In the dynamic semiconductor industry, Tower Semiconductor Ltd. (TSEM) and IPG Photonics Corporation (IPGP) stand out as key players pushing technological boundaries. Tower Semiconductor specializes in analog mixed-signal chips, while IPG leads in high-performance fiber lasers and amplifiers. Both companies innovate within overlapping markets, offering distinct growth opportunities. This article will help you identify which company presents the most compelling investment case in 2026.

Table of contents

Companies Overview

I will begin the comparison between Tower Semiconductor Ltd. and IPG Photonics Corporation by providing an overview of these two companies and their main differences.

Tower Semiconductor Ltd. Overview

Tower Semiconductor Ltd. is an independent semiconductor foundry specializing in analog intensive mixed-signal semiconductor devices. The company offers customizable process technologies and wafer fabrication services to integrated device manufacturers and fabless companies. It serves diverse markets including consumer electronics, automotive, aerospace, and medical devices, positioning itself as a key player in the semiconductor manufacturing industry since its incorporation in 1993.

IPG Photonics Corporation Overview

IPG Photonics Corporation develops and manufactures high-performance fiber lasers, amplifiers, and diode lasers primarily for materials processing and communications. The company’s product portfolio includes hybrid fiber-solid state lasers and integrated laser systems, serving original equipment manufacturers and system integrators worldwide. Founded in 1990, IPG focuses on advanced laser technologies used in telecommunications, medical, and industrial applications.

Key similarities and differences

Both companies operate within the semiconductor and technology sectors but focus on distinct segments: Tower Semiconductor centers on semiconductor fabrication and mixed-signal devices, while IPG Photonics specializes in fiber laser and amplifier technologies. Each targets different customer bases with Tower servicing a broad range of electronics markets and IPG emphasizing materials processing and communications. Their business models reflect these differences, with Tower providing manufacturing services and IPG offering laser system products and components.

Income Statement Comparison

The table below presents a side-by-side comparison of the key income statement metrics for Tower Semiconductor Ltd. and IPG Photonics Corporation for the fiscal year 2024.

| Metric | Tower Semiconductor Ltd. | IPG Photonics Corporation |

|---|---|---|

| Market Cap | 13.9B | 3.4B |

| Revenue | 1.44B | 977.1M |

| EBITDA | 451.3M | 75.9M |

| EBIT | 185.0M | 14.5M |

| Net Income | 207.9M | -181.5M |

| EPS | 1.87 | -4.09 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Tower Semiconductor Ltd.

Tower Semiconductor’s revenue showed moderate growth of 0.94% in 2024, continuing an overall 13.47% increase from 2020. Net income rose significantly over the period by 152.56%, despite a sharp 60.29% net margin decline last year. Gross and EBIT margins remain favorable at 23.64% and 12.88%, though 2024 saw a notable slowdown in profitability and earnings per share.

IPG Photonics Corporation

IPG Photonics experienced a revenue decline of 24.1% in 2024, extending an overall decrease of 18.62% since 2020. Net income deteriorated markedly, with a negative net margin of -18.58% and a 188.34% drop in EPS last year. Gross margin held at a solid 34.61%, but EBIT margin weakened to 1.48%, indicating significant pressure on operating profitability during 2024.

Which one has the stronger fundamentals?

Tower Semiconductor presents stronger fundamentals, supported by favorable margin levels and positive growth in revenue and net income over the period. In contrast, IPG Photonics shows unfavorable trends across most metrics, including declining revenue, net income, and margins. While both faced earnings challenges in 2024, Tower’s overall income statement health remains relatively resilient compared to IPG’s downturn.

Financial Ratios Comparison

The table below presents the most recent financial ratios for Tower Semiconductor Ltd. (TSEM) and IPG Photonics Corporation (IPGP) for the fiscal year ending 2024, providing a snapshot of their profitability, liquidity, leverage, efficiency, and dividend metrics.

| Ratios | Tower Semiconductor Ltd. (TSEM) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| ROE | 7.83% | -8.97% |

| ROIC | 6.41% | -9.97% |

| P/E | 27.54 | -17.76 |

| P/B | 2.16 | 1.59 |

| Current Ratio | 6.18 | 6.98 |

| Quick Ratio | 5.23 | 5.59 |

| D/E (Debt-to-Equity) | 0.07 | 0.01 |

| Debt-to-Assets | 5.87% | 0.78% |

| Interest Coverage | 32.64 | 0 |

| Asset Turnover | 0.47 | 0.43 |

| Fixed Asset Turnover | 1.11 | 1.66 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Tower Semiconductor Ltd. (TSEM)

Tower Semiconductor shows a mixed profile with a favorable net margin of 14.47% and low debt levels, reflected by a debt-to-equity ratio of 0.07 and debt to assets at 5.87%. However, weaknesses include an unfavorable return on equity (7.83%) and a high price-to-earnings ratio of 27.54. The current ratio is unusually high at 6.18, indicating potential inefficiency in asset use. The company does not pay dividends, likely prioritizing reinvestment, supported by positive free cash flow to equity of $104M.

IPG Photonics Corporation (IPGP)

IPG Photonics displays several unfavorable ratios, including a negative net margin (-18.58%) and negative returns on equity (-8.97%) and invested capital (-9.97%). Despite these weaknesses, it benefits from very low debt levels, with debt to equity at 0.01, and a strong interest coverage ratio. The company also pays no dividends, consistent with its negative earnings, possibly focusing on R&D and growth investments. Free cash flow to equity remains positive at $751M, indicating solid cash generation despite losses.

Which one has the best ratios?

Comparing both, Tower Semiconductor exhibits a slightly more favorable overall financial profile, balancing profitability and low leverage despite some inefficiencies. IPG Photonics faces greater challenges with negative profitability and returns, although it maintains strong liquidity and conservative debt. With 42.86% favorable ratios for TSEM versus 35.71% for IPGP, Tower Semiconductor holds a modest edge in ratio strength.

Strategic Positioning

This section compares the strategic positioning of Tower Semiconductor Ltd. and IPG Photonics Corporation, focusing on market position, key segments, and exposure to technological disruption:

Tower Semiconductor Ltd.

- Independent semiconductor foundry with diversified global markets and moderate competitive pressure.

- Serves multiple segments: consumer electronics, automotive, aerospace, medical devices, and industrial markets.

- Provides customizable semiconductor process technologies, less exposed to rapid technological disruption.

IPG Photonics Corporation

- Develops and sells high-performance fiber lasers, facing specialized competition in laser technology.

- Focuses on laser and amplifier segments for materials processing, communications, and medical applications.

- Operates in advanced fiber laser technology, exposed to evolving materials processing and communications tech.

Tower Semiconductor Ltd. vs IPG Photonics Corporation Positioning

Tower Semiconductor adopts a diversified approach across multiple device markets, offering broad exposure but facing varied competition. IPG Photonics concentrates on fiber laser technology, benefiting from specialized product focus yet higher technological volatility.

Which has the best competitive advantage?

Based on MOAT evaluation, Tower Semiconductor shows slightly unfavorable value destruction but improving profitability, whereas IPG Photonics faces very unfavorable value destruction with declining profitability, indicating Tower has a relatively stronger competitive advantage.

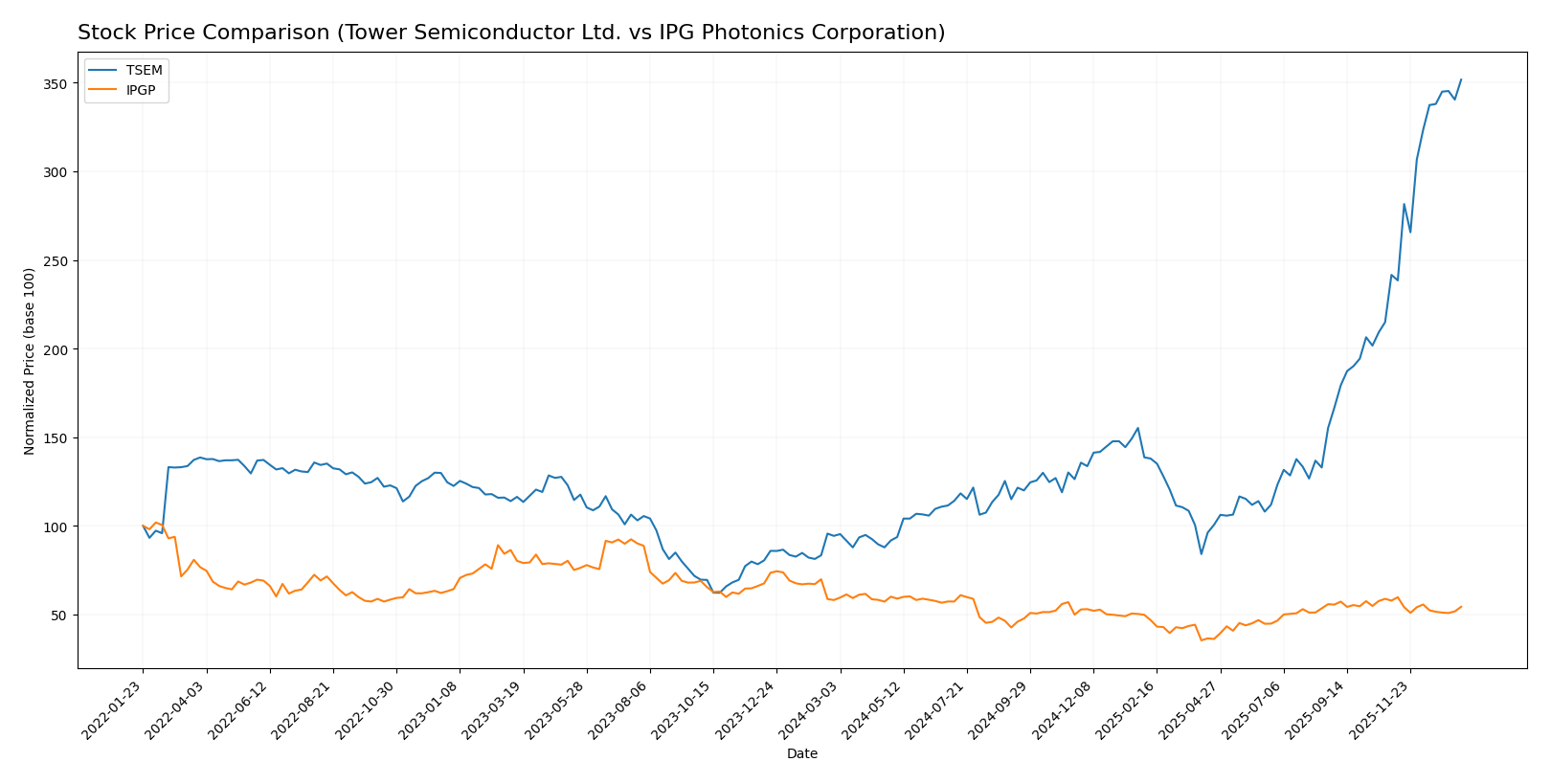

Stock Comparison

The stock prices of Tower Semiconductor Ltd. (TSEM) and IPG Photonics Corporation (IPGP) have exhibited contrasting dynamics over the past year, with TSEM showing strong bullish momentum and IPGP experiencing a bearish decline.

Trend Analysis

Tower Semiconductor Ltd. (TSEM) has demonstrated a robust bullish trend over the past 12 months, with a 272.71% price increase and accelerating momentum, supported by high volatility (std deviation 23.67) and a price range between 29.65 and 124.0.

IPG Photonics Corporation (IPGP) experienced a bearish trend with a -6.49% price decline over the same period, showing deceleration and lower volatility (std deviation 9.27), with its price fluctuating between 52.12 and 90.69.

Comparing the two, TSEM delivered the highest market performance with significant bullish acceleration, whereas IPGP saw a moderate bearish decline with decelerating losses.

Target Prices

The target price consensus for Tower Semiconductor Ltd. and IPG Photonics Corporation reflects varied analyst expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Tower Semiconductor Ltd. | 125 | 66 | 96 |

| IPG Photonics Corporation | 96 | 92 | 94 |

Analysts expect Tower Semiconductor’s price to moderate below its current level of 124 USD, while IPG Photonics shows a modest upside potential versus its current 80.03 USD price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Tower Semiconductor Ltd. (TSEM) and IPG Photonics Corporation (IPGP):

Rating Comparison

TSEM Rating

- Rating: B+, classified as Very Favorable overall rating.

- Discounted Cash Flow Score: Moderate at 3, indicating balanced valuation.

- ROE Score: Moderate at 3, showing average efficiency in generating profit.

- ROA Score: Favorable at 4, reflecting effective asset utilization.

- Debt To Equity Score: Favorable at 4, implying strong balance sheet position.

- Overall Score: Moderate at 3, summarizing a balanced financial standing.

IPGP Rating

- Rating: B+, classified as Very Favorable overall rating.

- Discounted Cash Flow Score: Favorable at 4, suggesting relatively better valuation.

- ROE Score: Moderate at 2, indicating slightly lower efficiency compared to TSEM.

- ROA Score: Moderate at 3, indicating decent but lower asset utilization.

- Debt To Equity Score: Favorable at 4, also indicating solid financial stability.

- Overall Score: Moderate at 3, indicating similar overall financial position.

Which one is the best rated?

Both TSEM and IPGP hold the same overall rating of B+ and a Moderate overall score of 3. However, IPGP scores higher in discounted cash flow, while TSEM leads in return on equity and return on assets, reflecting differences in valuation and operational efficiency.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

TSEM Scores

- Altman Z-Score: 21.06, indicating a very safe zone.

- Piotroski Score: 7, reflecting strong financial health.

IPGP Scores

- Altman Z-Score: 9.65, indicating a safe zone.

- Piotroski Score: 7, reflecting strong financial health.

Which company has the best scores?

Both TSEM and IPGP have strong Piotroski Scores of 7, indicating solid financial health. However, TSEM’s Altman Z-Score of 21.06 is significantly higher than IPGP’s 9.65, suggesting a stronger financial stability for TSEM based on this metric.

Grades Comparison

I present here the latest available grading data from reputable firms for Tower Semiconductor Ltd. and IPG Photonics Corporation:

Tower Semiconductor Ltd. Grades

This table summarizes recent grades and rating actions for Tower Semiconductor Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2026-01-09 |

| Wedbush | Downgrade | Neutral | 2025-12-31 |

| Benchmark | Maintain | Buy | 2025-11-11 |

| Susquehanna | Maintain | Positive | 2025-11-11 |

| Wedbush | Maintain | Outperform | 2025-11-11 |

| Barclays | Maintain | Equal Weight | 2025-11-11 |

| Benchmark | Maintain | Buy | 2025-09-08 |

| Susquehanna | Maintain | Positive | 2025-08-05 |

| Benchmark | Maintain | Buy | 2025-08-05 |

| Benchmark | Maintain | Buy | 2025-08-04 |

Overall, Tower Semiconductor Ltd. shows a predominantly positive trend with multiple “Buy” and “Positive” grades, although one notable downgrade to “Neutral” by Wedbush occurred recently.

IPG Photonics Corporation Grades

This table details recent grades and rating changes for IPG Photonics Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Upgrade | Buy | 2025-11-05 |

| Bernstein | Upgrade | Outperform | 2025-08-07 |

| Raymond James | Maintain | Strong Buy | 2025-05-07 |

| CL King | Upgrade | Buy | 2025-03-18 |

| Citigroup | Maintain | Sell | 2025-02-18 |

| Stifel | Maintain | Buy | 2025-02-12 |

| Needham | Maintain | Hold | 2025-02-12 |

| Seaport Global | Downgrade | Neutral | 2024-08-01 |

| Stifel | Maintain | Buy | 2024-07-31 |

| Raymond James | Maintain | Strong Buy | 2024-07-31 |

IPG Photonics Corporation exhibits a mixed grading profile with upgrades to “Buy” and “Outperform” but also retains a “Sell” rating from Citigroup and some “Hold” and “Neutral” grades.

Which company has the best grades?

Both companies hold a consensus “Buy” grade overall, but Tower Semiconductor Ltd. displays a more consistent positive grading pattern with fewer downgrades. This steadiness in grades may suggest relatively lower rating volatility for Tower Semiconductor Ltd., potentially impacting investor confidence differently compared to the more mixed ratings for IPG Photonics Corporation.

Strengths and Weaknesses

Below is a comparison table summarizing the key strengths and weaknesses of Tower Semiconductor Ltd. (TSEM) and IPG Photonics Corporation (IPGP) based on the most recent financial and operational data.

| Criterion | Tower Semiconductor Ltd. (TSEM) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Diversification | Moderate; focused on semiconductor manufacturing with steady niche market | High; diversified laser product portfolio including amplifiers, CW lasers, pulsed lasers |

| Profitability | Moderate profitability: net margin 14.47%, ROIC 6.41% (slightly unfavorable compared to WACC) | Negative profitability: net margin -18.58%, ROIC -9.97%, declining profitability trend |

| Innovation | Growing ROIC indicates improving efficiency and potential innovation | Declining ROIC and profitability suggest challenges in innovation or market adaptation |

| Global presence | Moderate global footprint primarily in semiconductor markets | Strong global presence in laser systems, serving multiple industries worldwide |

| Market Share | Stable but limited by competitive pressures and scale | Strong market share in laser systems but facing profitability issues |

Key takeaways: TSEM shows improving operational efficiency with moderate profitability and strong financial health, suggesting cautious optimism. IPGP offers a diverse product range and global presence but suffers from declining profitability and value destruction, advising heightened risk awareness before investment.

Risk Analysis

Below is a comparison table of key risks for Tower Semiconductor Ltd. (TSEM) and IPG Photonics Corporation (IPGP) based on their latest 2024 financial and operational data.

| Metric | Tower Semiconductor Ltd. (TSEM) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Market Risk | Moderate (Beta 0.876) | Moderate (Beta 1.017) |

| Debt level | Low (Debt/Equity 0.07, favorable) | Very Low (Debt/Equity 0.01, favorable) |

| Regulatory Risk | Medium (Global semiconductor regulations) | Medium (Laser tech regulations) |

| Operational Risk | Moderate (Asset turnover 0.47, some inefficiency) | Moderate (Asset turnover 0.43) |

| Environmental Risk | Moderate (Semiconductor fabrication impact) | Moderate (Manufacturing and materials) |

| Geopolitical Risk | Elevated (Operations in Israel and Asia) | Elevated (US-based, global markets) |

The most impactful risks for both companies are geopolitical tensions affecting supply chains and regulatory challenges in their high-tech sectors. Tower Semi’s moderate operational inefficiencies and IPG’s negative profitability metrics add caution for investors. Both maintain low debt, supporting financial stability.

Which Stock to Choose?

Tower Semiconductor Ltd. (TSEM) shows a favorable income evolution with overall revenue and net income growth, despite recent declines. Its financial ratios are slightly favorable, supported by low debt levels and strong interest coverage. Profitability ratios are mixed, with a moderate return on equity and a slightly unfavorable price-to-earnings ratio. The company carries very low net debt and benefits from a very favorable rating of B+, reflecting solid financial health.

IPG Photonics Corporation (IPGP) presents an unfavorable income evolution, marked by declining revenue and net income over recent years. Its financial ratios lean slightly unfavorable with negative profitability metrics, though debt remains minimal and interest coverage is strong. The rating also stands at B+, indicating moderate overall financial strength despite challenges in profitability and cash flow trends.

For investors, TSEM could appear more favorable due to its overall positive income statement and slightly favorable financial ratios, suggesting potential value creation despite some short-term setbacks. Conversely, IPGP’s negative profitability and declining income might be more suitable for risk-tolerant investors willing to accept volatility. Thus, growth-oriented investors might lean toward TSEM, while those with a higher risk appetite could consider IPGP.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Tower Semiconductor Ltd. and IPG Photonics Corporation to enhance your investment decisions: