Home > Comparison > Healthcare > ISRG vs COO

The strategic rivalry between Intuitive Surgical, Inc. and The Cooper Companies, Inc. defines the evolving landscape of the medical instruments and supplies sector. Intuitive Surgical operates as a capital-intensive innovator focused on minimally invasive surgical systems. In contrast, Cooper Companies combines diversified medical devices with a broader healthcare services model. This analysis will evaluate which company’s distinct operational trajectory offers a superior risk-adjusted return for a diversified healthcare portfolio.

Table of contents

Companies Overview

Intuitive Surgical and The Cooper Companies dominate distinct niches within the medical instruments market.

Intuitive Surgical, Inc.: Pioneer in Minimally Invasive Surgical Systems

Intuitive Surgical leads in robotic-assisted surgery, generating revenue primarily from its da Vinci Surgical System. Its innovative technology enables complex surgeries with minimal invasiveness, enhancing patient outcomes. In 2026, the company strategically expanded its portfolio beyond surgery to include diagnostic tools like the Ion endoluminal system, reinforcing its competitive edge in advanced medical instrumentation.

The Cooper Companies, Inc.: Comprehensive Vision and Women’s Health Solutions

The Cooper Companies excels in contact lenses and women’s healthcare products, operating through CooperVision and CooperSurgical segments. It earns revenue by providing corrective lenses and medical devices for fertility and diagnostics worldwide. The firm’s 2026 strategy emphasizes broadening its product lines in family health and eye care, aiming to deepen market penetration across global healthcare sectors.

Strategic Collision: Similarities & Divergences

Both firms innovate within healthcare technology, but Intuitive Surgical focuses on high-tech surgical robotics, while Cooper prioritizes broad medical supplies and vision care. They compete indirectly through advancing patient care solutions but target different clinical needs. Intuitive Surgical offers a capital-intensive, high-margin model, whereas Cooper presents a diversified, volume-driven approach with stable recurring demand.

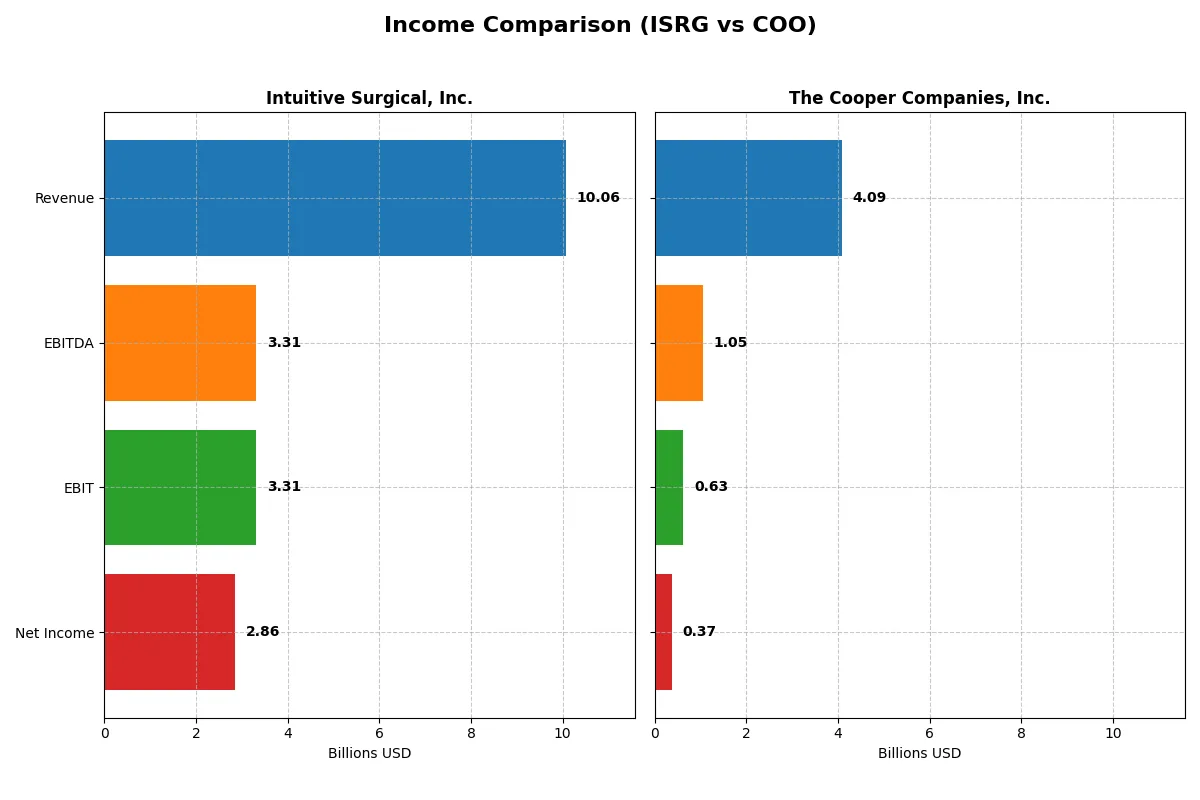

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Intuitive Surgical, Inc. (ISRG) | The Cooper Companies, Inc. (COO) |

|---|---|---|

| Revenue | 10.1B | 4.1B |

| Cost of Revenue | 3.4B | 1.6B |

| Operating Expenses | 3.7B | 1.8B |

| Gross Profit | 6.7B | 2.5B |

| EBITDA | 3.3B | 1.1B |

| EBIT | 3.3B | 630M |

| Interest Expense | 0 | 100M |

| Net Income | 2.9B | 375M |

| EPS | 8.00 | 1.87 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company converts revenue into profit most efficiently, exposing the strengths of their corporate engines.

Intuitive Surgical, Inc. Analysis

Intuitive Surgical’s revenue climbed steadily from 5.7B in 2021 to 10.1B in 2025, with net income rising from 1.7B to 2.9B. Gross margins remain robust at 66%, and net margins hold firm near 28%. Their 2025 results show accelerating EBIT growth, signaling strong operational momentum and efficient cost control.

The Cooper Companies, Inc. Analysis

Cooper Companies grew revenue from 2.9B in 2021 to 4.1B in 2025, but net income declined sharply from 2.9B to 375M. Gross margin is healthy at 61%, yet net margin dropped to 9%, reflecting pressure on profitability. The latest year reveals margin contraction and a notable dip in earnings, indicating operational challenges.

Margin Strength vs. Earnings Trajectory

Intuitive Surgical dominates with superior margin expansion and consistent earnings growth, while Cooper Companies struggles with declining profitability despite revenue gains. Intuitive’s profile suits investors prioritizing stable profit expansion, whereas Cooper exhibits riskier earnings volatility. The clear fundamental winner on efficiency and bottom-line quality is Intuitive Surgical.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Intuitive Surgical, Inc. (ISRG) | The Cooper Companies, Inc. (COO) |

|---|---|---|

| ROE | 14.13% (2024) | 4.55% (2025) |

| ROIC | 11.99% (2024) | 3.98% (2025) |

| P/E | 79.82 (2024) | 37.30 (2025) |

| P/B | 11.28 (2024) | 1.70 (2025) |

| Current Ratio | 4.07 (2024) | 1.89 (2025) |

| Quick Ratio | 3.22 (2024) | 1.13 (2025) |

| D/E | 0.009 (2024) | 0.34 (2025) |

| Debt-to-Assets | 0.008 (2024) | 0.22 (2025) |

| Interest Coverage | 0 (2024) | 6.83 (2025) |

| Asset Turnover | 0.44 (2024) | 0.33 (2025) |

| Fixed Asset Turnover | 1.75 (2024) | 1.97 (2025) |

| Payout ratio | 0% (2024) | 0% (2025) |

| Dividend yield | 0% (2024) | 0% (2025) |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, uncovering hidden risks and revealing operational efficiency and valuation clarity.

Intuitive Surgical, Inc.

Intuitive Surgical posts a strong net margin of 28.38%, signaling operational excellence despite an unfavorable ROE and ROIC at zero. Its P/E ratio of 70.78 indicates a stretched valuation, suggesting high growth expectations. The company retains earnings aggressively with no dividend, focusing on R&D investment at over 13% of revenue.

The Cooper Companies, Inc.

Cooper Companies shows a modest net margin of 9.16% and a low ROE of 4.55%, reflecting subdued profitability. Its P/E of 37.3 is high but more reasonable than Intuitive Surgical’s. The firm maintains a solid liquidity position and manageable leverage, though it returns no dividends, likely reinvesting to support moderate growth and maintain operational stability.

Premium Valuation vs. Operational Safety

Intuitive Surgical carries a premium valuation with superior margin efficiency but lacks return on equity, raising valuation risk. Cooper Companies offers a better balance with slightly favorable ratios and stronger financial stability. Investors seeking growth might lean toward Intuitive Surgical, while those favoring operational safety may prefer Cooper.

Which one offers the Superior Shareholder Reward?

I observe that Intuitive Surgical (ISRG) pays no dividends but reinvests heavily in innovation, reflected in high margins and strong FCF growth. Cooper Companies (COO) also avoids dividends but returns value modestly through smaller buybacks. ISRG’s share buyback intensity and zero payout ratio suggest a more sustainable growth-focused model. COO’s lower margins and higher leverage constrain its distribution flexibility. I conclude ISRG offers a superior total return profile for 2026 investors due to its robust capital allocation and reinvestment strategy.

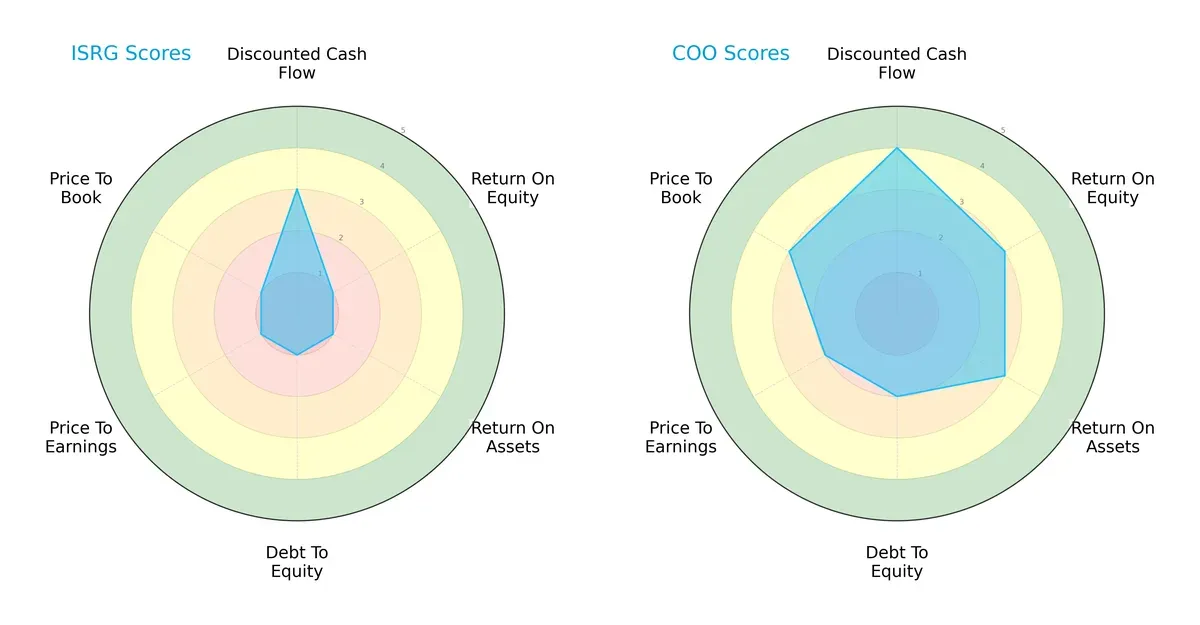

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Intuitive Surgical, Inc. and The Cooper Companies, Inc.:

I observe that The Cooper Companies, Inc. holds a more balanced profile with favorable scores across DCF (4), ROE (3), ROA (3), and valuation metrics (P/E 2, P/B 3). Intuitive Surgical, Inc. relies heavily on a moderate DCF score (3) but shows significant weaknesses in profitability (ROE 1, ROA 1), leverage (Debt/Equity 1), and valuation (P/E 1, P/B 1). Cooper’s moderate debt-to-equity score (2) supports stronger financial stability compared to Intuitive’s concerning leverage.

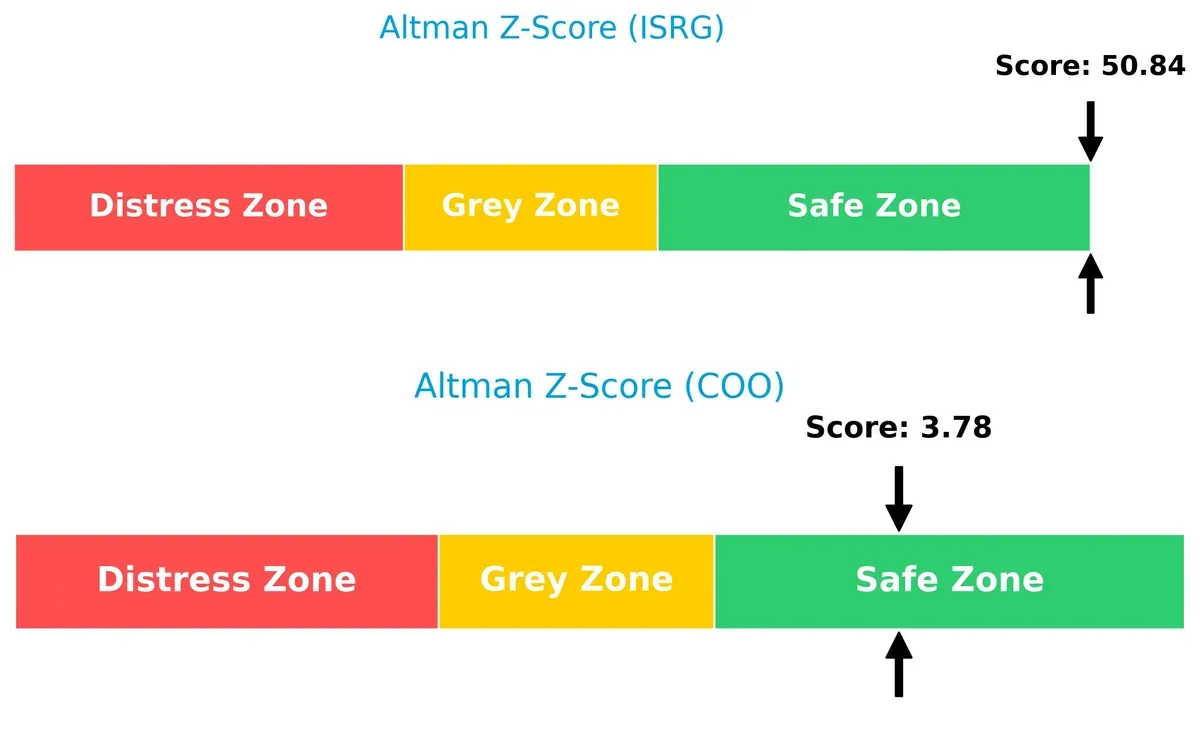

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap highlights a clear solvency advantage for Intuitive Surgical, Inc. with a score of 50.8 versus Cooper’s 3.78, both in the safe zone:

This suggests Intuitive Surgical is exceptionally well-positioned to survive long-term shocks, far surpassing typical industry safety thresholds. Cooper remains safe but with a more modest margin of financial security.

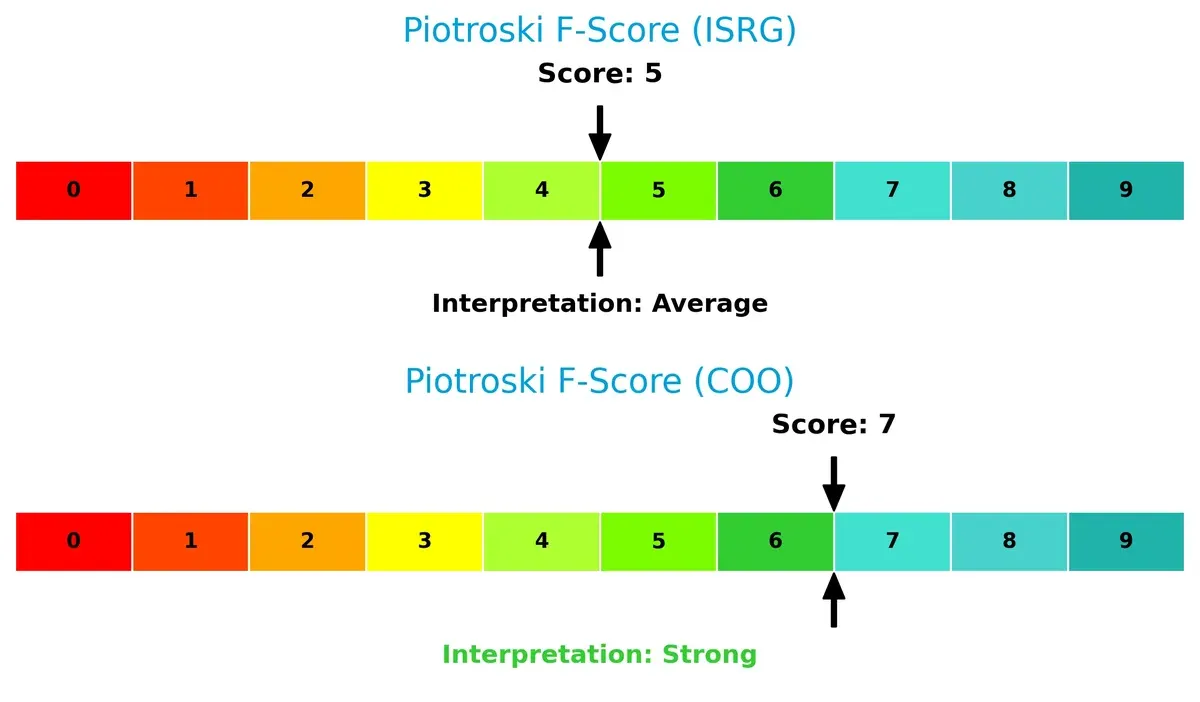

Financial Health: Quality of Operations

The Piotroski F-Score comparison shows The Cooper Companies, Inc. at 7 (strong) and Intuitive Surgical, Inc. at 5 (average), indicating operational quality differences:

Cooper’s higher score signals more consistent profitability, liquidity, and efficiency, while Intuitive’s average score raises caution around internal financial controls and operational strength. Investors should note these red flags when weighing risk exposure.

How are the two companies positioned?

This section dissects the operational DNA of ISRG and COO by comparing revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient, sustainable advantage.

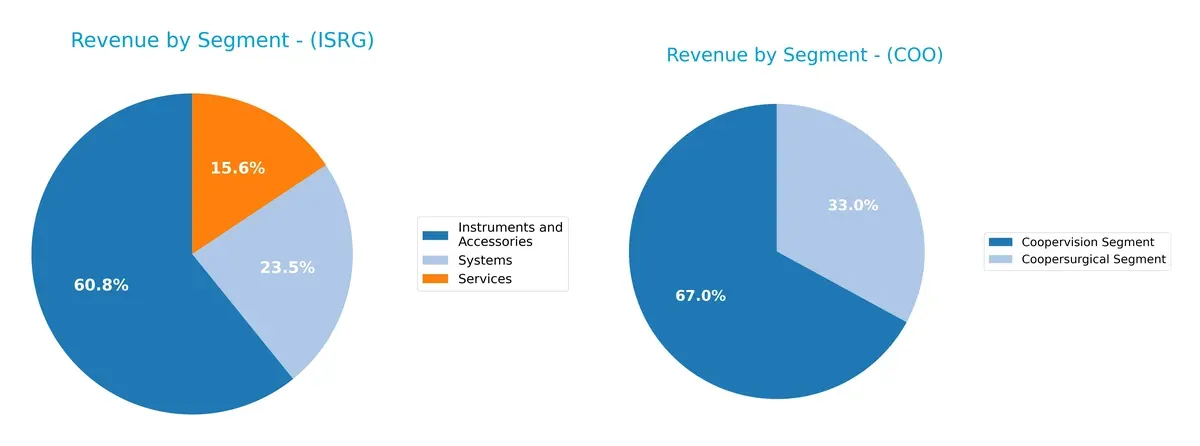

Revenue Segmentation: The Strategic Mix

The following comparison dissects how Intuitive Surgical, Inc. and The Cooper Companies, Inc. diversify their income streams and where their primary sector bets lie:

Intuitive Surgical anchors revenue on Instruments and Accessories with $5.08B in 2024, supported by Systems at $1.97B and Services at $1.31B, showing moderate diversification. Conversely, Cooper Companies pivots mainly on Coopervision at $2.74B, dwarfs its Coopersurgical Segment at $1.35B, indicating higher concentration risk. Intuitive’s broader segment spread signals ecosystem lock-in, while Cooper’s reliance on vision care demands vigilant market monitoring.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Intuitive Surgical, Inc. and The Cooper Companies, Inc.:

Intuitive Surgical, Inc. Strengths

- High net margin at 28.38%

- Favorable debt to equity and debt to assets ratios

- Infinite interest coverage ratio indicates strong ability to cover debt

- Diverse revenue streams across Instruments, Services, and Systems segments

The Cooper Companies, Inc. Strengths

- Favorable current and quick ratios indicate strong liquidity

- Favorable debt management and interest coverage ratios

- Slightly favorable global financial ratios

- Significant global presence with large revenue from US and Europe

Intuitive Surgical, Inc. Weaknesses

- Unfavorable ROE and ROIC at 0% indicate poor profitability efficiency

- Unavailable WACC complicates cost of capital assessment

- Unfavorable PE ratio at 70.78 suggests high valuation risk

- Poor liquidity ratios with current and quick ratios at 0

- Unfavorable asset and fixed asset turnover suggest inefficient asset use

- No dividend yield

The Cooper Companies, Inc. Weaknesses

- Unfavorable ROE and ROIC below WACC highlight value destruction risk

- PE ratio at 37.3 remains relatively high

- Asset turnover is low at 0.33

- No dividend yield

Both companies show strengths in managing debt and interest coverage, but Intuitive Surgical’s profitability metrics and liquidity ratios signal caution. Cooper demonstrates better liquidity and geographic diversification, though profitability efficiency and valuation remain concerns. These factors shape each company’s capacity to invest and grow profitably.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only defense against competition eroding long-term profits. Let’s dissect the core moats of two medical instruments leaders:

Intuitive Surgical, Inc.: Innovation-Driven Switching Costs

Intuitive Surgical leverages high switching costs with its da Vinci system, reflected in strong gross margins (66%) and stable net margins (~28%). Its expansion into diagnostics with the Ion system could deepen this moat in 2026.

The Cooper Companies, Inc.: Diversified Product Portfolio

Cooper Companies relies on product breadth across vision and women’s health, contrasting ISRG’s focused innovation. However, weakening margins (net margin 9%) and declining ROIC signal a shrinking moat, despite global market reach.

Innovation Lock-in vs. Portfolio Breadth: Who Holds the Moat Edge?

Intuitive Surgical’s innovation-driven switching costs create a deeper moat than Cooper’s broad but less profitable portfolio. ISRG remains better positioned to defend and grow market share in 2026.

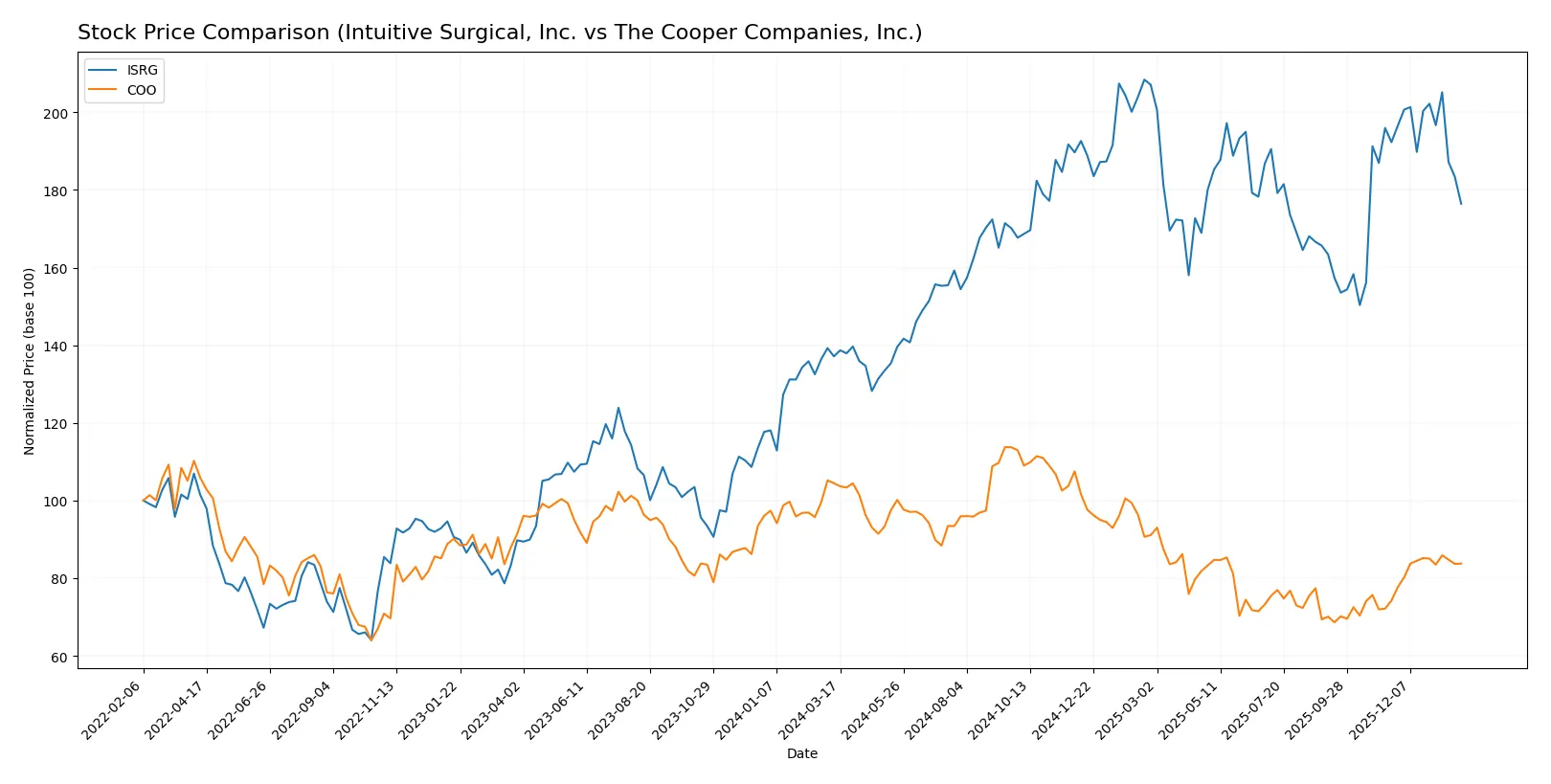

Which stock offers better returns?

Over the past year, Intuitive Surgical, Inc. surged 28.7% before slowing down recently, while The Cooper Companies, Inc. declined sharply overall but gained momentum in the final months.

Trend Comparison

Intuitive Surgical, Inc. shows a bullish trend with a 28.7% gain over 12 months, hitting a high of 595.55, though recent months reveal an 8.2% decline and decelerating momentum.

The Cooper Companies, Inc. exhibits a 19.8% loss over the year, marking a bearish trend, but recent performance improves with a 12.8% uptick and accelerating recovery signs.

Intuitive Surgical leads with higher annual returns despite recent weakness, while Cooper’s late rebound contrasts its prolonged decline.

Target Prices

Analysts show a bullish consensus on Intuitive Surgical and The Cooper Companies, reflecting confidence in their healthcare innovation.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Intuitive Surgical, Inc. | 550 | 750 | 641.25 |

| The Cooper Companies, Inc. | 73 | 100 | 91.75 |

Intuitive Surgical’s consensus target sits about 27% above its current 504 price, signaling strong growth expectations. The Cooper Companies’ target consensus exceeds its 81 current price by 13%, indicating moderate upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Intuitive Surgical, Inc. Grades

The table below lists recent grades from reputable financial institutions for Intuitive Surgical, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Freedom Capital Markets | Buy | Buy | 2026-01-27 |

| Barclays | Maintain | Overweight | 2026-01-26 |

| Bernstein | Maintain | Outperform | 2026-01-23 |

| Citigroup | Maintain | Neutral | 2026-01-23 |

| Evercore ISI Group | Maintain | In Line | 2026-01-23 |

| BTIG | Maintain | Buy | 2026-01-23 |

| Piper Sandler | Maintain | Overweight | 2026-01-23 |

| Bernstein | Maintain | Outperform | 2026-01-09 |

| Barclays | Maintain | Overweight | 2026-01-07 |

| BTIG | Maintain | Buy | 2026-01-07 |

The Cooper Companies, Inc. Grades

The following table shows recent grades assigned to The Cooper Companies, Inc. by financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-26 |

| Citigroup | Maintain | Neutral | 2025-12-08 |

| Goldman Sachs | Maintain | Sell | 2025-12-08 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-08 |

| Mizuho | Maintain | Outperform | 2025-12-05 |

| Stifel | Maintain | Buy | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

| Needham | Maintain | Buy | 2025-12-05 |

| JP Morgan | Maintain | Neutral | 2025-12-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-05 |

Which company has the best grades?

Intuitive Surgical holds consistently strong ratings, including multiple Buy and Outperform grades from top firms. The Cooper Companies’ grades are more mixed, with a notable Sell rating from Goldman Sachs. Investors may view Intuitive Surgical’s more positive consensus as a sign of greater institutional confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Intuitive Surgical, Inc.

- Faces intense innovation pressure in robotic surgery, with high P/E signaling growth expectations.

The Cooper Companies, Inc.

- Competes in diversified medical devices with moderate valuation and stable market segments.

2. Capital Structure & Debt

Intuitive Surgical, Inc.

- Zero debt reported; strong interest coverage but liquidity ratios are unfavorable.

The Cooper Companies, Inc.

- Moderate debt levels with solid current and quick ratios, indicating balanced leverage and liquidity.

3. Stock Volatility

Intuitive Surgical, Inc.

- High beta (1.67) shows elevated price sensitivity to market swings.

The Cooper Companies, Inc.

- Lower beta (1.03) suggests more stable stock price behavior.

4. Regulatory & Legal

Intuitive Surgical, Inc.

- Operates in highly regulated surgical robotics, facing complex FDA scrutiny risks.

The Cooper Companies, Inc.

- Diverse healthcare segments face regulatory risks but with broader product base mitigating impact.

5. Supply Chain & Operations

Intuitive Surgical, Inc.

- Relies on advanced manufacturing for robotic systems; supply disruptions could delay product delivery.

The Cooper Companies, Inc.

- Operates global supply chains for lenses and surgical products, exposed to multi-region logistical risks.

6. ESG & Climate Transition

Intuitive Surgical, Inc.

- Limited public ESG data; technology-focused firms face pressure to demonstrate sustainable innovation.

The Cooper Companies, Inc.

- Increasing focus on sustainable manufacturing and social governance in healthcare products.

7. Geopolitical Exposure

Intuitive Surgical, Inc.

- Global sales subject to trade tensions and export regulations impacting technology transfers.

The Cooper Companies, Inc.

- Broad international footprint with exposure to currency fluctuations and regional healthcare policies.

Which company shows a better risk-adjusted profile?

The Cooper Companies faces manageable debt and lower stock volatility, reflecting a more stable financial footing. Intuitive Surgical’s high valuation and liquidity concerns increase its risk profile. Cooper’s stronger Piotroski score and safe Altman Z-score also signal better risk management. Intuitive Surgical’s aggressive growth stance heightens vulnerability to market swings and operational disruptions. The Cooper Companies thus offers a superior risk-adjusted profile, supported by robust liquidity and moderate leverage trends.

Final Verdict: Which stock to choose?

Intuitive Surgical, Inc. (ISRG) wields a powerhouse advantage in innovation and operational efficiency, driving sustained revenue growth in a complex healthcare market. Its point of vigilance lies in valuation multiples, which appear stretched, suggesting cautious timing. ISRG suits aggressive growth portfolios willing to weather premium pricing for cutting-edge leadership.

The Cooper Companies, Inc. (COO) offers a strategic moat through steady recurring revenues and a balanced capital structure that underpins resilience. Relative to ISRG, it presents a more moderate risk profile with healthier liquidity metrics. COO aligns well with GARP investors seeking stable growth without excessive valuation premiums.

If you prioritize rapid innovation and market dominance, ISRG is the compelling choice due to its superior top-line growth and technological edge. However, if you seek better financial stability and a more conservative risk profile, COO offers better balance, though with slower growth prospects. Each fits distinct investor avatars navigating different tolerance for risk and return.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Intuitive Surgical, Inc. and The Cooper Companies, Inc. to enhance your investment decisions: