In the competitive semiconductor industry, IPG Photonics Corporation and indie Semiconductor, Inc. stand out with distinct innovation strategies and market focuses. IPG Photonics excels in high-performance fiber lasers and optical systems, while indie Semiconductor targets automotive semiconductors and connected car technologies. Both companies influence cutting-edge technological advancements, making their comparison crucial for investors seeking growth and innovation. Let’s explore which one offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between IPG Photonics Corporation and indie Semiconductor, Inc. by providing an overview of these two companies and their main differences.

IPG Photonics Corporation Overview

IPG Photonics Corporation develops, manufactures, and sells high-performance fiber lasers, fiber amplifiers, and diode lasers primarily for materials processing worldwide. The company’s product range includes hybrid fiber-solid state lasers, high-energy pulsed lasers, and integrated laser systems, serving industries such as communications, medical, and advanced applications. Founded in 1990, IPG operates globally and markets to OEMs, system integrators, and end users.

indie Semiconductor, Inc. Overview

indie Semiconductor, Inc. provides automotive semiconductors and software solutions focused on advanced driver assistance, connected cars, and electrification applications. Its offerings include devices for parking assistance, in-cabin wireless charging, infotainment, and telematics, along with photonic components for optical sensing and communication markets. Founded in 2007, indie targets the automotive technology sector with a focus on enhancing user experience and connectivity.

Key similarities and differences

Both companies operate in the semiconductor industry and develop advanced technology products involving lasers and photonics. IPG Photonics emphasizes fiber lasers and amplifiers for industrial and communications applications, while indie Semiconductor specializes in automotive semiconductors and software for connected and electrified vehicles. IPG is larger with a 3.4B market cap and 4,740 employees, whereas indie is smaller at 873M market cap and 920 employees, reflecting different market focuses and scales.

Income Statement Comparison

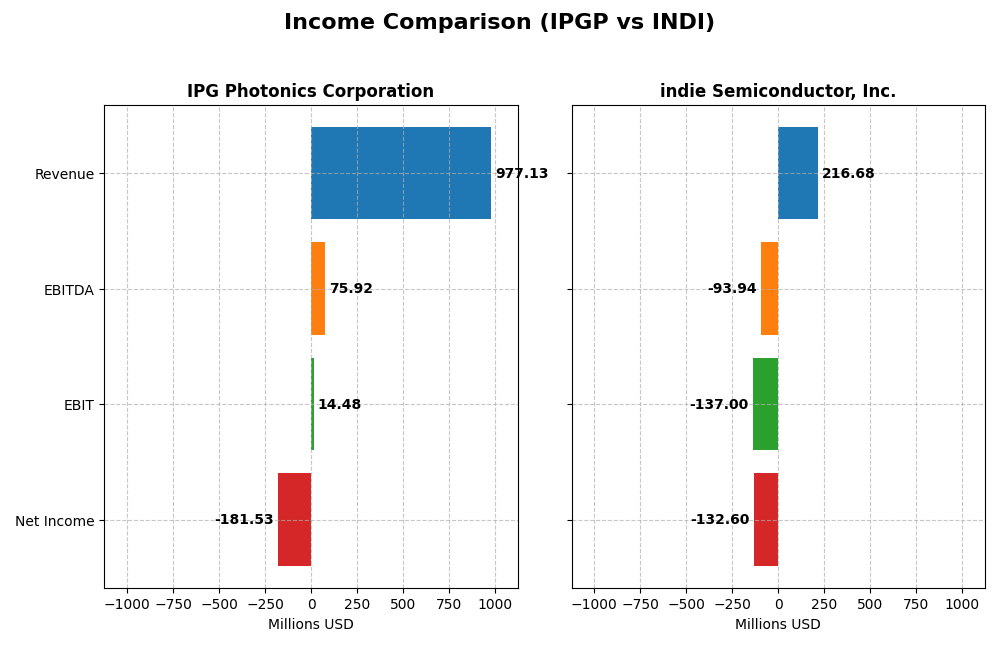

The table below presents a side-by-side comparison of key income statement metrics for IPG Photonics Corporation and indie Semiconductor, Inc. for the fiscal year 2024.

| Metric | IPG Photonics Corporation | indie Semiconductor, Inc. |

|---|---|---|

| Market Cap | 3.39B | 873M |

| Revenue | 977M | 217M |

| EBITDA | 76M | -94M |

| EBIT | 14M | -137M |

| Net Income | -182M | -133M |

| EPS | -4.09 | -0.76 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

IPG Photonics Corporation

IPG Photonics experienced declining revenue and net income from 2020 to 2024, with revenue dropping from $1.46B to $977M and net income turning negative at -$181.5M in 2024. Gross margin remained favorable at 34.6%, but net margin deteriorated to -18.6%. The most recent year showed significant profit erosion and a 24.1% revenue decline, reflecting operational challenges.

indie Semiconductor, Inc.

indie Semiconductor’s revenue grew substantially over the period, reaching $217M in 2024, though it declined slightly by 2.9% in the latest year. Gross margin improved favorably to 41.7%, despite persistent net losses reaching -$132.6M in 2024. EBIT margin remained deeply negative at -63.2%, signaling ongoing operating difficulties despite some EPS growth.

Which one has the stronger fundamentals?

IPG Photonics shows a long-term revenue decline with worsening net profitability and a negative net margin, raising concerns despite stable gross margins. indie Semiconductor presents rapid revenue growth but sustained heavy losses and poor EBIT margins. Overall, IPG’s fundamentals appear less volatile but troubled, while indie’s growth is offset by persistent unprofitability, resulting in a neutral stance on its income statement strength.

Financial Ratios Comparison

Below is a comparison of key financial ratios for IPG Photonics Corporation and indie Semiconductor, Inc. based on their most recent full-year data from 2024.

| Ratios | IPG Photonics Corporation | indie Semiconductor, Inc. |

|---|---|---|

| ROE | -8.97% | -31.73% |

| ROIC | -9.97% | -19.25% |

| P/E | -17.76 | -5.35 |

| P/B | 1.59 | 1.70 |

| Current Ratio | 6.98 | 4.82 |

| Quick Ratio | 5.59 | 4.23 |

| D/E (Debt to Equity) | 0.009 | 0.95 |

| Debt-to-Assets | 0.78% | 42.34% |

| Interest Coverage | 0 | -18.37 |

| Asset Turnover | 0.43 | 0.23 |

| Fixed Asset Turnover | 1.66 | 4.30 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

IPG Photonics Corporation

IPGP shows a mixed ratio profile with unfavorable metrics in net margin (-18.58%), return on equity (-8.97%), and return on invested capital (-9.97%), indicating profitability and efficiency concerns. However, debt levels are low and interest coverage is strong, reflecting solid financial stability. IPGP does not pay dividends, likely prioritizing reinvestment or growth.

indie Semiconductor, Inc.

INDI presents weaker ratios overall, with significant unfavorable returns such as net margin at -61.2% and return on equity at -31.73%. The company’s weighted average cost of capital is high at 11.44%, and interest coverage is negative, suggesting financial stress. As with IPGP, INDI does not pay dividends, possibly due to negative earnings and a focus on R&D and expansion.

Which one has the best ratios?

Based on the ratio evaluations, IPGP holds a relatively stronger position with fewer unfavorable metrics and better financial stability, while INDI faces more pronounced profitability and solvency challenges. Both companies have zero dividend yield, reflecting no shareholder returns through dividends. Overall, IPGP’s ratios are slightly unfavorable compared to INDI’s clearly unfavorable profile.

Strategic Positioning

This section compares the strategic positioning of IPG Photonics Corporation and indie Semiconductor, Inc., including market position, key segments, and exposure to technological disruption:

IPGP

- Established market presence in semiconductor lasers with moderate beta and NASDAQ listing.

- Focused on fiber lasers, amplifiers, and integrated laser systems; driven by materials processing.

- Exposure to photonic integration and optical communications; reliant on established laser tech.

INDI

- Smaller market cap with higher beta, listed on NASDAQ Capital Market, facing more volatility.

- Concentrated on automotive semiconductors and software for ADAS, connected car, and electrification.

- Involved in photonic components and automotive tech; faces disruption in automotive electronics.

IPGP vs INDI Positioning

IPGP has a diversified product portfolio centered on fiber lasers and materials processing, while INDI focuses narrowly on automotive semiconductor solutions. IPGP’s broad application base contrasts with INDI’s concentrated reliance on automotive technology markets.

Which has the best competitive advantage?

Both companies show a very unfavorable moat with declining ROIC trends and are currently shedding value. Neither displays a sustainable competitive advantage based on the MOAT evaluation data provided.

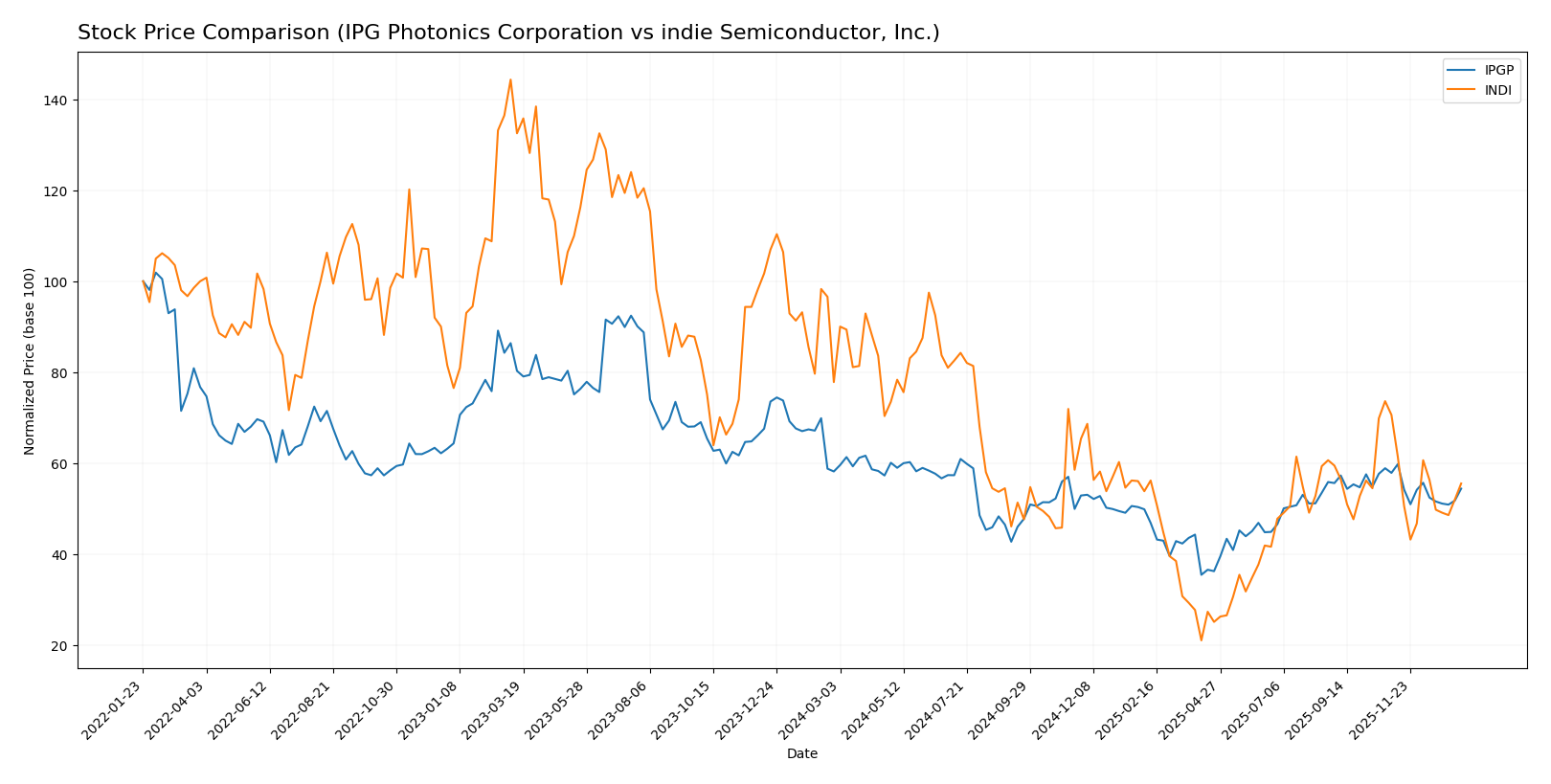

Stock Comparison

The stock price charts of IPG Photonics Corporation and indie Semiconductor, Inc. over the past 12 months reveal notable bearish trends with decelerating price declines and contrasting volume dynamics.

Trend Analysis

IPG Photonics Corporation’s stock declined by 6.49% over the past year, indicating a bearish trend with deceleration. The price ranged from a high of 90.69 to a low of 52.12, exhibiting significant volatility with a 9.27 standard deviation.

indie Semiconductor, Inc. experienced a sharper bearish trend, falling 28.67% over the same period. Its price fluctuated between 7.43 and 1.6, but with lower volatility at 1.35 standard deviation and decelerating negative momentum.

Comparing both stocks, IPGP delivered a less severe market decline than INDI, thus showing relatively stronger market performance over the last 12 months.

Target Prices

The current analyst consensus shows a moderately optimistic outlook for both IPG Photonics Corporation and indie Semiconductor, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| IPG Photonics Corporation | 96 | 92 | 94 |

| indie Semiconductor, Inc. | 8 | 8 | 8 |

Analysts expect IPGP to trade moderately above its current price of 80.51 USD, suggesting upside potential. INDI’s target consensus of 8 USD is nearly double its current price of 4.31 USD, indicating a strong growth expectation.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for IPG Photonics Corporation and indie Semiconductor, Inc.:

Rating Comparison

IPGP Rating

- Rating: B+ indicating a very favorable outlook.

- Discounted Cash Flow Score: 4, favorable status.

- ROE Score: 2, moderate efficiency in profit generation.

- ROA Score: 3, moderate asset utilization.

- Debt To Equity Score: 4, favorable financial risk profile.

- Overall Score: 3, moderate financial standing.

INDI Rating

- Rating: C- with a very unfavorable outlook.

- Discounted Cash Flow Score: 1, very unfavorable.

- ROE Score: 1, very unfavorable efficiency.

- ROA Score: 1, very unfavorable asset use.

- Debt To Equity Score: 1, very unfavorable risk.

- Overall Score: 1, very unfavorable financial standing.

Which one is the best rated?

Based strictly on the provided data, IPGP is better rated than INDI in all categories including overall score, DCF, ROE, ROA, and debt-to-equity. IPGP’s ratings indicate a more favorable financial profile and stability compared to INDI’s very unfavorable scores.

Scores Comparison

Here is a comparison of the financial scores for IPGP and INDI:

IPGP Scores

- Altman Z-Score: 9.65, indicating a safe zone of low bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial health and value.

INDI Scores

- Altman Z-Score: 0.12, indicating distress zone with high bankruptcy risk.

- Piotroski Score: 2, reflecting very weak financial health and value.

Which company has the best scores?

IPGP clearly outperforms INDI with a very high Altman Z-Score placing it in the safe zone, and a strong Piotroski Score of 7. INDI’s scores indicate financial distress and very weak financial health.

Grades Comparison

The following presents the latest grades from verified grading companies for the two companies:

IPG Photonics Corporation Grades

This table summarizes recent grade changes and current ratings from established financial institutions for IPG Photonics Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Upgrade | Buy | 2025-11-05 |

| Bernstein | Upgrade | Outperform | 2025-08-07 |

| Raymond James | Maintain | Strong Buy | 2025-05-07 |

| CL King | Upgrade | Buy | 2025-03-18 |

| Citigroup | Maintain | Sell | 2025-02-18 |

| Stifel | Maintain | Buy | 2025-02-12 |

| Needham | Maintain | Hold | 2025-02-12 |

| Seaport Global | Downgrade | Neutral | 2024-08-01 |

| Stifel | Maintain | Buy | 2024-07-31 |

| Raymond James | Maintain | Strong Buy | 2024-07-31 |

Overall, IPG Photonics shows mostly positive upgrades and maintained strong buy and buy ratings, with a few neutral and one sell rating maintained, indicating mixed but generally favorable analyst sentiment.

indie Semiconductor, Inc. Grades

This table presents recent grade maintenance and ratings by credible grading agencies for indie Semiconductor, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-11-10 |

| Benchmark | Maintain | Buy | 2025-06-25 |

| Benchmark | Maintain | Buy | 2025-06-11 |

| Benchmark | Maintain | Buy | 2025-05-21 |

| Benchmark | Maintain | Buy | 2025-05-13 |

| Craig-Hallum | Maintain | Buy | 2025-05-13 |

| Keybanc | Maintain | Overweight | 2025-05-13 |

| Benchmark | Maintain | Buy | 2025-04-09 |

| Benchmark | Maintain | Buy | 2025-02-21 |

| Keybanc | Maintain | Overweight | 2025-02-21 |

indie Semiconductor’s grades are predominantly stable buy and overweight ratings, with one neutral rating, reflecting consistent analyst confidence without recent upgrades or downgrades.

Which company has the best grades?

IPG Photonics has received a broader range of grades, including strong buy and multiple upgrades, suggesting a more dynamic analyst view. Indie Semiconductor’s stable buy and overweight ratings indicate steady confidence but fewer high-level upgrades. Investors might interpret IPGP’s grades as signaling potential for stronger near-term performance, while INDI’s ratings suggest moderate stability.

Strengths and Weaknesses

Below is a comparative table highlighting the key strengths and weaknesses of IPG Photonics Corporation (IPGP) and indie Semiconductor, Inc. (INDI) based on the most recent 2024 data and financial evaluations.

| Criterion | IPG Photonics Corporation (IPGP) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Diversification | Moderate product range focused on laser systems with multiple laser categories contributing to revenues | Limited diversification, primarily products with some service revenue |

| Profitability | Negative net margin (-18.58%), ROIC -9.97%, value destroying | Severe negative net margin (-61.2%), ROIC -19.25%, value destroying |

| Innovation | Established in laser tech with stable segments; innovation challenged by declining ROIC | Emerging semiconductor tech, but profitability and innovation under pressure |

| Global presence | Strong global market in materials processing and laser applications | Smaller scale with less global footprint |

| Market Share | Leading niche in industrial lasers; revenue over $1B in materials processing (2017 data) | Smaller market player, revenue under $250M in 2024 |

Key takeaways: Both IPGP and INDI are currently facing significant profitability challenges, with declining returns on invested capital and negative margins. IPGP benefits from a broader, more established product range and global presence, while INDI is more limited in diversification and scale. Caution is advised given their unfavorable financial health.

Risk Analysis

Below is a comparative table of key risks for IPG Photonics Corporation (IPGP) and indie Semiconductor, Inc. (INDI) based on the latest 2024 data:

| Metric | IPG Photonics Corporation (IPGP) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Market Risk | Moderate (Beta 1.02) | High (Beta 2.54) |

| Debt level | Very Low (D/E 0.01) | Moderate to High (D/E 0.95) |

| Regulatory Risk | Moderate (Tech industry, US-based) | Elevated (Automotive tech, US-based) |

| Operational Risk | Moderate (Established, 4,740 employees) | High (Smaller scale, 920 employees) |

| Environmental Risk | Low (Fiber laser manufacturing) | Moderate (Automotive semiconductor focus) |

| Geopolitical Risk | Moderate (Global supply chains) | Moderate to High (Auto industry exposure) |

The most impactful risks are market volatility and financial instability for indie Semiconductor, with a beta of 2.54 and a distressed Altman Z-score indicating high bankruptcy risk. IPG Photonics shows strong balance sheet resilience but faces pressure from negative profitability margins and moderate market risk. Investors should weigh indie Semiconductor’s high growth potential against its elevated financial and operational risks.

Which Stock to Choose?

IPG Photonics Corporation (IPGP) shows a declining income trend with a 24.1% revenue drop in 2024 and unfavorable net margin of -18.58%. Its financial ratios are slightly unfavorable overall, despite very low debt and strong liquidity. Profitability is negative, and the company has a very favorable B+ rating.

indie Semiconductor, Inc. (INDI) presents a neutral income statement with mixed growth, including a favorable 858% revenue increase overall but a significant net margin loss of -61.2%. Its financial ratios are mostly unfavorable, with higher debt levels and weak profitability. The firm holds a very favorable C- rating despite financial challenges.

For investors prioritizing financial stability and stronger rating, IPGP might appear more favorable given its better rating and moderate financial standing. Conversely, investors with a higher risk tolerance or seeking potential growth could interpret INDI’s mixed signals as opportunities, despite its unfavorable ratios and distress zone scores.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of IPG Photonics Corporation and indie Semiconductor, Inc. to enhance your investment decisions: