Onto Innovation Inc. and IPG Photonics Corporation are two prominent players in the semiconductor industry, each pushing innovation in process control and laser technologies. Both companies serve advanced manufacturing and tech sectors, overlapping in high-precision equipment and materials processing solutions. This comparison explores their market strategies, technological edge, and growth potential to help you identify which company might be the smarter addition to your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Onto Innovation Inc. and IPG Photonics Corporation by providing an overview of these two companies and their main differences.

Onto Innovation Inc. Overview

Onto Innovation Inc. specializes in designing and manufacturing process control tools for semiconductor and advanced packaging device manufacturers. The company provides solutions such as macro defect inspection, 2D/3D optical metrology, lithography systems, and process control software. It operates globally, serving various industries including silicon wafers and LEDs, and is headquartered in Wilmington, Massachusetts.

IPG Photonics Corporation Overview

IPG Photonics Corporation focuses on developing and producing high-performance fiber lasers, amplifiers, and diode lasers mainly for materials processing and telecommunications applications. Its product range includes hybrid and direct diode lasers, integrated laser systems, and optical transceivers. IPG serves original equipment manufacturers and end users worldwide from its base in Oxford, Massachusetts.

Key similarities and differences

Both Onto Innovation and IPG Photonics operate in the semiconductor technology sector, offering specialized equipment for industrial applications. Onto Innovation emphasizes process control and metrology tools, while IPG Photonics centers on laser technologies and fiber amplifiers. Their customer bases overlap in advanced manufacturing, but their product portfolios and core technologies differ significantly, reflecting distinct market focuses within the broader technology industry.

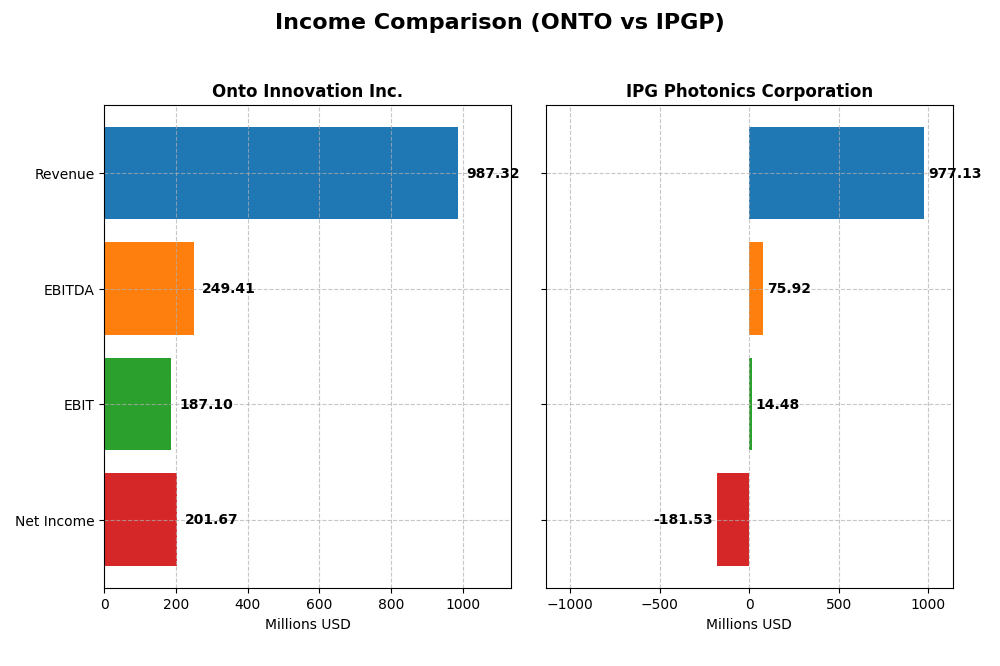

Income Statement Comparison

Below is a side-by-side comparison of the latest available income statement metrics for Onto Innovation Inc. and IPG Photonics Corporation, reflecting their fiscal year 2024 performance.

| Metric | Onto Innovation Inc. | IPG Photonics Corporation |

|---|---|---|

| Market Cap | 10.7B | 3.4B |

| Revenue | 987M | 977M |

| EBITDA | 249M | 76M |

| EBIT | 187M | 14M |

| Net Income | 202M | -182M |

| EPS | 4.09 | -4.09 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Onto Innovation Inc.

Onto Innovation demonstrated strong revenue growth from 2020 to 2024, rising from $556M to $987M, with net income surging from $31M to $202M. Margins remained solid, with a gross margin above 52% and net margin over 20%. The latest fiscal year showed accelerated growth, with revenue up 21% and net income increasing 38%, reflecting improved profitability and operational efficiency.

IPG Photonics Corporation

IPG Photonics experienced declining revenues over the five-year span, dropping from $1.2B in 2020 to $977M in 2024, accompanied by a shift to a net loss of $182M in 2024 from a $160M profit in 2020. Margins weakened significantly, with a gross margin of 35% and negative net margin in 2024. The most recent year marked a sharp downturn, with a 24% revenue decline and a severe contraction in EBIT and net income.

Which one has the stronger fundamentals?

Onto Innovation exhibits stronger fundamentals with consistent revenue and net income growth, robust margins, and a favorable income statement evaluation. Conversely, IPG Photonics faces significant challenges, including declining revenue, negative net margins, and unfavorable growth trends, leading to an overall unfavorable income statement evaluation. These contrasting trajectories highlight Onto Innovation’s relative financial strength.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Onto Innovation Inc. and IPG Photonics Corporation based on their most recent fiscal year data (2024).

| Ratios | Onto Innovation Inc. (ONTO) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| ROE | 10.5% | -8.97% |

| ROIC | 8.77% | -9.97% |

| P/E | 41.8 | -17.8 |

| P/B | 4.37 | 1.59 |

| Current Ratio | 8.69 | 6.98 |

| Quick Ratio | 7.00 | 5.59 |

| D/E | 0.0079 | 0.0089 |

| Debt-to-Assets | 0.72% | 0.78% |

| Interest Coverage | 0 | 0 |

| Asset Turnover | 0.47 | 0.43 |

| Fixed Asset Turnover | 7.16 | 1.66 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Onto Innovation Inc.

Onto Innovation displays a mixed ratio profile for 2024 with strengths in net margin (20.43%) and strong quick ratio (7.0), debt to equity (0.01), and interest coverage (infinite), indicating solid liquidity and low leverage. However, high price multiples (PE 41.76, PB 4.37), weak asset turnover (0.47), and an elevated current ratio (8.69) raise concerns. The company does not pay dividends, likely reinvesting earnings to support growth and R&D.

IPG Photonics Corporation

IPG Photonics shows several unfavorable profitability ratios in 2024, including negative net margin (-18.58%), ROE (-8.97%), and ROIC (-9.97%), reflecting operational challenges. Favorable aspects include low debt levels (debt to equity 0.01), strong interest coverage, and a decent quick ratio (5.59). IPG also does not pay dividends, probably due to negative earnings, focusing on reinvestment and R&D instead.

Which one has the best ratios?

Comparing both, Onto Innovation has a more balanced ratio set with positive profitability and liquidity indicators, though some valuation and efficiency metrics are weak. IPG Photonics suffers from negative profitability ratios but maintains solid solvency and liquidity. Overall, Onto Innovation’s ratios appear more favorable, while IPG’s ratios suggest operational difficulties despite good balance sheet metrics.

Strategic Positioning

This section compares the strategic positioning of Onto Innovation Inc. and IPG Photonics Corporation including market position, key segments, and exposure to technological disruption:

Onto Innovation Inc.

- Mid-cap semiconductor firm facing moderate competitive pressure.

- Focuses on process control tools, metrology, lithography, and software for semiconductors and advanced packaging.

- Products serve semiconductor manufacturing and advanced packaging; moderate risk of disruption.

IPG Photonics Corporation

- Smaller market cap with moderate competitive pressure in semiconductors.

- Specializes in high-performance fiber lasers, amplifiers, and diode lasers for materials processing and communications.

- Laser technologies for materials processing and communications, exposed to rapid tech advances in photonics.

Onto Innovation Inc. vs IPG Photonics Corporation Positioning

Onto Innovation shows a diversified portfolio across semiconductor process control and software, supporting various device manufacturers. IPG Photonics concentrates on laser and amplifier technologies mainly for materials processing and communications, reflecting a more focused product offering.

Which has the best competitive advantage?

Both companies are currently shedding value with ROIC below WACC; Onto Innovation’s profitability is improving whereas IPG Photonics experiences declining returns, indicating Onto has a less unfavorable competitive moat.

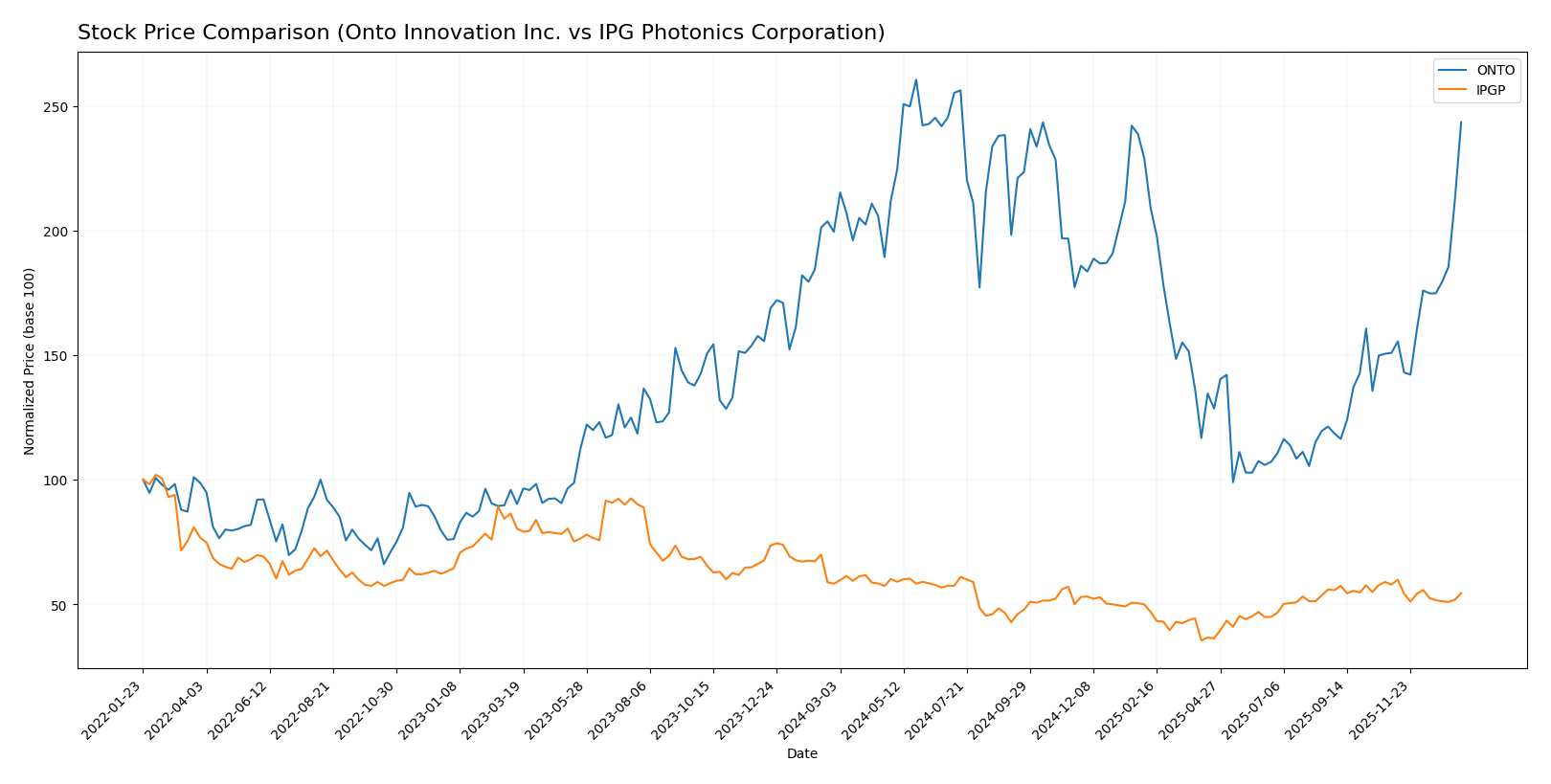

Stock Comparison

The stock price movements of Onto Innovation Inc. and IPG Photonics Corporation over the past year reveal contrasting trends, with Onto Innovation showing strong gains and IPG Photonics experiencing declines amidst differing trading dynamics.

Trend Analysis

Onto Innovation Inc. exhibited a bullish trend over the past 12 months with a 22.07% price increase and accelerating momentum, reaching a high of 233.14 and a low of 88.5, accompanied by significant volatility.

IPG Photonics Corporation displayed a bearish trend over the same period with a -6.49% price decline, decelerating downward momentum, a high of 90.69, and a low of 52.12, with relatively lower volatility.

Comparing both, Onto Innovation delivered the highest market performance with a clear bullish trend, whereas IPG Photonics showed a moderate bearish trend over the past year.

Target Prices

The current analyst consensus presents a cautiously optimistic outlook for these semiconductor companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Onto Innovation Inc. | 200 | 160 | 178 |

| IPG Photonics Corporation | 96 | 92 | 94 |

Analysts expect Onto Innovation’s price to settle below its current level of 217.85 USD, while IPG Photonics shows targets modestly above its current 80.03 USD price, indicating more upside potential for IPG.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Onto Innovation Inc. and IPG Photonics Corporation:

Rating Comparison

ONTO Rating

- Rating: B+ with a very favorable status

- Discounted Cash Flow Score: Moderate at 3

- ROE Score: Moderate at 3

- ROA Score: Favorable at 4

- Debt To Equity Score: Favorable at 4

- Overall Score: Moderate at 3

IPGP Rating

- Rating: B+ with a very favorable status

- Discounted Cash Flow Score: Favorable at 4

- ROE Score: Moderate at 2

- ROA Score: Moderate at 3

- Debt To Equity Score: Favorable at 4

- Overall Score: Moderate at 3

Which one is the best rated?

Both Onto and IPG share the same overall rating of B+ with very favorable status and equal overall scores. IPG scores higher on discounted cash flow, while Onto outperforms on return on assets, indicating a balanced but distinct profile in their respective evaluations.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Onto Innovation Inc. and IPG Photonics Corporation:

ONTO Scores

- Altman Z-Score: 34.16, indicating safe zone, very low bankruptcy risk.

- Piotroski Score: 4, categorized as average financial strength.

IPGP Scores

- Altman Z-Score: 9.65, indicating safe zone, low bankruptcy risk.

- Piotroski Score: 7, categorized as strong financial strength.

Which company has the best scores?

Based on the provided data, ONTO has a higher Altman Z-Score, indicating very low bankruptcy risk, while IPGP has a stronger Piotroski Score, reflecting better financial strength. Each company leads in one key score.

Grades Comparison

I present a comparison of the recent grades and ratings for Onto Innovation Inc. and IPG Photonics Corporation:

Onto Innovation Inc. Grades

The following table shows the latest grades assigned by recognized grading companies for Onto Innovation Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Hold | 2026-01-14 |

| Needham | Maintain | Buy | 2026-01-06 |

| Jefferies | Maintain | Buy | 2025-12-15 |

| B. Riley Securities | Maintain | Buy | 2025-11-18 |

| Needham | Maintain | Buy | 2025-11-18 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-05 |

| Oppenheimer | Maintain | Outperform | 2025-10-14 |

| Stifel | Maintain | Hold | 2025-10-13 |

| B. Riley Securities | Maintain | Buy | 2025-10-10 |

| Jefferies | Upgrade | Buy | 2025-09-23 |

Onto Innovation has consistently received predominantly Buy and Outperform grades, with a few Hold ratings, indicating stable positive sentiment.

IPG Photonics Corporation Grades

Below is the table of recent grades from recognized grading companies for IPG Photonics Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Upgrade | Buy | 2025-11-05 |

| Bernstein | Upgrade | Outperform | 2025-08-07 |

| Raymond James | Maintain | Strong Buy | 2025-05-07 |

| CL King | Upgrade | Buy | 2025-03-18 |

| Citigroup | Maintain | Sell | 2025-02-18 |

| Stifel | Maintain | Buy | 2025-02-12 |

| Needham | Maintain | Hold | 2025-02-12 |

| Seaport Global | Downgrade | Neutral | 2024-08-01 |

| Stifel | Maintain | Buy | 2024-07-31 |

| Raymond James | Maintain | Strong Buy | 2024-07-31 |

IPG Photonics shows a wider range of ratings, including Strong Buy and Outperform, but also some Hold, Neutral, and a Sell rating, reflecting mixed opinions.

Which company has the best grades?

Both Onto Innovation and IPG Photonics have a consensus “Buy” rating, but Onto Innovation’s grades show more uniformity with mostly Buy and Outperform ratings. IPG Photonics has greater variability, including some Sell and Neutral grades. This difference may influence investor perception of stability and risk profiles.

Strengths and Weaknesses

Below is a comparative overview of the strengths and weaknesses of Onto Innovation Inc. (ONTO) and IPG Photonics Corporation (IPGP) based on recent financial and market data.

| Criterion | Onto Innovation Inc. (ONTO) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Diversification | Well-diversified product segments: Systems & Software (approx. $850M), Parts ($77M), Services ($60M) | Focused on laser technologies with several laser categories; less diversified but specialized segments |

| Profitability | Moderate profitability: Net margin 20.4%, ROIC 8.77%, but ROIC below WACC | Negative profitability: Net margin -18.6%, ROIC -9.97%, declining returns |

| Innovation | Growing ROIC trend indicates improving efficiency and potential innovation | Declining ROIC trend signals challenges in maintaining competitive edge |

| Global presence | Strong presence indicated by high fixed asset turnover (7.16) and healthy liquidity | Also global but lower asset turnover (1.66) suggests less operational efficiency |

| Market Share | Moderate market share with steady growth in software and systems revenue | Strong in materials processing lasers but shrinking profitability hampers growth |

Key takeaways: Onto Innovation shows promising growth and improving profitability despite currently shedding value, supported by diversification and operational efficiency. IPG Photonics faces significant profitability and efficiency challenges, with declining returns and a less favorable financial outlook, signaling higher risk for investors.

Risk Analysis

Below is a comparative risk analysis table for Onto Innovation Inc. (ONTO) and IPG Photonics Corporation (IPGP) based on the most recent 2024 data:

| Metric | Onto Innovation Inc. (ONTO) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Market Risk | Beta 1.46: higher volatility; sensitive to semiconductor cycle | Beta 1.02: moderate volatility; diversified laser applications |

| Debt level | Very low debt-to-equity 0.01; strong balance sheet | Very low debt-to-equity 0.01; solid leverage control |

| Regulatory Risk | Moderate, due to semiconductor industry regulations | Moderate, laser technology regulations and export controls |

| Operational Risk | Medium: complex manufacturing and software integration | Medium-high: advanced fiber laser production complexity |

| Environmental Risk | Low: semiconductor process controls, limited emissions | Low to moderate: manufacturing lasers involves energy use and waste |

| Geopolitical Risk | Moderate: supply chain exposure, US-centric operations | Moderate: global sales and potential export restrictions |

The most impactful risks for both companies are market volatility and operational complexities, especially given their exposure to semiconductor cycles and advanced manufacturing. Onto Innovation’s higher beta suggests greater sensitivity to market swings. IPG Photonics faces challenges from its reliance on fiber laser tech markets and geopolitical export controls. Both maintain very low debt, reducing financial risk. Investors should weigh cyclical market risks and technology execution when considering these stocks.

Which Stock to Choose?

Onto Innovation Inc. (ONTO) shows a favorable income evolution with strong revenue and net income growth over 2020-2024. Its financial ratios are balanced, featuring a high net margin and low debt, though some ratios are unfavorable. Profitability is improving, but the company is slightly value-destroying according to its MOAT analysis. Its overall rating is very favorable with a B+ score.

IPG Photonics Corporation (IPGP) displays an unfavorable income trend marked by declining revenue and net income. Financial ratios lean slightly unfavorable, with negative profitability metrics despite low debt and a strong Altman Z-score. The MOAT evaluation is very unfavorable due to shrinking returns. Yet, it holds a similar B+ rating with mixed score evaluations.

Investors favoring growth and improving profitability might find ONTO more appealing given its positive income trends and improving returns. In contrast, those with a tolerance for risk and seeking potential value turnaround opportunities could consider IPGP, given its strong bankruptcy safety scores despite current profit challenges. The choice could depend on the investor’s risk appetite and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Onto Innovation Inc. and IPG Photonics Corporation to enhance your investment decisions: