Home > Comparison > Healthcare > ISRG vs NOVT

The strategic rivalry between Intuitive Surgical, Inc. and Novanta Inc. shapes innovation in healthcare and technology sectors. Intuitive Surgical operates as a medical instruments leader specializing in minimally invasive surgical systems. Novanta, a precision hardware and photonics provider, supports both medical and industrial markets with advanced components. This head-to-head contrasts a capital-intensive medical innovator against a diversified tech component supplier. The analysis aims to identify which path offers superior risk-adjusted returns for a diversified portfolio.

Table of contents

Companies Overview

Intuitive Surgical and Novanta both hold pivotal roles in advancing technology-driven healthcare solutions.

Intuitive Surgical, Inc.: Pioneer in Minimally Invasive Surgery

Intuitive Surgical dominates the medical instruments sector with its flagship da Vinci Surgical System. It generates revenue by selling advanced robotic surgical platforms and related instruments. In 2026, the company strategically expanded its portfolio into diagnostic procedures with the Ion endoluminal system, enhancing its minimally invasive care offerings globally.

Novanta Inc.: Precision Technology Innovator

Novanta operates in the hardware and equipment sector, providing photonics, vision, and precision motion components primarily to medical and industrial OEMs. Its core revenue comes from diverse laser, imaging, and motion control products. The 2026 focus sharpened on integrating cutting-edge medical-grade technologies and optical solutions to broaden its impact across healthcare and industrial markets.

Strategic Collision: Similarities & Divergences

Both firms emphasize high-tech medical solutions but diverge in approach. Intuitive Surgical owns a closed ecosystem centered on robotic surgery platforms. Novanta supplies components and subsystems, fostering an open infrastructure model. Their primary competition unfolds in healthcare technology innovation, with Intuitive focusing on complete systems and Novanta on critical components. These distinctions create unique investment profiles reflecting system dominance versus diversified hardware specialization.

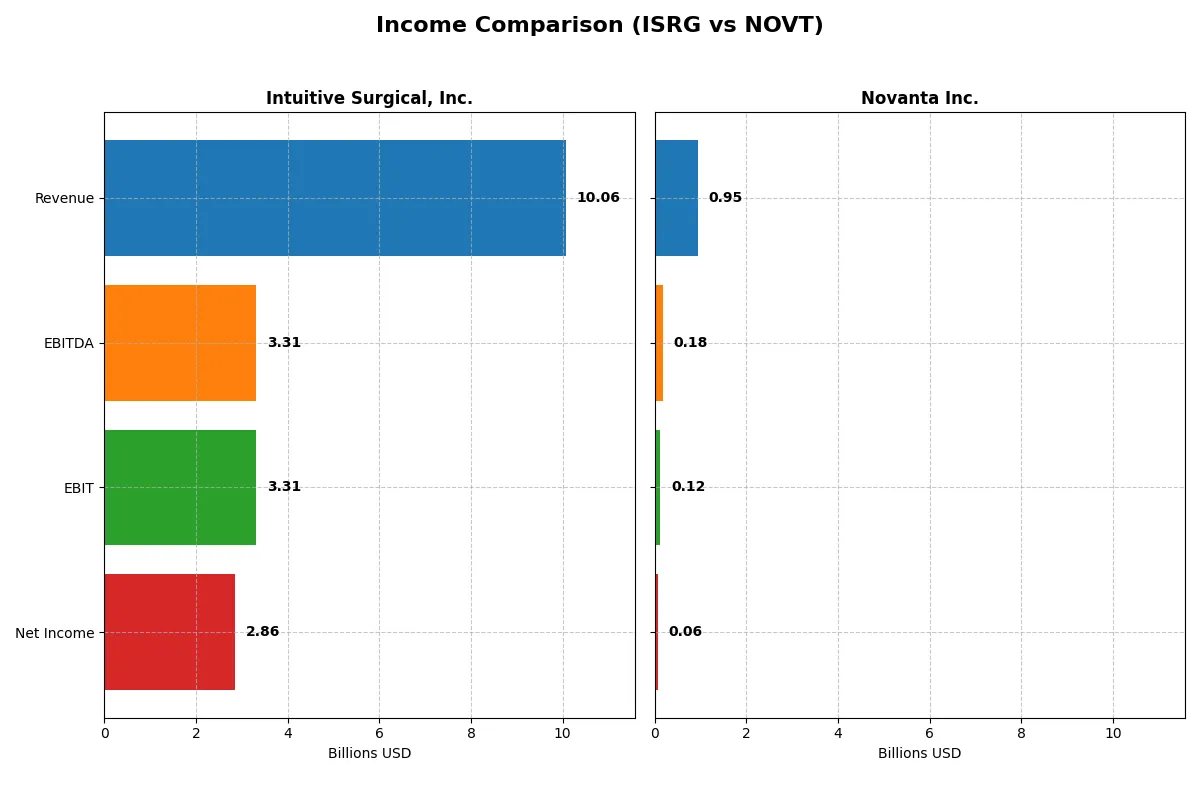

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Intuitive Surgical, Inc. (ISRG) | Novanta Inc. (NOVT) |

|---|---|---|

| Revenue | 10.1B | 949M |

| Cost of Revenue | 3.41B | 528M |

| Operating Expenses | 3.71B | 311M |

| Gross Profit | 6.66B | 422M |

| EBITDA | 3.31B | 180M |

| EBIT | 3.31B | 124M |

| Interest Expense | 0 | 31M |

| Net Income | 2.86B | 64M |

| EPS | 8.00 | 1.78 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company drives true operational efficiency and bottom-line growth through their corporate engines.

Intuitive Surgical, Inc. Analysis

Intuitive Surgical’s revenue surged from 5.7B in 2021 to 10.1B in 2025, with net income rising from 1.7B to 2.9B. Gross margin remains robust at 66%, and net margin stands near 28%, reflecting strong profitability. In 2025, EBIT jumped nearly 41%, underscoring solid momentum and operational leverage.

Novanta Inc. Analysis

Novanta’s revenue climbed steadily from 590M in 2020 to 949M in 2024, with net income growing from 45M to 64M. Gross margin held firm around 44%, while net margin lagged at 6.7%, signaling modest profitability. The latest year showed neutral EBIT growth and declining net margin, indicating margin pressures despite revenue gains.

Margin Strength vs. Revenue Scale

Intuitive Surgical dominates with superior margins and faster profit growth, delivering scale and efficiency unmatched by Novanta. Novanta’s steady revenue rise contrasts with its weaker net margins and stagnant EBIT. For investors, Intuitive Surgical’s profile offers a more compelling blend of high margins and accelerating earnings growth.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Intuitive Surgical, Inc. (ISRG) | Novanta Inc. (NOVT) |

|---|---|---|

| ROE | 14.13% (2024) | 8.59% (2024) |

| ROIC | 11.99% (2024) | 7.25% (2024) |

| P/E | 79.82 (2024) | 85.70 (2024) |

| P/B | 11.28 (2024) | 7.37 (2024) |

| Current Ratio | 4.07 (2024) | 2.58 (2024) |

| Quick Ratio | 3.22 (2024) | 1.72 (2024) |

| D/E | 0.01 (2024) | 0.63 (2024) |

| Debt-to-Assets | 0.78% (2024) | 33.92% (2024) |

| Interest Coverage | N/A | 3.51 (2024) |

| Asset Turnover | 0.44 (2024) | 0.68 (2024) |

| Fixed Asset Turnover | 1.75 (2024) | 6.08 (2024) |

| Payout ratio | 0% (2024) | 0% (2024) |

| Dividend yield | 0% (2024) | 0% (2024) |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, revealing hidden risks and operational excellence that shape investor confidence and long-term value.

Intuitive Surgical, Inc.

Intuitive Surgical shows strong profitability with a 28.4% net margin but suffers from zero reported ROE and ROIC, signaling potential operational inefficiencies. Its P/E ratio at 70.8 marks the stock as expensive. The absence of dividends points to reinvestment in R&D, reflecting a growth-focused capital allocation strategy.

Novanta Inc.

Novanta posts a modest 6.8% net margin with an 8.6% ROE, indicating lower profitability and efficiency. The P/E ratio of 85.7 classifies the stock as stretched relative to earnings. Novanta pays no dividend, suggesting reinvestment in growth initiatives. Its solid current and quick ratios support operational stability despite leverage concerns.

Premium Valuation vs. Operational Safety

Intuitive Surgical commands a premium valuation with strong margins but lacks key returns metrics, while Novanta balances moderate profitability and liquidity with a stretched price. Intuitive suits investors prioritizing innovation and growth, whereas Novanta fits those valuing operational safety amid moderate risk.

Which one offers the Superior Shareholder Reward?

Intuitive Surgical (ISRG) and Novanta Inc. (NOVT) both reinvest profits rather than pay dividends. ISRG’s margin dominance and strong free cash flow per share (3.7 vs. NOVT’s 3.9) support a robust buyback capacity. ISRG’s price-to-free-cash-flow ratio is a steep 142x, signaling premium valuation but also confidence in growth. NOVT trades cheaper at 39x FCF ratio but carries higher debt (debt-to-assets 34% vs. ISRG’s <1%), risking financial flexibility. ISRG’s negligible debt and large cash reserves underpin sustainable buybacks fueling total return. I see ISRG’s capital allocation as superior, offering a more attractive long-term shareholder reward in 2026.

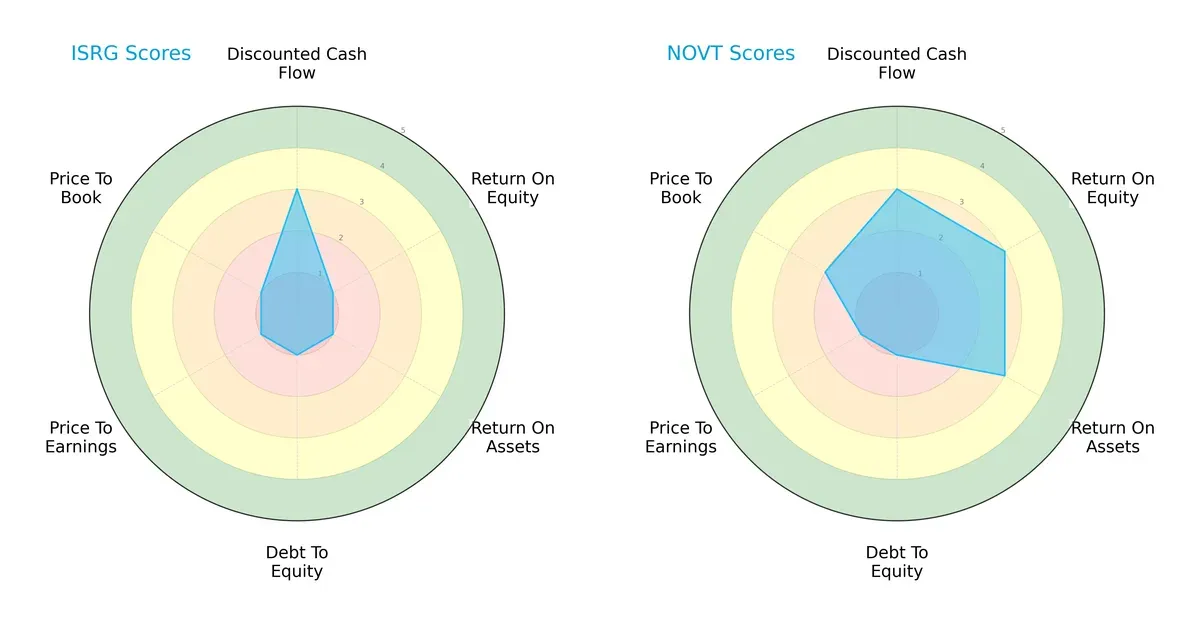

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Intuitive Surgical, Inc. and Novanta Inc., highlighting their distinct financial strengths and weaknesses:

Novanta delivers a more balanced financial profile with moderate scores in ROE (3), ROA (3), and Price-to-Book (2). In contrast, Intuitive Surgical leans heavily on its Discounted Cash Flow score (3) but suffers from very unfavorable scores in profitability and valuation metrics. Novanta’s diversified strengths suggest better operational efficiency, while Intuitive Surgical relies on a single valuation edge.

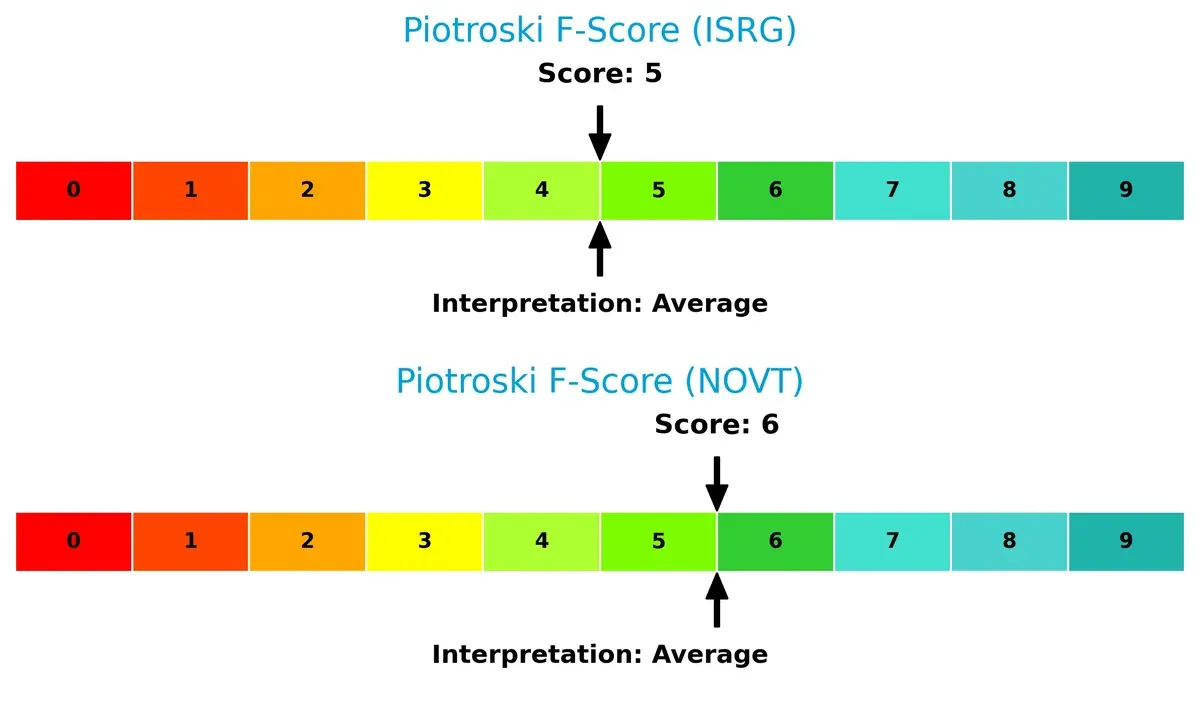

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap favors Intuitive Surgical with a score of 50.8 versus Novanta’s 5.7, both safely above distress levels, indicating robust solvency for long-term survival in this cycle:

Financial Health: Quality of Operations

Novanta posts a slightly stronger Piotroski F-Score of 6 compared to Intuitive Surgical’s 5, suggesting marginally better financial health and fewer red flags in internal metrics:

How are the two companies positioned?

This section dissects ISRG and NOVT’s operational DNA by comparing revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and reveal which model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

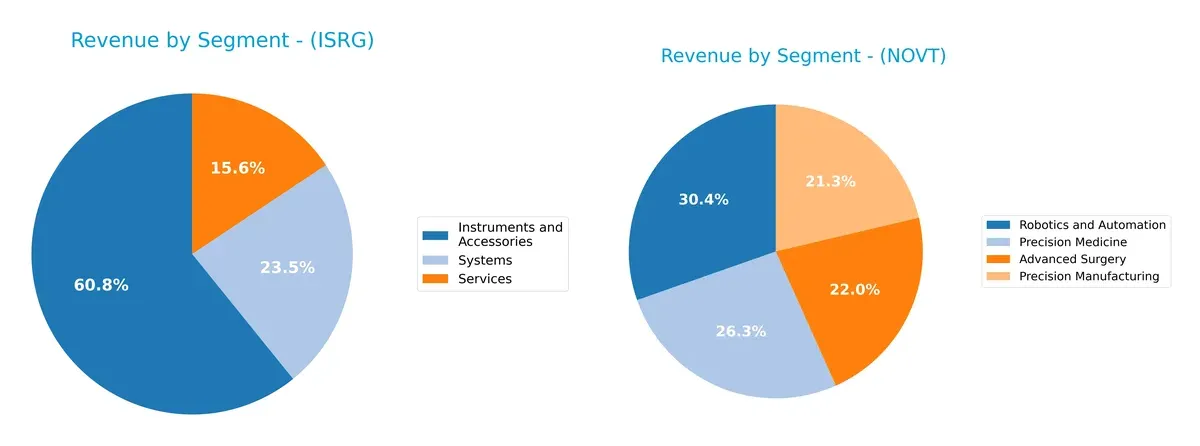

The following visual comparison dissects how Intuitive Surgical and Novanta diversify their income streams and where their primary sector bets lie:

Intuitive Surgical anchors its revenue in Instruments and Accessories with $5.08B, dwarfing its Systems ($1.97B) and Services ($1.31B). This concentration signals a strong ecosystem lock-in around its surgical tools. Novanta, by contrast, pivots across Precision Manufacturing ($202M), Robotics and Automation ($288M), Advanced Surgery ($209M), and Precision Medicine ($250M), showcasing a diversified portfolio that spreads risk and capitalizes on multiple tech frontiers simultaneously.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Intuitive Surgical, Inc. and Novanta Inc.:

ISRG Strengths

- High net margin at 28.38%

- Favorable debt to equity and debt to assets ratios

- Infinite interest coverage ratio

- Diverse product segments generating multi-billion revenues

- Strong market presence in surgical instruments

NOVT Strengths

- Favorable current and quick ratios indicate solid liquidity

- High fixed asset turnover at 6.08

- Balanced revenue streams across medical and precision technologies

- Geographic diversification including US, Europe, Asia Pacific

- Moderate leverage with neutral debt ratios

ISRG Weaknesses

- Unfavorable ROE and ROIC at 0%

- Unavailable WACC data limits capital efficiency assessment

- Overvalued PE ratio at 70.78

- Low liquidity ratios (current and quick ratio at 0)

- Weak asset turnover measures

- Zero dividend yield

NOVT Weaknesses

- Low net margin at 6.75%

- Unfavorable ROE and WACC above ROIC

- Overvalued PE at 85.7 and high PB at 7.37

- Neutral to unfavorable interest coverage ratio at 3.95

- No dividend yield

Both companies exhibit strengths in product and geographic diversification. ISRG leads in profitability and debt management but shows liquidity and capital allocation concerns. NOVT displays sound liquidity and asset efficiency but struggles with profitability and valuation metrics. These contrasts frame each firm’s strategic priorities moving forward.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield defending long-term profits from relentless competition erosion in dynamic markets:

Intuitive Surgical, Inc. (ISRG): Innovation-Driven Switching Costs

Intuitive Surgical’s moat stems from high switching costs tied to its da Vinci surgical system ecosystem. This creates margin stability and 28% net margins. The 2026 launch of diagnostic tools could deepen its medical tech dominance but declining ROIC signals caution.

Novanta Inc. (NOVT): Precision Engineering with Growth Potential

Novanta’s moat relies on specialized photonics and precision motion components, distinct from ISRG’s platform lock-in. Despite shedding value (ROIC < WACC), its improving profitability and global footprint, including expanding U.S. and Asian markets, suggest emerging strength.

Innovation Ecosystem vs. Specialized Components: The Moat Battle

ISRG’s entrenched switching costs create a wider moat, safeguarding its high margins and revenue growth. Novanta’s narrower, technical moat shows promise with rising ROIC but currently struggles to match ISRG’s durable competitive advantage. ISRG stands better poised to defend market share long term.

Which stock offers better returns?

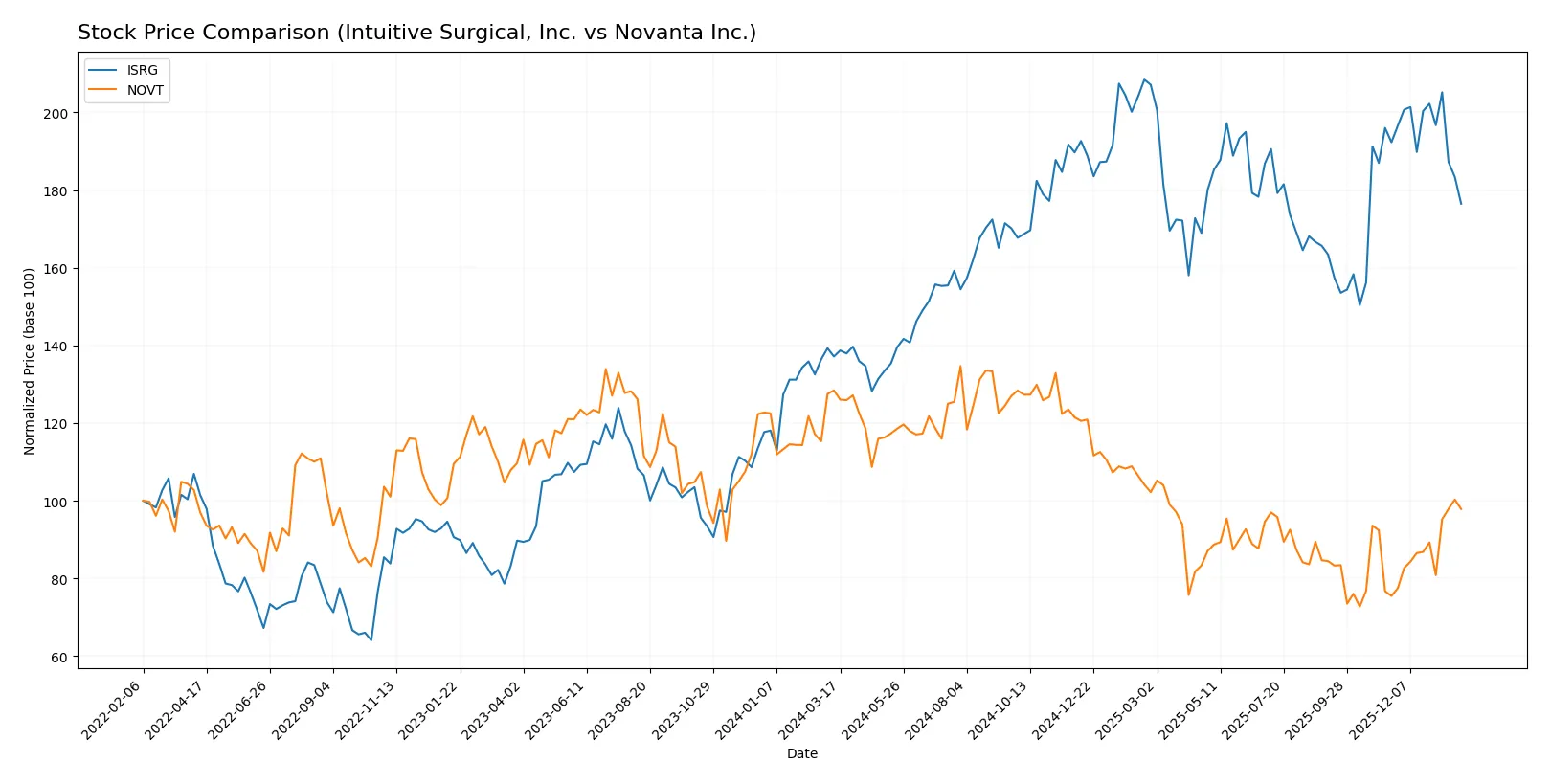

Over the past year, Intuitive Surgical, Inc. and Novanta Inc. exhibited contrasting price movements, with ISRG showing strong gains despite recent weakness, while NOVT reversed prior losses with significant recent strength.

Trend Comparison

Intuitive Surgical, Inc. posted a 28.68% price increase over the past 12 months, marking a bullish trend with decelerating momentum. Its price ranged from $366.34 to a high of $595.55.

Novanta Inc. declined 23.79% over the same period, indicating a bearish trend but with accelerating downside. However, recent months show a 29.63% rebound, suggesting emerging strength.

Comparing these trends, ISRG delivered the highest market performance over 12 months despite recent softness, while NOVT’s recent rally contrasts with its overall negative return.

Target Prices

Analysts present a confident target consensus for Intuitive Surgical, Inc. and Novanta Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Intuitive Surgical, Inc. | 550 | 750 | 641.25 |

| Novanta Inc. | 160 | 160 | 160 |

The target consensus for Intuitive Surgical exceeds its current price by roughly 27%, signaling strong growth expectations. Novanta’s target price sits about 19% above its current level, reflecting optimism in its technology segment.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Intuitive Surgical, Inc. Grades

The following table shows recent institutional grades for Intuitive Surgical, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Freedom Capital Markets | Buy | Buy | 2026-01-27 |

| Barclays | Maintain | Overweight | 2026-01-26 |

| Bernstein | Maintain | Outperform | 2026-01-23 |

| Citigroup | Maintain | Neutral | 2026-01-23 |

| Evercore ISI Group | Maintain | In Line | 2026-01-23 |

| BTIG | Maintain | Buy | 2026-01-23 |

| Piper Sandler | Maintain | Overweight | 2026-01-23 |

| Bernstein | Maintain | Outperform | 2026-01-09 |

| Barclays | Maintain | Overweight | 2026-01-07 |

| BTIG | Maintain | Buy | 2026-01-07 |

Novanta Inc. Grades

The following table shows recent institutional grades for Novanta Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Baird | Maintain | Neutral | 2025-08-11 |

| Baird | Maintain | Neutral | 2025-03-03 |

| Baird | Maintain | Neutral | 2024-11-06 |

| Baird | Maintain | Neutral | 2024-08-07 |

| Baird | Maintain | Neutral | 2023-05-11 |

| Baird | Maintain | Neutral | 2023-05-10 |

| William Blair | Upgrade | Outperform | 2022-05-11 |

| William Blair | Upgrade | Outperform | 2022-05-10 |

| Berenberg | Maintain | Hold | 2020-11-13 |

| Baird | Maintain | Neutral | 2020-05-13 |

Which company has the best grades?

Intuitive Surgical, Inc. consistently receives strong buy and outperform ratings from multiple firms. Novanta Inc. mostly holds neutral grades with fewer upgrades. Investors may see Intuitive Surgical as favored by analysts, reflecting stronger confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Intuitive Surgical, Inc.

- Dominates minimally invasive surgery but faces pressure from emerging robotic competitors.

Novanta Inc.

- Operates in photonics and precision tech with diverse industrial and medical customers; competitive but niche.

2. Capital Structure & Debt

Intuitive Surgical, Inc.

- Virtually no debt, extremely low financial risk and strong interest coverage.

Novanta Inc.

- Moderate leverage (D/E 0.63), manageable but limits financial flexibility.

3. Stock Volatility

Intuitive Surgical, Inc.

- High beta at 1.67 indicates above-market volatility, sensitive to sector cycles.

Novanta Inc.

- Also volatile with beta 1.60, exposed to tech sector swings and earnings surprises.

4. Regulatory & Legal

Intuitive Surgical, Inc.

- Healthcare sector faces regulatory scrutiny and approval risks globally.

Novanta Inc.

- Technology hardware exposed to export controls and intellectual property litigation risks.

5. Supply Chain & Operations

Intuitive Surgical, Inc.

- Complex global supply chain; critical to maintain quality and availability of surgical components.

Novanta Inc.

- Relies on specialized components; supply disruptions could affect multiple industrial and medical product lines.

6. ESG & Climate Transition

Intuitive Surgical, Inc.

- Pressure to improve sustainability in medical device manufacturing and energy consumption.

Novanta Inc.

- Faces increasing demand for greener operations in photonics and precision manufacturing.

7. Geopolitical Exposure

Intuitive Surgical, Inc.

- Global sales expose it to trade tensions and healthcare policy changes.

Novanta Inc.

- International footprint subjects it to geopolitical risks in supply and demand markets.

Which company shows a better risk-adjusted profile?

Intuitive Surgical’s most impactful risk is its high stock volatility and exposure to regulatory hurdles, despite strong debt management. Novanta’s key risk lies in its moderate leverage and high valuation multiples, which constrain financial resilience. I regard Novanta as slightly riskier due to financial leverage and valuation pressures, despite better liquidity ratios. The recent deterioration in Novanta’s stock price (-4.2%) versus ISRG’s modest decline (-0.7%) signals market concern over its capital structure and earnings growth prospects.

Final Verdict: Which stock to choose?

Intuitive Surgical, Inc. (ISRG) wields a formidable superpower in unmatched operational efficiency and robust free cash flow generation. Its dominant market position in robotic surgery fuels consistent growth. However, a point of vigilance is its lofty valuation, which could pressure returns if growth slows. ISRG suits aggressive growth portfolios seeking technological leadership.

Novanta Inc. (NOVT) benefits from a strategic moat rooted in specialized photonics and laser technology, fostering recurring revenue streams. Compared to ISRG, it offers a more conservative safety profile with a healthier liquidity position but a less commanding market presence. NOVT fits well in GARP portfolios aiming for steady growth at a reasonable price.

If you prioritize aggressive growth and market dominance, ISRG is the compelling choice due to its operational excellence and cash flow strength. However, if you seek more stability and a strategic niche presence with improving profitability, NOVT offers better downside protection and a growing ROIC trend. Both present analytical scenarios tailored to different investor risk tolerances and portfolio strategies.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Intuitive Surgical, Inc. and Novanta Inc. to enhance your investment decisions: