In the ever-evolving landscape of industrial machinery, JBT Marel Corporation (JBTM) and Kadant Inc. (KAI) stand out as two compelling players. Both companies operate within the same industry and share market overlaps, yet they pursue distinct innovation strategies. JBTM focuses on technology solutions for the food and beverage sector, while KAI specializes in engineered systems and fluid-handling technologies. As we delve into their performance and prospects, I aim to help you identify which company holds the greatest potential for your investment portfolio.

Table of contents

Company Overview

JBT Marel Corporation Overview

JBT Marel Corporation, trading under the ticker JBTM, specializes in providing technology solutions for the food and beverage industry across multiple global regions, including North America and Europe. The company focuses on value-added processing, offering a wide array of services from chilling and mixing to packaging and material handling. By leveraging automated guided vehicle systems, JBT Marel enhances manufacturing efficiency in sectors such as pharmaceuticals and food production. With a market capitalization of approximately $7.3B and a workforce of around 11,700 employees, JBT Marel is well-positioned to capitalize on the growing demand for innovative processing solutions.

Kadant Inc. Overview

Kadant Inc. (ticker KAI) is a global leader in engineered systems and technologies, boasting a market cap of about $3.3B. The company operates through three distinct segments: Flow Control, Industrial Processing, and Material Handling. Kadant excels in fluid-handling systems and offers a comprehensive suite of products that serve the packaging, tissue, and wood products industries. With a staff of 3,500 and a focus on sustainability through biodegradable solutions, Kadant is an important player in the industrial machinery sector, continuously evolving its offerings to meet market demands.

Key similarities and differences

Both JBT Marel Corporation and Kadant Inc. operate within the industrial machinery sector and focus on technology-driven solutions. However, JBT Marel primarily serves the food and beverage industry, while Kadant provides a broader range of engineered systems across various sectors, including packaging and wood products. This distinction highlights JBT Marel’s niche market focus compared to Kadant’s diverse industrial applications.

Income Statement Comparison

The table below presents a comparison of key income statement metrics for JBT Marel Corporation and Kadant Inc. for the most recent fiscal year.

| Metric | JBT Marel Corporation | Kadant Inc. |

|---|---|---|

| Market Cap | 7.30B | 3.28B |

| Revenue | 1.72B | 1.05B |

| EBITDA | 204M | 223M |

| EBIT | 115M | 173M |

| Net Income | 85M | 112M |

| EPS | 2.67 | 9.51 |

| Fiscal Year | 2024 | 2024 |

Interpretation of Income Statement

In the most recent fiscal year, JBT Marel Corporation experienced a slight revenue increase to 1.72B, reflecting a steady growth trajectory. However, its net income dropped to 85M, indicating margin compression. Conversely, Kadant Inc. saw revenue rise to 1.05B with net income at 112M, suggesting robust profitability and improved margins. The EBITDA margins for Kadant appear more favorable, indicating efficient operations despite a challenging market environment. Overall, while both companies showed resilience, Kadant’s stronger performance in margins and profitability metrics could make it a more attractive option for investors.

Financial Ratios Comparison

The following table provides a comparative view of the most recent financial ratios for JBT Marel Corporation (JBTM) and Kadant Inc. (KAI).

| Metric | JBT Marel Corporation (JBTM) | Kadant Inc. (KAI) |

|---|---|---|

| ROE | 5.53% | 13.17% |

| ROIC | 3.65% | 10.08% |

| P/E | 47.63 | 28.26 |

| P/B | 2.63 | 4.86 |

| Current Ratio | 3.48 | 2.31 |

| Quick Ratio | 3.04 | 1.55 |

| D/E | 0.81 | 0.38 |

| Debt-to-Assets | 36.68% | 22.57% |

| Interest Coverage | 6.10 | 19.74 |

| Asset Turnover | 0.50 | 0.74 |

| Fixed Asset Turnover | 7.34 | 6.18 |

| Payout Ratio | 15.34% | 13.15% |

| Dividend Yield | 0.32% | 0.36% |

Interpretation of Financial Ratios

The ratios indicate that Kadant Inc. (KAI) presents stronger returns on equity and invested capital compared to JBTM, suggesting better efficiency in utilizing equity for generating profit. KAI’s lower debt ratios and higher interest coverage indicate a more solid financial position and lower risk. However, JBTM’s higher current and quick ratios signal better short-term liquidity, which is a positive indicator for investors concerned about immediate financial obligations.

Dividend and Shareholder Returns

JBT Marel Corporation (JBTM) offers dividends with a payout ratio of 15.34%, reflecting a consistent annual dividend yield of 0.32%. The company also engages in share buybacks, enhancing shareholder returns. Meanwhile, Kadant Inc. (KAI) has a slightly higher dividend payout ratio of 13.15% and a yield of 0.40%. Both companies demonstrate a commitment to returning value to shareholders, suggesting a sustainable approach to long-term value creation.

Strategic Positioning

In the industrial machinery sector, JBT Marel Corporation (JBTM) holds a market cap of $7.3B, focusing on comprehensive food and beverage processing solutions. Its key competitive edge lies in technology-driven automation and diverse offerings across multiple industries. Kadant Inc. (KAI), valued at $3.3B, specializes in engineered systems and fluid-handling technologies, facing competitive pressure from emerging tech disruptors. Both companies are navigating a landscape marked by rapid innovation and shifting market demands, necessitating strategic agility to maintain and grow their market shares.

Stock Comparison

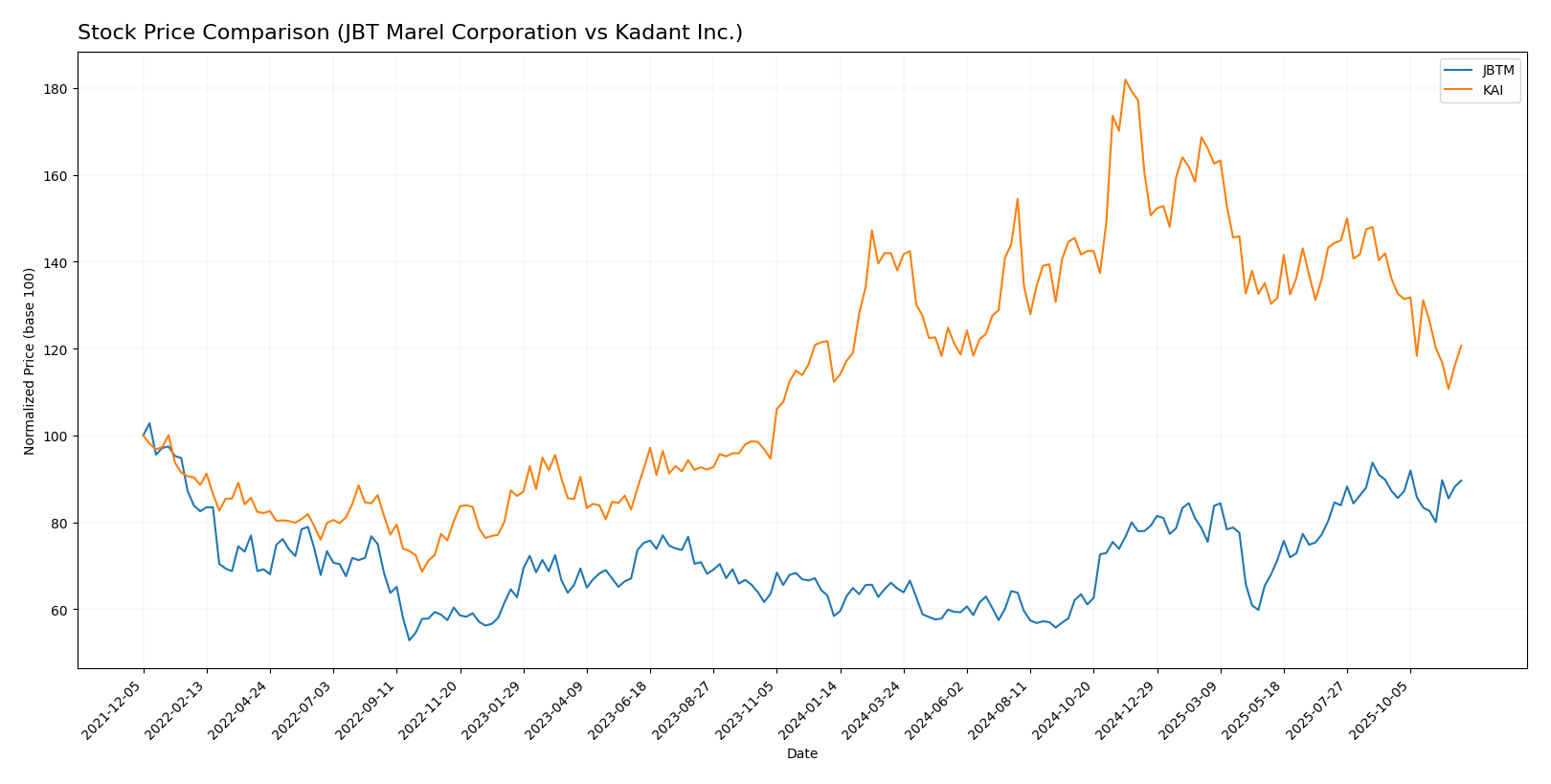

In the past year, both JBT Marel Corporation (JBTM) and Kadant Inc. (KAI) have exhibited notable movements in their stock prices, reflecting varying trading dynamics that warrant closer inspection.

Trend Analysis

Analyzing the stock trends over the past year reveals the following:

JBT Marel Corporation (JBTM): The stock has experienced a remarkable price change of +52.67%, indicating a bullish trend. However, the trend is currently characterized by deceleration, with a recent price change of +2.24% from September 14, 2025, to November 30, 2025. The highest price recorded during this period was 147.7, while the lowest was 87.85. The standard deviation of 17.43 suggests moderate volatility, which investors should consider when assessing risk.

Kadant Inc. (KAI): The stock has shown a price change of +7.49%, also reflecting a bullish trend. Nonetheless, the recent period from September 14, 2025, to November 30, 2025, reveals a price decline of -11.29%, indicating a potential shift in market sentiment. The highest price reached was 419.01, with a low of 254.91, and a standard deviation of 35.59 points to higher volatility compared to JBTM.

In summary, JBTM presents a solid bullish trend with positive long-term performance, albeit with some recent deceleration, while KAI shows short-term challenges despite a generally positive annual trend.

Analyst Opinions

Recent analyst recommendations for JBT Marel Corporation (JBTM) indicate a “C” rating, suggesting a hold strategy due to concerns over return on equity and assets, with analysts highlighting potential risks in its financial structure. In contrast, Kadant Inc. (KAI) received a “B+” rating, with recommendations leaning towards buy, driven by strong performance in return on assets and equity. Analysts suggest KAI presents a more robust investment opportunity for 2025, while JBTM remains a cautious hold. Overall, the consensus for KAI is buy, while JBTM is viewed more neutrally.

Stock Grades

In the current market landscape, reliable stock ratings can provide valuable insights for informed investment decisions. Here’s a look at the recent grades for two companies:

JBT Marel Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| William Blair | upgrade | Outperform | 2025-08-06 |

Kadant Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barrington Research | maintain | Outperform | 2025-10-30 |

| Barrington Research | maintain | Outperform | 2025-10-29 |

| Barrington Research | maintain | Outperform | 2025-10-27 |

| Barrington Research | maintain | Outperform | 2025-10-10 |

| Barrington Research | maintain | Outperform | 2025-09-23 |

| DA Davidson | maintain | Neutral | 2025-08-04 |

| Barrington Research | maintain | Outperform | 2025-07-30 |

| Barrington Research | maintain | Outperform | 2025-07-29 |

| DA Davidson | maintain | Neutral | 2025-05-01 |

| Barrington Research | maintain | Outperform | 2025-05-01 |

Overall, JBT Marel Corporation has received an upgrade to “Outperform,” indicating a positive shift in sentiment. In contrast, Kadant Inc. maintains a consistent “Outperform” rating across multiple evaluations, suggesting strong performance expectations from analysts.

Target Prices

The consensus target prices for the companies analyzed indicate strong expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| JBT Marel Corporation (JBTM) | 169 | 169 | 169 |

| Kadant Inc. (KAI) | 410 | 275 | 342.5 |

For JBT Marel Corporation, the target consensus of 169 suggests stability around its current price of 140.53. Conversely, Kadant Inc. has a broader target range, with a consensus of 342.5 compared to its current price of 278.12, indicating potential upside.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of JBT Marel Corporation (JBTM) and Kadant Inc. (KAI), two companies in the industrial machinery sector.

| Criterion | JBT Marel Corporation (JBTM) | Kadant Inc. (KAI) |

|---|---|---|

| Diversification | Moderate, focused on food tech | High, multiple segments |

| Profitability | Net margin: 4.98% | Net margin: 10.59% |

| Innovation | Steady investment in R&D | Strong R&D focus |

| Global presence | Operates in multiple regions | Strong global footprint |

| Market Share | Moderate | High |

| Debt level | Moderate (Debt-to-Equity: 0.81) | Low (Debt-to-Equity: 0.38) |

In summary, while Kadant Inc. exhibits stronger profitability and lower debt levels, JBT Marel Corporation holds a diverse but focused portfolio. Investors should consider these factors in their decision-making process.

Risk Analysis

The following table outlines the potential risks associated with JBT Marel Corporation (JBTM) and Kadant Inc. (KAI).

| Metric | JBT Marel Corporation | Kadant Inc. |

|---|---|---|

| Market Risk | Medium | High |

| Regulatory Risk | High | Medium |

| Operational Risk | Medium | Medium |

| Environmental Risk | Low | Medium |

| Geopolitical Risk | Medium | High |

In summary, both companies face significant market and regulatory risks, especially Kadant Inc., which operates in a high-risk environment. JBTM’s operational frameworks and regulatory compliance may pose challenges, but its diversified portfolio offers some protection.

Which one to choose?

In comparing JBT Marel Corporation (JBTM) and Kadant Inc. (KAI), Kadant emerges as the more favorable option for investors. KAI boasts a higher gross profit margin of 44.25% compared to JBTM’s 36.51%, indicating superior profitability. Furthermore, KAI’s overall rating of B+ surpasses JBTM’s C, reflecting stronger financial health and operational efficiency.

KAI’s recent price trends, though slightly negative at -11.29%, are steady compared to JBTM’s 52.67% increase, revealing more volatility in JBTM’s stock. Analysts generally favor KAI due to its better balance sheet, lower debt-to-equity ratio, and robust return on equity.

Investors focused on stability and consistent performance may prefer KAI, while those willing to embrace higher risk could consider JBTM for potential high returns. However, both companies face industry risks related to competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of JBT Marel Corporation and Kadant Inc. to enhance your investment decisions: