Investors seeking exposure to the packaged foods sector often consider industry giants like JBS N.V. and The Kraft Heinz Company. Both firms operate globally, offering diverse food products and competing in overlapping markets with distinct innovation strategies. JBS focuses on protein and integrated supply chains, while Kraft Heinz emphasizes brand strength and product variety. This article will help you decide which company presents the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between JBS N.V. and The Kraft Heinz Company by providing an overview of these two companies and their main differences.

JBS N.V. Overview

JBS N.V. operates globally as a protein and food company, offering a broad range of products including beef, pork, chicken, fish, and plant-based foods. Founded in 1953 and based in Amstelveen, Netherlands, it also engages in leather production, biodiesel, and logistics services. With 280K employees, JBS covers multiple aspects of food processing and related industrial activities, positioning itself as a diversified leader in the packaged foods industry.

The Kraft Heinz Company Overview

The Kraft Heinz Company manufactures and markets food and beverage products primarily in North America, the UK, and internationally. Founded in 1869 and headquartered in Pittsburgh, Pennsylvania, it offers condiments, dairy, meals, coffee, and snacks through various retail and foodservice channels. Employing 36K people, Kraft Heinz focuses on branded grocery products, selling through its own sales force and independent distributors, emphasizing consumer convenience and broad market reach.

Key similarities and differences

Both JBS and Kraft Heinz operate in the packaged foods sector, serving global markets with diverse product portfolios. JBS focuses heavily on protein products and related industrial activities, whereas Kraft Heinz emphasizes branded grocery items and beverages. JBS has a much larger workforce and wider scope of operations, including logistics and by-product trading, while Kraft Heinz concentrates more on marketing and distribution through retail and foodservice channels.

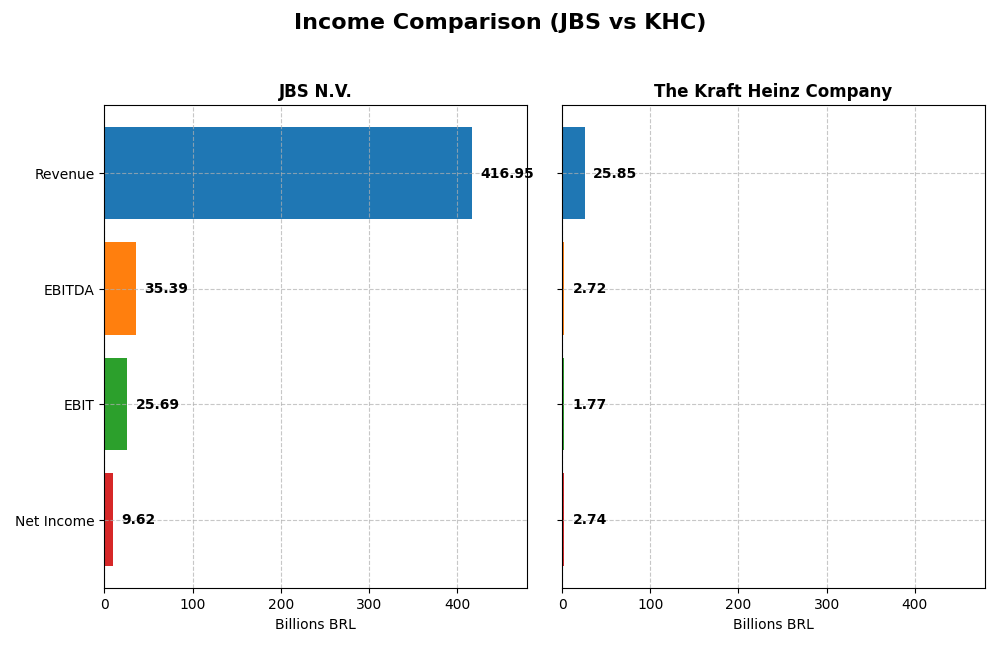

Income Statement Comparison

The table below presents a side-by-side comparison of the most recent fiscal year income statement figures for JBS N.V. and The Kraft Heinz Company, providing key metrics for evaluation.

| Metric | JBS N.V. (2024) | The Kraft Heinz Company (2024) |

|---|---|---|

| Market Cap | 31.7B BRL | 27.7B USD |

| Revenue | 417B BRL | 25.8B USD |

| EBITDA | 35.4B BRL | 2.72B USD |

| EBIT | 25.7B BRL | 1.77B USD |

| Net Income | 9.62B BRL | 2.74B USD |

| EPS | 30.55 BRL | 2.27 USD |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

JBS N.V.

JBS exhibited strong revenue growth from 2020 to 2024, increasing from 270B to 417B BRL, with a notable rebound in net income from a loss in 2023 to 9.6B BRL in 2024. Margins remained mostly stable, with gross margin around 15% and net margin at 2.3%, both assessed as neutral. The 2024 fiscal year showed robust profit growth and margin improvements, reflecting operational efficiency gains.

The Kraft Heinz Company

Kraft Heinz’s revenue slightly declined over the period, from 26B to 25.8B USD, with net income rising overall but dipping in 2024 to 2.7B USD. Gross margin was strong at nearly 35%, while net margin was a favorable 10.6%. However, recent annual growth was negative in revenue and EBIT, signaling a slowdown despite generally solid margins and interest expense management.

Which one has the stronger fundamentals?

JBS demonstrates stronger fundamentals with robust revenue and net income growth, improved margins, and favorable interest expense ratios, indicating operational resilience. Kraft Heinz shows mixed signals: solid margins and net income growth overall but recent declines in revenue and EBIT growth present caution. JBS’s predominantly favorable income statement evaluation contrasts with Kraft Heinz’s neutral stance due to offsetting positive and negative factors.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for JBS N.V. and The Kraft Heinz Company for the fiscal year 2024.

| Ratios | JBS N.V. | The Kraft Heinz Company |

|---|---|---|

| ROE | 21.47% | 5.58% |

| ROIC | 8.61% | 6.61% |

| P/E | 3.20 | 13.53 |

| P/B | 0.69 | 0.75 |

| Current Ratio | 1.47 | 1.06 |

| Quick Ratio | 0.90 | 0.59 |

| D/E | 3.01 | 0.40 |

| Debt-to-Assets | 53.56% | 22.51% |

| Interest Coverage | 2.33 | 1.85 |

| Asset Turnover | 1.65 | 0.29 |

| Fixed Asset Turnover | 4.85 | 3.61 |

| Payout Ratio | 46.14% | 70.37% |

| Dividend Yield | 14.42% | 5.20% |

Interpretation of the Ratios

JBS N.V.

JBS shows a mixed financial ratio profile with favorable metrics in return on equity (21.47%), price-to-earnings (3.2), and interest coverage (15.6), but unfavorable debt levels (debt-to-equity 3.01, debt-to-assets 53.56%). The current and quick ratios are neutral, reflecting moderate liquidity. The dividend yield is notable at 14.42%, indicating a significant shareholder return, though caution is warranted due to the high leverage.

The Kraft Heinz Company

Kraft Heinz presents strong net margin (10.62%) and solid valuation ratios (PE 13.53, PB 0.75), but weak returns on equity (5.58%) and asset turnover (0.29). Debt levels are low and favorable (debt-to-equity 0.4, debt-to-assets 22.51%), yet interest coverage at 1.94 is concerning. The dividend yield stands at a moderate 5.2%, reflecting steady shareholder returns with manageable risk.

Which one has the best ratios?

Both companies have an equal proportion of favorable ratios (50%), but JBS carries higher financial risk due to elevated leverage and debt ratios. Kraft Heinz, while showing some weaker profitability and cash flow efficiency, benefits from lower debt and a more conservative capital structure. Overall, both are slightly favorable, but with distinct risk-return profiles.

Strategic Positioning

This section compares the strategic positioning of JBS and The Kraft Heinz Company, focusing on Market position, Key segments, and Exposure to technological disruption:

JBS

- Operates worldwide in protein and food with diverse products; faces competitive pressure globally.

- Key segments include beef, pork, poultry, plant-based products, leather, biodiesel, and logistics.

- Exposure to disruption not explicitly stated; operates in traditional food processing and diversified products.

The Kraft Heinz Company

- Operates internationally in packaged foods with strong presence in condiments, dairy, and meals segments.

- Diverse food segments including cheese, dairy, coffee, meals, snacks, beverages, and condiments drive revenue.

- No explicit exposure to technological disruption mentioned; focuses on established packaged food categories.

JBS vs The Kraft Heinz Company Positioning

JBS has a diversified portfolio spanning protein, leather, biodiesel, and logistics, offering broad market exposure. Kraft Heinz concentrates on packaged foods with multiple food categories. JBS’s approach is broader, while Kraft Heinz focuses on consumer packaged goods segments.

Which has the best competitive advantage?

Both companies create value with ROIC above WACC. Kraft Heinz shows a very favorable moat with growing ROIC, indicating durable advantage. JBS has a slightly favorable moat with declining profitability, suggesting a less robust competitive position.

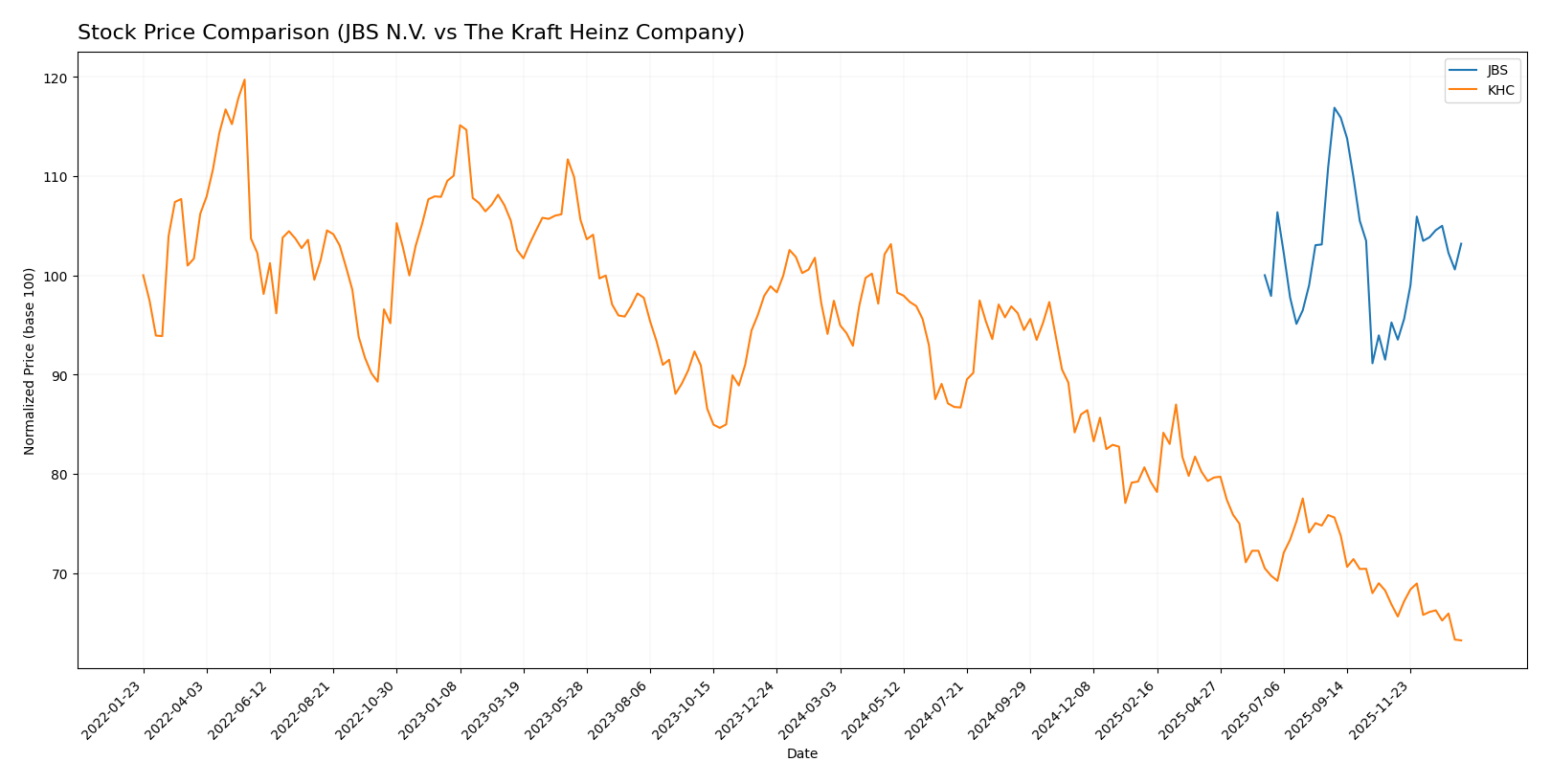

Stock Comparison

The stock price movements of JBS N.V. and The Kraft Heinz Company over the past year reveal contrasting trading dynamics, with JBS exhibiting a moderate upward trend while Kraft Heinz faces a significant decline.

Trend Analysis

JBS N.V. shows a bullish trend over the past 12 months with a 3.17% price increase, accelerated momentum, and a price range between 12.64 and 16.21. Recent weeks indicate further acceleration with an 8.33% gain.

The Kraft Heinz Company’s stock has experienced a bearish trend marked by a 35.12% decline over 12 months, with accelerating downward pressure and a wide price range from 23.39 to 38.16. Recent performance confirms continued decline at -5.42%.

Comparing both stocks, JBS N.V. delivered the highest market performance with sustained gains, while Kraft Heinz encountered substantial losses, reflecting divergent investor sentiment and momentum.

Target Prices

The current analyst consensus reveals optimistic target prices for both JBS N.V. and The Kraft Heinz Company.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| JBS N.V. | 20 | 17 | 18.5 |

| The Kraft Heinz Company | 28 | 24 | 26.29 |

Analysts expect JBS’s stock to appreciate from its current price of $14.31 toward a consensus target of $18.5, indicating a potential upside. Kraft Heinz’s consensus target of $26.29 also suggests a significant gain compared to its current price of $23.39.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for JBS N.V. and The Kraft Heinz Company:

Rating Comparison

JBS Rating

- Rating: A, indicating a very favorable overall assessment by analysts.

- Discounted Cash Flow Score: 4, favorable outlook on valuation based on future cash flows.

- ROE Score: 5, very favorable, showing efficient profit generation from equity.

- ROA Score: 5, very favorable, reflecting excellent asset utilization.

- Debt To Equity Score: 1, very unfavorable, indicating higher financial risk.

- Overall Score: 4, favorable, summarizing strong financial standing.

KHC Rating

- Rating: B-, also considered very favorable but lower than JBS’s grade.

- Discounted Cash Flow Score: 5, very favorable, suggesting strong undervaluation potential.

- ROE Score: 1, very unfavorable, indicating weak profitability from equity.

- ROA Score: 1, very unfavorable, showing poor asset efficiency.

- Debt To Equity Score: 3, moderate, showing balanced financial leverage.

- Overall Score: 3, moderate, reflecting average financial health.

Which one is the best rated?

Based strictly on the data, JBS holds a higher overall rating and scores better in ROE, ROA, and overall assessment, despite a weaker debt-to-equity score. KHC excels only in discounted cash flow valuation and debt management.

Scores Comparison

Here is a comparison of the financial scores for JBS and KHC:

JBS Scores

- Altman Z-Score: 10.74, indicating a safe zone and low bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial health.

KHC Scores

- Altman Z-Score: 0.44, indicating a distress zone with high bankruptcy risk.

- Piotroski Score: 6, classified as average financial health.

Which company has the best scores?

Based strictly on the provided data, JBS has significantly better scores with a safe zone Altman Z-Score and a very strong Piotroski Score. KHC’s scores suggest financial distress and only average financial health.

Grades Comparison

Here is a detailed comparison of the recent grades assigned to JBS N.V. and The Kraft Heinz Company by established grading firms:

JBS N.V. Grades

The following table lists the latest grades awarded to JBS N.V. by reputable firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2025-10-14 |

| JP Morgan | Maintain | Overweight | 2025-09-03 |

| Stephens & Co. | Maintain | Overweight | 2025-08-15 |

| Stephens & Co. | Maintain | Overweight | 2025-06-26 |

The grades for JBS N.V. consistently show an Overweight rating, indicating a favorable outlook maintained over several months.

The Kraft Heinz Company Grades

The following table summarizes recent grades for The Kraft Heinz Company from recognized grading firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2025-12-15 |

| Barclays | Maintain | Equal Weight | 2025-10-31 |

| JP Morgan | Maintain | Neutral | 2025-10-30 |

| UBS | Maintain | Neutral | 2025-10-30 |

| TD Cowen | Maintain | Hold | 2025-10-30 |

| Evercore ISI Group | Maintain | In Line | 2025-10-30 |

| Piper Sandler | Maintain | Neutral | 2025-10-30 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-30 |

| Mizuho | Maintain | Neutral | 2025-10-28 |

| UBS | Maintain | Neutral | 2025-10-08 |

The Kraft Heinz Company’s grades predominantly fall within Neutral, Hold, or Equal Weight categories, reflecting a more cautious and balanced stance across various analysts.

Which company has the best grades?

JBS N.V. has received consistently higher grades, predominantly Overweight, compared to The Kraft Heinz Company’s mostly Neutral to Hold ratings. This difference may suggest that analysts view JBS N.V. with more confidence, potentially signaling stronger growth prospects or a more attractive risk-return profile for investors.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for JBS N.V. and The Kraft Heinz Company based on the most recent financial and operational data.

| Criterion | JBS N.V. | The Kraft Heinz Company |

|---|---|---|

| Diversification | Focused on meat processing; less diversified product portfolio | Highly diversified product segments including meals, dairy, coffee, snacks, and beverages |

| Profitability | Moderate net margin (2.31%, unfavorable); strong ROE (21.47%, favorable) | Strong net margin (10.62%, favorable); weaker ROE (5.58%, unfavorable) |

| Innovation | Limited innovation emphasis; traditional industry | Active product innovation in various categories like Taste Elevation and Easy Ready Meals |

| Global presence | Strong global meat market presence, especially in Americas | Extensive global reach with broad consumer packaged goods distribution |

| Market Share | Significant in meat industry but facing profitability pressure | Leading market share in condiments and snacks with growing profitability |

Key takeaways: JBS excels in meat industry scale and return on equity but faces challenges in profit margin and diversification. Kraft Heinz offers broad product diversity and improving profitability, though with some operational efficiency concerns. Investors should weigh JBS’s focused strength against Kraft Heinz’s innovation and product breadth.

Risk Analysis

Below is a comparative table highlighting key risks for JBS N.V. and The Kraft Heinz Company based on the most recent data from 2024:

| Metric | JBS N.V. | The Kraft Heinz Company |

|---|---|---|

| Market Risk | Moderate (Beta 0.48) | Low (Beta 0.07) |

| Debt Level | High (Debt-to-Equity 3.01, Debt-to-Assets 53.56%) | Low (Debt-to-Equity 0.40, Debt-to-Assets 22.51%) |

| Regulatory Risk | Moderate (Global operations with exposure to food safety and environmental regulations) | Moderate (US and international food regulations) |

| Operational Risk | High (Complex supply chain with 280K employees and multiple product lines) | Moderate (36K employees, more focused product portfolio) |

| Environmental Risk | Moderate to High (Meat processing and logistics impact) | Moderate (Packaged foods with some sustainability initiatives) |

| Geopolitical Risk | Moderate (Based in Netherlands with South American operations) | Low to Moderate (Primarily US-based with global sales) |

JBS faces the most impactful risks from high debt levels and operational complexity, raising financial and execution risks despite strong profitability indicators. Kraft Heinz’s biggest concerns lie in moderate regulatory and operational risks, compounded by weaker profitability and distress-level Altman Z-score, signaling financial vulnerability. Investors should weigh JBS’s leverage risk against Kraft Heinz’s financial stability challenges.

Which Stock to Choose?

JBS N.V. shows a favorable income evolution with 14.61% revenue growth over one year and strong profitability metrics, including a 21.47% ROE. Its financial ratios are slightly favorable overall, despite some concerns over debt levels (debt-to-equity at 3.01). The company’s rating is very favorable with an A grade, supported by strong Altman Z-Score and Piotroski scores, indicating financial stability.

The Kraft Heinz Company displays a mixed income evolution, with a 2.98% revenue decline recently but favorable net margin at 10.62%. Its financial ratios are also slightly favorable, yet it faces challenges such as a high net debt-to-EBITDA ratio of 6.82 and weaker profitability metrics (5.58% ROE). The company holds a very favorable B- rating, though its Altman Z-Score places it in the distress zone with an average Piotroski score.

For investors prioritizing growth and robust profitability, JBS might appear more favorable given its strong income growth, profitability, and solid financial health. Conversely, investors with a focus on value or looking for a company with a durable competitive advantage and improving ROIC trends may find The Kraft Heinz Company’s profile more aligned with their strategy, despite its recent income challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of JBS N.V. and The Kraft Heinz Company to enhance your investment decisions: