Investors seeking exposure to the specialty REIT sector often consider Iron Mountain Incorporated (IRM) and SBA Communications Corporation (SBAC), two leaders with distinct yet overlapping market roles. Iron Mountain excels in secure information management and storage, while SBA Communications dominates wireless infrastructure leasing. Both companies innovate within real estate but serve different growth drivers. In this article, I will analyze their strengths to help you decide which is the more compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Iron Mountain Incorporated and SBA Communications Corporation by providing an overview of these two companies and their main differences.

Iron Mountain Incorporated Overview

Iron Mountain Incorporated (NYSE: IRM) is a global leader in storage and information management services, serving over 225,000 organizations worldwide. Founded in 1951, it operates a vast real estate network with more than 90M square feet across 1,450 facilities in about 50 countries. Iron Mountain offers secure records storage, digital transformation, data centers, and cloud services, focusing on reducing costs and risks for its clients.

SBA Communications Corporation Overview

SBA Communications Corporation (NASDAQ: SBAC) is a leading owner and operator of wireless communications infrastructure across the Americas and South Africa. The company primarily generates revenue by leasing antenna space on multi-tenant communication sites through long-term contracts with wireless service providers. SBA also provides site development services, emphasizing building and managing wireless infrastructure to support growing connectivity needs.

Key similarities and differences

Both companies operate as specialty REITs in the real estate sector, focusing on infrastructure management but in different markets. Iron Mountain specializes in information and records storage solutions with a global footprint, while SBA Communications focuses on wireless communications infrastructure leasing in the Americas and South Africa. Their business models share reliance on long-term leases but serve distinct industry needs—data management versus wireless network support.

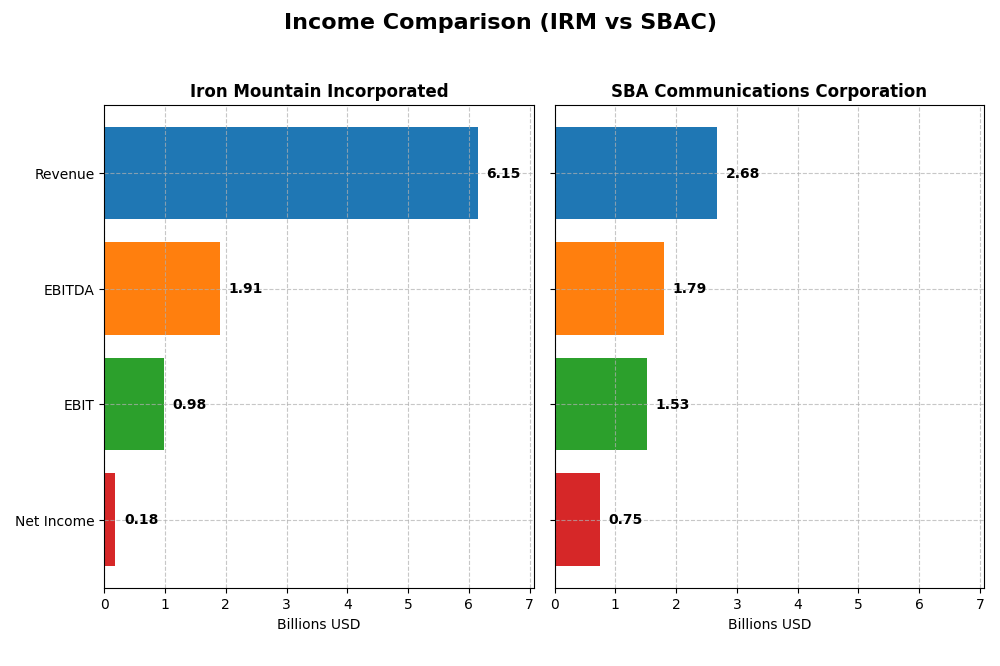

Income Statement Comparison

The table below presents the latest fiscal year income statement metrics for Iron Mountain Incorporated and SBA Communications Corporation, allowing for a straightforward financial comparison.

| Metric | Iron Mountain Incorporated (IRM) | SBA Communications Corporation (SBAC) |

|---|---|---|

| Market Cap | 25.8B USD | 19.5B USD |

| Revenue | 6.15B USD | 2.68B USD |

| EBITDA | 1.91B USD | 1.79B USD |

| EBIT | 981M USD | 1.53B USD |

| Net Income | 180M USD | 750M USD |

| EPS | 0.61 USD | 6.96 USD |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Iron Mountain Incorporated

From 2020 to 2024, Iron Mountain’s revenue increased steadily by 48.3%, reaching $6.15B in 2024, while net income declined sharply by 47.4% to $180M. Gross and EBIT margins remained favorable at 56.2% and 16.0%, respectively, though net margin was neutral at 2.9%. The latest year showed revenue growth of 12.2% and EBIT growth of 18.8%, but net margin and EPS deteriorated.

SBA Communications Corporation

SBA Communications exhibited a 28.6% revenue rise over 2020-2024, with 2024 revenue at $2.68B. Net income surged dramatically by over 3000% to $750M, supported by strong gross (77.3%), EBIT (56.9%), and net margins (28.0%). Despite a slight revenue decline of 1.2% in 2024, EBIT jumped 41.9%, and net margin and EPS improved significantly, reflecting operational efficiency gains.

Which one has the stronger fundamentals?

SBA Communications shows stronger fundamentals, with consistently high margins, exceptional net income growth, and favorable interest expense management. Iron Mountain has solid revenue growth and stable gross margins but faces challenges with declining net income and higher interest costs impacting profitability. Overall, SBA’s income statement performance appears more robust and consistent.

Financial Ratios Comparison

Below is a comparison of the key financial ratios for Iron Mountain Incorporated (IRM) and SBA Communications Corporation (SBAC) based on their most recent fiscal year data for 2024.

| Ratios | Iron Mountain Incorporated (IRM) | SBA Communications Corporation (SBAC) |

|---|---|---|

| ROE | -35.8% | -14.7% |

| ROIC | 4.6% | 12.6% |

| P/E | 171.2 | 29.4 |

| P/B | -61.3 | -4.3 |

| Current Ratio | 0.55 | 1.10 |

| Quick Ratio | 0.55 | 1.10 |

| D/E (Debt-to-Equity) | -32.5 | -3.1 |

| Debt-to-Assets | 87.5% | 138.0% |

| Interest Coverage | 1.37 | 0 |

| Asset Turnover | 0.33 | 0.23 |

| Fixed Asset Turnover | 0.61 | 0.42 |

| Payout ratio | 438% | 57% |

| Dividend yield | 2.56% | 1.93% |

Interpretation of the Ratios

Iron Mountain Incorporated

Iron Mountain’s 2024 ratios reveal weaknesses in profitability and efficiency, with unfavorable net margin (2.93%), ROE (-35.81%), and asset turnover (0.33). The current ratio of 0.55 signals liquidity concerns. Despite a favorable dividend yield of 2.56%, the company faces risks from high debt levels (debt to assets 87.46%) and limited interest coverage. Dividend payments appear supported but caution is advised due to financial strain.

SBA Communications Corporation

SBA Communications shows stronger profitability with a favorable net margin of 27.97% and ROIC at 12.57%, though ROE remains negative at -14.67%. Liquidity is adequate with a current ratio of 1.1. The dividend yield is moderate at 1.93%, with a neutral rating. While certain efficiency ratios are unfavorable, the company benefits from high interest coverage and manageable debt structure, indicating relatively stable financial health.

Which one has the best ratios?

SBA Communications Corporation presents a more favorable overall ratio profile, with half of its metrics positive and only about a third unfavorable. Iron Mountain displays predominantly unfavorable ratios, particularly in profitability and liquidity. SBA’s blend of profitability and liquidity metrics, despite some inefficiencies, suggests a comparatively stronger financial position in 2024.

Strategic Positioning

This section compares the strategic positioning of Iron Mountain Incorporated (IRM) and SBA Communications Corporation (SBAC), focusing on Market position, Key segments, and Exposure to technological disruption:

Iron Mountain Incorporated (IRM)

- Global leader in storage and information management with broad competitive pressure in REIT specialty sector.

- Key segments include global records and information management plus data centers, driving revenue growth.

- Exposure to technological disruption through digital transformation and cloud services in data management.

SBA Communications Corporation (SBAC)

- Leading owner and operator of wireless infrastructure under competitive pressure in REIT specialty sector.

- Main segments are domestic and international site leasing and site development construction services.

- Limited direct exposure to tech disruption; focus on leasing long-term antenna space to wireless providers.

IRM vs SBAC Positioning

IRM operates a diversified business model spanning records management and data centers, offering multiple revenue streams. SBAC focuses on wireless infrastructure leasing and development, concentrating on core telecom real estate assets, with a narrower business scope.

Which has the best competitive advantage?

Based on MOAT evaluation, SBAC shows a very favorable position with growing ROIC and value creation, indicating a durable competitive advantage. IRM’s very unfavorable MOAT reflects declining profitability and value destruction over 2020-2024.

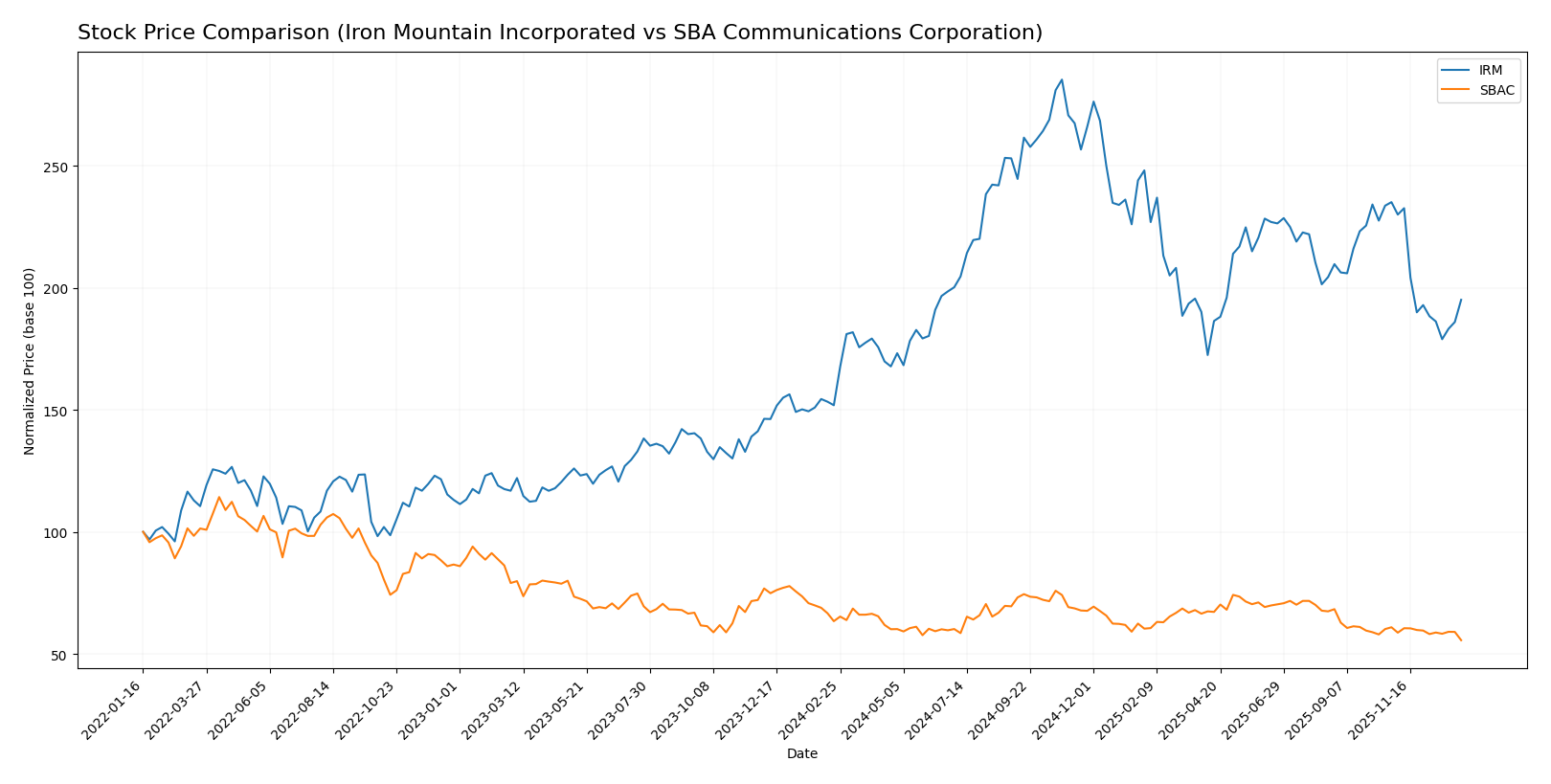

Stock Comparison

The past year has seen Iron Mountain Incorporated’s stock exhibit a strong bullish trend with notable price gains, while SBA Communications Corporation has faced a sustained bearish movement, reflecting differing investor sentiment and trading dynamics.

Trend Analysis

Iron Mountain Incorporated’s stock showed a bullish trend over the past 12 months with a 28.45% price increase, though the trend has recently decelerated with a -17.02% decline since late October 2025. SBA Communications Corporation experienced a bearish trend over the same period, falling 12.3%, with deceleration continuing into early 2026 marked by an -8.72% drop. Comparing the two, Iron Mountain posted the highest market performance over the last year, outperforming SBA Communications despite recent downward pressure.

Target Prices

Analysts present a clear and optimistic target consensus for both Iron Mountain Incorporated and SBA Communications Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Iron Mountain Incorporated | 120 | 120 | 120 |

| SBA Communications Corporation | 280 | 205 | 240.57 |

The consensus target prices suggest significant upside potential for Iron Mountain, currently trading at $87.32, and SBA Communications, trading at $181.36, reflecting positive analyst expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Iron Mountain Incorporated and SBA Communications Corporation:

Rating Comparison

Iron Mountain Incorporated Rating

- Rating: D+, considered very favorable overall.

- Discounted Cash Flow Score: 1, very unfavorable valuation.

- ROE Score: 1, very unfavorable profitability from equity.

- ROA Score: 2, moderate effectiveness in asset use.

- Debt To Equity Score: 1, very unfavorable financial risk.

- Overall Score: 1, very unfavorable financial standing.

SBA Communications Corporation Rating

- Rating: B-, considered very favorable overall.

- Discounted Cash Flow Score: 5, very favorable valuation.

- ROE Score: 1, very unfavorable profitability from equity.

- ROA Score: 5, very favorable effectiveness in asset use.

- Debt To Equity Score: 1, very unfavorable financial risk.

- Overall Score: 3, moderate financial standing.

Which one is the best rated?

Based on the provided data, SBA Communications holds a better overall rating and scores, notably outperforming Iron Mountain in discounted cash flow and return on assets, despite both having equally low scores in ROE and debt-to-equity.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

IRM Scores

- Altman Z-Score: 0.92, in distress zone indicating high bankruptcy risk.

- Piotroski Score: 5, average financial strength.

SBAC Scores

- Altman Z-Score: 0.49, in distress zone indicating very high bankruptcy risk.

- Piotroski Score: 6, average financial strength.

Which company has the best scores?

Both IRM and SBAC fall into the distress zone for Altman Z-Score, but IRM’s score is higher, indicating slightly less bankruptcy risk. SBAC has a marginally better Piotroski Score, suggesting somewhat stronger financial health.

Grades Comparison

Here is a comparison of the recent grades assigned to Iron Mountain Incorporated and SBA Communications Corporation:

Iron Mountain Incorporated Grades

The following table shows recent grades from reputable financial institutions for Iron Mountain Incorporated:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-11-12 |

| JP Morgan | Maintain | Overweight | 2025-11-06 |

| Barclays | Maintain | Overweight | 2025-08-20 |

| JP Morgan | Maintain | Overweight | 2025-08-07 |

| Barclays | Maintain | Overweight | 2025-05-27 |

| Barclays | Maintain | Overweight | 2025-03-20 |

| JP Morgan | Maintain | Overweight | 2025-02-18 |

| Wells Fargo | Maintain | Overweight | 2025-02-04 |

| Barclays | Maintain | Overweight | 2025-01-28 |

| RBC Capital | Maintain | Outperform | 2024-11-27 |

Grades for Iron Mountain show consistent Overweight and Outperform ratings, indicating a stable positive outlook.

SBA Communications Corporation Grades

The following table presents recent grades from reputable financial institutions for SBA Communications Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2025-12-16 |

| Barclays | Maintain | Overweight | 2025-12-01 |

| Barclays | Maintain | Overweight | 2025-11-17 |

| RBC Capital | Maintain | Outperform | 2025-11-10 |

| BMO Capital | Maintain | Market Perform | 2025-11-04 |

| TD Cowen | Maintain | Buy | 2025-11-04 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-20 |

| Citigroup | Maintain | Buy | 2025-10-16 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-16 |

| UBS | Maintain | Buy | 2025-10-14 |

SBA Communications exhibits a range of ratings from Equal Weight to Buy and Outperform, reflecting a generally positive but more varied consensus.

Which company has the best grades?

Both Iron Mountain and SBA Communications have a “Buy” consensus, but Iron Mountain’s grades are more consistently Overweight and Outperform, while SBA shows more variation including Equal Weight and Market Perform. This consistency for Iron Mountain may indicate a steadier analyst confidence, potentially impacting investor perceptions of risk and return stability.

Strengths and Weaknesses

The table below summarizes the strengths and weaknesses of Iron Mountain Incorporated (IRM) and SBA Communications Corporation (SBAC) based on recent financial and strategic data.

| Criterion | Iron Mountain Incorporated (IRM) | SBA Communications Corporation (SBAC) |

|---|---|---|

| Diversification | Strong focus on Records and Information Management (approx. $5B revenue in 2024), smaller Data Center segment ($620M). Limited diversification beyond core services. | Primarily focused on Site Leasing (domestic $1.86B, international $665M) with Site Development ($153M). Moderate diversification within telecom infrastructure. |

| Profitability | Low net margin (2.93%), negative ROE (-35.81%), and unfavorable ROIC (4.55%) below WACC (7.03%). High debt and low liquidity ratios indicate financial stress. | High net margin (27.97%), positive ROIC (12.57%) well above WACC (5.58%). Some profitability concerns with negative ROE (-14.67%), but generally financially healthier. |

| Innovation | Limited evidence of strong innovation, with declining profitability and value destruction trend over 2020-2024. | Demonstrates durable competitive advantage with growing ROIC (+229%), signaling innovation or effective market positioning. |

| Global presence | Global Records and Data Center business, but revenue heavily concentrated in Records Management segment. | Global exposure with significant international site leasing revenue (~26% of total leasing revenue), supporting growth. |

| Market Share | Leading market share in Records and Information Management but facing profitability challenges and declining returns. | Strong market position in wireless infrastructure with expanding revenues and positive trends in invested capital returns. |

Key takeaways: SBA Communications shows a strong and growing economic moat with superior profitability and global presence, making it a more attractive investment. Iron Mountain, despite its market leadership, struggles with declining returns and financial weaknesses, signaling caution for investors.

Risk Analysis

Below is a comparative overview of the key risks affecting Iron Mountain Incorporated (IRM) and SBA Communications Corporation (SBAC) as of 2024.

| Metric | Iron Mountain Incorporated (IRM) | SBA Communications Corporation (SBAC) |

|---|---|---|

| Market Risk | Beta 1.15, moderate volatility; PE very high at 171.16 indicates potential overvaluation risk | Beta 0.87, lower volatility; PE 29.37, more reasonable but still elevated |

| Debt Level | High debt-to-assets at 87.5%, weak interest coverage (1.33x), distress zone Altman Z-score (0.92) | Very high debt-to-assets at 138%, excellent interest coverage (infinite), distress zone Altman Z-score (0.49) |

| Regulatory Risk | Moderate, due to global info management services and data handling | Moderate, given telecom infrastructure subject to spectrum and construction regulations |

| Operational Risk | Large real estate footprint with 1,450 facilities worldwide; exposure to digital transformation challenges | Dependency on long-term leases with wireless providers and multi-region operations |

| Environmental Risk | Exposure to climate-related risks affecting physical storage sites | Risks related to infrastructure resilience to weather and environmental changes |

| Geopolitical Risk | Operations in ~50 countries, exposed to global geopolitical tensions | Operations concentrated in Americas and South Africa, regional geopolitical risks |

In synthesis, both companies face significant debt-related risks with distress-level Altman Z-scores, suggesting financial vulnerability. IRM’s high PE ratio and weak profitability metrics increase market risk, while SBAC’s strong interest coverage somewhat mitigates debt servicing concerns. Operational and geopolitical risks are notable but less immediate than financial strains. Caution is advised, prioritizing risk management.

Which Stock to Choose?

Iron Mountain Incorporated (IRM) shows favorable income growth with a 12.22% revenue increase in 2024 and solid gross and EBIT margins, but exhibits unfavorable profitability ratios, high debt levels, and a very unfavorable overall rating. Its return on equity is negative at -35.81%, and it is assessed as shedding value with a declining ROIC trend.

SBA Communications Corporation (SBAC) presents a strong income statement with high gross and EBIT margins and significant net income growth over the period. Financial ratios are slightly favorable overall, despite negative return on equity and high debt-to-assets. SBAC’s rating is very favorable with a moderate overall score, and it demonstrates a durable competitive advantage with growing ROIC.

For investors prioritizing growth and value creation, SBAC could appear more favorable given its strong income metrics and very favorable moat evaluation. Conversely, more risk-averse investors might view IRM’s unfavorable financial ratios and declining profitability as signals to wait before considering exposure. The choice might therefore depend on the investor’s tolerance for risk and focus on stability versus growth.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Iron Mountain Incorporated and SBA Communications Corporation to enhance your investment decisions: