In the dynamic healthcare sector, IQVIA Holdings Inc. and Mettler-Toledo International Inc. stand out as leaders in diagnostics and research solutions. IQVIA excels with advanced analytics and clinical research services, while Mettler-Toledo focuses on precision instruments and laboratory technologies. Their overlapping markets and innovation-driven strategies make this comparison particularly relevant. Join me as we explore which company presents the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between IQVIA Holdings Inc. and Mettler-Toledo International Inc. by providing an overview of these two companies and their main differences.

IQVIA Overview

IQVIA Holdings Inc. provides advanced analytics, technology solutions, and clinical research services to the life sciences industry across multiple continents. It operates through three segments: Technology & Analytics Solutions, Research & Development Solutions, and Contract Sales & Medical Solutions. The company focuses on supporting pharmaceutical, biotechnology, device, and diagnostic companies to improve healthcare decision-making and patient outcomes.

MTD Overview

Mettler-Toledo International Inc. manufactures and supplies precision instruments and services worldwide, operating through five geographic segments. Its product range includes laboratory instruments, industrial weighing devices, and retail weighing solutions complemented by software platforms. Mettler-Toledo serves diverse industries such as life sciences, food and beverage, chemicals, transportation, and academia, leveraging direct sales and distribution channels.

Key similarities and differences

Both IQVIA and Mettler-Toledo operate within the healthcare sector and cater to life sciences among other industries. IQVIA emphasizes technology-driven analytics, clinical research, and consulting services, while Mettler-Toledo focuses on manufacturing precision instruments and software for laboratory, industrial, and retail applications. IQVIA’s business model centers on data and research services, whereas Mettler-Toledo concentrates on hardware solutions with supporting software.

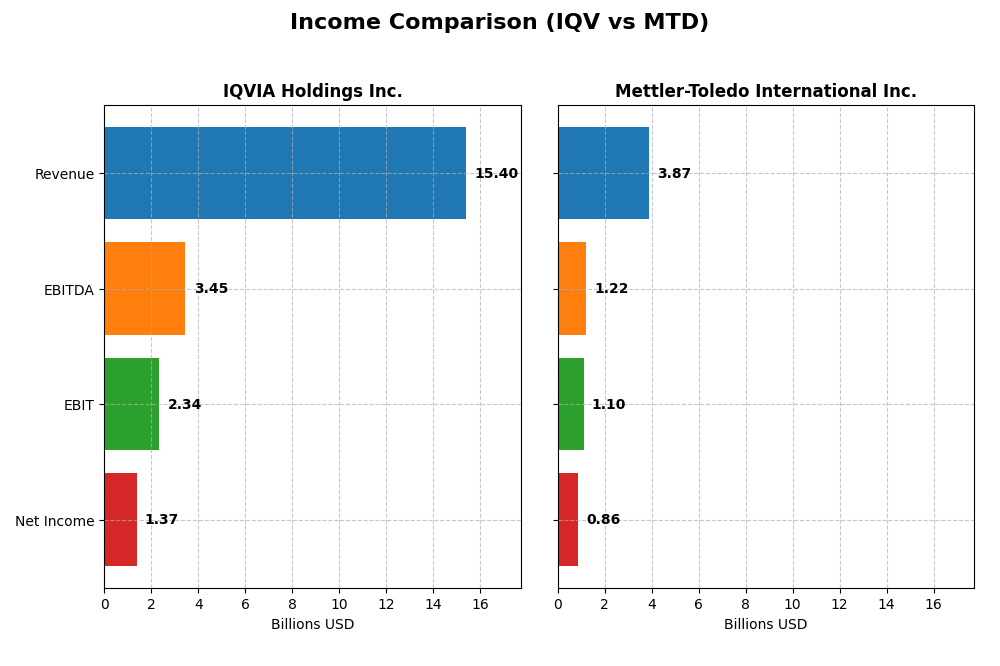

Income Statement Comparison

The table below compares key income statement metrics for IQVIA Holdings Inc. and Mettler-Toledo International Inc. for the fiscal year 2024, providing a snapshot of their financial performance.

| Metric | IQVIA Holdings Inc. | Mettler-Toledo International Inc. |

|---|---|---|

| Market Cap | 41.3B | 30.3B |

| Revenue | 15.4B | 3.9B |

| EBITDA | 3.45B | 1.22B |

| EBIT | 2.34B | 1.10B |

| Net Income | 1.37B | 863M |

| EPS | 7.57 | 40.67 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

IQVIA Holdings Inc.

IQVIA demonstrated solid revenue growth from 2020 to 2024, increasing from $11.36B to $15.41B, with net income rising substantially from $279M to $1.37B. Gross and EBIT margins remained favorable, around 34.9% and 15.2% respectively. In 2024, revenue growth slowed to 2.8%, but EBIT grew by 9.8%, indicating improved operational efficiency despite a slight net margin dip.

Mettler-Toledo International Inc.

Mettler-Toledo’s revenue grew from $3.09B in 2020 to $3.87B in 2024, with net income increasing from $603M to $863M. Gross margin stayed strong at 58.2%, and EBIT margin at 28.4%. The latest year showed modest revenue growth of 2.2%, with a 7.1% net margin improvement and 13.3% EPS growth, reflecting controlled expenses and enhanced profitability.

Which one has the stronger fundamentals?

IQVIA presents stronger overall income growth, with a 35.6% revenue increase and nearly 4x net income rise over five years, supported by solid margin improvements. Mettler-Toledo exhibits higher profitability margins and better net margin growth recently but with more moderate income growth. Both have favorable fundamentals, with IQVIA excelling in scale and growth, Mettler-Toledo in margin strength.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for IQVIA Holdings Inc. (IQV) and Mettler-Toledo International Inc. (MTD) based on their most recent fiscal year data for 2024.

| Ratios | IQVIA Holdings Inc. (IQV) | Mettler-Toledo International Inc. (MTD) |

|---|---|---|

| ROE | 22.63% | -680.23% |

| ROIC | 8.59% | 41.06% |

| P/E | 25.95 | 30.09 |

| P/B | 5.87 | -204.66 |

| Current Ratio | 0.84 | 1.02 |

| Quick Ratio | 0.84 | 0.73 |

| D/E (Debt-to-Equity) | 2.33 | -16.79 |

| Debt-to-Assets | 52.63% | 65.77% |

| Interest Coverage | 3.29 | 15.10 |

| Asset Turnover | 0.57 | 1.20 |

| Fixed Asset Turnover | 19.93 | 5.03 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

IQVIA Holdings Inc.

IQVIA shows a mixed financial profile with favorable return on equity at 22.63% and strong fixed asset turnover, yet it faces concerns such as a low current ratio of 0.84 and a high debt-to-equity ratio of 2.33, indicating liquidity and leverage risks. The company does not pay dividends, reflecting a reinvestment strategy likely prioritizing growth and operational funding.

Mettler-Toledo International Inc.

MTD demonstrates strong operational efficiency with a net margin of 22.29%, high return on invested capital at 41.06%, and excellent asset turnover ratios. However, it reports a negative return on equity and a high debt-to-assets ratio of 65.77%, which could signal financial stress. MTD also does not pay dividends, consistent with potential reinvestment in R&D or acquisitions.

Which one has the best ratios?

MTD holds a more favorable overall ratio profile with 50% favorable metrics, reflecting strong operational returns and asset utilization despite some financial concerns. IQVIA, with only 14.29% favorable ratios and several liquidity and leverage red flags, appears less robust in comparison. The evaluation leans toward MTD’s slightly favorable standing versus IQVIA’s slightly unfavorable.

Strategic Positioning

This section compares the strategic positioning of IQV and MTD, focusing on market position, key segments, and exposure to technological disruption:

IQVIA Holdings Inc. (IQV)

- Leading global provider in life sciences with competitive pressure from analytics and research firms.

- Diverse segments: Technology & Analytics, Research & Development, Contract Sales & Medical Solutions.

- Exposure to cloud-based solutions, virtual trials, and advanced analytics driving tech innovation.

Mettler-Toledo International Inc. (MTD)

- Strong global precision instruments supplier facing competition in industrial and laboratory markets.

- Focused on industrial, laboratory, and retail weighing products and services across multiple industries.

- Incorporates laboratory software and automated measurement tech, adapting to digital transformation.

IQV vs MTD Positioning

IQV pursues a diversified life sciences services approach with broad technology and research offerings, while MTD concentrates on precision instruments across industrial and laboratory sectors. IQV’s segmentation offers wider market exposure; MTD’s focus may allow specialized operational efficiencies.

Which has the best competitive advantage?

MTD demonstrates a very favorable moat with value creation and growing ROIC, indicating a durable competitive advantage, whereas IQV’s slightly unfavorable moat suggests it is currently shedding value despite improving profitability.

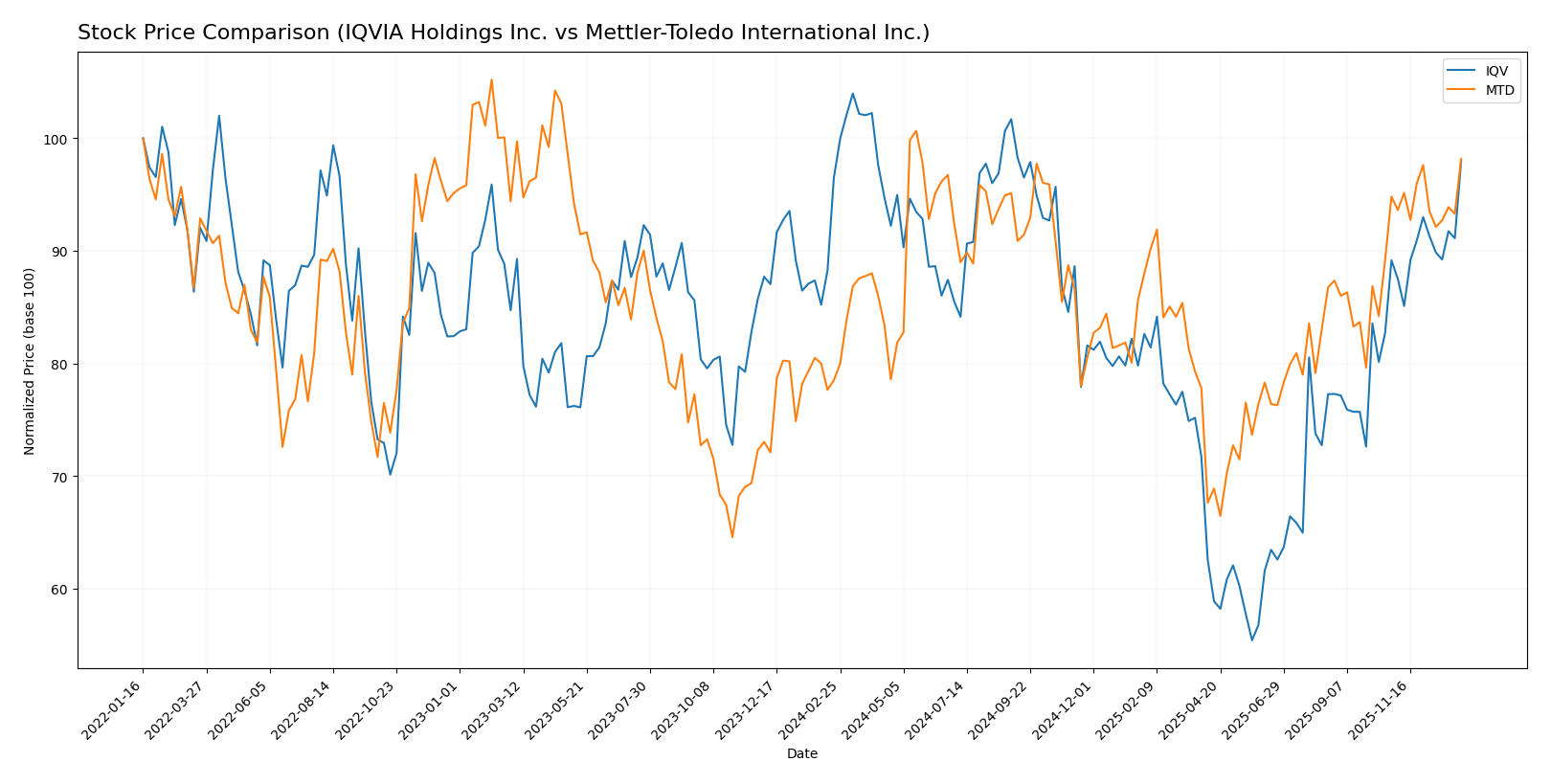

Stock Comparison

The stock price movements of IQVIA Holdings Inc. and Mettler-Toledo International Inc. over the past year reveal distinct bullish trends with varying acceleration patterns and volatility levels.

Trend Analysis

IQVIA Holdings Inc. experienced a 1.6% price increase over the past 12 months, indicating a neutral to slightly bullish trend with acceleration and moderate volatility (std deviation 30.97). The recent three-month period showed a stronger 9.93% rise, confirming upward momentum.

Mettler-Toledo International Inc. posted a robust 25.07% gain over the past year, reflecting a clear bullish trend with acceleration and higher volatility (std deviation 116.45). Its recent three-month growth of 3.54% maintained positive momentum but at a decelerated pace.

Comparing both, Mettler-Toledo outperformed IQVIA significantly in overall market performance, delivering the highest price appreciation and stronger buyer dominance during the year.

Target Prices

Analysts present a positive target price consensus for both IQVIA Holdings Inc. and Mettler-Toledo International Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| IQVIA Holdings Inc. | 290 | 214 | 253.2 |

| Mettler-Toledo International Inc. | 1600 | 1400 | 1504.17 |

The consensus target prices suggest upside potential for IQV, currently trading at 242.41 USD, and for MTD, trading near 1485.12 USD, indicating moderate to strong analyst confidence in future gains.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for IQVIA Holdings Inc. (IQV) and Mettler-Toledo International Inc. (MTD):

Rating Comparison

IQV Rating

- Rating: B+ indicating a very favorable overall assessment.

- Discounted Cash Flow Score: 4, showing a favorable outlook on future cash flow projections.

- ROE Score: 5, very favorable, indicating high efficiency in generating profit from equity.

- ROA Score: 4, favorable, indicating effective asset utilization to generate earnings.

- Debt To Equity Score: 1, very unfavorable, indicating higher financial risk from debt level.

- Overall Score: 3, moderate, summarizing the company’s financial standing.

MTD Rating

- Rating: C+ with a very favorable status.

- Discounted Cash Flow Score: 3, reflecting a moderate outlook.

- ROE Score: 1, very unfavorable, showing low efficiency in profit generation from equity.

- ROA Score: 5, very favorable, demonstrating excellent asset utilization.

- Debt To Equity Score: 1, very unfavorable, also indicating higher financial risk from debt.

- Overall Score: 2, moderate, summarizing the company’s financial standing.

Which one is the best rated?

Based on the provided data, IQV holds a higher rating (B+) and better scores in discounted cash flow and return on equity, while MTD outperforms only in return on assets. Overall, IQV is rated more favorably.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for IQVIA Holdings Inc. and Mettler-Toledo International Inc.:

IQV Scores

- Altman Z-Score: 2.15, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 5, indicating average financial strength.

MTD Scores

- Altman Z-Score: 6.88, in the safe zone indicating very low bankruptcy risk.

- Piotroski Score: 8, indicating very strong financial health.

Which company has the best scores?

Based strictly on the provided data, Mettler-Toledo International Inc. has significantly stronger scores, with a safe-zone Altman Z-Score and a very strong Piotroski Score, compared to IQVIA’s grey zone and average scores.

Grades Comparison

I compare the recent grades and ratings issued by reputable financial institutions for IQVIA Holdings Inc. and Mettler-Toledo International Inc.:

IQVIA Holdings Inc. Grades

This table shows the latest grades awarded by major financial firms to IQVIA Holdings Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2026-01-08 |

| UBS | Maintain | Buy | 2026-01-08 |

| Morgan Stanley | Maintain | Overweight | 2025-12-02 |

| TD Cowen | Downgrade | Hold | 2025-11-03 |

| Baird | Upgrade | Outperform | 2025-10-29 |

| Truist Securities | Maintain | Buy | 2025-10-29 |

| JP Morgan | Maintain | Overweight | 2025-10-29 |

| Stifel | Maintain | Buy | 2025-10-29 |

| Citigroup | Maintain | Neutral | 2025-10-29 |

| UBS | Maintain | Buy | 2025-10-29 |

IQVIA’s grades mostly range from Buy to Overweight, with a single recent downgrade to Hold and an upgrade to Outperform, reflecting a generally positive but slightly mixed analyst sentiment.

Mettler-Toledo International Inc. Grades

The following grades summarize recent analyst opinions for Mettler-Toledo International Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2025-12-15 |

| Barclays | Maintain | Overweight | 2025-12-15 |

| Citigroup | Maintain | Buy | 2025-11-10 |

| Barclays | Maintain | Overweight | 2025-11-10 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-10 |

| Stifel | Maintain | Buy | 2025-11-10 |

| JP Morgan | Maintain | Neutral | 2025-10-09 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-07 |

| Barclays | Maintain | Overweight | 2025-10-02 |

| B of A Securities | Maintain | Neutral | 2025-09-22 |

Mettler-Toledo’s grades display a mix of Overweight, Buy, and Equal Weight ratings, indicating moderate optimism with some caution from analysts.

Which company has the best grades?

IQVIA Holdings Inc. has a stronger consensus with more Buy and Overweight ratings, while Mettler-Toledo International Inc. shows more Hold and Equal Weight grades. This suggests IQVIA is currently viewed more favorably, potentially influencing investors seeking growth opportunities.

Strengths and Weaknesses

Below is a comparative overview of the key strengths and weaknesses for IQVIA Holdings Inc. (IQV) and Mettler-Toledo International Inc. (MTD), based on recent financial and operational data.

| Criterion | IQVIA Holdings Inc. (IQV) | Mettler-Toledo International Inc. (MTD) |

|---|---|---|

| Diversification | Highly diversified across R&D, technology, and contract sales segments | Balanced revenue streams from industrial, laboratory, and retail products |

| Profitability | Moderate net margin (8.91%), neutral ROIC (8.59%), slightly unfavorable valuation ratios | High net margin (22.29%), very favorable ROIC (41.06%) but volatile ROE |

| Innovation | Strong focus on technology and analytics solutions (~6.2B USD revenue) | Consistent investment in product innovation, reflected in asset turnover |

| Global presence | Extensive global operations in healthcare and pharma sectors | Global footprint in precision instruments and services |

| Market Share | Leading in healthcare R&D services but facing value creation challenges | Durable competitive advantage with growing profitability and market share |

Key takeaways: Mettler-Toledo demonstrates a stronger and more favorable financial and operational profile, with superior profitability and innovation metrics. IQV shows growing profitability but currently struggles to create value consistently, highlighting a need for cautious investment consideration.

Risk Analysis

Below is a comparative overview of key risks for IQVIA Holdings Inc. (IQV) and Mettler-Toledo International Inc. (MTD) based on the most recent data from 2024.

| Metric | IQVIA Holdings Inc. (IQV) | Mettler-Toledo International Inc. (MTD) |

|---|---|---|

| Market Risk | Beta 1.37; moderate volatility, sensitive to healthcare sector trends | Beta 1.42; slightly higher volatility, exposed to global industrial markets |

| Debt level | Debt-to-Equity 2.33 (unfavorable), Debt-to-Assets 52.63% (high leverage) | Debt-to-Equity -16.79 (favorable, possibly net cash), Debt-to-Assets 65.77% (high asset leverage) |

| Regulatory Risk | High, due to dependency on clinical research and healthcare regulations globally | Moderate, with exposure to industrial and medical device regulations across regions |

| Operational Risk | Complex clinical trial and data analytics operations; scale of 89K employees | Precision instrument manufacturing; smaller workforce (16K) but global operations |

| Environmental Risk | Moderate, with growing pressure on data centers and sustainability in healthcare tech | Moderate to high, manufacturing processes and compliance with environmental standards significant |

| Geopolitical Risk | Present due to multi-region operations spanning Americas, EMEA, Asia-Pacific | Present, with supply chain exposure to China and Europe |

The most impactful risks are IQV’s high financial leverage and regulatory pressures in the healthcare sector, which could affect profitability. MTD’s strength in operational and financial stability contrasts with its higher asset leverage and geopolitical supply chain risks. Both companies require close monitoring of regulatory changes and market volatility in 2026.

Which Stock to Choose?

IQVIA Holdings Inc. shows a favorable income statement with strong profitability and growing ROIC, yet faces challenges like unfavorable debt ratios and a slightly unfavorable global ratio evaluation. Its rating is very favorable, reflecting solid financial health despite some liquidity concerns.

Mettler-Toledo International Inc. presents a favorable income evolution and a very favorable MOAT with strong value creation. However, it has a mixed rating due to unfavorable return on equity and some debt concerns. Its global ratio evaluation is slightly favorable, indicating robust operational efficiency.

Investors seeking durable competitive advantages and strong capital efficiency might find Mettler-Toledo appealing, while those valuing solid profitability and a very favorable rating could lean toward IQVIA. The choice could depend on whether the investor prioritizes value creation with growth or balanced financial stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of IQVIA Holdings Inc. and Mettler-Toledo International Inc. to enhance your investment decisions: