In the evolving landscape of residential real estate investment trusts (REITs), Invitation Homes Inc. (INVH) and UDR, Inc. (UDR) stand out as prominent players with distinct strategies. Invitation Homes focuses on single-family home leasing, while UDR specializes in multifamily apartment communities. Both companies operate in competitive U.S. markets, leveraging innovation to enhance tenant experiences. This analysis will help you determine which company presents the most compelling opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Invitation Homes Inc. and UDR, Inc. by providing an overview of these two companies and their main differences.

Invitation Homes Inc. Overview

Invitation Homes Inc. is the nation’s premier single-family home leasing company focused on providing access to high-quality, updated homes with valued features such as proximity to jobs and good schools. Their mission, “Together with you, we make a house a home,” highlights their commitment to delivering homes where individuals and families can thrive, supported by high-touch service to enhance residents’ living experiences. The company operates within the residential REIT sector.

UDR, Inc. Overview

UDR, Inc. is a leading multifamily real estate investment trust with a strong history of delivering dependable returns through managing, buying, selling, developing, and redeveloping real estate communities in targeted U.S. markets. With over 48 years in operation, UDR owns or holds ownership in more than 51K apartment homes and emphasizes long-term shareholder value, high service standards for residents, and quality experiences for its associates. It also operates within the residential REIT sector.

Key similarities and differences

Both Invitation Homes and UDR operate as residential real estate investment trusts listed on the NYSE, focusing on providing quality housing solutions. Invitation Homes specializes in single-family home leasing, while UDR concentrates on multifamily apartment communities. Both companies prioritize delivering value to residents and shareholders, but their asset types and operational models differ, reflecting distinct approaches within the residential real estate market.

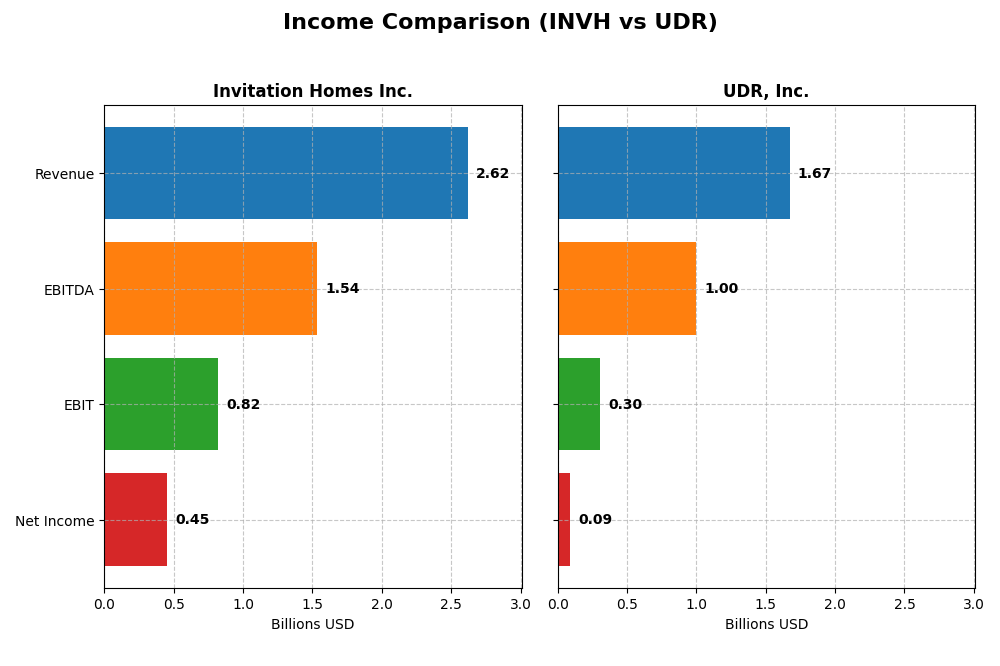

Income Statement Comparison

Below is a side-by-side comparison of the most recent annual income statement figures for Invitation Homes Inc. and UDR, Inc. to assist investors in evaluating their financial performance.

| Metric | Invitation Homes Inc. (INVH) | UDR, Inc. (UDR) |

|---|---|---|

| Market Cap | 16.3B | 12.3B |

| Revenue | 2.62B | 1.67B |

| EBITDA | 1.54B | 1.00B |

| EBIT | 821M | 305M |

| Net Income | 453M | 90M |

| EPS | 0.74 | 0.26 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Invitation Homes Inc.

Invitation Homes Inc. exhibited steady growth in revenue from 1.8B in 2020 to 2.6B in 2024, with net income rising from 196M to 453M. Gross margin remained strong at 59%, while net margin improved to 17.3%. The latest year showed moderate revenue growth of 7.7%, but net income and EBIT margins declined, indicating some margin pressure despite overall favorable trends.

UDR, Inc.

UDR, Inc. saw revenue climb from 1.24B in 2020 to 1.67B in 2024, with net income increasing from 64M to 89M. Gross margin stayed low but stable near 25%, while the net margin was modest at 5.4%. The most recent year experienced a small 2.7% revenue rise but a sharp decline in net margin and EPS, reflecting significant margin compression and profitability challenges.

Which one has the stronger fundamentals?

Invitation Homes holds stronger fundamentals with higher margins and more robust net income growth over five years, despite a slight recent EBIT and net margin dip. UDR’s lower margins and sharper recent profitability declines weigh on its fundamentals, though it maintains favorable revenue and net income growth overall. Invitation Homes’ scale and margin strength give it a relative edge in income statement metrics.

Financial Ratios Comparison

The table below compares key financial ratios for Invitation Homes Inc. (INVH) and UDR, Inc. (UDR) based on their most recent fiscal year data as of 2024.

| Ratios | Invitation Homes Inc. (INVH) | UDR, Inc. (UDR) |

|---|---|---|

| ROE | 4.65% | 2.60% |

| ROIC | 4.02% | 2.69% |

| P/E | 43.1 | 159.6 |

| P/B | 2.01 | 4.15 |

| Current Ratio | 0.82 | 0.39 |

| Quick Ratio | 0.82 | 0.39 |

| D/E (Debt-to-Equity) | 0.84 | 1.75 |

| Debt-to-Assets | 43.9% | 55.1% |

| Interest Coverage | 2.02 | 1.37 |

| Asset Turnover | 0.14 | 0.15 |

| Fixed Asset Turnover | 36.61 | 8.94 |

| Payout Ratio | 152% | 629% |

| Dividend Yield | 3.52% | 3.94% |

Interpretation of the Ratios

Invitation Homes Inc.

Invitation Homes shows a mixed ratio profile with a favorable net margin of 17.33% and a strong fixed asset turnover of 36.61, but faces concerns with a low return on equity (4.65%) and return on invested capital (4.02%). The current ratio at 0.82 suggests moderate liquidity risk. Dividend yield is favorable at 3.52%, indicating steady shareholder returns supported by dividends.

UDR, Inc.

UDR’s ratios reveal challenges, including an unfavorable debt-to-equity ratio of 1.75 and a low interest coverage of 1.47, raising concerns about financial leverage and risk. The price-to-earnings ratio is very high at 159.56, signaling potential overvaluation. Despite this, the dividend yield is slightly higher at 3.94%, contributing positively to shareholder returns.

Which one has the best ratios?

Invitation Homes holds a slightly unfavorable overall rating but benefits from stronger profitability and liquidity metrics compared to UDR. UDR’s ratios reflect greater financial risk and overvaluation, resulting in an unfavorable global opinion. Therefore, Invitation Homes exhibits a comparatively more balanced ratio profile for investors to consider.

Strategic Positioning

This section compares the strategic positioning of Invitation Homes Inc. and UDR, Inc., focusing on market position, key segments, and exposure to technological disruption:

Invitation Homes Inc.

- Premier single-family home leasing company facing competitive pressure in residential REIT market.

- Focuses on single-family homes with emphasis on quality, location near jobs, and schools.

- No explicit data on technological disruption exposure provided.

UDR, Inc.

- Leading multifamily REIT with strong presence in targeted U.S. markets, competing in residential sector.

- Operates multifamily apartments with additional revenue from management services segment.

- No explicit data on technological disruption exposure provided.

Invitation Homes Inc. vs UDR, Inc. Positioning

Invitation Homes concentrates on single-family home leasing, emphasizing quality and location, while UDR operates diversified multifamily properties including management services. Invitation Homes targets lifestyle demands, whereas UDR focuses on community development and redevelopment in multiple markets.

Which has the best competitive advantage?

Both companies currently shed value as ROIC is below WACC, but both show growing profitability trends. Neither holds a strong economic moat; their competitive advantages remain slightly unfavorable based on recent MOAT evaluations.

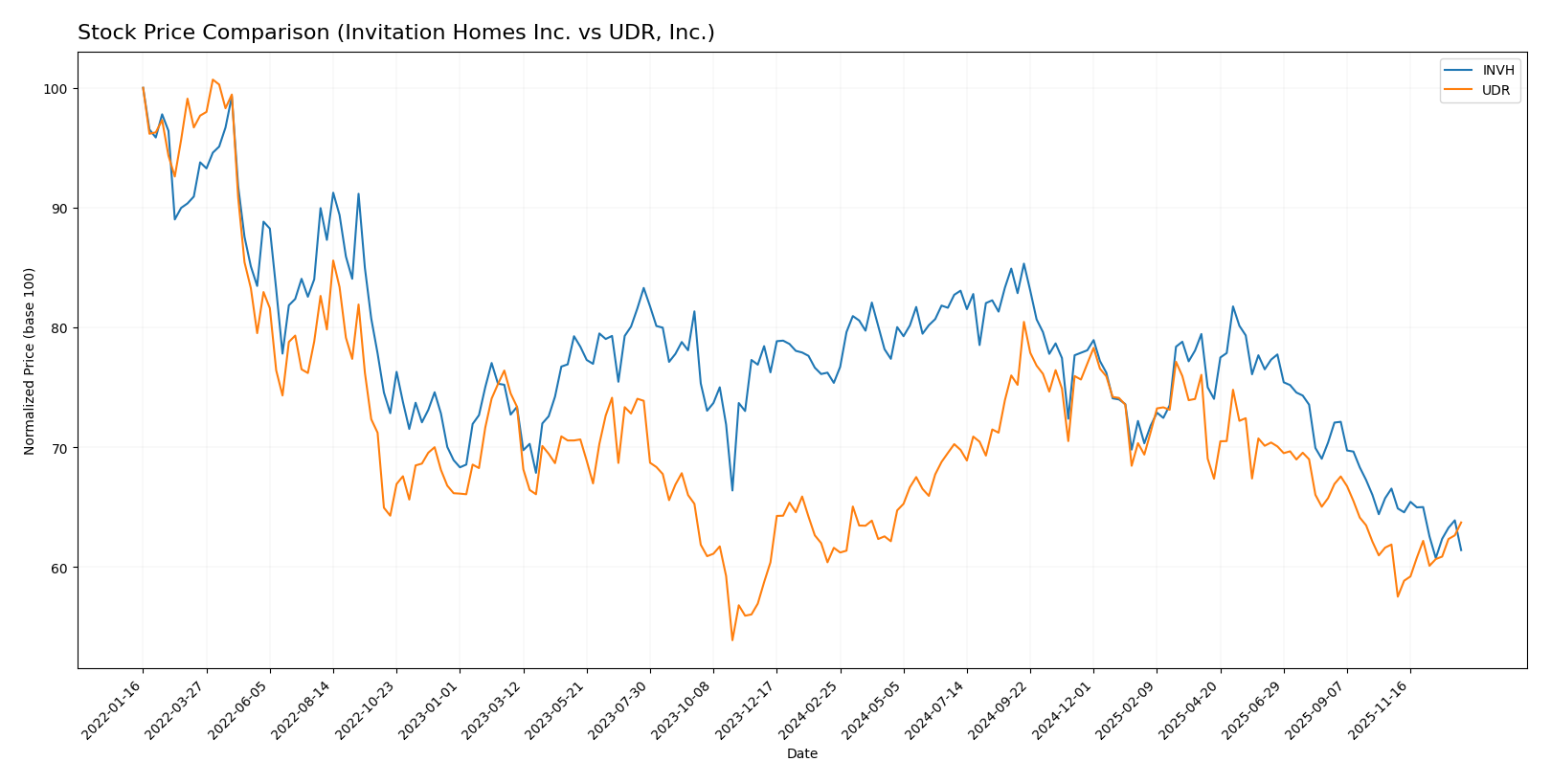

Stock Comparison

The stock prices of Invitation Homes Inc. (INVH) and UDR, Inc. have shown contrasting trends over the past 12 months, with INVH experiencing a notable decline while UDR displayed moderate gains, reflecting differing market dynamics and investor sentiment.

Trend Analysis

Invitation Homes Inc. (INVH) recorded an 18.53% price decrease over the past year, indicating a bearish trend with deceleration. The stock ranged between $26.35 and $37.02, showing moderate volatility (std deviation 2.66).

UDR, Inc. posted a 3.44% gain over 12 months, signaling a bullish trend with acceleration. Its price moved from $33.69 to $47.13, accompanied by slightly higher volatility (std deviation 3.16).

Comparing both, UDR delivered the highest market performance with a positive price change, while INVH suffered a significant decline, reflecting divergent investor preferences and market outcomes.

Target Prices

The consensus target prices for Invitation Homes Inc. and UDR, Inc. indicate positive analyst expectations over current market prices.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Invitation Homes Inc. | 38 | 27 | 32.71 |

| UDR, Inc. | 44.5 | 33 | 40.68 |

Analysts see Invitation Homes’ stock price rising from $26.64 to around $32.71 on average, while UDR’s current price of $37.32 is expected to increase toward a consensus of $40.68. This reflects moderate upside potential for both REITs.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Invitation Homes Inc. and UDR, Inc.:

Rating Comparison

INVH Rating

- Rating: B+ denotes a very favorable assessment of financial standing.

- Discounted Cash Flow Score: 5, reflecting a very favorable valuation outlook.

- ROE Score: 3, representing a moderate efficiency in generating equity returns.

- ROA Score: 4, indicating favorable asset utilization.

- Debt To Equity Score: 2, moderate financial risk due to debt level.

- Overall Score: 3, a moderate overall financial standing.

UDR Rating

- Rating: C+ indicates a very favorable assessment of financial standing.

- Discounted Cash Flow Score: 4, showing a favorable valuation outlook.

- ROE Score: 3, also moderate efficiency in generating equity returns.

- ROA Score: 2, suggesting moderate effectiveness in asset utilization.

- Debt To Equity Score: 1, reflecting very unfavorable financial risk from debt.

- Overall Score: 2, a moderate overall financial standing but lower than INVH.

Which one is the best rated?

Based strictly on the provided data, Invitation Homes Inc. (INVH) is better rated overall with a higher rating (B+ vs. C+), superior discounted cash flow and return on assets scores, and a stronger debt-to-equity position compared to UDR, Inc.

Scores Comparison

This section compares the Altman Z-Score and Piotroski Score of Invitation Homes Inc. and UDR, Inc.:

INVH Scores

- Altman Z-Score: 1.31, indicating financial distress

- Piotroski Score: 7, categorized as strong

UDR Scores

- Altman Z-Score: 0.76, indicating financial distress

- Piotroski Score: 8, categorized as very strong

Which company has the best scores?

UDR has a lower Altman Z-Score, indicating slightly higher distress, but a higher Piotroski Score reflecting very strong financial health compared to INVH’s strong rating. Overall, UDR shows stronger financial strength by Piotroski standards.

Grades Comparison

Here is a comparison of the latest reliable grades from major financial institutions for Invitation Homes Inc. and UDR, Inc.:

Invitation Homes Inc. Grades

This table summarizes recent grades assigned by respected financial firms to Invitation Homes Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-11-25 |

| JP Morgan | Maintain | Overweight | 2025-11-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-13 |

| B of A Securities | Maintain | Neutral | 2025-11-12 |

| Scotiabank | Maintain | Sector Perform | 2025-11-10 |

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-31 |

| RBC Capital | Maintain | Sector Perform | 2025-10-31 |

| Mizuho | Maintain | Outperform | 2025-10-21 |

| JP Morgan | Upgrade | Overweight | 2025-10-17 |

Invitation Homes Inc. displays a generally positive trend with multiple “Overweight” and “Outperform” grades, indicating moderate analyst confidence.

UDR, Inc. Grades

This table presents recent grades granted by reputable grading companies for UDR, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Downgrade | Underweight | 2025-12-18 |

| Truist Securities | Maintain | Hold | 2025-12-01 |

| Barclays | Maintain | Overweight | 2025-11-25 |

| Mizuho | Maintain | Neutral | 2025-11-24 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-13 |

| UBS | Maintain | Buy | 2025-11-10 |

| Wells Fargo | Maintain | Overweight | 2025-11-10 |

| Scotiabank | Maintain | Sector Perform | 2025-11-04 |

| Goldman Sachs | Maintain | Sell | 2025-11-04 |

| RBC Capital | Maintain | Sector Perform | 2025-11-04 |

UDR, Inc. shows a mixed picture with a recent downgrade to “Underweight” by JP Morgan, balanced by several “Overweight” and “Buy” grades, reflecting divergent analyst views.

Which company has the best grades?

Invitation Homes Inc. has received predominantly positive grades such as “Overweight” and “Outperform,” whereas UDR, Inc. has a more mixed rating profile including a recent downgrade. This suggests Invitation Homes may currently enjoy stronger analyst support, which could influence investor sentiment and portfolio decisions.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Invitation Homes Inc. (INVH) and UDR, Inc. (UDR) based on the most recent financial and operational data.

| Criterion | Invitation Homes Inc. (INVH) | UDR, Inc. (UDR) |

|---|---|---|

| Diversification | Primarily focused on single-family home rentals; limited diversification. | Revenue mainly from multifamily communities and management services; moderate diversification. |

| Profitability | Net margin strong at 17.33%; ROIC at 4.02% below WACC (6.58%), indicating value destruction but improving profitability. | Lower net margin at 5.36%; ROIC 2.69% below WACC (5.9%), showing value destruction with slight ROIC growth. |

| Innovation | Moderate innovation with operational efficiency improvements; no major breakthroughs reported. | Limited innovation focus; emphasis on management services growth but high P/E ratio indicates market expectations. |

| Global presence | Concentrated in the U.S. residential market; no international footprint. | Also U.S.-centric with no global operations; focused on domestic multifamily sector. |

| Market Share | Leading player in U.S. single-family rental market with strong asset base. | Significant presence in multifamily housing but faces intense competition; market share stable but not dominant. |

Key takeaways: Both INVH and UDR are slightly unfavorable investments due to ROIC below WACC, indicating value destruction. INVH shows better profitability and operational efficiency, while UDR struggles with higher debt and valuation concerns. Investors should weigh growth potential against these risks carefully.

Risk Analysis

Below is a comparative table of key risks for Invitation Homes Inc. (INVH) and UDR, Inc. (UDR) based on the latest available data from 2024:

| Metric | Invitation Homes Inc. (INVH) | UDR, Inc. (UDR) |

|---|---|---|

| Market Risk | Moderate (Beta 0.83) | Moderate-Low (Beta 0.71) |

| Debt Level | Moderate (Debt/Equity 0.84) | High (Debt/Equity 1.75) |

| Regulatory Risk | Moderate (US residential REIT) | Moderate (US residential REIT) |

| Operational Risk | Moderate (Net margin 17.33%) | Moderate-Low (Net margin 5.36%) |

| Environmental Risk | Moderate (Residential sector) | Moderate (Residential sector) |

| Geopolitical Risk | Low (US focused) | Low (US focused) |

The most impactful risks are the high debt level and weak interest coverage for UDR, which pose significant financial stress and bankruptcy risk (Altman Z-score in distress zone at 0.76). INVH also faces a distress zone Altman Z-score (1.31) but has a more moderate debt position and stronger profitability. Investors should monitor debt management and interest coverage carefully, as these financial risks dominate the outlook for both companies.

Which Stock to Choose?

Invitation Homes Inc. (INVH) shows a favorable income statement with strong gross and net margins, though recent net margin and EPS growth are negative. Its financial ratios reveal a slightly unfavorable global profile, balanced by a very favorable B+ rating. The company carries moderate debt and exhibits a slightly unfavorable but improving MOAT.

UDR, Inc. (UDR) also displays a favorable income statement overall, despite weak recent revenue and margin growth. Its financial ratios are largely unfavorable, with high leverage and valuation concerns, reflected in a moderate C+ rating. The firm’s MOAT is slightly unfavorable with signs of improving profitability.

Investors focused on value and financial stability might find Invitation Homes’ stronger rating and income profile more appealing, while those seeking potential turnaround or growth opportunities could see UDR’s improving MOAT and recent bullish price trend as noteworthy. Ultimately, the choice could depend on an investor’s risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Invitation Homes Inc. and UDR, Inc. to enhance your investment decisions: