Microchip Technology Incorporated and IPG Photonics Corporation stand out in the semiconductor industry, each driving innovation in embedded control solutions and high-performance fiber lasers, respectively. Their technologies serve overlapping markets in advanced manufacturing and communications, making their comparison especially relevant. As an investor, understanding their strengths and growth potential is key—this article will help you decide which company deserves a place in your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Microchip Technology Incorporated and IPG Photonics Corporation by providing an overview of these two companies and their main differences.

Microchip Technology Incorporated Overview

Microchip Technology Incorporated specializes in developing, manufacturing, and selling embedded control solutions globally. Its product portfolio includes microcontrollers, microprocessors, analog and interface products, memory devices, and FPGA products. The company serves diverse sectors including automotive, industrial, communications, and computing, emphasizing secure, connected, and smart embedded control technologies. Headquartered in Chandler, Arizona, it employs 22,300 people and operates mainly in the semiconductor industry.

IPG Photonics Corporation Overview

IPG Photonics Corporation focuses on producing high-performance fiber lasers, fiber amplifiers, and diode lasers primarily for materials processing and communications. Its offerings include hybrid fiber-solid state lasers, pulsed lasers, optical fiber delivery systems, and integrated laser systems for industrial and advanced applications. Based in Marlborough, Massachusetts, IPG Photonics serves original equipment manufacturers and end users worldwide, with a workforce of approximately 4,740 employees, also within the semiconductor sector.

Key similarities and differences

Both companies operate in the semiconductor industry and offer advanced technology products, but their core business models differ significantly. Microchip Technology provides a broad range of embedded control solutions and semiconductor components catering to multiple market segments, while IPG Photonics specializes in laser and amplifier technologies for materials processing and communications applications. The scale of operations also contrasts, with Microchip being substantially larger in terms of market capitalization and workforce size.

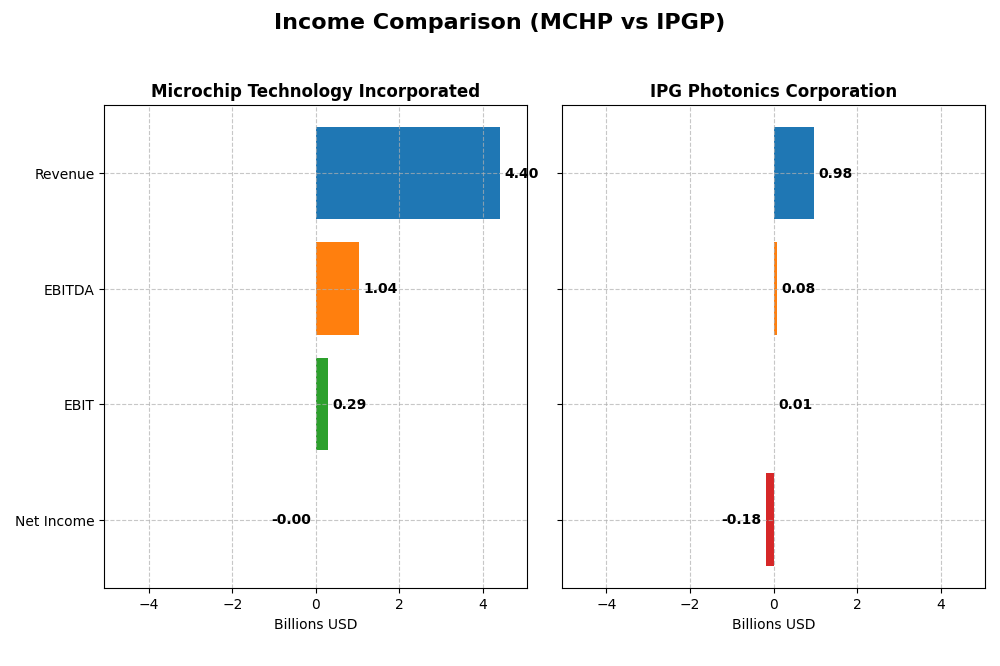

Income Statement Comparison

This table compares the latest fiscal year income statement metrics for Microchip Technology Incorporated and IPG Photonics Corporation, providing a snapshot of their financial performance.

| Metric | Microchip Technology Incorporated | IPG Photonics Corporation |

|---|---|---|

| Market Cap | 40.2B | 3.37B |

| Revenue | 4.40B | 977M |

| EBITDA | 1.04B | 76M |

| EBIT | 290M | 14.5M |

| Net Income | -0.5M | -182M |

| EPS | -0.005 | -4.09 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Microchip Technology Incorporated

Microchip Technology showed a declining trend in revenue from $8.44B in 2023 to $4.40B in 2025, with net income falling sharply from $2.24B to a slight loss of $0.5M in 2025. Gross margins remained relatively strong at 56.07%, but net margin deteriorated to -0.01%. The most recent year reflected a significant downturn in profitability and revenue, indicating operational challenges.

IPG Photonics Corporation

IPG Photonics experienced revenue decline from $1.47B in 2021 to $977M in 2024, alongside net income dropping from $278M to a loss of $182M. Gross margin stayed favorable at 34.61%, yet net margin was negative at -18.58%. The latest fiscal year showed worsening net income and margin, with a steep fall in EBIT, signaling profitability pressures despite stable gross margins.

Which one has the stronger fundamentals?

Both companies faced revenue and net income declines over their respective periods, with unfavorable net margin trends and earnings erosion. Microchip maintains a higher gross margin but suffered a near breakeven net income in 2025. IPG’s gross margin is lower but also stable, though it shows a deeper net loss in 2024. Fundamentally, both display weaknesses in profitability and growth based on recent income statement data.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Microchip Technology Incorporated (MCHP) and IPG Photonics Corporation (IPGP) based on their most recent fiscal year data.

| Ratios | Microchip Technology Incorporated (MCHP) FY2025 | IPG Photonics Corporation (IPGP) FY2024 |

|---|---|---|

| ROE | -0.007% | -8.97% |

| ROIC | -0.027% | -9.97% |

| P/E | -52021 | -17.76 |

| P/B | 3.67 | 1.59 |

| Current Ratio | 2.59 | 6.98 |

| Quick Ratio | 1.47 | 5.59 |

| D/E | 0.80 | 0.009 |

| Debt-to-Assets | 36.85% | 0.78% |

| Interest Coverage | 1.18 | 0 |

| Asset Turnover | 0.29 | 0.43 |

| Fixed Asset Turnover | 3.72 | 1.66 |

| Payout ratio | -1951.4 | 0 |

| Dividend yield | 3.75% | 0% |

Interpretation of the Ratios

Microchip Technology Incorporated

Microchip Technology shows mixed financial ratios with a slightly unfavorable global opinion. While liquidity ratios like current (2.59) and quick ratios (1.47) are favorable, profitability indicators such as net margin (-0.01%), ROE (-0.01%), and ROIC (-0.03%) are weak. The dividend yield is attractive at 3.75%, supported by a moderate payout, though coverage by free cash flow appears challenging given recent negative free cash flow to equity.

IPG Photonics Corporation

IPG Photonics exhibits similarly mixed ratios, with a slightly unfavorable overall evaluation. The company has an exceptionally strong liquidity position (current ratio 6.98, quick ratio 5.59) and low leverage (debt-to-assets 0.78%), yet suffers from poor profitability metrics including a negative net margin of -18.58% and ROE at -8.97%. It does not pay dividends, indicative of possible reinvestment or restructuring priorities.

Which one has the best ratios?

Both companies share a slightly unfavorable global ratios opinion, but Microchip Technology presents stronger dividend returns despite weaker profitability, whereas IPG Photonics offers superior liquidity and minimal debt with no dividends. Each shows notable weaknesses, making a clear superiority in ratios between them inconclusive based solely on this data.

Strategic Positioning

This section compares the strategic positioning of Microchip Technology Incorporated and IPG Photonics Corporation, including market position, key segments, and exposure to technological disruption:

Microchip Technology Incorporated

- Large market cap of 40B, facing competitive pressure in semiconductors.

- Focused on embedded control solutions and semiconductor products, with technology licensing.

- Moderate exposure to disruption through embedded flash tech licensing and semiconductor innovation.

IPG Photonics Corporation

- Smaller market cap of 3.4B, competing in niche laser technologies.

- Specializes in fiber lasers and amplifiers across materials processing and communications.

- Exposure to disruption in fiber laser advancements and integrated communications systems.

Microchip Technology Incorporated vs IPG Photonics Corporation Positioning

Microchip’s diversified semiconductor portfolio contrasts with IPG’s concentrated focus on fiber laser systems and amplifiers. Microchip leverages broader applications and licensing, while IPG targets specialized laser segments, each with distinct competitive dynamics and innovation challenges.

Which has the best competitive advantage?

Both companies exhibit very unfavorable MOAT evaluations, with declining ROIC trends and returns below WACC, indicating value destruction and weak competitive advantages based on provided data.

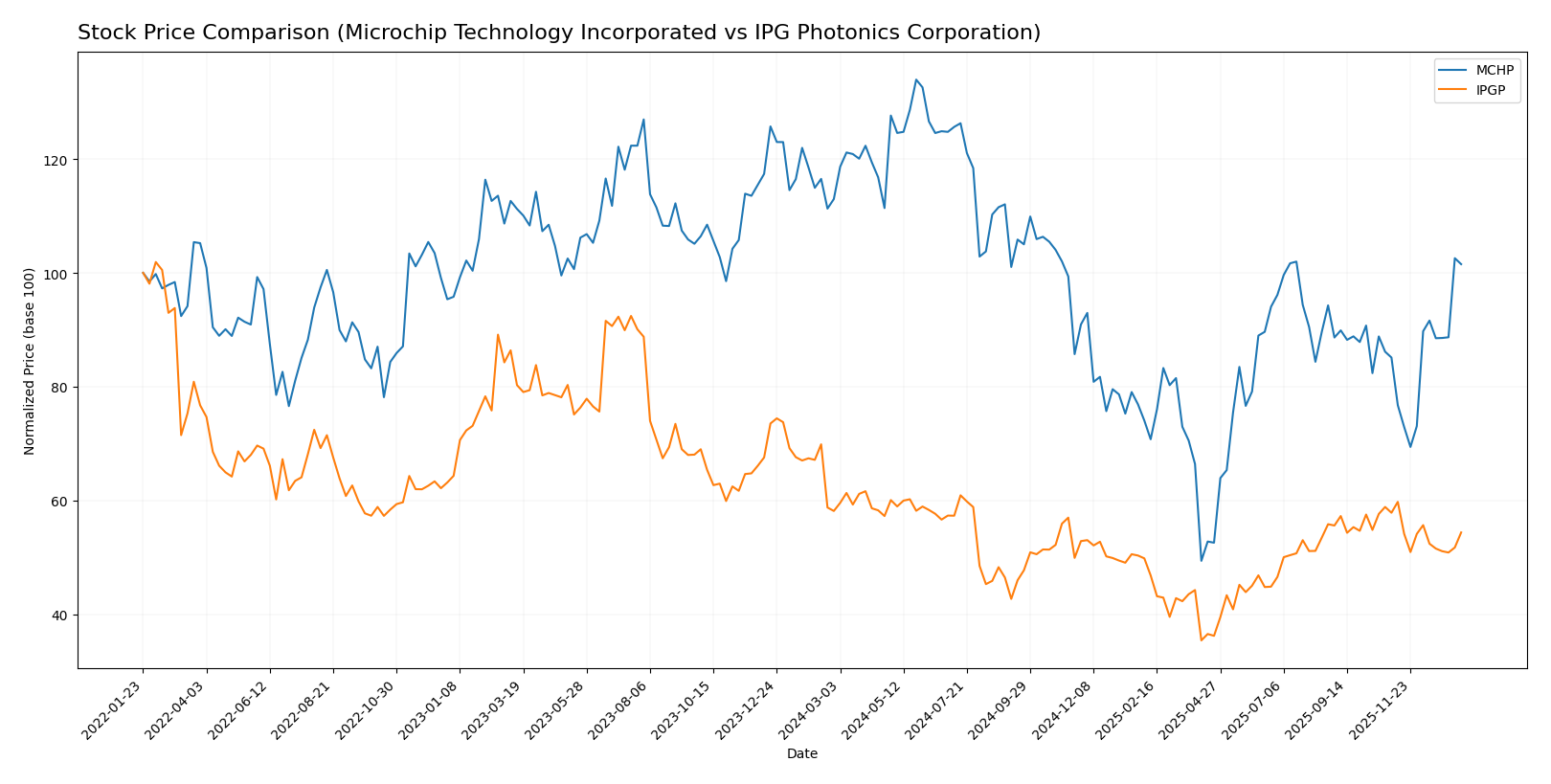

Stock Comparison

This chart presents the stock price movements of Microchip Technology Incorporated and IPG Photonics Corporation over the past 12 months, highlighting contrasting bearish trends and recent trading dynamics.

Trend Analysis

Microchip Technology Incorporated (MCHP) experienced a -10.13% price decline over the past year, indicating a bearish trend with accelerating downward momentum. The stock showed a wide price range between 36.22 and 98.23 and high volatility (14.38 std deviation).

IPG Photonics Corporation (IPGP) also recorded a bearish trend with a -6.49% price drop and deceleration in the decline. Its price fluctuated between 52.12 and 90.69, with moderate volatility (9.27 std deviation).

Comparing both, MCHP registered the larger negative price change, thus underperforming IPGP in market performance over the analyzed period.

Target Prices

Analysts present a clear target price consensus for Microchip Technology Incorporated and IPG Photonics Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Microchip Technology Incorporated | 85 | 60 | 77.44 |

| IPG Photonics Corporation | 96 | 92 | 94 |

The consensus target prices for both stocks suggest potential upside compared to current prices: Microchip at $74.45 versus a $77.44 consensus and IPG Photonics at $80.03 with a strong $94 consensus, indicating bullish analyst expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Microchip Technology Incorporated (MCHP) and IPG Photonics Corporation (IPGP):

Rating Comparison

MCHP Rating

- Rating: C-, considered very favorable overall by analysts.

- Discounted Cash Flow Score: 3, indicating a moderate valuation based on cash flow.

- ROE Score: 1, very unfavorable, showing low efficiency in generating profit from equity.

- ROA Score: 1, very unfavorable, reflecting weak asset utilization.

- Debt To Equity Score: 1, very unfavorable, signaling higher financial risk.

IPGP Rating

- Rating: B+, considered very favorable overall by analysts.

- Discounted Cash Flow Score: 4, indicating a favorable valuation based on cash flow.

- ROE Score: 2, moderate efficiency in generating profit from equity.

- ROA Score: 3, moderate asset utilization.

- Debt To Equity Score: 4, favorable, reflecting stronger balance sheet stability.

| Overall Score: 1, very unfavorable summary of financial standing. | Overall Score: 3, moderate summary of financial standing. |

Which one is the best rated?

Based strictly on the provided data, IPGP is better rated than MCHP across all key financial scores, including overall score, cash flow valuation, profitability, and debt management. IPGP’s ratings suggest a stronger financial position and lower risk.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score for Microchip Technology Incorporated and IPG Photonics Corporation:

MCHP Scores

- Altman Z-Score: 3.99, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 3, classified as very weak financial strength.

IPGP Scores

- Altman Z-Score: 9.65, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

Which company has the best scores?

IPG Photonics exhibits a higher Altman Z-Score and a significantly stronger Piotroski Score than Microchip Technology. Based on these scores alone, IPG Photonics shows better financial health and lower bankruptcy risk compared to Microchip.

Grades Comparison

The following analysis compares the recent grades and consensus ratings for Microchip Technology Incorporated and IPG Photonics Corporation:

Microchip Technology Incorporated Grades

This table summarizes the latest grades assigned by recognized grading companies for Microchip Technology Incorporated:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Overweight | 2026-01-15 |

| B. Riley Securities | Maintain | Buy | 2026-01-12 |

| Mizuho | Maintain | Outperform | 2026-01-09 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-07 |

| JP Morgan | Maintain | Overweight | 2026-01-06 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-06 |

| Stifel | Maintain | Buy | 2026-01-06 |

| Rosenblatt | Maintain | Buy | 2026-01-06 |

| Needham | Maintain | Buy | 2026-01-06 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-16 |

Overall, Microchip Technology’s grades predominantly indicate a positive outlook, with multiple “Buy” and “Overweight” ratings and stable maintenance actions.

IPG Photonics Corporation Grades

This table presents the latest grades assigned by recognized grading companies for IPG Photonics Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Upgrade | Buy | 2025-11-05 |

| Bernstein | Upgrade | Outperform | 2025-08-07 |

| Raymond James | Maintain | Strong Buy | 2025-05-07 |

| CL King | Upgrade | Buy | 2025-03-18 |

| Citigroup | Maintain | Sell | 2025-02-18 |

| Stifel | Maintain | Buy | 2025-02-12 |

| Needham | Maintain | Hold | 2025-02-12 |

| Seaport Global | Downgrade | Neutral | 2024-08-01 |

| Stifel | Maintain | Buy | 2024-07-31 |

| Raymond James | Maintain | Strong Buy | 2024-07-31 |

IPG Photonics shows a mixed grading pattern, with several upgrades to “Buy” and “Strong Buy,” but also some downgrades and a “Sell” rating maintained by Citigroup.

Which company has the best grades?

Microchip Technology Incorporated has received more consistently positive grades, with a stronger cluster of “Buy” and “Overweight” ratings, compared to IPG Photonics Corporation’s more varied ratings including some downgrades and a maintained “Sell.” This consistency may suggest a more stable analyst sentiment for Microchip, potentially influencing investor confidence differently.

Strengths and Weaknesses

Below is a comparative overview of the strengths and weaknesses of Microchip Technology Incorporated (MCHP) and IPG Photonics Corporation (IPGP) based on their latest financial and operational data.

| Criterion | Microchip Technology Incorporated (MCHP) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Diversification | Moderate: Primarily focused on semiconductor products, with a smaller technology licensing segment. | High: Diverse laser product portfolio including amplifiers, CW lasers, pulsed lasers, and service offerings. |

| Profitability | Weak: Negative net margin (-0.01%) and declining ROIC; company is value destructive. | Weak: Significant negative net margin (-18.58%) and steeply declining ROIC; value destruction ongoing. |

| Innovation | Moderate: Steady semiconductor product revenue but limited growth in licensing income. | Strong: Broad laser technology innovation across multiple segments, despite recent financial struggles. |

| Global presence | Strong: Well-established semiconductor supplier with global customer base. | Strong: Global reach in industrial and materials processing laser markets. |

| Market Share | Solid in semiconductor niche; revenue in FY 2025 from products approx. $4.27B. | Niche leader in fiber lasers with FY 2024 revenue approx. $946M across segments. |

Key takeaways: Both companies face profitability challenges with declining returns on invested capital, indicating value destruction. However, IPG Photonics shows stronger diversification in innovative laser technologies, while Microchip is more concentrated in semiconductors. Investors should approach cautiously, prioritizing risk management given current financial weaknesses.

Risk Analysis

Below is a comparative table highlighting key risks for Microchip Technology Incorporated (MCHP) and IPG Photonics Corporation (IPGP) based on the most recent data available for 2025 and 2024 respectively.

| Metric | Microchip Technology Incorporated (MCHP) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Market Risk | High beta (1.445) indicates elevated volatility | Moderate beta (1.017) suggests average volatility |

| Debt level | Moderate debt-to-equity ratio (~0.8, neutral) | Very low debt-to-equity (~0.01, favorable) |

| Regulatory Risk | Moderate, typical for semiconductor sector | Moderate, with focus on advanced photonics products |

| Operational Risk | Unfavorable margins and low asset turnover point to operational inefficiencies | Negative margins but high interest coverage; operational risks from niche tech |

| Environmental Risk | Standard semiconductor manufacturing impact | Manufacturing of lasers involves hazardous materials; moderate risk |

| Geopolitical Risk | Exposure in Americas, Europe, Asia; supply chain sensitivities | Global sales but smaller scale; potential export restrictions impact |

Synthesis: Both companies face market volatility, with Microchip showing higher beta and operational inefficiencies reflected in weak profitability ratios. IPG benefits from low debt and strong bankruptcy safety but struggles with negative margins, indicating potential operational risks. Geopolitical and regulatory risks remain moderate but relevant given their global footprint and industry specifics. Careful risk management is advised when considering investment in either stock.

Which Stock to Choose?

Microchip Technology Incorporated (MCHP) shows a declining income trend with a 42% revenue drop in one year and negative net margin. Its financial ratios are slightly unfavorable, with weak profitability and moderate debt levels. The rating is very favorable despite low profitability scores.

IPG Photonics Corporation (IPGP) also reveals an unfavorable income statement with a 24% revenue decrease and negative net margin. Its financial ratios are slightly unfavorable, though it benefits from low debt and strong liquidity. The rating is very favorable with moderate financial stability scores.

Considering ratings and overall financial evaluations, MCHP might appeal to investors seeking dividend yield and higher current liquidity, while IPGP could be more suitable for those valuing stronger balance sheets and operational stability. Both show declining profitability and value destruction, suggesting cautious interpretation based on risk tolerance.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Microchip Technology Incorporated and IPG Photonics Corporation to enhance your investment decisions: