Home > Comparison > Financial Services > NTRS vs IVZ

The strategic rivalry between Northern Trust Corporation and Invesco Ltd. defines the current trajectory of the asset management industry. Northern Trust operates as a comprehensive wealth and asset servicing provider with a strong institutional focus. Invesco, by contrast, emphasizes broad investment management with a diverse product suite targeting retail and institutional clients. This analysis explores which business model delivers superior risk-adjusted returns amid evolving market dynamics, guiding portfolio allocation decisions in financial services.

Table of contents

Companies Overview

Northern Trust Corporation and Invesco Ltd. stand as pivotal players in the global asset management landscape.

Northern Trust Corporation: Wealth and Institutional Asset Specialist

Northern Trust Corporation dominates as a financial holding company focused on wealth management and asset servicing. Its revenue streams flow from servicing institutional clients and high-net-worth individuals through custody, investment management, and banking solutions. In 2026, it sharpens its competitive edge by balancing asset servicing with personalized wealth management, targeting both institutional and family offices.

Invesco Ltd.: Global Investment Manager

Invesco Ltd. operates as a public investment manager specializing in retail, institutional, and high-net-worth client portfolios. It generates income by managing diversified equity, fixed income, and alternative investments, including mutual funds and ETFs. In 2026, Invesco focuses on expanding its product mix and deploying quantitative strategies to capture growth across global markets.

Strategic Collision: Similarities & Divergences

Both firms compete fiercely in asset management but differ in approach. Northern Trust emphasizes a bespoke, service-driven model blending trust and banking with asset servicing. Invesco pursues a scale-driven, diversified product strategy with a strong quantitative edge. Their battleground centers on institutional and high-net-worth clients, yet their distinct operational models craft unique investment profiles for shareholders.

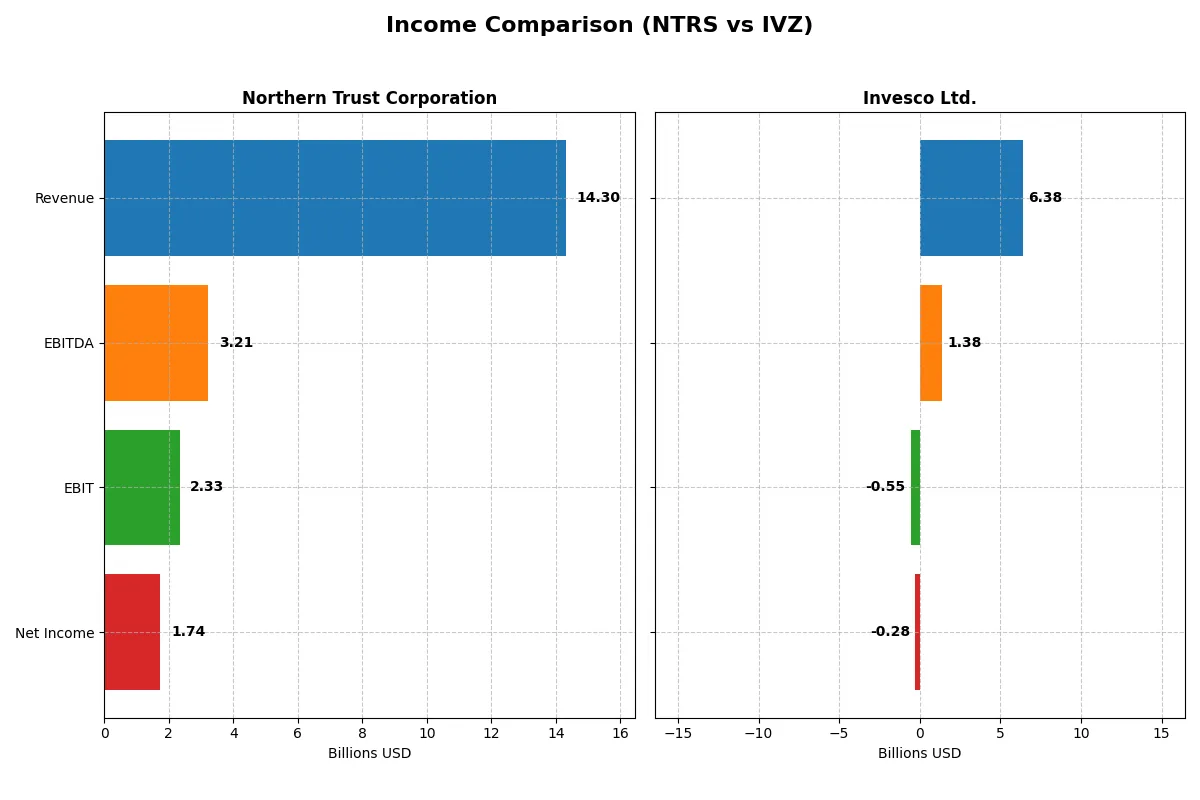

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Northern Trust Corporation (NTRS) | Invesco Ltd. (IVZ) |

|---|---|---|

| Revenue | 14.3B | 6.38B |

| Cost of Revenue | 6.21B | 3.62B |

| Operating Expenses | 5.75B | 3.45B |

| Gross Profit | 8.09B | 2.75B |

| EBITDA | 3.21B | 1.38B |

| EBIT | 2.33B | -547M |

| Interest Expense | 6.21B | 82.5M |

| Net Income | 1.74B | -282M |

| EPS | 8.79 | -1.61 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company converts revenue into profit more efficiently amidst recent economic challenges.

Northern Trust Corporation Analysis

Northern Trust’s revenue surged 120% from 2021 to 2025, peaking at 14.3B in 2025 despite a 10% dip from 2024. Its net income grew 12.4% overall, finishing at 1.7B in 2025. Northern Trust sustains strong gross (56.5%) and net margins (12.2%), reflecting disciplined cost control and stable profitability despite a slight margin contraction.

Invesco Ltd. Analysis

Invesco’s revenue declined 7.5% over five years, reaching 6.4B in 2025 but showing a 5% growth from the prior year. The company posted a net loss of 281M in 2025, reversing prior profits. Gross margin of 43.2% contrasts with a negative net margin (-4.4%), driven by high operating and other expenses eroding profitability and signaling operational challenges.

Margin Power vs. Revenue Scale

Northern Trust clearly outperforms Invesco with higher revenue scale and consistent profitability. While Northern Trust’s margins remain healthy despite slight recent declines, Invesco struggles with sustained losses and weaker margin metrics. Investors prioritizing stable earnings and operational efficiency will find Northern Trust’s profile more attractive.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Northern Trust Corporation (NTRS) | Invesco Ltd. (IVZ) |

|---|---|---|

| ROE | 13.4% (2025) | 5.3% (2024) |

| ROIC | 5.0% (2025) | 2.4% (2024) |

| P/E | 14.7 (2025) | 10.3 (2024) |

| P/B | 2.0 (2025) | 0.55 (2024) |

| Current Ratio | 0.41 (2025) | 3.14 (2024) |

| Quick Ratio | 0.41 (2025) | 3.14 (2024) |

| D/E (Debt-to-Equity) | 1.27 (2025) | 0.52 (2024) |

| Debt-to-Assets | 9.3% (2025) | 28.0% (2024) |

| Interest Coverage | 0.38 (2025) | 14.3 (2024) |

| Asset Turnover | 0.08 (2025) | 0.22 (2024) |

| Fixed Asset Turnover | 30.8 (2025) | 12.7 (2024) |

| Payout ratio | 33.5% (2025) | 78.5% (2024) |

| Dividend yield | 2.3% (2025) | 7.6% (2024) |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, uncovering hidden risks and revealing operational strengths and weaknesses essential for investment decisions.

Northern Trust Corporation

Northern Trust delivers solid profitability with a 13.4% ROE and a favorable 12.15% net margin. Its valuation appears reasonable, trading at a P/E of 14.75 and P/B of 1.98. The firm rewards shareholders with a 2.27% dividend yield, reflecting confidence in steady cash flow amid some operational inefficiencies.

Invesco Ltd.

Invesco struggles with negative profitability metrics, including a -11.39% net margin and zero ROE. Despite an unusual negative P/E of -16.37, its valuation signals market challenges. The 3.18% dividend yield offers some income, but the firm’s lack of operational efficiency and negative returns raise caution.

Premium Valuation vs. Operational Safety

Northern Trust balances profitability and valuation more effectively than Invesco, which suffers from weak earnings and operational issues. Investors prioritizing income stability and moderate growth may lean toward Northern Trust’s profile, while those accepting higher risk might consider Invesco’s yield despite its unfavorable fundamentals.

Which one offers the Superior Shareholder Reward?

Northern Trust Corporation (NTRS) delivers a more balanced and sustainable shareholder reward compared to Invesco Ltd. (IVZ). NTRS maintains a solid dividend yield around 3.1% with a manageable payout ratio near 33%, underpinned by stable free cash flow. Its buyback activity is moderate, supporting steady capital return without compromising growth. IVZ pays a higher dividend yield near 7.6% but suffers from negative net margins and volatile earnings, raising sustainability concerns. IVZ’s payout ratio spikes above 78%, risking future cuts. Despite decent buyback programs, IVZ’s earnings instability and weaker cash coverage undermine its total return profile. I conclude that NTRS offers a superior long-term total shareholder return due to its prudent capital allocation and robust dividend sustainability in 2026.

Comparative Score Analysis: The Strategic Profile

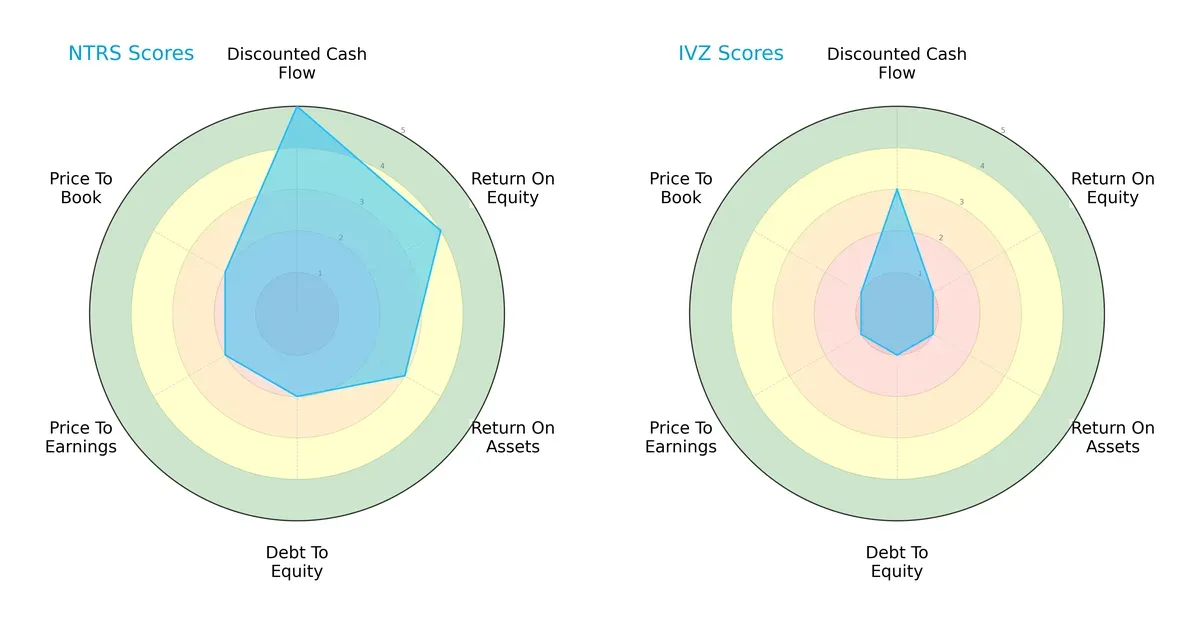

The radar chart reveals the fundamental DNA and trade-offs of Northern Trust Corporation and Invesco Ltd.:

Northern Trust exhibits a more balanced profile with strong discounted cash flow (5) and favorable returns on equity (4) and assets (3). Its moderate debt-to-equity (2) and valuation scores (P/E and P/B at 2) suggest prudent capital management. Invesco relies on a weaker edge, scoring very unfavorably (1) across most metrics, indicating operational and valuation challenges. Northern Trust stands as the stronger, more diversified performer.

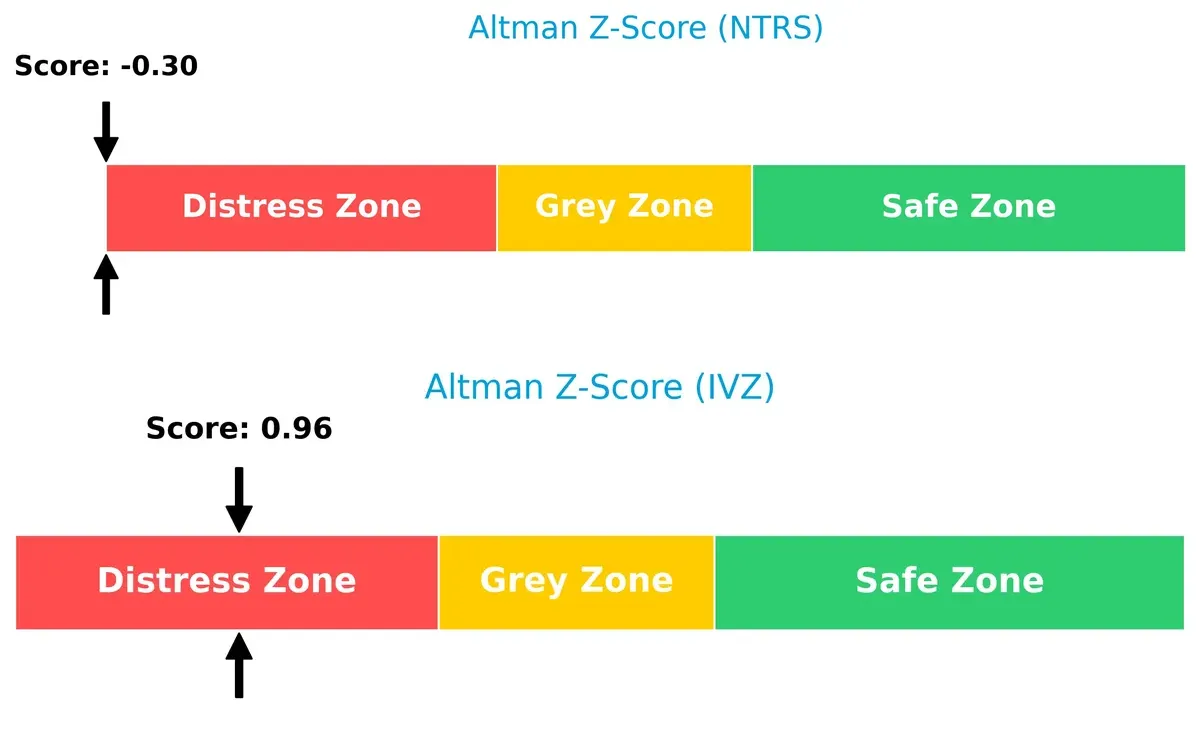

Bankruptcy Risk: Solvency Showdown

Northern Trust’s Altman Z-Score of -0.30 versus Invesco’s 0.96 places both firms in the distress zone, signaling elevated bankruptcy risks. However, Invesco’s slightly higher score suggests marginally better solvency prospects in this challenging market cycle:

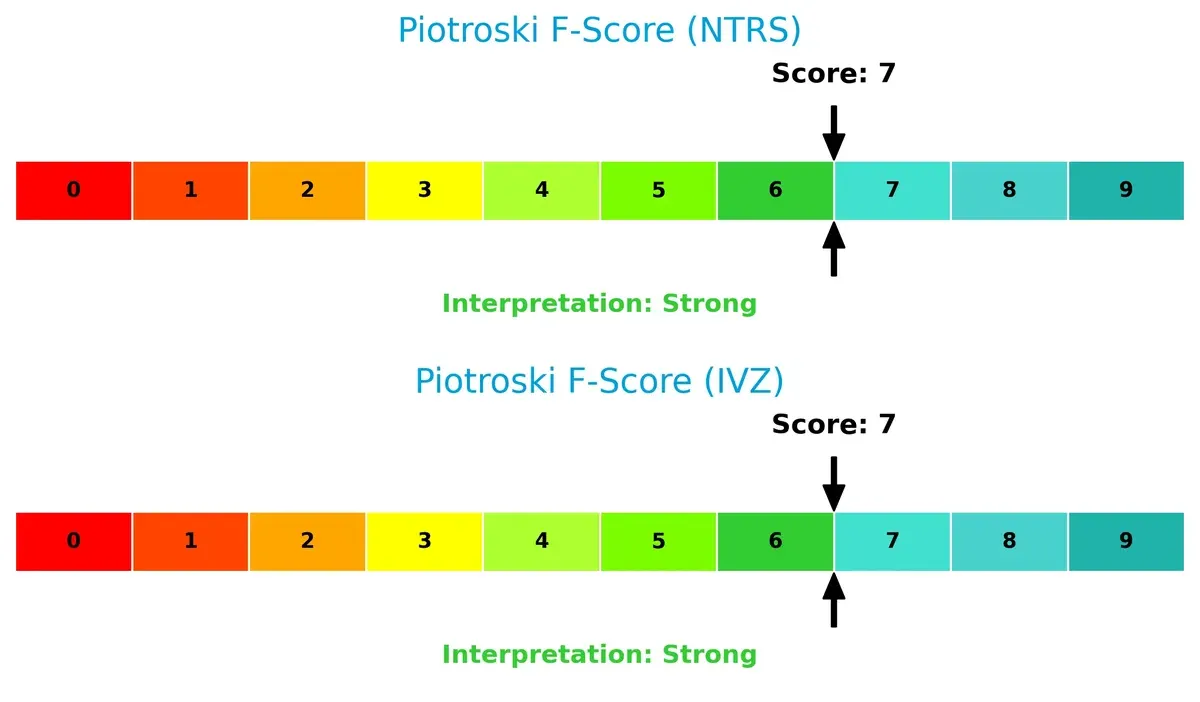

Financial Health: Quality of Operations

Both companies share a strong Piotroski F-Score of 7, indicating solid financial health and operational quality. Neither firm shows immediate red flags, but vigilance remains prudent given their distress-zone solvency scores:

How are the two companies positioned?

This section dissects the operational DNA of Northern Trust and Invesco by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to reveal which model delivers the most resilient competitive advantage today.

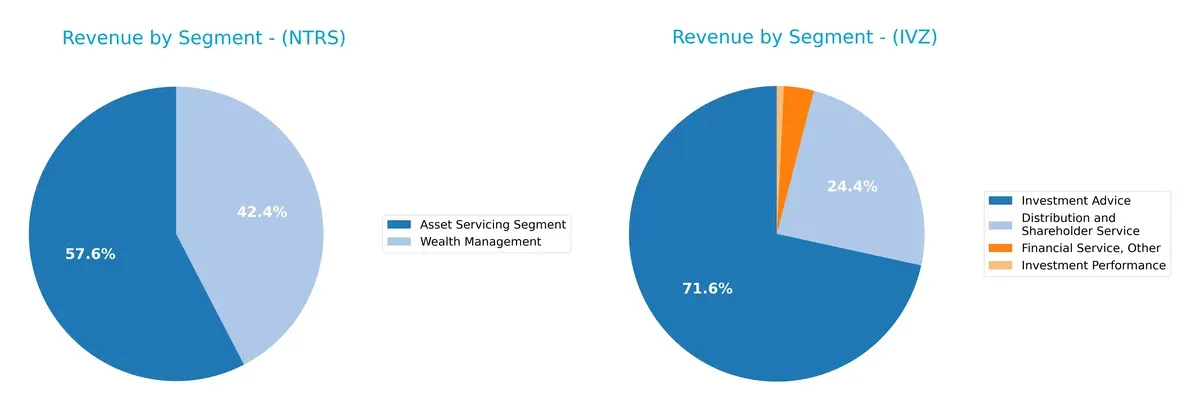

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Northern Trust and Invesco diversify their income streams and where their primary sector bets lie:

Northern Trust pivots on Asset Servicing with $4.37B, alongside Wealth Management at $3.21B, showing moderate diversification. Invesco dwarfs with $4.34B in Investment Advice but anchors less in Distribution at $1.48B. Northern Trust’s dual focus reduces concentration risk, while Invesco’s heavy reliance on advisory services signals ecosystem lock-in but heightens vulnerability to market shifts.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Northern Trust Corporation and Invesco Ltd.:

Northern Trust Corporation Strengths

- Diversified revenue from Asset Servicing and Wealth Management

- Favorable net margin at 12.15%

- Strong fixed asset turnover at 30.78

- Low debt-to-assets ratio at 9.27%

- Dividend yield at 2.27%

- Significant domestic and foreign revenue streams

Invesco Ltd. Strengths

- Diverse revenue streams including Investment Advice and Distribution Services

- Favorable price-to-earnings and price-to-book ratios

- Dividend yield higher at 3.18%

- Favorable debt-to-equity and debt-to-assets ratios

- Broad geographic presence across Americas, Asia, and EMEA

Northern Trust Corporation Weaknesses

- Current and quick ratios low at 0.41, indicating liquidity concerns

- Debt-to-equity ratio unfavorable at 1.27

- Interest coverage very low at 0.38

- Asset turnover weak at 0.08

- ROIC below WACC, signaling capital inefficiency

Invesco Ltd. Weaknesses

- Negative net margin at -11.39% and zero ROE and ROIC show profitability issues

- Interest coverage negative at -6.63, raising solvency risks

- Zero current and quick ratios suggest liquidity challenges

- Asset and fixed asset turnover at zero indicate operational inefficiency

Northern Trust shows operational strengths in asset turnover and steady profitability but faces liquidity and capital efficiency challenges. Invesco displays broad diversification and strong leverage metrics yet struggles with profitability and liquidity, which may impact strategic resilience.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole safeguard preserving long-term profits from relentless competitive pressure. Let’s dissect how each firm defends its franchise:

Northern Trust Corporation: Intangible Asset Moat

Northern Trust leverages deep client trust and sophisticated wealth management expertise. This moat shows in stable margins near 16% EBIT, despite recent revenue dips. Expansion into global markets in 2026 could reinforce its intangible advantage.

Invesco Ltd.: Cost and Scale Advantage

Invesco competes on scale and diversified asset offerings, contrasting Northern Trust’s niche focus. Yet, it struggles with negative EBIT margins and declining earnings, signaling a fragile moat. Growth opportunities hinge on cost control and innovative products to regain footing.

Legacy Relationships vs. Scale Efficiency

Northern Trust’s moat is deeper, rooted in client loyalty and specialized services. Invesco’s scale offers potential but currently lacks profitability resilience. Northern Trust appears better equipped to defend and grow its market share in 2026.

Which stock offers better returns?

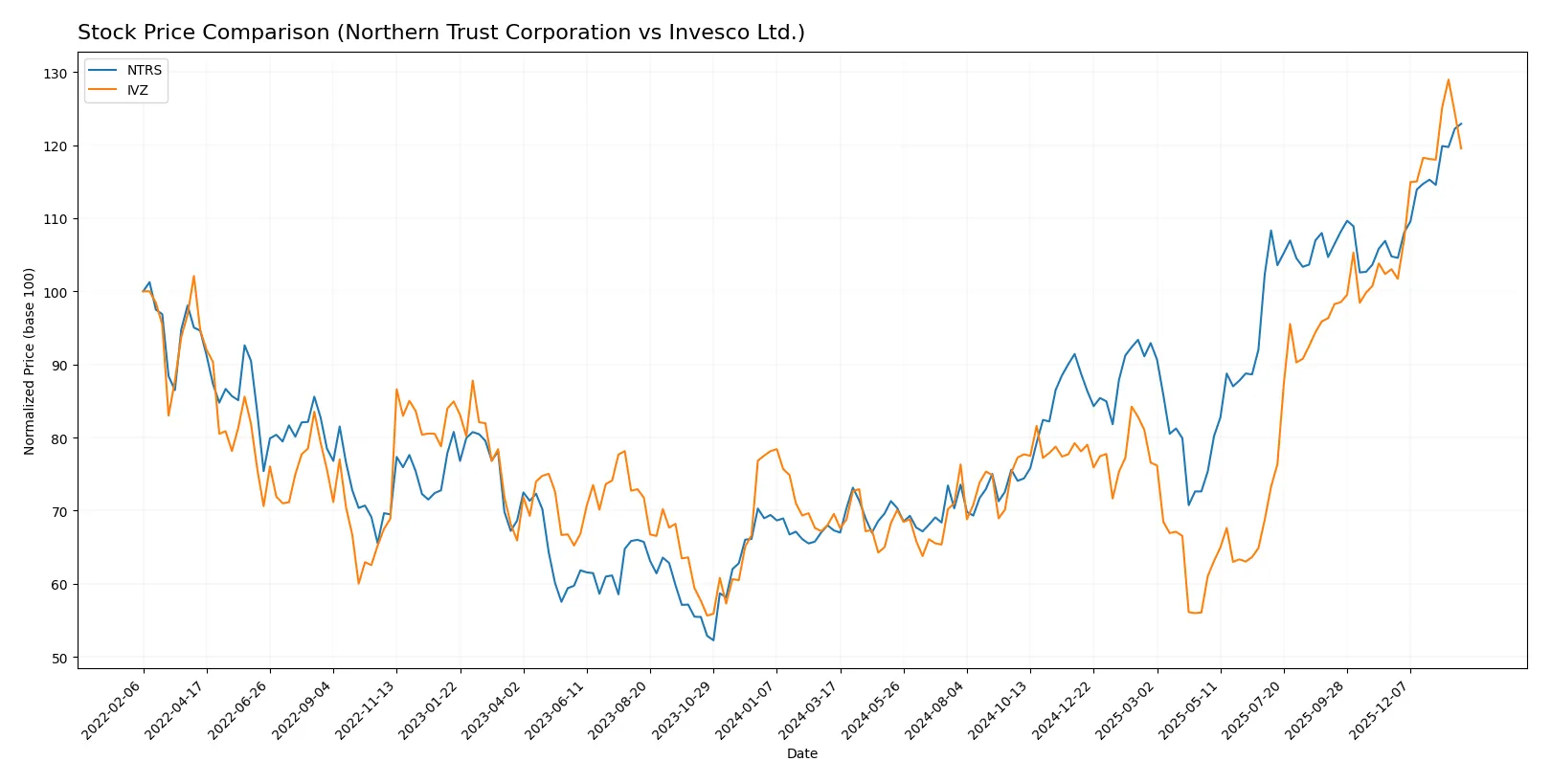

Northern Trust Corporation and Invesco Ltd. both show strong upward price movements over the past year, with notable acceleration and distinct trading volume dynamics.

Trend Comparison

Northern Trust Corporation’s stock surged 82.65% over the past year, showing a bullish trend with accelerating momentum and higher volatility (std dev 19.71). The price ranged from 81.45 to 149.43.

Invesco Ltd.’s stock rose 71.85% over the same period, also bullish with acceleration, but exhibited lower volatility (std dev 3.99). The price moved between 12.78 and 29.44.

Northern Trust delivered stronger market performance, outpacing Invesco by nearly 11 percentage points in price appreciation over the past year.

Target Prices

Analysts present a moderate upside potential for both Northern Trust Corporation and Invesco Ltd.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Northern Trust Corporation | 131 | 160 | 146.17 |

| Invesco Ltd. | 24 | 34.5 | 29.8 |

Northern Trust’s consensus target of 146.17 is near its current price of 149.43, suggesting limited upside. Invesco’s target of 29.8 exceeds its current 27.29, indicating potential appreciation but with moderate risk.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Northern Trust Corporation Grades

The following table summarizes recent institutional grades for Northern Trust Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | Maintain | Sell | 2026-01-28 |

| Citigroup | Maintain | Neutral | 2026-01-28 |

| TD Cowen | Maintain | Buy | 2026-01-26 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-23 |

| RBC Capital | Maintain | Outperform | 2026-01-23 |

| Evercore ISI Group | Maintain | In Line | 2026-01-23 |

| Morgan Stanley | Maintain | Underweight | 2026-01-23 |

| TD Cowen | Maintain | Buy | 2026-01-07 |

| Barclays | Maintain | Equal Weight | 2026-01-05 |

| Citigroup | Maintain | Neutral | 2025-12-30 |

Invesco Ltd. Grades

The following table summarizes recent institutional grades for Invesco Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | Maintain | Neutral | 2026-01-28 |

| Barclays | Maintain | Equal Weight | 2026-01-28 |

| RBC Capital | Maintain | Outperform | 2026-01-28 |

| Argus Research | Maintain | Buy | 2026-01-28 |

| RBC Capital | Upgrade | Outperform | 2026-01-21 |

| JP Morgan | Maintain | Neutral | 2026-01-20 |

| Barclays | Maintain | Equal Weight | 2026-01-15 |

| Deutsche Bank | Upgrade | Buy | 2025-12-17 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-17 |

| Barclays | Maintain | Equal Weight | 2025-12-12 |

Which company has the best grades?

Invesco Ltd. has received more positive upgrades and buy ratings than Northern Trust. This suggests stronger institutional confidence, which may influence investor sentiment and stock performance.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Northern Trust Corporation

- Strong brand in wealth and asset servicing; faces pressure from fintech innovation and low interest rates.

Invesco Ltd.

- Struggles with profitability; intense competition in asset management and ETF markets pressures margins.

2. Capital Structure & Debt

Northern Trust Corporation

- Debt-to-equity ratio of 1.27 is unfavorable; interest coverage at 0.38 signals risk in debt servicing.

Invesco Ltd.

- Zero debt reported, indicating low financial leverage and reduced bankruptcy risk.

3. Stock Volatility

Northern Trust Corporation

- Beta of 1.285 indicates moderate volatility relative to the market.

Invesco Ltd.

- Higher beta of 1.626 signals greater stock price swings and risk exposure.

4. Regulatory & Legal

Northern Trust Corporation

- Subject to strict financial regulations; compliance costs remain high but manageable.

Invesco Ltd.

- Faces regulatory scrutiny amid ongoing industry reforms; compliance challenges persist.

5. Supply Chain & Operations

Northern Trust Corporation

- Operations rely on technology infrastructure and skilled human capital; disruption risk is moderate.

Invesco Ltd.

- Operational risk elevated due to scale and complexity of global asset management services.

6. ESG & Climate Transition

Northern Trust Corporation

- Increasing focus on ESG investing; adapting products to client demand but transition costs remain.

Invesco Ltd.

- ESG integration incomplete; reputational risk higher as investors demand sustainable portfolios.

7. Geopolitical Exposure

Northern Trust Corporation

- Primarily US-based with global clients; geopolitical tensions impact cross-border flows moderately.

Invesco Ltd.

- Greater international exposure, especially in Europe and Asia; vulnerable to geopolitical shocks.

Which company shows a better risk-adjusted profile?

Northern Trust’s main risk lies in debt servicing with weak interest coverage, highlighting financial strain. Invesco’s largest risk is persistent unprofitability, reflecting deeper operational challenges. Despite Northern Trust’s leverage issues, its diversified business and moderate volatility offer a better risk-adjusted profile. The recent low interest coverage ratio at 0.38 for Northern Trust justifies close monitoring of its financial flexibility.

Final Verdict: Which stock to choose?

Northern Trust Corporation (NTRS) stands out as a cash-generating powerhouse with a history of strong capital efficiency despite facing headwinds in profitability metrics. Its main point of vigilance is a stretched liquidity position, which could pressure short-term resilience. NTRS fits a portfolio focused on aggressive growth with a tolerance for cyclical risks.

Invesco Ltd. (IVZ) offers a strategic moat rooted in recurring revenue streams and relatively conservative leverage, providing a safer harbor amid market uncertainties. However, its profitability challenges and declining ROIC trend temper enthusiasm. IVZ suits investors seeking growth at a reasonable price with a preference for stability over rapid expansion.

If you prioritize capital efficiency and growth potential, Northern Trust outshines thanks to its robust free cash flow and operational leverage. However, if you seek better stability with moderate growth prospects, Invesco offers a more defensive profile despite its profitability struggles. Both present analytical scenarios that require careful risk assessment aligned with your investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Northern Trust Corporation and Invesco Ltd. to enhance your investment decisions: