In the dynamic world of residential real estate investment trusts (REITs), Invitation Homes Inc. (INVH) and Mid-America Apartment Communities, Inc. (MAA) stand out as key players with distinct strategies. INVH focuses on single-family home leasing, while MAA specializes in apartment communities across multiple U.S. regions. Both companies innovate to meet evolving housing demands, making their comparison essential. Join me as we explore which presents the most compelling opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Invitation Homes Inc. and Mid-America Apartment Communities, Inc. by providing an overview of these two companies and their main differences.

Invitation Homes Inc. Overview

Invitation Homes Inc. is a leading single-family home leasing company in the United States. Its mission, “Together with you, we make a house a home,” emphasizes providing high-quality, updated homes with valued features such as proximity to jobs and good schools. The company focuses on delivering a high-touch service that enhances residents’ living experiences.

Mid-America Apartment Communities, Inc. Overview

Mid-America Apartment Communities, Inc. (MAA) is a real estate investment trust (REIT) specializing in apartment communities across the Southeast, Southwest, and Mid-Atlantic U.S. regions. As an S&P 500 company, MAA aims to deliver superior investment performance through ownership, management, and development of quality apartment properties, holding over 102,000 units across 16 states and the District of Columbia.

Key similarities and differences

Both companies operate in the residential REIT sector, focusing on providing housing solutions. Invitation Homes emphasizes single-family home leasing, while MAA specializes in apartment communities. Invitation Homes prioritizes resident experience and lifestyle-focused features, whereas MAA focuses on investment performance through large-scale property ownership and development across multiple states.

Income Statement Comparison

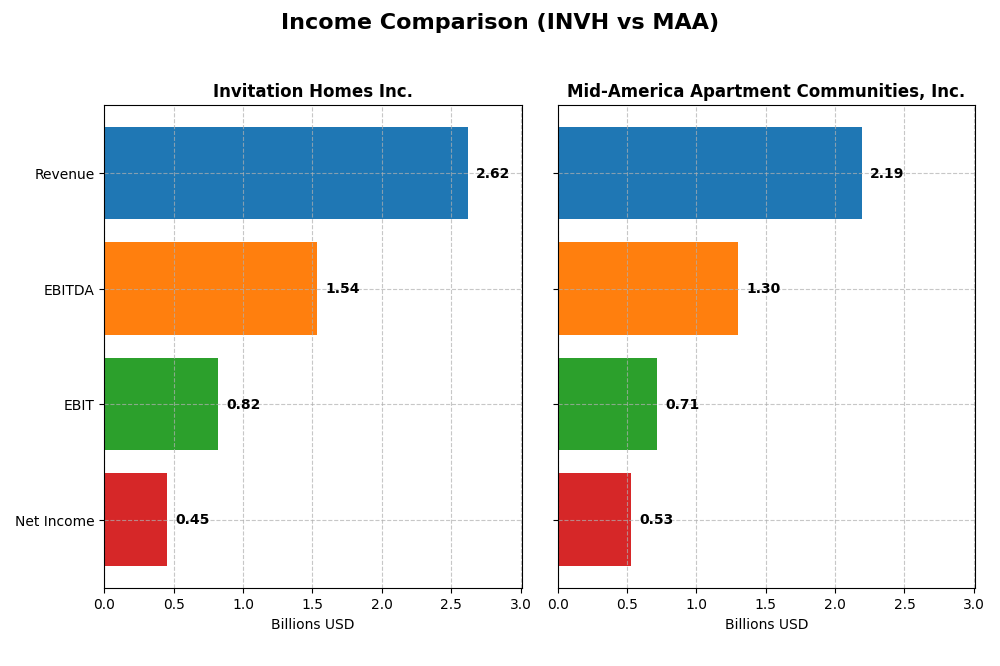

The table below compares the key income statement metrics for Invitation Homes Inc. and Mid-America Apartment Communities, Inc. for the fiscal year 2024.

| Metric | Invitation Homes Inc. (INVH) | Mid-America Apartment Communities, Inc. (MAA) |

|---|---|---|

| Market Cap | 16.3B | 16.2B |

| Revenue | 2.62B | 2.19B |

| EBITDA | 1.54B | 1.30B |

| EBIT | 821M | 713M |

| Net Income | 453M | 528M |

| EPS | 0.74 | 4.49 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Invitation Homes Inc.

Invitation Homes showed consistent growth in revenue from 2020 to 2024, increasing from $1.82B to $2.62B, with net income more than doubling from $196M to $454M. Gross and EBIT margins remained favorable, around 59% and 31% respectively. However, the latest year saw a slight EBIT decline (-3.87%) and a net margin dip (-18.85%), indicating some pressure despite solid revenue growth.

Mid-America Apartment Communities, Inc.

MAA experienced steady revenue growth from $1.68B in 2020 to $2.19B in 2024, with net income rising from $255M to $528M. Margins were stable and favorable, with gross margin near 33% and EBIT margin at 32.56%. The most recent year showed a slowdown in growth, with revenue up just 1.98% and declines in gross profit (-4.58%) and net margin (-6.42%), suggesting some operational challenges.

Which one has the stronger fundamentals?

Both companies demonstrate favorable income statement fundamentals with solid revenue and net income growth over five years. Invitation Homes leads with higher gross margin and larger overall net income growth, though recent EBIT and margin contractions pose caution. MAA maintains more stable margins but faces slower recent growth and slight declines in profitability. Each shows strengths balanced by areas requiring attention.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Invitation Homes Inc. (INVH) and Mid-America Apartment Communities, Inc. (MAA) based on their most recent fiscal year data from 2024.

| Ratios | Invitation Homes Inc. (INVH) | Mid-America Apartment Communities, Inc. (MAA) |

|---|---|---|

| ROE | 4.65% | 8.84% |

| ROIC | 4.02% | 5.80% (Return on Invested Capital) |

| P/E | 43.14 | 34.22 |

| P/B | 2.01 | 3.03 |

| Current Ratio | 0.82 | 0.08 |

| Quick Ratio | 0.82 | 0.08 |

| D/E (Debt-to-Equity) | 0.84 | 0.84 |

| Debt-to-Assets | 43.86% | 42.39% |

| Interest Coverage | 2.02 | 3.90 |

| Asset Turnover | 0.14 | 0.19 |

| Fixed Asset Turnover | 36.61 | N/A |

| Payout ratio | 152% | 131% |

| Dividend yield | 3.52% | 3.83% |

Interpretation of the Ratios

Invitation Homes Inc.

Invitation Homes displays mixed financial ratios with a favorable net margin of 17.33% and a strong fixed asset turnover of 36.61, yet it shows weaknesses in return on equity (4.65%) and asset turnover (0.14). Its current ratio is below 1 at 0.82, indicating potential liquidity concerns. The company pays dividends with a 3.52% yield, supported by a manageable payout ratio, but caution is advised given some unfavorable profitability metrics.

Mid-America Apartment Communities, Inc.

Mid-America Apartment Communities presents a solid net margin of 24.08%, reflecting strong profitability, but also faces challenges with a low current ratio of 0.08 and an unfavorable price-to-book ratio of 3.03. Return on equity stands at 8.84%, better than Invitation Homes but still flagged as unfavorable. The dividend yield is 3.83%, supported by consistent payouts, though elevated debt levels and asset turnover weaknesses warrant attention.

Which one has the best ratios?

Both companies have a slightly unfavorable overall ratio profile with Invitation Homes showing a better balance between favorable and neutral ratios, while Mid-America Apartment Communities struggles more with liquidity and valuation metrics. Invitation Homes benefits from stronger asset efficiency, but Mid-America offers higher profitability margins and dividend yield. Neither stands out decisively as superior based solely on these ratios.

Strategic Positioning

This section compares the strategic positioning of Invitation Homes Inc. and Mid-America Apartment Communities, Inc. across Market position, Key segments, and Exposure to technological disruption:

Invitation Homes Inc.

- Leading single-family home leasing company with focus on quality homes near jobs and schools.

- Concentrates on single-family home leasing; emphasizes resident experience and home quality.

- No explicit information on technological disruption exposure or innovation noted.

Mid-America Apartment Communities, Inc.

- S&P 500 REIT focused on apartment communities in Southeast, Southwest, Mid-Atlantic U.S. regions.

- Owns and manages 102,772 apartment units, with development and redevelopment activities.

- No explicit information on technological disruption exposure or innovation noted.

Invitation Homes Inc. vs Mid-America Apartment Communities, Inc. Positioning

Invitation Homes is concentrated on single-family home leasing, prioritizing high-quality updated homes, while Mid-America has a diversified apartment portfolio across multiple regions. Invitation Homes focuses more on lifestyle features, whereas Mid-America emphasizes scale and geographic breadth.

Which has the best competitive advantage?

Both companies are shedding value with ROIC below WACC but show growing profitability trends. Neither has a clearly favorable moat; both currently hold a slightly unfavorable competitive advantage status.

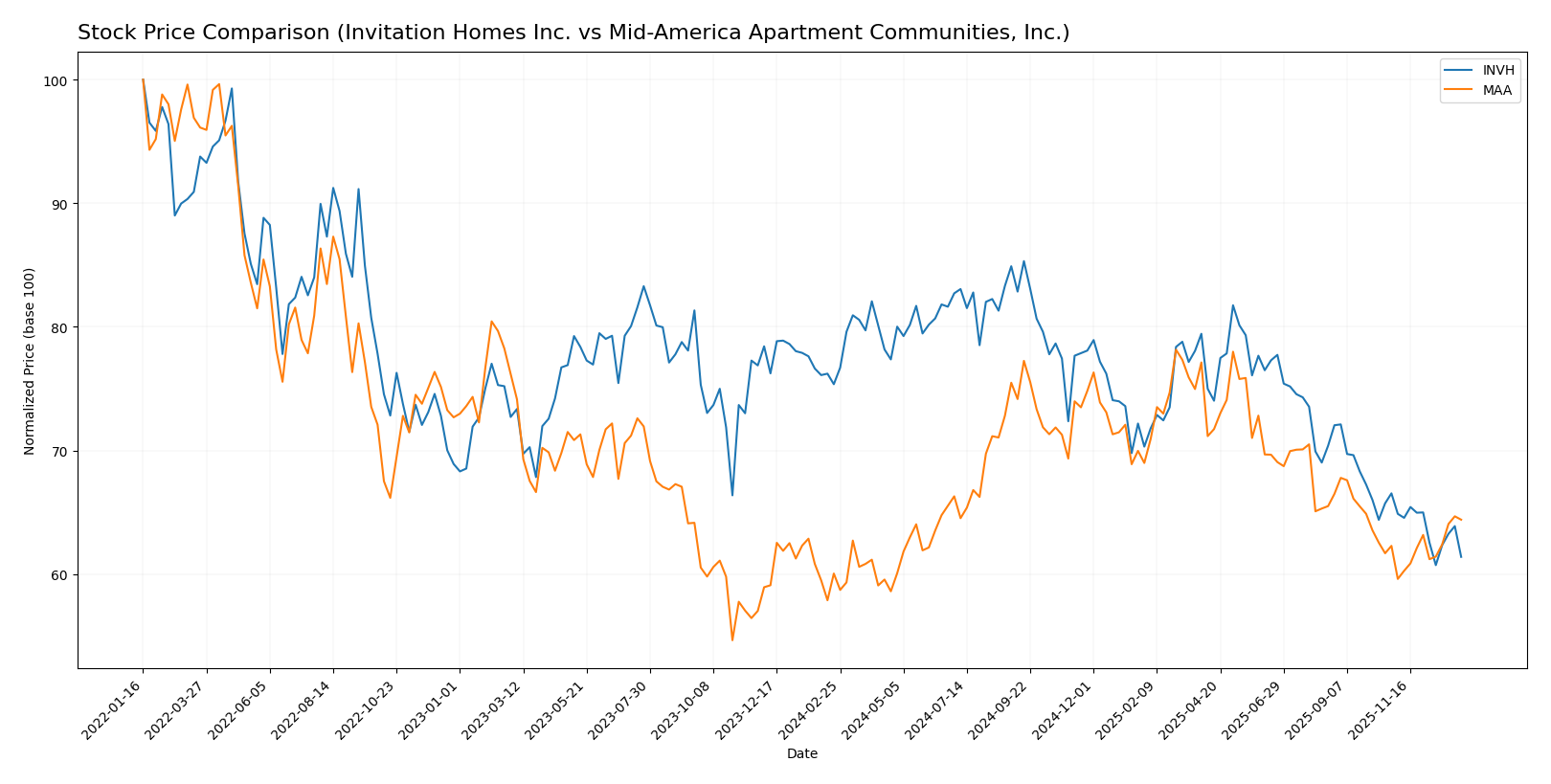

Stock Comparison

The stock price movements over the past year reveal contrasting performance dynamics, with Invitation Homes Inc. showing a notable decline while Mid-America Apartment Communities, Inc. experiences a steady upward trajectory.

Trend Analysis

Invitation Homes Inc. (INVH) shows a bearish trend with an 18.53% price decline over the past 12 months, accompanied by deceleration and moderate volatility (std deviation 2.66). The stock hit a high of 37.02 and a low of 26.35.

Mid-America Apartment Communities, Inc. (MAA) exhibits a bullish trend with a 7.25% price increase over the past year, accelerating upward amid higher volatility (std deviation 11.77), reaching a peak of 168.12 and a low of 126.08.

Comparing the two, MAA has delivered the highest market performance with a positive 7.25% gain, contrasting with INVH’s significant 18.53% loss during the same period.

Target Prices

Analysts present a solid consensus on target prices for Invitation Homes Inc. and Mid-America Apartment Communities, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Invitation Homes Inc. | 38 | 27 | 32.71 |

| Mid-America Apartment Communities, Inc. | 150 | 134 | 142.22 |

The consensus target prices for both companies exceed their current stock prices, indicating analyst expectations of potential upside for Invitation Homes Inc. and Mid-America Apartment Communities, Inc. investors.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Invitation Homes Inc. and Mid-America Apartment Communities, Inc.:

Rating Comparison

INVH Rating

- Rating: B+, considered very favorable overall.

- Discounted Cash Flow Score: 5, indicating a very favorable valuation.

- ROE Score: 3, assessed as moderate profitability generation.

- ROA Score: 4, showing favorable asset utilization.

- Debt To Equity Score: 2, reflecting moderate financial risk.

- Overall Score: 3, categorized as moderate overall financial standing.

MAA Rating

- Rating: B, also considered very favorable overall.

- Discounted Cash Flow Score: 4, indicating a favorable valuation.

- ROE Score: 4, assessed as favorable profitability generation.

- ROA Score: 4, showing similarly favorable asset utilization.

- Debt To Equity Score: 2, also reflecting moderate financial risk.

- Overall Score: 3, also categorized as moderate overall financial standing.

Which one is the best rated?

INVH holds a slightly higher rating (B+) compared to MAA’s B. INVH has a superior discounted cash flow score, indicating better valuation, while MAA demonstrates stronger return on equity. Both companies share similar overall and debt risk scores.

Scores Comparison

This section compares the Altman Z-Score and Piotroski Score of Invitation Homes Inc. and Mid-America Apartment Communities, Inc.:

INVH Scores

- Altman Z-Score: 1.31, in distress zone indicating high bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

MAA Scores

- Altman Z-Score: 1.65, also in distress zone with high bankruptcy risk.

- Piotroski Score: 5, classified as average financial health.

Which company has the best scores?

INVH shows a stronger Piotroski Score of 7 compared to MAA’s 5, indicating better financial strength, while both companies fall in the distress zone for Altman Z-Score, suggesting elevated bankruptcy risk.

Grades Comparison

Here is a detailed comparison of the latest grades assigned to Invitation Homes Inc. and Mid-America Apartment Communities, Inc.:

Invitation Homes Inc. Grades

The following table summarizes recent grades from reputable financial institutions for Invitation Homes Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-11-25 |

| JP Morgan | Maintain | Overweight | 2025-11-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-13 |

| B of A Securities | Maintain | Neutral | 2025-11-12 |

| Scotiabank | Maintain | Sector Perform | 2025-11-10 |

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-31 |

| RBC Capital | Maintain | Sector Perform | 2025-10-31 |

| Mizuho | Maintain | Outperform | 2025-10-21 |

| JP Morgan | Upgrade | Overweight | 2025-10-17 |

Invitation Homes Inc. shows a consistent pattern of maintaining or upgrading to positive ratings, predominantly in the range of Overweight to Outperform.

Mid-America Apartment Communities, Inc. Grades

Here are recent grades for Mid-America Apartment Communities, Inc. from verified sources:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | Maintain | In Line | 2025-12-15 |

| Scotiabank | Downgrade | Sector Perform | 2025-12-05 |

| BTIG | Maintain | Buy | 2025-12-05 |

| Wells Fargo | Maintain | Overweight | 2025-11-25 |

| Barclays | Maintain | Equal Weight | 2025-11-25 |

| Mizuho | Maintain | Outperform | 2025-11-24 |

| Morgan Stanley | Maintain | Overweight | 2025-11-13 |

| Truist Securities | Maintain | Buy | 2025-11-10 |

| UBS | Upgrade | Neutral | 2025-11-10 |

| Scotiabank | Maintain | Sector Outperform | 2025-11-04 |

Mid-America Apartment Communities, Inc. grades present a mix of buy and outperform ratings with occasional downgrades, demonstrating a broadly positive but slightly more varied outlook.

Which company has the best grades?

Both companies hold a majority of buy and outperform ratings, but Invitation Homes Inc. has more consistent upgrades and fewer downgrades, suggesting a steadier positive sentiment. This consistency may reflect more stable analyst confidence, which can influence investor perception of risk and potential returns.

Strengths and Weaknesses

Below is a comparison of Invitation Homes Inc. (INVH) and Mid-America Apartment Communities, Inc. (MAA) on key financial and strategic criteria:

| Criterion | Invitation Homes Inc. (INVH) | Mid-America Apartment Communities, Inc. (MAA) |

|---|---|---|

| Diversification | Focused on single-family rental homes; limited diversification | Strong focus on multifamily apartments; steady same-store revenue growth over years indicates stable asset portfolio |

| Profitability | Net margin 17.33% (favorable), but ROIC 4.02% below WACC (6.58%), value shedding | Net margin 24.08% (favorable), ROIC 5.8% slightly below WACC (6.49%), value shedding but improving |

| Innovation | Moderate asset turnover (0.14), fixed asset turnover favorable (36.61) | Lower asset turnover (0.19) and unfavorable fixed asset turnover (0), limited innovation impact |

| Global presence | Primarily US residential market; limited international reach | Also US-focused with no significant global presence |

| Market Share | Large player in single-family rental market; steady growth in ROIC | Major in multifamily sector; consistent same-store revenue increases |

Key takeaways: Both INVH and MAA are slightly unfavorable in value creation, as their ROICs remain below WACC, though improving. MAA shows stronger profitability and stable revenue growth, while INVH benefits from favorable fixed asset turnover. Investors should watch their improving ROIC trends but remain cautious due to current value shedding.

Risk Analysis

Below is a comparative table summarizing the key risk factors for Invitation Homes Inc. (INVH) and Mid-America Apartment Communities, Inc. (MAA) based on the most recent 2024 data:

| Metric | Invitation Homes Inc. (INVH) | Mid-America Apartment Communities, Inc. (MAA) |

|---|---|---|

| Market Risk | Moderate (Beta 0.83) | Moderate (Beta 0.77) |

| Debt Level | Neutral (D/E 0.84, Debt/Assets 43.9%) | Neutral (D/E 0.84, Debt/Assets 42.4%) |

| Regulatory Risk | Moderate (Real Estate sector exposure) | Moderate (Real Estate sector exposure) |

| Operational Risk | Slightly unfavorable (Current ratio 0.82) | Unfavorable (Current ratio 0.08) |

| Environmental Risk | Moderate (Residential REIT exposure) | Moderate (Residential REIT exposure) |

| Geopolitical Risk | Low (US-focused operations) | Low (US-focused operations) |

Synthesis: Both companies face moderate market and regulatory risks typical of residential REITs, with operational risk notably higher for MAA due to very low liquidity ratios. Both show distress-zone Altman Z-scores, indicating potential financial stress, but INVH has a stronger Piotroski score suggesting better financial health. Debt levels remain manageable but require monitoring amid economic fluctuations.

Which Stock to Choose?

Invitation Homes Inc. (INVH) shows favorable income statement metrics with strong gross and EBIT margins, but its recent EBIT and net margin growth are negative. Financial ratios reveal a mixed picture: several unfavorable indicators like ROE and asset turnover, yet a solid dividend yield. The company carries moderate debt and holds a very favorable B+ rating.

Mid-America Apartment Communities, Inc. (MAA) also presents favorable income metrics, though with weaker recent revenue and profit growth. Its financial ratios are slightly less favorable overall, with concerns around valuation multiples and liquidity ratios. Debt levels are moderate, and MAA holds a very favorable B rating but shows some unfavorable valuation scores.

From a rating and financial standpoint, both INVH and MAA appear slightly unfavorable overall but maintain favorable income profiles and growing profitability. INVH’s stronger dividend yield and growing ROIC might appeal to income-focused investors, while MAA’s higher net margin and moderate debt profile could be more attractive to those valuing operational efficiency. Risk-averse investors might find MAA’s stable income preferable, whereas risk-tolerant investors seeking growth potential may see merits in INVH’s evolving profitability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Invitation Homes Inc. and Mid-America Apartment Communities, Inc. to enhance your investment decisions: