Intuit Inc. and PagerDuty, Inc. are two prominent players in the software application industry, each carving out distinct yet overlapping niches in digital financial management and operations. Intuit, a seasoned giant, specializes in comprehensive financial solutions for individuals and businesses, while PagerDuty pioneers real-time digital operations management through advanced machine learning. This comparison explores their innovation strategies and market positions to help you decide which company holds the most promise for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Intuit and PagerDuty by providing an overview of these two companies and their main differences.

Intuit Overview

Intuit Inc. provides financial management and compliance products for consumers, small businesses, self-employed, and accounting professionals across the US, Canada, and internationally. Operating four segments—Small Business & Self-Employed, Consumer, Credit Karma, and ProConnect—Intuit offers cloud-based accounting, tax preparation, personal finance, and payroll solutions. Founded in 1983, it is headquartered in Mountain View, CA, with a market cap of $152B.

PagerDuty Overview

PagerDuty, Inc. operates a digital operations management platform leveraging machine learning to analyze data signals from software-enabled systems and devices. Serving industries like technology, telecommunications, retail, and financial services, PagerDuty provides predictive insights and issue resolution. Founded in 2009 and based in San Francisco, CA, PagerDuty has a market cap of $1B and focuses primarily on real-time digital operations management solutions.

Key similarities and differences

Both companies operate in the software application industry and serve a global customer base. Intuit specializes in financial management and compliance software, targeting small businesses and consumers, while PagerDuty focuses on digital operations management using machine learning across various sectors. Intuit’s business model is broader, with diversified product lines and services, whereas PagerDuty’s platform centers on operational intelligence and incident response.

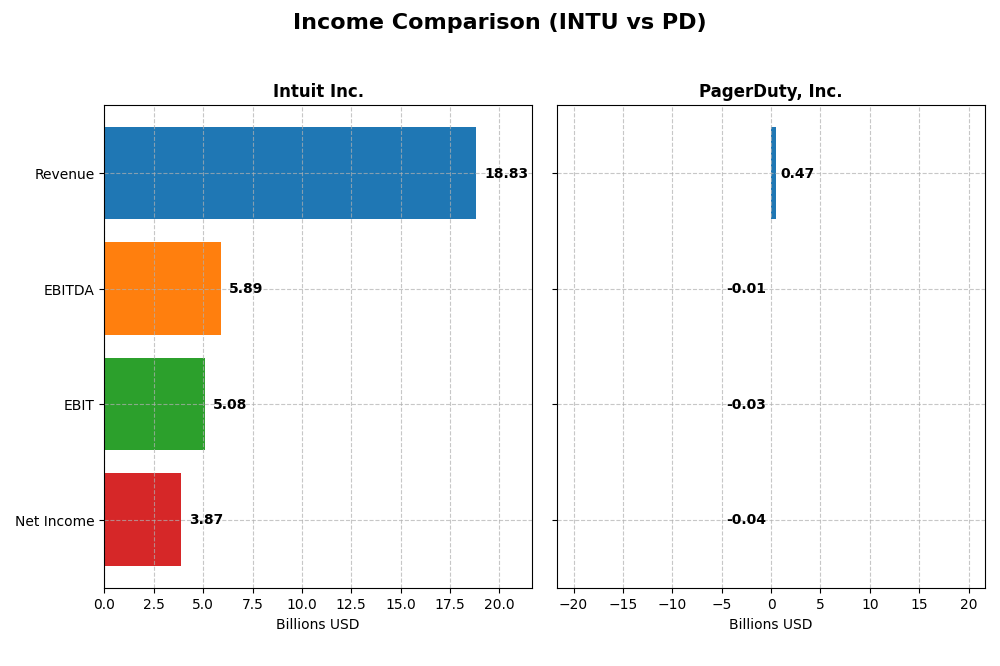

Income Statement Comparison

This table compares the most recent fiscal year income statement metrics for Intuit Inc. and PagerDuty, Inc., highlighting their scale and profitability in 2025.

| Metric | Intuit Inc. (INTU) | PagerDuty, Inc. (PD) |

|---|---|---|

| Market Cap | 152B | 1.04B |

| Revenue | 18.83B | 468M |

| EBITDA | 5.89B | -12M |

| EBIT | 5.08B | -32.5M |

| Net Income | 3.87B | -42.7M |

| EPS | 13.82 | -0.59 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Intuit Inc.

Intuit’s revenue and net income showed consistent growth from 2021 to 2025, nearly doubling revenue to $18.8B and net income to $3.87B. Margins remained strong, with a gross margin of 80.76% and net margin around 20.55%. The latest year saw accelerated EBIT growth of 33.99%, indicating improved profitability despite a slight net margin contraction over the full period.

PagerDuty, Inc.

PagerDuty’s revenue increased steadily from $213M in 2021 to $467M in 2025, accompanied by improving net losses, with net margin still negative at -9.14%. Gross margins remained favorable above 80%, but EBIT margins are negative at -6.95%. The most recent year showed significant EBIT and net margin improvements, with respective growths of 55.46% and 51.84%, signaling operational progress.

Which one has the stronger fundamentals?

Intuit displays stronger fundamentals with robust revenue and net income growth, high and stable gross and net margins, and favorable EBIT margins. PagerDuty, while growing rapidly and improving losses, still operates at a negative net margin and EBIT margin. Intuit’s consistent profitability contrasts with PagerDuty’s ongoing investment phase and negative earnings.

Financial Ratios Comparison

This table presents the most recent key financial ratios for Intuit Inc. and PagerDuty, Inc., offering a snapshot of their profitability, liquidity, leverage, efficiency, and dividend metrics.

| Ratios | Intuit Inc. (INTU) | PagerDuty, Inc. (PD) |

|---|---|---|

| ROE | 19.6% | -32.9% |

| ROIC | 14.8% | -9.7% |

| P/E | 56.8 | -39.9 |

| P/B | 11.2 | 13.1 |

| Current Ratio | 1.36 | 1.87 |

| Quick Ratio | 1.36 | 1.87 |

| D/E (Debt to Equity) | 0.34 | 3.57 |

| Debt-to-Assets | 18.0% | 50.0% |

| Interest Coverage | 19.9 | -6.5 |

| Asset Turnover | 0.51 | 0.50 |

| Fixed Asset Turnover | 12.5 | 16.6 |

| Payout ratio | 30.7% | 0% |

| Dividend yield | 0.54% | 0% |

Interpretation of the Ratios

Intuit Inc.

Intuit displays predominantly strong financial ratios, with favorable net margin (20.55%), ROE (19.63%), and ROIC (14.78%), indicating efficient profitability and capital use. However, high PE (56.82) and PB (11.15) ratios suggest the stock is potentially overvalued. The company pays dividends, with a modest 0.54% yield, supported by stable free cash flow, though the yield is considered low.

PagerDuty, Inc.

PagerDuty’s ratios reveal weaknesses, including negative net margin (-9.14%), ROE (-32.92%), and ROIC (-9.66%), reflecting ongoing losses and inefficient capital use. Its balance sheet shows high leverage and poor interest coverage. The company does not pay dividends, likely due to its negative earnings and growth emphasis, prioritizing reinvestment and R&D over shareholder payouts.

Which one has the best ratios?

Intuit clearly outperforms PagerDuty in terms of profitability, return metrics, and financial stability, with a majority of favorable ratios and a sustainable dividend policy. PagerDuty faces significant challenges with negative profitability, high debt, and no dividends, resulting in an overall unfavorable ratio profile relative to Intuit’s favorable standing.

Strategic Positioning

This section compares the strategic positioning of Intuit Inc. and PagerDuty, Inc. focusing on market position, key segments, and exposure to technological disruption:

Intuit Inc.

- Large market cap at 151.7B with established competitive presence in financial software.

- Diverse segments including Small Business, Consumer, Credit Karma, and ProConnect driving growth.

- Operates in cloud-based financial management and payment solutions, with moderate disruption risk.

PagerDuty, Inc.

- Smaller market cap of 1.04B, competing in digital operations management.

- Focused on digital operations platform serving various industries including tech and financial services.

- Uses machine learning to enhance software operations, exposed to evolving tech disruption.

Intuit Inc. vs PagerDuty, Inc. Positioning

Intuit demonstrates a diversified business model across multiple financial software segments, offering stability and scale, while PagerDuty concentrates on digital operations management with a narrower focus, potentially allowing for specialized innovation but higher dependency on one segment.

Which has the best competitive advantage?

Intuit holds a slightly favorable moat status, creating value despite declining profitability. PagerDuty shows a slightly unfavorable moat, shedding value but improving profitability, reflecting a less stable competitive advantage.

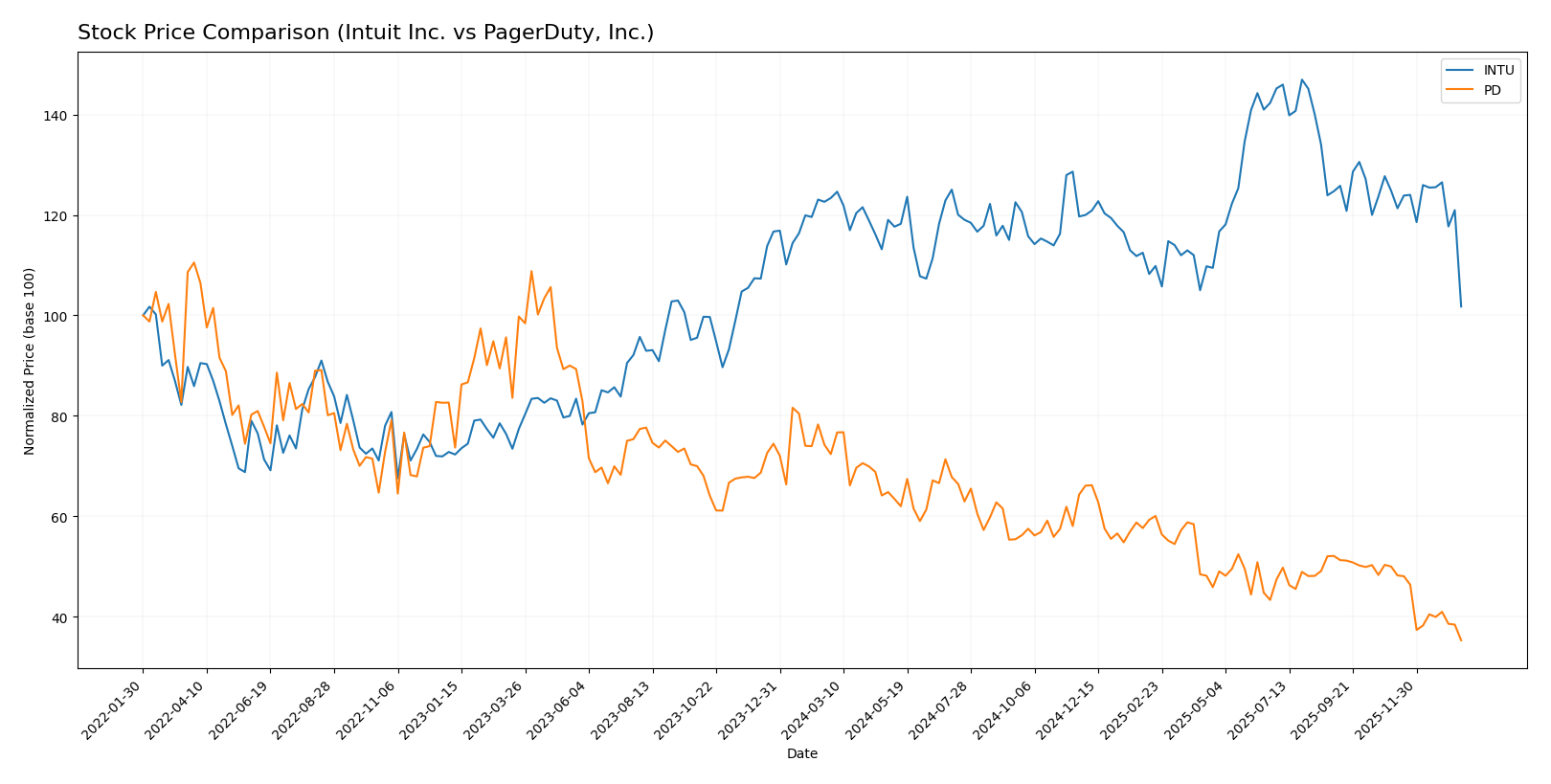

Stock Comparison

The stock price trends of Intuit Inc. and PagerDuty, Inc. over the past 12 months reveal significant bearish movements with varying degrees of deceleration and trading volume dynamics.

Trend Analysis

Intuit Inc. (INTU) experienced a bearish trend with a -17.52% price change over the past year, marked by deceleration and high volatility, ranging between 785.95 and 544.22.

PagerDuty, Inc. (PD) showed a stronger bearish trend with a -51.27% price change over the same period, also decelerating but with much lower volatility and a narrower price range.

Comparing both, Intuit’s stock outperformed PagerDuty’s, delivering a smaller loss and higher price stability during the analyzed period.

Target Prices

The current analyst consensus reveals clear upside potential for both Intuit Inc. and PagerDuty, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Intuit Inc. | 880 | 700 | 798.4 |

| PagerDuty, Inc. | 19 | 15 | 16.2 |

Analysts expect Intuit’s stock to rise significantly from its current price of $545.06, while PagerDuty shows moderate upside from $11.30, indicating cautious optimism for both stocks.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Intuit Inc. and PagerDuty, Inc.:

Rating Comparison

Intuit Inc. Rating

- Rating: B, considered very favorable by analysts.

- Discounted Cash Flow Score: 4, favorable outlook.

- ROE Score: 4, favorable return on equity.

- ROA Score: 5, very favorable asset utilization.

- Debt To Equity Score: 2, moderate financial risk.

- Overall Score: 3, moderate overall financial health.

PagerDuty, Inc. Rating

- Rating: A-, also very favorable overall.

- Discounted Cash Flow Score: 5, very favorable.

- ROE Score: 5, very favorable return on equity.

- ROA Score: 5, very favorable asset utilization.

- Debt To Equity Score: 1, very unfavorable ratio.

- Overall Score: 4, favorable overall financial health.

Which one is the best rated?

PagerDuty, Inc. holds a higher overall score and better ratings in discounted cash flow, ROE, and ROA compared to Intuit Inc. However, PagerDuty’s debt-to-equity score indicates higher financial risk. Intuit shows a more moderate overall rating with better debt management.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Intuit Inc. and PagerDuty, Inc.:

Intuit Inc. Scores

- Altman Z-Score: 9.35, indicating a safe zone.

- Piotroski Score: 9, classified as very strong.

PagerDuty, Inc. Scores

- Altman Z-Score: 1.26, indicating distress zone.

- Piotroski Score: 7, classified as strong.

Which company has the best scores?

Intuit Inc. has significantly better scores, with a much higher Altman Z-Score in the safe zone and a very strong Piotroski Score compared to PagerDuty’s distress zone Altman Z-Score and a strong Piotroski Score.

Grades Comparison

Here is a detailed comparison of the latest grades assigned to Intuit Inc. and PagerDuty, Inc.:

Intuit Inc. Grades

The following table shows recent grades from established financial institutions for Intuit Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Downgrade | Equal Weight | 2026-01-08 |

| Wells Fargo | Maintain | Overweight | 2025-11-21 |

| RBC Capital | Maintain | Outperform | 2025-11-21 |

| BMO Capital | Maintain | Outperform | 2025-11-21 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-18 |

| RBC Capital | Maintain | Outperform | 2025-09-02 |

| RBC Capital | Maintain | Outperform | 2025-08-22 |

| UBS | Maintain | Neutral | 2025-08-22 |

| Morgan Stanley | Maintain | Overweight | 2025-08-22 |

| Barclays | Maintain | Overweight | 2025-08-22 |

Intuit’s grades mostly indicate strong positive outlooks, with several “Outperform” and “Overweight” ratings, though a recent downgrade to “Equal Weight” suggests some caution.

PagerDuty, Inc. Grades

Below are the latest grades from recognized grading institutions for PagerDuty, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2026-01-07 |

| RBC Capital | Downgrade | Sector Perform | 2026-01-05 |

| TD Cowen | Maintain | Buy | 2025-11-26 |

| Craig-Hallum | Downgrade | Hold | 2025-11-26 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-26 |

| RBC Capital | Maintain | Outperform | 2025-11-26 |

| Truist Securities | Maintain | Buy | 2025-11-19 |

| Baird | Maintain | Neutral | 2025-09-04 |

| RBC Capital | Maintain | Outperform | 2025-09-04 |

| Canaccord Genuity | Maintain | Buy | 2025-09-04 |

PagerDuty’s grades show a mixture of “Buy,” “Outperform,” and more cautious “Hold” or “Sector Perform” ratings, reflecting some variability in analyst sentiment.

Which company has the best grades?

Intuit Inc. holds a more consistently positive grade profile with multiple “Outperform” and “Overweight” ratings, contrasting with PagerDuty’s more mixed evaluations. This suggests Intuit currently enjoys stronger analyst confidence, which may influence investor perceptions of stability and growth potential.

Strengths and Weaknesses

Here is a comparative overview of Intuit Inc. (INTU) and PagerDuty, Inc. (PD) based on their key strengths and weaknesses:

| Criterion | Intuit Inc. (INTU) | PagerDuty, Inc. (PD) |

|---|---|---|

| Diversification | Strong diversification with multiple segments including Consumer, Global Business Solutions, Credit Karma, and Professional Tax. | Limited diversification; primarily focused on digital operations management. |

| Profitability | Favorable profitability: net margin 20.55%, ROE 19.63%, ROIC 14.78%, generating value with positive ROIC > WACC. | Unfavorable profitability: net margin -9.14%, ROE -32.92%, ROIC -9.66%, shedding value with ROIC < WACC. |

| Innovation | Consistent investment in technology with strong fixed asset turnover (12.54), sustaining competitive advantage. | Growing ROIC trend suggests improving innovation and operational efficiency despite current losses. |

| Global presence | Well-established global footprint, especially in business solutions and consumer finance sectors. | More limited global presence, mainly serving technology and IT operations markets. |

| Market Share | Large market share in tax, accounting, and financial software sectors, supported by steady segment revenue growth. | Smaller market share with a niche focus; still in growth phase with revenue concentrated in core services. |

Key takeaways: Intuit exhibits strong diversification and solid profitability despite a slight decline in ROIC, making it a more stable investment. PagerDuty shows growth potential with improving ROIC but suffers from current losses and limited diversification, posing higher risk.

Risk Analysis

Below is a table summarizing key risks for Intuit Inc. and PagerDuty, Inc. based on the most recent data from 2025.

| Metric | Intuit Inc. (INTU) | PagerDuty, Inc. (PD) |

|---|---|---|

| Market Risk | Beta 1.25 – moderately volatile | Beta 0.63 – relatively low volatility |

| Debt level | Low debt-to-equity 0.34 – favorable | High debt-to-equity 3.57 – unfavorable |

| Regulatory Risk | Moderate, operates in financial software sector | Moderate, operates in digital operations software |

| Operational Risk | Medium – large scale operations, diverse product lines | Medium – smaller scale, but reliant on tech innovation |

| Environmental Risk | Low – mainly software business | Low – software-focused, limited environmental impact |

| Geopolitical Risk | Moderate – US and international markets exposure | Moderate – US and Japan focus, potential trade impacts |

The most impactful and likely risks differ between the two. Intuit’s moderate market volatility and regulatory environment pose manageable risks, while its strong financial health and low debt mitigate major concerns. PagerDuty faces significant financial risks due to high leverage and negative profitability, reflected in its distress-level Altman Z-Score. Market volatility is lower, but its financial instability and operational reliance on evolving technology could lead to greater investment risk.

Which Stock to Choose?

Intuit Inc. (INTU) shows strong income growth with a 15.63% revenue increase in 2025 and favorable margins, profitability, and stable debt levels. Its financial ratios mostly indicate strength, supported by a very favorable rating and solid credit metrics.

PagerDuty, Inc. (PD) exhibits moderate revenue growth of 8.54% in 2025 but suffers from negative profitability ratios and high debt levels. Despite a very favorable overall rating, its financial ratios reflect challenges, including an unfavorable debt-to-equity position and negative returns.

For risk-averse or quality-focused investors, Intuit’s favorable income evolution and robust financial ratios might appear more suitable, while growth-oriented investors might find PagerDuty’s improving trends and high rating more appealing despite its current financial challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Intuit Inc. and PagerDuty, Inc. to enhance your investment decisions: