.

KLA Corporation

KLA shows outstanding profitability with an 86.6% ROE and a strong 33.4% net margin. However, its valuation looks stretched, trading at a 29.3 P/E and 25.4 P/B, well above sector averages. The modest 0.76% dividend yield contrasts with solid reinvestment in R&D, fueling sustainable growth.

indie Semiconductor, Inc.

indie Semiconductor struggles with negative profitability metrics, including a -31.7% ROE and -61.2% net margin, reflecting operational challenges. Its valuation appears attractive with a negative P/E and a reasonable 1.7 P/B. The company pays no dividends, opting instead to invest heavily in R&D, aiming for long-term value creation.

Premium Valuation vs. Recovery Potential

KLA offers a robust profitability profile but at a premium valuation, suggesting higher risk if growth slows. indie Semiconductor’s metrics signal financial stress but hint at potential upside through aggressive R&D. Risk-averse investors may prefer KLA’s stability, while those seeking turnaround opportunities might consider indie’s speculative profile.

Which one offers the Superior Shareholder Reward?

I compare KLA Corporation (KLAC) and indie Semiconductor, Inc. (INDI) on distribution strategies and shareholder returns. KLAC pays a modest dividend with a yield near 0.76% in 2025, supported by a prudent payout ratio of 22%. Its free cash flow comfortably covers dividends, signaling sustainability. KLAC also executes consistent buybacks, boosting total returns. Conversely, INDI pays no dividends and reports negative margins and free cash flow, reflecting reinvestment into growth and R&D amid ongoing losses. Its balance sheet shows strong liquidity but lacks buyback activity. Historically, KLAC’s model balances income and capital appreciation, while INDI bets entirely on future growth. For 2026, I favor KLAC’s disciplined distributions and buybacks as a superior, sustainable shareholder reward.

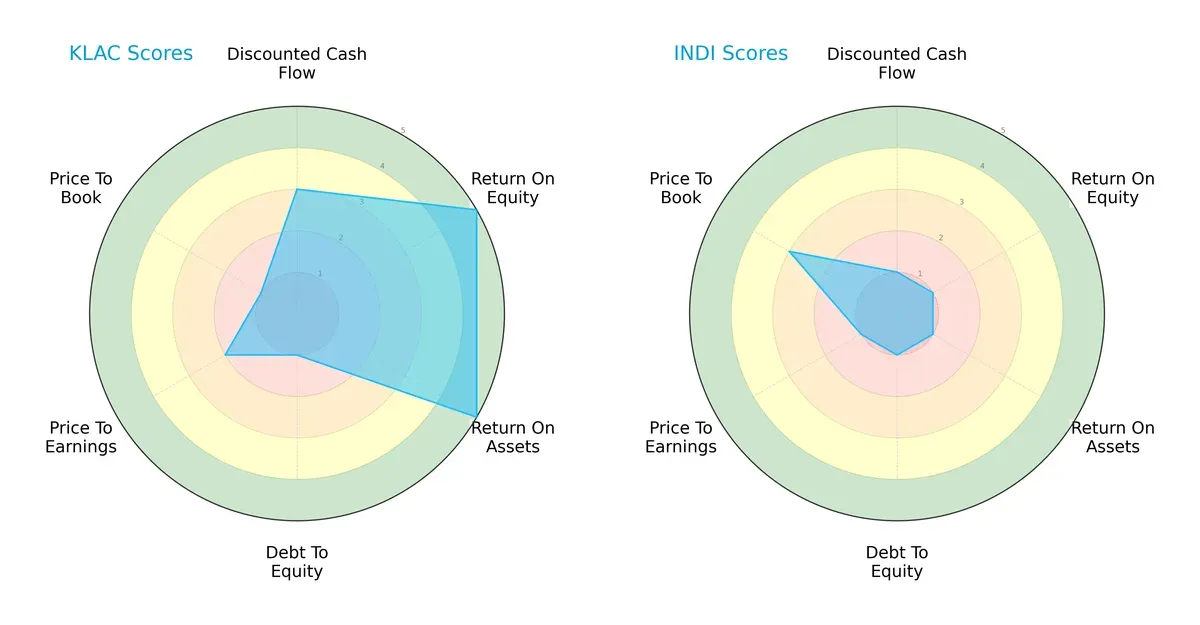

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of KLA Corporation and indie Semiconductor, highlighting their financial strengths and vulnerabilities:

KLA exhibits a balanced profile with strong ROE and ROA scores at 5 each, signaling efficient profit generation and asset use. However, its debt-to-equity and price-to-book scores are weak at 1, indicating financial leverage risks and potential overvaluation concerns. Indie Semiconductor relies heavily on its modest price-to-book score of 3 but scores poorly across all other metrics, reflecting operational and valuation struggles. KLA clearly maintains a more robust and diversified financial foundation.

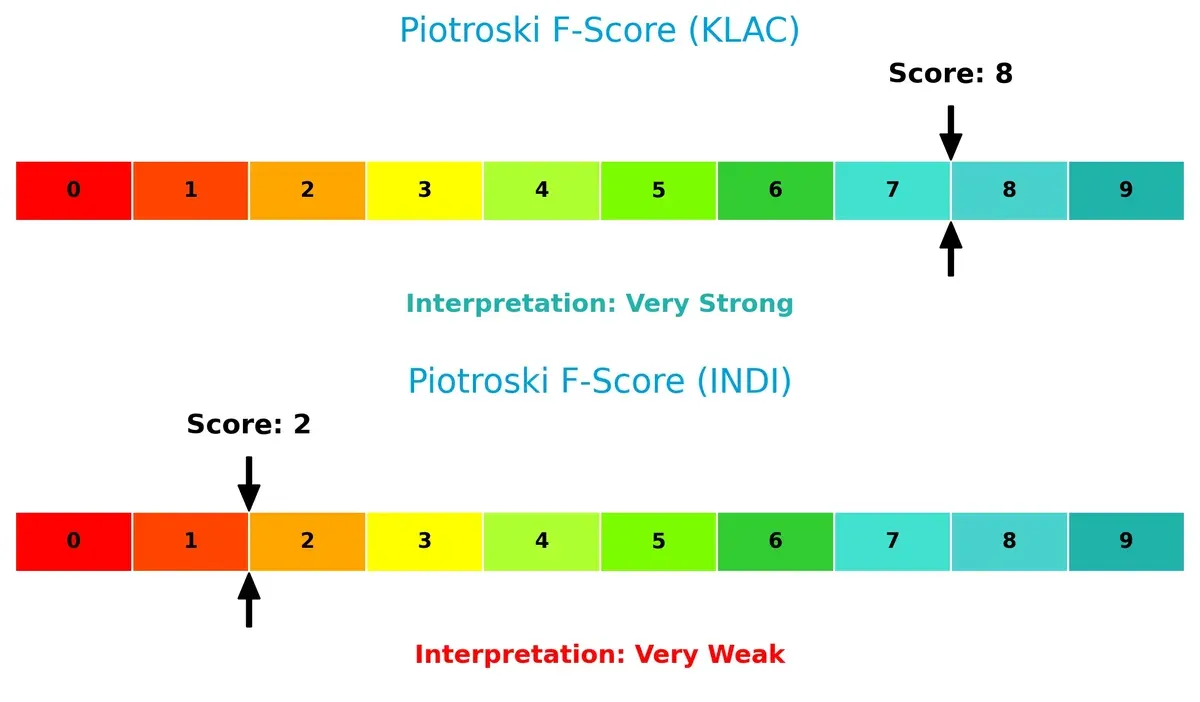

Bankruptcy Risk: Solvency Showdown

KLA’s Altman Z-Score stands at a safe 12.6, suggesting strong solvency and low bankruptcy risk. Indie Semiconductor’s score of 0.22 places it in distress, signaling a high probability of financial distress and default in this cycle:

Financial Health: Quality of Operations

KLA’s Piotroski F-Score of 8 indicates very strong financial health and operational quality. Indie Semiconductor’s score of 2 reveals significant red flags in profitability, leverage, and efficiency, undermining investor confidence:

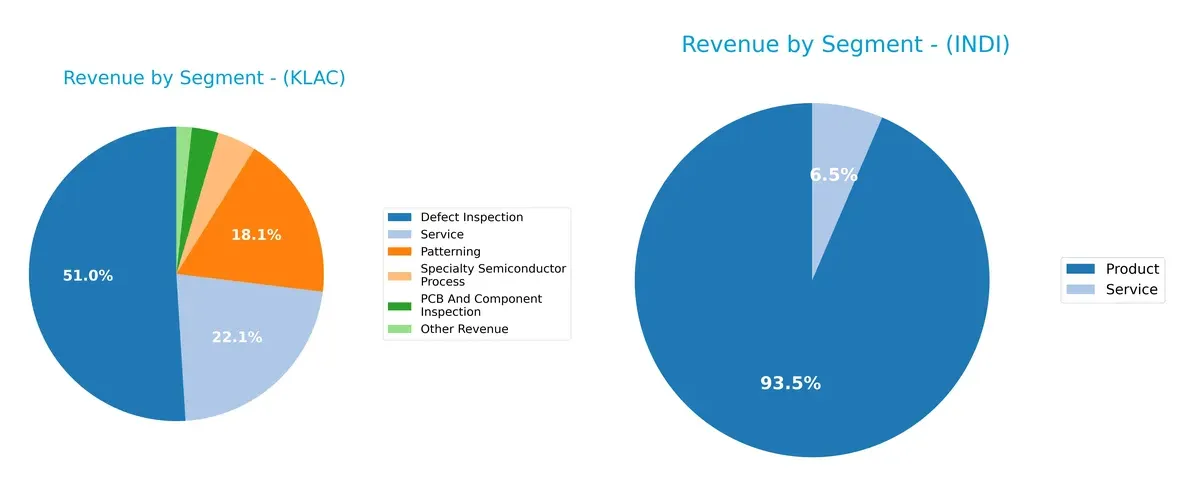

How are the two companies positioned?

This section dissects KLAC and INDI’s operational DNA by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats to reveal which model offers the strongest, most sustainable competitive edge today.

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how KLA Corporation and indie Semiconductor diversify their income streams and where their primary sector bets lie:

KLA dominates with a broad portfolio anchored by Defect Inspection at $6.2B, followed by Service ($2.7B) and Patterning ($2.2B). This mix signals strong ecosystem lock-in and infrastructure dominance in semiconductor manufacturing. Indie Semiconductor leans heavily on Product revenue, $203M in 2024, dwarfing its Service segment at $14M, revealing concentration risk but a clear focus on product sales growth. KLA’s diversification offers stability; Indie’s specialization demands close monitoring.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of KLA Corporation and indie Semiconductor, Inc.:

KLA Corporation Strengths

- Diverse revenue streams with strong service and defect inspection segments

- High profitability with 33.41% net margin and 86.56% ROE

- Solid liquidity ratios: current ratio 2.62 and quick ratio 1.83

- Strong global presence with significant sales in China and Taiwan

- Efficient asset use with fixed asset turnover 9.7

indie Semiconductor Strengths

- Moderate product revenue growth from 44M in 2021 to 203M in 2024

- Favorable quick ratio of 4.23 suggests good short-term liquidity

- Some geographic diversification including US, China, Europe, and Asia Pacific

- Fixed asset turnover of 4.3 indicates reasonable asset efficiency

- PE ratio favorable despite losses, indicating market potential

KLA Corporation Weaknesses

- High valuation multiples: PE 29.34 and PB 25.39, possibly overvalued

- Debt to equity ratio at 1.3 shows higher leverage risk

- Dividend yield low at 0.76%, limiting income appeal

- Weighted average cost of capital (WACC) unfavorable at 10.42%

- Neutral asset turnover at 0.76 limits overall efficiency

indie Semiconductor Weaknesses

- Negative profitability with -61.2% net margin, -31.73% ROE, and -19.25% ROIC

- Unfavorable interest coverage at -14.8 signals financial stress

- Current ratio of 4.82 flagged unfavorable, possibly inefficient capital use

- High debt to assets ratio at 42.34% is a leverage concern

- Lower asset turnover at 0.23 and zero dividend yield indicate limited returns

KLA Corporation excels in profitability and global diversification but faces valuation and leverage risks. indie Semiconductor shows early-stage growth with liquidity strengths but struggles with significant losses and financial efficiency. Both firms’ profiles reflect distinct strategic priorities and risk exposures.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive erosion. Let’s dissect the moats of two semiconductor players:

KLA Corporation: Precision Inspection with a Durable Economic Moat

KLA’s moat lies in specialized process control technology, driving a robust 27.5% ROIC premium over WACC and stable 40%+ EBIT margins. Its expanding footprint in advanced wafer inspection deepens this durable moat in 2026.

indie Semiconductor, Inc.: Emerging Innovator with a Fragile Moat

indie’s moat centers on niche automotive semiconductor solutions but suffers from a steeply negative ROIC trend and crushing -63% EBIT margin. Its innovation in connected car tech offers growth potential but remains a weak moat in 2026.

Verdict: Process Mastery vs. Automotive Ambition

KLA’s wide, growing moat outclasses indie’s fragile and value-eroding position. KLA stands better equipped to defend and expand its semiconductor process control dominance.

Which stock offers better returns?

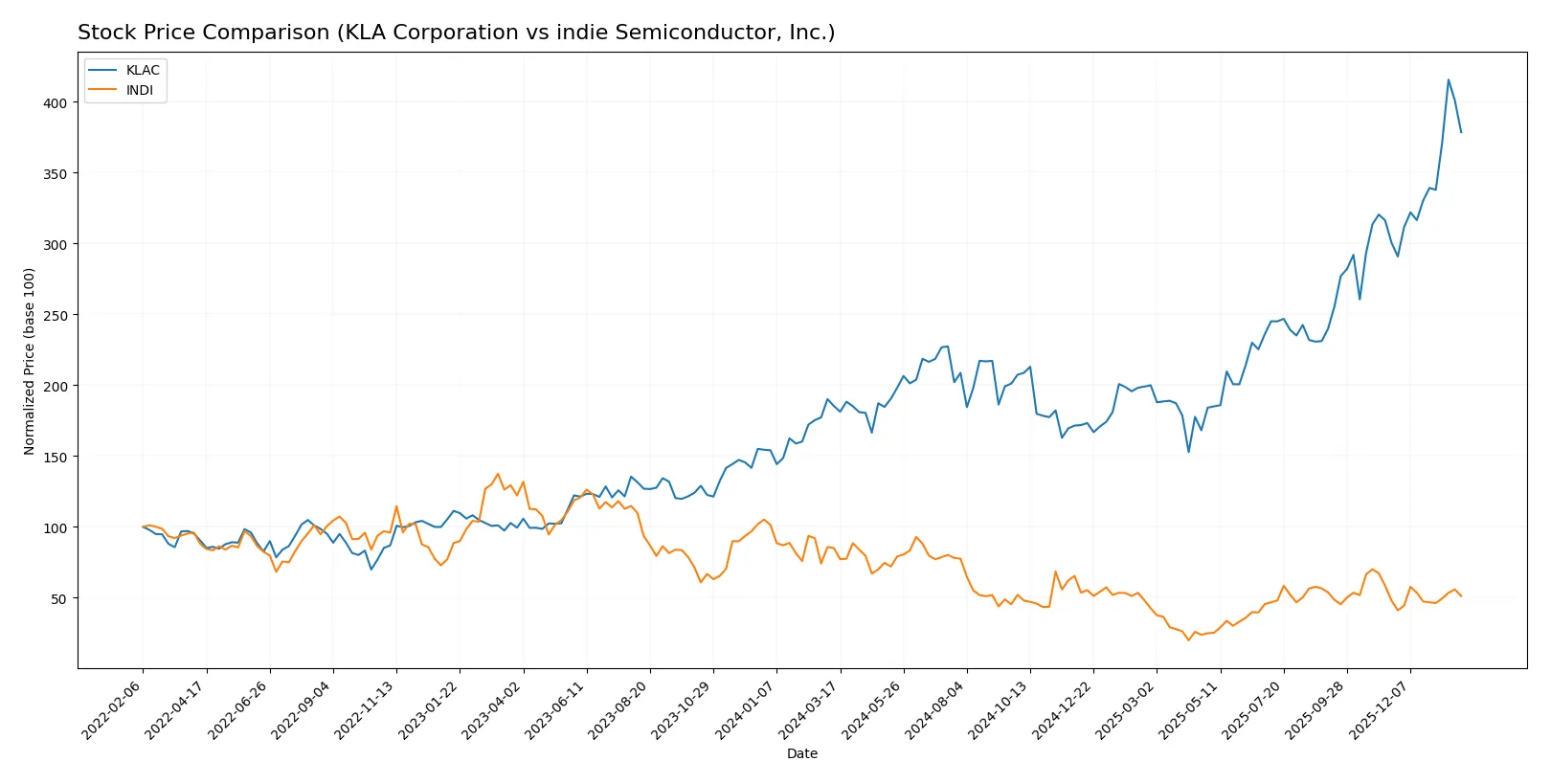

The past year shows starkly divergent price trajectories for KLA Corporation and indie Semiconductor, with KLA surging sharply while indie Semiconductor declined notably.

Trend Comparison

KLA Corporation exhibits a strong bullish trend over the past 12 months with a 104.22% price increase, accelerating from a low of 576.53 to a high of 1567.82.

indie Semiconductor, Inc. reveals a bearish trend over the same period, falling 39.79%, despite recent mild gains and acceleration from 1.6 to 7.43.

KLA’s robust 104.22% gain clearly outperforms indie Semiconductor’s 39.79% loss, marking KLA as the stronger market performer.

Target Prices

Analysts present a clear consensus on target prices for KLA Corporation and indie Semiconductor, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| KLA Corporation | 1400 | 1900 | 1672.25 |

| indie Semiconductor, Inc. | 8 | 8 | 8 |

KLA’s consensus target of 1672.25 suggests moderate upside from its current 1427.94 price. indie Semiconductor’s target at 8 implies significant growth potential from its 4.1 level.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent institutional grades for KLA Corporation and indie Semiconductor, Inc.:

KLA Corporation Grades

This table presents the latest grades assigned to KLA Corporation by various reputable firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | Maintain | Outperform | 2026-01-30 |

| Barclays | Maintain | Overweight | 2026-01-30 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-30 |

| Jefferies | Maintain | Buy | 2026-01-30 |

| Stifel | Maintain | Buy | 2026-01-30 |

| Wells Fargo | Maintain | Overweight | 2026-01-30 |

| Needham | Maintain | Buy | 2026-01-30 |

| RBC Capital | Maintain | Sector Perform | 2026-01-30 |

| Deutsche Bank | Maintain | Hold | 2026-01-21 |

| Needham | Maintain | Buy | 2026-01-20 |

indie Semiconductor, Inc. Grades

The following grades reflect recent analyst opinions from credible institutions on indie Semiconductor, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-11-10 |

| Benchmark | Maintain | Buy | 2025-06-25 |

| Benchmark | Maintain | Buy | 2025-06-11 |

| Benchmark | Maintain | Buy | 2025-05-21 |

| Benchmark | Maintain | Buy | 2025-05-13 |

| Craig-Hallum | Maintain | Buy | 2025-05-13 |

| Keybanc | Maintain | Overweight | 2025-05-13 |

| Benchmark | Maintain | Buy | 2025-04-09 |

| Benchmark | Maintain | Buy | 2025-02-21 |

| Keybanc | Maintain | Overweight | 2025-02-21 |

Which company has the best grades?

KLA Corporation consistently receives buy and outperform ratings from top-tier firms, reflecting strong confidence. Indie Semiconductor also earns mostly buy ratings but includes a neutral from UBS, indicating more cautious sentiment. Investors might view KLA’s broader institutional endorsement as a sign of greater market trust.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

KLA Corporation

- Dominates semiconductor process control with strong market cap and diversified segments.

indie Semiconductor, Inc.

- Faces intense competition in automotive semiconductors with smaller scale and niche focus.

2. Capital Structure & Debt

KLA Corporation

- Debt/equity ratio of 1.3 signals higher leverage risk despite strong coverage ratio.

indie Semiconductor, Inc.

- Moderate debt load but negative interest coverage signals financial strain and risk of distress.

3. Stock Volatility

KLA Corporation

- Beta of 1.44 indicates moderately higher volatility than market average.

indie Semiconductor, Inc.

- High beta of 2.54 shows elevated stock price volatility and market sensitivity.

4. Regulatory & Legal

KLA Corporation

- Operates globally with compliance in semiconductor manufacturing regulations.

indie Semiconductor, Inc.

- Emerging company with potential regulatory hurdles in automotive and software segments.

5. Supply Chain & Operations

KLA Corporation

- Established global supply chain with operational scale supports resilience.

indie Semiconductor, Inc.

- Smaller scale and reliance on evolving technologies increase operational risks.

6. ESG & Climate Transition

KLA Corporation

- Likely advanced ESG policies due to scale and investor scrutiny.

indie Semiconductor, Inc.

- ESG practices less mature, risk in automotive sector’s transition to electrification.

7. Geopolitical Exposure

KLA Corporation

- Global footprint exposes it to US-China tensions impacting semiconductor supply chains.

indie Semiconductor, Inc.

- Exposure concentrated in automotive markets may face regional geopolitical disruptions.

Which company shows a better risk-adjusted profile?

KLA Corporation’s strongest risk is its elevated leverage, but its robust profitability and financial strength mitigate concerns. indie Semiconductor struggles with negative profitability and financial distress signals, especially poor interest coverage and weak liquidity metrics. KLA’s Altman Z-Score of 12.6 places it safely away from bankruptcy risk, while indie’s 0.22 signals imminent distress. KLA’s lower volatility and scale provide a superior risk-adjusted profile for 2026 investors.

Final Verdict: Which stock to choose?

KLA Corporation’s superpower lies in its durable competitive advantage and unmatched capital efficiency, consistently generating returns well above its cost of capital. Its robust financial health supports growth, though investors should watch its elevated valuation multiples as a point of vigilance. It suits portfolios targeting aggressive growth with a quality moat.

indie Semiconductor’s strategic moat is its high R&D intensity, aiming to carve out innovation-led niches. However, it currently struggles with profitability and financial stability, making it a riskier choice compared to KLA. This stock might appeal to speculative investors focused on early-stage growth potential and transformative technology exposure.

If you prioritize sustainable value creation and strong financial footing, KLA outshines indie Semiconductor with superior profitability and stability. However, if you seek high-risk, high-reward plays with innovation upside, indie could fit that profile despite its challenges. Both present distinct analytical scenarios depending on your risk tolerance and investment horizon.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of KLA Corporation and indie Semiconductor, Inc. to enhance your investment decisions: