In the rapidly evolving semiconductor industry, IPG Photonics Corporation and SkyWater Technology, Inc. emerge as notable players with distinct approaches to innovation and market focus. IPG Photonics excels in high-performance fiber lasers, while SkyWater specializes in semiconductor development and manufacturing services. Comparing these companies offers valuable insights into their growth potential and technological edge. Join me as we explore which investment opportunity stands out in this dynamic sector.

Table of contents

Companies Overview

I will begin the comparison between IPG Photonics Corporation and SkyWater Technology, Inc. by providing an overview of these two companies and their main differences.

IPGP Overview

IPG Photonics Corporation specializes in developing, manufacturing, and selling high-performance fiber lasers, fiber amplifiers, and diode lasers primarily used in materials processing worldwide. Founded in 1990 and headquartered in Marlborough, Massachusetts, IPG serves various industries with advanced laser products and integrated laser systems, marketing mainly to original equipment manufacturers, system integrators, and end users.

SKYT Overview

SkyWater Technology, Inc., founded in 2017 and based in Bloomington, Minnesota, provides semiconductor development and manufacturing services. It offers engineering support and semiconductor manufacturing for silicon-based analog, mixed-signal, power discrete, microelectromechanical systems, and radiation-hardened integrated circuits, serving sectors such as aerospace, defense, automotive, bio-health, and industrial IoT.

Key similarities and differences

Both IPGP and SKYT operate in the semiconductor industry but differ in focus: IPGP centers on laser technologies used in materials processing and communications, while SKYT specializes in semiconductor manufacturing and development services. IPGP targets end users and equipment manufacturers with its products, whereas SKYT provides co-development and manufacturing services catering to a broad range of industries including aerospace and automotive.

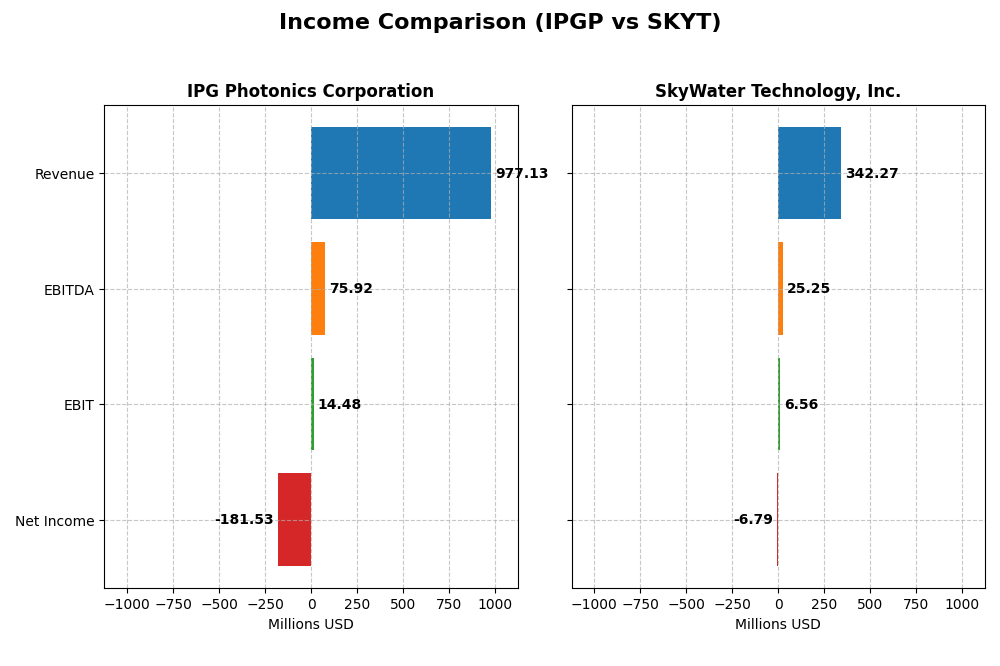

Income Statement Comparison

The table below compares key income statement metrics for IPG Photonics Corporation and SkyWater Technology, Inc. for the fiscal year 2024.

| Metric | IPG Photonics Corporation | SkyWater Technology, Inc. |

|---|---|---|

| Market Cap | 3.4B | 1.6B |

| Revenue | 977M | 342M |

| EBITDA | 76M | 25M |

| EBIT | 14M | 7M |

| Net Income | -182M | -7M |

| EPS | -4.09 | -0.14 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

IPG Photonics Corporation

IPG Photonics showed a declining trend in revenue from $1.46B in 2021 to $977M in 2024, with net income swinging from $278M profit in 2021 to a $182M loss in 2024. Gross margin remained relatively strong at 34.61% in 2024, but net margin dropped to -18.58%. The latest year revealed significant contraction in revenue and profitability, with margins deteriorating sharply.

SkyWater Technology, Inc.

SkyWater Technology experienced consistent revenue growth from $140M in 2020 to $342M in 2024, while net losses narrowed from $21M in 2020 to $7M in 2024. Gross margin improved to 20.34%, and EBIT margin stood at 1.92% in 2024. The most recent year showed positive momentum with stronger revenue growth and improved profitability metrics, reflecting operational progress.

Which one has the stronger fundamentals?

SkyWater Technology demonstrates stronger fundamentals with favorable growth in revenue, net income, and margins over the period, alongside improving profitability in 2024. Conversely, IPG Photonics faces unfavorable trends, including declining revenue and net losses, with sharply deteriorated margins. SkyWater’s positive trajectory contrasts with IPG’s recent financial challenges.

Financial Ratios Comparison

The following table presents a side-by-side comparison of key financial ratios for IPG Photonics Corporation and SkyWater Technology, Inc. based on their most recent fiscal year data.

| Ratios | IPG Photonics Corporation (2024) | SkyWater Technology, Inc. (2024) |

|---|---|---|

| ROE | -8.97% | -11.79% |

| ROIC | -9.97% | 3.40% |

| P/E | -17.8 | -100.3 |

| P/B | 1.59 | 11.82 |

| Current Ratio | 6.98 | 0.86 |

| Quick Ratio | 5.59 | 0.76 |

| D/E (Debt-to-Equity) | 0.009 | 1.33 |

| Debt-to-Assets | 0.78% | 24.46% |

| Interest Coverage | 0 | 0.74 |

| Asset Turnover | 0.43 | 1.09 |

| Fixed Asset Turnover | 1.66 | 2.07 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

IPG Photonics Corporation

IPG Photonics shows a mixed ratio profile with 35.71% favorable and 42.86% unfavorable metrics, resulting in a slightly unfavorable overall view. Strong points include a low debt-to-equity ratio of 0.01 and infinite interest coverage, but concerns arise from negative net margin (-18.58%) and returns on equity (-8.97%) and invested capital (-9.97%). The company does not pay dividends, likely prioritizing reinvestment or growth.

SkyWater Technology, Inc.

SkyWater Technology exhibits a largely unfavorable ratio set, with 71.43% unfavorable and only 21.43% favorable, indicating financial stress. Negative net margin (-1.98%) and return on equity (-11.79%) are key weaknesses, alongside a low current ratio (0.86) and high debt-to-equity (1.33). Like IPG, SkyWater pays no dividends, reflecting its reinvestment focus or high growth phase.

Which one has the best ratios?

Comparing the two, IPG Photonics has a relatively stronger ratio profile with fewer unfavorable metrics and better liquidity and leverage ratios. SkyWater’s ratios suggest higher financial risk and weaker profitability, making its overall ratio evaluation less favorable than IPG’s slightly unfavorable standing.

Strategic Positioning

This section compares the strategic positioning of IPG Photonics Corporation and SkyWater Technology, Inc. in terms of market position, key segments, and exposure to technological disruption:

IPG Photonics Corporation

- Established market presence with significant scale in fiber lasers; faces competitive pressure in semiconductors.

- Focuses on high-performance fiber lasers, amplifiers, and integrated systems serving materials processing and communications.

- Exposure to disruption via advanced laser and amplifier technologies but relies on established fiber laser innovations.

SkyWater Technology, Inc.

- Smaller market cap with niche focus; high beta indicates greater volatility and competitive challenges.

- Provides semiconductor development and manufacturing services across aerospace, defense, automotive, and IoT sectors.

- Faces technological risks in semiconductor manufacturing but benefits from co-creation and engineering services with clients.

IPGP vs SKYT Positioning

IPGP holds a diversified product portfolio centered on laser technologies, supporting broad applications in materials processing and communications. SKYT concentrates on semiconductor manufacturing services, targeting specific industries like aerospace and IoT, providing tailored engineering solutions but with a narrower business scope.

Which has the best competitive advantage?

Both companies are shedding value with ROIC below WACC; however, SKYT shows a growing ROIC trend suggesting improving profitability, while IPGP’s declining ROIC indicates worsening value destruction, positioning SKYT with a slightly better competitive advantage.

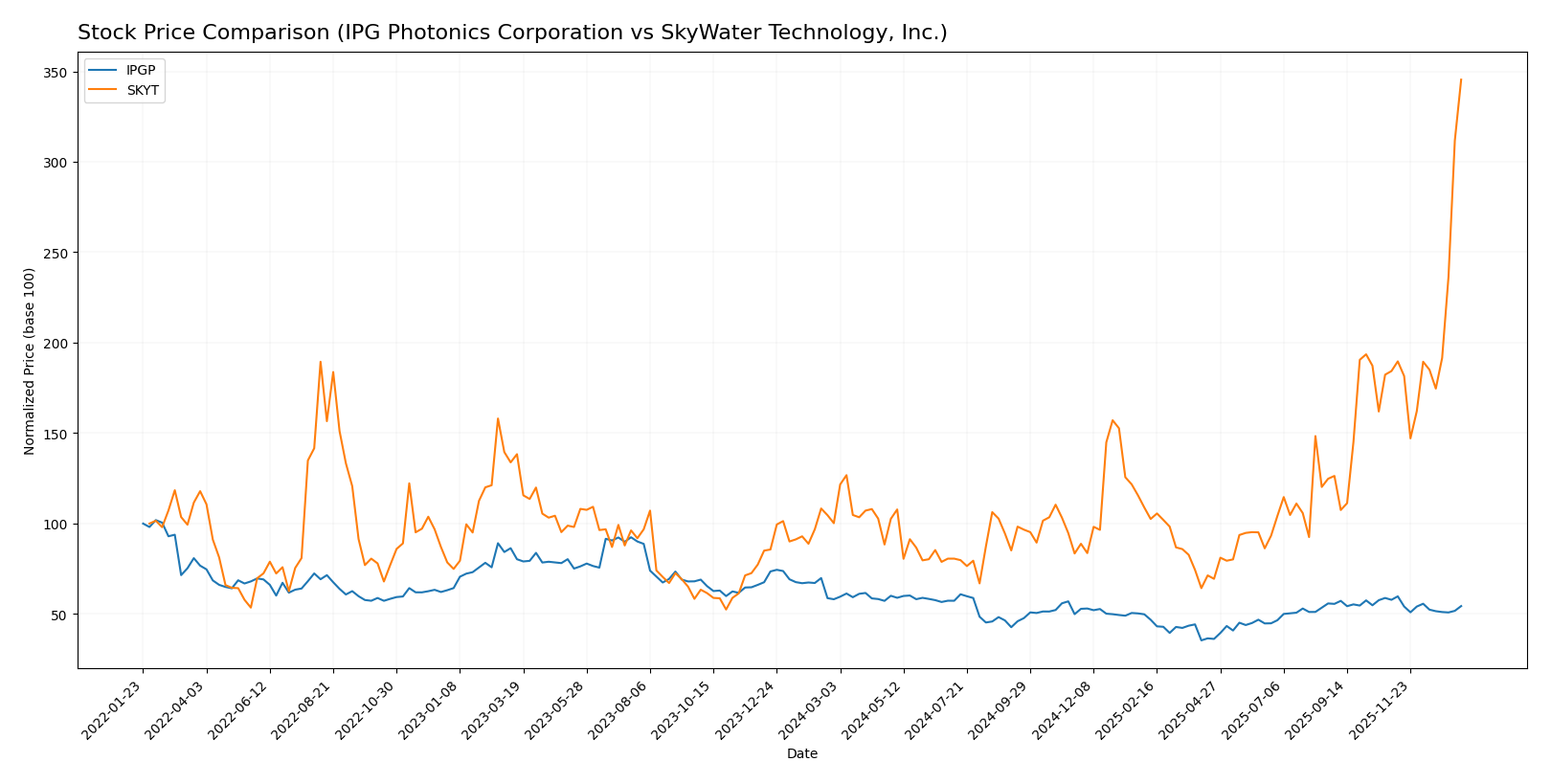

Stock Comparison

The stock prices of IPG Photonics Corporation and SkyWater Technology, Inc. have shown markedly different trajectories over the past year, with SkyWater exhibiting strong bullish momentum while IPG Photonics faced a declining trend amid changing buyer-seller dynamics.

Trend Analysis

IPG Photonics Corporation’s stock posted a -6.49% decline over the past 12 months, indicating a bearish trend with deceleration. The price ranged between 52.12 and 90.69, showing moderate volatility (std deviation 9.27).

SkyWater Technology, Inc. experienced a 244.69% increase in stock price over the same period, reflecting a strong bullish trend with acceleration. Its price fluctuated between 6.1 and 32.78, with lower volatility (std deviation 4.45).

Comparing both, SkyWater Technology delivered the highest market performance with substantial price gains, contrasting with IPG Photonics’ negative trend during the analyzed period.

Target Prices

The latest analyst target price consensus reflects moderate upside potential for both companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| IPG Photonics Corporation | 96 | 92 | 94 |

| SkyWater Technology, Inc. | 25 | 25 | 25 |

Analysts expect IPG Photonics’ price to rise above the current $80.71, targeting around $94, indicating a positive outlook. Conversely, SkyWater Technology’s consensus target of $25 is below its current price of $32.78, suggesting a potential downside or correction.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for IPG Photonics Corporation and SkyWater Technology, Inc.:

Rating Comparison

IPGP Rating

- Rating: B+, assessed as Very Favorable

- Discounted Cash Flow Score: 4, Favorable indicating undervaluation potential

- ROE Score: 2, Moderate efficiency in generating profit from equity

- ROA Score: 3, Moderate asset utilization efficiency

- Debt To Equity Score: 4, Favorable, indicating lower financial risk

- Overall Score: 3, Moderate financial standing

SKYT Rating

- Rating: B+, assessed as Very Favorable

- Discounted Cash Flow Score: 1, Very Unfavorable indicating possible overvaluation

- ROE Score: 5, Very Favorable, excellent profit generation from equity

- ROA Score: 5, Very Favorable, high asset utilization efficiency

- Debt To Equity Score: 1, Very Unfavorable, indicating higher financial risk

- Overall Score: 3, Moderate financial standing

Which one is the best rated?

Both IPGP and SKYT share the same overall rating of B+ and an overall score of 3, indicating moderate financial standing. SKYT excels in ROE and ROA but scores poorly on debt to equity and discounted cash flow, while IPGP shows the opposite pattern with stronger debt management and discounted cash flow scores.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for IPGP and SKYT:

IPGP Scores

- Altman Z-Score: 9.65, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial health based on nine criteria.

SKYT Scores

- Altman Z-Score: 2.20, positioned in the grey zone with moderate bankruptcy risk.

- Piotroski Score: 5, showing average financial strength and value potential.

Which company has the best scores?

Based strictly on the provided data, IPGP has higher Altman Z-Score and Piotroski Score compared to SKYT, indicating better financial stability and stronger investment fundamentals.

Grades Comparison

The following is a comparison of the recent grades assigned to IPG Photonics Corporation and SkyWater Technology, Inc.:

IPG Photonics Corporation Grades

This table summarizes recent grade changes from reputable grading companies for IPG Photonics Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Upgrade | Buy | 2025-11-05 |

| Bernstein | Upgrade | Outperform | 2025-08-07 |

| Raymond James | Maintain | Strong Buy | 2025-05-07 |

| CL King | Upgrade | Buy | 2025-03-18 |

| Citigroup | Maintain | Sell | 2025-02-18 |

| Stifel | Maintain | Buy | 2025-02-12 |

| Needham | Maintain | Hold | 2025-02-12 |

| Seaport Global | Downgrade | Neutral | 2024-08-01 |

| Stifel | Maintain | Buy | 2024-07-31 |

| Raymond James | Maintain | Strong Buy | 2024-07-31 |

Overall, IPG Photonics shows a positive trend with multiple upgrades and strong buy ratings from major firms, although a few hold and sell ratings persist.

SkyWater Technology, Inc. Grades

This table displays stable grades from recognized grading companies for SkyWater Technology, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-08-07 |

| Needham | Maintain | Buy | 2025-05-08 |

| Needham | Maintain | Buy | 2025-02-27 |

| Needham | Maintain | Buy | 2024-11-11 |

| Piper Sandler | Maintain | Overweight | 2024-10-25 |

| Piper Sandler | Maintain | Overweight | 2024-08-08 |

| Needham | Maintain | Buy | 2024-05-09 |

SkyWater Technology maintains consistent buy and overweight ratings, with no recent upgrades or downgrades, indicating stable analyst confidence.

Which company has the best grades?

IPG Photonics Corporation has a broader range of ratings including strong buy and outperform upgrades, while SkyWater Technology shows consistent buy ratings without upgrades. IPG’s more frequent upgrades suggest stronger analyst momentum, potentially impacting investor sentiment through greater perceived growth opportunities.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for IPG Photonics Corporation (IPGP) and SkyWater Technology, Inc. (SKYT) based on the most recent data.

| Criterion | IPG Photonics Corporation (IPGP) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Diversification | Moderate: Focused primarily on laser and photonics products with segmented offerings in CW and pulsed lasers. | Moderate: Concentrated on advanced technology and wafer services, with some revenue variety within segments. |

| Profitability | Weak: Negative net margin (-18.6%), ROIC (-9.97%), and declining profitability trend; value destroying. | Weak: Negative margins (-1.98%), ROIC positive but below WACC, improving trend but still shedding value. |

| Innovation | Strong product innovation in high-power laser systems and amplifiers. | Moderate innovation in semiconductor manufacturing services, improving ROIC trend. |

| Global presence | Established global footprint in materials processing and laser systems markets. | More niche global presence focused on wafer and advanced technology services. |

| Market Share | Significant in laser systems market, especially high-power lasers. | Smaller, more specialized market share in semiconductor services. |

Key takeaways: IPG Photonics shows strong product innovation and market position but suffers from declining profitability and value destruction. SkyWater Technology has a less diversified portfolio and weaker profitability but demonstrates improving returns and potential in niche semiconductor services. Investors should weigh innovation and market position against profitability risks.

Risk Analysis

Below is a comparative table outlining key risks for IPG Photonics Corporation (IPGP) and SkyWater Technology, Inc. (SKYT) based on their 2024 financial and operational data:

| Metric | IPG Photonics Corporation (IPGP) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Risk | Moderate (Beta 1.017, semiconductor cyclicality) | High (Beta 3.487, high volatility) |

| Debt Level | Very Low (D/E 0.01, favorable) | High (D/E 1.33, unfavorable) |

| Regulatory Risk | Moderate (US tech regulations) | Moderate to High (defense and aerospace exposure) |

| Operational Risk | Moderate (complex laser systems) | Moderate (advanced semiconductor manufacturing) |

| Environmental Risk | Moderate (manufacturing emissions) | Moderate (semiconductor process waste) |

| Geopolitical Risk | Moderate (global supply chains) | High (aerospace/defense reliance) |

The most impactful risks are market volatility for SkyWater due to its high beta and leverage, raising financial vulnerability. IPG shows strong balance sheet stability but faces operational challenges amid semiconductor market fluctuations. SkyWater’s elevated debt and geopolitical exposure pose higher default risk despite moderate profitability, while IPG’s financial metrics suggest resilience but with some margin pressures. Investors should weigh SkyWater’s growth potential against its financial risks and consider IPG’s steadier profile for risk-managed exposure in semiconductors.

Which Stock to Choose?

IPG Photonics Corporation (IPGP) shows a declining income trend with a -24.1% revenue drop in 2024 and unfavorable profitability ratios, including a -18.58% net margin and -8.97% ROE. It maintains low debt and strong liquidity, reflected in a B+ rating and a slightly unfavorable overall financial ratio assessment.

SkyWater Technology, Inc. (SKYT) exhibits favorable income growth with a 19.39% revenue rise in 2024 and mostly positive income statement metrics. However, it faces challenges in debt management and liquidity, with a current ratio below 1, and an unfavorable global ratio evaluation despite a B+ rating.

For investors prioritizing value creation and consistent profitability, IPGP’s strong balance sheet and moderate rating might appear more suitable, while those focusing on growth potential could find SKYT’s accelerating income growth and improving profitability more compelling, acknowledging its higher financial risk profile.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of IPG Photonics Corporation and SkyWater Technology, Inc. to enhance your investment decisions: