In the dynamic world of semiconductors, Skyworks Solutions, Inc. and IPG Photonics Corporation stand out as innovative players shaping the future of technology. Both U.S.-based companies operate in overlapping markets, focusing on cutting-edge components that fuel wireless communication and advanced laser applications. This comparison highlights their industry roles and innovation strategies to help you identify which stock may be the most compelling addition to your investment portfolio. Let’s explore which company presents the best opportunity for investors today.

Table of contents

Companies Overview

I will begin the comparison between Skyworks Solutions, Inc. and IPG Photonics Corporation by providing an overview of these two companies and their main differences.

Skyworks Solutions, Inc. Overview

Skyworks Solutions, Inc. designs, develops, manufactures, and markets proprietary semiconductor products, serving sectors such as aerospace, automotive, broadband, and smartphones. Founded in 1962 and headquartered in Irvine, California, it operates globally with a diverse portfolio including amplifiers, filters, and front-end modules. The company leverages direct sales and distributors to reach markets worldwide, emphasizing innovation in wireless analog systems.

IPG Photonics Corporation Overview

IPG Photonics Corporation specializes in high-performance fiber lasers, amplifiers, and diode lasers used primarily in materials processing, communications, and medical applications. Established in 1990 and based in Marlborough, Massachusetts, IPG markets its products to OEMs and system integrators globally. Its portfolio includes fiber-solid state lasers and integrated laser systems supporting telecommunications and advanced manufacturing sectors.

Key similarities and differences

Both companies operate within the technology sector focusing on semiconductor-related products, yet their business models differ. Skyworks Solutions offers a broad range of semiconductor components for diverse industries, including consumer electronics and automotive. In contrast, IPG Photonics concentrates on laser-based solutions tailored to materials processing and communications. Both utilize direct sales complemented by distributor networks, but their end markets and product specializations vary significantly.

Income Statement Comparison

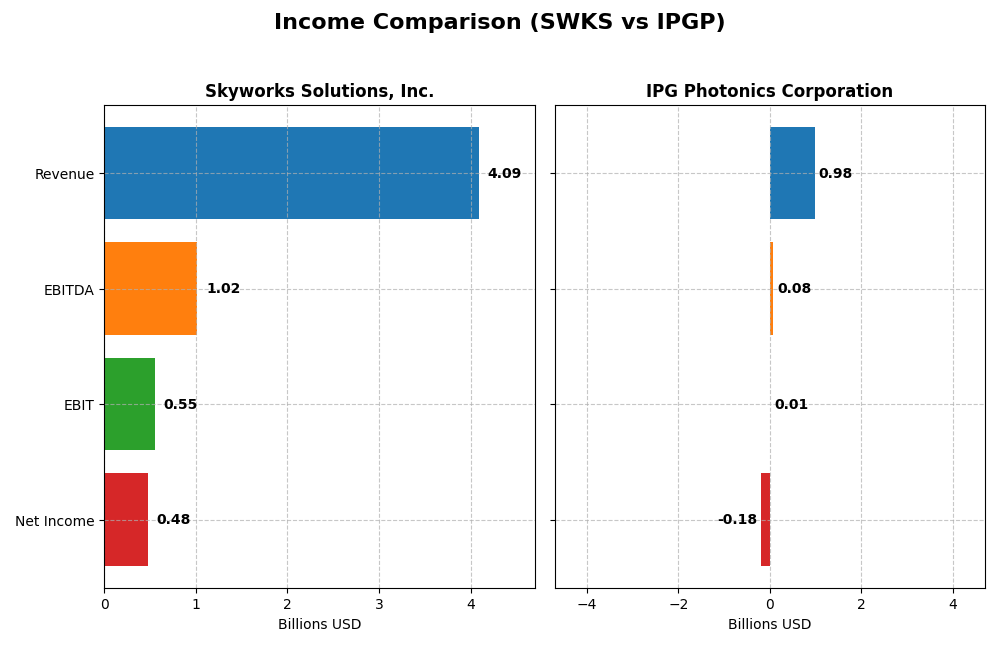

The table below presents a side-by-side comparison of key income statement metrics for Skyworks Solutions, Inc. and IPG Photonics Corporation for their most recent fiscal years.

| Metric | Skyworks Solutions, Inc. (SWKS) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Market Cap | 8.76B | 3.37B |

| Revenue | 4.09B | 977M |

| EBITDA | 1.02B | 76M |

| EBIT | 554M | 14M |

| Net Income | 477M | -182M |

| EPS | 3.09 | -4.09 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Skyworks Solutions, Inc.

Skyworks Solutions saw declining revenue and net income from 2021 to 2025, with revenue dropping from $5.11B to $4.09B and net income falling from $1.50B to $477M. Margins remained relatively stable but contracted in the most recent year, with net margin at 11.67%. The 2025 performance showed a slowdown in growth and margin compression, reflecting unfavorable trends across key profitability metrics.

IPG Photonics Corporation

IPG Photonics experienced a downward trend in revenue and net income over 2020–2024, with revenue decreasing from $1.20B to $977M and net income turning negative to -$182M in 2024. Gross margin remained favorable at 34.61%, but net margin dropped sharply to -18.58%. The latest fiscal year revealed significant declines, including a steep fall in EBIT and net income, signaling challenging operational conditions.

Which one has the stronger fundamentals?

Both companies face unfavorable income statement trends over their respective periods, with declining revenues and deteriorating net margins. Skyworks maintains higher profitability margins and positive net income, despite declines, whereas IPG Photonics suffers from negative net income and deeper margin erosion. Overall, Skyworks exhibits relatively stronger fundamental profitability metrics compared to IPG Photonics.

Financial Ratios Comparison

The table below compares key financial ratios for Skyworks Solutions, Inc. and IPG Photonics Corporation based on their most recent fiscal year data, offering a snapshot of their financial performance and stability.

| Ratios | Skyworks Solutions, Inc. (SWKS) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| ROE | 8.29% | -8.97% |

| ROIC | 6.35% | -9.97% |

| P/E | 24.95 | -17.76 |

| P/B | 2.07 | 1.59 |

| Current Ratio | 2.33 | 6.98 |

| Quick Ratio | 1.76 | 5.59 |

| D/E (Debt-to-Equity) | 0.21 | 0.01 |

| Debt-to-Assets | 15.20% | 0.78% |

| Interest Coverage | 18.45 | 0 |

| Asset Turnover | 0.52 | 0.43 |

| Fixed Asset Turnover | 2.95 | 1.66 |

| Payout Ratio | 90.67% | 0% |

| Dividend Yield | 3.63% | 0% |

Interpretation of the Ratios

Skyworks Solutions, Inc.

Skyworks Solutions presents a balanced financial profile with half of its key ratios rated favorable, including a strong current ratio of 2.33 and a low debt-to-equity of 0.21. Its return on equity at 8.29% is slightly unfavorable, indicating moderate profitability. The company offers a dividend yield of 3.63%, supported by a stable payout ratio and free cash flow coverage, reflecting a steady shareholder return approach.

IPG Photonics Corporation

IPG Photonics shows a mixed set of ratios, with 35.71% favorable and 42.86% unfavorable. The firm reports negative net margin (-18.58%) and return on equity (-8.97%), signaling profitability challenges. It does not pay dividends, likely due to its current losses and reinvestment focus. Its low debt-to-assets ratio (0.78%) and strong interest coverage indicate solid financial stability despite operational setbacks.

Which one has the best ratios?

Skyworks Solutions’ ratios are overall more favorable, displaying stronger liquidity, moderate leverage, and consistent profitability with dividend payments. IPG Photonics faces significant profitability difficulties and does not distribute dividends, reflecting more risk. Therefore, Skyworks demonstrates a more balanced and slightly favorable financial ratio profile compared to IPG Photonics.

Strategic Positioning

This section compares the strategic positioning of Skyworks Solutions, Inc. and IPG Photonics Corporation across market position, key segments, and exposure to technological disruption:

Skyworks Solutions, Inc.

- Large market cap of 8.76B, faces competition in semiconductors industry.

- Diverse product portfolio serving aerospace, automotive, medical, smartphone, and other markets.

- Exposure to semiconductor industry disruption with broad technology applications.

IPG Photonics Corporation

- Smaller market cap of 3.37B, operates in niche fiber laser market.

- Focused on high-performance fiber lasers and amplifiers primarily for materials processing.

- Faces disruption risks tied to fiber laser and advanced optical technologies.

Skyworks Solutions, Inc. vs IPG Photonics Corporation Positioning

Skyworks has a diversified approach with a broad product range across multiple end markets, offering resilience but exposure to varied competitive pressures. IPG is more concentrated, specializing in fiber lasers, which may limit its market but focus enhances expertise in its niche.

Which has the best competitive advantage?

Both companies have a very unfavorable MOAT status with declining ROIC trends, indicating value destruction and weak competitive advantages. Neither currently demonstrates sustainable economic moats based on their financial efficiency.

Stock Comparison

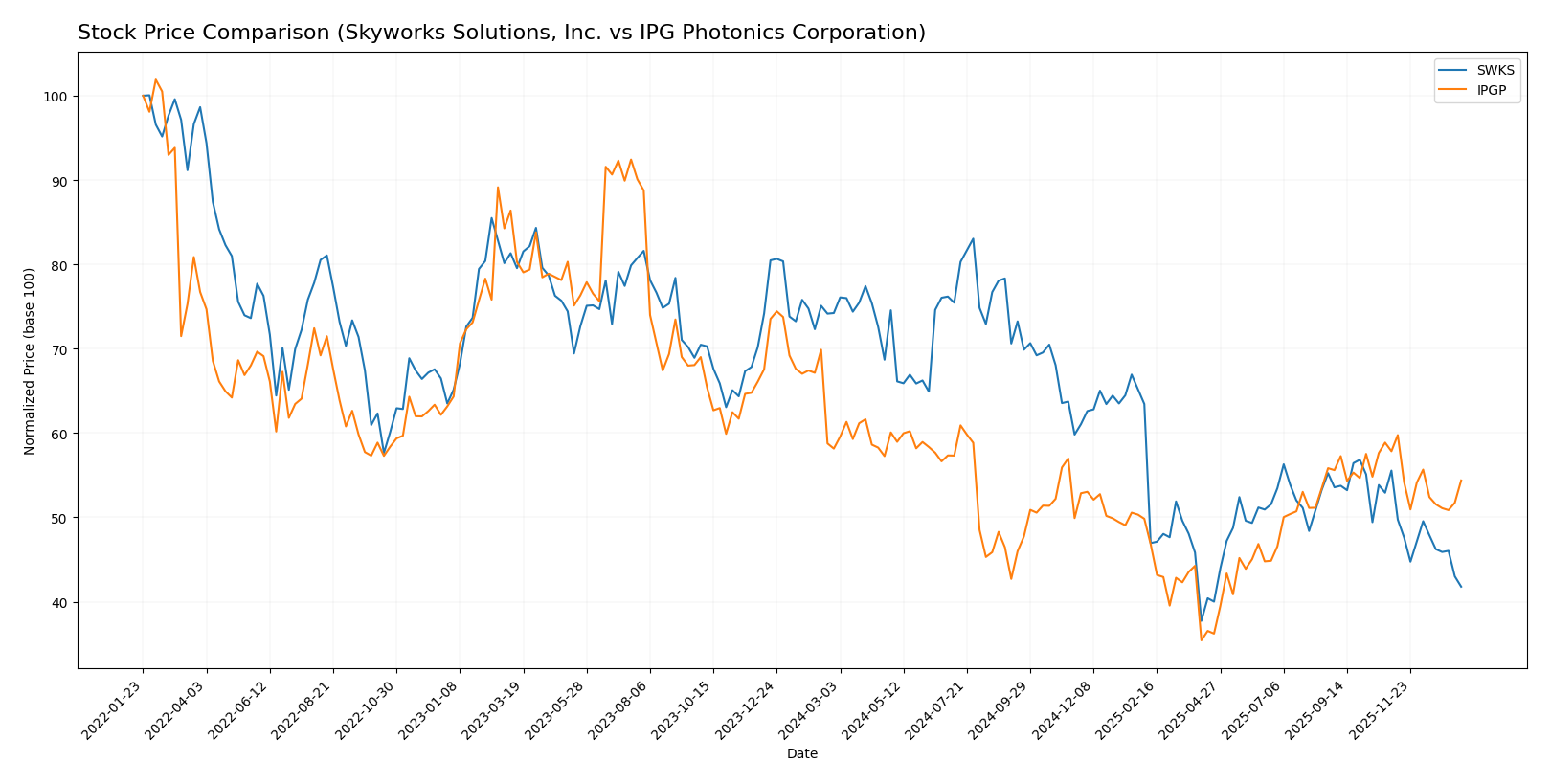

The stock price movements of Skyworks Solutions, Inc. (SWKS) and IPG Photonics Corporation (IPGP) over the past year reveal significant bearish trends with marked declines and shifting trading dynamics.

Trend Analysis

Skyworks Solutions, Inc. (SWKS) experienced a 43.71% price decline over the past 12 months, indicating a strong bearish trend with deceleration. Its price ranged from a high of 116.18 to a low of 52.78, showing high volatility with a standard deviation of 16.35.

IPG Photonics Corporation (IPGP) showed a 6.49% decrease over the same period, also bearish with deceleration. Its price fluctuated between 90.69 and 52.12, with moderate volatility and a standard deviation of 9.27.

Comparing both, SWKS delivered the lowest market performance with a substantially larger decline, while IPGP’s bearish trend was less severe, reflecting relatively better resilience over the year.

Target Prices

The current target price consensus for these semiconductor companies reflects varied analyst expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Skyworks Solutions, Inc. | 140 | 60 | 85.11 |

| IPG Photonics Corporation | 96 | 92 | 94 |

Analysts see Skyworks Solutions with a consensus target price significantly above its current price of 58.46 USD, indicating potential upside. IPG Photonics’ consensus target at 94 USD also suggests room for growth from its present price of 80.03 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Skyworks Solutions, Inc. (SWKS) and IPG Photonics Corporation (IPGP):

Rating Comparison

SWKS Rating

- Rating: B+, considered very favorable.

- Discounted Cash Flow Score: 4, favorable.

- ROE Score: 3, moderate level of profitability efficiency.

- ROA Score: 4, favorable asset utilization.

- Debt To Equity Score: 3, moderate financial risk.

- Overall Score: 3, moderate overall financial standing.

IPGP Rating

- Rating: B+, considered very favorable.

- Discounted Cash Flow Score: 4, favorable.

- ROE Score: 2, moderate but lower than SWKS.

- ROA Score: 3, moderate asset utilization.

- Debt To Equity Score: 4, favorable lower financial risk.

- Overall Score: 3, moderate overall financial standing.

Which one is the best rated?

Both SWKS and IPGP share the same overall rating of B+ and an identical overall score of 3. SWKS performs better on ROE and ROA, while IPGP has a stronger debt-to-equity score, indicating lower financial risk. Both have favorable DCF scores.

Scores Comparison

The scores of Skyworks Solutions, Inc. and IPG Photonics Corporation are compared below:

SWKS Scores

- Altman Z-Score: 4.44, indicating a safe zone, low bankruptcy risk.

- Piotroski Score: 7, categorized as strong financial health.

IPGP Scores

- Altman Z-Score: 9.65, indicating a safe zone, very low bankruptcy risk.

- Piotroski Score: 7, categorized as strong financial health.

Which company has the best scores?

IPG Photonics has a higher Altman Z-Score than Skyworks Solutions, both in the safe zone, indicating stronger financial stability. Both companies share the same Piotroski Score, reflecting equally strong financial health.

Grades Comparison

Here is the comparison of grades provided by reputable grading companies for both Skyworks Solutions, Inc. and IPG Photonics Corporation:

Skyworks Solutions, Inc. Grades

The table below summarizes recent grades from established financial institutions for Skyworks Solutions, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Upgrade | Neutral | 2025-11-11 |

| JP Morgan | Maintain | Neutral | 2025-11-05 |

| UBS | Maintain | Neutral | 2025-11-05 |

| Citigroup | Upgrade | Neutral | 2025-10-29 |

| Benchmark | Maintain | Hold | 2025-10-29 |

| Piper Sandler | Upgrade | Overweight | 2025-10-29 |

| Barclays | Upgrade | Equal Weight | 2025-10-29 |

| Keybanc | Upgrade | Overweight | 2025-10-29 |

| UBS | Maintain | Neutral | 2025-10-29 |

| Citigroup | Maintain | Sell | 2025-08-06 |

Overall, grades for Skyworks Solutions have shown an upward revision trend from sell/underperform to neutral and overweight, indicating improving sentiment.

IPG Photonics Corporation Grades

Below is the recent grading data from credible financial analysts for IPG Photonics Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Upgrade | Buy | 2025-11-05 |

| Bernstein | Upgrade | Outperform | 2025-08-07 |

| Raymond James | Maintain | Strong Buy | 2025-05-07 |

| CL King | Upgrade | Buy | 2025-03-18 |

| Citigroup | Maintain | Sell | 2025-02-18 |

| Stifel | Maintain | Buy | 2025-02-12 |

| Needham | Maintain | Hold | 2025-02-12 |

| Seaport Global | Downgrade | Neutral | 2024-08-01 |

| Stifel | Maintain | Buy | 2024-07-31 |

| Raymond James | Maintain | Strong Buy | 2024-07-31 |

IPG Photonics exhibits mostly positive or strong buy grades, with a few holds and a single sell maintained by Citigroup, reflecting a generally bullish outlook.

Which company has the best grades?

Both companies have a consensus “Buy” rating. IPG Photonics has more strong buy and outperform grades, suggesting stronger analyst conviction. Skyworks Solutions shows improving but generally neutral to overweight grades. This difference could influence investor confidence and risk appetite accordingly.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Skyworks Solutions, Inc. (SWKS) and IPG Photonics Corporation (IPGP) based on the latest financial and operational data.

| Criterion | Skyworks Solutions, Inc. (SWKS) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Diversification | Moderate product range focused on semiconductors | Highly diversified in laser systems and applications |

| Profitability | Positive net margin (11.67%), but ROIC below WACC | Negative net margin (-18.58%) and declining ROIC |

| Innovation | Stable technology base, moderate innovation pace | Strong innovation in laser tech, though profitability challenges persist |

| Global presence | Strong global footprint in wireless communications | Global leader in industrial lasers with broad market reach |

| Market Share | Significant in semiconductor wireless components | Leading market share in high-power laser systems |

Key takeaways: Skyworks Solutions shows solid profitability and financial stability but faces challenges in value creation with a declining ROIC. IPG Photonics, though a global leader in laser innovation and diversified segments, struggles with profitability and value destruction, indicating higher investment risk.

Risk Analysis

Below is a comparative table outlining key risks for Skyworks Solutions, Inc. (SWKS) and IPG Photonics Corporation (IPGP) based on the most recent data.

| Metric | Skyworks Solutions, Inc. (SWKS) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Market Risk | Beta 1.30 indicating moderate volatility; exposed to semiconductor cyclical trends | Beta 1.02 showing moderate market sensitivity; niche laser market exposure |

| Debt Level | Low debt-to-equity ratio 0.21; favorable leverage | Very low debt-to-equity 0.01; minimal financial risk |

| Regulatory Risk | Moderate; operates globally with exposure to US-China trade policies | Moderate; global sales but specialized tech may face export controls |

| Operational Risk | Medium; complex supply chain for semiconductor components | Medium; reliance on advanced manufacturing of fiber lasers |

| Environmental Risk | Moderate; semiconductor manufacturing involves hazardous materials | Moderate; laser production has environmental controls but energy intensive |

| Geopolitical Risk | Elevated; significant sales in Asia-Pacific, vulnerable to geopolitical tensions | Elevated; global customer base with exposure to international trade policies |

In synthesis, the most impactful and likely risks are market volatility and geopolitical tensions affecting supply chains and sales, particularly for Skyworks given its larger global footprint. IPG Photonics’ financial stability is strong, but its niche market and operational complexity warrant cautious monitoring. Both companies show resilience but face industry-specific cyclical and regulatory uncertainties.

Which Stock to Choose?

Skyworks Solutions, Inc. (SWKS) shows a declining income trend with unfavorable revenue and net income growth over 2021-2025. Its financial ratios are slightly favorable overall, highlighting good profitability margins, low debt, and strong liquidity, yet ROE is unfavorable. The company is rated B+ with a very favorable overall rating but demonstrates a very unfavorable MOAT due to declining ROIC below WACC, signaling value destruction.

IPG Photonics Corporation (IPGP) also faces unfavorable income trends with significant declines in net margin and earnings over 2020-2024. Its financial ratios appear slightly unfavorable, marked by negative profitability ratios but favorable debt metrics and strong liquidity. IPGP holds a B+ rating with a very favorable overall rating, yet its MOAT is very unfavorable, reflecting deteriorating profitability and value destruction.

Investors seeking growth might find Skyworks’ stronger profitability margins and moderate financial ratios more aligned with their goals, while those prioritizing balance sheet strength and liquidity could interpret IPG Photonics’ favorable debt metrics and safe financial scores as more suitable. Both firms show value erosion with unfavorable MOATs, suggesting cautious evaluation depending on risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Skyworks Solutions, Inc. and IPG Photonics Corporation to enhance your investment decisions: