Home > Comparison > Financial Services > BK vs IVZ

The strategic rivalry between The Bank of New York Mellon Corporation and Invesco Ltd. shapes asset management’s competitive landscape. BK operates as a diversified financial services firm with extensive custody and wealth management capabilities. IVZ focuses on investment management with a broad range of mutual and exchange-traded funds. This analysis will assess which company’s operational model offers superior risk-adjusted returns for a balanced portfolio navigating evolving market dynamics.

Table of contents

Companies Overview

The Bank of New York Mellon Corporation and Invesco Ltd. stand as major players in the asset management landscape, each wielding distinct strengths.

The Bank of New York Mellon Corporation: Custodian and Wealth Services Giant

This company leads in custody and wealth management services worldwide. Its revenue stems from Securities Services, Market and Wealth Services, and Investment and Wealth Management segments, offering custody, clearing, and investment solutions. In 2026, it focuses on enhancing technology-driven enterprise data management and integrated cash management, aiming to solidify its competitive edge in comprehensive financial services.

Invesco Ltd.: Global Investment Manager

Invesco operates as a diversified investment manager serving retail and institutional clients. It generates income through managing equity, fixed income, multi-asset, and alternative investment funds, including ETFs and private funds. Its 2026 strategy emphasizes quantitative analysis and a broad product mix to capture growth in global public and alternative markets, maintaining agility in portfolio management.

Strategic Collision: Similarities & Divergences

Both firms excel in asset management but diverge in business models—BNY Mellon centers on a service-based custody platform, while Invesco is a product-driven investment manager. They compete primarily in institutional asset servicing versus fund management. Their investment profiles differ sharply: BNY Mellon offers stability through diversified financial infrastructure; Invesco pursues growth with active portfolio strategies and market exposure.

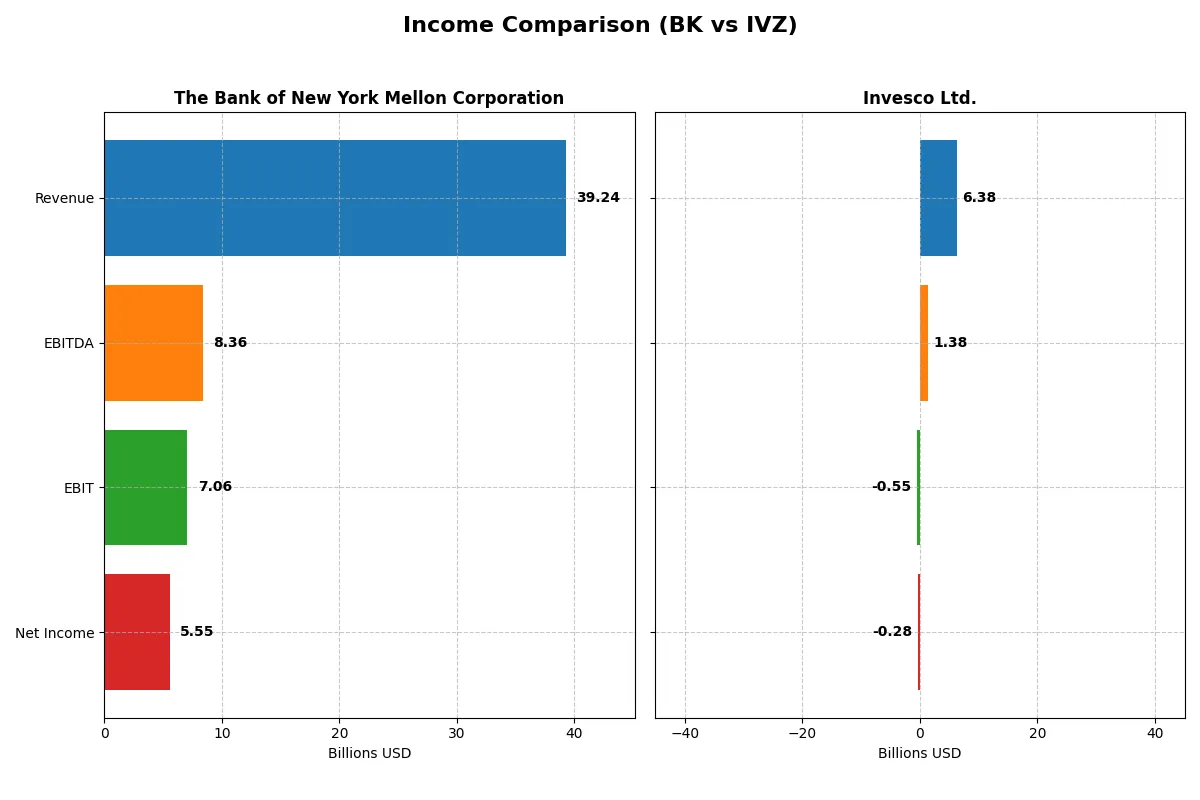

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | The Bank of New York Mellon Corporation (BK) | Invesco Ltd. (IVZ) |

|---|---|---|

| Revenue | 39.2B | 6.38B |

| Cost of Revenue | 19.4B | 3.62B |

| Operating Expenses | 12.8B | 3.45B |

| Gross Profit | 19.9B | 2.75B |

| EBITDA | 8.36B | 1.38B |

| EBIT | 7.06B | -547M |

| Interest Expense | 20.7B | 82.5M |

| Net Income | 5.55B | -282M |

| EPS | 7.46 | -1.61 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

The income statement comparison reveals the true efficiency and profitability trends of these two financial firms over recent years.

The Bank of New York Mellon Corporation Analysis

BK’s revenue rose sharply from 15.9B in 2021 to 39.2B in 2025, though it slightly dipped last year. Net income climbed steadily to 5.55B in 2025. Gross margin stands robust at 50.6%, with net margin healthy at 14.1%. EBIT margin improved 21% last year, signaling strong operational leverage and momentum.

Invesco Ltd. Analysis

IVZ shows modest revenue growth from 6.9B in 2021 to 6.38B in 2025, with a slight increase last year. However, net income turned negative in 2023 and deepened losses to -282M in 2025. Gross margin holds at 43.2%, but negative EBIT (-8.6%) and net margins (-4.4%) reflect operational challenges and margin compression.

Margin Power vs. Revenue Scale

BK outperforms IVZ decisively with superior revenue growth and consistently positive net income. BK’s strong margins and improving EBIT margin highlight efficient cost management and capital allocation. IVZ’s negative profitability and shrinking net income signal structural issues. BK’s profile suits investors seeking stable earnings; IVZ presents higher risk with uncertain turnaround prospects.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose underlying fiscal health, valuation premiums, and capital efficiency for the companies compared below:

| Ratios | The Bank of New York Mellon Corporation (BK) | Invesco Ltd. (IVZ) |

|---|---|---|

| ROE | 12.5% | 5.3% |

| ROIC | 6.4% | 2.4% |

| P/E | 14.7 | -16.4 |

| P/B | 1.85 | 0 |

| Current Ratio | 0.70 | 0 |

| Quick Ratio | 0.70 | 0 |

| D/E (Debt-to-Equity) | 0.76 | 0 |

| Debt-to-Assets | 7.2% | 0 |

| Interest Coverage | 0.34 | 8.43 |

| Asset Turnover | 0.08 | 0 |

| Fixed Asset Turnover | 10.96 | 0 |

| Payout ratio | 25.4% | -52.0% |

| Dividend yield | 1.72% | 3.18% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing operational strengths and hidden risks that shape investment decisions.

The Bank of New York Mellon Corporation

BK demonstrates solid profitability with a 12.5% ROE and a favorable 14.7 P/E ratio, indicating reasonable valuation. Its net margin at 14.14% confirms operational efficiency. Dividend yield stands at 1.72%, reflecting a moderate shareholder return alongside balanced reinvestment in growth. Some liquidity concerns persist with a low current ratio of 0.7.

Invesco Ltd.

IVZ shows a negative net margin and zero ROE, signaling profitability struggles. Despite a favorable negative P/E metric, this reflects losses rather than value. The company offers a higher 3.18% dividend yield, indicating shareholder returns despite operational challenges. Lack of liquidity ratios and unfavorable interest coverage raise red flags on financial stability.

Balanced Operational Strength vs. Profitability Struggles

BK offers a more balanced risk-reward profile with solid profitability and reasonable valuation despite liquidity weaknesses. IVZ’s attractive dividend masks deeper operational and financial vulnerabilities. Investors favoring stable operations may lean toward BK, while those seeking income amid volatility might consider IVZ’s yield.

Which one offers the Superior Shareholder Reward?

I observe that The Bank of New York Mellon Corporation (BK) delivers a more balanced and sustainable distribution model than Invesco Ltd. (IVZ). BK pays a moderate dividend yield around 1.7% to 3.6%, with payout ratios consistently below 55%, ensuring reliable free cash flow coverage. BK also executes steady buybacks, reinforcing shareholder value without overstretching capital. Conversely, IVZ offers higher dividend yields near 7.6% but suffers from volatile profitability and negative net income in 2025, raising payout sustainability concerns. IVZ’s aggressive buyback and dividend strategies appear riskier given weaker margins and elevated leverage. For 2026, I prefer BK’s prudent capital allocation and durable total return profile over IVZ’s higher but less secure payouts.

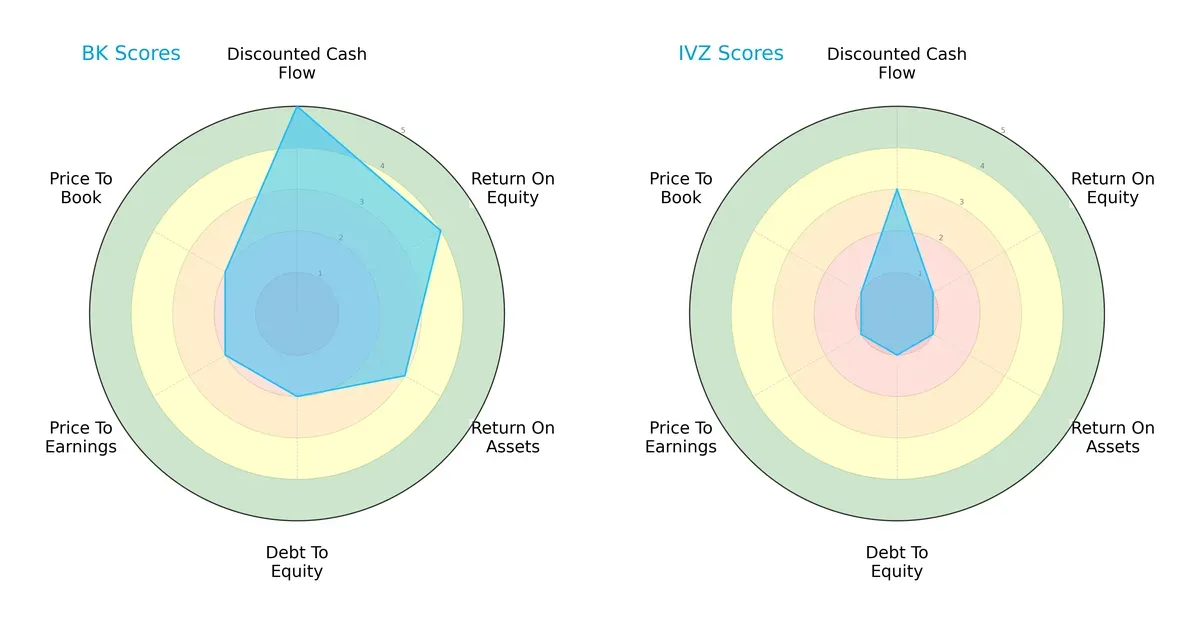

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of The Bank of New York Mellon Corporation and Invesco Ltd.:

BK shows a more balanced scorecard with strong DCF (5) and solid profitability metrics (ROE 4, ROA 3). IVZ lags across all categories, relying on weaker operational efficiency and valuation scores of 1. BK’s moderate debt-to-equity score (2) contrasts IVZ’s higher leverage risk, confirming BK’s superior financial discipline.

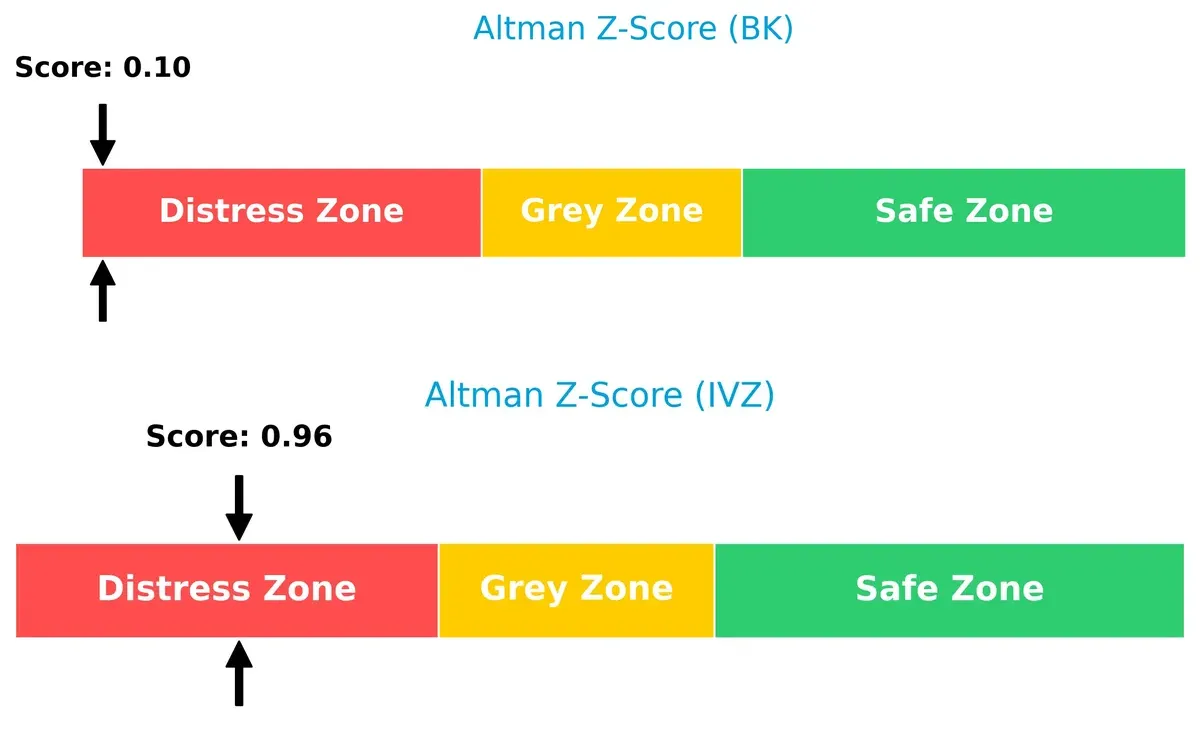

Bankruptcy Risk: Solvency Showdown

The Altman Z-Scores indicate both firms reside in the distress zone, but IVZ’s score (0.96) is nearly tenfold BK’s (0.10), suggesting IVZ faces less immediate bankruptcy risk despite challenges:

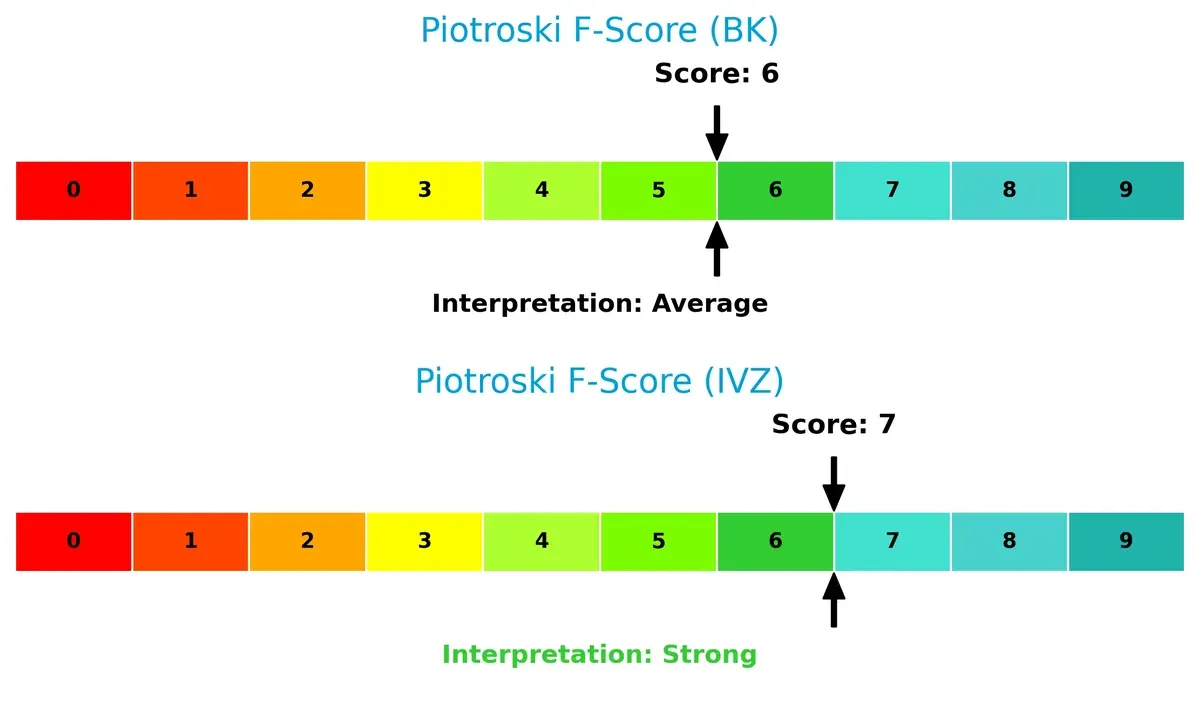

Financial Health: Quality of Operations

Piotroski F-Scores show IVZ at 7 (strong) versus BK’s 6 (average), signaling IVZ’s marginally better operational quality and internal financial metrics. BK’s average score highlights some internal weaknesses despite stronger market scores:

How are the two companies positioned?

This section dissects BK and IVZ’s operational DNA by analyzing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to reveal which model delivers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

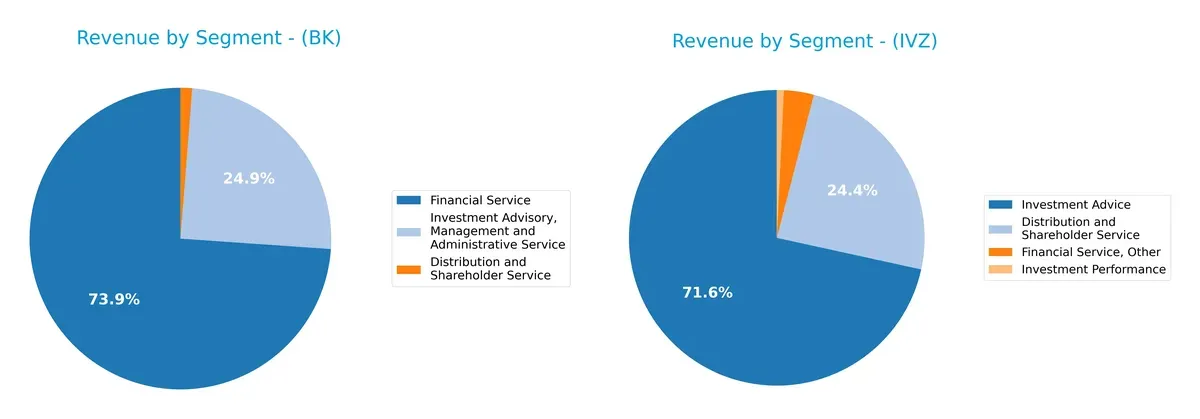

This visual comparison dissects how The Bank of New York Mellon Corporation and Invesco Ltd. diversify income streams and where their primary sector bets lie:

The Bank of New York Mellon anchors 9.3B USD in Financial Service, complemented by 3.1B in Investment Advisory and 158M in Distribution services, showing a strong concentration in financial infrastructure. Invesco pivots on a broad 4.3B USD Investment Advice base, with 1.5B from Distribution and smaller Financial Service contributions. BK’s concentration signals infrastructure dominance but carries sector concentration risk. IVZ’s more balanced mix suggests strategic diversification across advisory and distribution channels.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of BK and IVZ based on diversification, profitability, financials, innovation, global presence, and market share:

BK Strengths

- Diverse revenue streams across financial and investment advisory services

- Strong net margin at 14.14%

- Favorable P/E of 14.74

- Low debt-to-assets ratio at 7.17%

- Significant presence in US, EMEA, Asia Pacific

- High fixed asset turnover at 10.96

IVZ Strengths

- Favorable dividend yield at 3.18%

- Low debt and debt-to-assets ratios

- Favorable P/E and P/B ratios despite losses

- Stable revenue from distribution and investment advice

- Geographic diversification across Americas, EMEA, Asia

BK Weaknesses

- Unfavorable current and quick ratios at 0.7 indicating liquidity risk

- WACC at 19.98% exceeds ROIC at 6.38%

- Low interest coverage at 0.34

- Unfavorable asset turnover at 0.08

- Neutral ROE at 12.52%

- Slightly unfavorable overall financial ratio profile

IVZ Weaknesses

- Negative net margin and zero ROE and ROIC

- Unfavorable current and quick ratios at 0

- Negative interest coverage at -6.63

- Unavailable WACC data limits cost of capital insight

- Unfavorable asset and fixed asset turnover

- Overall unfavorable financial ratio profile

BK demonstrates broader revenue diversification and stronger profitability metrics, but struggles with liquidity and capital efficiency. IVZ shows weakness in profitability and liquidity despite some favorable valuation metrics. Both face financial challenges that may impact strategic flexibility.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only true shield against competitive forces eroding long-term profits. Let’s dissect the moats of two asset managers:

The Bank of New York Mellon Corporation: Custody and Integration Moat

BK’s primary moat lies in its comprehensive custody services and integrated wealth management. This manifests in stable margins and improving ROIC trends despite value destruction. Expansion into data analytics and prime brokerage in 2026 could strengthen its position.

Invesco Ltd.: Diversified Product Moat

Invesco’s moat depends on its broad product mix across equities, fixed income, and alternatives, contrasting BK’s custody focus. However, declining ROIC and unfavorable margin trends weaken its moat. Growth in quantitative strategies and alternative assets offers a chance to reverse this trend.

Custody Integration vs. Product Diversification: Who Holds the Moat Edge?

BK’s slightly unfavorable but improving moat outpaces IVZ’s deteriorating competitive defensibility. BK’s entrenched client relationships and expanding service lines better equip it to defend market share in 2026.

Which stock offers better returns?

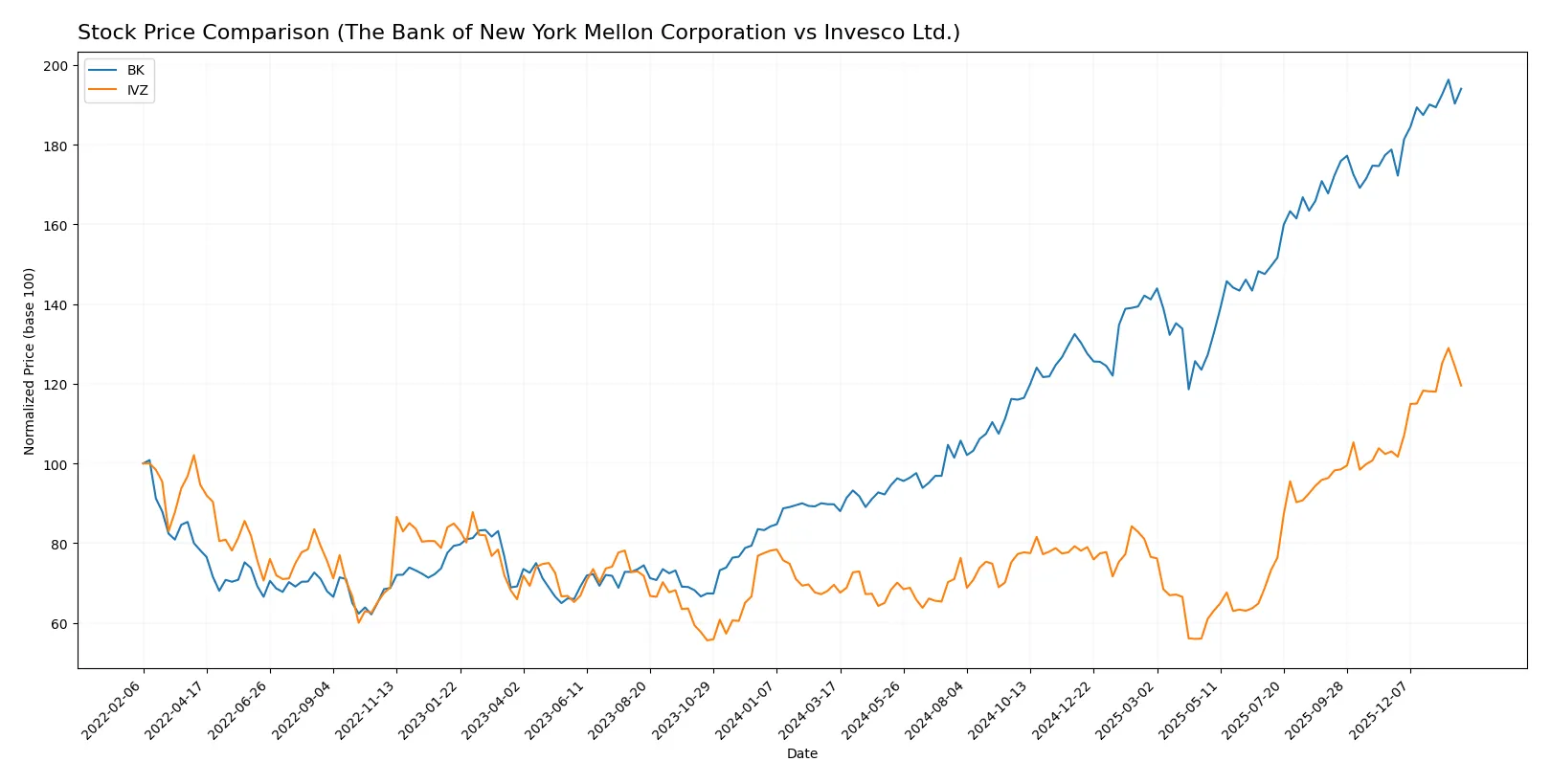

The past year shows robust price gains for both stocks, with The Bank of New York Mellon accelerating higher and Invesco Ltd. also trending upward but with lower volatility.

Trend Comparison

The Bank of New York Mellon’s stock rose 116.19% over the past 12 months, marking a bullish trend with accelerating momentum and a high price peak at 121.33. Volatility is elevated at a 19.39 standard deviation.

Invesco Ltd. increased 71.85% in the same period, also bullish with acceleration, but with far lower volatility at 3.99 standard deviation and a highest price of 29.44.

Comparing both, The Bank of New York Mellon delivered the highest market performance, outperforming Invesco Ltd. by over 44 percentage points in price appreciation.

Target Prices

Analysts present a cautiously optimistic consensus on target prices for both The Bank of New York Mellon Corporation and Invesco Ltd.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| The Bank of New York Mellon Corporation | 110 | 143 | 130.25 |

| Invesco Ltd. | 24 | 34.5 | 29.8 |

The target consensus for BK stands roughly 8.5% above its current price of $119.92, signaling moderate upside. IVZ’s target consensus exceeds its $27.29 price by about 9.3%, indicating similar potential gains.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The Bank of New York Mellon Corporation Grades

The latest institutional grades for The Bank of New York Mellon Corporation are as follows:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-01-14 |

| Morgan Stanley | Maintain | Overweight | 2026-01-14 |

| RBC Capital | Maintain | Sector Perform | 2026-01-14 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-14 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2026-01-14 |

| Truist Securities | Upgrade | Buy | 2026-01-07 |

| TD Cowen | Maintain | Buy | 2026-01-07 |

| Barclays | Maintain | Overweight | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| TD Cowen | Maintain | Buy | 2025-10-20 |

Invesco Ltd. Grades

The latest institutional grades for Invesco Ltd. are as follows:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | Maintain | Neutral | 2026-01-28 |

| Barclays | Maintain | Equal Weight | 2026-01-28 |

| RBC Capital | Maintain | Outperform | 2026-01-28 |

| Argus Research | Maintain | Buy | 2026-01-28 |

| RBC Capital | Upgrade | Outperform | 2026-01-21 |

| JP Morgan | Maintain | Neutral | 2026-01-20 |

| Barclays | Maintain | Equal Weight | 2026-01-15 |

| Deutsche Bank | Upgrade | Buy | 2025-12-17 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-17 |

| Barclays | Maintain | Equal Weight | 2025-12-12 |

Which company has the best grades?

The Bank of New York Mellon Corporation has several “Buy” and “Overweight” ratings, while Invesco Ltd. mainly receives “Equal Weight” and “Neutral” grades, with some “Outperform” and “Buy” upgrades. Investors might interpret this as stronger institutional confidence in The Bank of New York Mellon Corporation’s near-term prospects.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing The Bank of New York Mellon Corporation and Invesco Ltd. in the 2026 market environment:

1. Market & Competition

The Bank of New York Mellon Corporation

- Strong heritage with diversified financial services but faces intense competition in asset management.

Invesco Ltd.

- Smaller scale with niche investment products but contends with larger, diversified asset managers.

2. Capital Structure & Debt

The Bank of New York Mellon Corporation

- Moderate debt-to-equity ratio (0.76) with unfavorable interest coverage (0.34) signals some risk in servicing debt.

Invesco Ltd.

- Virtually no reported debt, reducing financial risk but possibly limiting leverage for growth.

3. Stock Volatility

The Bank of New York Mellon Corporation

- Beta at 1.109 indicates moderate volatility relative to the market.

Invesco Ltd.

- Higher beta of 1.626 shows elevated sensitivity to market swings, increasing risk.

4. Regulatory & Legal

The Bank of New York Mellon Corporation

- Large financial institution subject to strict regulatory scrutiny, increasing compliance costs.

Invesco Ltd.

- Asset manager exposed to regulations across multiple jurisdictions, with potential compliance complexity.

5. Supply Chain & Operations

The Bank of New York Mellon Corporation

- Complex operational infrastructure with extensive technology and data management requirements.

Invesco Ltd.

- Leaner operational model but dependent on third-party platforms and market data providers.

6. ESG & Climate Transition

The Bank of New York Mellon Corporation

- Active in renewable energy investments but must manage transition risks in traditional finance.

Invesco Ltd.

- May face pressure to enhance ESG integration amid increasing investor demands.

7. Geopolitical Exposure

The Bank of New York Mellon Corporation

- Global footprint exposes it to geopolitical risks including regulatory changes and market instability.

Invesco Ltd.

- Concentrated presence primarily in the US and Bermuda lowers some geopolitical risks but limits diversification.

Which company shows a better risk-adjusted profile?

The Bank of New York Mellon’s most impactful risk is its strained capital structure, notably weak interest coverage despite a solid market position. Invesco struggles primarily with poor profitability and high stock volatility, heightening downside risk. I judge BK has a better risk-adjusted profile, supported by its larger scale and more stable financial metrics despite some leverage concerns. The alarming Altman Z-Scores for both firms signal distress zones, but Invesco’s negative margins and zero ROIC intensify my caution.

Final Verdict: Which stock to choose?

The Bank of New York Mellon Corporation (BK) showcases a superpower in steadily improving profitability and robust cash flow generation. Its growing return on invested capital hints at improving operational efficiency, but the weak liquidity ratios remain a point of vigilance. BK suits portfolios aiming for stable income with moderate growth ambitions.

Invesco Ltd. (IVZ) holds a strategic moat in its diversified asset management platform, offering recurring revenue streams and a defensive dividend yield. Compared to BK, IVZ appears riskier given its declining profitability and weaker financial health, yet it appeals to investors focused on value and potential turnaround plays.

If you prioritize consistent profitability and improving capital efficiency, BK is the compelling choice due to its stronger operational fundamentals and bullish price momentum. However, if you seek value opportunities with higher dividend yield potential and can tolerate financial instability, IVZ offers a scenario worth monitoring for a cyclical recovery.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Bank of New York Mellon Corporation and Invesco Ltd. to enhance your investment decisions: