In today’s competitive beverage market, Monster Beverage Corporation (MNST) and Keurig Dr Pepper Inc. (KDP) stand out as key players driving innovation and growth. Both companies operate in the non-alcoholic beverage industry but differentiate themselves through unique product portfolios and strategic approaches. This article will explore their strengths and challenges to help you decide which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Monster Beverage Corporation and Keurig Dr Pepper Inc. by providing an overview of these two companies and their main differences.

Monster Beverage Corporation Overview

Monster Beverage Corporation focuses on the development, marketing, sale, and distribution of energy drink beverages and concentrates globally. Operating through segments like Monster Energy Drinks and Strategic Brands, it offers a wide variety of carbonated and non-carbonated beverages. Headquartered in Corona, California, Monster has built a strong market presence with popular brands such as Monster Energy and Reign, serving retail chains, distributors, and e-commerce platforms.

Keurig Dr Pepper Inc. Overview

Keurig Dr Pepper Inc. operates as a diversified beverage company with segments including Coffee Systems, Packaged Beverages, Beverage Concentrates, and Latin America Beverages. It manufactures and distributes a broad portfolio of beverages like Dr Pepper, Snapple, and K-Cup pods. Based in Burlington, Massachusetts, KDP serves retailers, bottlers, restaurants, and consumers both in the U.S. and internationally, leveraging its extensive product range and distribution network.

Key similarities and differences

Both companies operate in the non-alcoholic beverages sector, distributing a variety of drinks to retailers and consumers. Monster specializes primarily in energy drinks and related products, whereas Keurig Dr Pepper has a more diversified portfolio including coffee systems, soft drinks, and beverage concentrates. Additionally, KDP employs significantly more staff and covers broader geographic markets, while Monster focuses more narrowly on energy and specialty beverages.

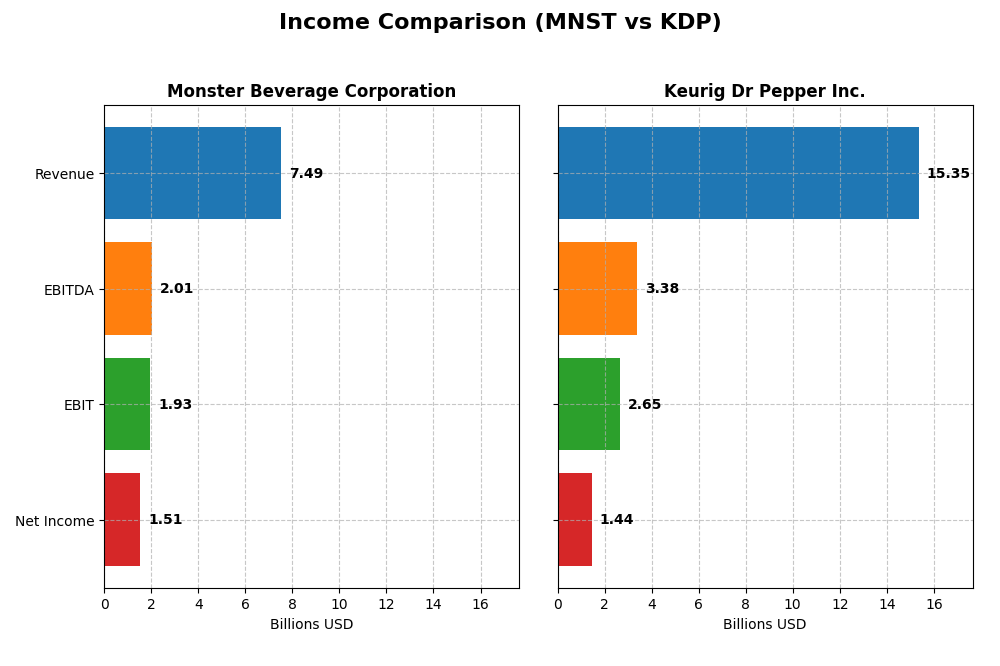

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Monster Beverage Corporation and Keurig Dr Pepper Inc. based on their most recent fiscal year 2024.

| Metric | Monster Beverage Corporation | Keurig Dr Pepper Inc. |

|---|---|---|

| Market Cap | 75.7B | 37.6B |

| Revenue | 7.49B | 15.35B |

| EBITDA | 2.01B | 3.38B |

| EBIT | 1.93B | 2.65B |

| Net Income | 1.51B | 1.44B |

| EPS | 1.50 | 1.06 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Monster Beverage Corporation

Monster Beverage Corporation has shown consistent revenue growth from 2020 to 2024, reaching $7.49B in 2024, with net income increasing moderately to $1.51B. Gross and EBIT margins remain strong at 54.04% and 25.76%, respectively, though net margin contracted by 11.83% in 2024. The latest year saw a slight revenue growth slowdown and unfavorable margin and EPS declines, despite overall favorable trends.

Keurig Dr Pepper Inc.

Keurig Dr Pepper’s revenue rose steadily from $11.62B in 2020 to $15.35B in 2024, with net income increasing to $1.44B. The company maintains a favorable gross margin of 55.56%, but EBIT margin is lower at 17.26%. In 2024, revenue growth slowed with a 3.62% increase, and net margin and EPS suffered significant declines, indicating margin pressure despite overall favorable long-term growth.

Which one has the stronger fundamentals?

Both companies show favorable income statement fundamentals with solid revenue and net income growth over the past five years. Monster Beverage exhibits stronger EBIT and net margins with lower interest expense, supporting higher profitability. Keurig Dr Pepper, while growing revenue more substantially, faces greater margin compression and higher interest costs. Overall, each has strengths and weaknesses in profitability and growth metrics.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Monster Beverage Corporation (MNST) and Keurig Dr Pepper Inc. (KDP) based on their most recent fiscal year data (2024).

| Ratios | Monster Beverage Corporation (MNST) | Keurig Dr Pepper Inc. (KDP) |

|---|---|---|

| ROE | 25.3% | 5.9% |

| ROIC | 22.1% | 4.0% |

| P/E | 35.0 | 30.4 |

| P/B | 8.9 | 1.8 |

| Current Ratio | 3.32 | 0.49 |

| Quick Ratio | 2.65 | 0.33 |

| D/E (Debt-to-Equity) | 0.06 | 0.71 |

| Debt-to-Assets | 4.8% | 32.3% |

| Interest Coverage | 69.2 | 3.8 |

| Asset Turnover | 0.97 | 0.29 |

| Fixed Asset Turnover | 7.16 | 3.99 |

| Payout ratio | 0% | 82.9% |

| Dividend yield | 0% | 2.73% |

Interpretation of the Ratios

Monster Beverage Corporation

Monster Beverage shows strong profitability ratios, including a favorable net margin of 20.14% and robust returns on equity (25.33%) and invested capital (22.11%). However, valuation multiples such as PE (34.99) and PB (8.86) appear high, and the current ratio of 3.32 is considered unfavorable despite a strong quick ratio. The company pays no dividends, reflecting a reinvestment strategy focused on growth and operational strength.

Keurig Dr Pepper Inc.

Keurig Dr Pepper displays weaker profitability with a net margin of 9.39% and return on equity at 5.94%, both less favorable than its peer. Liquidity ratios are low, with a current ratio of 0.49 and quick ratio of 0.33, signaling potential short-term solvency concerns. The company pays dividends, yielding 2.73%, supported by moderate payout ratios, though some leverage and asset turnover metrics are less encouraging.

Which one has the best ratios?

Based on the ratio analysis, Monster Beverage Corporation holds a more favorable overall profile with a higher percentage of strong ratios and better profitability metrics. Keurig Dr Pepper’s ratios indicate some financial stress in liquidity and weaker returns, despite offering dividends. Thus, Monster Beverage’s ratios appear more robust and balanced relative to Keurig Dr Pepper.

Strategic Positioning

This section compares the strategic positioning of Monster Beverage Corporation and Keurig Dr Pepper Inc., including Market position, Key segments, and Exposure to technological disruption:

Monster Beverage Corporation

- Leading non-alcoholic beverage company with less competitive pressure, market cap of $75.7B

- Focused on energy drinks and related beverages; major revenue from Monster Energy Drinks

- Limited explicit exposure to technological disruption mentioned

Keurig Dr Pepper Inc.

- Mid-sized beverage company with more competitive pressure, market cap of $37.6B

- Diversified segments including Coffee Systems, Packaged Beverages, and Beverage Concentrates

- Coffee systems segment relies on technology; moderate exposure to disruption in coffee brewing

Monster Beverage Corporation vs Keurig Dr Pepper Inc. Positioning

Monster Beverage’s approach centers on a concentrated energy drink portfolio generating significant revenue, while Keurig Dr Pepper pursues diversification across coffee systems, concentrates, and beverages, offering broader business drivers but with greater complexity.

Which has the best competitive advantage?

Monster Beverage shows a slightly favorable moat with positive value creation despite declining profitability, whereas Keurig Dr Pepper is very unfavorable, shedding value with declining returns, indicating Monster holds a stronger competitive advantage based on MOAT evaluation.

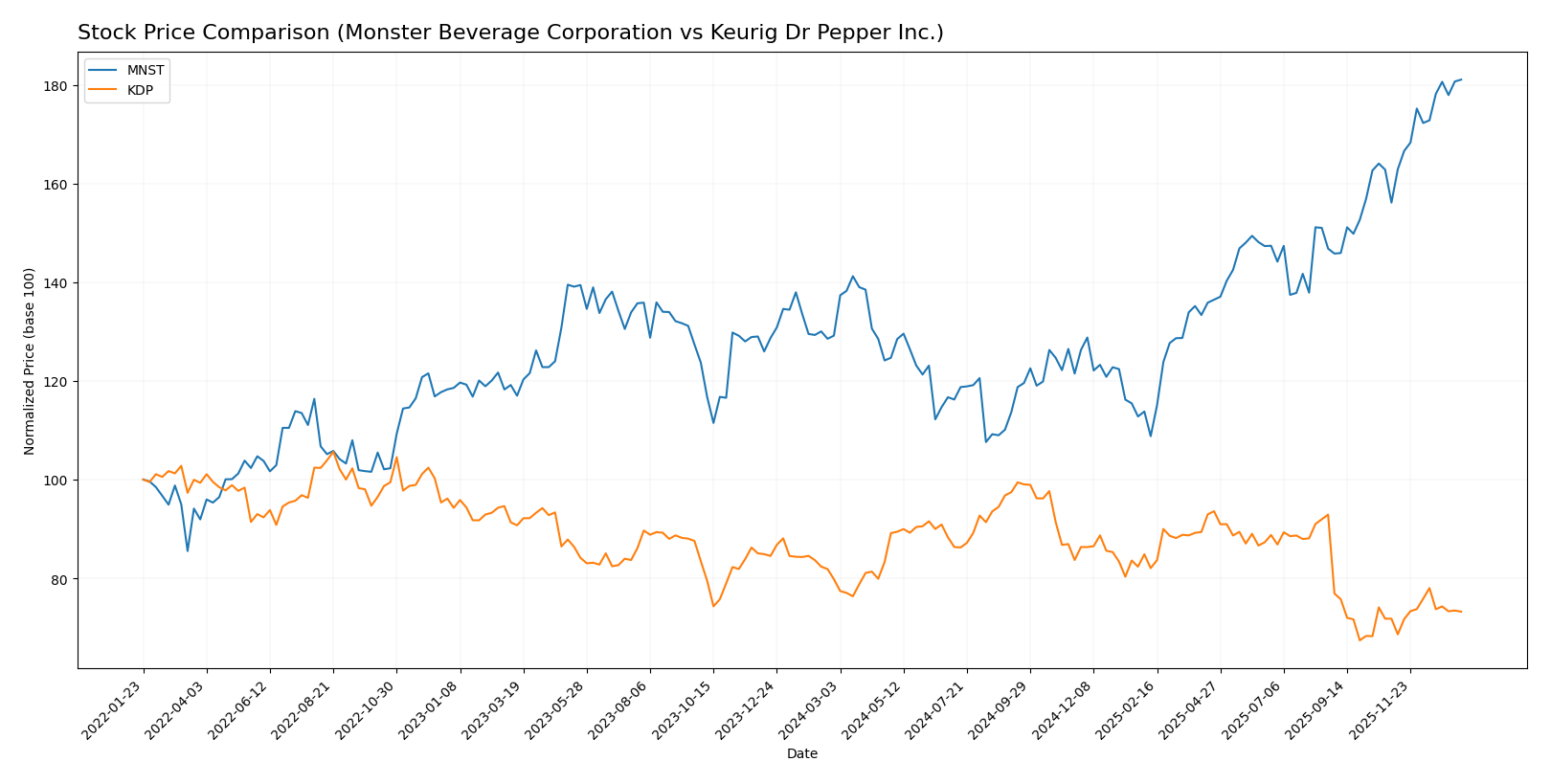

Stock Comparison

The stock prices of Monster Beverage Corporation and Keurig Dr Pepper Inc. have exhibited contrasting movements over the past 12 months, with Monster showing significant gains while Keurig Dr Pepper faced declines amid shifting trading volumes and buyer dominance.

Trend Analysis

Monster Beverage Corporation’s stock demonstrated a bullish trend over the past year with a 40.17% price increase, marked by accelerating momentum and notable volatility (8.13 std deviation). The stock reached a high of 77.5 and a low of 46.06.

Keurig Dr Pepper Inc.’s stock experienced a bearish trend with an 8.25% decline over the same period, despite accelerating trend dynamics. Volatility remained moderate with a 2.98 standard deviation, and the price ranged from 25.5 to 37.61.

Comparing these stocks, Monster Beverage Corporation delivered the highest market performance over the last year, outperforming Keurig Dr Pepper by a wide margin in price appreciation.

Target Prices

Here is the current target price consensus from reliable analysts for Monster Beverage Corporation and Keurig Dr Pepper Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Monster Beverage Corporation | 87 | 70 | 79.44 |

| Keurig Dr Pepper Inc. | 38 | 24 | 32 |

Analysts expect Monster Beverage’s stock to slightly appreciate above its current price of $77.5, while Keurig Dr Pepper shows moderate upside potential compared to its $27.7 share price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Monster Beverage Corporation and Keurig Dr Pepper Inc.:

Rating Comparison

Monster Beverage Corporation Rating

- Rating: B, classified as Very Favorable overall rating.

- Discounted Cash Flow Score: 4, indicating a favorable valuation based on future cash flows.

- ROE Score: 5, very favorable, showing excellent profit generation from equity.

- ROA Score: 5, very favorable, reflecting strong asset utilization.

- Debt To Equity Score: 1, very unfavorable, indicating high financial risk.

- Overall Score: 3, moderate summary of financial standing.

Keurig Dr Pepper Inc. Rating

- Rating: B, classified as Very Favorable overall rating.

- Discounted Cash Flow Score: 4, also favorable for valuation prospects.

- ROE Score: 3, moderate, indicating average efficiency in profit generation.

- ROA Score: 3, moderate, showing average asset utilization.

- Debt To Equity Score: 2, moderate, suggesting a more balanced financial risk.

- Overall Score: 3, also a moderate overall financial assessment.

Which one is the best rated?

Both companies share the same overall rating and score, but Monster Beverage displays stronger profitability metrics with very favorable ROE and ROA scores. However, it carries higher financial risk with a very unfavorable debt-to-equity score compared to Keurig Dr Pepper’s moderate risk level.

Scores Comparison

Here is a comparison of the financial health scores for Monster Beverage Corporation and Keurig Dr Pepper Inc.:

MNST Scores

- Altman Z-Score: 25.33, indicating a safe zone.

- Piotroski Score: 8, classified as very strong.

KDP Scores

- Altman Z-Score: 1.33, indicating distress zone.

- Piotroski Score: 6, classified as average.

Which company has the best scores?

Based on the provided data, MNST shows significantly stronger financial health with a safe zone Altman Z-Score and a very strong Piotroski Score, while KDP falls in distress and average categories respectively.

Grades Comparison

The following tables summarize the latest reliable grades from recognized grading companies for Monster Beverage Corporation and Keurig Dr Pepper Inc.:

Monster Beverage Corporation Grades

This table shows recent grading updates from major financial institutions for Monster Beverage Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Hold | 2026-01-08 |

| Wells Fargo | Maintain | Overweight | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-23 |

| Citigroup | Maintain | Buy | 2025-12-17 |

| Stifel | Maintain | Buy | 2025-12-12 |

| Wells Fargo | Maintain | Overweight | 2025-12-03 |

| Piper Sandler | Maintain | Overweight | 2025-12-03 |

| BMO Capital | Maintain | Market Perform | 2025-12-03 |

| RBC Capital | Maintain | Outperform | 2025-12-01 |

| Piper Sandler | Maintain | Overweight | 2025-12-01 |

Most grades for Monster Beverage Corporation are positive, with a strong emphasis on “Buy” and “Overweight” ratings from reputable firms, indicating broad analyst confidence.

Keurig Dr Pepper Inc. Grades

This table presents recent grading updates from recognized financial institutions for Keurig Dr Pepper Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Downgrade | Hold | 2025-12-17 |

| Piper Sandler | Maintain | Overweight | 2025-12-15 |

| Barclays | Maintain | Equal Weight | 2025-10-28 |

| Wells Fargo | Maintain | Overweight | 2025-10-28 |

| JP Morgan | Maintain | Overweight | 2025-10-20 |

| B of A Securities | Maintain | Buy | 2025-10-08 |

| Goldman Sachs | Maintain | Neutral | 2025-10-02 |

| Wells Fargo | Maintain | Overweight | 2025-09-25 |

| Barclays | Downgrade | Equal Weight | 2025-09-24 |

| BNP Paribas | Downgrade | Underperform | 2025-09-22 |

Ratings for Keurig Dr Pepper Inc. show a mix of “Overweight,” “Buy,” and some downgrades toward “Hold” and “Underperform,” reflecting a more cautious analyst stance.

Which company has the best grades?

Monster Beverage Corporation has received generally stronger and more consistent grades, mostly “Buy” and “Overweight,” compared to Keurig Dr Pepper Inc., which shows mixed ratings and recent downgrades. This suggests investors may view Monster as having a more favorable outlook, potentially impacting portfolio positioning and risk assessment.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Monster Beverage Corporation (MNST) and Keurig Dr Pepper Inc. (KDP) based on the latest available data.

| Criterion | Monster Beverage Corporation (MNST) | Keurig Dr Pepper Inc. (KDP) |

|---|---|---|

| Diversification | Moderate: Primarily energy drinks with some alcohol and strategic brands (6.9B USD in 2024) | High: Broad product mix including beverages, coffee systems, appliances (15.7B USD in 2024) |

| Profitability | Strong: High net margin (20.14%), ROIC (22.11%), and ROE (25.33%) | Moderate to weak: Lower net margin (9.39%), ROIC (4.04%), and ROE (5.94%) |

| Innovation | Good: Focus on strategic brand development and new product lines | Moderate: Innovation in coffee systems and K-Cup pods, but slower growth in some segments |

| Global presence | Growing: Expanding beyond US with strategic brands and alcohol segment | Strong: Significant Latin America beverage presence and diversified markets |

| Market Share | Strong in energy drinks segment with consistent growth | Moderate: Competitive in coffee and beverage markets, but facing margin pressure |

Key takeaways: Monster Beverage stands out for its strong profitability and focused product portfolio, despite a slightly declining ROIC trend. Keurig Dr Pepper benefits from diversification and global reach but struggles with profitability and efficiency, reflecting challenges in value creation.

Risk Analysis

Below is a comparative risk overview for Monster Beverage Corporation (MNST) and Keurig Dr Pepper Inc. (KDP) based on the most recent 2024 data.

| Metric | Monster Beverage Corporation (MNST) | Keurig Dr Pepper Inc. (KDP) |

|---|---|---|

| Market Risk | Low beta (0.46) suggests lower volatility relative to market. | Low beta (0.35) also indicates lower market volatility. |

| Debt Level | Very low debt-to-equity (0.06) and debt-to-assets (4.8%), strong interest coverage (69x). | Moderate debt-to-equity (0.71) and debt-to-assets (32%), interest coverage around 3.9x. |

| Regulatory Risk | Moderate; beverage industry faces regulations on labeling and health claims. | Moderate; similar exposure to regulatory constraints, especially in coffee and beverage segments. |

| Operational Risk | Moderate; dependence on energy drink market trends and brand diversification. | Moderate to high; larger workforce (29K employees) and complex supply chain increase operational complexity. |

| Environmental Risk | Moderate; sustainability demands increasing, especially for packaging and water use. | Moderate; similar environmental pressures including resource use and waste management. |

| Geopolitical Risk | Low to moderate; primarily US-based but international sales expose it to trade risks. | Moderate; Latin America segment increases exposure to geopolitical and currency risks. |

The most impactful risks for these companies are debt levels and operational complexity. Monster’s very low leverage and strong liquidity position it better to weather financial stress, while Keurig Dr Pepper’s higher debt and lower liquidity ratios increase financial risk. Additionally, KDP’s international exposure, especially in Latin America, brings heightened geopolitical risk compared to MNST. Investors should weigh these factors carefully, balancing Monster’s financial strength against Keurig Dr Pepper’s broader market footprint.

Which Stock to Choose?

Monster Beverage Corporation (MNST) shows favorable income growth with a 63% revenue increase over five years and strong profitability metrics, including a 20.14% net margin and 25.33% ROE. Its debt levels are low, reflected by a 0.06 debt-to-equity ratio, and it holds a very favorable B rating, despite some unfavorable valuation ratios.

Keurig Dr Pepper Inc. (KDP) has moderate income growth with a 32% revenue increase over five years and a lower net margin of 9.39%. Its financial ratios reveal mixed strength, with moderate debt levels (0.71 debt-to-equity) and a slightly unfavorable global ratio profile. KDP also holds a B rating but with more neutral to unfavorable score components.

For investors prioritizing high profitability and strong financial health, MNST’s very favorable rating and income metrics could appear more attractive. Conversely, those with a tolerance for higher leverage and seeking dividend yield may view KDP’s profile as fitting their strategy, given its favorable dividend yield and stable income statement. The choice might therefore depend on the investor’s risk tolerance and investment focus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Monster Beverage Corporation and Keurig Dr Pepper Inc. to enhance your investment decisions: