Home > Comparison > Technology > KEYS vs SANM

The strategic rivalry between Keysight Technologies, Inc. and Sanmina Corporation shapes the dynamics of the hardware, equipment & parts sector. Keysight, a technology-driven test and measurement solutions provider, contrasts with Sanmina’s integrated manufacturing and supply chain services model. This analysis probes their divergent operational approaches and competitive moats. It aims to identify which company offers superior risk-adjusted returns for diversified portfolios amidst evolving technology demands.

Table of contents

Companies Overview

Keysight Technologies and Sanmina Corporation stand as pivotal players in the hardware and equipment sector, shaping technology infrastructure worldwide.

Keysight Technologies, Inc.: Electronic Design & Test Innovator

Keysight dominates electronic design and test solutions for diverse industries, including aerospace and semiconductors. Its revenue stems from high-tech instruments like oscilloscopes, analyzers, and network test platforms. In 2026, Keysight’s strategic focus sharpens on advanced software and hardware integration to address evolving communications and security demands.

Sanmina Corporation: Integrated Manufacturing Powerhouse

Sanmina excels in integrated manufacturing solutions spanning product design, assembly, and after-market services. Its revenue engine relies on delivering complex components and systems to OEMs in sectors such as defense and cloud solutions. The company prioritizes expanding its manufacturing capacity and digital execution tools to enhance supply chain efficiency in 2026.

Strategic Collision: Similarities & Divergences

Both companies serve the hardware equipment sector but diverge sharply in business philosophy. Keysight pursues a technology-centric, innovation-driven model focused on testing and measurement, while Sanmina emphasizes manufacturing scale and supply chain integration. The primary battleground lies in complex hardware production and technological precision. Their distinct approaches shape contrasting investment profiles: Keysight as a specialized tech innovator, Sanmina as a manufacturing and logistics leader.

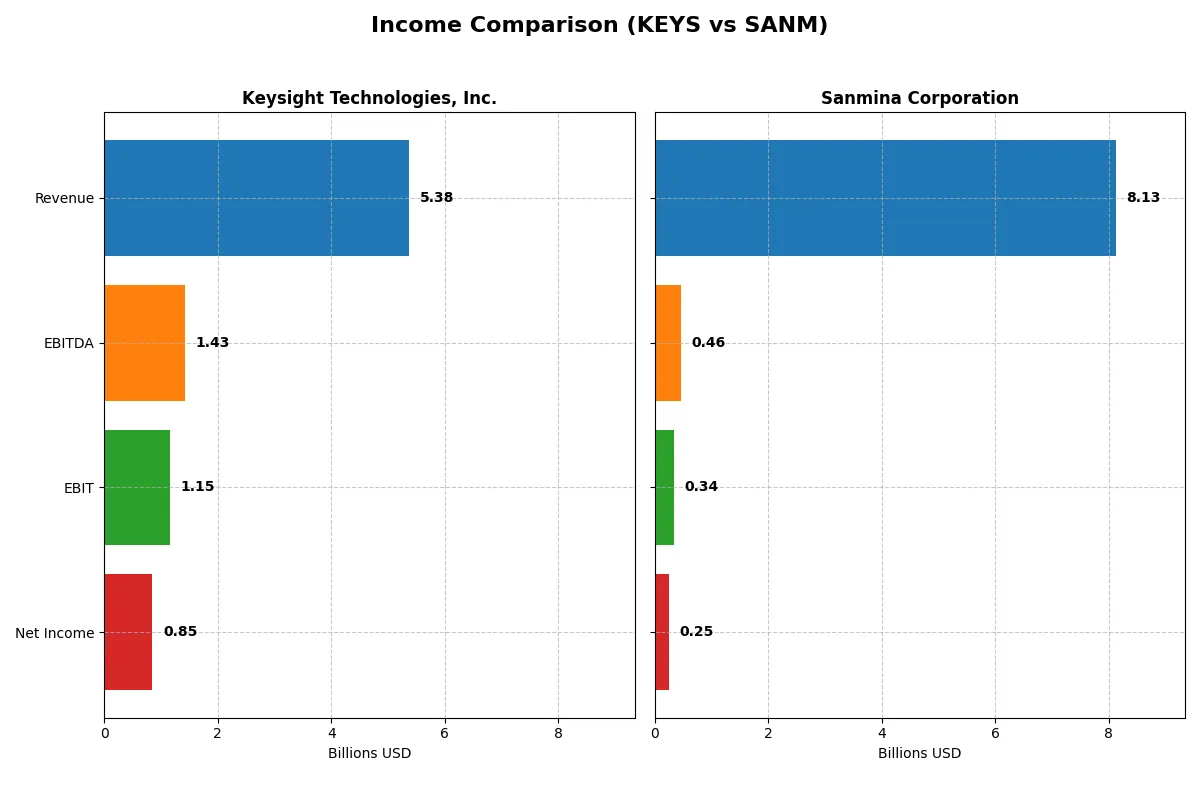

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Keysight Technologies, Inc. (KEYS) | Sanmina Corporation (SANM) |

|---|---|---|

| Revenue | 5.38B | 8.13B |

| Cost of Revenue | 2.04B | 7.41B |

| Operating Expenses | 2.39B | 362M |

| Gross Profit | 3.34B | 716M |

| EBITDA | 1.43B | 463M |

| EBIT | 1.15B | 344M |

| Interest Expense | 96M | 4.3M |

| Net Income | 846M | 246M |

| EPS | 4.9 | 4.56 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals how efficiently each company converts sales into profit and sustains margins in a competitive environment.

Keysight Technologies, Inc. Analysis

Keysight’s revenue grew steadily to $5.38B in 2025, with net income at $846M, reflecting solid profitability. Its gross margin holds strong at 62.1%, while net margin improved to 15.7%, signaling operational excellence. The 2025 jump in EBIT by 21% highlights accelerating momentum and effective cost management.

Sanmina Corporation Analysis

Sanmina posted $8.13B in revenue for 2025, growing moderately year-over-year. However, its net income of $246M yields a thin 3.0% net margin, reflecting a challenging cost structure. Despite favorable gross profit growth of 11.9%, declining EBIT and modest margin gains suggest efficiency struggles in the latest fiscal year.

Margin Strength vs. Scale Challenge

Keysight outperforms Sanmina with superior margins and stronger EBIT growth, despite Sanmina’s larger revenue base. Keysight’s ability to sustain a 62% gross margin and expand net margins makes it the fundamental winner in profitability. Investors seeking robust profit conversion will find Keysight’s profile more attractive.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | Keysight Technologies, Inc. (KEYS) | Sanmina Corporation (SANM) |

|---|---|---|

| ROE | 14.40% | 10.45% |

| ROIC | 8.02% | 9.04% |

| P/E | 37.41 | 25.59 |

| P/B | 5.39 | 2.67 |

| Current Ratio | 2.35 | 1.72 |

| Quick Ratio | 1.78 | 1.02 |

| D/E (Debt-to-Equity) | 0.51 | 0.17 |

| Debt-to-Assets | 26.31% | 6.73% |

| Interest Coverage | 9.88 | 82.53 |

| Asset Turnover | 0.48 | 1.39 |

| Fixed Asset Turnover | 5.21 | 11.91 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, unveiling hidden risks and highlighting operational strengths critical for investment decisions.

Keysight Technologies, Inc.

Keysight delivers solid profitability with a 14.4% ROE and a favorable 15.74% net margin, showing operational efficiency. However, its valuation appears stretched, with a high 37.41 P/E and a 5.39 P/B ratio. The company pays no dividend, instead reinvesting heavily in R&D, fueling long-term growth potential.

Sanmina Corporation

Sanmina posts a moderate 10.45% ROE but struggles with a low 3.03% net margin, reflecting margin pressure. Its valuation is more reasonable, with a 25.59 P/E and neutral 2.67 P/B, suggesting less premium pricing. Like Keysight, it pays no dividend, focusing capital on operational improvements and growth initiatives.

Premium Valuation vs. Operational Balance

Keysight shows stronger profitability but trades at a significant premium, increasing valuation risk. Sanmina offers a more balanced valuation with less profitability. Investors seeking growth with operational efficiency may prefer Keysight’s profile, while those favoring valuation discipline might lean toward Sanmina.

Which one offers the Superior Shareholder Reward?

I observe that neither Keysight Technologies (KEYS) nor Sanmina Corporation (SANM) pays dividends, focusing instead on reinvestment and buybacks. KEYS has a robust free cash flow per share of 7.4 and a strong buyback discipline inferred from zero dividend payout ratio but significant capital efficiency. SANM’s free cash flow per share is 8.6, slightly higher, but its operating cash flow ratio is lower at 0.22, indicating weaker operational cash conversion. SANM trades at a lower price-to-earnings ratio (17 vs. KEYS’s 37), suggesting better valuation. KEYS’s distribution philosophy centers on capital allocation towards innovation and buybacks, sustaining high margins (net margin ~16%). SANM focuses on asset turnover and cost control but shows thinner margins (~3%). I judge KEYS’s model more sustainable due to its margin resilience and cash flow quality, despite a higher valuation. Therefore, KEYS offers a superior total return profile for disciplined investors in 2026.

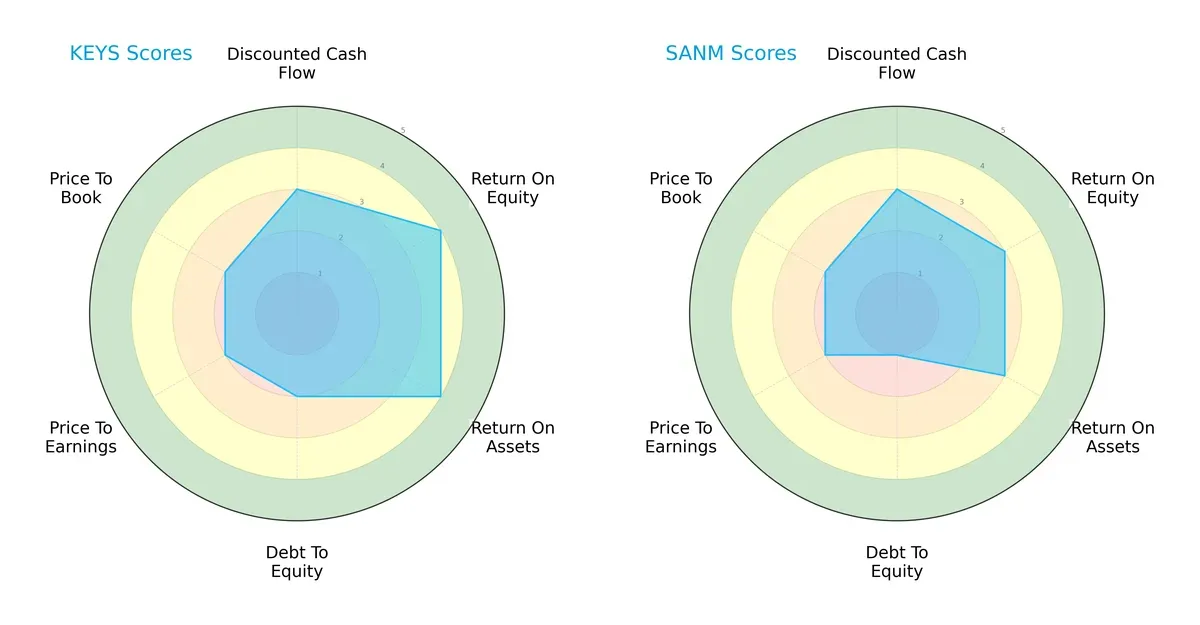

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Keysight Technologies and Sanmina Corporation, highlighting their financial strengths and weaknesses:

Keysight exhibits a more balanced profile, with higher scores in ROE (4 vs. 3) and ROA (4 vs. 3), indicating superior profitability and asset efficiency. Sanmina struggles with a weaker debt-to-equity score (1 vs. 2), signaling higher financial risk. Both firms share moderate valuations (PE/PB scores at 2). Keysight’s edge lies in operational efficiency, while Sanmina relies more on stable cash flow (DCF score equal at 3).

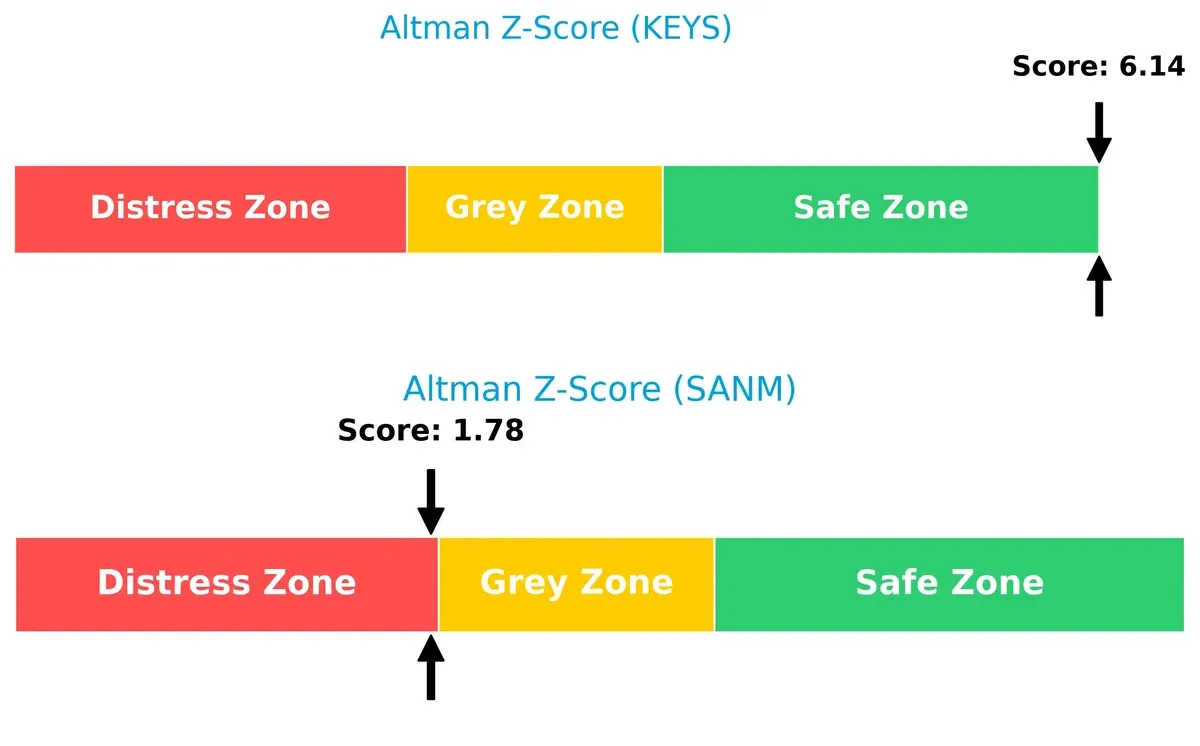

Bankruptcy Risk: Solvency Showdown

Keysight’s Altman Z-Score of 6.14 places it firmly in the safe zone, while Sanmina’s 1.78 signals distress risk. This gap implies Keysight is structurally more resilient in the volatile 2026 market cycle, whereas Sanmina faces heightened bankruptcy risk:

Financial Health: Quality of Operations

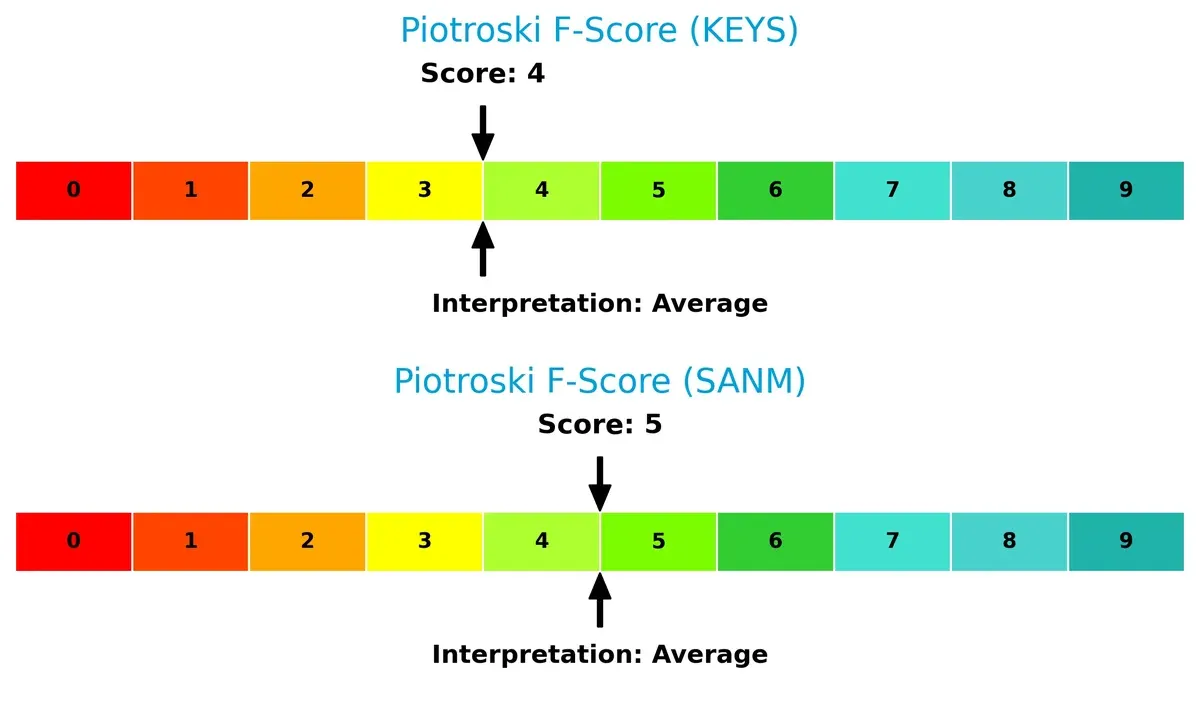

Keysight and Sanmina both score in the average range on the Piotroski F-Score, with 4 and 5 respectively. Neither demonstrates peak financial health, but Sanmina slightly outperforms in operational quality. No immediate red flags emerge, though both companies should improve internal metrics to strengthen fundamentals:

How are the two companies positioned?

This section dissects KEYS and SANM’s operational DNA by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats and identify the more resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

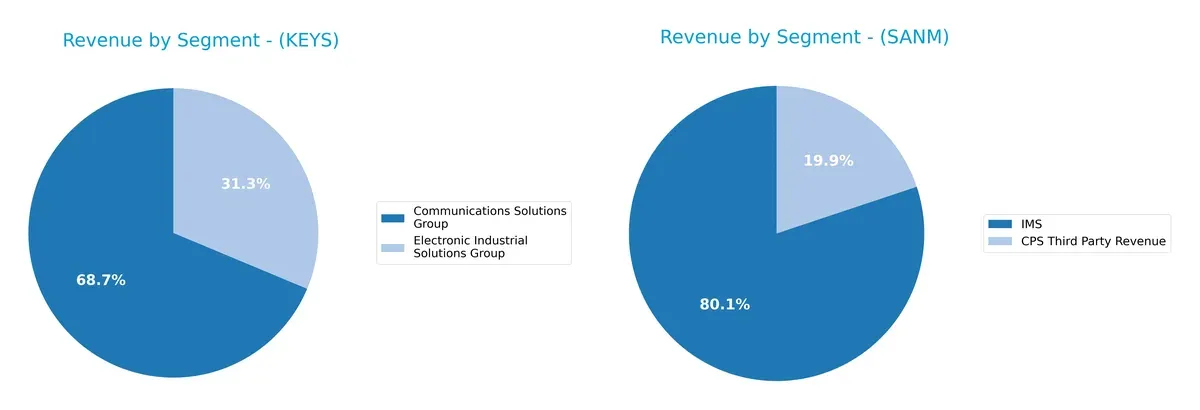

This visual comparison dissects how Keysight Technologies and Sanmina Corporation diversify their income streams and reveals their primary sector bets:

Keysight anchors its revenue in two main segments: Communications Solutions at $3.42B and Electronic Industrial Solutions at $1.56B in 2024. This mix shows moderate diversification, balancing high-tech communications with industrial electronics. Sanmina relies heavily on its IMS segment, generating $6.51B, dwarfing its CPS Third Party Revenue of $1.62B. Sanmina’s concentration in IMS signals strong infrastructure dominance but exposes it to concentration risk absent broader diversification.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Keysight Technologies, Inc. and Sanmina Corporation:

Keysight Strengths

- High net margin at 15.74%

- Strong current and quick ratios indicate solid liquidity

- Moderate debt with favorable debt-to-assets ratio

- Significant revenues from diversified segments

- Balanced geographic sales in Americas and Asia Pacific

- Favorable fixed asset turnover ratio

Sanmina Strengths

- Favorable asset and fixed asset turnover ratios show operational efficiency

- Low debt and very high interest coverage ratio reduce financial risk

- Favorable liquidity ratios support short-term obligations

- Large revenue base with multiple segments

- Strong presence in Americas with growth in Asia Pacific

- Neutral price-to-book ratio

Keysight Weaknesses

- Unfavorable valuation ratios with high P/E and P/B

- Moderate ROIC below WACC signals cautious capital returns

- Lower asset turnover may limit efficiency

- No dividend yield reduces income appeal

Sanmina Weaknesses

- Low net margin at 3.03% constrains profitability

- Unfavorable P/E ratio suggests valuation risk

- Zero dividend yield limits shareholder returns

Overall, Keysight demonstrates stronger profitability and liquidity but faces valuation and efficiency challenges. Sanmina offers operational efficiency and low leverage but struggles with profitability and valuation metrics. Both companies maintain slightly favorable overall financial profiles, suggesting differing strategic priorities.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat protects long-term profits from competitors eroding market share and pricing power. Let’s dissect how these two firms defend their turf:

Keysight Technologies, Inc.: Intangible Assets and Innovation Moat

Keysight leverages proprietary electronic design and test solutions, reflected in its premium 21.4% EBIT margin. However, its declining ROIC signals weakening capital efficiency. Expansion into software-defined networking could deepen its moat if execution improves in 2026.

Sanmina Corporation: Cost Advantage and Scale Moat

Sanmina relies on large-scale integrated manufacturing and supply chain expertise, enabling competitive pricing. Its low but stable margins and slight ROIC decline contrast with Keysight’s margin strength. Growth in cloud-based manufacturing software offers a path to reinforce its position.

Moat Strength Showdown: Innovation vs. Scale Efficiency

Keysight’s moat hinges on innovation and high margins but suffers a steep ROIC decline, eroding value creation. Sanmina’s scale-based moat is shallower but more stable, albeit with modest profitability. I see Sanmina better equipped to defend market share amid current financial trends.

Which stock offers better returns?

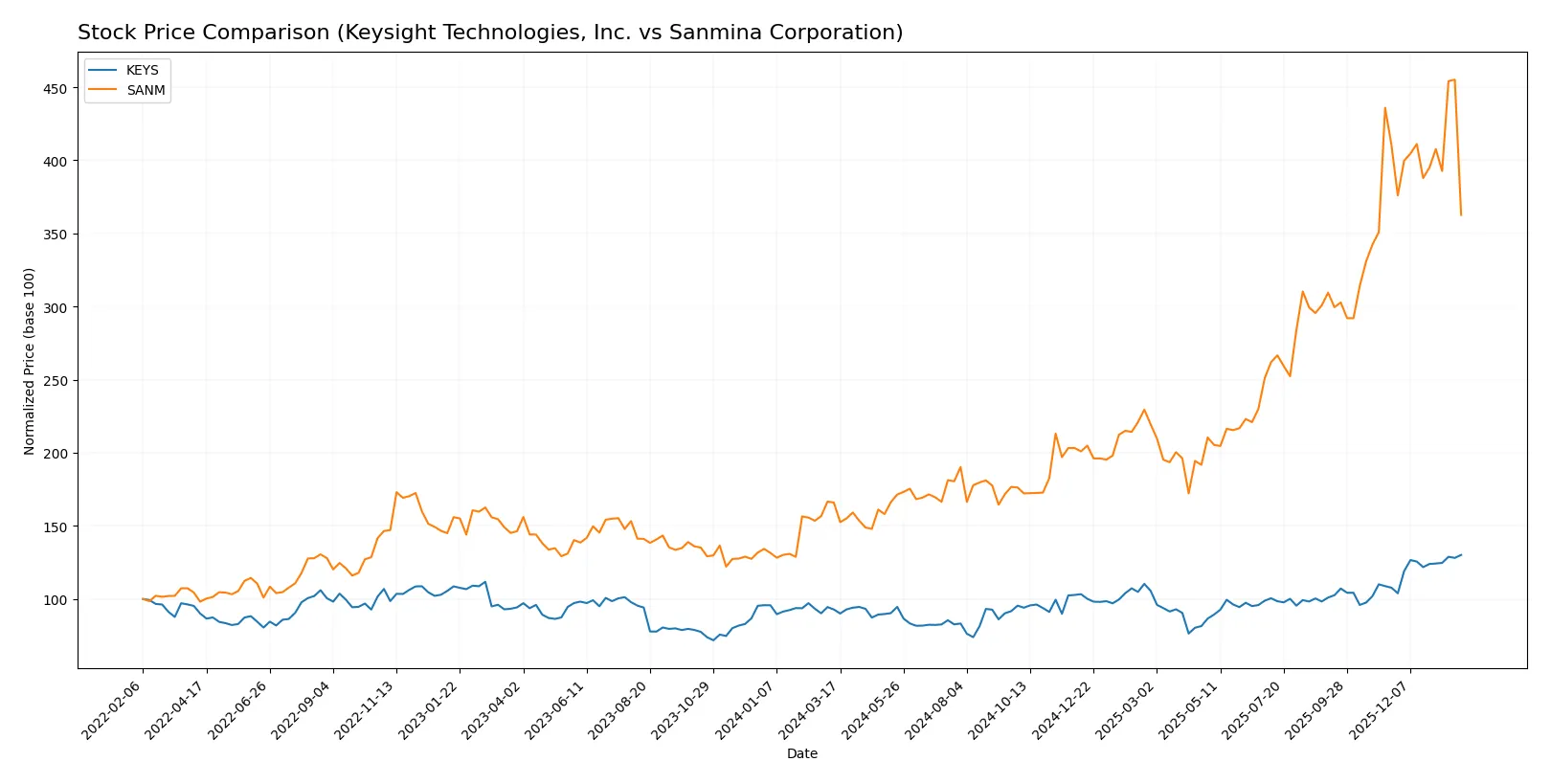

Over the past year, Keysight Technologies and Sanmina Corporation showed significant price movements, with contrasting recent trading dynamics and volume trends.

Trend Comparison

Keysight Technologies posted a strong 40.17% price gain over 12 months, signaling a bullish trend with accelerating momentum and a high of 216.33.

Sanmina Corporation surged 118.44% over the same period, marking a bullish trend but with decelerating momentum and a peak of 177.83.

Sanmina delivered the highest market performance despite recent short-term weakness, while Keysight maintained steady buyer dominance and volume stability.

Target Prices

Analysts project solid upside potential for Keysight Technologies and Sanmina Corporation based on current consensus estimates.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Keysight Technologies, Inc. | 210 | 243 | 226.5 |

| Sanmina Corporation | 200 | 200 | 200 |

Keysight’s consensus target of 226.5 suggests a moderate premium to its 216.33 market price, signaling analyst confidence. Sanmina’s target of 200 implies roughly 41% upside from its current 141.68 price, indicating strong bullish sentiment.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is a summary of recent institutional grades for Keysight Technologies, Inc. and Sanmina Corporation:

Keysight Technologies, Inc. Grades

The following table shows recent grades from reputable financial institutions for Keysight Technologies, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2025-12-17 |

| Jefferies | Maintain | Hold | 2025-12-10 |

| Baird | Maintain | Outperform | 2025-11-26 |

| Barclays | Maintain | Overweight | 2025-11-25 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-25 |

| Wells Fargo | Maintain | Overweight | 2025-11-25 |

| JP Morgan | Maintain | Overweight | 2025-11-25 |

| Susquehanna | Maintain | Positive | 2025-11-25 |

| Citigroup | Maintain | Buy | 2025-11-25 |

| UBS | Maintain | Buy | 2025-11-25 |

Sanmina Corporation Grades

This table presents recent grades issued by recognized grading firms for Sanmina Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | Maintain | Buy | 2026-01-28 |

| B of A Securities | Maintain | Neutral | 2025-07-11 |

| B of A Securities | Maintain | Neutral | 2025-06-09 |

| B of A Securities | Upgrade | Neutral | 2025-01-29 |

| Craig-Hallum | Maintain | Hold | 2024-11-05 |

| Craig-Hallum | Downgrade | Hold | 2024-04-30 |

| Sidoti & Co. | Upgrade | Buy | 2022-11-08 |

| Sidoti & Co. | Upgrade | Buy | 2022-11-07 |

| Sidoti & Co. | Downgrade | Neutral | 2022-10-31 |

| Sidoti & Co. | Downgrade | Neutral | 2022-10-30 |

Which company has the best grades?

Keysight Technologies holds consistently stronger grades, including multiple Buy and Overweight ratings from major firms. Sanmina’s grades trend more neutral and Hold, suggesting less bullish sentiment. Investors may view Keysight’s grades as signaling higher confidence from institutions.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Keysight Technologies, Inc.

- Faces intense competition in high-tech test solutions; premium pricing pressures reflect in high P/E and P/B ratios.

Sanmina Corporation

- Competes in contract manufacturing with lower margins; diversified client base but faces commoditization risks.

2. Capital Structure & Debt

Keysight Technologies, Inc.

- Moderate leverage with D/E at 0.51; interest coverage strong at 12x, indicating manageable debt risk.

Sanmina Corporation

- Low leverage with D/E at 0.17; exceptionally high interest coverage at 80x, signaling robust debt service capacity.

3. Stock Volatility

Keysight Technologies, Inc.

- Beta of 1.18 suggests above-market volatility; stock price range indicates moderate trading fluctuations.

Sanmina Corporation

- Beta near market average at 1.05; wider price range and recent sharp decline indicate higher downside risk.

4. Regulatory & Legal

Keysight Technologies, Inc.

- Operates globally in regulated sectors like aerospace and defense; compliance complexity poses ongoing risks.

Sanmina Corporation

- Exposure to multiple industries including defense and medical devices increases regulatory scrutiny and compliance costs.

5. Supply Chain & Operations

Keysight Technologies, Inc.

- Relies on advanced component suppliers; global supply chain disruptions could impact production timelines.

Sanmina Corporation

- Heavy dependence on contract manufacturing and logistics; supply chain volatility can affect fulfillment and margins.

6. ESG & Climate Transition

Keysight Technologies, Inc.

- Faces pressure to reduce carbon footprint in tech manufacturing; opportunities in energy-efficient product lines.

Sanmina Corporation

- Larger workforce and manufacturing footprint amplify ESG risks; must manage emissions and waste for compliance.

7. Geopolitical Exposure

Keysight Technologies, Inc.

- Significant global operations expose it to trade tensions, especially US-China relations affecting tech exports.

Sanmina Corporation

- Global manufacturing footprint vulnerable to geopolitical disruptions; supply chain and customer base in sensitive regions.

Which company shows a better risk-adjusted profile?

Keysight’s primary risk lies in valuation and competitive pricing pressures, while Sanmina struggles with profitability and stock volatility. Despite moderate leverage, Keysight’s Altman Z-score of 6.14 places it firmly in the safe zone, unlike Sanmina’s distress-zone score near 1.78. Keysight’s stronger balance sheet and stable liquidity offer a superior risk-adjusted profile in 2026’s volatile tech sector.

Final Verdict: Which stock to choose?

Keysight Technologies, Inc. (KEYS) excels as a cash-generating powerhouse with robust operational efficiency. Its superpower lies in consistent free cash flow and strong income quality. A point of vigilance remains its declining return on invested capital, signaling potential value erosion. KEYS suits portfolios targeting aggressive growth with a tolerance for premium valuation.

Sanmina Corporation (SANM) builds its case on a strategic moat grounded in operational asset efficiency and a conservative balance sheet. Its lower debt and solid interest coverage offer a safer profile than KEYS. SANM fits well within GARP (Growth at a Reasonable Price) portfolios seeking stable cash flow growth with moderate risk exposure.

If you prioritize aggressive growth and can absorb valuation premiums, KEYS is the compelling choice due to its superior cash flow generation. However, if you seek better balance sheet stability and operational efficiency at a more reasonable price, SANM offers a safer scenario despite slower momentum. Both carry risks tied to declining ROIC trends, warranting close monitoring.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Keysight Technologies, Inc. and Sanmina Corporation to enhance your investment decisions: