Investors often seek stability and growth in the non-alcoholic beverage sector, making The Coca-Cola Company (KO) and Keurig Dr Pepper Inc. (KDP) compelling contenders. Both firms dominate this industry with strong brand portfolios and innovative product strategies, yet differ in market scale and innovation focus. This article will carefully analyze their strengths and risks to help you decide which company deserves a place in your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between The Coca-Cola Company and Keurig Dr Pepper Inc. by providing an overview of these two companies and their main differences.

The Coca-Cola Company Overview

The Coca-Cola Company is a leading global beverage firm based in Atlanta, Georgia, with a market cap of 303B USD. Founded in 1886, it manufactures, markets, and sells a broad range of nonalcoholic beverages, including sparkling soft drinks, water, sports drinks, coffee, tea, and plant-based beverages. It operates through independent bottlers, distributors, and retailers worldwide, maintaining a strong presence in the consumer defensive sector.

Keurig Dr Pepper Inc. Overview

Keurig Dr Pepper Inc., headquartered in Burlington, Massachusetts, has a market cap of 37.6B USD and focuses on beverage production and distribution in the US and internationally. Established in 1981, it operates through segments such as Coffee Systems, Packaged Beverages, Beverage Concentrates, and Latin America Beverages. Its portfolio includes coffee systems, K-Cup pods, soft drinks, and concentrates, serving retailers, bottlers, and consumers primarily in the consumer defensive sector.

Key similarities and differences

Both companies operate in the nonalcoholic beverages industry within the consumer defensive sector, serving global markets through diverse product lines. Coca-Cola emphasizes a wide variety of beverages and a vast global bottling network, while Keurig Dr Pepper integrates coffee systems with beverage concentrates and regional distribution. The Coca-Cola Company significantly exceeds Keurig Dr Pepper in market capitalization and employee count, reflecting different scales and operational scopes.

Income Statement Comparison

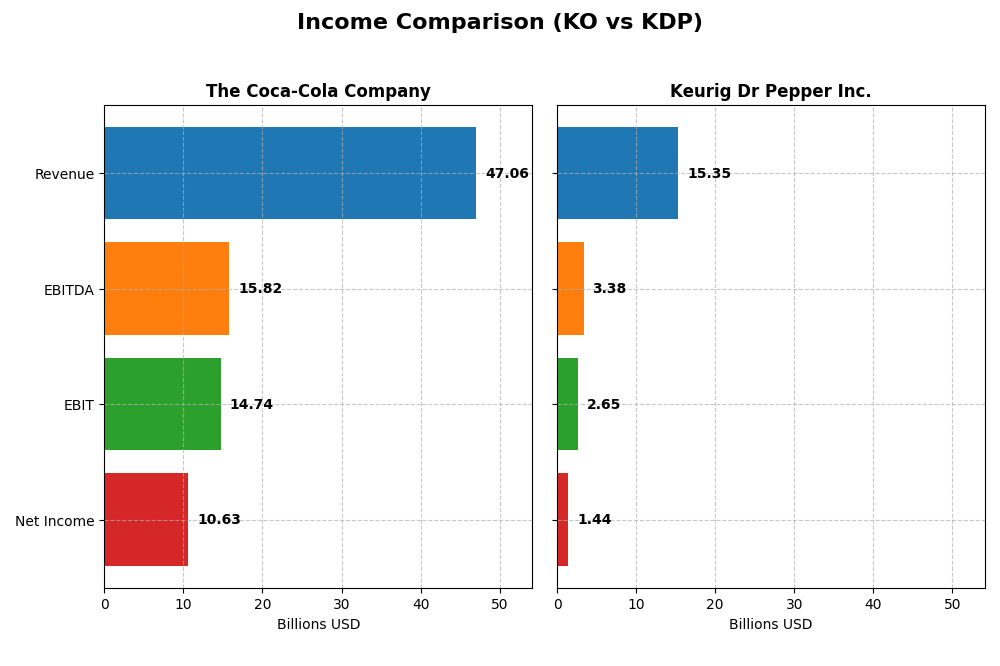

The table below compares key income statement metrics for The Coca-Cola Company and Keurig Dr Pepper Inc. based on their most recent fiscal year data (2024).

| Metric | The Coca-Cola Company | Keurig Dr Pepper Inc. |

|---|---|---|

| Market Cap | 303.4B | 37.6B |

| Revenue | 47.1B | 15.4B |

| EBITDA | 15.8B | 3.4B |

| EBIT | 14.7B | 2.6B |

| Net Income | 10.6B | 1.4B |

| EPS | 2.47 | 1.06 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

The Coca-Cola Company

From 2020 to 2024, The Coca-Cola Company showed consistent revenue growth, increasing from $33B to $47B, with net income rising from $7.75B to $10.63B. Margins remained strong, with a gross margin of 61.06% and a net margin of 22.59% in 2024. However, revenue growth slowed to 2.86% in the latest year, accompanied by a slight decline in net margin and EPS.

Keurig Dr Pepper Inc.

Keurig Dr Pepper experienced revenue growth from $11.6B in 2020 to $15.35B in 2024, while net income rose modestly from $1.33B to $1.44B. The company maintained a favorable gross margin of 55.56% but a lower net margin of 9.39%. In 2024, revenue grew by 3.62%, yet EBIT, net margin, and EPS all declined significantly, indicating margin pressures despite top-line improvement.

Which one has the stronger fundamentals?

Both companies exhibit favorable global income statement evaluations with similar balance of favorable and unfavorable metrics. Coca-Cola demonstrates larger scale, higher margins, and stronger net income growth over five years, albeit with recent margin compression. Keurig Dr Pepper shows steady revenue growth but weaker profitability and sharper recent margin declines. Fundamentals favor scale and profitability strength in Coca-Cola, while Keurig faces more pronounced margin challenges.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for The Coca-Cola Company (KO) and Keurig Dr Pepper Inc. (KDP) based on their most recent full-year data for 2024.

| Ratios | The Coca-Cola Company (KO) | Keurig Dr Pepper Inc. (KDP) |

|---|---|---|

| ROE | 42.8% | 5.9% |

| ROIC | 10.5% | 4.0% |

| P/E | 25.2 | 30.4 |

| P/B | 10.8 | 1.80 |

| Current Ratio | 1.03 | 0.49 |

| Quick Ratio | 0.84 | 0.33 |

| D/E (Debt-to-Equity) | 1.84 | 0.71 |

| Debt-to-Assets | 45.5% | 32.3% |

| Interest Coverage | 6.03 | 3.79 |

| Asset Turnover | 0.47 | 0.29 |

| Fixed Asset Turnover | 4.10 | 3.99 |

| Payout Ratio | 78.6% | 82.9% |

| Dividend Yield | 3.12% | 2.73% |

Interpretation of the Ratios

The Coca-Cola Company

The Coca-Cola Company shows strong profitability ratios including a high net margin of 22.59%, ROE of 42.77%, and ROIC at 10.46%, indicating efficient capital use. However, valuation multiples like P/E at 25.24 and P/B at 10.79 are less favorable, suggesting a premium price. Dividend yield is solid at 3.12%, supported by steady payouts, but free cash flow to equity is negative, which could signal payout risks.

Keurig Dr Pepper Inc.

Keurig Dr Pepper has more mixed ratios, with a neutral net margin of 9.39% but unfavorable ROE of 5.94% and ROIC of 4.04%, reflecting lower profitability and capital efficiency. Its liquidity ratios are weak, with a current ratio of 0.49 and quick ratio of 0.33. The company pays dividends with a 2.73% yield, though free cash flow to equity is negative, which may pressure dividend sustainability.

Which one has the best ratios?

The Coca-Cola Company presents a more favorable ratio profile with superior profitability and capital returns, though valuation appears stretched and leverage is relatively high. Keurig Dr Pepper shows weaker profitability and liquidity metrics with more unfavorable ratios overall. Thus, Coca-Cola’s ratios are generally stronger, while Keurig Dr Pepper’s highlight some financial risks and operational challenges.

Strategic Positioning

This section compares the strategic positioning of The Coca-Cola Company and Keurig Dr Pepper Inc., including market position, key segments, and exposure to technological disruption:

The Coca-Cola Company

- Leading global beverage company with strong brand recognition and competitive pressure in non-alcoholic beverages.

- Diverse segments including sparkling drinks, water, coffee, tea, juice, dairy, and plant-based beverages.

- Operates through independent bottlers and distributors, less exposed to technological disruption.

Keurig Dr Pepper Inc.

- US and international beverage company facing competitive pressure in coffee systems and packaged beverages.

- Key segments: Coffee Systems, Packaged Beverages, Beverage Concentrates, Latin America Beverages.

- Coffee Systems segment involves brewing technology; moderate exposure to disruption in coffee pod market.

The Coca-Cola Company vs Keurig Dr Pepper Inc. Positioning

The Coca-Cola Company has a diversified beverage portfolio covering multiple categories globally, while Keurig Dr Pepper focuses on specific segments like coffee systems and North American beverages. This leads to different exposure levels to market changes and operational models.

Which has the best competitive advantage?

The Coca-Cola Company demonstrates a very favorable moat with growing ROIC exceeding WACC, indicating durable competitive advantage. Keurig Dr Pepper shows a very unfavorable moat with declining ROIC, suggesting value destruction and weaker competitive positioning.

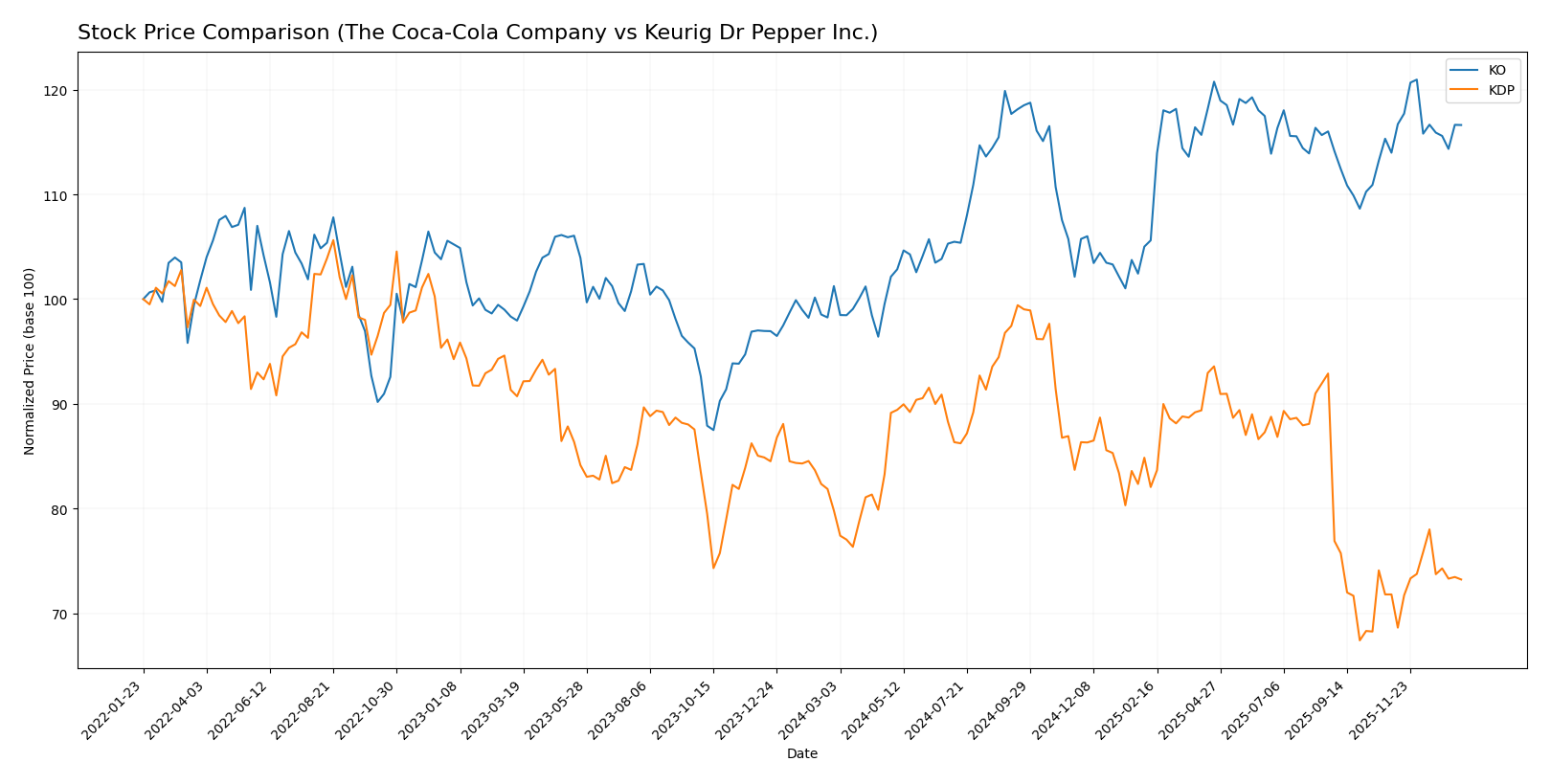

Stock Comparison

The stock price movements of The Coca-Cola Company and Keurig Dr Pepper Inc. over the past 12 months reveal contrasting trends, with Coca-Cola showing a significant positive shift and Keurig Dr Pepper experiencing a decline, while recent trading dynamics indicate nuanced short-term changes.

Trend Analysis

The Coca-Cola Company (KO) exhibited a bullish trend over the past year with a 15.2% price increase, despite a deceleration phase and moderate volatility (4.08 std deviation); the highest price reached 73.12 and the lowest was 58.28.

Keurig Dr Pepper Inc. (KDP) showed a bearish trend with an 8.25% decline during the same period, accompanied by accelerating price drops and lower volatility (2.98 std deviation); its price ranged between 25.5 and 37.61.

Comparing both, KO outperformed KDP over the past year, delivering the highest market performance with a clear bullish trend versus KDP’s sustained bearish movement.

Target Prices

The current analyst consensus presents a cautiously optimistic outlook for both The Coca-Cola Company and Keurig Dr Pepper Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| The Coca-Cola Company | 82 | 76 | 79 |

| Keurig Dr Pepper Inc. | 38 | 24 | 32 |

Analysts expect Coca-Cola’s stock to appreciate moderately above its current price of 70.5 USD, while Keurig Dr Pepper’s consensus target suggests a potential upside from the current 27.7 USD, reflecting moderate growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for The Coca-Cola Company and Keurig Dr Pepper Inc.:

Rating Comparison

The Coca-Cola Company Rating

- Rating: B+, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: 5, reflecting Very Favorable valuation.

- ROE Score: 5, showing very efficient profit generation from equity.

- ROA Score: 5, demonstrating highly effective asset utilization.

- Debt To Equity Score: 1, rated Very Unfavorable due to higher financial risk.

- Overall Score: 3, reflecting a Moderate overall assessment.

Keurig Dr Pepper Inc. Rating

- Rating: B, also considered Very Favorable.

- Discounted Cash Flow Score: 4, indicating Favorable valuation.

- ROE Score: 3, moderate efficiency in profit generation.

- ROA Score: 3, moderate asset utilization.

- Debt To Equity Score: 2, Moderate financial risk.

- Overall Score: 3, also a Moderate overall assessment.

Which one is the best rated?

Based strictly on the data, The Coca-Cola Company holds higher scores in discounted cash flow, ROE, and ROA, but has a less favorable debt to equity score. Both have equal overall scores, with Coca-Cola’s rating slightly higher at B+ versus KDP’s B.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

KO Scores

- Altman Z-Score: 4.59, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

KDP Scores

- Altman Z-Score: 1.33, in the distress zone indicating high bankruptcy risk.

- Piotroski Score: 6, indicating average financial strength.

Which company has the best scores?

Based strictly on the provided data, KO has better scores, with a safe zone Altman Z-Score and a strong Piotroski Score. KDP’s scores show higher bankruptcy risk and average financial strength.

Grades Comparison

Here is a comparison of the latest available grades from recognized grading companies for both companies:

The Coca-Cola Company Grades

This table summarizes recent grades and rating actions for The Coca-Cola Company from established firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Buy | 2025-11-07 |

| Barclays | Maintain | Overweight | 2025-10-23 |

| Wells Fargo | Maintain | Overweight | 2025-10-22 |

| TD Cowen | Maintain | Buy | 2025-10-22 |

| Piper Sandler | Maintain | Overweight | 2025-10-22 |

| Wells Fargo | Maintain | Overweight | 2025-09-25 |

| UBS | Maintain | Buy | 2025-09-11 |

| JP Morgan | Maintain | Overweight | 2025-07-23 |

| UBS | Maintain | Buy | 2025-07-23 |

| BNP Paribas | Maintain | Outperform | 2025-07-21 |

The Coca-Cola Company maintains predominantly positive grades, with all recent actions as “maintain” and consensus leaning towards Buy or Overweight ratings.

Keurig Dr Pepper Inc. Grades

This table presents the recent grades and rating changes for Keurig Dr Pepper Inc. from reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Downgrade | Hold | 2025-12-17 |

| Piper Sandler | Maintain | Overweight | 2025-12-15 |

| Barclays | Maintain | Equal Weight | 2025-10-28 |

| Wells Fargo | Maintain | Overweight | 2025-10-28 |

| JP Morgan | Maintain | Overweight | 2025-10-20 |

| B of A Securities | Maintain | Buy | 2025-10-08 |

| Goldman Sachs | Maintain | Neutral | 2025-10-02 |

| Wells Fargo | Maintain | Overweight | 2025-09-25 |

| Barclays | Downgrade | Equal Weight | 2025-09-24 |

| BNP Paribas | Downgrade | Underperform | 2025-09-22 |

Keurig Dr Pepper has a mixed trend with some downgrades and several maintained overweight or buy ratings, indicating a more cautious stance by analysts.

Which company has the best grades?

The Coca-Cola Company generally receives stronger and more consistent buy and overweight grades compared to Keurig Dr Pepper Inc., which shows recent downgrades and more mixed ratings. This disparity may influence investors’ perception of stability and growth potential between the two.

Strengths and Weaknesses

Below is a comparative table outlining key strengths and weaknesses of The Coca-Cola Company (KO) and Keurig Dr Pepper Inc. (KDP) based on their recent financial and strategic performance:

| Criterion | The Coca-Cola Company (KO) | Keurig Dr Pepper Inc. (KDP) |

|---|---|---|

| Diversification | Strong product and geographic diversification; large revenue from Pacific and global ventures segments | Moderate diversification focused on coffee systems and beverages; less geographic spread |

| Profitability | High net margin (22.6%), ROIC (10.5%), and ROE (42.8%); creating value with growing profitability | Lower profitability with net margin 9.4%, ROIC 4.0%, and declining ROE (5.9%); value destroying |

| Innovation | Consistent innovation with global ventures contributing $3.1B in revenue | Innovation centered on coffee systems and appliances, but overall profitability and ROIC are declining |

| Global presence | Extensive global presence, especially in Pacific markets generating $38.8B revenue | More regional focus, with Latin America beverages at $10.6B and limited global reach |

| Market Share | Strong market leadership with durable competitive advantage | Smaller market share with financial challenges and value erosion |

Key takeaways: Coca-Cola demonstrates a robust and growing competitive moat supported by strong profitability and wide global reach. In contrast, Keurig Dr Pepper faces challenges with declining returns and weaker profitability, signaling higher investment risk despite niche innovation.

Risk Analysis

Below is a comparison of key risk factors for The Coca-Cola Company (KO) and Keurig Dr Pepper Inc. (KDP) based on the latest 2024 data and 2026 insights:

| Metric | The Coca-Cola Company (KO) | Keurig Dr Pepper Inc. (KDP) |

|---|---|---|

| Market Risk | Moderate (Beta 0.39, stable demand but premium valuation) | Moderate (Beta 0.35, competitive market with pressure on margins) |

| Debt Level | High (Debt/Equity 1.84, debt to assets 45.5%) | Moderate (Debt/Equity 0.71, debt to assets 32.3%) |

| Regulatory Risk | Moderate (stringent beverage regulations, sugar taxes) | Moderate (similar beverage regulations, plus coffee system regulations) |

| Operational Risk | Moderate (complex global supply chain) | Moderate (diverse product segments but smaller scale) |

| Environmental Risk | Moderate (focus on sustainability but water use pressure) | Moderate (increasing focus on packaging and sustainability) |

| Geopolitical Risk | Moderate (global footprint with exposure to trade tensions) | Moderate (primarily US-focused but some international exposure) |

The most significant risks lie in KO’s high debt level and valuation pressures, while KDP faces operational challenges and financial distress signals reflected in its Altman Z-Score. Both companies operate in regulated industries with environmental and geopolitical risks that require ongoing monitoring. I advise cautious exposure, favoring KO’s stronger financial stability but mindful of its leverage.

Which Stock to Choose?

The Coca-Cola Company (KO) shows a favorable income statement with strong profitability metrics, including a 22.59% net margin and a 42.77% ROE. Despite a slight recent revenue growth slowdown, KO maintains a very favorable rating with a B+ grade and demonstrates a very favorable moat with ROIC consistently above WACC, indicating value creation.

Keurig Dr Pepper Inc. (KDP) presents a favorable income statement but with lower profitability, including a 9.39% net margin and a subdued 5.94% ROE. Its financial ratios are slightly unfavorable overall, and it holds a B rating. The company’s moat evaluation is very unfavorable, showing ROIC below WACC and declining profitability, suggesting value destruction.

Investors focused on stable profitability and durable competitive advantage might find KO’s profile more aligned with their preferences, while those willing to tolerate higher risk for potential recovery might consider KDP’s situation. The choice could depend on whether the investor prioritizes value creation with strong financial health or seeks opportunities in companies facing challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Coca-Cola Company and Keurig Dr Pepper Inc. to enhance your investment decisions: