Home > Comparison > Technology > LSCC vs IPGP

The strategic rivalry between Lattice Semiconductor Corporation and IPG Photonics Corporation shapes the trajectory of the semiconductor industry. Lattice operates as a specialized FPGA provider with a strong IP licensing model, while IPG focuses on high-performance fiber lasers and integrated laser systems. This head-to-head pits programmable logic innovation against laser technology leadership. This analysis aims to identify which company offers a superior risk-adjusted growth outlook for a diversified technology portfolio.

Table of contents

Companies Overview

Lattice Semiconductor and IPG Photonics are pivotal players shaping the semiconductor and photonics markets.

Lattice Semiconductor Corporation: Specialized FPGA Innovator

Lattice Semiconductor dominates the field programmable gate arrays (FPGAs) niche, generating revenue by selling highly configurable semiconductor products. Its 2026 strategy emphasizes expanding the Certus-NX and ECP families to capture communications, computing, and automotive OEM markets. Lattice leverages a diverse product portfolio and IP licensing to sustain its competitive edge.

IPG Photonics Corporation: Laser Technology Leader

IPG Photonics leads in high-performance fiber lasers and amplifiers, driving revenue through sales of advanced laser systems for materials processing and communications. In 2026, it focuses on broadening its integrated laser and optical transceiver solutions for OEMs and system integrators, reinforcing its footprint in industrial, telecom, and medical sectors worldwide.

Strategic Collision: Similarities & Divergences

Both companies compete in technology-driven niches requiring innovation and precision. Lattice embraces a flexible FPGA platform, while IPG pursues proprietary laser systems with integrated optics. Their battleground lies in industrial and communications end markets, yet Lattice’s modular approach contrasts with IPG’s vertically integrated laser solutions. Each offers distinct risk-reward profiles shaped by their unique market moats and capital allocation strategies.

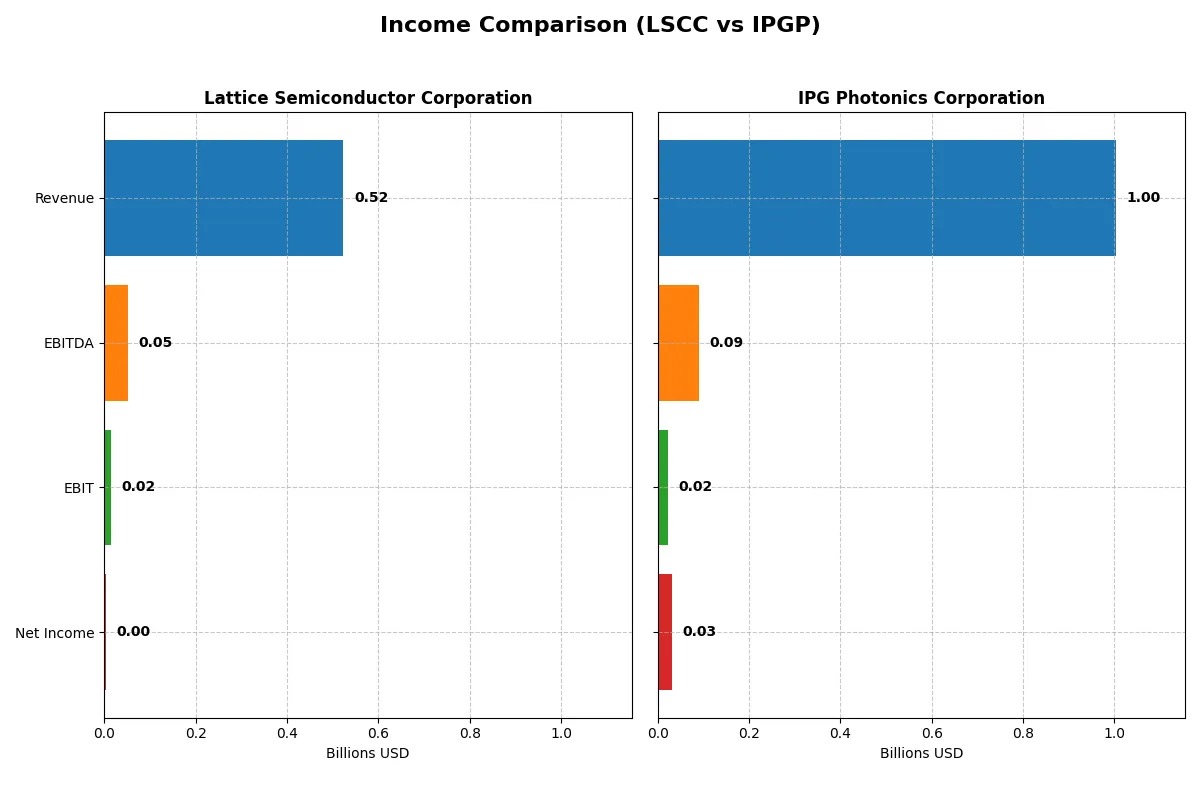

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Lattice Semiconductor Corporation (LSCC) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Revenue | 523M | 1.0B |

| Cost of Revenue | 166M | 622M |

| Operating Expenses | 342M | 368M |

| Gross Profit | 357M | 381M |

| EBITDA | 51M | 90M |

| EBIT | 15M | 23M |

| Interest Expense | 3M | 0 |

| Net Income | 3M | 31M |

| EPS | 0.02 | 0.73 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

The income statement comparison below exposes the true operational efficiency and profitability trajectories of two distinct corporate engines.

Lattice Semiconductor Corporation Analysis

Lattice Semiconductor’s revenue shows modest growth, reaching $523M in 2025, but net income plummets to $3M, reflecting sharply declining margins. Gross margin remains strong at 68%, yet net margin sinks to 0.6%, signaling efficiency issues. The latest year reveals severe margin compression and reduced operating income, undermining momentum.

IPG Photonics Corporation Analysis

IPG Photonics posts $1B revenue in 2025, with net income improving to $31M after a loss the prior year. Gross margin stays healthy at 38%, while net margin rises to 3.1%, indicating recovering profitability. Year-over-year gains in EBIT and net margin show operational improvements and better cost control driving positive momentum.

Margin Resilience vs. Profit Recovery

Lattice Semiconductor boasts a superior gross margin but suffers from collapsing net income and profitability. IPG Photonics, despite lower top-line scale, demonstrates a stronger net margin rebound and improving earnings momentum. For investors, IPG’s profile suggests a more compelling recovery story, while Lattice’s sharp margin decline raises caution.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | Lattice Semiconductor (LSCC) | IPG Photonics (IPGP) |

|---|---|---|

| ROE | 0.43% | 1.46% |

| ROIC | 0.47% | 0.41% |

| P/E | 3496.2 | 98.1 |

| P/B | 15.10 | 1.43 |

| Current Ratio | 3.09 | 6.08 |

| Quick Ratio | 2.33 | 4.74 |

| D/E | 0.10 | 0.00 |

| Debt-to-Assets | 8.38% | 0.00% |

| Interest Coverage | 5.27 | 0.00 |

| Asset Turnover | 0.61 | 0.41 |

| Fixed Asset Turnover | 4.49 | 1.57 |

| Payout Ratio | 0.00 | 0.00 |

| Dividend Yield | 0.00% | 0.00% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios serve as a company’s DNA, exposing hidden risks and operational strengths investors must decode carefully.

Lattice Semiconductor Corporation

Lattice Semiconductor shows weak profitability with ROE at 0.43% and a net margin of 0.59%, signaling operational challenges. Its P/E ratio is stretched at 3496, indicating an expensive valuation. The company pays no dividends, instead funneling substantial resources into R&D (36% of revenue), aiming for future growth despite current inefficiencies.

IPG Photonics Corporation

IPG Photonics posts modest profitability with a 1.46% ROE and 3.1% net margin, yet still falls short of strong benchmarks. Its P/E of 98 is high but more reasonable than Lattice’s extreme multiple. The firm yields no dividends but maintains solid balance sheet metrics, focusing on reinvestment to stabilize returns amid slightly unfavorable ratios.

Premium Valuation vs. Operational Safety

Lattice Semiconductor’s valuation is far more stretched, with poorer returns and high R&D investment that may pressure near-term profits. IPG Photonics offers a more balanced risk profile, with modest profitability and a cleaner balance sheet. Investors favoring growth at a steep price might lean toward Lattice, while those seeking operational stability should consider IPG’s steadier metrics.

Which one offers the Superior Shareholder Reward?

Lattice Semiconductor Corporation (LSCC) and IPG Photonics Corporation (IPGP) both forgo dividends, focusing on reinvestment and buybacks. LSCC’s robust free cash flow per share (~0.87 in 2025) funds aggressive buybacks, while IPGP shows negative free cash flow in 2025, limiting buyback capacity. LSCC’s superior operating margins (~12% EBIT) and strong cash coverage ratios suggest a more sustainable distribution model. IPGP’s lower margin and inconsistent free cash flow signal riskier reinvestment efficiency. I favor LSCC for a superior total shareholder return in 2026 due to its disciplined capital allocation and buyback intensity.

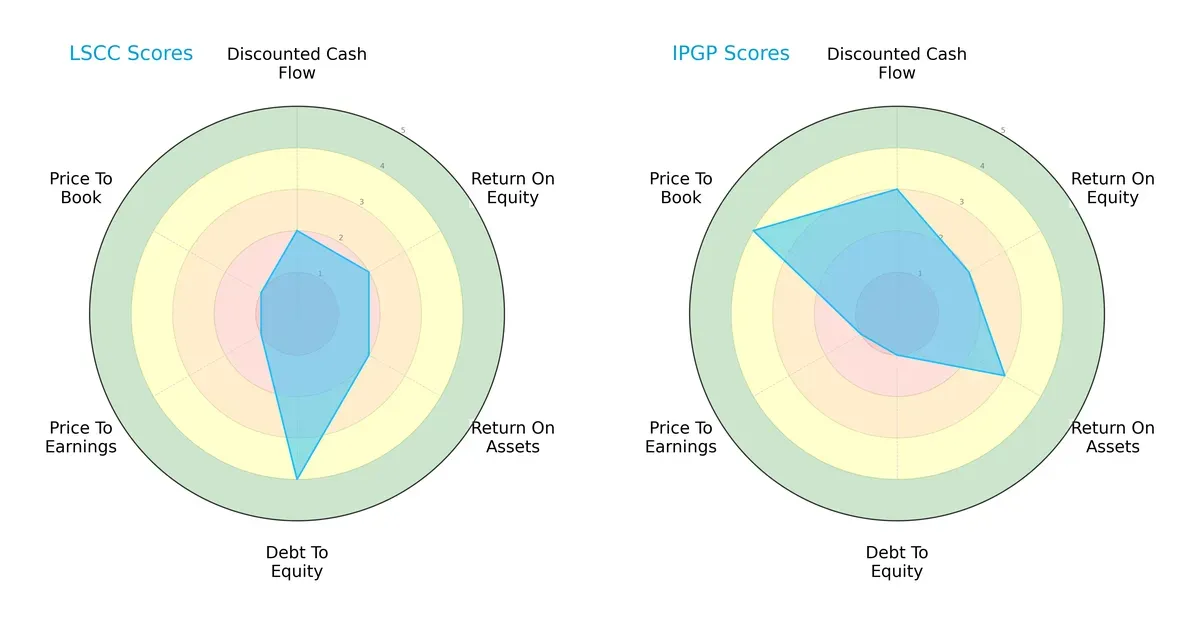

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Lattice Semiconductor Corporation and IPG Photonics Corporation, highlighting their distinct financial strengths and weaknesses:

Lattice Semiconductor shows strong debt management with a debt-to-equity score of 4 but struggles on valuation and profitability metrics (PE/PB and ROE/ROA scores at 1-2). IPG Photonics offers a more balanced profile, outperforming LSCC in discounted cash flow and asset utilization (scores of 3), though it carries higher financial risk with a weak debt-to-equity score of 1. IPGP leverages operational efficiency, while LSCC depends on conservative leverage as its main edge.

Bankruptcy Risk: Solvency Showdown

The Altman Z-Scores place both LSCC (48.7) and IPGP (15.0) comfortably in the safe zone, implying strong long-term survival prospects amid current market pressures:

Financial Health: Quality of Operations

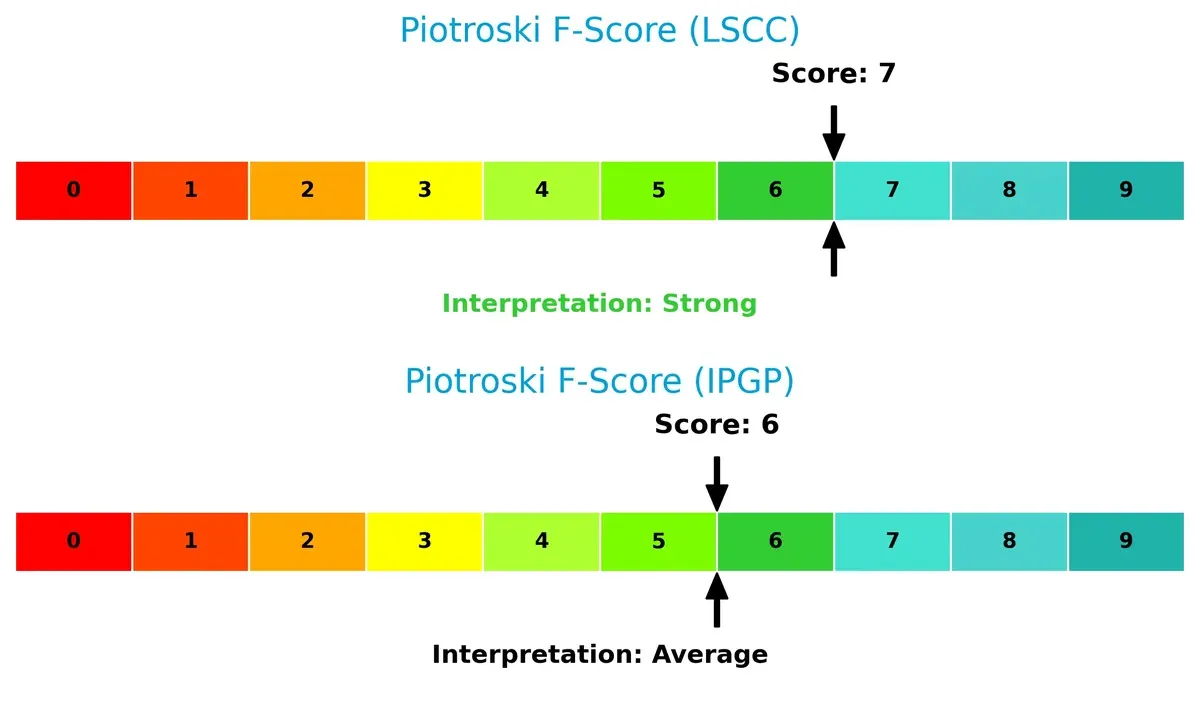

Lattice Semiconductor’s Piotroski F-Score of 7 indicates strong financial health, outperforming IPG Photonics’ score of 6, which suggests some caution is warranted regarding internal operational metrics:

How are the two companies positioned?

This section dissects the operational DNA of LSCC and IPGP by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

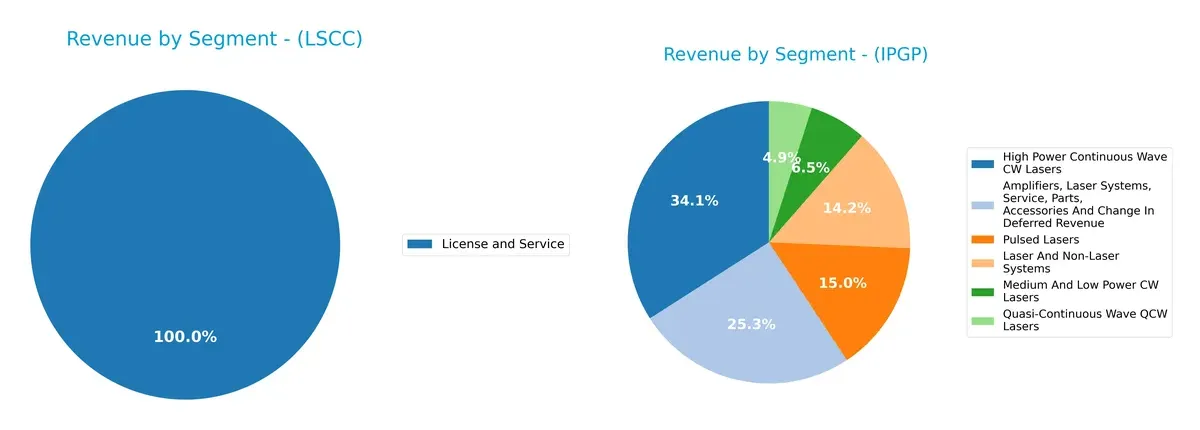

This visual comparison dissects how Lattice Semiconductor and IPG Photonics diversify their income streams and where their primary sector bets lie:

Lattice Semiconductor leans heavily on its distributor channel, generating over $330M versus $50M direct product sales and $17M in licenses. This concentration anchors its ecosystem lock-in but signals dependence risks. In contrast, IPG Photonics boasts a richly diversified portfolio, with no single segment dominating. High Power CW Lasers reach $333M, complemented by pulsed lasers and amplifiers around $147M-$247M, reflecting infrastructure dominance and agile capital allocation.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Lattice Semiconductor Corporation and IPG Photonics Corporation:

Lattice Semiconductor Corporation Strengths

- Low debt-to-equity of 0.1 implies prudent leverage

- Favorable quick ratio of 2.33 supports liquidity

- Strong fixed asset turnover at 4.49 signals efficient asset use

- Diverse geographic revenue across Americas, Asia, Europe

IPG Photonics Corporation Strengths

- Zero debt enhances financial stability

- Favorable PB of 1.43 indicates reasonable valuation

- Infinite interest coverage denotes robust ability to service debt

- Broad geographic presence including North America, China, Europe

Lattice Semiconductor Corporation Weaknesses

- Unfavorable net margin at 0.59% reflects weak profitability

- ROE and ROIC well below WACC at 0.43% and 0.47% respectively

- Very high PE ratio at 3496 suggests overvaluation risk

- Current ratio above 3.0 may indicate inefficient working capital

IPG Photonics Corporation Weaknesses

- Low net margin at 3.1% signals profitability pressure

- ROE and ROIC below WACC at 1.46% and 0.41% respectively

- Elevated PE ratio of 98.1 limits upside

- Low asset turnover at 0.41 implies less efficient use of assets

Both companies show strengths in conservative debt management and geographic diversification. However, profitability metrics lag well behind industry cost of capital, raising concerns about capital efficiency. These weaknesses highlight the importance of operational improvements to support long-term value creation.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only thing protecting long-term profits from the erosion of competition. Let’s dissect two semiconductor players’ moats:

Lattice Semiconductor Corporation: Niche IP Licensing & FPGA Focus

Lattice’s moat stems from its specialized field programmable gate arrays and IP licensing. However, declining ROIC and shrinking profitability signal serious erosion in 2026.

IPG Photonics Corporation: Fiber Laser Innovation & Application Depth

IPG leverages advanced fiber laser technology, differentiating it from Lattice’s programmable logic focus. Despite recent growth spikes, its ROIC also declines, hinting at emerging competitive pressure.

Verdict: Specialized IP vs. Advanced Laser Tech — Both Moats Under Pressure

Both firms show very unfavorable ROIC trends and value destruction. IPG’s broader product applications offer a slightly deeper moat, but both face tough battles defending market share in 2026.

Which stock offers better returns?

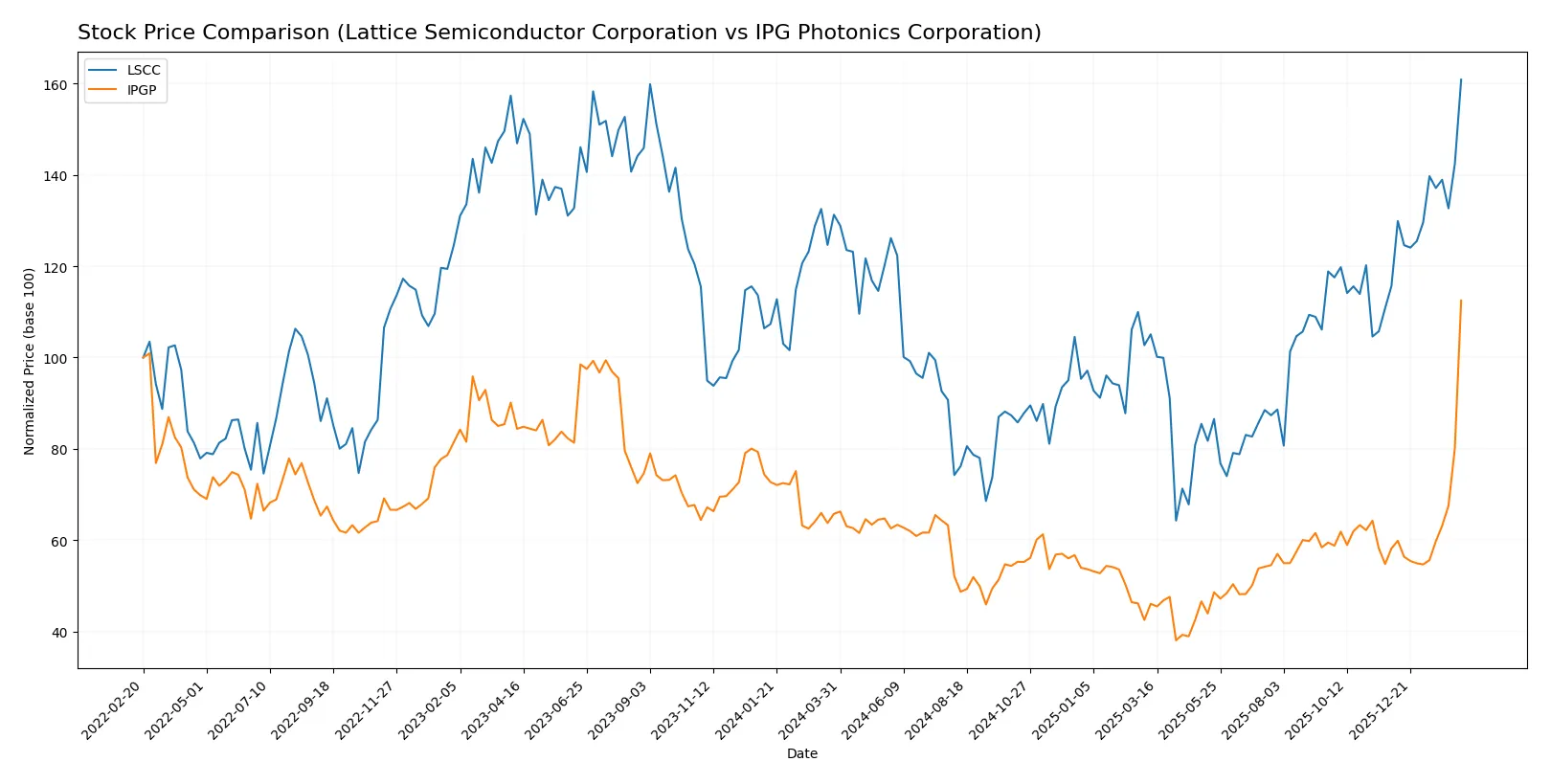

Over the past year, both Lattice Semiconductor and IPG Photonics displayed strong price appreciation with notable acceleration in their upward trends.

Trend Comparison

Lattice Semiconductor’s stock gained 22.53% over the past 12 months, showing a bullish trend with accelerating momentum and a high near 97.63.

IPG Photonics outpaced with a 71.01% rise over the same period, also bullish and accelerating, reaching a peak price of 153.91.

IPG Photonics delivered the highest market performance, nearly tripling Lattice Semiconductor’s percentage gain over the past year.

Target Prices

Analysts present a clear consensus on target prices for Lattice Semiconductor Corporation and IPG Photonics Corporation.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Lattice Semiconductor Corporation | 80 | 125 | 104.7 |

| IPG Photonics Corporation | 110 | 180 | 151.67 |

The consensus target prices suggest upside potential for both stocks relative to current prices. Lattice Semiconductor trades near $97.63, below its $104.7 consensus. IPG Photonics trades around $153.91, closely aligned with its $151.67 consensus.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Lattice Semiconductor Corporation Grades

The following table summarizes recent grades from reputable institutions for Lattice Semiconductor Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | Maintain | Positive | 2026-02-11 |

| Jefferies | Maintain | Buy | 2026-02-11 |

| Keybanc | Maintain | Overweight | 2026-02-11 |

| Stifel | Maintain | Buy | 2026-02-11 |

| Needham | Maintain | Buy | 2026-02-11 |

| Benchmark | Maintain | Buy | 2026-02-11 |

| RBC Capital | Maintain | Outperform | 2026-02-11 |

| Rosenblatt | Maintain | Buy | 2026-02-11 |

| Susquehanna | Maintain | Positive | 2026-01-22 |

| Keybanc | Maintain | Overweight | 2026-01-13 |

IPG Photonics Corporation Grades

Below is a summary of recent grades from established institutions for IPG Photonics Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Buy | 2026-02-13 |

| Raymond James | Downgrade | Outperform | 2026-02-13 |

| Roth Capital | Maintain | Buy | 2026-02-03 |

| Citigroup | Upgrade | Buy | 2025-11-05 |

| Bernstein | Upgrade | Outperform | 2025-08-07 |

| Raymond James | Maintain | Strong Buy | 2025-05-07 |

| CL King | Upgrade | Buy | 2025-03-18 |

| Citigroup | Maintain | Sell | 2025-02-18 |

| Needham | Maintain | Hold | 2025-02-12 |

| Stifel | Maintain | Buy | 2025-02-12 |

Which company has the best grades?

Lattice Semiconductor consistently receives strong positive ratings, mostly “Buy” and “Outperform,” indicating broad institutional confidence. IPG Photonics shows more variability, including recent downgrades and a lingering “Sell” rating. Investors may perceive Lattice as more favorably graded, potentially reflecting steadier analyst sentiment.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Lattice Semiconductor Corporation

- Faces intense competition in programmable semiconductors with pressure on margins and high valuation multiples.

IPG Photonics Corporation

- Competes in niche high-performance fiber lasers but faces moderate growth and pricing pressure.

2. Capital Structure & Debt

Lattice Semiconductor Corporation

- Maintains low debt levels with a favorable debt-to-equity ratio of 0.1 and manageable interest coverage.

IPG Photonics Corporation

- Operates with zero debt, which strengthens balance sheet but may limit leverage benefits.

3. Stock Volatility

Lattice Semiconductor Corporation

- Exhibits higher beta (1.67), indicating greater stock price volatility relative to the market.

IPG Photonics Corporation

- Lower beta (1.03) reflects more stable stock price movement and lower market sensitivity.

4. Regulatory & Legal

Lattice Semiconductor Corporation

- Subject to semiconductor export controls and IP licensing risks in global markets.

IPG Photonics Corporation

- Faces regulatory scrutiny on laser safety standards and export compliance in materials processing sectors.

5. Supply Chain & Operations

Lattice Semiconductor Corporation

- Dependent on global semiconductor manufacturing networks vulnerable to geopolitical disruptions.

IPG Photonics Corporation

- Relies on specialized components and manufacturing capacity that could be constrained by supply chain bottlenecks.

6. ESG & Climate Transition

Lattice Semiconductor Corporation

- Moderate ESG focus; limited public disclosures on climate risk management.

IPG Photonics Corporation

- Increasing emphasis on sustainable manufacturing and energy-efficient laser technologies.

7. Geopolitical Exposure

Lattice Semiconductor Corporation

- Exposure to US-China tensions affecting semiconductor trade and technology transfer.

IPG Photonics Corporation

- Global customer base mitigates risk, but supply chain remains sensitive to geopolitical shifts.

Which company shows a better risk-adjusted profile?

IPG Photonics faces fewer leverage and valuation risks but contends with operational supply constraints and moderate margin pressure. Lattice Semiconductor endures higher volatility, stretched valuation, and competitive pressure but benefits from low debt and solid liquidity. IPG’s zero debt and lower beta suggest a more stable risk-adjusted profile, despite its weaker asset turnover. Recent data shows IPG’s interest coverage is infinite, underscoring its strong solvency compared to Lattice’s moderate coverage of 5.27. This highlights IPG as the safer option in a volatile semiconductor market.

Final Verdict: Which stock to choose?

Lattice Semiconductor Corporation (LSCC) stands out for its operational resilience and strong liquidity buffer, showcasing a superpower in cash management despite its struggles with profitability and value creation. Its volatile earnings and declining returns make it a point of vigilance, better suited for aggressive growth portfolios willing to weather profit margin pressures.

IPG Photonics Corporation (IPGP) commands a strategic moat through its robust balance sheet and lower financial risk, reflected in a pristine debt profile and dependable cash flow. Although its profitability is modest and returns are shrinking, IPGP offers greater stability compared to LSCC, fitting well within GARP (Growth at a Reasonable Price) strategies seeking cautious growth.

If you prioritize high-risk, high-reward potential with an emphasis on liquidity and operational efficiency, LSCC might be the compelling choice despite its value destruction trend. However, if you seek better stability and a safer capital structure alongside moderate growth prospects, IPGP outshines as a more prudent pick. Both present risks, so investors should weigh their tolerance for profitability volatility versus balance sheet strength.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Lattice Semiconductor Corporation and IPG Photonics Corporation to enhance your investment decisions: