Home > Comparison > Technology > SLAB vs IPGP

The strategic rivalry between Silicon Laboratories Inc. and IPG Photonics Corporation defines the semiconductor industry’s innovation frontier. Silicon Labs operates as a fabless semiconductor firm specializing in analog-intensive mixed-signal solutions, while IPG Photonics excels in high-performance fiber lasers and amplifiers. This clash pits diversified IoT-focused semiconductors against specialized photonics tech. This analysis aims to identify which trajectory promises superior risk-adjusted returns for a diversified technology portfolio.

Table of contents

Companies Overview

Silicon Laboratories Inc. and IPG Photonics Corporation stand as key innovators in the semiconductor technology sector.

Silicon Laboratories Inc.: Mixed-Signal Semiconductor Pioneer

Silicon Laboratories Inc. dominates the analog-intensive mixed-signal semiconductor market. Its revenue stems from wireless microcontrollers and sensor products powering the Internet of Things (IoT) across industrial automation, smart homes, and medical devices. In 2026, it focuses strategically on expanding its IoT footprint through innovation in connected devices and enhancing its global sales network.

IPG Photonics Corporation: Fiber Laser Technology Leader

IPG Photonics Corporation leads in high-performance fiber lasers and amplifiers used worldwide for materials processing and communications. Its core revenue derives from laser systems, amplifiers, and integrated optical solutions sold to OEMs and system integrators. The company prioritizes advancing laser technology and expanding its applications in manufacturing and telecommunications in 2026.

Strategic Collision: Similarities & Divergences

Both companies operate within high-tech semiconductor niches but follow distinct philosophies. Silicon Labs pursues a broad IoT-driven semiconductor ecosystem, while IPG Photonics focuses on specialized laser technology and materials processing. They primarily compete on technology innovation and end-market penetration. Their investment profiles contrast: Silicon Labs offers diversified IoT exposure, whereas IPG Photonics provides a laser-focused play on advanced industrial applications.

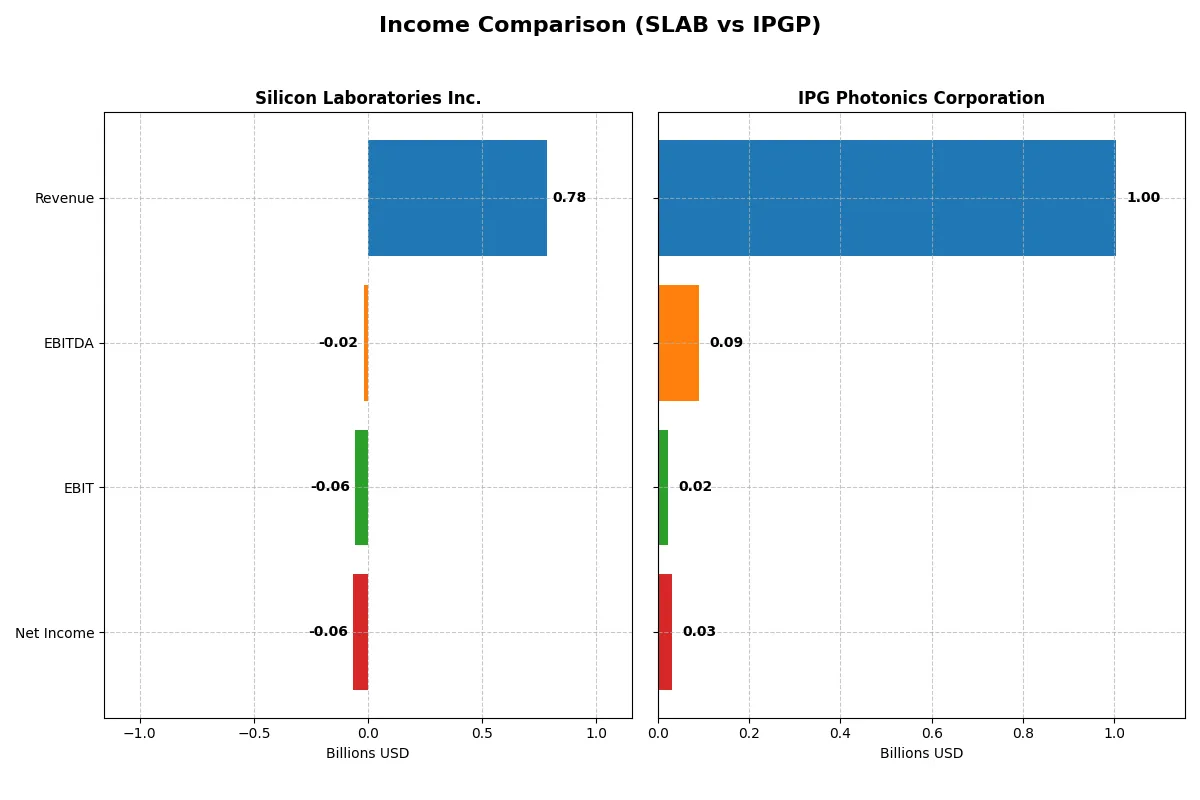

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Silicon Laboratories Inc. (SLAB) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Revenue | 785M | 1.00B |

| Cost of Revenue | 328M | 622M |

| Operating Expenses | 528M | 368M |

| Gross Profit | 457M | 381M |

| EBITDA | -19M | 90M |

| EBIT | -57M | 23M |

| Interest Expense | 1M | 0 |

| Net Income | -65M | 31M |

| EPS | -1.98 | 0.73 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company converts revenue into profit most efficiently over recent years.

Silicon Laboratories Inc. Analysis

Silicon Laboratories shows a mixed trajectory with revenue rising from 720M in 2021 to 785M in 2025, yet net income turned consistently negative, hitting -65M in 2025. Gross margins remain strong at 58%, indicating good cost control on production, but operating losses and negative net margins around -8.3% highlight operational inefficiencies and high expenses eroding profitability despite revenue growth momentum.

IPG Photonics Corporation Analysis

IPG Photonics posts higher revenue, peaking near 1.46B in 2021 and settling at 1B in 2025. Net income fluctuates, recovering to 31M in 2025 after a significant loss in 2024. Gross margin at 38% is lower than Silicon Labs but stable, while a modest positive net margin of 3.1% and EBIT margin around 2.3% signal improved operational control and profitability despite a slight revenue decline over the period.

Verdict: Margin Strength vs. Revenue Resilience

Silicon Labs excels in gross margin but struggles with operating losses and net income deficits, reflecting costly overheads and R&D intensity. IPG, although facing top-line contraction, achieves positive net income and EBIT margins, demonstrating better bottom-line discipline. For investors, IPG’s profile offers steadier profitability, while Silicon Labs shows promising revenue growth offset by margin challenges.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of these companies:

| Ratios | Silicon Laboratories Inc. (SLAB) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| ROE | -5.93% (2025) | 1.46% (2025) |

| ROIC | -6.27% (2025) | 0.41% (2025) |

| P/E | -66.51 (2025) | 98.08 (2025) |

| P/B | 3.94 (2025) | 1.43 (2025) |

| Current Ratio | 4.69 (2025) | 6.08 (2025) |

| Quick Ratio | 4.02 (2025) | 4.74 (2025) |

| D/E | 0 (2025) | 0 (2025) |

| Debt-to-Assets | 0 (2025) | 0 (2025) |

| Interest Coverage | -72.35 (2025) | 0 (2025) |

| Asset Turnover | 0.62 (2025) | 0.41 (2025) |

| Fixed Asset Turnover | 6.10 (2025) | 1.57 (2025) |

| Payout ratio | 0% (2025) | 0% (2025) |

| Dividend yield | 0% (2025) | 0% (2025) |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, unveiling hidden risks and operational strengths that raw numbers alone cannot reveal.

Silicon Laboratories Inc.

Silicon Laboratories shows weak profitability with a negative ROE of -5.93% and poor net margins at -8.27%. Its valuation appears attractive with a negative P/E of -66.51, suggesting losses but potential undervaluation. No dividends are paid; instead, the company heavily reinvests in R&D, dedicating 45% of revenue to innovation, signaling a growth focus despite operational challenges.

IPG Photonics Corporation

IPG Photonics posts modest profitability, with a positive but low ROE of 1.46% and a slim net margin of 3.1%. Its P/E ratio is stretched at 98.08, indicating high market expectations. The firm does not pay dividends either, channeling capital into steady R&D spending near 12% of revenue. This strategy supports long-term growth amid a cautious valuation.

Valuation Tension: Growth Ambitions vs. Profitability Challenges

Silicon Laboratories offers an intriguing valuation paired with heavy R&D investment but struggles with negative returns and operational inefficiencies. IPG Photonics trades at a premium, reflecting market confidence in its modest profitability and disciplined capital allocation. Investors seeking growth might prefer Silicon’s reinvestment profile, while those favoring stability may lean toward IPG’s cautious profitability.

Which one offers the Superior Shareholder Reward?

Silicon Laboratories Inc. (SLAB) pays no dividends and has no share buybacks, relying on reinvestment to recover from recent losses, with negative margins and free cash flow volatility. IPG Photonics Corporation (IPGP) also pays no dividends but conducts moderate buybacks, showing positive operating margins and steadier free cash flow. I see IPGP’s disciplined buyback program and stable profitability as a more sustainable model for total shareholder return in 2026.

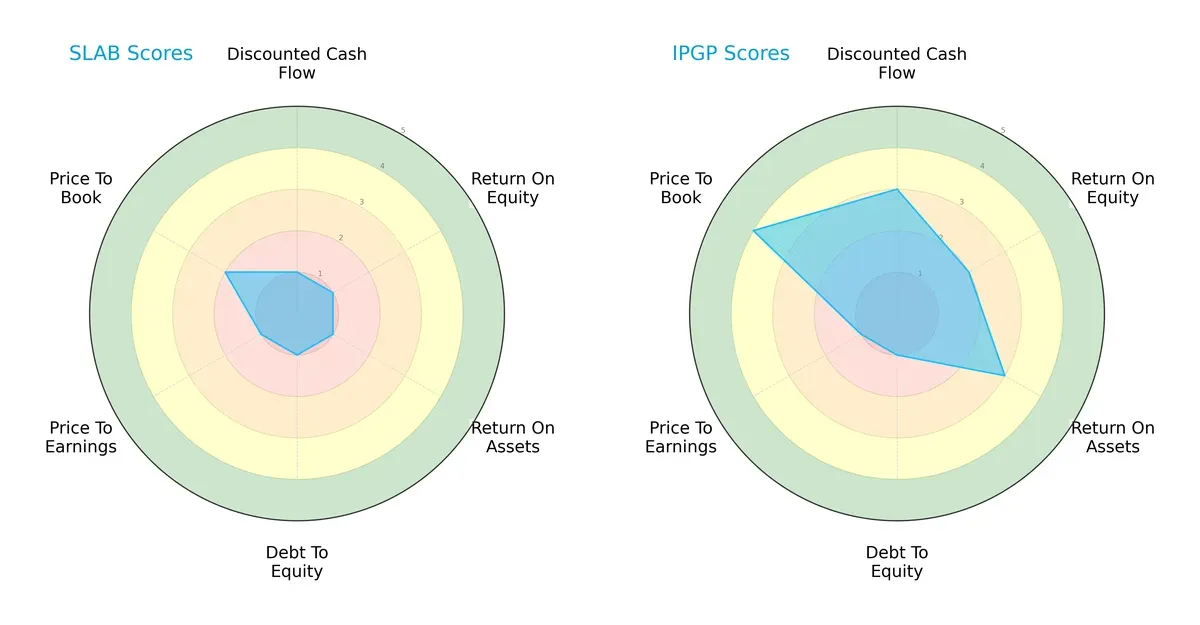

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Silicon Laboratories Inc. and IPG Photonics Corporation, highlighting their financial strengths and weaknesses across key metrics:

IPG Photonics shows a more balanced profile with moderate DCF (3), ROE (2), and ROA (3) scores, while Silicon Labs lags with uniformly very unfavorable scores (all 1s except P/B at 2). Both firms face challenges in debt-to-equity and valuation metrics. IPGP leverages moderate operational efficiency and cash flow, whereas SLAB depends on a weak foothold without a clear edge.

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap favors Silicon Labs with 25.2 versus IPG Photonics’ 15.0, indicating both companies reside safely above distress thresholds but SLAB enjoys significantly stronger solvency and lower bankruptcy risk in this cycle:

Financial Health: Quality of Operations

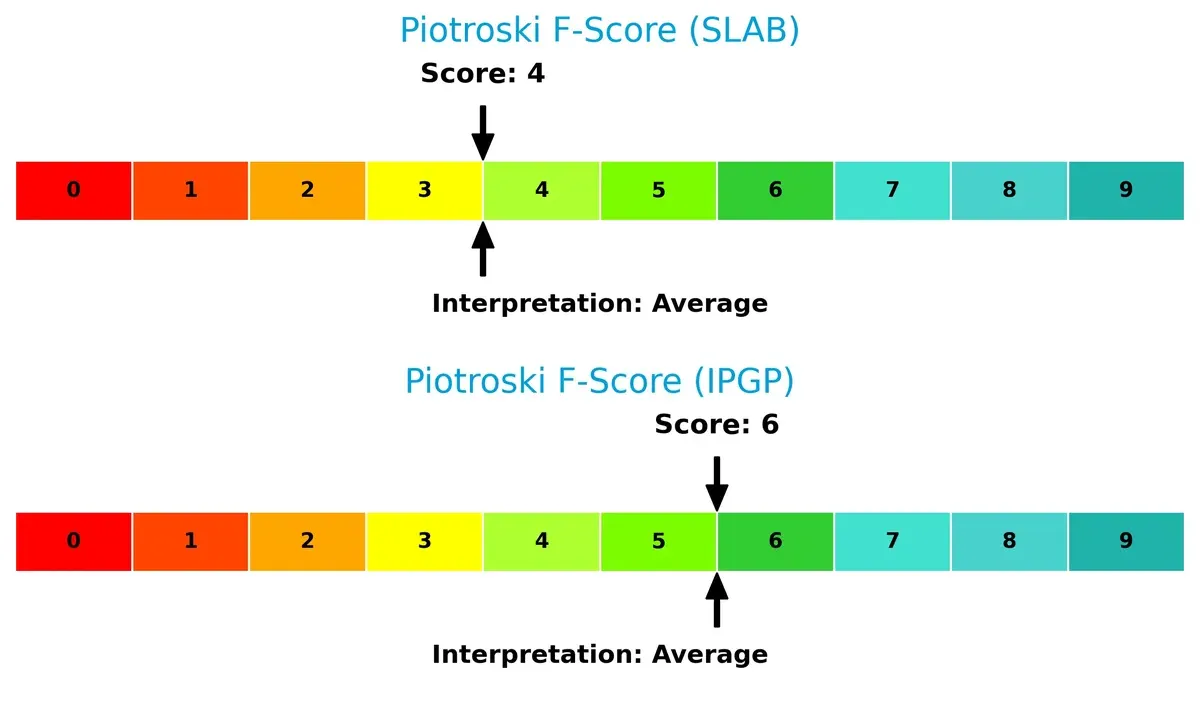

IPG Photonics attains a higher Piotroski F-Score of 6 compared to Silicon Labs’ 4, suggesting better internal financial quality. Neither firm exhibits peak financial health, but Silicon Labs’ lower score signals potential red flags in operational efficiency or profitability metrics:

How are the two companies positioned?

This section dissects the operational DNA of SLAB and IPGP by comparing revenue distribution and analyzing their internal strengths and weaknesses. The ultimate goal is to confront their economic moats to reveal which model offers a more resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

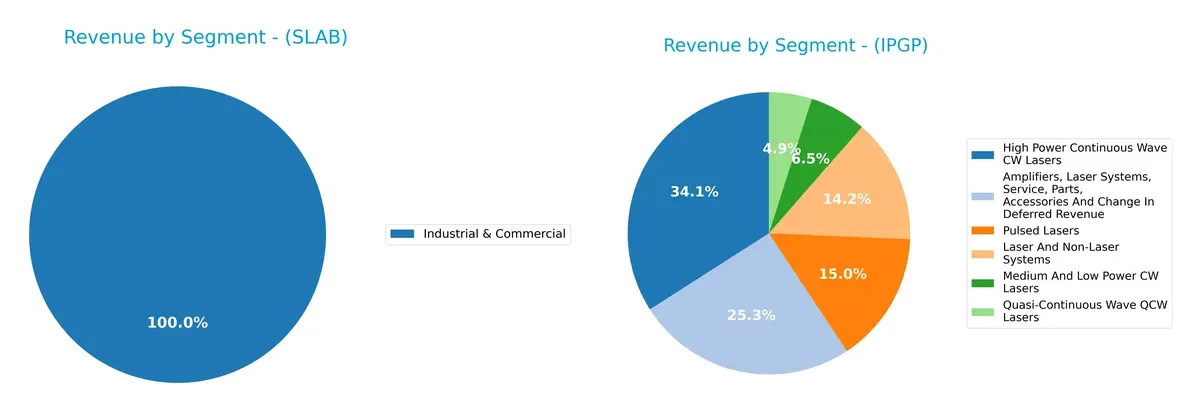

This visual comparison dissects how Silicon Laboratories Inc. and IPG Photonics Corporation diversify income streams and reveals their primary sector bets:

Silicon Labs anchors nearly all revenue in “Industrial & Commercial” at $445M in 2025, showing a concentrated but focused approach. IPG Photonics spreads revenue across six laser-related segments, with “High Power Continuous Wave CW Lasers” dominating at $333M. IPG’s diversified portfolio reduces concentration risk, while Silicon Labs’ narrow focus may expose it to sector-specific downturns but benefits from clear market specialization.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Silicon Laboratories Inc. and IPG Photonics Corporation:

Silicon Laboratories Inc. Strengths

- Strong quick ratio at 4.02 indicates good short-term liquidity

- No debt, zero debt to assets ratio supports financial stability

- High fixed asset turnover at 6.1 reflects efficient asset use

IPG Photonics Corporation Strengths

- Favorable price-to-book ratio at 1.43 suggests undervaluation

- No debt and zero debt to assets ratio enhance balance sheet strength

- Infinite interest coverage ratio shows excellent debt service capacity

Silicon Laboratories Inc. Weaknesses

- Negative net margin (-8.27%) signals unprofitability

- Negative ROE (-5.93%) and ROIC (-6.27%) indicate poor capital returns

- Unfavorable high WACC (10.86%) increases capital cost

- Negative interest coverage (-58.4) raises solvency concerns

- Unfavorable price-to-earnings ratio (-66.51) suggests market skepticism

IPG Photonics Corporation Weaknesses

- Low net margin (3.1%) and ROE (1.46%) show weak profitability

- ROIC barely positive (0.41%) questions capital efficiency

- High P/E ratio (98.08) implies stretched valuation

- Low asset turnover (0.41) indicates inefficient asset use

- Current ratio at 6.08 flagged as unfavorable, possible working capital imbalance

Silicon Laboratories benefits from strong liquidity and zero leverage but struggles with profitability and capital efficiency. IPG Photonics maintains a solid balance sheet and valuation metrics but faces challenges in profitability and asset utilization. Both companies exhibit financial risks that could impact their strategic execution.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competition erosion. Let’s dissect the moats of two semiconductor firms:

Silicon Laboratories Inc.: Intangible Assets and Niche Innovation

Silicon Labs relies on patented analog and mixed-signal technology, driving high gross margins (58%) despite negative net margins. Its IoT focus offers growth, but declining ROIC signals vulnerability in 2026.

IPG Photonics Corporation: Technological Leadership in Fiber Lasers

IPG’s competitive edge stems from specialized fiber laser technology and deep customer integration. Its moderate margins and stable earnings growth contrast with Silicon Labs’ volatility, though ROIC decline demands caution.

Moat Battle: Intangible Innovation vs. Specialized Technology Leadership

Both firms face shrinking ROIC, signaling weakened moats. However, IPG’s focused product dominance and steady margin growth give it a deeper competitive edge. IPG appears better positioned to defend market share in the evolving semiconductor landscape.

Which stock offers better returns?

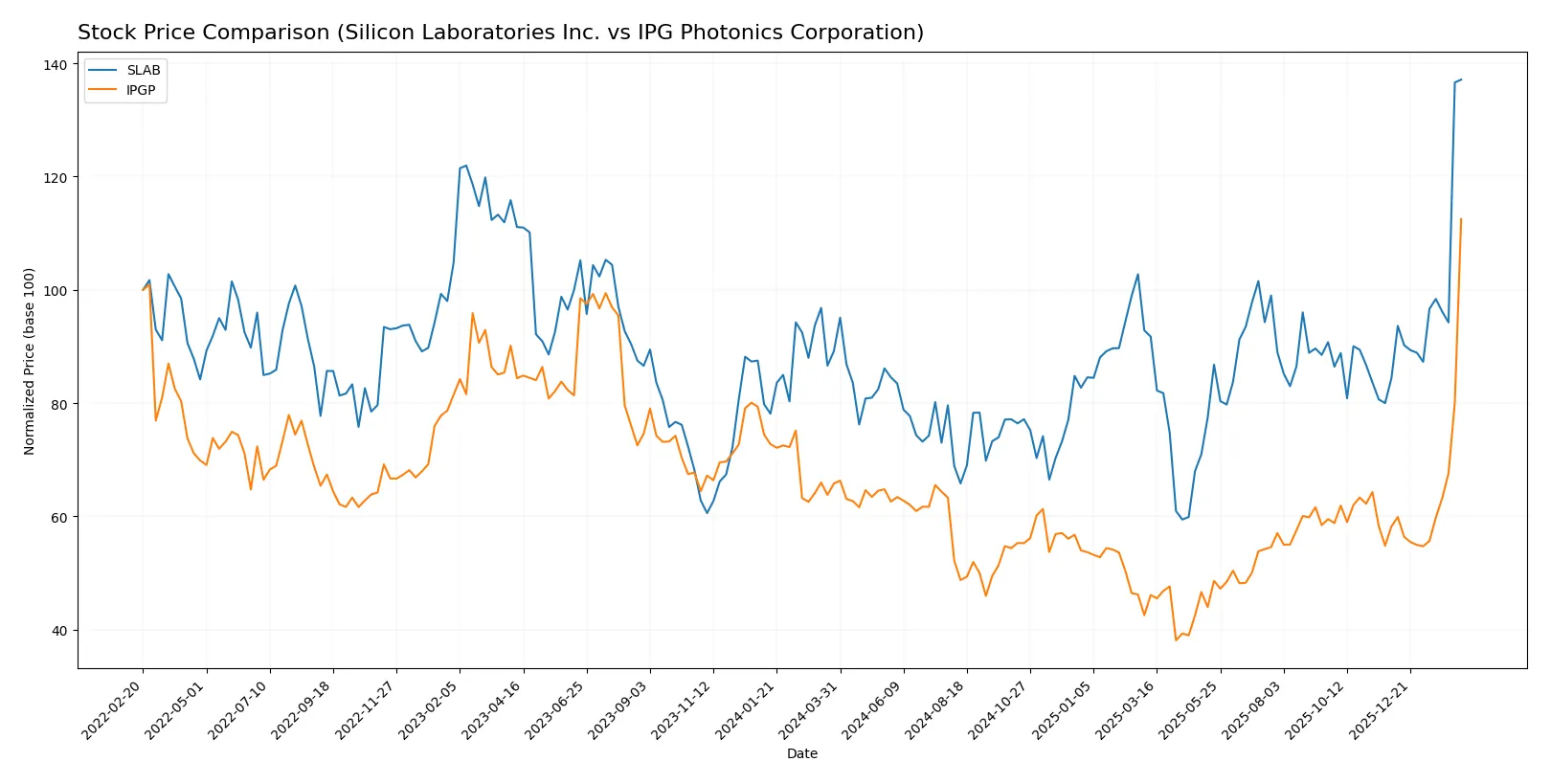

Both Silicon Laboratories Inc. (SLAB) and IPG Photonics Corporation (IPGP) demonstrated strong price appreciation over the past year with notable acceleration in their upward trends.

Trend Comparison

Silicon Laboratories Inc. (SLAB) shows a bullish trend with a 53.82% price increase over 12 months. The trend accelerates, reaching a recent 62.46% gain, with volatility reflected by an 18.09 std deviation.

IPG Photonics Corporation (IPGP) exhibits a stronger bullish trend, rising 71.01% over the past year. The acceleration continues recently with a 93.26% increase and a lower overall volatility of 12.46 std deviation.

Comparing both, IPGP outperformed SLAB in market returns with a higher annual price increase and sustained acceleration, making it the stronger market performer.

Target Prices

Analysts show a generally bullish outlook with solid upside potential for both Silicon Laboratories Inc. and IPG Photonics Corporation.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Silicon Laboratories Inc. | 160 | 231 | 211.6 |

| IPG Photonics Corporation | 110 | 180 | 151.67 |

The target consensus for Silicon Laboratories exceeds its current price of $207, indicating room for growth. IPG Photonics’ consensus aligns closely with its $153.91 price, suggesting moderate appreciation potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

This section compares recent institutional grades for Silicon Laboratories Inc. and IPG Photonics Corporation:

Silicon Laboratories Inc. Grades

The table below shows grade updates from several reliable institutions for Silicon Laboratories Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-02-06 |

| RBC Capital | Maintain | Sector Perform | 2026-02-05 |

| Benchmark | Downgrade | Hold | 2026-02-04 |

| Needham | Downgrade | Hold | 2026-02-04 |

| Keybanc | Downgrade | Sector Weight | 2026-02-04 |

| Morgan Stanley | Maintain | Equal Weight | 2025-08-06 |

| Susquehanna | Maintain | Neutral | 2025-08-06 |

| Barclays | Maintain | Equal Weight | 2025-08-05 |

| Susquehanna | Maintain | Neutral | 2025-07-22 |

| Stifel | Maintain | Buy | 2025-07-18 |

IPG Photonics Corporation Grades

The following table summarizes recent grading changes for IPG Photonics Corporation from reputable grading firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Buy | 2026-02-13 |

| Raymond James | Downgrade | Outperform | 2026-02-13 |

| Roth Capital | Maintain | Buy | 2026-02-03 |

| Citigroup | Upgrade | Buy | 2025-11-05 |

| Bernstein | Upgrade | Outperform | 2025-08-07 |

| Raymond James | Maintain | Strong Buy | 2025-05-07 |

| CL King | Upgrade | Buy | 2025-03-18 |

| Citigroup | Maintain | Sell | 2025-02-18 |

| Needham | Maintain | Hold | 2025-02-12 |

| Stifel | Maintain | Buy | 2025-02-12 |

Which company has the best grades?

IPG Photonics holds generally stronger grades, including multiple Buy and Outperform ratings, compared to Silicon Laboratories’ mostly Neutral and Hold grades. This suggests more positive institutional sentiment toward IPG Photonics, which could influence investor confidence and demand.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Silicon Laboratories Inc. (SLAB)

- Faces intense competition in the semiconductor sector with a focus on analog and mixed-signal IoT solutions.

IPG Photonics Corporation (IPGP)

- Competes globally in high-performance fiber lasers, contending with niche and diversified laser technology firms.

2. Capital Structure & Debt

Silicon Laboratories Inc. (SLAB)

- Zero debt, strong balance sheet but poor interest coverage signals operational cash flow stress.

IPG Photonics Corporation (IPGP)

- Also debt-free with infinite interest coverage, indicating sound financial leverage and liquidity.

3. Stock Volatility

Silicon Laboratories Inc. (SLAB)

- Beta at 1.54 denotes higher volatility than the market, increasing risk in turbulent cycles.

IPG Photonics Corporation (IPGP)

- Beta near 1.03 suggests volatility closely aligned with market averages, implying moderate risk exposure.

4. Regulatory & Legal

Silicon Laboratories Inc. (SLAB)

- Subject to U.S. and international semiconductor export controls and IP litigation risks.

IPG Photonics Corporation (IPGP)

- Faces regulatory scrutiny in laser safety standards and export restrictions impacting global sales.

5. Supply Chain & Operations

Silicon Laboratories Inc. (SLAB)

- Relies on complex global supply chains vulnerable to semiconductor component shortages.

IPG Photonics Corporation (IPGP)

- Supply chain exposed to specialized fiber optic materials and advanced manufacturing constraints.

6. ESG & Climate Transition

Silicon Laboratories Inc. (SLAB)

- ESG risks from energy-intensive manufacturing and pressure to reduce carbon footprint in IoT production.

IPG Photonics Corporation (IPGP)

- Must manage environmental impacts of laser manufacturing and align with increasing sustainability demands.

7. Geopolitical Exposure

Silicon Laboratories Inc. (SLAB)

- Significant exposure to U.S.-China trade tensions affecting semiconductor supply and sales.

IPG Photonics Corporation (IPGP)

- Global operations face risks from geopolitical instability in key markets and export control regimes.

Which company shows a better risk-adjusted profile?

IPG Photonics’ strongest asset is its debt-free structure combined with stable interest coverage, reducing financial risk. Silicon Laboratories faces operational challenges signaled by negative profitability and weak interest coverage despite zero debt. Both companies endure sector-specific market and supply chain pressures, but SLAB’s higher stock volatility and unfavorable profitability metrics raise caution. The most impactful risk for SLAB is its poor profitability and cash flow strain, while for IPGP, it is the moderate returns and valuation concerns. IPGP’s more balanced financial health and lower volatility suggest a better risk-adjusted profile in 2026.

Final Verdict: Which stock to choose?

Silicon Laboratories Inc. (SLAB) stands out for its rapid revenue and gross profit growth, driven by a strong commitment to R&D that fuels innovation. Its superpower lies in operational agility and expanding market presence. However, investors should watch its ongoing profitability struggles and value destruction as a cautionary flag. SLAB fits well in aggressive growth portfolios willing to tolerate volatility for potential long-term rewards.

IPG Photonics Corporation (IPGP) offers a strategic moat through its recurring revenue streams and solid balance sheet, underpinning stable cash flows and moderate growth. While its returns on capital remain under pressure, its financial safety profile is comparatively stronger. IPGP suits growth-at-a-reasonable-price (GARP) investors seeking steadier exposure in the tech sector with less earnings volatility.

If you prioritize rapid expansion and can stomach earnings headwinds, SLAB presents a compelling scenario due to its innovation-driven growth engine. However, if you seek better stability and a clearer path to value creation, IPGP offers a superior risk-adjusted profile despite slower growth. Both demand careful risk management given their declining ROIC trends and ongoing value challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Silicon Laboratories Inc. and IPG Photonics Corporation to enhance your investment decisions: