Home > Comparison > Technology > LRCX vs IPGP

The strategic rivalry between Lam Research Corporation and IPG Photonics Corporation shapes the semiconductor sector’s evolution. Lam Research, a capital-intensive semiconductor equipment manufacturer, contrasts with IPG Photonics, a high-margin fiber laser solutions provider. This head-to-head represents a clash between manufacturing scale and specialized technology innovation. This analysis aims to identify which corporate path offers superior risk-adjusted returns for a diversified portfolio amid ongoing sector challenges and technological shifts.

Table of contents

Companies Overview

Lam Research and IPG Photonics stand as pivotal players in the semiconductor equipment and laser technology markets. Both firms influence critical supply chains for integrated circuits and advanced manufacturing.

Lam Research Corporation: Semiconductor Equipment Innovator

Lam Research dominates the semiconductor equipment industry, generating revenue by designing and servicing wafer fabrication machinery. Its product portfolio includes plasma etch and deposition systems critical to integrated circuit manufacturing. In 2026, Lam sharpened its focus on enhancing precision and throughput in chip production, reinforcing its competitive advantage in high-end semiconductor process technology.

IPG Photonics Corporation: Fiber Laser Technology Leader

IPG Photonics leads in high-performance fiber lasers and amplifiers, selling to materials processing and telecommunications sectors. Its revenue stems from sophisticated laser systems, including diode and hybrid fiber lasers. In 2026, IPG emphasized expanding its system integration capabilities and specialized laser applications, strengthening its market position in advanced laser solutions.

Strategic Collision: Similarities & Divergences

Both companies operate within semiconductor-related technologies but diverge in business philosophy: Lam focuses on closed, highly specialized wafer fabrication tools, while IPG pursues open laser system integration. Their primary battleground lies in supplying next-generation manufacturing equipment for semiconductor and materials processing industries. Lam’s scale and precision contrast with IPG’s niche laser expertise, defining distinct investment profiles shaped by sector depth and technological focus.

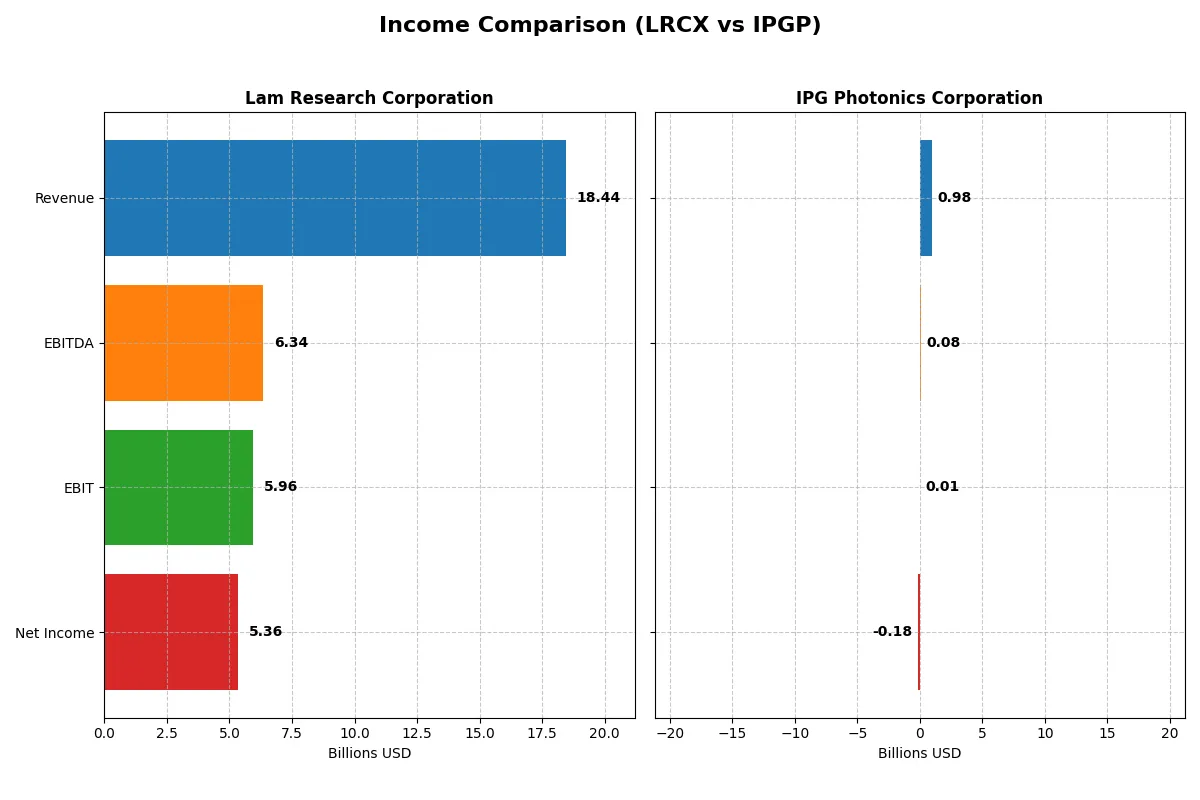

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Lam Research Corporation (LRCX) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Revenue | 18.4B | 977M |

| Cost of Revenue | 9.5B | 639M |

| Operating Expenses | 3.1B | 546M |

| Gross Profit | 9.0B | 338M |

| EBITDA | 6.3B | 76M |

| EBIT | 6.0B | 14M |

| Interest Expense | 178M | 0 |

| Net Income | 5.4B | -182M |

| EPS | 4.17 | -4.09 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true efficiency and profitability trends driving each company’s financial engine.

Lam Research Corporation (LRCX) Analysis

Lam Research has steadily grown revenue from $14.6B in 2021 to $18.4B in 2025, boosting net income from $3.9B to $5.4B. Its gross margin sits strongly at 48.7%, with a net margin near 29%, reflecting excellent cost control. The latest fiscal year shows robust momentum, with net income surging 40% year-over-year, signaling high operational efficiency.

IPG Photonics Corporation (IPGP) Analysis

IPG Photonics exhibits declining revenue, down from $1.46B in 2021 to $977M in 2024, while net income swung from $278M profit in 2021 to a $182M loss in 2024. Gross margin weakened but remains moderate at 34.6%. The latest year reflects sharp deterioration, with a negative net margin of -18.6%, highlighting serious profitability challenges and operational strain.

Verdict: Consistent Growth vs. Profitability Crisis

Lam Research demonstrates consistent revenue and profit growth with strong margins, outperforming IPG Photonics’ shrinking top line and escalating losses. Lam’s disciplined cost management and expanding net margin mark it as the fundamentally stronger performer. Investors seeking resilient earnings are likely to favor Lam’s proven profit engine over IPG’s troubled financial trajectory.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Lam Research Corporation (LRCX) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| ROE | 54.3% (2025) | -8.97% (2024) |

| ROIC | 34.0% (2025) | -9.97% (2024) |

| P/E | 23.4 (2025) | -17.8 (2024) |

| P/B | 12.7 (2025) | 1.59 (2024) |

| Current Ratio | 2.21 (2025) | 6.98 (2024) |

| Quick Ratio | 1.55 (2025) | 5.59 (2024) |

| D/E | 0.48 (2025) | 0.009 (2024) |

| Debt-to-Assets | 22.3% (2025) | 0.78% (2024) |

| Interest Coverage | 33.1 (2025) | 0 (2024) |

| Asset Turnover | 0.86 (2025) | 0.43 (2024) |

| Fixed Asset Turnover | 7.59 (2025) | 1.66 (2024) |

| Payout Ratio | 21.5% (2025) | 0% (2024) |

| Dividend Yield | 0.92% (2025) | 0% (2024) |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, revealing hidden risks and operational excellence essential for investment insight.

Lam Research Corporation

Lam Research delivers strong profitability with a 54.3% ROE and a robust 29.1% net margin, signaling operational efficiency. Its P/E ratio of 23.4 suggests a fairly valued stock, while a high P/B of 12.7 raises valuation concerns. Dividends yield 0.9%, though buybacks and growth investment support shareholder returns.

IPG Photonics Corporation

IPG shows weak profitability with negative ROE (-9.0%) and net margin (-18.6%), reflecting operational challenges. The negative P/E ratio indicates losses, but a low P/B of 1.6 signals reasonable book valuation. IPG lacks dividends, reinvesting heavily in R&D to fuel potential growth, despite a stretched current ratio of 7.0.

Robust Profitability vs. Recovery Potential

Lam Research offers a superior balance of strong profitability and fair valuation, minimizing risk relative to reward. IPG’s profile suits risk-tolerant investors focused on turnaround prospects and aggressive reinvestment rather than income.

Which one offers the Superior Shareholder Reward?

Lam Research (LRCX) pays a modest dividend yield near 0.9% with a sustainable payout ratio around 21-27%. It maintains disciplined buybacks, enhancing shareholder returns. IPG Photonics (IPGP) pays no dividend, focusing free cash flow on growth and acquisitions, but suffers a net loss in 2024. LRCX’s balanced dividend and share repurchase strategy offers a more reliable total return profile in 2026. I see Lam Research’s model as superior for steady income and capital appreciation, while IPG’s reinvestment approach carries higher risk amid profitability challenges.

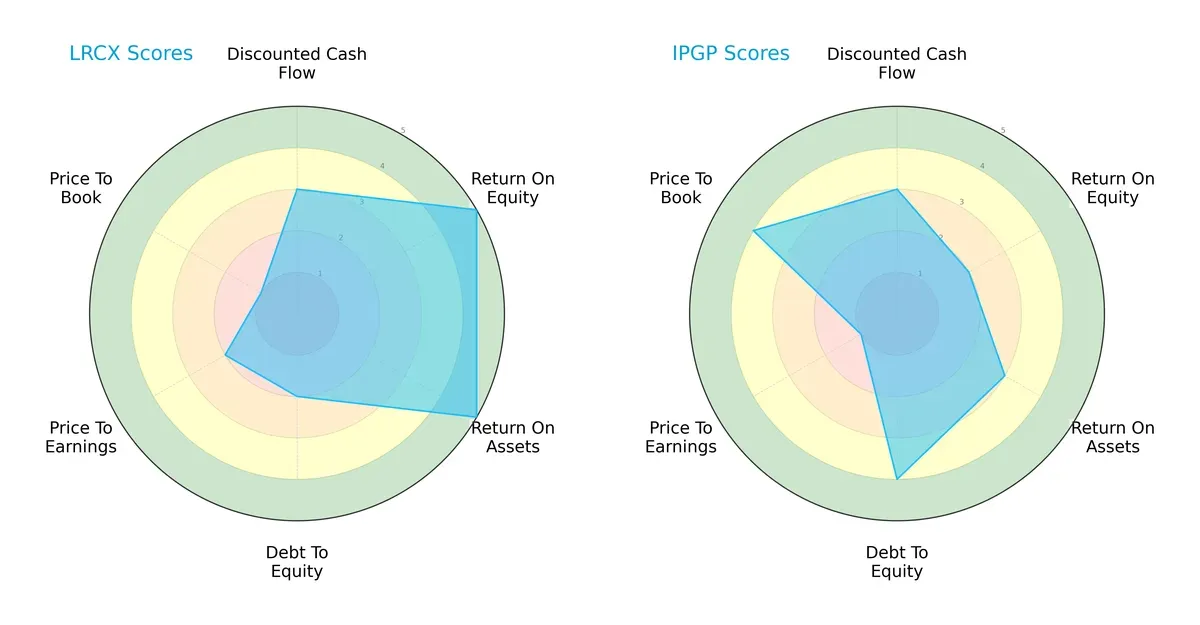

Comparative Score Analysis: The Strategic Profile

The radar chart highlights the core financial DNA and trade-offs of Lam Research Corporation and IPG Photonics Corporation:

Lam Research excels in profitability metrics, scoring very favorably on ROE and ROA, signaling efficient capital and asset utilization. IPG Photonics shows strength in financial risk management with a superior debt-to-equity score, reflecting a stronger balance sheet. However, IPG struggles with valuation, indicated by weaker P/E and P/B scores. Lam Research’s profile is more balanced across profitability and valuation, while IPG relies heavily on low leverage as its competitive edge.

Bankruptcy Risk: Solvency Showdown

Lam Research’s Altman Z-Score of 21.18 versus IPG Photonics’ 10.91 firmly places both companies in the safe zone. This wide gap underscores Lam Research’s stronger buffer against financial distress in volatile markets:

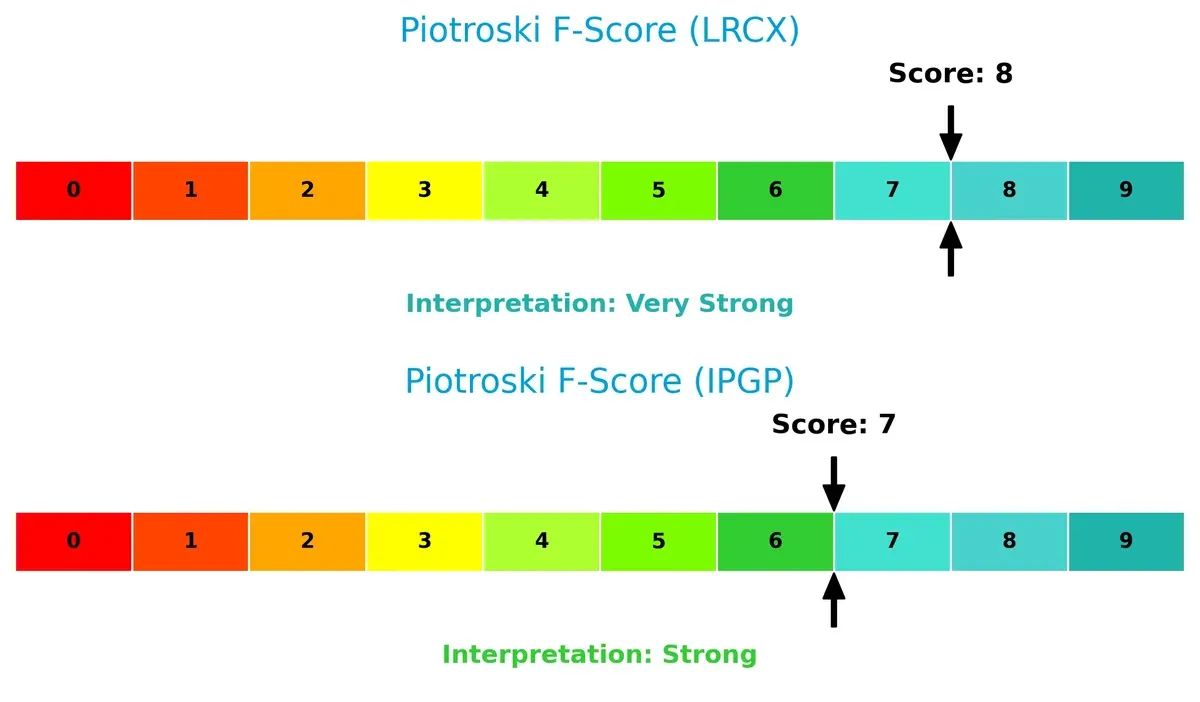

Financial Health: Quality of Operations

Lam Research’s Piotroski F-Score of 8 versus IPG Photonics’ 7 indicates superior operational quality and financial strength. Both are strong, but Lam Research’s higher score suggests fewer internal red flags and better value reliability:

How are the two companies positioned?

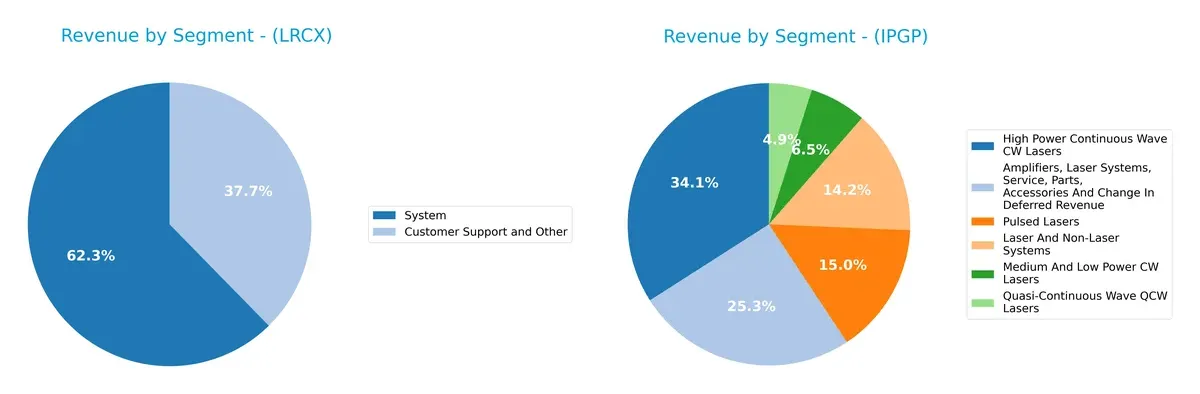

This section dissects Lam Research and IPG Photonics’ operational DNA by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats to identify the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how Lam Research Corporation and IPG Photonics diversify their income streams and reveals where their primary sector bets lie:

Lam Research anchors its revenue in two robust segments: $11.5B from Systems and $6.9B from Customer Support. This tight focus contrasts with IPG Photonics, which spreads its revenue across six laser-related segments, none surpassing $0.33B. Lam Research’s concentrated mix signals infrastructure dominance with high ecosystem lock-in, while IPG’s diversified portfolio mitigates concentration risk but lacks a singular revenue powerhouse.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Lam Research Corporation and IPG Photonics Corporation:

Lam Research Corporation Strengths

- High profitability with net margin 29% ROE 54% ROIC 34%

- Strong liquidity ratios current 2.21 quick 1.55

- Low debt levels debt/assets 22% interest coverage 33x

- Diverse revenue streams systems and customer support

- Solid global presence with key markets in China Korea USA

IPG Photonics Corporation Strengths

- Very low debt debt/assets below 1%

- Favorable quick ratio 5.59 indicating good short-term liquidity

- Infinite interest coverage shows strong ability to service debt

- Multiple laser product lines diversify revenue sources

- Presence across China North America Europe and Asia regions

Lam Research Corporation Weaknesses

- Unfavorable high WACC 12% compared to ROIC could pressure value

- High price to book 12.69 signals possible overvaluation

- Dividend yield under 1% may deter income investors

- Asset turnover moderate at 0.86 below ideal levels

IPG Photonics Corporation Weaknesses

- Negative profitability metrics net margin -18% ROE -9% ROIC -10%

- Unfavorable current ratio 6.98 may signal inefficient working capital

- Asset turnover low at 0.43 limits revenue generation from assets

- No dividend yield reduces income appeal

Lam Research demonstrates strong profitability, liquidity, and global diversification but faces valuation and capital cost challenges. IPG Photonics shows solid balance sheet health and product diversity, yet struggles with profitability and asset efficiency. These factors will shape each company’s strategic focus going forward.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive erosion. Let’s break down the moats of two semiconductor players:

Lam Research Corporation: Capital Efficiency and Innovation Moat

Lam Research dominates through a capital-efficient moat, driven by a 22% ROIC well above its WACC. This translates into high and stable margins, with a 29% net margin in 2025. Lam’s continuous innovation in wafer fabrication tools deepens its moat, especially with expansion in Asia’s semiconductor hubs in 2026.

IPG Photonics Corporation: Technology-Driven Niche Moat

IPG Photonics relies on proprietary fiber laser technology, a narrower moat than Lam’s broad capital efficiency. However, declining ROIC and a negative 18% spread versus WACC signal value destruction. IPG faces margin compression and shrinking revenue, but new laser applications could offer a turnaround opportunity if executed well.

Verdict: Capital Efficiency vs. Technology Niche – Which Moat Holds Stronger?

Lam Research’s wide and growing moat, anchored by superior ROIC and margin strength, vastly outperforms IPG Photonics’ eroding competitive position. Lam is clearly better equipped to defend and expand its market share amid semiconductor cycle volatility.

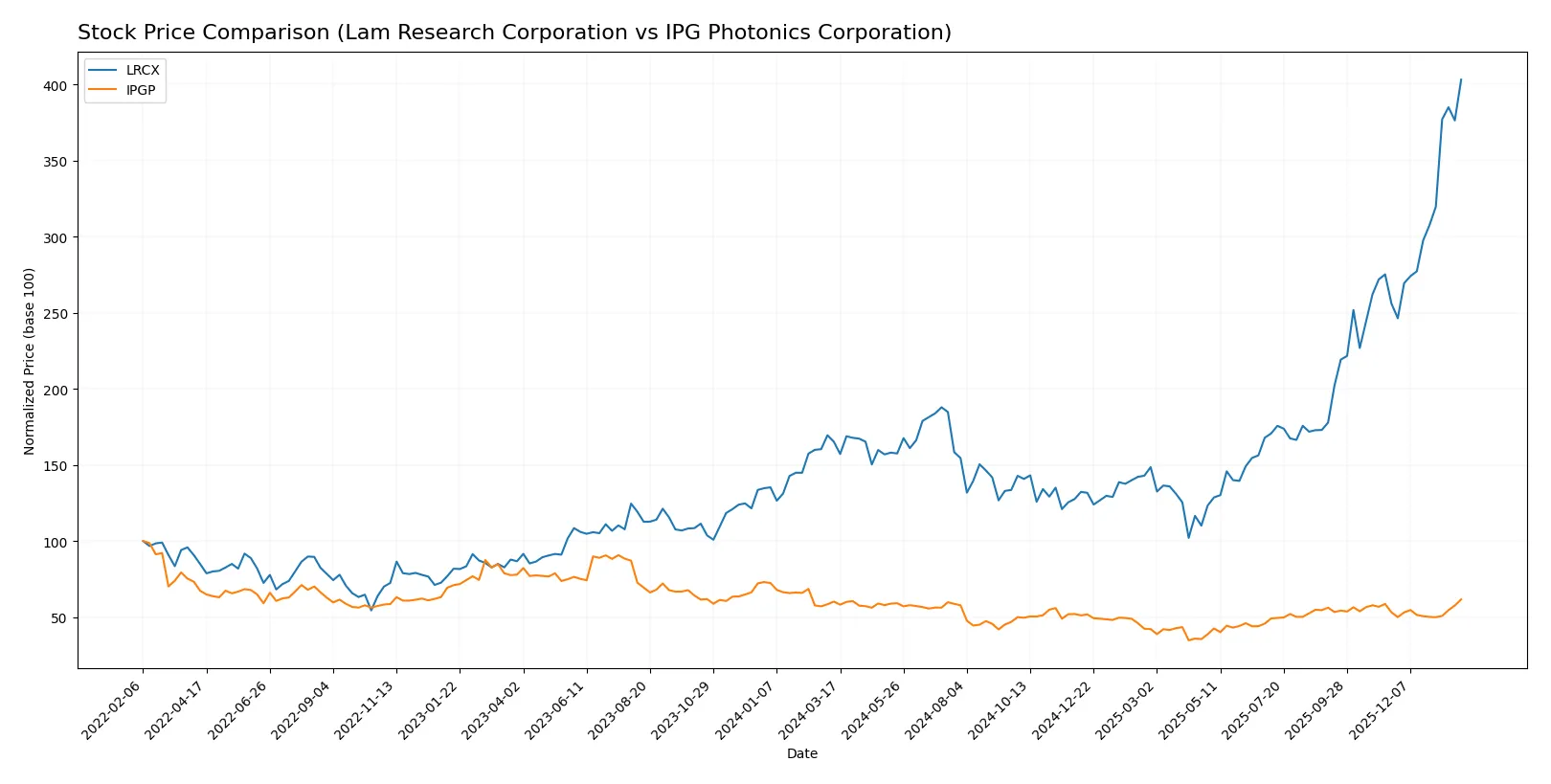

Which stock offers better returns?

The past year shows Lam Research Corporation surging sharply with accelerating gains, while IPG Photonics Corporation posts mild but steady growth under less volatile conditions.

Trend Comparison

Lam Research’s stock climbs 144.03% over 12 months, signaling a strong bullish trend with acceleration and high volatility. The price ranges from 59.09 to 233.46, reflecting robust upward momentum.

IPG Photonics rises 2.4% in the same period, marking a marginal bullish trend with acceleration but much lower volatility. The price fluctuates between 52.12 and 92.41, showing steady but restrained gains.

Lam Research outperforms IPG Photonics clearly, delivering significantly higher returns and stronger price acceleration over the past year.

Target Prices

Analysts present a mixed but generally optimistic consensus for Lam Research Corporation and IPG Photonics Corporation.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Lam Research Corporation | 127 | 325 | 266.76 |

| IPG Photonics Corporation | 92 | 96 | 94 |

Lam Research’s target consensus of $267 significantly exceeds its current $233 price, indicating upside potential. IPG Photonics’ targets hover just above its $92 market price, suggesting a stable outlook with modest gains.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Lam Research Corporation Grades

The following table summarizes recent institutional grades for Lam Research Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-29 |

| Wells Fargo | Maintain | Overweight | 2026-01-29 |

| JP Morgan | Maintain | Overweight | 2026-01-29 |

| RBC Capital | Maintain | Outperform | 2026-01-29 |

| Citigroup | Maintain | Buy | 2026-01-29 |

| Stifel | Maintain | Buy | 2026-01-29 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-29 |

| Needham | Maintain | Buy | 2026-01-29 |

| Susquehanna | Maintain | Positive | 2026-01-29 |

| Goldman Sachs | Maintain | Buy | 2026-01-29 |

IPG Photonics Corporation Grades

The following table summarizes recent institutional grades for IPG Photonics Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Upgrade | Buy | 2025-11-05 |

| Bernstein | Upgrade | Outperform | 2025-08-07 |

| Raymond James | Maintain | Strong Buy | 2025-05-07 |

| CL King | Upgrade | Buy | 2025-03-18 |

| Citigroup | Maintain | Sell | 2025-02-18 |

| Stifel | Maintain | Buy | 2025-02-12 |

| Needham | Maintain | Hold | 2025-02-12 |

| Seaport Global | Downgrade | Neutral | 2024-08-01 |

| Stifel | Maintain | Buy | 2024-07-31 |

| Raymond James | Maintain | Strong Buy | 2024-07-31 |

Which company has the best grades?

Lam Research consistently earns positive grades, mostly “Buy” or better, with no recent downgrades. IPG Photonics shows mixed grades, including Sell and Neutral ratings, despite some upgrades. This suggests Lam Research holds stronger institutional confidence, which may influence investor sentiment more favorably.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Lam Research Corporation

- Faces intense competition in semiconductor equipment, pressured by rapid tech innovation and cyclical chip demand.

IPG Photonics Corporation

- Competes in niche fiber laser market but struggles with profitability amid growing competition and slower adoption rates.

2. Capital Structure & Debt

Lam Research Corporation

- Maintains moderate leverage (D/E 0.48), strong interest coverage (33.43x), showing prudent capital management.

IPG Photonics Corporation

- Extremely low debt (D/E 0.01) minimizes financial risk but may limit growth opportunities through leverage.

3. Stock Volatility

Lam Research Corporation

- Beta of 1.78 indicates higher volatility than market, reflecting sensitivity to semiconductor cycles.

IPG Photonics Corporation

- Beta near 1.02 suggests stock moves roughly in line with overall market, lower volatility risk.

4. Regulatory & Legal

Lam Research Corporation

- Subject to semiconductor export controls and IP protection laws, particularly given China exposure.

IPG Photonics Corporation

- Faces regulatory scrutiny mainly on export compliance and safety standards in laser applications.

5. Supply Chain & Operations

Lam Research Corporation

- Complex global supply chains vulnerable to geopolitical tensions and component shortages.

IPG Photonics Corporation

- Relies on specialized components; supply disruptions impact production but less scale risk than LRCX.

6. ESG & Climate Transition

Lam Research Corporation

- Increasing focus on energy efficiency and emissions in semiconductor manufacturing processes.

IPG Photonics Corporation

- Laser tech offers energy-efficient solutions, but must manage environmental impact of manufacturing.

7. Geopolitical Exposure

Lam Research Corporation

- Significant China exposure risks due to US-China tensions affecting sales and supply chains.

IPG Photonics Corporation

- Lower geographic risk but must monitor export restrictions impacting international sales.

Which company shows a better risk-adjusted profile?

Lam Research’s biggest risk is high market volatility and geopolitical exposure, yet it boasts strong financial health and moderate leverage. IPG Photonics suffers from poor profitability and operational inefficiencies despite low debt and steady stock volatility. Lam Research shows a superior risk-adjusted profile, supported by a robust Altman Z-Score of 21.2 versus IPG’s 10.9, signaling stronger financial stability. Recent market turbulence and US-China export restrictions heighten risk for Lam Research, but its capital structure and profitability provide crucial buffers absent in IPG Photonics.

Final Verdict: Which stock to choose?

Lam Research Corporation’s superpower lies in its robust capital efficiency and durable competitive moat. It consistently generates returns well above its cost of capital, reflecting disciplined capital allocation and operational excellence. Its main point of vigilance is a relatively high price-to-book ratio, which could signal stretched valuation. This stock fits well in an Aggressive Growth portfolio focused on long-term value creation.

In contrast, IPG Photonics Corporation’s strategic moat is its strong balance sheet and low leverage, offering a safety cushion amid industry volatility. However, its deteriorating profitability and declining return on invested capital are clear red flags. IPG suits investors seeking GARP—Growth at a Reasonable Price—with a tolerance for turnaround risk and a focus on balance sheet strength.

If you prioritize durable economic moats and sustained profitability, Lam Research outshines with superior capital returns and growth momentum. However, if you seek a more conservative profile emphasizing financial stability over growth, IPG Photonics offers better stability despite its current earnings challenges. Each represents an analytical scenario tailored to distinct investor profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Lam Research Corporation and IPG Photonics Corporation to enhance your investment decisions: