In the dynamic world of technology, Shopify Inc. and Intuit Inc. stand out as leaders in software applications, yet they serve distinct yet overlapping markets. Shopify empowers merchants with comprehensive e-commerce solutions, while Intuit specializes in financial management software for individuals and businesses. Both companies innovate to simplify commerce and finance, making them compelling investment candidates. This article will guide you in deciding which company holds the most promise for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Shopify Inc. and Intuit Inc. by providing an overview of these two companies and their main differences.

Shopify Inc. Overview

Shopify Inc. is a commerce company headquartered in Ottawa, Canada, providing a platform and services that enable merchants to display, market, and sell products across multiple sales channels globally. Its offerings include product and inventory management, payment processing, order fulfillment, and merchant solutions such as financing and shipping. The company focuses on empowering merchants with tools to build customer relationships and streamline commerce operations.

Intuit Inc. Overview

Intuit Inc., based in Mountain View, California, delivers financial management and compliance products tailored to consumers, small businesses, and accounting professionals. Operating through segments like Small Business & Self-Employed and Consumer, Intuit offers software like QuickBooks and TurboTax, along with payment-processing and personal finance solutions. Its platform supports tax preparation, payroll, and financial product recommendations, serving a broad international market.

Key similarities and differences

Both Shopify and Intuit operate in the technology sector focusing on software applications, targeting small to medium-sized businesses. Shopify emphasizes commerce platform services enabling sales and fulfillment, while Intuit centers on financial management, tax, and compliance software. Shopify’s business model is commerce facilitation; Intuit’s is financial software and service provision, reflecting their distinct but complementary roles in supporting business operations.

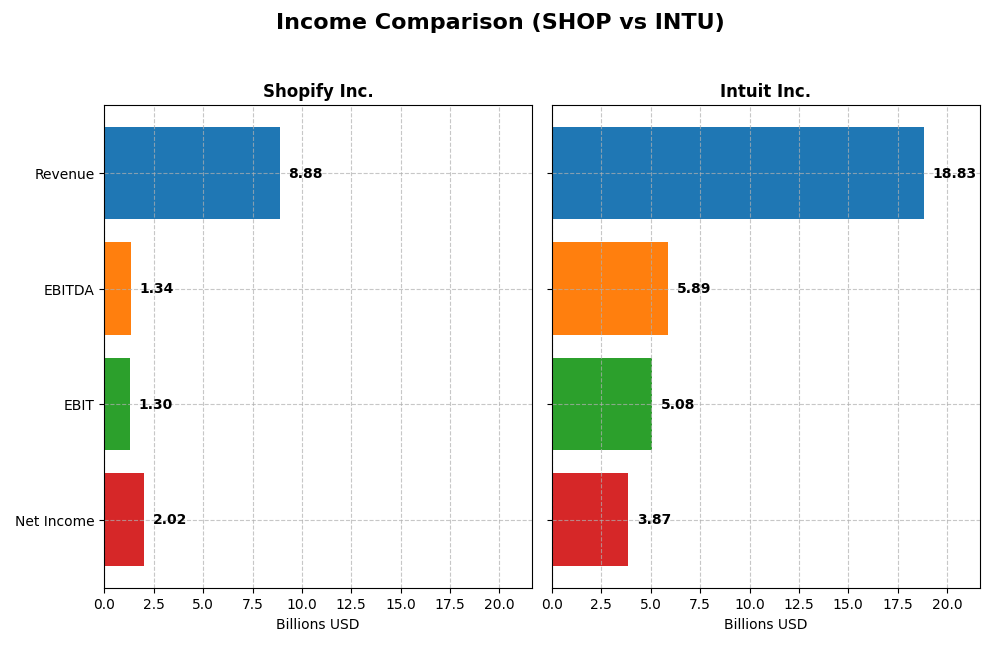

Income Statement Comparison

The table below compares the key income statement metrics for Shopify Inc. and Intuit Inc. for their most recent fiscal years, providing a snapshot of their financial performance.

| Metric | Shopify Inc. (2024) | Intuit Inc. (2025) |

|---|---|---|

| Market Cap | 206B | 152B |

| Revenue | 8.88B | 18.83B |

| EBITDA | 1.34B | 5.89B |

| EBIT | 1.30B | 5.08B |

| Net Income | 2.02B | 3.87B |

| EPS | 1.56 | 13.82 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Shopify Inc.

Shopify exhibits strong revenue growth from 2020 to 2024, rising from $2.93B to $8.88B, with net income swinging from a loss of $3.46B in 2022 to a profit of $2.02B in 2024. Margins improved markedly, with gross margin at 50.36% and net margin reaching 22.74% in 2024. The latest year showed robust growth acceleration and margin expansion, signaling operational leverage.

Intuit Inc.

Intuit’s revenue increased steadily from $9.63B in 2021 to $18.83B in 2025, while net income rose from $2.06B to $3.87B over the same period. Gross margin remains high at 80.76%, with a net margin of 20.55% in 2025. The latest fiscal year continued positive growth trends, albeit with a slight unfavorable net margin contraction over the overall period, suggesting moderate margin pressure.

Which one has the stronger fundamentals?

Both companies present favorable income statement trends with consistent revenue and net income growth. Shopify demonstrates exceptional margin expansion and a sharp net income recovery recently, supported by a 100% favorable income statement evaluation. Intuit maintains higher margins but shows slight net margin deterioration overall. Thus, fundamentals are strong for both, with Shopify showing more pronounced improvement.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Shopify Inc. and Intuit Inc. based on their most recent fiscal year data, facilitating a clear view of their financial performance and stability.

| Ratios | Shopify Inc. (2024) | Intuit Inc. (2025) |

|---|---|---|

| ROE | 17.5% | 19.6% |

| ROIC | 7.5% | 14.8% |

| P/E | 68.2 | 56.8 |

| P/B | 11.9 | 11.2 |

| Current Ratio | 3.71 | 1.36 |

| Quick Ratio | 3.70 | 1.36 |

| D/E (Debt to Equity) | 0.097 | 0.337 |

| Debt-to-Assets | 8.1% | 18.0% |

| Interest Coverage | 0 | 19.9 |

| Asset Turnover | 0.64 | 0.51 |

| Fixed Asset Turnover | 63.4 | 12.5 |

| Payout ratio | 0% | 31% |

| Dividend yield | 0% | 0.54% |

Interpretation of the Ratios

Shopify Inc.

Shopify shows a mixed ratio profile with strong net margin (22.74%) and return on equity (17.47%), but some concerns arise from its high price-to-earnings (68.18) and price-to-book (11.91) ratios. The company’s current ratio is elevated at 3.71, indicating potential inefficiency in asset use. Shopify does not pay dividends, focusing instead on growth and reinvestment.

Intuit Inc.

Intuit presents generally favorable ratios, including a solid net margin of 20.55% and a return on equity of 19.63%. Its weighted average cost of capital (WACC) is more moderate at 9.42%, with a healthy interest coverage ratio of 20.57. Intuit pays dividends with a yield of 0.54%, supported by consistent free cash flow, though payout sustainability should be monitored.

Which one has the best ratios?

Intuit’s ratios are more balanced with a higher proportion of favorable metrics (57.14%) and a moderate WACC, indicating efficient capital usage. Shopify, while showing strong profitability, has more unfavorable ratios (35.71%) and a very high valuation multiple. Overall, Intuit’s profile is slightly stronger based on these financial ratios.

Strategic Positioning

This section compares the strategic positioning of Shopify and Intuit, focusing on Market position, Key segments, and Exposure to technological disruption:

Shopify Inc.

- Leading commerce platform with global reach, faces high competition in e-commerce

- Key drivers: Merchant Solutions and Subscription Services fueling platform growth

- Exposed to disruption through evolving e-commerce technologies and payment systems

Intuit Inc.

- Strong presence in financial management software; competitive in tax and small business markets

- Diverse segments: Small Business, Consumer, Credit Karma, and Professional Tax products

- Faces disruption risks in fintech and cloud-based financial services, but with established base

Shopify vs Intuit Positioning

Shopify pursues a concentrated commerce platform strategy focused on merchant services and subscriptions, while Intuit employs a diversified approach across financial management and tax segments. Shopify benefits from focused innovation; Intuit gains from segment diversification but faces complexity.

Which has the best competitive advantage?

Intuit shows a slightly favorable moat by creating value despite declining profitability, indicating stronger capital efficiency. Shopify has a slightly unfavorable moat with value destruction but improving profitability trends. Intuit currently holds a more sustainable competitive advantage.

Stock Comparison

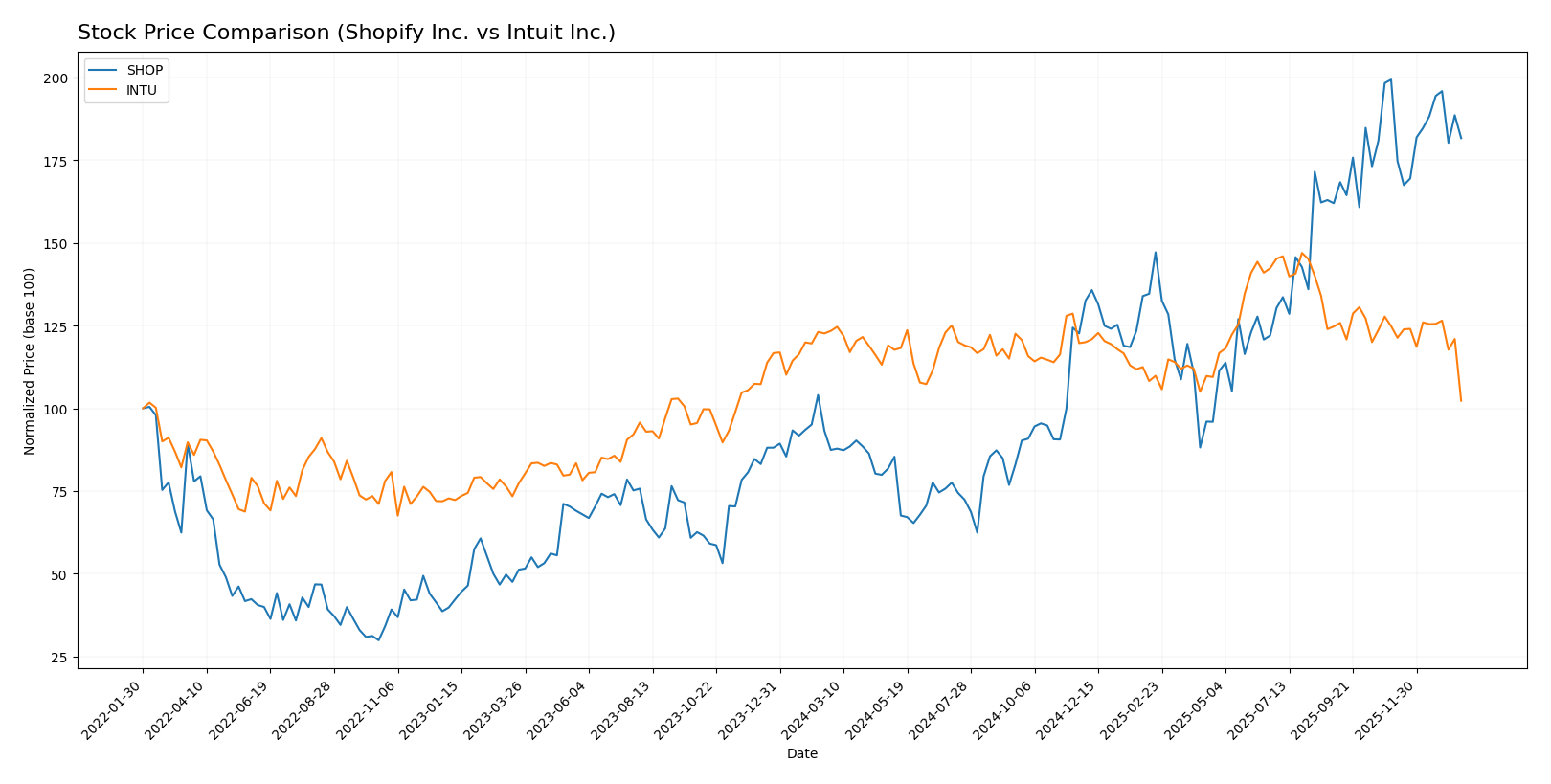

The stock price movements of Shopify Inc. and Intuit Inc. over the past year reveal contrasting trends, with Shopify showing strong gains despite recent deceleration, while Intuit has experienced a consistent decline.

Trend Analysis

Shopify Inc. exhibited a bullish trend over the past 12 months with a 107.82% price increase, peaking at 173.86 and bottoming at 54.43, though the upward momentum has decelerated recently. Intuit Inc. showed a bearish trend with a 17.11% decrease in stock price over the same period, hitting a high of 785.95 and a low of 546.94, accompanied by decelerating downward momentum. Comparing both companies, Shopify delivered the highest market performance with a substantial price appreciation, while Intuit’s stock declined over the past year.

Target Prices

Analysts present a bullish consensus on Shopify Inc. and Intuit Inc., reflecting positive outlooks for both stocks.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Shopify Inc. | 200 | 140 | 186.24 |

| Intuit Inc. | 880 | 700 | 798.4 |

Shopify’s consensus target of 186.24 is above its current price of 158.28, indicating expected appreciation. Intuit’s consensus target of 798.4 also exceeds its current price of 546.40, suggesting significant upside potential according to analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Shopify Inc. and Intuit Inc.:

Rating Comparison

Shopify Inc. Rating

- Rating: B, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: Moderate at 2 out of 5.

- ROE Score: Favorable at 4, indicating efficient profit generation.

- ROA Score: Very Favorable at 5, excellent asset utilization.

- Debt To Equity Score: Moderate at 3, reflecting average financial risk.

- Overall Score: Moderate at 3, summarizing the financial standing.

Intuit Inc. Rating

- Rating: B, also Very Favorable by analysts.

- Discounted Cash Flow Score: Favorable at 4 out of 5.

- ROE Score: Favorable at 4, showing similar efficiency.

- ROA Score: Very Favorable at 5, equally strong asset use.

- Debt To Equity Score: Moderate at 2, slightly lower financial risk.

- Overall Score: Moderate at 3, indicating comparable overall performance.

Which one is the best rated?

Both companies share the same overall rating of B and a moderate overall score of 3. Intuit has a higher discounted cash flow score and a slightly better debt to equity score, while Shopify scores higher in debt to equity. Both have equal ROE and ROA scores.

Scores Comparison

Here is a comparison of the financial scores for Shopify Inc. and Intuit Inc.:

SHOP Scores

- Altman Z-Score: 50.42, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 6, classified as average financial strength.

INTU Scores

- Altman Z-Score: 9.35, also in the safe zone, indicating low bankruptcy risk.

- Piotroski Score: 9, classified as very strong financial health.

Which company has the best scores?

Intuit has both a strong Piotroski Score of 9 and a safe zone Altman Z-Score of 9.35, while Shopify has a higher Altman Z-Score but a lower Piotroski Score. Intuit shows stronger overall financial health based on these metrics.

Grades Comparison

Here is a detailed comparison of the latest grades assigned to Shopify Inc. and Intuit Inc. by reputable grading companies:

Shopify Inc. Grades

The table below shows recent grade changes and actions by major financial institutions for Shopify Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Scotiabank | Upgrade | Sector Outperform | 2026-01-08 |

| Wolfe Research | Downgrade | Peer Perform | 2026-01-06 |

| Wells Fargo | Maintain | Overweight | 2025-12-17 |

| Truist Securities | Maintain | Hold | 2025-11-05 |

| CIBC | Maintain | Outperform | 2025-11-05 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-11-05 |

| DA Davidson | Maintain | Buy | 2025-11-05 |

| Scotiabank | Maintain | Sector Perform | 2025-11-05 |

| Needham | Maintain | Buy | 2025-11-05 |

| JP Morgan | Maintain | Overweight | 2025-11-05 |

Overall, Shopify’s grades show a mix of upgrades and downgrades, with a majority maintaining positive ratings such as Buy, Outperform, and Overweight.

Intuit Inc. Grades

Below is a summary table of recent grade updates for Intuit Inc. from credible financial analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Downgrade | Equal Weight | 2026-01-08 |

| Wells Fargo | Maintain | Overweight | 2025-11-21 |

| RBC Capital | Maintain | Outperform | 2025-11-21 |

| BMO Capital | Maintain | Outperform | 2025-11-21 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-18 |

| RBC Capital | Maintain | Outperform | 2025-09-02 |

| RBC Capital | Maintain | Outperform | 2025-08-22 |

| UBS | Maintain | Neutral | 2025-08-22 |

| Morgan Stanley | Maintain | Overweight | 2025-08-22 |

| Barclays | Maintain | Overweight | 2025-08-22 |

Intuit’s grades mostly reflect stable Outperform and Overweight ratings, with a recent minor downgrade from Overweight to Equal Weight by Wells Fargo.

Which company has the best grades?

Both Shopify and Intuit currently hold a consensus “Buy” rating with strong institutional support. Shopify has a broader mix of ratings including some Hold and Neutral grades, while Intuit demonstrates a steadier trend of Outperform and Overweight recommendations. Investors may interpret Intuit’s more consistent higher-tier grades as a sign of confidence, whereas Shopify’s varied grades suggest a more mixed outlook.

Strengths and Weaknesses

Below is a comparison of Shopify Inc. and Intuit Inc. based on key criteria reflecting their market positions and financial health.

| Criterion | Shopify Inc. (SHOP) | Intuit Inc. (INTU) |

|---|---|---|

| Diversification | Moderate: Focused on e-commerce platforms with growing merchant and subscription services revenue streams. | High: Diverse business segments including consumer, small business, professional tax, and credit services. |

| Profitability | Moderate: Net margin 22.7%, ROE 17.5%, but ROIC below WACC indicating value destruction despite improving profitability. | Strong: Net margin 20.6%, ROE 19.6%, ROIC well above WACC, consistent value creation. |

| Innovation | High: Rapidly growing ROIC trend (+514%), reflecting ongoing innovation and efficiency gains, but currently value-destroying. | Moderate: Declining ROIC trend (-5.3%) suggests some erosion in innovation or efficiency despite profitability. |

| Global presence | Moderate: Primarily focused on e-commerce solutions with expanding global reach but limited compared to diversified firms. | High: Global business solutions and broad market segments indicate strong international footprint. |

| Market Share | Growing in e-commerce platform space with significant revenue growth in merchant solutions. | Established leader in financial and tax software with sizable and diverse market share. |

Key takeaways: Shopify shows strong innovation and revenue growth but currently destroys value due to high capital costs. Intuit delivers consistent profitability and value creation with broad diversification, though its profitability is slightly declining. Investors should weigh Shopify’s growth potential against its current inefficiencies, while Intuit offers stability with moderate risk.

Risk Analysis

Below is a comparative table highlighting key risks for Shopify Inc. (SHOP) and Intuit Inc. (INTU) based on the most recent data:

| Metric | Shopify Inc. (SHOP) | Intuit Inc. (INTU) |

|---|---|---|

| Market Risk | High beta (2.84) indicates high volatility | Moderate beta (1.25), more stable |

| Debt level | Low debt/equity (0.10), low debt to assets (8.09%) | Moderate debt/equity (0.34), debt to assets 17.96% |

| Regulatory Risk | Moderate, operates internationally with varying regulations | Moderate, financial services subject to compliance |

| Operational Risk | Platform reliance with global operations; potential tech disruptions | Diverse segments, reliance on software & cloud services |

| Environmental Risk | Moderate, tech sector with less direct environmental impact | Moderate, similar tech sector exposure |

| Geopolitical Risk | Exposure to global markets, including emerging regions | Primarily US & Canada, less geopolitical exposure |

Shopify faces higher market risk due to its elevated beta, reflecting greater stock price volatility. Both companies maintain manageable debt levels, with Shopify showing a stronger balance sheet. Regulatory and operational risks are moderate for both, given their technology-driven business models and global footprints. Geopolitical risks are more pronounced for Shopify due to broader international exposure. These factors should be weighed carefully against growth prospects when considering investment.

Which Stock to Choose?

Shopify Inc. (SHOP) shows strong income growth with a 203% revenue increase over five years and favorable profitability metrics, including a 22.74% net margin and 17.47% ROE. Its debt levels are low, with a debt-to-equity ratio rated favorable. However, the company currently destroys value as ROIC is below WACC, and its rating is very favorable but with some valuation concerns.

Intuit Inc. (INTU) demonstrates solid income evolution, with a 95% revenue growth over five years and favorable margins, including a 20.55% net margin and 19.63% ROE. Its debt is moderate but well covered, and it creates value with ROIC exceeding WACC. The company holds a very favorable rating and stronger financial ratios overall.

Investors seeking growth might find Shopify’s accelerating income and improving profitability attractive despite its value destruction signal, while those prioritizing value creation and financial stability could view Intuit’s consistent value creation and solid ratios as more favorable. The choice may depend on the investor’s tolerance for risk and preference for growth versus stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Shopify Inc. and Intuit Inc. to enhance your investment decisions: